How to Start Day Trading A Practical Guide for Beginners

So, you’re ready to take the plunge into day trading. Before you even think about hitting that "buy" button, you need to build a solid foundation. Forget the get-rich-quick hype; successful trading is built on four pillars: grasping core market concepts, picking the right broker and platform, building a simple strategy, and mastering risk management.

Let's break down how to lay the groundwork, step by step.

Laying the Groundwork for Your First Trade

Before you execute a single trade, you have to understand the environment you're stepping into. This isn't about chasing hot stock tips or getting lucky on a meme stock. It’s about understanding the forces that create real, tradable opportunities.

Three concepts are absolutely non-negotiable for a day trader: liquidity, volatility, and trading volume.

Think of liquidity like the depth of a river. A deep river (high liquidity) lets big ships (large trades) pass through easily without causing a ripple. In the markets, this means you can get in and out of a position quickly without your own trade drastically moving the price against you.

Volatility is the river's current. A calm, slow-moving river is predictable, but a turbulent one with rapids offers both excitement and danger. Highly volatile assets see big, fast price swings—creating the potential for quick profits but also for significant, rapid losses.

Finally, trading volume is the amount of traffic on that river. High volume shows there’s a lot of interest in an asset, which helps confirm the strength of a price move. Low volume, on the other hand, suggests a lack of conviction, making price action less reliable.

Grasping the Market Landscape

Understanding these three pillars is what helps you decide where to trade. For beginners, stocks and forex are two of the most popular arenas, and they each have a different feel.

-

Stocks: When you trade stocks, you're betting on the short-term performance of companies like Apple (AAPL) or Tesla (TSLA). The stock market is massive. The NYSE alone handles around 1.36 billion shares every day, and the total U.S. stock market capitalization has swelled to about $54.88 trillion. That sheer size ensures there’s almost always a buyer for every seller, which is exactly what you want.

-

Forex (Foreign Exchange): This is all about trading currency pairs, like the Euro versus the U.S. Dollar (EUR/USD). The forex market is the largest financial market in the world, hands down. Its immense liquidity often translates to tighter spreads (the difference between the buy and sell price), meaning lower transaction costs for you.

The key takeaway is this: Liquidity and volume provide the opportunities, while volatility provides the movement. Your job is to find assets where all three align with your strategy.

Before you jump in, it's worth taking a moment to organize your thoughts. A simple checklist can keep you focused on what truly matters as you get started.

Day Trading Starter Checklist

Here’s a quick summary of the essential components and mindset needed before you begin your day trading journey.

| Component | Key Consideration | Why It Matters for Beginners |

|---|---|---|

| Market Understanding | Grasp liquidity, volatility, and volume. | These three pillars dictate where opportunities exist and help you avoid illiquid, unpredictable assets that can trap new traders. |

| Realistic Expectations | Trading is a skill-based profession, not a get-rich-quick scheme. | A professional mindset prevents emotional decisions and burnout, focusing you on long-term consistency over short-term luck. |

| Structured Routine | Develop a daily process for analysis, execution, and review. | Structure builds discipline. It turns chaotic market action into a manageable process you can repeat and improve upon. |

| Risk-Free Practice | Master your strategy in a simulated environment first. | Paper trading lets you make mistakes and learn lessons without losing real money, building confidence for when the stakes are real. |

This checklist isn't just a to-do list; it's a mindset. Internalize these points, and you'll be starting miles ahead of most beginners.

Setting Realistic Expectations

Let’s be real for a second. The biggest misconception about day trading is that it's a fast track to easy money. It's not. It demands discipline, intense focus, and a structured routine. Building the right habits from day one is everything, and that includes mastering effective time management schedules.

Your day won't be a constant adrenaline rush of high-stakes trades. It’s far more methodical.

- Pre-Market Analysis: This is your homework. You're researching news, scanning for stocks that are "in play," and building your watchlist for the day.

