Trading Plan Template: Blueprint for Market Success

Why Profitable Traders Never Skip The Plan

Take the TRADING QUIZ? Click here

Stepping into the financial markets without a plan is like wandering through a dark forest. Beginner traders might occasionally stumble upon a lucky win, but consistent profits require a trading plan template. This isn’t simply about creating a document. It’s about developing a structured approach to navigate the markets and manage your psychological responses.

The Psychology of a Trading Plan

Your trading plan is your market compass. It provides the direction needed to avoid impulsive decisions fueled by fear or greed. Markets can be volatile, often swaying unprepared traders into costly errors. A trading plan keeps you grounded, reminding you of your strategies and risk tolerance, especially during turbulent times.

Benefits of a Structured Approach

A solid trading plan template offers numerous benefits.

- It helps you pinpoint real opportunities based on your predefined criteria, not fleeting market trends.

- It encourages disciplined execution through clear entry and exit rules, reducing second-guessing.

- It allows for consistent performance tracking and improvement by analyzing your trades against your plan.

This analysis helps identify weaknesses and refine your approach over time.

Before we explore further, let’s look at the key differences a trading plan makes:

To illustrate the impact of trading with and without a plan, the following table provides a clear comparison.

Trading With vs. Without a Trading Plan

This comparison table shows the critical differences between trading with a structured plan versus trading without one, highlighting both short-term and long-term impacts.

| Aspect | Trading With a Plan | Trading Without a Plan |

|---|---|---|

| Emotional Control | Disciplined, rational decisions | Impulsive, emotionally-driven decisions |

| Risk Management | Defined risk parameters, controlled losses | Uncontrolled risk, potential for significant losses |

| Consistency | Consistent approach, repeatable results | Inconsistent approach, unpredictable results |

| Long-Term Profitability | Higher probability of long-term success | Lower probability of long-term success |

| Adaptability | Systematic adjustments to changing conditions | Reactive, emotional adjustments to market shifts |

As you can see, a well-defined trading plan significantly increases your chances of consistent success. By adhering to a structured approach, you can effectively manage risk, control emotions, and make informed decisions based on your predefined strategy.

Setting Trading Goals and Objectives

One crucial aspect of a trading plan template is setting trading goals and objectives. A trader might aim for a 2% monthly return, approximately 24% annually. This goal can be broken down further, like aiming for 3 trades per week. Setting objectives helps track progress and adjust strategies as needed. Traders with clear goals tend to perform better long-term, sticking to their plans and avoiding emotional decisions.

From Restriction to Enhancement

Some traders believe a trading plan restricts flexibility. However, a well-designed template enhances adaptability. The framework allows you to react to changing market conditions systematically, not emotionally. You can adjust tactics while staying true to your overall strategy, maximizing your long-term success in the dynamic trading world.

Core Elements of High-Performance Trading Templates

A successful trading plan template provides a structured blueprint for navigating the market. It’s the foundation upon which profitable traders build strategies, manage risk, and execute trades. This section explores the core components found in templates used by consistently profitable traders.

Defining Your Trading Edge and Market Approach

The first crucial element of a high-performance trading template is defining your trading edge. This is your unique approach to identifying and capitalizing on market opportunities. It involves specifying your target markets (stocks, forex, commodities, etc.), your preferred trading style (day trading, swing trading, etc.), and the logic behind your strategy.

For example, a day trader might focus on volatile tech stocks using a momentum-based strategy. A swing trader, on the other hand, might target currency pairs based on technical patterns and fundamental analysis. Articulating your edge ensures your template aligns with your skills and market understanding.

Setting Measurable Trading Goals and Objectives

A robust trading plan template must include clear goals and objectives. This creates a roadmap for your trading activities and allows you to track progress effectively. These goals should be SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

Instead of aiming for vague “big profits,” a trader might target a 1.5% weekly return, with a maximum risk per trade of 0.5% and a win rate goal of 60%. Visualizing these metrics helps focus your efforts. The following infographic demonstrates how these metrics can be presented.

This chart illustrates the relationship between desired return, acceptable risk, and anticipated win rate, allowing traders to understand their target performance. Defining these metrics allows for accurate performance evaluation and helps maintain focus on long-term objectives.

Establishing Clear Entry and Exit Rules

Explicit entry and exit rules are essential for any successful trading plan template. These rules form the core of your execution strategy, dictating when to enter and exit trades. Entry rules should be based on objective criteria derived from your trading edge.

