Top Price Action Trading Books to Boost Your 2025 Trading Skills

Unlocking Market Secrets: Why Price Action Matters

Want to decipher market movements without relying on lagging indicators? This curated list of top price action trading books offers valuable techniques for all skill levels, from novice to professional. Learn to identify patterns, pinpoint trends, and seize trading opportunities using raw price data. Whether you’re new to trading or seeking to refine your approach, these resources provide the foundational knowledge and advanced strategies to improve your trading performance. Discover how price action trading can unlock market secrets and elevate your profitability.

1. Encyclopedia of Chart Patterns by Thomas N. Bulkowski

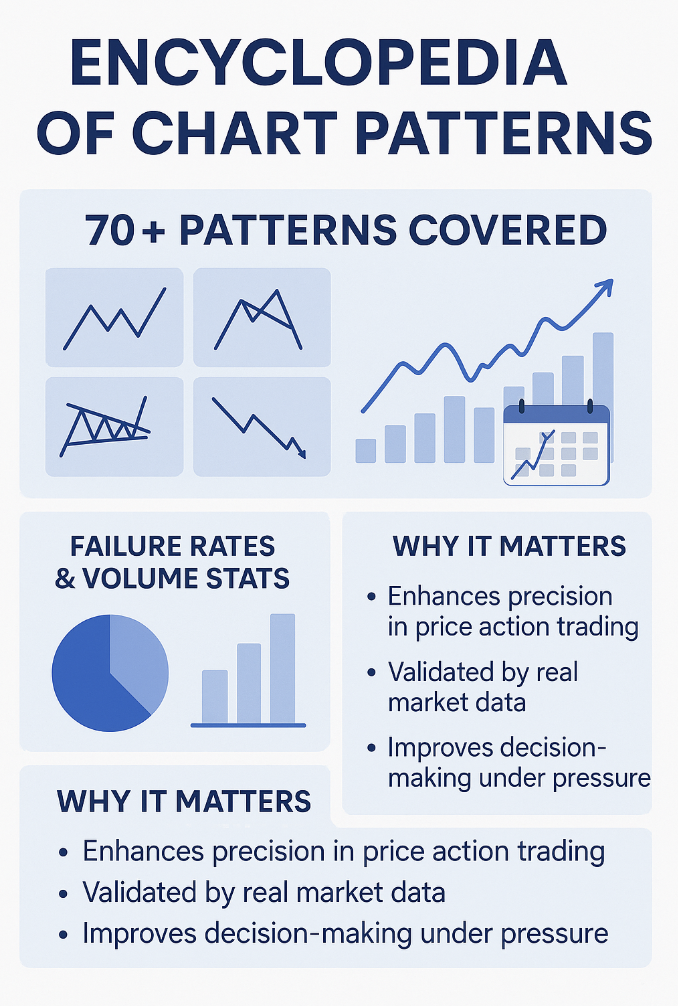

For traders seeking to master price action trading, understanding chart patterns is crucial. Thomas N. Bulkowski’s Encyclopedia of Chart Patterns stands as a cornerstone resource in this area. This book goes beyond simple pattern identification, delving into the statistical performance and practical application of nearly 70 chart patterns. It provides a data-driven approach to price action trading, equipping traders with the knowledge to identify high-probability setups and manage risk effectively. This methodical analysis makes it a valuable addition to any price action trading book collection.

The infographic above provides a quick reference for the key takeaways from Bulkowski’s work. It highlights the comprehensive nature of the book, covering both common and less-frequent patterns, emphasizing the importance of statistical validation, and showcasing its practical approach to trading.

Bulkowski meticulously categorizes each pattern, detailing identification criteria, typical volume behavior, historical failure rates, and suggested trading tactics. This information empowers traders to make informed decisions based on statistical probabilities rather than relying on gut feeling. He uses extensive market data, spanning over five years, to back up his findings, providing a quantifiable edge for traders of all experience levels. For instance, the book might reveal that a particular bullish pennant has a 60% success rate when traded with specific volume confirmation. This type of data allows traders to assess the risk-reward ratio and adjust their position sizing accordingly. Further enhancing its practical application, Encyclopedia of Chart Patterns includes real-world examples and case studies, demonstrating how specific patterns played out in different market conditions.