- Active Trading: You're not trading all day. You're executing trades during specific, high-volume windows—usually the first one or two hours after the market opens when the action is most predictable.

- Post-Market Review: At the end of the day, you're journaling every trade. You analyze what worked, what didn't, and why. This is how you refine your strategy and improve.

This structured approach is absolutely non-negotiable. And before you even think about putting real money on the line, you need to practice this routine religiously in a simulated environment. Learning https://www.colibritrader.com/what-is-paper-trading/ is the perfect way to test your strategy, build confidence, and make your rookie mistakes without paying the market for them.

Selecting Your Broker and Trading Platform

This is one of the most important decisions you'll make when you start day trading. Forget the flashy ads promising the lowest commissions—that's a classic rookie mistake. Your broker and trading platform are your command center, your lifeline to the markets. Speed, stability, and the quality of your data feed are infinitely more important than saving a few pennies on a trade.

Think of it like this: your broker is the highway, and your platform is the car. A cheap highway full of potholes (slow execution speeds) or one that closes down without warning (platform crashes) makes it impossible to get where you're going, no matter how skilled a driver you are.

Differentiating Broker Types

Not all brokers are built the same. You'll mainly run into two types: direct access brokers and market makers.

A direct access broker sends your order straight to an exchange. This means faster execution and gives you far more control, which is exactly what you want in the fast-paced world of day trading.

Market makers, on the other hand, often trade against their own clients. While they might offer tighter spreads sometimes, this setup creates a clear conflict of interest. When milliseconds can make or break a trade, most serious day traders will choose the transparency and raw speed of a direct access model every time.

Key Takeaway: Prioritize execution speed and platform stability over rock-bottom commission fees. A few saved cents on a trade are worthless if you miss your entry or exit due to a slow or crashing platform.

Evaluating Essential Platform Features

A slick-looking interface is nice, but it's the engine under the hood that really matters. When you're comparing platforms, you need to zero in on the non-negotiable features that support rapid, high-stakes decision-making.