This could involve specific technical indicators, candlestick patterns, or a combination of fundamental factors. Similarly, exit rules should be pre-defined, based on both profit targets and stop-loss levels. This minimizes emotional decision-making during live trading, promoting consistency and discipline.

Before we dive into risk management, let’s take a look at a helpful checklist to make sure you’ve covered all the essential components of your trading plan template.

The following table provides a comprehensive overview of the key elements to include in your trading plan, along with descriptions and implementation tips.

Trading Plan Template Components Checklist

| Component | Description | Implementation Tips |

|---|---|---|

| Trading Edge | Your unique approach to identifying and capitalizing on market opportunities | Clearly define the markets you’ll trade, your trading style, and the logic behind your strategy |

| Goals and Objectives | Specific, Measurable, Achievable, Relevant, and Time-bound targets | Set realistic goals for weekly/monthly returns, maximum risk per trade, and desired win rate |

| Entry Rules | Objective criteria for entering trades | Define specific technical indicators, candlestick patterns, or fundamental factors that trigger entries |

| Exit Rules | Pre-defined rules for exiting trades | Establish profit targets and stop-loss levels to minimize emotional decision-making |

| Risk Management | Measures to protect capital and manage potential losses | Determine position sizing, stop-loss strategy, maximum drawdown limits, and diversification strategies |

This checklist serves as a valuable tool for ensuring your trading plan is comprehensive and well-structured. Remember, a well-defined plan is crucial for consistent success in the markets.

Implementing Robust Risk Management Parameters

Finally, a high-performance trading plan template always includes a comprehensive risk management section. This outlines the measures taken to protect capital and manage potential losses. This section should cover position sizing, which determines the appropriate investment amount for each trade based on account size and risk tolerance.

It should also detail your stop-loss strategy, outlining how you’ll limit losses on individual trades. Furthermore, it should include parameters for managing overall portfolio risk, such as maximum drawdown limits and diversification strategies. By defining these rules, traders can protect their capital during market volatility and prevent significant losses. A strong risk management framework ensures longevity and allows traders to navigate market fluctuations.

Crafting Trading Goals That Drive Real Results

Many traders find themselves setting vague, unrealistic goals, only to be met with disappointment. This section explores how successful traders create meaningful objectives and practical performance metrics. These are incorporated within their trading plan template to achieve real progress. We’ll look at both quantitative and qualitative targets that create a comprehensive performance framework.

Defining Quantitative Trading Goals

Quantitative goals offer concrete benchmarks to measure trading success. These are numerically defined and easy to track. They allow traders to objectively evaluate performance and identify areas for improvement.

Some common quantitative goals include:

