Swing Trading for Dummies: Easy Strategies for Beginners

The Swing Trader’s Edge: Why This Strategy Works

Swing trading offers a compelling balance between the fast-paced nature of day trading and the long-term perspective of buy-and-hold strategies. This means you can potentially profit from market movements without constant monitoring. For example, a swing trader might hold a position for several days or weeks, aiming to capitalize on a predicted price swing within that period. This approach allows for greater schedule flexibility, making it suitable for individuals with other commitments.

Balancing Profit and Time

A key advantage of swing trading is its potential to capture significant price changes without requiring excessive time spent watching the market. This is particularly beneficial for those balancing trading with work or other obligations. Additionally, holding positions for longer durations compared to day trading minimizes the effects of transaction costs.

However, swing trading still necessitates dedicated time for analysis and research. New traders often encounter obstacles. It’s crucial to research common missteps and learn how to avoid them.

Capitalizing on Market Swings

Swing trading seeks to profit from the natural fluctuations of market prices. Traders identify swing highs and swing lows, aiming to buy near support levels and sell near resistance levels. This strategy takes advantage of the tendency for prices to move back and forth within larger trends.

For example, a trader might buy a stock after a price drop, anticipating a rebound to its previous high. This is a classic swing trading scenario, highlighting the importance of understanding technical analysis and chart patterns.

Market Conditions and Swing Trading

Market volatility is essential for successful swing trading. One compelling aspect of swing trading relates to mean reversion tendencies in major markets. For instance, since 1980, buying the S&P 500 after a 5% dip from recent highs has historically resulted in a median return of +6% over the following three months, with an 84% probability of a positive return.

This effect can be even more pronounced after larger corrections. For example, 10% pullbacks have often been followed by positive returns, although with a lower success rate, particularly if accompanied by recession concerns.

Therefore, understanding and adapting to current market conditions is vital for effective swing trading. This underscores the importance of continuous learning and adapting one’s strategy.

