The Great Debate: Swing Trading vs Day Trading

The fast-paced world of active trading strategies like swing trading and day trading tantalizes newcomers with fortunes made in minutes. But peeling beyond the veneer of get-rich promises reveals a reality where disciplined risk management and emotional resilience determine success.

Both swing trading and day trading offer alluring potential, yet each demands a specific mindset and methodology to master. This raises an eternal question that ignites heated debate – which active trading style ultimately proves more profitable?

We will dive into the intricacies of swing trading vs day trading to reveal the truth.

By scrutinizing how both approaches utilize volatility, leverage risk/reward ratios and leverage to generate returns, the puzzle pieces fall into place!

Introduction

Digital trading platforms have recently opened access for self-directed beginners to short-term trading approaches like swing trading and day trading. Their surge in popularity fuels fantasies fanned by financial influencers and brokerage ads promising effortless profits.

Beneath the slick veneer perpetuating this mythology though lie nuanced skillsets combining analytics, risk management, and psychology mastery honed over years through brutal trial-and-error.

At their core, swing trading and day trading both aim to systematically profit from short-term price fluctuations in equities and other liquid markets.

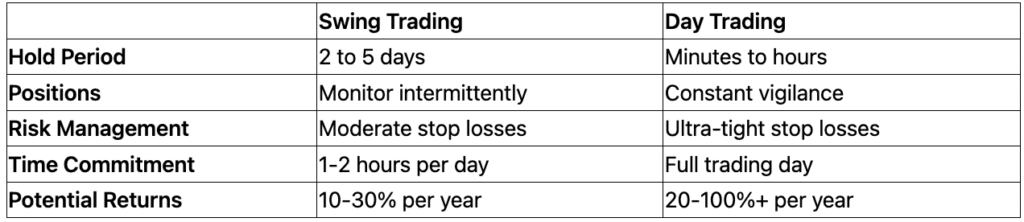

However, stark differences in their holding periods, time commitments, and risk tolerances upend conventional wisdom on comparative profitability.

To settle the debate, let’s dive into the data.

Swing Trading: Riding The Market Waves

Swing trading sits between passive investing and intensive high-frequency day trading.

Position holding periods range from several days to weeks with the objective of capturing gains from short-term swings in stock or options prices.

Swing traders analyze technical chart patterns, price data, and market news flow to strategically time entries and exits as trends emerge, pivot, or retrace.

Three factors distinguish swing trading from buy-and-hold investing:

- Risk-Reward Ratios – Swing traders utilize wider stop losses allowing higher reward potential from extended upside price moves.

- Momentum Trading – Breakouts from key support/resistance levels often prelude accelerated moves which swing traders capitalize on.

- Market Timing – Combining technical and fundamental analysis provides an edge in anticipating inflection points in price moves.

For methodically timing markets amid volatility without full-time dedication, swing trading offers an appealing balance. Now let’s see how day trading compares.

Day Trading: Surfing Intraday Market Moves

Day trading involves holding open positions only within a single trading session, never overnight. Leveraging margins provided by brokers, day traders aim to profit from intraday stock price movements triggered by news events, earnings data, and macroeconomic forces.

Three factors distinguish day trading from swing trading:

- High Leverage – Day trading enables controlling large position sizes with limited capital through margin trading.

- Frequency – New profit opportunities emerge every minute as prices fluctuate intraday.

- Ultra-short Hold Times – Modern trading platforms facilitate entering and exiting positions in seconds thanks to real-time data flows.

Thus day trading presents tremendous profit potential thanks to volatility, margin-enabled scale, and immediacy in execution.

But don’t be fooled – success requires intense commitment!

Evaluating Profitability: Swing Trading vs Day Trading

Having explored their core mechanisms independently, let’s now contrast swing trading and day trading head-to-head addressing the pivotal question of profitability:

Given its extreme time demands, day trading clearly offers greater profit potential than swing trading on paper. However, realized profitability depends substantially on risk planning, fees, and consistency.

The Profitability Puzzle Solved

Raw return metrics reveal little about actual profit drivers in swing trading vs day trading. Three crucial yet underappreciated determinants of profitability hold the key:

- Risk Management

- Surviving market volatility requires predefining acceptable loss per trades and total portfolio drawdown based on account size.

- Adhering strictly to loss-cutting rules matters more than chasing perfect entries or exotic indicators.

- Swing traders risk 1-3% per trade with ~30% total account drawdowns. Day traders risk less than 1% targeting ~15% portfolio drawdowns through ultra-tight stop losses.

- Uncompromising discipline to cut losses quickly and let winners ride enables long-term success.

- Trading Psychology

- No trader escapes the emotional rollercoaster of wins and losses.

- Maintaining focus by confidently sticking to risk rules during major swings requires tremendous mental resilience.

- Reigning in greed and fear catalyzes continuous improvement.

- Consistency

- Scaling profitably relies on consistent execution of trading plans, not sporadic lucky wins.

- This demands immense patience during inevitable losses without emotional decisions jeopardizing long-term progress.

- By benchmarking overall performance across hundreds of trades, temporary setbacks normalize. Consistency emerges from sound strategies executed with metronomic regularity.

Conclusion: Embrace the Challenge

While the appeal of swing trading and day trading is easily understood, concealed dangers trip most beginners drawn in by fantasies of quick riches. Sustainable success relies on skills developed through years of dedication – neither enables profits overnight.

The myth alluring legions of ill-prepared traders exploits those lured into markets without balanced expectations around risk techniques, emotional discipline, and consistent rule execution required.

But significant rewards await those willing to honor the risk/reward bargain.

Whether swing trader or day trader, commit to continuous skills improvement guided by data-driven performance analysis while tempering greed triggers that derail progress.

Mature trading psyches embrace losses as tuition on the path to mastery.

Now prepared for the challenge? Approach seasoned mentors for guidance in planning risk parameters, strategy selection, and realistic goal setting essential to long-term profitability.

Master markets with mindfulness…then unlock your potential!