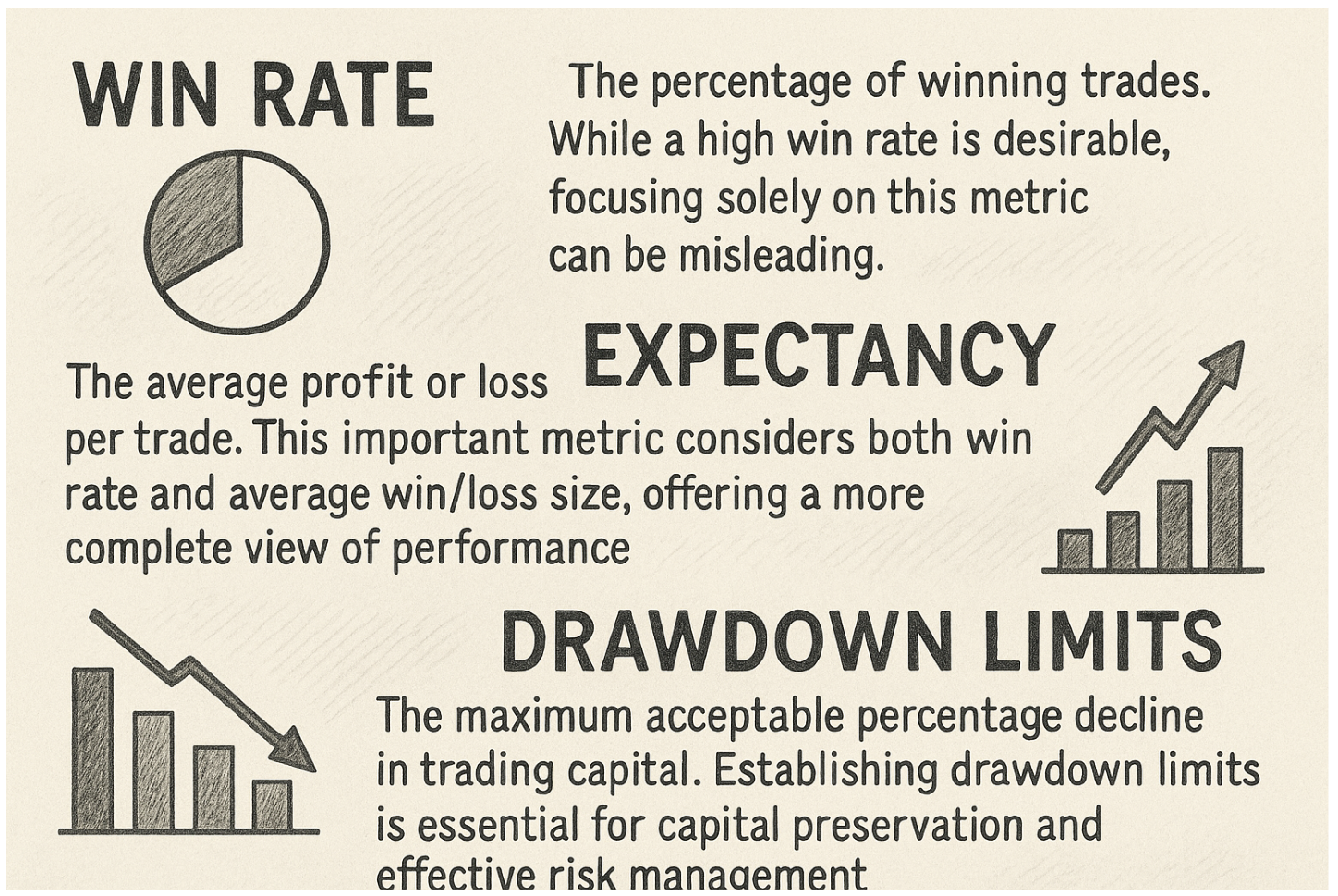

- Win Rate: The percentage of winning trades. While a high win rate is desirable, focusing solely on this metric can be misleading.

- Expectancy: The average profit or loss per trade. This important metric considers both win rate and average win/loss size, offering a more complete view of performance.

- Drawdown Limits: The maximum acceptable percentage decline in trading capital. Establishing drawdown limits is essential for capital preservation and effective risk management.

For example, a trader might aim for a 60% win rate, a positive expectancy of 0.5% per trade, and a maximum drawdown limit of 10%.

Setting Qualitative Trading Goals

While numbers are essential, qualitative goals address the psychological and behavioral aspects of trading, focusing on improving the trading process itself. These less tangible targets are crucial for long-term success.

Key qualitative goals to consider:

- Trading Psychology: Managing emotions like fear and greed. A trading plan template can help maintain discipline during periods of market volatility.

- Decision Quality: Making objective, data-driven trading decisions. A pre-defined plan helps prevent impulsive trades based on emotions.

- Execution Discipline: Consistently following the rules outlined in your trading plan. This removes hesitation and second-guessing during live trading.

By incorporating these qualitative goals, traders can build a more disciplined and consistent trading approach, leading to improved long-term performance.

Building a Goal Hierarchy

Effective traders create a connected hierarchy of goals, aligning short-term, medium-term, and long-term objectives. This involves setting daily, weekly, and monthly benchmarks that contribute to the overall trading goals. For instance, a day trader might establish daily goals for the number of trades taken and minimum profit targets. These then contribute to their weekly and monthly return objectives.

Adapting to Changing Market Conditions

Market dynamics are in constant flux, meaning your trading plan template and its associated goals shouldn’t be static. Successful traders regularly review and adapt their goals based on prevailing market conditions. This might involve modifying profit targets, adjusting position sizes, or refining entry and exit criteria. This adaptability allows traders to navigate different market environments effectively.

By creating a clear framework of quantitative and qualitative goals within your trading plan template, you build a roadmap for consistent trading success. Reaching these goals takes discipline, adaptability, and a commitment to continuous improvement. Colibri Trader emphasizes practical, action-based training. This approach complements this goal-oriented methodology, providing traders with the necessary tools and skills to succeed.

Risk Management: The Backbone of Trading Longevity

While finding profitable entries is a key focus for many, seasoned traders know that risk management is essential for navigating the market’s uncertainties. This section explores how successful traders build protective measures into their trading plan template. This safeguards capital during volatile periods and paves the way for long-term success and consistent performance.

Calculating Position Size

The foundation of effective risk management lies in determining the correct position size for every trade. This involves calculating the capital allocation based on your account size and pre-determined risk tolerance. This process helps prevent overexposure and protects your capital during inevitable losing streaks.