The following infographic summarizes key aspects of Encyclopedia of Chart Patterns:

As this visual summary highlights, Encyclopedia of Chart Patterns emphasizes the importance of data-driven analysis and practical application in price action trading. These features make it a valuable resource for both novice and experienced traders.

This video offers further insights into Bulkowski’s work and the practical use of chart patterns in trading.

Pros:

- Extremely comprehensive coverage: From common head and shoulders patterns to more obscure formations, the book provides detailed information on a vast range of chart patterns.

- Data-driven approach: The statistical analysis of pattern performance gives traders a quantifiable edge, enabling informed decision-making.

- Practical trading tactics: The book offers clear guidelines on how to trade each pattern, including entry and exit strategies.

Cons:

- Overwhelming for beginners: The sheer volume of information can be daunting for new traders.

- Extensive data can be excessive: Some traders may find the level of statistical detail overwhelming.

- Requires significant time investment: Mastering the content requires dedicated study and practice.

Tips for using Encyclopedia of Chart Patterns:

- Prioritize patterns: Use the performance statistics to focus on patterns with higher success rates in your chosen market.

- Master identification: Pay close attention to the identification guidelines to ensure accurate pattern recognition.

- Focus on volume: Study the volume characteristics associated with each pattern, as volume often confirms the validity of a pattern.

Whether you are a novice trader looking for foundational knowledge or an experienced professional seeking to refine your skills, Encyclopedia of Chart Patterns provides a powerful framework for understanding and applying price action trading principles. This book deserves its place on this list because it offers a unique blend of statistical analysis and practical trading advice, empowering traders to make data-driven decisions and improve their trading performance.

2. Japanese Candlestick Charting Techniques by Steve Nison

Considered the cornerstone of modern price action trading, Steve Nison’s Japanese Candlestick Charting Techniques is frequently dubbed the bible of candlestick analysis. This groundbreaking work introduced Western traders to the power of Japanese candlesticks, transforming how many analyze financial markets. The book provides a comprehensive exploration of candlestick patterns, explaining their formations and interpretations for effective price action trading. Nison delves into the rich history of these patterns, illuminating their origins and demonstrating how they can be seamlessly integrated with Western technical analysis methods to enhance trading decisions. This makes it an invaluable resource for traders of all skill levels seeking to improve their understanding of price action.

Candlestick charting offers a visual representation of price movement over a given timeframe. Each “candlestick” depicts the open, high, low, and close price of an asset. The candlestick’s “body” represents the range between the open and close prices, while the “wicks” (or shadows) extend to the high and low prices. By analyzing the shapes and combinations of these candlesticks, traders can gain insights into market sentiment and potential future price movements. For example, a “doji” candlestick, characterized by a very small body, often suggests market indecision, whereas a long-bodied candlestick indicates strong buying or selling pressure.

Nison’s book details a wide array of candlestick patterns, from single candlestick formations like the doji and hammer to more complex patterns like the engulfing pattern and morning/evening star. He explains the psychology behind these patterns, helping traders understand the underlying market sentiment they represent. The book goes beyond simple pattern recognition and emphasizes the importance of confirmation signals from other indicators or price action itself, leading to more robust trading strategies. Numerous real-world chart examples, drawn from stock, futures, and forex markets, illustrate the practical application of these techniques. Nison demonstrates how certain candlestick patterns predicted major market turning points in historical data, underscoring their potential predictive power.

When and why should you use this approach? Candlestick analysis is valuable for any trader relying on price action, whether you’re a novice just starting out or a seasoned professional. It provides a framework for understanding market sentiment and identifying potential trading opportunities across various timeframes and markets.

Actionable Tips:

- Begin by mastering the major reversal patterns, such as the engulfing and doji patterns. These offer clear signals of potential trend changes.

- Pay close attention to the sections on confirmation signals. Avoid relying solely on candlestick patterns; look for confluence with other indicators or price action.

