Join Our Trading Mentorship Program for Success

Why Trading Mentorship Programs Actually Work

Imagine exploring a new city for the first time without a map or GPS. Pretty daunting, isn’t it? Trading without mentorship can feel just as overwhelming. Sure, online resources provide a basic understanding, but a trading mentorship program pairs you with an experienced guide who's already navigated the market's twists and turns. Think of it as having a local show you the hidden gems and steer you clear of the tourist traps.

This individual guidance is what makes mentorship so valuable. It's not just about learning strategies; it’s about developing the market intuition to apply them effectively. Imagine learning to play basketball. You could study the rules and watch endless games, but nothing compares to the direct feedback from a coach who can refine your technique. A mentor acts as your trading coach, providing personalized feedback based on your strengths and weaknesses.

Another key benefit of mentorship programs is the emotional support they offer, something often overlooked in trading success. Markets are volatile; losses are part of the game. A mentor serves as a sounding board, offering perspective and helping you manage the psychological rollercoaster of trading. They’ve been there, faced similar setbacks, and can offer invaluable advice on staying disciplined when things get tough. This support can be the difference between throwing in the towel after a losing streak and persevering to achieve long-term profits.

This blend of personalized guidance and emotional support is especially valuable in the fast-paced world of proprietary trading. In today’s markets, with their complex strategies and constantly shifting dynamics, mentors play a crucial role in trader development. They help traders manage risk, maintain composure under pressure, and craft effective trading plans. This accelerates the learning process, essentially distilling years of hard-won expertise into actionable lessons. Learn more about the power of mentorship in prop trading here.

Ultimately, a trading mentorship program helps you develop a resilient trading psychology, a cornerstone of consistent success. A mentor understands the mental game of trading—the doubts, the fears, and even the thrill of winning. They can help you build the mental fortitude to weather the inevitable market swings. Combining this psychological guidance with practical trading skills creates a powerful formula for long-term achievement. It’s not just about making money; it’s about building the confidence and discipline to consistently execute your plan, no matter what the market throws your way.

The Hidden Advantages That Change Everything

Beyond the allure of quick profits, a trading mentorship program offers advantages that significantly impact a trader's development. These go far beyond simply grasping technical analysis or a specific trading strategy. They delve into the psychological and emotional aspects, the often-overlooked 90% of trading that isn't about charts and indicators.

Think of it like learning to play basketball. You could study diagrams and practice dribbling alone, but without a coach's guidance, you'd miss crucial nuances like court awareness and teamwork. Similarly, a mentor helps you navigate the complexities of the trading world that go beyond the technical.

Personalized Guidance and Support

One key advantage is personalized feedback. Unlike generic online courses, a mentor tailors their advice to your individual trading style and learning pace. This focused attention accelerates your learning, allowing you to identify and correct mistakes more efficiently. For example, a mentor can help you spot hidden biases in your decision-making or identify self-sabotaging patterns hindering your progress. It’s like having a personalized training regimen crafted just for you.

Trading can be an emotional rollercoaster. Markets are inherently volatile, and losses are unavoidable. During these tough times, a mentor provides invaluable emotional support and perspective. They help you steer clear of impulsive decisions fueled by fear or frustration, and reinforce the importance of sticking to your trading plan. They're your anchor in the storm, helping you weather the market’s inevitable ups and downs. You might be interested in: Psychological Strategies for Trading Success.

Building Resilience and Accountability

Mentorship programs also foster accountability. Knowing you're answerable to someone can be a strong motivator. A mentor helps you stay committed to your goals and prevents you from deviating from your strategy after a few losing trades. This structure is especially important for new traders who haven’t yet developed the self-discipline required to navigate market volatility.

This benefit is reflected in corporate mentoring programs, where retention rates are significantly higher for participants. Mentees and mentors show retention rates of 72% and 69%, respectively, compared to 49% for employees not involved in such programs. This highlights mentorship's power in building commitment and perseverance, a principle directly applicable to the challenging world of trading. Explore more insights on mentoring and retention here.