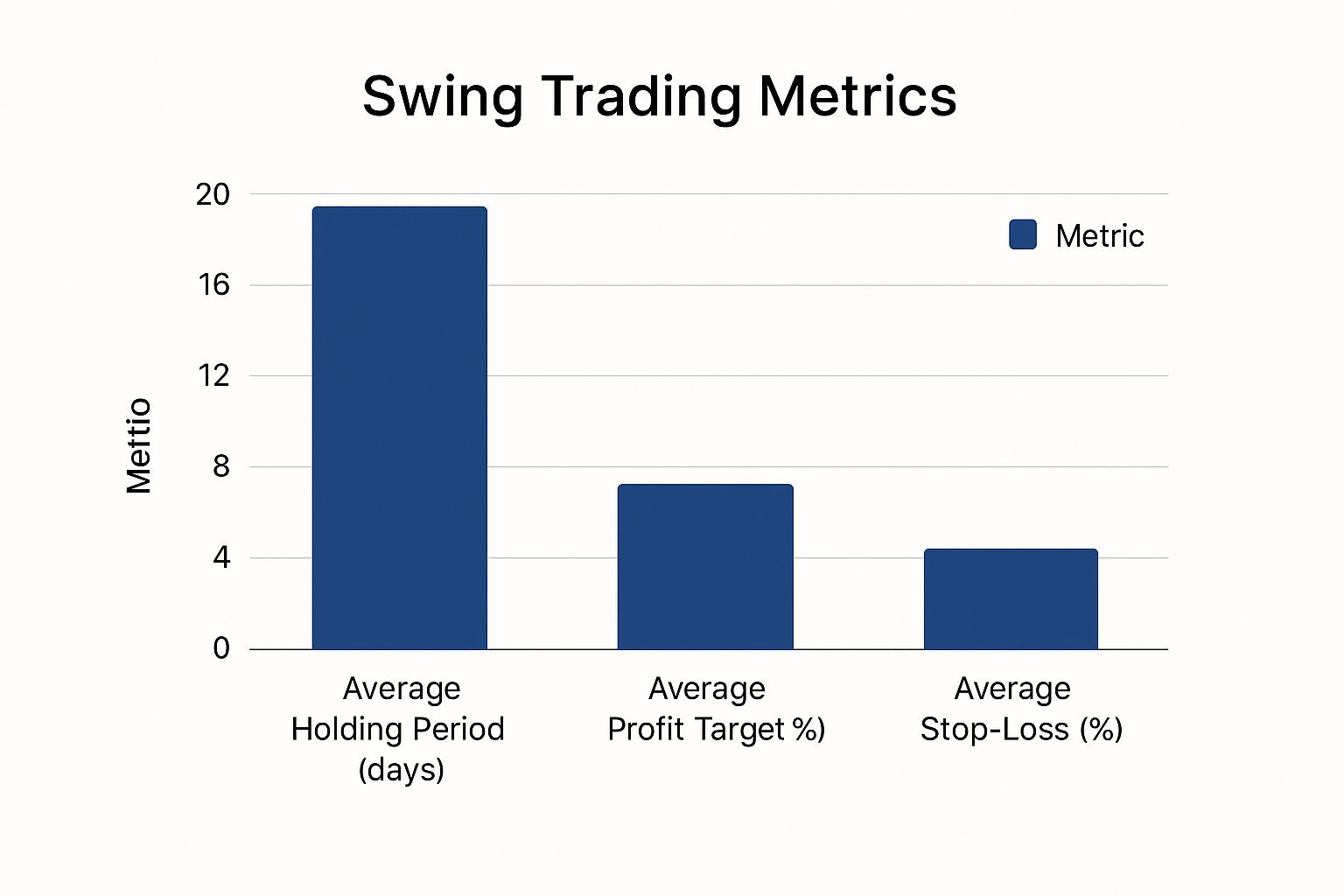

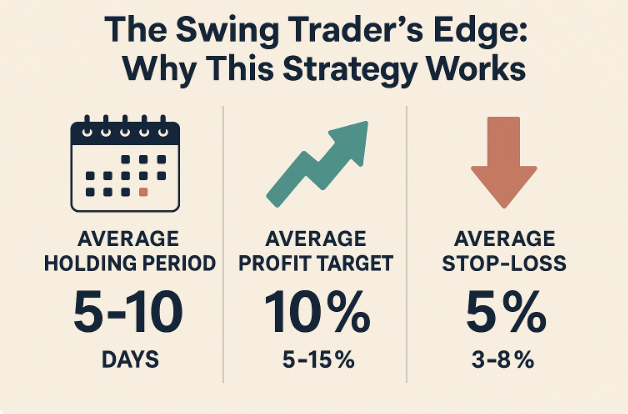

Essential Tools That Actually Move the Needle

The infographic above gives a quick overview of three key swing trading metrics: average holding period, average profit target, and average stop-loss. You can see that the average holding period is typically around 5-10 days, with profit targets in the 5-15% range, and stop-losses generally set between 3-8%. This visualizes the balance swing traders strive for – managing risk while allowing for moderate price swings to generate profit.

Effective swing trading goes beyond basic chart reading. It requires a combination of technical indicators and insightful analysis tools. Think of it like a skilled carpenter needing both the proper saws and the knowledge of how to wield them. Let’s delve into some essential tools for the aspiring swing trader.

Chart Patterns: Reading the Market’s Story

Chart patterns, such as the head and shoulders or double bottoms, provide a visual representation of recurring price actions. These patterns can offer clues about potential trend reversals or continuations. For instance, a head and shoulders pattern might suggest an upcoming downtrend. On the other hand, a double bottom formation could hint at a possible upward reversal.

Recognizing these patterns enables traders to anticipate market direction and enhance their trading decisions.

Momentum Indicators: Measuring the Speed of Price Change

Momentum indicators, like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), measure the velocity and magnitude of price fluctuations. For example, an RSI reading above 70 usually suggests an overbought market, hinting at a possible pullback. Conversely, an RSI below 30 often signals an oversold market, potentially leading to a rebound.

These indicators help swing traders assess trend strength and identify potential entry and exit points.

Volume Analysis: Confirming the Conviction

Volume analysis is crucial for validating the robustness of a trend. High trading volume accompanying price increases indicates strong buyer interest. Conversely, low volume during declines can point to weakening selling pressure. Volume acts as a confirmation tool, supporting or challenging signals from other indicators. Integrating volume analysis into your swing trading strategy can enhance your trading confidence.

Market Conditions: Riding the Waves of Volatility

Favorable market conditions play a significant role in swing trading success. Sideways markets, characterized by volatility in both directions, present excellent opportunities. This price fluctuation around a central value provides numerous swing trading setups. In such conditions, traders can often hold positions with a reduced risk of substantial losses. Learn more about market conditions and swing trading.