- Practice identifying candlestick patterns on historical charts before risking real capital. This will build your pattern recognition skills and trading confidence.

Pros:

- Authored by the pioneer who brought candlestick charting to the West.

- Offers clear explanations of pattern psychology and market sentiment.

- Focuses on practical trading applications rather than just theory.

- Suitable for traders of all experience levels.

Cons:

- Mastering the more complex pattern combinations can be challenging.

- The book predates algorithmic trading, lacking specific coverage of modern market dynamics.

- Some traders find certain pattern names confusing initially.

This book deserves its place on this list because it remains the definitive guide to candlestick charting. It provides a solid foundation for understanding price action and remains relevant for traders seeking to enhance their market analysis skills. Learn more about Japanese Candlestick Charting Techniques by Steve Nison. Whether you aim to generate flexible, location-independent income, refine your understanding of supply and demand, or simply improve your trading consistency, mastering candlestick analysis is a crucial step.

3. Trading Price Action Trends by Al Brooks

Al Brooks’ Trading Price Action Trends delves deep into the art of trend identification and exploitation using only the raw price chart. This book, a crucial component of Brooks’ larger Trading Price Action series, eschews indicators and focuses on understanding market structure through the lens of individual price bars and their resulting patterns. The core concept is that all the information a trader needs resides within the price itself. By meticulously studying bar-by-bar price action, traders can decipher the underlying market sentiment and anticipate future movements with greater accuracy. Brooks’ method emphasizes a sophisticated approach to reading market movement, enabling traders to identify high-probability trading setups based purely on price.

This book provides a comprehensive guide to understanding trend lines, channels, and pullbacks. It dissects different types of trends, teaching readers how to classify them based on their characteristics and volatility. Further, the book offers concrete trading strategies tailored specifically for trending markets, empowering traders to capitalize on sustained price movements. It meticulously covers concepts like breakouts, pullback entries, and trailing stops, all through the framework of pure price action. The focus is firmly on practical trading applications rather than abstract theories, making it a valuable resource for traders of all levels seeking actionable insights.

Examples abound within Trading Price Action Trends, predominantly featuring charts from the E-mini S&P 500 futures market. Brooks provides detailed, bar-by-bar breakdowns of specific price patterns, demonstrating how they unfolded in real market conditions and the resulting trading opportunities. This detailed analysis provides readers with a practical understanding of how to apply the concepts discussed in the book to real-world scenarios.

Pros:

- Authored by a seasoned professional day trader with decades of experience.

- Pure price action methodology eliminates the need for potentially confusing indicators.

- Unparalleled depth of market structure analysis.

- Focuses on practical trading applications rather than theoretical concepts.

Cons:

- Dense writing style can be challenging for some, especially beginners.

- Repetition and complexity of concepts can be overwhelming initially.

- Requires dedicated time and effort to fully grasp and master the presented concepts.

- Unconventional terminology might require adjustment for traders accustomed to more standard terms.

Tips for utilizing the book effectively:

- Begin with simpler concepts like trend lines and basic pullbacks before progressing to more advanced setups.

- Repeatedly review chapters as your understanding deepens with experience and practice.

- Actively practice identifying the patterns on historical and real-time charts to solidify your grasp of the material.

Trading Price Action Trends deserves its place on this list of top price action trading books because it offers a unique and in-depth approach to trend trading. Its focus on pure price action, coupled with its practical and detailed analysis, makes it an invaluable resource for traders looking to refine their skills and enhance their profitability. This approach is particularly valuable for novice traders seeking foundational price action techniques, intermediate traders frustrated with inconsistent strategies, experienced traders aiming to refine their understanding, professionals desiring flexible, location-independent income, and self-paced learners looking for proven, action-based programs. Learn more about Trading Price Action Trends by Al Brooks It equips traders with a robust framework for identifying and capitalizing on trends solely through the interpretation of price.

