Intraday Trading: A Quick Guide for Beginners to Navigate the Fast-Paced World of Financial Markets

Intraday trading offers aspiring traders a gateway to engaging dynamically with near-term market movements.

Gain an edge by understanding its strategies, tools, and discipline required to thrive in this high-octane environment.

Visions of fortune-building lure new traders to markets, attracted by stories of intrepid day traders capitalizing on short-term fluctuations across stocks and futures.

But beneath the veneer of get-rich hype lies an intricate craft requiring steel nerve and ice-cold discipline.

Master its essence, though, and intraday trading unlocks a thriving express lane through the financial highway for those willing to take the wheel.

This guide lights the way for beginners seeking to navigate the fast lane safely.

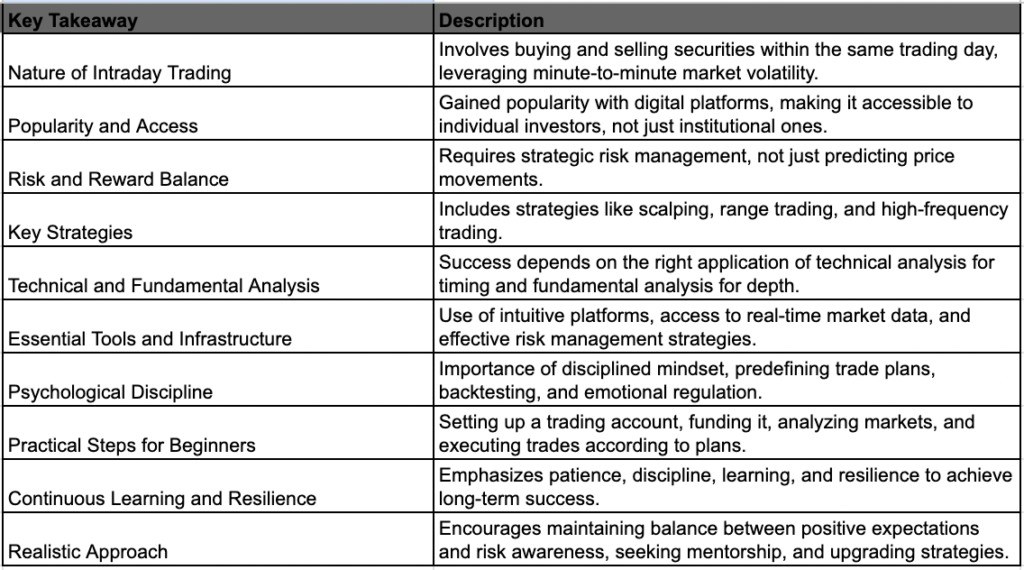

Here are the key takeaways from this article👇

Introduction

Intraday trading has surged in popularity over the last decade, with digital platforms enabling easy access for individual investors to trading domains once reserved for institutional participants.

The ability to profit from minute-to-minute volatility captures imagination.

While the lack of formal barriers to entry seems promising for democratizing finance, caveat emptor prevails.

Glory stories publicized routinely obscure the sophistication behind consistent profitability.

Success relies on strategically applying tools for risk management, not just predicting price movements.

This overview covers everything from core concepts to essential psychology for intraday trading while unveiling common pitfalls.

Embrace the vision but discipline the mind.

Opportunity awaits!

Delving into the Fundamentals of Intraday Trading

Intraday trading, true to its name, involves opening and closing positions in a security within the same trading session.

Traders attempt to profit from narrow bid-ask spreads and short-term price fluctuations driven by volatility over the trading day.

It differs from other trading styles thus:

- Swing Trading – Swing trading holds positions from days to weeks, focusing on technical analysis to ride price trends.

- Position Trading – Position trading entails holding stocks, options, or futures from weeks to months targeting larger movements.

Now let’s explore popular intraday strategies:

- Scalping – Scalpers attempt to profit from fleeting micro-moves in price, utilizing large position sizes to multiply small per-share gains.