Putting It All Together: Creating a Powerful Trading System

Combining chart patterns, momentum indicators, and volume analysis allows swing traders to view the market from multiple perspectives. Imagine spotting a bullish chart pattern backed by increasing volume and a positive MACD crossover. This confluence of signals significantly strengthens the likelihood of an upward swing.

To further aid in your understanding of these key indicators, the following table provides a comparison:

To better understand the combined power of these indicators, let’s explore a comparison of their strengths, weaknesses, and ideal use cases in swing trading.

Essential Swing Trading Indicators Comparison: This table compares important technical indicators for swing traders, highlighting their strengths, weaknesses, and best usage scenarios.

| Indicator | Best For | Timeframe | Reliability | Common Pitfalls |

|---|---|---|---|---|

| Chart Patterns (e.g., Head and Shoulders, Double Bottom) | Identifying potential trend reversals and continuations | Any (Daily and Weekly preferred) | Moderate (Confirmation from other indicators recommended) | Subjectivity in identification, false signals |

| RSI | Identifying overbought and oversold conditions | Any | Moderate (Use with other indicators for confirmation) | False signals in strong trending markets |

| MACD | Identifying trend changes and momentum shifts | Any | Moderate (More effective in trending markets) | Lagging indicator, can provide late signals |

| Volume Analysis | Confirming trend strength and identifying potential breakouts | Any | High (Especially when combined with price action and other indicators) | Difficult to interpret in isolation |

By understanding the nuances of each indicator, swing traders can make more informed decisions. The goal is to develop a robust trading system that integrates multiple tools, enabling you to identify and capitalize on profitable swing trades with greater confidence.

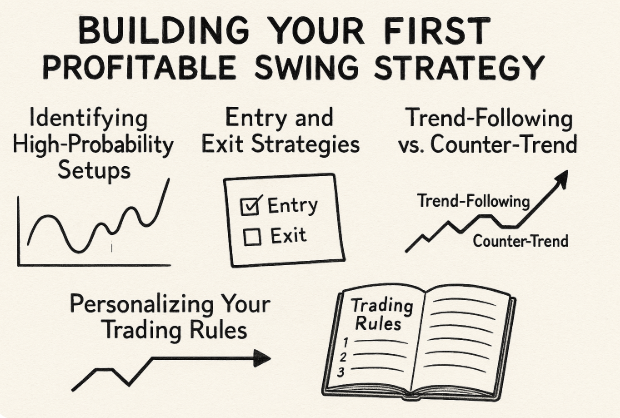

Building Your First Profitable Swing Strategy

This section offers a practical guide to developing a winning swing trading strategy. We’ll move beyond theory and delve into specific techniques for spotting opportunities, timing entries, and planning exits. This structured approach helps eliminate guesswork and emotional decision-making from your trading.

Identifying High-Probability Setups

A profitable swing trading strategy starts with recognizing high-probability setups. This involves analyzing both trending and ranging markets.

In trending markets, we look for pullbacks within the prevailing trend. These pullbacks can offer excellent entry points with positive risk-reward ratios. For instance, in an uptrend, we might buy during a temporary dip, expecting the upward trend to continue. Conversely, in a downtrend, we might seek short-selling opportunities during brief upward rallies.

Ranging markets offer a different set of opportunities. Here, prices fluctuate between defined support and resistance levels. The strategy involves buying near support and selling near resistance, profiting from these predictable price swings. This approach is especially helpful when markets lack a clear direction. Proper identification is key for successful entry and exit strategies.

Entry and Exit Strategies

Timing is everything in swing trading. Precise entries and exits maximize gains and minimize losses.

In trend-following strategies, we use technical indicators like moving averages to pinpoint entry points during pullbacks. Just as important, we establish clear exit strategies before entering any trade. This includes setting profit targets and stop-loss levels. Profit targets dictate when to close a winning position to lock in profits. Stop-loss orders automatically close trades if the market moves against us, protecting us from large losses. This pre-planning prevents emotional reactions to market volatility. Effective time management is also crucial. Many swing traders use tools and techniques to improve their efficiency, much like the productivity tips outlined in this guide: Essential Tools and Techniques.

Trend-Following vs. Counter-Trend Strategies

There are two primary swing trading approaches: trend-following and counter-trend.

Trend-following strategies, as the name suggests, aim to capitalize on established trends by entering trades in the direction of the prevailing market movement. This approach leverages the momentum of the market. Counter-trend strategies, however, seek to profit from short-term reversals within a trend, meaning trades are entered against the prevailing trend. Each approach has pros and cons; the best one depends on your risk tolerance and current market conditions. For beginners, trend-following can be easier to understand. Counter-trend strategies offer potentially higher profits if timed correctly, but they also come with greater risk.

