Pump and Dump Trading Strategy (The Ultimate Guide)

Pump and Dump Introduction

Most investors may want to stay away from the pump and dump strategy.

The reason is obvious: pump-and-dump is regarded as illegal according to the SEC.

Another reason is the high risk and volatility presented by this trading strategy.

However, every trader knows that volatility provides high risk as well as increased opportunities.

So, while you may want to avoid this trading strategy, experts often ask: are pump and dumps profitable?

DOWNLOAD 5 LESS-KNOWN FUTURES TRADING STRATEGIES

Contents in this article

What are Pump and Dump?

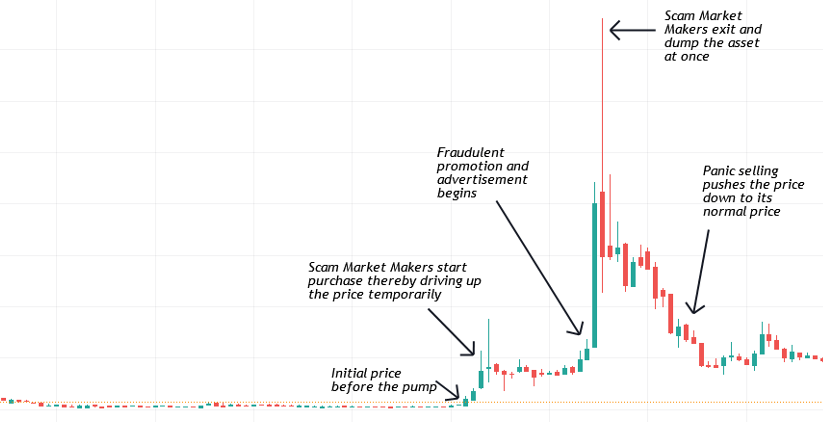

A pump and dump occur when the value of an asset rises dramatically only to be “dumped” afterwards when the price falls.

According to the Securities and Exchange Commission (SEC), P&D is illegal.

The dramatic ‘pump’ of the asset is often induced by some fraudsters who have purchased the asset at a low price.

Afterwards, the fraudsters sell at high rates and ‘dump’ the investment.

Pump and dumps are common in:

- Penny stocks

- OTC (Over The Counter) markets

- Small capitalisation markets

- Markets with fewer regulations

- Lastly, markets that are not required to share their performance metrics.

Pump and dump have been compared to Ponzi schemes according to the SEC.

However, many experts believe it is also similar to a short squeeze.

A short squeeze is considered legal since it uses metrics, not fake hype, to drive the price of an undervalued stock high.

The chart below shows a popular short squeeze that occurred with Volkswagen shares.

Note that a short squeeze usually shows a quick low before rising high unlike a pump and dump that continues to rise swiftly.

In general, both pump-and-dump and short squeeze often lead to losses among naive investors who fail to recognize the true nature of performing assets.

Understanding how pumps and dump works can help you reduce your losses and maximise profits.

How Pump and Dump Works

Pump and dump strategies capitalise on people’s urge to make quick money from shares and cryptocurrency trading.

It entices inexperienced investors by presenting a poor asset as highly lucrative.

The approach begins when some fraudulent stockholders engage in deceptive advertising.

They constantly use disinformation, fraudulent stories, and misleading remarks to promote the firm as the next great thing.

Unwitting investors buy the shares, believing that the company would rise in value over time.

The asset price rises as a result of panic buying.

Next, the fraudsters start selling the hyped-up shares to profit handsomely.

The stock price plummets as a result of massive dumping after the euphoria.

As a result, many investors suffer significant losses.

And the asset may never regain the fake value again since it did not experience real market growth.

In other circumstances, the subject business is formed solely for the purpose of executing a pump-and-dump plan.

All sides (marketer, corporate officers, and legal staff) are usually in collaboration with each other in this situation.

This is known as a reverse merger.

Reverse Merger

It is among the most obvious warning signs when looking at a small or nano-cap company.

In a reverse merger, a firm is essentially permitted to “go public” sans having to do any of the investigative work or comply with securities laws that financial regulators and marketplaces need.

Pump and dump have been in existence since the early 1990s.

Then, the famous brokerage company known as Stratton Oakmont used misleading tales to inflate prices artificially.

Jordan Belfort, the co-founder of Stratton, was eventually convicted of the crime.

Although only used this trick on penny stocks, pump and dump schemes are now active in all trading markets, especially those with fewer regulations like cryptocurrencies.