- Range Trading – Range traders target to buy near support and sell near resistance levels of identified price ranges.

- High-Frequency Trading – Utilizing algorithmic systems, HFTs transact large order flows in milliseconds benefiting from latency arbitrage.

The thrill of capitalizing from market volatility in hours rather than years charges the atmosphere.

Are you ready?

Let’s continue!

Understanding the Trading Landscape

Success requires applying the right tools at the right moments.

For intraday traders, technical analysis takes precedence for timing entries and exits during compressed holding periods while fundamental analysis provides depth.

- Technical Indicators help assess overbought/oversold conditions and emerging price momentum using mathematical formulas to forecast potential reversals.

- Chart Patterns like wedges, triangles, and double tops indicate potential breakouts, providing advanced warning of imminent movements.

- Fundamental Analysis evaluates financial statements, management changes, competitive positioning, and macro conditions to determine valuation.

Combining these approaches enables trading opportunistically while avoiding risky assets.

Now let’s prepare you to take action and manage risk.

Equipping Yourself with the Tools of the Trade

Beyond analysis skillsets, tactical access to trading infrastructure remains vital:

- Trading Platforms – Easy-to-use intuitive platforms like MetaTrader facilitate opening accounts, analyzing charts, backtesting strategies, and executing orders rapidly across asset classes.

- Market Data – Subscription services like Bloomberg and Refinitiv Eikon provide streaming worldwide exchange data for intraday monitoring. Access real-time quotes, breaking news, advanced analytics, and alt data feeds.

- Risk Management – Employ stop losses, position size limits, and diversification across uncorrelated assets to minimize volatility drawdowns. Adhere strictly to loss-cutting rules.

Now armed with an execution toolkit, developing optimal mental frameworks cements your foundation.

Developing a Disciplined Trading Mindset

Success in intraday trading relies substantially on psychology and emotion regulation during high-pressure decisions:

- Predefine Trade Plans – Employ written strategies delineating asset selection, entries/exits, position sizing, and loss limits aligned to account size and risk appetite.

- Refine Through Backtesting – Utilize historical data on trading platform simulators to repeatedly test and optimize strategy effectiveness across diverse market conditions.

- Cultivate Discipline – Foster discipline by sticking to risk/reward ratios despite temptation to bet larger hoping for turnarounds. Reign in emotions that derail rules.

Now let’s pull all these tools together and enter the trading arena!

Embarking on the Intraday Trading Journey

Follow these steps to launch your intraday trading endeavors:

- Open Trading Account – Establish a brokerage account with a reputable platform, providing access to markets with minimal latency.

- Fund Account – Transfer adequate risk capital into account using wire transfer or e-wallet to begin trading based on strategy requirements. Start small!

- Analyze Markets – Utilize technical indicators, chart patterns, and research fundamentals to identify trading opportunities suiting your strategy.

- Place Orders – Input buy/sell orders for selected assets using trading ticket functionality and execute per plan rules.

Through accumulated screen time and trading experience, your competency and consistency will compound over time.

Stay hungry for expanding capabilities!

Conclusion

Hopefully, this guide illuminated intraday trading, dispelling hype while framing practical realities all beginners face.

Embrace patience and discipline while rejecting impulsive decisions. Commit to continuous incremental progress above all else.

Remember, 90% of new traders fall prey to common psychological pitfalls and under-preparedness – don’t become a casualty by internalizing the lessons here.

Mature trading skills take time and resilience. But the paradigm shifts possible make it profoundly worthwhile!

Ready to continue your journey?

Approach trusted mentors, keep researching diverse strategies, and never stop learning. Maintain positive expectations balanced with risk awareness.

You’ve got this! Now boldly chart the course towards trading mastery one step at a time.

Onward and upward!

Happy trading,

Colibri Trader

P.S.

Did you read this extensive article on the Pros and Cons of Day Trading?