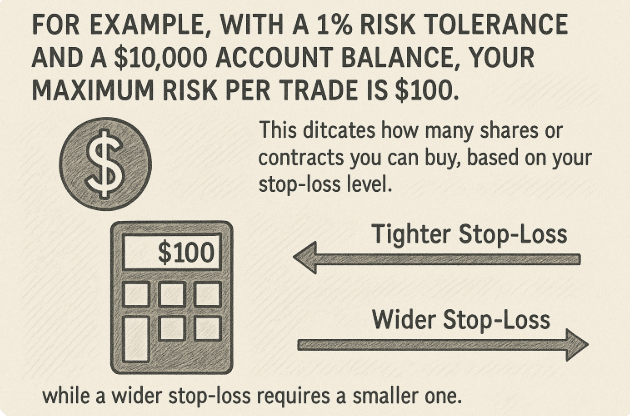

For example, with a 1% risk tolerance and a $10,000 account balance, your maximum risk per trade is $100. This dictates how many shares or contracts you can buy, based on your stop-loss level. A tighter stop-loss permits a larger position, while a wider stop-loss requires a smaller one.

Market volatility also plays a significant role. In volatile markets, it’s wise to reduce your position size to account for potentially larger price swings. This adjustment safeguards against substantial losses during periods of heightened market uncertainty.

Advanced Stop-Loss Methodologies

Stop-loss orders are essential for mitigating losses. However, the chosen methodology significantly impacts overall performance. Traders utilize several advanced techniques, each with its own set of advantages and disadvantages.

- Fixed-Dollar Stops: These involve a fixed dollar amount below the entry price, offering clear boundaries but potentially failing to adapt to changing market dynamics.

- Percentage-Based Stops: This method defines a percentage-based stop-loss, automatically adjusting to price fluctuations.

- Volatility-Adjusted Stops: These stops account for market volatility, widening during turbulent periods and tightening during calmer ones, preventing whipsaws from short-term fluctuations.

- Technical Stops: These leverage technical levels, such as support levels or trendlines, aligning risk management with market structure.

Experimentation is key to finding the methodology that best suits your trading style and risk tolerance.

Understanding Risk-Reward Ratios

The risk-reward ratio compares potential profit to potential loss. A 1:2 ratio signifies aiming for twice the profit compared to the acceptable loss. While theoretical ratios provide guidance, practical application is crucial. Market conditions and the probability of a trade’s success influence the effectiveness of any risk-reward calculation.

Setting Drawdown and Exposure Limits

Beyond individual trades, managing overall portfolio risk is paramount. Maximum drawdown limits define the acceptable percentage decline in trading capital. For example, a 15% drawdown limit would halt trading upon reaching that threshold. This allows for strategy reassessment and prevents catastrophic losses. Maximum exposure thresholds, limiting capital exposed to open positions at any given time, promote diversification and prevent excessive risk concentration.

Documenting Risk Management in Your Trading Plan

Effective risk management requires meticulous documentation within your trading plan template. Clearly defined rules for position sizing, stop-loss methods, risk-reward ratios, drawdown limits, and exposure thresholds create a framework for disciplined trading. This enables rational decision-making even under pressure. Colibri Trader emphasizes practical, action-based training, including robust risk management principles, to equip traders with the skills needed for consistent success.

Entry and Exit Rules That Eliminate Hesitation

Hesitation can be a trader’s worst enemy. A well-defined trading plan template provides the clarity you need to execute trades decisively, removing emotional reactions that can lead to costly errors. This section explores creating clear entry and exit rules, transforming analysis into consistent action.

Defining Objective Entry Signals

Your entry signals should be rooted in your trading edge – the unique strategy that gives you a market advantage. Whether your edge comes from technical analysis, fundamental insights, or a combination of the two, the key is translating it into objective, measurable criteria within your trading plan template.

-

Technical Patterns: These could involve recognizing specific candlestick formations, chart patterns like head and shoulders, or breakouts from established trendlines.

-

Indicator Alignments: Using technical indicators like moving averages, RSI, or MACD can create objective entry triggers when specific conditions are met.

-

Fundamental Catalysts: For longer-term trades, fundamental factors like earnings reports, news releases, or economic data can signal opportune entry points.

-

Hybrid Approaches: Combining technical and fundamental factors can strengthen entry signals and improve overall trade selection.