4. Price Action Breakdown by Laurentiu Damir

If you’re looking for a practical, no-nonsense introduction to price action trading, Laurentiu Damir’s Price Action Breakdown deserves a spot on your reading list. This book stands out among other price action trading books for its simplified methodology, making it particularly suitable for beginners and intermediate traders who might feel overwhelmed by more complex systems. It cuts through the noise and focuses on the core principles of price action, allowing traders to quickly grasp the concepts and apply them to real-world trading scenarios.

This book champions a “naked chart” approach. This means Damir emphasizes reading the raw price movements on the chart without relying on indicators. He argues that indicators lag price and can obscure the true picture of market dynamics. By focusing solely on price, traders can develop a deeper understanding of support and resistance, trend identification, and entry/exit strategies.

How it Works:

Price Action Breakdown lays out a clear, step-by-step process for analyzing price charts. The foundation of the methodology lies in identifying key swing highs and lows. These swing points form the basis for drawing support and resistance zones, which are crucial for anticipating potential price reversals or breakouts. Damir then explains how to interpret these zones in the context of the prevailing trend, allowing traders to pinpoint high-probability entry and exit points. The book provides numerous practical trade examples with detailed explanations, walking readers through the analysis process from start to finish.

Examples of Successful Implementation:

The book showcases various examples of successful trades based on the principles outlined. These examples, primarily from the forex market, demonstrate how to identify trading opportunities using support and resistance, trend lines, and price patterns like double tops and bottoms. The step-by-step analysis provided with each example helps readers understand the rationale behind the trade and how to apply the concepts in their own trading.

Actionable Tips for Readers:

- Master the Basics: Start by thoroughly understanding the concept of swing highs and lows. This is the bedrock of the entire system.

- Practice Drawing Zones: Don’t just read about support and resistance; actively practice drawing these zones on historical charts using the guidelines provided in the book.

- Risk Management is Key: Pay close attention to the risk management examples provided. Protecting your capital is just as important as identifying winning trades.

When and Why to Use This Approach:

- Beginners: If you’re new to price action trading, this book offers a great starting point. The simplified approach prevents information overload and allows you to focus on the core concepts.

- Intermediate Traders: If you’re struggling with inconsistent results using indicator-based strategies, Price Action Breakdown can help you develop a more robust trading framework.

- Refining Skills: Even experienced traders can benefit from the book’s focused approach, using it to refine their understanding of support and resistance and improve their entry/exit timing.

Pros:

- Accessible and easy-to-understand writing style.

- Focused approach avoids overwhelming readers with too many patterns.

- Practical and action-oriented.

- Can be read and implemented quickly.

Cons:

- May lack the depth of more comprehensive price action resources.

- Limited coverage of advanced price action concepts.

- Might be too basic for some experienced traders.

- Provides fewer statistical insights compared to other books.

While Price Action Breakdown may not be the definitive guide to every nuance of price action, it offers a valuable, practical foundation for traders of all levels. Its clear and concise presentation of core price action principles makes it an excellent choice for those seeking a straightforward and effective approach to trading. It earns its place on this list by providing a clear path for beginners to grasp the essentials of price action trading, allowing them to quickly progress from theory to practical application.

5. Technical Analysis of the Financial Markets by John J. Murphy

While not solely dedicated to price action trading, John J. Murphy’s Technical Analysis of the Financial Markets earns its place on this list as a foundational text that provides the essential building blocks for understanding price movements. It serves as a comprehensive guide to technical analysis principles, many of which directly underpin effective price action trading strategies. This book offers a deep dive into chart patterns, market indicators, and the interplay between different asset classes, equipping traders with the knowledge to interpret price charts and make informed trading decisions.

This method, technical analysis, involves studying historical market data, primarily price and volume, to forecast future price movements. It operates under the assumption that market trends and patterns repeat themselves, and that by understanding these patterns, traders can anticipate future market behavior. Technical Analysis of the Financial Markets goes beyond simply identifying patterns; it teaches you the underlying market mechanics that drive these patterns. This includes understanding support and resistance levels, trendlines, and various technical indicators.

The book is replete with historical examples demonstrating how specific chart patterns foreshadowed major market turns in past decades, across multiple asset classes like stocks, bonds, and currencies. For instance, Murphy illustrates how head and shoulders patterns, flags, and pennants have historically indicated trend reversals, providing valuable insights for anticipating potential price action setups.