The incidence of pump-and-dump strategies in the cryptocurrency industry was investigated in major research led by Hamrick and Rouhi in 2018.

From January through July 2018, the researchers discovered over 3,700 similar methods discussed and marketed on two major cryptocurrency internet forums.

Investors were advised to acquire specific cryptocurrencies by the specified advertising.

Despite the illegal nature of pump and dump, the puzzling question is: Can it be profitable?

Yes, pump and dump are profitable.

But first, you must be good at spotting its occurrence.

Is Pump and Dump Trading Strategy illegal?

Yes, market makers and traders who engage in spreading fake rumours about an asset are fraudsters.

However, recognising when to enter and exit a market during a pump and dump is legal.

Why It is Important to Recognise Pump and Dump

Many traders often make wrong calls due to their inability to spot a pump and dump scheme.

Even if you don’t want to trade the pump and dump strategy, recognizing its occurrence can help you reduce losses.

And if you want to use the pump and dump trading strategy, the first step is to learn how to recognize it.

There are three basic ways to identify a pump and dump.

Unregistered Source of Information

Legitimate, regulated, and ethical investment bankers are obligated by law to make financial recommendations that would favor you.

Unlicensed, anonymous advocates or “consultants” owe you no statutory commitments.

Most of the time, all they care about is putting profit in their wallets.

As such, once you notice a sudden jump in a penny stock or low-performing asset together with promising news from unregistered sources, which is a sure sign of a pump and dump.

Social Media Hypes

Spam mails are increasingly getting outdated due to the rapid advancement of technology.

Social networking sites and online forums with their wider reach is a better alternative for scammers.

Scammers use this platform to reach thousands of users with lesser effort. An example is the sudden increase of Gamestop stock in January 2021.

The sudden rise, which is still being argued if it is a short squeeze or pump-and-dump, was influenced by a Reddit group known as WallStreetBets.

Unusual Fame

It is always important to look closely at stocks that suddenly became famous without any major reason.

Of course, this may be fuelled by social media influence but most times the source of the sudden fame is typically unknown.

Generally, the best assets are popular with big market caps which denotes that it is safe i.e fraudulent market makers cannot use these stocks to carry out their manipulations.

However, trending assets with very small market caps are suspicious.

These stocks may not have a great history of large trade volumes but became suddenly popular out of the blues.

You should either choose to get into this market early or refrain from trading it totally.

How to Use Pump and Dump as a Trading Strategy

Once you realise a particular market is gaining sudden momentum from social media hype or fake news, you need to know when to take a position or stay away from the asset.

The truth is that pump and dump occur on all markets at all timeframes.

As such, it is essential to know when to get in and out of any manipulative market.

The first approach in examining a promoted commodity is to look for the red signals, i.e. the best times to avoid the market.

This way, you may start looking for a green signal to enter a transaction.

If you don’t deal with the red flags first, your greed will eventually force you to overlook it whenever it arises.

What should you avoid first?

Do Not Trade Momentum Divergences

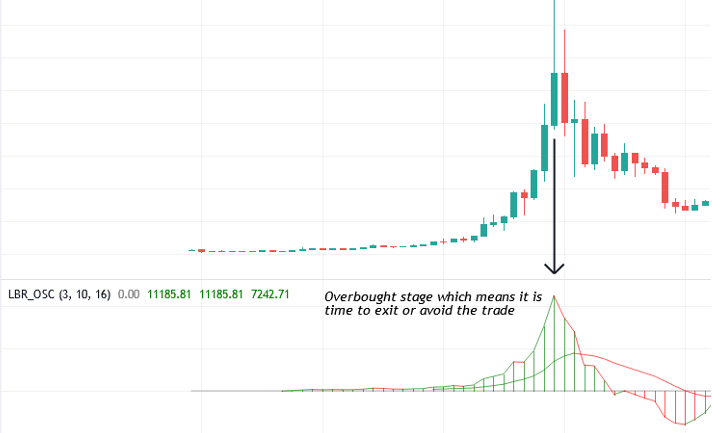

The variance of volume and price exhibited as a continuance of a pattern without the essential drive to maintain the advance is known as momentum divergence.

For instance, an asset’s value may keep growing, but volume plunges behind the gain, showing a lack of confidence among purchasers.

Avoid assets that create a momentum gap, which means the price achieves a recent peak, but the movement doesn’t.

This is a massive red signal, and you must avoid investing in the stock long term.

Momentum is an indicator of how competitive market players are or the rate at which prices fluctuate.