To illustrate this point, let's compare learning to trade independently versus with a mentor:

Let’s take a look at the following table summarizing the benefits:

Benefits Comparison: Mentorship vs Self-Learning

| Learning Aspect | Self-Learning | Mentorship Program | Impact |

|---|---|---|---|

| Technical Skills | Can be learned through books, courses, etc. | Structured learning, personalized to your needs | Faster, more efficient skill development |

| Emotional Control | Difficult to manage alone | Guidance and support during challenging periods | Improved decision-making, reduced emotional trading |

| Accountability | Relies solely on self-discipline | Regular check-ins and guidance | Increased commitment, higher likelihood of sticking to the plan |

| Market Understanding | Limited to readily available resources | Access to mentor's experience and insights | Deeper understanding of market dynamics |

| Adaptability | Slow and challenging | Quicker feedback and course correction | Faster adaptation to changing market conditions |

As this table shows, a mentorship program provides significant benefits in key areas that self-learning often struggles to address. This isn't to say self-learning isn't valuable, but mentorship adds layers of support and guidance that can greatly accelerate your progress.

Beyond the Technical: Mastering the Mental Game

The true value of a trading mentorship program lies in the mentor’s understanding of the psychological challenges of trading. They've been through the sleepless nights, the self-doubt, and the thrill of winning trades. This shared experience creates a unique bond, enabling them to offer support and guidance unavailable through self-study or online courses. A mentor can provide practical techniques for managing stress, overcoming fear, and maintaining a healthy trading mindset.

By addressing the psychological aspects, a mentorship program equips you with resilience, a crucial trait for long-term success. It helps you develop the mental fortitude to withstand market swings and make rational decisions even under pressure. This resilience forms the bedrock of consistent profitability and separates successful traders from those who succumb to emotional pressures and give up.

What Makes Trading Mentorship Programs Worth Your Investment

Not all trading mentorship programs offer the same value. Some are genuinely helpful, while others can be costly mistakes. This section explores the key elements that set exceptional programs apart. We'll delve into what real, personalized coaching looks like, how an effective curriculum is structured, and why ongoing support is so vital.

Beyond Scheduled Calls: Genuine Personalized Coaching

A truly valuable mentorship program goes beyond pre-arranged calls. It's about access to a mentor who gets your individual trading style, strengths, and weaknesses. This might involve analyzing your trades together, creating strategies tailored to your risk tolerance, or even practicing live trading scenarios. This personalized approach accelerates learning and helps you develop a trading style that truly fits you. For example, a mentor might observe you hesitating to enter trades and then work with you to build your confidence in those crucial moments.

Imagine a basketball coach working with a player to improve their free throws. It's not just about telling them the mechanics; it's about understanding their specific challenges and developing drills tailored to their needs. A good trading mentor operates similarly, providing individualized guidance to address your particular trading hurdles.

Curriculum Structure: Building Skills Progressively

Effective programs structure their curriculum like building blocks, starting with fundamental concepts and gradually introducing more advanced strategies. This progressive approach ensures a solid understanding of each element before moving on, preventing overwhelm and building confidence. It’s like learning to cook – you wouldn’t attempt a complex soufflé before mastering basic knife skills. 10 Fatal Mistakes Traders Make provides further insights into avoiding common trading pitfalls.

Ongoing Support: The Real Value Proposition

Flashy introductory sessions might be appealing, but the real value of a mentorship program comes from the ongoing support it provides. Markets change constantly, and traders inevitably face periods of uncertainty. A reliable support system through regular check-ins, Q&A sessions, and community forums can be essential during these times. This continuous mentorship offers reassurance and guidance to stay focused and navigate market fluctuations.

Spotting Red Flags and Asking the Right Questions

When choosing a program, look beyond marketing hype. Be cautious of programs guaranteeing profits or minimizing the inherent risks of trading. Instead, focus on programs emphasizing risk management, realistic expectations, and personalized guidance. Ask crucial questions: What's the mentor's trading experience? How is the curriculum designed? What kind of ongoing support is offered? These questions will help you assess the program's true worth and make a sound decision. Finding the right program is an investment in your trading future.