Features and Benefits:

- Comprehensive coverage of technical analysis fundamentals: From basic chart construction to complex indicators, the book covers a wide range of topics essential for understanding market dynamics.

- Extensive sections on chart patterns and price action: Murphy dedicates significant portions of the book to explaining and illustrating various chart patterns, providing a strong foundation for price action traders.

- Coverage of market indicators and their relationship to price: Learn how indicators like moving averages, RSI, and MACD can be used to confirm price action signals and identify potential trading opportunities.

- Multiple timeframe analysis techniques: The book explores how analyzing price action across different timeframes can provide a more comprehensive view of market trends.

Pros:

- Provides a complete education in technical analysis, making it an excellent resource for traders of all levels.

- Clear explanations with numerous examples, facilitating a deeper understanding of the concepts.

- Balanced approach between theory and application, bridging the gap between academic knowledge and practical trading.

- Respected and time-tested resource, trusted by institutional traders and technical analysts for decades. Popularized by John J. Murphy himself, it continues to be a cornerstone of technical analysis education.

Cons:

- Not exclusively focused on price action trading, meaning some content may not be directly applicable to pure price action strategies.

- Some content on older technical methods that are less relevant in today’s fast-paced electronic markets.

- Less detailed on specific trading strategies compared to books specializing in particular price action methodologies.

- Some examples use older markets and time periods, which may not perfectly reflect current market conditions.

Actionable Tips for Readers:

- Master the basic chart patterns chapter before moving to more advanced concepts. This will provide a solid foundation for understanding more complex price action setups.

- Pay special attention to the chapters on support/resistance and trend analysis. These concepts are crucial for identifying high-probability trading opportunities.

- Use the intermarket analysis section to understand broader market context and how different asset classes influence each other.

When and Why to Use This Approach:

This book is ideal for novice traders seeking foundational price action techniques, intermediate traders frustrated with inconsistent strategies, and even experienced traders aiming to refine their understanding of market dynamics. It’s particularly valuable for those who want to understand the “why” behind price movements, not just the “what.” By grasping the underlying principles of technical analysis, you can develop more robust and adaptable trading strategies.

Learn more about Technical Analysis of the Financial Markets by John J. Murphy

6. Naked Forex: High-Probability Techniques for Trading Without Indicators by Alex Nekritin and Walter Peters

This book earns its spot on our list of best price action trading books by offering a laser focus on trading forex using pure, unadulterated price action. Naked Forex: High-Probability Techniques for Trading Without Indicators by Alex Nekritin and Walter Peters champions the idea that stripping your charts bare of indicators allows for clearer market analysis and, ultimately, more profitable trades. It provides a refreshing perspective for those bogged down by lagging indicators and seeking a more direct connection to the market’s underlying forces. This approach resonates with traders seeking a pure price action trading strategy, making it a valuable resource for those interested in price action trading books.

The core of this book revolves around identifying specific high-probability price action setups tailored for the forex market. These patterns, including the intriguing “last kiss,” the powerful “big shadow,” and the dynamic “kangaroo tail,” are not typically found in other price action trading books, giving readers a unique edge. Each setup is meticulously explained, providing clear entry and exit rules, stop-loss placement, and position sizing guidelines. This detailed instruction makes the strategies readily actionable, even for novice traders exploring the world of price action trading books.

How it Works: The “naked” approach emphasizes reading the raw price movements on a chart. Instead of relying on indicators to interpret price, traders learn to recognize recurring patterns that signal potential trading opportunities. For example, the “last kiss” pattern identifies points where the price briefly retraces before continuing in its original direction, offering a low-risk entry point. The “big shadow” signifies a strong rejection of a particular price level, hinting at potential reversals.

Examples of Successful Implementation: The book is replete with real-world forex chart examples and case studies, showcasing both winning and losing trades. This practical approach allows readers to see the setups in action and understand how to apply them in real market scenarios. The case studies are particularly valuable, offering insights into the psychological aspects of trading and the importance of discipline and risk management.