If the degree of aggressiveness begins to wane, the fake investors will notice and start unloading the remainder of their shares as quickly as possible, detecting the top falling out.

Momentum Comes Before Price

Remember the popular trading philosophy: momentum comes before price.

This implies that bulls will typically strike the offering hard before the asset moves up due to the competition.

The same idea applies in reverse: a drop in momentum naturally follows a reduction in value.

Using a momentum analyzer is the easiest way to measure momentum.

In this case, you will need indicators like RSI and MACD.

You can choose the revised 3/10 oscillator, a variation of MACD indicator.

When you’re not dealing with pump and dumps, momentum differences usually means the price is about to enter a consolidating period rather than a total trend turnaround.

Nonetheless, when stocks or assets are manipulated, the momentum divergence will reveal when the dump is about to start.

This is more of a function of when you buy the shares.

Of course, if you’re in really early, say within hours of receiving an email tip from a popular marketer, there will be a fresh momentum peak since the share will have gapped up after floating sideways for weeks.

If the surge is already in progress when you’re prepared to begin, though, you’ll prefer to do so on a fresh momentum high.

Keep in mind that pricing comes after momentum.

Stay Away From Volume Divergences

Investors use divergences to try to figure out if a trend is weakening, which might result in a pullback or breakout.

Get out of markets where the volume of the retreat is more than the recent surge.

This shows that fraudulent investors are beginning to pull back fast.

Momentum and volume work hand in hand.

The loss of one usually precedes the loss of another.

A volume divergence in this example refers to the fact that the market sentiment and volume express slightly different meanings.

Examine the volume distribution.

If the price continues to rise as buying volume falls, it indicates that the boosters have begun to depart.

This is a warning indicator that it’s time to leave your deal.

Buy early, most favorable in the day.

Of course, getting the asset as early as possible in the campaign is excellent.

However, if you get in late, the wisest decision is to wait for the next day when trading opens.

The finest marketing lasts many days before dumping, with the bulk of the trades taking place when markets open in the morning.

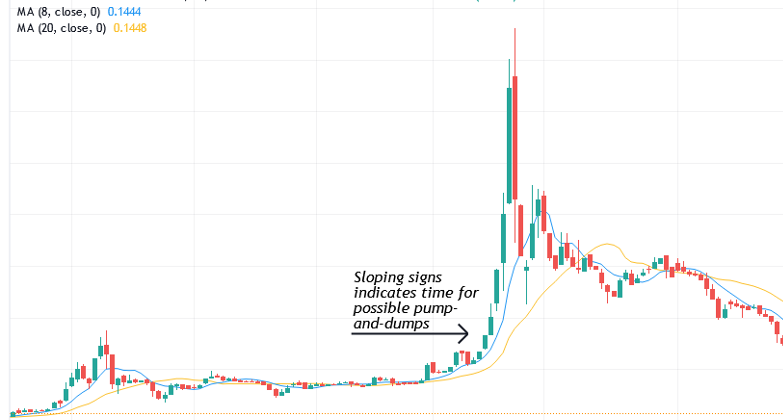

Use the trend line

Trend lines are an excellent way to recognise a pump and dump scheme, especially when you get in late into the market.

Generally, sloping behavior is a good sign that an asset has started pumping.

You can wait for the third slope to form before making your entry.

Using an eight and 20-period moving average together with the trendline can also increase your accuracy.

Ensure that the candles are hovering over the moving averages before making your entry.

When big blocks of stocks start to trade on the bid, the manipulative insiders may be measuring up their exit as the pump’s climax approaches.

An excellent tip to remember is to continually search for high bidding in over-the-counter and lightly traded marketed cryptocurrencies or stocks.

It is essential to see numerous bidders lined up to purchase the shares, with offers remaining tiny as buyers continue to withdraw them.

Conclusion

In general, pump and dump is a fraudulent scheme meant to deceive innocent traders like you and me.

The best way to stay clear of the scam is to understand how it works and when it occurs.

This way, you will not only reduce your losses but increase your profits as you learn how to spot the scam.

With the help of trend lines, moving averages, MACD, and volume indicators, you can master the pump and dump trading strategy.

AMAZING MAN

Thank you!

HEY BRO CAN YOU PUBLISH AN ARTICLE ON THE TYPE OF MARKET YOU TRADE AND WHY YOU TRADE AND THE ONES YOU AVOID AND WHY.. AGAIN THANKS YOUR ARTICLES ARE SMASHING.

Sure thing! Great suggestion