Adapting to Different Styles and Experience Levels

A quality mentorship program recognizes that there's no one-size-fits-all approach. It adapts to different trading styles and experience levels. Whether you’re a day trader focused on short-term price movements or a swing trader taking a longer-term view, the program should provide tailored guidance. This includes recognizing that beginners need more foundational support, while seasoned traders may benefit from advanced strategies and mentorship focused on refining existing skills. The program should be flexible enough to nurture individual growth within a structured framework.

Finding Your Perfect Trading Mentorship Match

Choosing the right trading mentorship program can be overwhelming. With so many options out there, it’s easy to get lost in the noise. Think of it like trying to pick a restaurant in a new city – lots of menus, lots of promises, but how do you know which one will actually deliver a great meal? This section provides a roadmap to help you navigate the options and find the program that truly aligns with your needs.

We’ll explore how to assess your current skills, identify your learning gaps, and match those gaps with the right program’s strengths. It's about finding the perfect fit, just like choosing the right pair of shoes. You wouldn't wear running shoes to a formal event, right?

First, take an honest look at your trading skills. Are you a complete novice, just dipping your toes into the market? Or do you have some experience under your belt, perhaps a few trades executed, some wins, some losses? This self-assessment is like laying the foundation of a house – crucial for building something solid and stable.

Knowing where you stand is the first step. Next, identify where you need to improve. Are you struggling with managing risk, like knowing how much to invest in each trade? Do your emotions get the best of you, causing you to make impulsive decisions? Or maybe you have a solid strategy, but applying it consistently is a challenge. Pinpointing these weaknesses allows you to focus on programs designed to strengthen those specific areas.