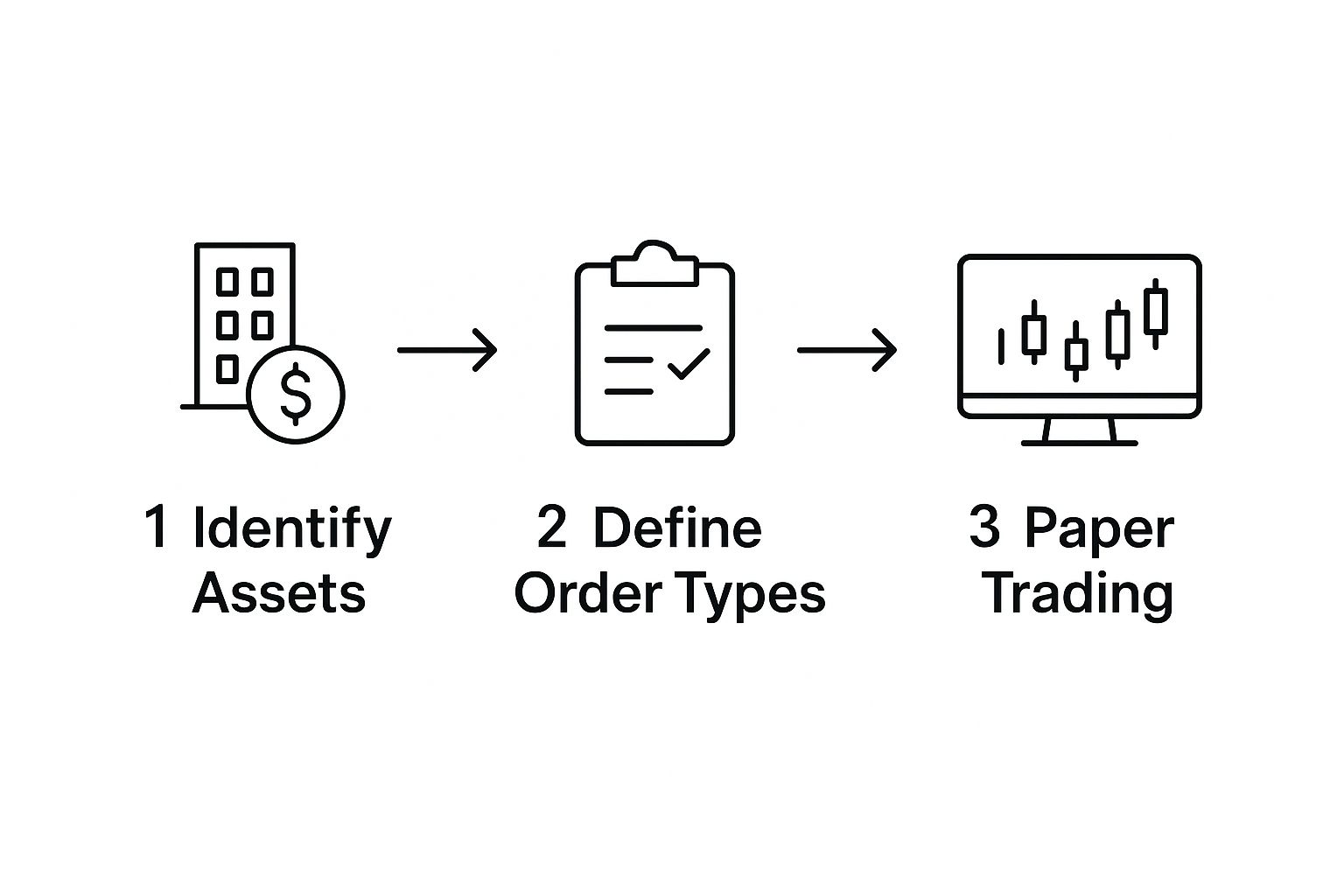

This simple workflow shows the basic steps you'll be taking once you're all set up: finding assets, knowing your order types, and getting your reps in with paper trading.

What this image really drives home is that you absolutely must master the mechanics in a risk-free environment before putting real money on the line. The right tools make all the difference.

Here’s what you should be looking for:

- Advanced Charting Tools: You need way more than a basic line chart. Your platform must have candlestick charts, multiple timeframes, and a full suite of customizable technical indicators.

- Level 2 Data: This is your window into market depth, showing you the bid and ask prices from different market participants. It's critical for seeing buying and selling pressure build up in real-time.

- Hotkeys: In day trading, speed is everything. The ability to execute an order with a single keystroke is vital. Fumbling around with a mouse to click "buy" or "sell" is a surefire way to miss a perfect entry.

- Reliable Demo Account: Always, always test-drive a platform using its paper trading or simulator mode. Does it lag? Is the layout intuitive? This is your chance to find out without risking a dime of your capital.

Once you’ve narrowed it down to a few contenders, it's time to dig deeper. A good, comprehensive review of the best trading platforms for beginners can offer some great insights and help you compare the specific tools you’ll need.

Don't rush this step. Opening and funding your account is the last thing you do—only after you're completely confident you've found the right partner for your trading journey.

Developing Your First Day Trading Strategy

Let's get one thing straight: trading without a strategy is just gambling. It's a surefire way to let emotions and market noise dictate your decisions, and that rarely ends well. A solid strategy is your personal rulebook—a concrete set of conditions that must be met before you even think about risking a single dollar.

Your first strategy doesn’t need to be complex. In fact, simpler is almost always better when you’re just starting out. The goal here is to build a mechanical process, something you can repeat, based on what the market is actually doing, not what you feel it might do.

This means putting your focus squarely on price action—the pure, unadulterated movement of a stock's price on the chart. You might layer in one or two technical indicators for extra context, but price is king.