Personalizing Your Trading Rules

Every swing trader is unique. Creating personalized trading rules that fit your risk tolerance and time constraints is critical.

This means determining your acceptable risk per trade, often 1-2% of your total trading capital. This disciplined approach helps manage potential losses and safeguards your account. It also involves establishing a realistic trading schedule. Some traders may prefer a daily check-in, while others can dedicate more time. The key is a sustainable plan you can consistently follow without feeling overwhelmed. This personalized approach ensures your swing trading strategy aligns with your individual needs.

Risk Management: The Real Secret to Longevity

New swing traders often fixate on finding the perfect entry point. However, seasoned traders know that true success lies in robust risk management. This involves safeguarding your capital during market fluctuations. It requires meticulous position sizing, strategic stop-loss orders, and well-defined risk-reward parameters. Moreover, managing the psychological aspects of trading – handling losses and staying disciplined – is paramount.

Position Sizing: Protecting Your Capital

Position sizing involves determining the optimal amount of capital to allocate to each trade. This critical step helps prevent substantial losses from crippling your trading account. A common rule for beginners is to risk no more than 1-2% of your account balance on any single trade.

For instance, with a $10,000 account, a 1% risk equates to a maximum loss of $100 per trade. This measured approach promotes longevity in the markets, even during drawdowns.

Stop-Loss Orders: Your Safety Net

Stop-loss orders are automated orders that limit potential losses by automatically closing a trade when a security’s price hits a predetermined level. They function as a safety net, shielding your capital from unforeseen price plunges. This allows you to mitigate losses while preserving the potential for gains.

Proper stop-loss placement is crucial for swing traders. Placing them too tight can lead to early exits from winning trades due to normal market oscillations. Conversely, setting them too wide can expose you to excessive losses.

Risk-Reward Ratio: Balancing Potential Profit and Loss

The risk-reward ratio assesses the potential profit of a trade against its potential loss. This crucial calculation helps evaluate a trade’s viability. A higher risk-reward ratio is generally preferred, indicating a greater potential return relative to the risk undertaken.

For example, a 3:1 risk-reward ratio signifies a potential $3 profit for every $1 risked. Successful swing traders carefully analyze risk-reward ratios before entering trades. Another important factor is the success rate. Anecdotal evidence suggests win rates between 75% and 84% for experienced swing traders. However, the actual success rate across all investors can be considerably lower, with returns typically ranging from 12% to 45% per trade.

The Psychology of Winning: Mastering Your Mindset

While technical analysis and strategy are essential, the psychological aspects of trading are equally vital for long-term success. This involves controlling emotions, maintaining discipline, and processing losses effectively. The ability to remain composed under pressure, adhere to your trading plan, and learn from both wins and losses sets successful swing traders apart.

For instance, objectively reviewing a losing trade without emotional bias can provide valuable lessons and prevent repeating past errors. This ongoing process of learning and adapting is key to consistent profitability.

Finding Prime Opportunities Without Endless Screening

Profitable swing trading doesn’t mean being chained to your computer screen. You can find winning setups efficiently without sacrificing your valuable time. Effective screening, for example, helps filter thousands of securities down to a manageable watchlist. This section explores practical strategies to optimize your stock screener for swing trading.

Streamlining Your Search: Essential Screening Parameters

Understanding which parameters to adjust in your stock screener is crucial for finding ideal swing trading setups. These parameters help narrow your search, focusing on the most promising candidates in various market conditions. This systematic approach can save you hours of manual analysis.

- Price Action: Look for stocks with recent price swings or breakouts. You might set filters for percentage changes over specific timeframes.

- Volume Patterns: Identify stocks with unusual trading volume. This often signals increased investor interest. Filtering for stocks with volume significantly above their average can be a good starting point.

- Volatility Metrics: Stocks need sufficient volatility to generate swing trading opportunities. Use metrics like the Average True Range (ATR) to gauge price fluctuations.

- Sector Performance: Consider the overall sector performance. If the technology sector is strong, for instance, you might focus your screening on tech stocks.

Mastering the Filters: From Basic to Advanced Techniques

Whether you’re a novice or a seasoned trader, understanding both basic and advanced filtering techniques is essential. This empowers you to adapt to different market dynamics and refine your stock selection.