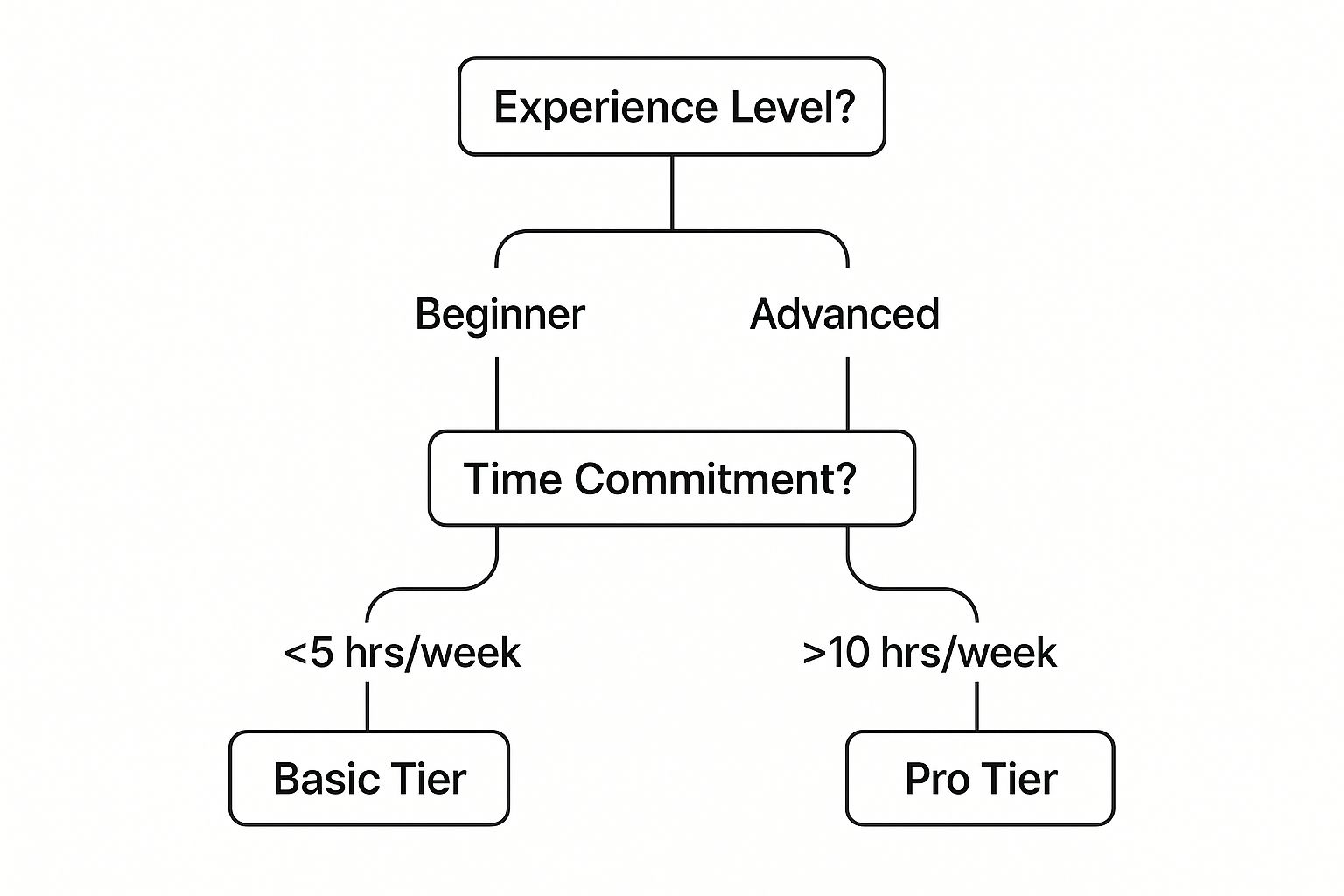

This infographic provides a visual guide to choosing the right program tier based on your experience and available time. Think of it as a decision tree. If you're a beginner with limited time, a basic tier might be the perfect starting point. But if you're an experienced trader ready to invest significant time, a pro tier could offer the depth you seek. The key is to find the tier that aligns with your individual circumstances.

Evaluating Mentors and Program Structures

Don’t be fooled by flashy profit screenshots. Those can be misleading, like judging a book by its cover. Instead, delve into the mentor's trading history. Look for a verifiable track record – consistent performance over time, not just a few lucky wins. Also, consider their teaching style. Does it click with your learning preferences? A successful trader isn’t automatically a great teacher, just as a star athlete isn't always a great coach.

Program structures also vary. Some emphasize group sessions, fostering a sense of community and shared learning. Others prioritize one-on-one coaching, offering personalized feedback and tailored guidance. It’s like choosing between a group fitness class and a personal trainer. Both have benefits, but one might be a better fit for your personality and learning style.

Calculating ROI and Asking Tough Questions

Think about the true return on investment (ROI). This goes beyond the program fee. Consider the opportunity cost – the value of the time you're investing. A more expensive program with intensive support might offer a higher ROI than a cheaper program with limited interaction. It’s like comparing a short, expensive flight to a longer, cheaper one with multiple layovers – the quicker option might be worth the extra cost in terms of time saved.

Before making a decision, don't be afraid to ask tough questions. What’s the mentor’s trading methodology? What kind of support is provided after the initial training? How flexible is the program in accommodating different trading styles? These questions are like due diligence before a big purchase. The answers will reveal the program's true value and help you steer clear of potential pitfalls.

To help you compare programs systematically, let's use a framework called the Program Selection Criteria Matrix. This matrix allows you to weigh different factors according to their importance to you.

Program Selection Criteria Matrix

A comprehensive evaluation framework for comparing different trading mentorship programs

| Criteria | Weight | Program A | Program B | Program C |

|---|---|---|---|---|

| Mentor Experience | 5 | High | Medium | Low |

| Program Structure | 4 | Group | 1-on-1 | Group |

| Post-Training Support | 3 | Limited | Extensive | Medium |

| Cost | 2 | High | Medium | Low |

| Adaptability to Styles | 1 | Low | Medium | High |

This table highlights the strengths and weaknesses of different programs across various criteria. For example, while Program A boasts high mentor experience, it lacks post-training support and adaptability. Program B offers a good balance, but its cost might be a deterrent. Program C is the most affordable and adaptable, but its lower mentor experience might be a concern for some.

By using this matrix, you can clearly see how programs stack up against your priorities. Remember, the "perfect" program is subjective and depends on your individual needs and preferences. This matrix helps you make an informed decision, ensuring the program you choose aligns with your trading goals.