Actionable Tips for Readers:

- Master the “Last Kiss”: This pattern is presented as a particularly reliable setup and is an excellent starting point for those new to the naked trading approach.

- Practice on Historical Charts: Before risking real capital, hone your pattern recognition skills by practicing on historical data. This will build your confidence and improve your ability to spot these setups in live market conditions.

- Position Sizing is Key: Pay close attention to the recommended position sizing techniques to effectively manage risk and protect your trading capital.

When and Why to Use This Approach:

This book is particularly well-suited for:

- Novice traders: Seeking a foundation in pure price action techniques.

- Intermediate traders: Frustrated with inconsistent strategies based on lagging indicators.

- Experienced traders: Aiming to refine their skills in reading supply and demand dynamics in the forex market.

- Traders seeking location independence: The strategies can be applied from anywhere with an internet connection.

Pros:

- Focused specifically on forex markets.

- Introduces unique price action patterns not commonly found elsewhere.

- Provides clear and practical trading strategies.

- Excellent coverage of trader psychology.

Cons:

- Limited application to markets outside of forex.

- Some setups may require significant screen time to identify.

- Less historical market context compared to some broader price action books.

- May oversimplify market complexity for some experienced traders.

While Naked Forex primarily focuses on the forex market, its core principles of reading raw price action can be adapted and applied to other markets with some modification. This book empowers traders to develop a deeper understanding of market dynamics and make informed trading decisions based on the purest form of market data – price.

7. The Art and Science of Technical Analysis by Adam Grimes

For those seeking a robust and evidence-based approach to price action trading books, “The Art and Science of Technical Analysis” by Adam Grimes stands out as a definitive resource. This book isn’t just another collection of chart patterns; it’s a deep dive into market structure, statistical analysis, and the psychological aspects of trading. It earns its place on this list by bridging the gap between quantitative research and practical application, offering a comprehensive methodology for understanding and profiting from price movements.

This book delves into the “why” behind price action, not just the “what.” Grimes emphasizes understanding market structure – how supply and demand interact to create trends, ranges, and breakouts. He meticulously analyzes various price patterns, backing his observations with statistical evidence, demonstrating which patterns hold up under scrutiny and which are statistically insignificant. This data-driven approach helps traders avoid common pitfalls associated with relying solely on subjective interpretations of price charts.

How it Works:

Grimes presents a complete trading methodology, guiding readers from initial market analysis and trade setup identification through entry, trade management, and exit strategies. He explores both discretionary and systematic trading approaches, offering flexibility for traders with varying styles. The book’s core strength lies in its integration of market structure, pattern recognition, and risk management, creating a holistic framework for approaching the markets.

Examples of Successful Implementation:

The book is replete with real-world examples across multiple markets, including stocks, futures, and currencies. Grimes showcases both winning and losing trades, providing detailed explanations of the reasoning behind each decision and the lessons learned. This analysis of both successes and failures provides invaluable insights into the practical application of the concepts discussed. For instance, he might illustrate a successful trend-following trade based on a breakout from a well-defined range, highlighting the confluence of supporting factors like increasing volume and favorable market breadth. Conversely, he might analyze a failed pattern setup, demonstrating how recognizing a false breakout prevented a significant loss.

Actionable Tips for Readers:

- Pay special attention to the chapters on market structure and trend-following: These concepts form the foundation of Grimes’s approach and are crucial for understanding how and why markets move.

- Focus on the risk management sections before implementing any patterns: Proper risk management is paramount to long-term trading success, and Grimes dedicates significant attention to this critical aspect.

- Use the pattern failure analysis to understand when setups don’t work: Learning to identify failing setups is just as important as recognizing successful ones, and Grimes provides valuable guidance in this area.

When and Why to Use This Approach:

“The Art and Science of Technical Analysis” is ideal for serious traders who are willing to invest the time and effort required to master a comprehensive trading methodology. It’s particularly suitable for:

- Intermediate traders frustrated with inconsistent strategies, seeking a more structured and research-backed approach.