- Basic Filtering: Start with simple criteria like price range, market capitalization, and volume. This quickly eliminates irrelevant securities.

- Advanced Filtering: Integrate technical indicators like RSI, MACD, and moving averages into your screener. This adds a deeper layer of analysis, identifying stocks meeting specific technical requirements.

Timing Your Trades: Market Trends and Security Selection

Broader market trends significantly impact individual security selection. In a bullish market, for example, you might use more aggressive screening criteria. During bearish periods, however, a more selective approach prioritizing risk management is often prudent.

To help you tailor your stock screening to different market conditions, let’s look at the following table:

Swing Trading Stock Screening Criteria

This table outlines the key parameters to use when screening for potential swing trading opportunities across different market conditions.

| Screening Parameter | Bullish Market Setting | Bearish Market Setting | Sideways Market Setting |

|---|---|---|---|

| Price Action | Upward breakouts, strong momentum | Downward breakouts, bearish patterns | Range-bound movement, support/resistance bounces |

| Volume Patterns | Increasing volume on up days, decreasing volume on down days | Increasing volume on down days, decreasing volume on up days | Spikes in volume near support/resistance levels |

| Volatility Metrics | Higher ATR, wider price swings | Lower ATR, tighter price swings | Moderate ATR, consistent price fluctuations within a range |

| Sector Performance | Focus on leading sectors | Avoid lagging sectors | Diversify across sectors |

This table summarizes the key parameters for screening swing trading opportunities in various market settings. Notice how volume patterns and volatility metrics shift depending on the market trend.

Building a Daily Routine: Efficient Opportunity Identification

By implementing these screening methods, you can establish a daily routine that efficiently pinpoints opportunities without consuming your entire day. This allows you to maintain balance while still capitalizing on market movements. By consistently applying these techniques, you’ll not only streamline your search process but also increase your probability of finding profitable swing trades.

Avoiding The Costly Mistakes That Derail New Traders

Swing trading offers flexibility and potentially significant profits. However, new traders often fall prey to common pitfalls that can hinder their success. This section explores these destructive patterns and provides strategies to avoid them.

Overtrading And The Illusion Of Action

Overtrading, often fueled by boredom or the mistaken belief that constant activity equals profits, is a frequent mistake. This leads to high transaction costs and impulsive decisions, ultimately eating away at potential gains. Imagine a baseball player swinging at every pitch; they might connect occasionally, but they’ll also strike out frequently.

Instead, prioritize quality over quantity in your trades. Wait for high-probability setups that align with your trading plan, like a sniper patiently waiting for the perfect shot.

Abandoning Strategies After Losses

Losses are an inevitable part of trading. However, abandoning a well-researched strategy after a few losses is a surefire way to derail your progress. This often stems from a lack of confidence or the temptation of a seemingly “better” approach.

Successful swing trading requires discipline and adherence to your plan, even during periods of drawdown. Treat losses as valuable learning opportunities. Conduct thorough post-trade analysis to pinpoint areas for improvement instead of discarding your entire strategy.

Cognitive Biases: The Silent Saboteurs

Cognitive biases, such as confirmation bias and loss aversion, can significantly influence trading decisions. Confirmation bias causes traders to seek out information that confirms their preconceived notions while disregarding contradictory evidence. Loss aversion makes traders feel the pain of a loss more intensely than the pleasure of an equivalent gain.

These biases can result in poor choices, like holding onto losing positions too long or prematurely exiting winning trades. By recognizing these biases, you can take measures to minimize their impact on your trading.

Maintaining Discipline During Emotional Market Periods

Market volatility can be emotionally charged, particularly for those new to trading. Fear and greed can lead to impulsive actions and costly errors. Developing strategies to maintain discipline during turbulent times is essential. This might involve stepping away from your trading platform during stressful periods or reviewing your trading plan to reaffirm your strategy.

The Power Of Post-Trade Analysis

Regardless of whether a trade results in a profit or a loss, conducting a thorough post-trade analysis is critical. This involves examining your entry and exit points, evaluating the efficacy of your indicators, and identifying any emotional factors that may have swayed your decisions. By learning from both successes and failures, you can continually refine your approach and enhance your overall performance. This continuous improvement distinguishes consistently profitable swing traders.

✅ Real Examples. Real Results.

📈 Stop Losing Money – Gain the Skills to Trade with Confidence.

🔗 Enroll Now and Transform Your Trading!