Your Trading Mentorship Journey: What Really Happens

Understanding what a trading mentorship program really entails is key to setting realistic expectations and getting the most out of your investment. Think of it like planning a cross-country road trip: you have your destination in mind, but the actual journey will likely involve unexpected detours, breathtaking views, and maybe even a flat tire or two. This section offers a realistic look at what you can expect during those first few weeks, the exciting "aha!" moments, and the inevitable challenges of a trading mentorship program.

The Initial Stages: Building the Foundation

Your first few weeks will likely be focused on building a solid foundation. This means getting to know your mentor, understanding their trading philosophy, and honestly assessing your own strengths and weaknesses. It's similar to meeting with a personal trainer for the first time. They'll evaluate your current fitness level, discuss your goals, and create a personalized workout plan. Likewise, your mentor will gauge your trading knowledge, understand your aspirations, and help you develop a personalized trading plan. This initial phase is crucial for setting the tone for your entire mentorship.

Your mentor might ask you to analyze past trades, discuss your risk tolerance, and clearly define your trading goals. This helps them understand your current skill level and chart a path for your development. Expect to absorb new information, familiarize yourself with the program's resources, and maybe even feel a little overwhelmed – these are all perfectly normal parts of the initial learning curve.

Breakthroughs and Challenges: Navigating the Market's Terrain

As you move through the program, you'll experience moments of clarity – those "aha!" moments where concepts suddenly click. These breakthroughs might happen during a mentoring session, while reviewing a trade, or even during live market hours. You might finally grasp the nuances of a specific trading pattern or figure out how to manage your emotions during a losing streak. These are the milestones that mark your growth as a trader.

But the path to trading success isn't always smooth. There will be times of frustration, self-doubt, and even some losses. These challenges are a natural part of the learning process. Think of them as the uphill climbs on your road trip; they might be tough, but they offer incredible views once you reach the top. Your mentor will be there to support you through these challenging times, providing guidance and encouragement to help you keep going. You might be interested in: The 5 Pillars of Successful Trading.

Communication and Application: Making the Most of Your Mentorship

Open communication is vital for a successful mentorship. Don't hesitate to ask questions, share your concerns, and seek clarification when needed. The more open and honest you are with your mentor, the more you'll gain from the program. Think of your mentor as your co-pilot on this trading journey. Regular communication ensures you're both on the same page and moving in the right direction.

Putting your mentor's guidance into action in live market conditions can be daunting at first. It's like taking the training wheels off your bike—there’s a natural hesitation, a fear of falling. But with practice and your mentor's support, you’ll gradually gain the confidence to execute trades on your own. This transition from guided learning to independent trading is a major step in your mentorship journey.

Building a Productive Mentorship Dynamic

The most successful mentorships thrive on mutual respect, trust, and open communication. Both mentor and mentee play an active role in creating this positive dynamic. Mentees should proactively prepare for sessions, set clear goals, and seek feedback. Mentors, in turn, should provide honest evaluations, offer constructive criticism, and create a supportive learning environment. This collaborative approach ensures that both parties benefit from the relationship and achieve their goals.

By understanding the different phases of a trading mentorship program, you can approach the experience with realistic expectations and a proactive mindset. Remember, it's a journey, not a race. Embrace the challenges, celebrate the wins, and use your mentor's expertise to unlock your full trading potential.

Real Transformations: Trading Mentorship Success Stories

So, you're intrigued by the idea of a trading mentorship program, but wondering if the hype is real? The best way to cut through the noise is to hear from traders who have walked the walk. This section dives into their real-world experiences, exploring the growth factors and the hurdles they conquered. Forget the glossy brochures – these are honest accounts of the challenging, and often messy, path to consistent profitability.

From Struggling Trader to Consistent Success

These stories often mirror a familiar pattern: the transition from struggling newbie to confident trader. Take Sarah, for example. She initially wrestled with emotional trading, making impulsive decisions that sabotaged her results. Through mentorship, she learned to manage her emotions and develop a disciplined trading plan.

Or consider John, who jumped from one strategy to another, never quite finding his footing. His mentor helped him identify a trading style that clicked with his personality and risk tolerance. These personal journeys show how mentorship can be tailored to address individual trading challenges.

