How to Grow a Small Trading Account

Many more people are eager to grow a small account than those already working with a big one.

Take it further.

Many novice trading enthusiasts wouldn’t even look at trading if they did have the means for a big trading account.

Why?

There are many ways to put your many to work, and trading isn’t the easiest one!

If you’re a mature professional, it’s easier to make a living consistently from a big trading account.

However, if you’re just starting out or didn’t get to consistent profitability, big money on the line won’t help you!

So, why trade a small trading account, and how to multiply your capital efficiently?

We’ll find out shortly!

Contents in this article

Now, let’s look at the three basic steps that you must follow to have a chance to grow your small trading account.

Step 1: Set the right expectations and goals

Set reasonable goals – no doubling an account in a day!

The goals will dictate your expectations about trading.

If your goals are too aggressive, it’s likely to impair your judgment, affecting performance.

Say you want to turn your small account into your main income source.

Quite a logical goal, isn’t it?

However, wishing to achieve that in months will put tremendous pressure on you.

Step 2: prepare your mindset

There will be ups and downs, and, guess what, you can get burnt on both!

There’s a whole array of destructive behavioral patterns.

For instance, while on the winning streak, we tend to get complacent, risking more than necessary.

During losing streaks, the mind can get clouded by gloomy stuff like doubts, second-guessing, etc.

Blablabla, it’s not about you, right?

You’re special, aren’t you?

Be careful!

If something like this crossed your mind, you got complacent even before starting trading!

Step 3: Have a plan

Don’t think you can figure it out along the way.

If there’s no clear framework in your trading approach, even the best idea can result in a loss.

You must know what specific things you’re looking for in the market.

Is it a mean reversal, momentum play, or a fake breakout?

What will you do if the market doesn’t move in your favor?

How much will your risk per trade?

Only start trading after you have a comprehensive trading plan.

Advice for Small Accounts

You can find many stories of people making a ridiculous return on a small account.

Such as when a guy turned $1000 into one million within two weeks!

You don’t see countless blown-up accounts due to risking too much for too long.

By the way, the one that made a million in two weeks lost it all another couple of weeks later!

If you’re serious about trading, consider where your approach will get you in 5-10 years.

You want to make sure you’re not merely staying in the game but generating a return.

Steady…

You may get fortunate a few times (the above’s ex-millionaire was profitable ten days in a row!).

But the time will always be against you if you keep trading too aggressively.

Growing a small trading account into a decent one is like taking a shortcut, and shortcuts come with a cost.

How do you grow a small account?

It takes elevated risks to make three digits returns within several months.

Still, some no-brainer tactics can dramatically increase your odds of success.

Let’s look at them below.

Select setups carefully

Focus on quality instead of quantity of your trades.

With a small account, you’re likely to be limited in instruments you can trade due to margin requirements and minimum lots.

And this is not a bad thing.

Such limitations may help you to focus on a few assets, learn their character, and pick the highest quality setups.

Fixed risk

We’ve been talking about high stakes here.

But it doesn’t mean the risk management should be loose.

If you know in advance how much exactly you’re risking, it gives you freedom.

Why? – Acceptance!

You accept the worst-case scenario and get reconciled with it in advance.

So, you’ll be free from fear when the market doesn’t go in your favor.

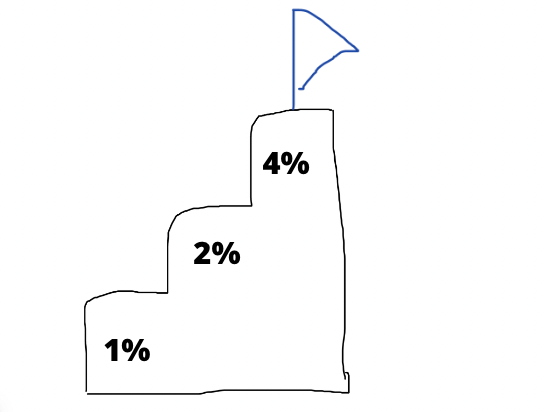

Use scale-in techniques

Plan how you’ll increase the size of your positions – bring some structure to betting higher.

For instance, use a tiered approach: risk a certain percentage (first tier) until your equity reaches a pre-defined target.

After you meet the first equity target, bet a specific higher percentage according to the next tier.

Using the market’s money techniques is a mentally comfortable way to bet more.

It’s always nicer spending somebody else’s money, isn’t it? 😊

The point is risking a fixed percentage of the starting equity AND another percentage of profits.

Risk more per trade

The golden rule is risking 1% per trade.

With this size, imagine making three risks on a $100,000 account – that’s $3000.

For many people, such net profit would make a month.

However, starting off with $1000, a profit of $30 doesn’t mean much in terms of disposable income and account growth.

If, and only if, your approach is time-tested, you should go for risking a higher percentage.

Sometimes, there are rare opportunities worth betting 10% or even 20%!

The problem is while you’re inexperienced, every second setup is “rare” for you!

So, know yourself first before taking on higher risks.

How do you trade a small account and not violate the pattern day trading rule?

If you make at least four trades intraday within five consecutive working days, you’ll be flagged as a pattern day trader (PTD).

The rule applies to margin trading – you use borrowed funds to buy shares.

To open a margin account, you must always maintain a $25,000 balance.

If they call you a PTD, you go on vacation from trading for 90 days, as your account gets frozen.

The exceptions include keeping a long trade overnight and selling it the next day before buying the same stock.

If your account is below $25,000, you can’t place more than three trades within five business days straight.

The US regulator allows a PDT removal once every 180 days.

So, how can you trade more frequently?

Below, we’ll look at the five ways.

Trade from a cash account

If you don’t use leverage, you’re not prohibited in trading frequency.

But, as you’re trading a small account, your buying power will be severely limited.

Settling a trade takes two days.

If you have $5000 and used $2000 for trade, for the next two days, you can use only $3000.

In the stock market, unless you can trade odd lots, you’ll only be able to trade penny stocks.

Also, you can’t go short with a cash account.

Open several accounts

Every account you have adds three trades within five consecutive trading days.

By having more accounts, you can trade more actively.

Although, it may be challenging to manage multiple accounts at once.

Spreading your funds among several accounts will also reduce your buying power in each.

Use an offshore account

If you open an account with a non-US broker, you won’t have to follow the PDT rule.

However, you may not be eligible for investor protections offered under US law.

Instead, you will follow the law of the country where the broker is registered

Trade futures, forex, and crypto

The capital requirements in these markets are much lower than in equities.

You can open an account with just a few hundred dollars and place trades as often as you want.

Brokers will just be happy about it!

What is considered a small trading account?

From the legal point of view, everything below $25,000 is considered a small trading account in the US stock market.

But, $25,000 in the US is different than the same somewhere in Asia.

It’s about the living costs.

Consider it a small trading account if you’re far from covering your basic costs from adequate (~30%) annual return on your capital.

Benefits of small trading accounts

A small trading account is ideal for learning.

When there’s some money on the line, you’ll take the endeavor more seriously.

Also, you’ll learn to manage your mental state, which can’t be done if you were just paper-trade.

Account blowups happen, especially at the beginning of a trading career.

If you blow up a small trading account, it’s not the end of the world.

Limited funds will teach you to work with what you have, be selective in your setups, and employ proper risk management.