Building a Simple Breakout Strategy

Let’s walk through a classic, beginner-friendly strategy that I’ve seen work time and again: the opening range breakout. It’s popular for a reason. It taps into the predictable burst of volume and volatility that hits the market right at the opening bell.

Here are the basic rules for a long (buy) position:

- Define the Range: For the first 15-30 minutes of the trading day, watch the stock and mark its highest and lowest price. This creates your "opening range," a clear channel of support and resistance.

- Set Your Entry Signal: Your entry trigger is simple. You place a buy order just a few cents above the high of that range. When the price breaks through that level, you're in the trade. That's the breakout.

- Establish Your Exit Plan: Before you even enter, you know your exits. Your stop-loss (the point where you cut your losses) goes just below the low of the opening range. For your take-profit target, you could aim for a fixed amount or, better yet, a specific risk-to-reward ratio, like 1.5 times whatever you risked.

This approach strips out the guesswork. The price either breaks the range and triggers your trade, or it doesn't. There's no room for "maybes." For more ideas on building clear, price-action-based plans, check out this guide to a simple day trading strategy.

Crucial Insight: A good strategy isn’t about winning 100% of the time. It’s about having a statistical edge that plays out over hundreds of trades. Your rulebook is what ensures you only take the setups where the odds are stacked in your favor.

Backtesting and Refining Your Approach

Okay, so you have a set of rules. How do you know if they actually work? You don't risk real money to find out. This is where backtesting comes in.

Backtesting is just the process of applying your strategy to historical charts to see how it would have performed in the past. You literally scroll back in time on your charting platform and "paper trade" your setup over and over, logging the wins and losses. This is critical for spotting a strategy's strengths and weaknesses without losing a dime. Maybe it works great on tech stocks but fails on industrials. You'll only find out by testing.

After you’ve done some manual backtesting, it's time to graduate to a trading simulator or a live paper trading account. This is where you practice executing your strategy in a real-time market environment, but with fake money. You'll build the muscle memory for placing orders, managing your position, and, most importantly, following your rules when the pressure is on. This is how you build the confidence you need before putting your hard-earned cash on the line.

Managing Risk to Protect Your Trading Capital

Let's get one thing straight: long-term survival in day trading has almost nothing to do with picking spectacular winners. It’s all about one thing: rigorously protecting the capital you already have.

Experienced traders think about what they could lose long before they even consider what they might gain. This isn't just a suggestion; it's the only way to stay in the game long enough to actually become profitable. Your primary job as a new trader isn't to make money—it's to stop losing it.

Without a non-negotiable set of rules, you’re just gambling. And in that game, the house always wins. Building a professional mindset starts with defending every single dollar in your account.

Implement the 1% Rule Without Exception

The single most powerful rule you can adopt is the 1% rule. It’s simple: you will never risk more than 1% of your total trading capital on a single trade.

If you have a $30,000 account, the absolute most you can afford to lose on any one position is $300. Period.

This rule is your psychological and financial lifeline. A single bad trade—and trust me, you will have them—cannot wipe you out. It stops you from making emotionally-charged "revenge trades" to win back losses. More than anything, it ensures your survival through the inevitable losing streaks.

By strictly following the 1% rule, you would need to lose 100 consecutive trades to completely blow up your account. This simple discipline gives you the resilience you need to learn and adapt without suffering a catastrophic financial hit.

Use Stop-Loss and Take-Profit Orders

Mechanical tools are your best friends when it comes to fighting emotional decision-making. For every single trade you place, two orders are completely non-negotiable: the stop-loss and the take-profit.

-

Stop-Loss (SL): This is a pre-set order that automatically closes your trade once the price hits a specific level, capping your loss. You figure out this price before you enter the trade based on your strategy—not on how you feel once the money is on the line.

-

Take-Profit (TP): This order automatically closes your position once it reaches your profit target. It locks in your winnings and prevents greed from turning a great trade into a mediocre—or even losing—one.