Building Multi-Factor Confirmation Systems

Many successful traders use multi-factor confirmation to improve the probability of successful trades. This involves requiring multiple criteria to align before entering a trade. For instance, a day trader might require a stock to break a resistance level on increasing volume while the RSI confirms momentum. These systems filter out market noise, identifying high-probability setups.

Establishing Profit Targets and Stop-Loss Levels

Just as crucial as entry rules, your trading plan template must define clear exit criteria. This eliminates emotional decision-making during live trading and protects against significant losses.

-

Profit Targets: Profit targets should be based on factors like market structure, expected volatility, and the trade’s risk-reward ratio. Taking profits at pre-determined levels ensures consistent gains.

-

Stop-Loss Orders: A stop-loss order is a critical risk management tool that automatically exits a trade at a specific price, limiting potential losses. Stop-loss placement can be based on technical levels or a fixed percentage of the trade’s value.

Implementing Trailing Stops and Dynamic Exits

Beyond initial stop-loss placement, professionals often use trailing stops that adjust as a trade moves favorably. This helps lock in profits while allowing the trade to continue running. Traders also adapt exit criteria based on a trade’s progress. For example, if a trade isn’t progressing as expected, an early exit might be warranted, even if the initial profit target hasn’t been reached. Effective risk management is vital to trading longevity.

Building Executable Rules for Consistent Action

The goal is to translate your market analysis into concrete, executable actions that you can follow without hesitation, regardless of market conditions. This consistency is key to achieving repeatable results and long-term trading success. By defining clear entry and exit criteria within your trading plan template, you empower yourself to make confident, objective decisions and avoid emotional pitfalls.

Turning Your Trading Plan Into a Performance Engine

A trading plan template isn’t just a document; it’s a dynamic tool for constant improvement. Successful traders treat their templates as adaptable blueprints, continually refining them to enhance their trading performance. This section explores how to transform your trading plan into a true performance engine that drives consistent growth.

Documenting Trades for Pattern Recognition

Effective documentation is the key to unlocking valuable performance insights. This involves tracking not only the hard numbers of your trades (entry and exit points, profit and loss) but also the qualitative factors behind your decisions. Record your reasoning for every trade, your emotional state at the time, and any external influences. This detailed logbook helps uncover recurring patterns, revealing your trading strengths and weaknesses. For instance, recognizing a tendency to overtrade after a series of losses can illuminate emotional vulnerabilities that need attention.

Conducting Impactful Trading Reviews

Regular reviews are essential for iterative improvement. Post-trade analysis provides immediate feedback, while monthly assessments offer a broader perspective.

-

Post-Trade Analysis: After each trade, compare its execution to your trading plan template. Did you adhere to your rules? Were your entry and exit points as effective as possible? This immediate feedback loop helps identify any deviations from your plan and understand their consequences.

-

Monthly Reviews: These broader reviews assess your overall performance against your defined goals. Analyze your win rate, average profit/loss, maximum drawdown, and other key performance indicators. Identify recurring patterns in both winning and losing trades to refine your approach.

These reviews should result in actionable adjustments, constantly refining your trading plan template for continuous improvement.

Refining Your Trading Plan Over Time

Your trading plan should evolve as you gain experience and as market conditions change. This requires a structured approach to evaluating any proposed modifications.

-

Substantive Changes: These involve fundamental shifts in your strategy, like changing your trading style or your target market. Such changes require thorough backtesting and careful consideration.

-

Minor Adjustments: These are smaller tweaks to your existing rules, such as adjusting your stop-loss placement or refining your entry criteria. These adjustments can be implemented more quickly but still require careful monitoring.

It’s important to differentiate between necessary adjustments and emotional reactions to short-term setbacks. Maintaining strategic discipline through challenges is crucial for long-term success.

Utilizing Journaling Templates and Performance Dashboards

Practical tools can significantly improve your plan’s effectiveness.

-

Journaling Templates: Structured templates ensure consistency in documenting trade details and analysis. This facilitates the identification of trends and patterns over time.

-

Performance Dashboards: Visual dashboards offer instant feedback on key metrics, allowing you to track progress towards your goals. These tools can reveal hidden correlations and highlight areas for improvement.

Measuring System Quality Beyond Profit/Loss

While profitability is the ultimate objective, evaluating your system’s quality involves more than just profit and loss. Consider factors like:

- Consistency: Are your results consistently positive over time?

- Robustness: Does your system perform well across various market conditions?

- Adaptability: Can your system adapt to changing market dynamics?

By focusing on these broader evaluation criteria, you ensure your trading plan isn’t just profitable today, but also built for sustained success in the dynamic market environment. Ready to enhance your trading potential?