These aren’t just vague success stories either. They get into the specifics: the strategies, the mindset shifts, and the real-world applications that separated those who persevered from those who threw in the towel. You might hear about how one trader learned to spot key support and resistance levels, while another shares how they conquered the fear of missing out (FOMO). These concrete examples offer priceless lessons.

The Power of Shared Experience

These success stories also underscore the importance of human connection in trading. Having a mentor who gets the emotional roller coaster of the market – the self-doubt, the fear, the thrill of victory – can be a game-changer. This echoes the widespread adoption of mentoring in other fields.

Did you know that as of 2025, 98% of U.S. Fortune 500 companies had mentoring programs, with 100% of the top 50 utilizing this approach? This speaks volumes about the recognized value of mentorship in fostering growth and resilience across diverse industries. Discover more insights.

Learning from Mistakes and Breakthroughs

These narratives aren't just about wins. They also explore the mistakes traders made along the way, providing invaluable learning opportunities. Hearing how someone overcame a specific challenge, like overleveraging or ignoring risk management, can be far more impactful than reading it in a textbook. This real-world perspective is often missing from polished marketing materials.

Developing Your Own Trading Edge

By examining these real transformations, you get a clearer picture of what a trading mentorship program can offer. It’s not about mimicking someone else’s methods. It’s about applying the principles of mentorship to craft your own unique trading style. These success stories provide a roadmap, not a rigid rulebook, for navigating the complexities of the market and achieving your trading goals. They empower you to learn from the experiences of others and chart your own course to success.

Maximizing Your Trading Mentorship Program Investment

Joining a trading mentorship program is a big commitment. It's like signing up for personal training at the gym. You have access to expert advice and resources, but your success depends on your own effort and dedication. So how do you make the most of this investment?

Preparing For Sessions: Laying the Groundwork

Just as you wouldn't walk into an important meeting empty-handed, you shouldn't enter a mentoring session without a clear plan. Before each session, take some time to pinpoint the questions you want answered. Review your recent trades, identify your wins and losses, and think about any roadblocks you've encountered. This focused approach ensures you get personalized guidance and make the most of your mentor's time.

For example, if you're struggling with trade entries, bring specific examples of trades you missed and explain your hesitation. This allows your mentor to diagnose the root cause and offer tailored solutions. Think of it like a doctor's appointment – the clearer you are about your symptoms, the better the diagnosis and treatment.

Tracking Your Development: Measuring What Matters

Tracking your progress is essential. While profit and loss are important, they don't tell the whole story. Other key performance indicators (KPIs), like your win rate, average trade duration, and risk-reward ratio, provide a more complete picture. These metrics reveal hidden strengths and weaknesses in your trading style.

Think of a basketball player who only focuses on points. While scoring is crucial, assists and rebounds contribute significantly to overall success. Similarly, focusing solely on profits can be misleading in trading. Analyzing other KPIs gives you a deeper understanding of your performance and areas for improvement.

Maintaining Momentum: Navigating the Rough Patches

Trading can be a rollercoaster. There will be inevitable downswings and moments of frustration. During these challenging times, your mentor becomes a crucial support system. They can provide perspective, suggest adjustments, and help you stay on track with your trading plan. They're like an experienced Sherpa guiding you through a difficult mountain climb, helping you navigate obstacles and reach your destination.

Building Confidence and Independence: Graduating from Mentorship

The ultimate goal of a mentorship program is to equip you with the skills and confidence to trade independently. This involves a gradual shift from relying on your mentor's guidance to making your own decisions. Think of it as learning to ride a bike. You start with training wheels, but the goal is to ride solo.

This transition means taking more ownership of your trades, proactively seeking feedback, and progressively reducing your dependence on direct input. Signs of readiness for independence include consistent application of your trading plan, effective emotional management, and a solid understanding of risk management principles.

When you reach this stage, you'll have the tools and confidence to navigate the markets with autonomy, knowing you have the foundation for consistent success. This is the true value of investing in a trading mentorship program.

Ready to elevate your trading? Visit Colibri Trader today and explore our range of programs designed to help you achieve consistent success.