- Experienced traders aiming to refine their understanding of market structure and enhance their pattern recognition skills.

- Individuals transitioning from discretionary to systematic trading, or those seeking a blended approach.

Pros:

- Blends quantitative research with practical trading experience.

- Skeptical, evidence-based approach to pattern trading.

- Deep coverage of market psychology and risk management.

- Includes both discretionary and systematic trading approaches.

Cons:

- More complex than entry-level price action trading books.

- Requires significant time investment to fully implement.

- Some concepts require basic statistical knowledge.

- Less recipe-like than traders seeking simple setups might prefer.

While this book demands more effort than simpler “price action trading books,” the rewards for dedicated readers are substantial. It equips traders with a deep understanding of market dynamics and a robust framework for making informed trading decisions.

Price Action Trading Books Comparison

| Title | Core Features/Characteristics | User Experience/Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Encyclopedia of Chart Patterns by Thomas N. Bulkowski | ~70 chart patterns, detailed stats, trading tactics | ★★★★☆ Comprehensive but dense | 💰 High value for deep research | Novice to experienced traders | 🏆 Most extensive chart pattern guide |

| Japanese Candlestick Charting Techniques by Steve Nison | Candlestick patterns, history, Western integration | ★★★★☆ Clear, practical, suitable for all levels | 💰 Strong foundational knowledge | All experience levels | 🏆 Pioneer of Western candlestick analysis |

| Trading Price Action Trends by Al Brooks | Bar-by-bar price action, trend focus, market structure | ★★★★ Dense, complex but expert-level | 💰 Premium for serious traders | Day & swing traders | ✨ Pure price action, no indicators |

| Price Action Breakdown by Laurentiu Damir | Simplified price action, support/resistance, practical trades | ★★★★ Accessible, beginner-friendly | 💰 Affordable and quick to implement | Beginners & intermediate traders | ✨ Practical and easy to read |

| Technical Analysis of the Financial Markets by John J. Murphy | Broad TA, chart patterns, indicators, multiple timeframes | ★★★★ Solid, balanced, time-tested | 💰 Comprehensive TA foundation | Institutional & technical analysts | 🏆 Classic “bible” of technical analysis |

| Naked Forex by Alex Nekritin & Walter Peters | Forex-focused price action, indicator-free strategies | ★★★★ Practical FX patterns and psychology | 💰 Valuable for forex traders | Retail forex traders | ✨ Unique forex-only naked trading setups |

| The Art and Science of Technical Analysis by Adam Grimes | Quantitative + practical price action, psychology, risk | ★★★★ Advanced, research-driven | 💰 High value for sophisticated traders | Institutional & advanced retail | ✨ Evidence-based + integrates quant analysis |

Sharpening Your Edge: Mastering Price Action

This collection of price action trading books offers invaluable insights for traders of all levels, from beginners learning chart patterns to experienced professionals seeking to refine their supply and demand skills. We’ve explored key works like Bulkowski’s encyclopedia of chart patterns, Nison’s candlestick charting techniques, and Brooks’ trend trading strategies, along with essential resources like Damir’s breakdown of price action, Murphy’s technical analysis guide, Nekritin and Peters’ “Naked Forex”, and Grimes’ blend of art and science in technical analysis. These price action trading books provide a robust foundation in understanding market dynamics and making sound trading decisions.

The most crucial takeaway is that reading alone isn’t enough. Consistent practice and a dedication to ongoing learning are vital for success in the ever-evolving markets. Mastering the concepts within these books can empower you with the flexibility and knowledge to potentially generate location-independent income and achieve your financial goals. By understanding price action, you’re not just reacting to the market; you’re anticipating it, giving yourself a distinct edge.

Your journey to price action mastery doesn’t end with reading. Take the next step and transform your theoretical knowledge into practical trading skills. Colibri Trader provides focused price action training that perfectly complements the insights from these books, bridging the gap between theory and real-world application. Ready to refine your skills and elevate your trading performance? Visit colibritrader.com today or start with the Price Action Course, which you can cover in one weekend and start trading consistently with Price Action