These tools enforce discipline when you're under pressure. Emotional control is the bedrock of risk management. It's a skill in itself, much like maintaining composure during volatile market conditions.

Master the Risk-to-Reward Ratio

Finally, you have to get comfortable only taking trades where the potential upside justifies the capital you’re putting on the line. We measure this with the risk-to-reward ratio.

A healthy ratio ensures your winning trades are significantly bigger than your losing ones. This is critical because it means you don't even need a high win rate to be profitable over the long run.

For instance, a trade with a 1:2 risk-to-reward ratio means you're risking $100 for the chance to make $200. This should be your absolute minimum. Why? Because with a 1:2 ratio, you only need to be right one-third of the time just to break even. Anything better than that, and you start tilting the odds firmly in your favor.

Let's look at how this plays out over a series of trades. Even with a win rate below 50%, a solid risk/reward ratio can make all the difference.

Risk/Reward Scenario Comparison

| Scenario | Risk/Reward Ratio | Win Rate | Outcome Over 10 Trades |

|---|---|---|---|

| Bad R/R | 1:1 (Risk $100 to make $100) | 50% (5 Wins, 5 Losses) | Breakeven ($500 gain – $500 loss = $0) |

| Minimum Good R/R | 1:2 (Risk $100 to make $200) | 40% (4 Wins, 6 Losses) | Profitable ($800 gain – $600 loss = +$200) |

| Excellent R/R | 1:3 (Risk $100 to make $300) | 40% (4 Wins, 6 Losses) | Highly Profitable ($1200 gain – $600 loss = +$600) |

As the table shows, a trader with a losing win rate (40%) can still be consistently profitable by sticking to trades with a favorable risk profile. This is the mathematical edge that separates professional traders from amateurs. Focus on finding high-quality setups, not on trying to win every single trade.

Placing Your First Trades with Confidence

This is it. The moment where all your preparation—picking a broker, building a strategy, setting your rules—finally hits the screen. This is where theory meets reality.

But before you put a single real dollar on the line, your first moves must happen in a simulated account. Paper trading isn't just for practice; it's the essential dress rehearsal. It’s where you build the mechanical skills and the confidence to perform when real money makes your heart pound.

The mission here is simple: bridge the gap between knowing your strategy and flawlessly executing it. That means pulling up a live chart, spotting your exact setup as it unfolds, and getting your orders in without fumbling or second-guessing.

Develop a Pre-Trade Routine

Great trades don't start with a profitable exit. They start with a disciplined entry. What separates the pros from the gamblers is a repeatable pre-trade routine—a simple checklist that guarantees you only take trades that tick every single box of your plan.

Your routine should be second nature. Mine looks something like this:

- Scan for My Setups: I’m actively hunting for the specific market conditions that match my strategy’s entry signals. Nothing else.

- Verify Every Criterion: Does the setup meet all my rules? Not most of them—all of them. If even one piece is missing, I walk away. No exceptions.

- Calculate Position Size: Based on my 1% risk rule, I figure out exactly how many shares I can take on this trade.

- Set My Orders in Stone: I define my precise entry price, my stop-loss, and my take-profit target before I even think about clicking the "buy" button.

Following a process like this drains the emotion right out of the trade. The market isn't telling you what to do; your plan is.

Execute with Precision in a Demo Account

Think of your demo account as your personal training ground. This is where you master the nuts and bolts of your trading platform until it feels like an extension of your own mind.

Get comfortable placing different order types, especially market orders (buy or sell immediately at the current price) and limit orders (buy or sell only at a specific price or better).

Let's say your breakout strategy requires you to buy a stock the moment it crosses $50.10. You'll need to practice placing a buy-stop-limit order to ensure you get in right at that price without chasing it. Do this over and over until it becomes muscle memory.

A lot of new traders also get their start in the Forex market because its massive liquidity makes for clean, fast execution. The average daily trading volume recently hit an astonishing $7.51 trillion, which means you can typically get in and out of trades with minimal price slippage. You can get a better sense of this massive market by checking out these Forex daily trading volume insights on BestBrokers.com.

Key Takeaway: The goal of paper trading isn't to rack up a pile of fake money. It's to prove to yourself that you can follow your rules without breaking them. Once you can execute your plan flawlessly for a solid chunk of time, only then are you ready to consider trading with real capital.

The Power of a Trading Journal

Your most valuable tool for improvement, without a doubt, is a trading journal. It’s non-negotiable. After every single session, you need to log every trade—the good, the bad, and the ugly.

Write down the setup, why you took the trade, the outcome, and—this is crucial—how you felt during the process. Were you anxious? Greedy? Impatient?

This habit of post-trade analysis turns your raw experiences into hard data. You'll start to see patterns in your performance, revealing what's working and, more importantly, shining a spotlight on the repetitive mistakes that are costing you. This feedback loop is the engine that drives real, lasting improvement.

Even with the best-laid plans, jumping into day trading is going to kick up a lot of questions. Getting straight, realistic answers is absolutely essential for managing your expectations and dealing with the inevitable bumps in the road.

Let's dig into some of the most common things new traders ask.

How Much Money Do I Really Need to Start?

This is the big one, and the answer isn't a simple number. Sure, you can open a brokerage account with just a few hundred dollars. But to really day trade the U.S. stock market, you legally need a minimum of $25,000 in your account to be classified as a Pattern Day Trader (PDT).

If you make more than three day trades in a five-day window and your account balance dips below that $25,000 mark, you'll find your account restricted. Fast.

It's for this very reason that most serious traders I know aim to start with at least $30,000. That extra $5,000 isn't for trading—it's a buffer. It means a few losing trades won't immediately knock you out of the game by dropping you below the PDT minimum.

Other markets, like forex or futures, have much lower starting capital requirements, but the principle is exactly the same. You need enough cash in your account to withstand a string of small, manageable losses without it derailing your entire trading career before it even starts.

Can I Day Trade with a Full-Time Job?

You absolutely can, but it demands a ton of discipline and a laser focus on very specific windows of opportunity. A lot of part-time traders I know concentrate only on the first hour or two after the market opens—from 9:30 AM to 11:30 AM EST.

This period is usually when the market is most alive with volume and volatility, which means more potential setups.

The trick is to treat it like a serious part-time job, not a casual hobby. You have to be 100% present during your trading window, completely free from the distractions of your day job. Trying to sneak in a trade during a work meeting is a guaranteed recipe for disaster.

There's also a growing push toward extended trading hours, which could open up more flexible options. As exchanges move closer to 24/5 operations, new trading windows might appear for those of us outside of traditional work hours.

What Are the Essential Tools for a Beginner?

It’s incredibly easy to get sucked into the vortex of flashy software, expensive subscriptions, and "guaranteed" signal services. When you're just learning how to start day trading, you only need a few core tools to be effective. Seriously.

- A Solid Brokerage Platform: Your broker is your single most important tool. You're looking for fast, reliable trade execution, good charting tools, and a high-quality demo account to practice on.

- A Real-Time Data Feed: This is non-negotiable. You need accurate, up-to-the-second price data, and that includes Level 2 quotes. Free, delayed data feeds are completely useless for day trading.

- A Trading Journal: This can be as simple as a spreadsheet or you can use dedicated software. Its purpose is to track every single trade, analyze your performance, and spot the recurring mistakes you're making. And you will make them.

That’s it. Forget the rest. Don't worry about the expensive news terminals, the black-box algorithms, or the Telegram signal groups. Your focus should be on one thing: mastering your strategy and your execution with these foundational tools.

Everything else is just noise.

At Colibri Trader, we provide the focused, price-action education you need to cut through the noise and build real, lasting trading skills. Learn more about our practical, indicator-free approach and start your journey with confidence.

Find out how we can help you at https://www.colibritrader.com.