Maximizing Net Worth: The Mathematical Dynamics Beyond the $100,000 Threshold

I. Introduction

Think of an additional $100,000 in your savings account.

What transformations would that bring to your lifestyle?

A recent study reveals that 75% of Americans don’t have $1,000 saved. However, through incremental, strategic actions, you could witness the transformative power of accumulating a net worth of six figures, a phenomenon often referred to as “The $100,000 Leap.”

By making informed financial choices and capitalizing on the magic of compound interest, you can alter your financial path toward sustained prosperity.

II. Deciphering the $100,000 Leap

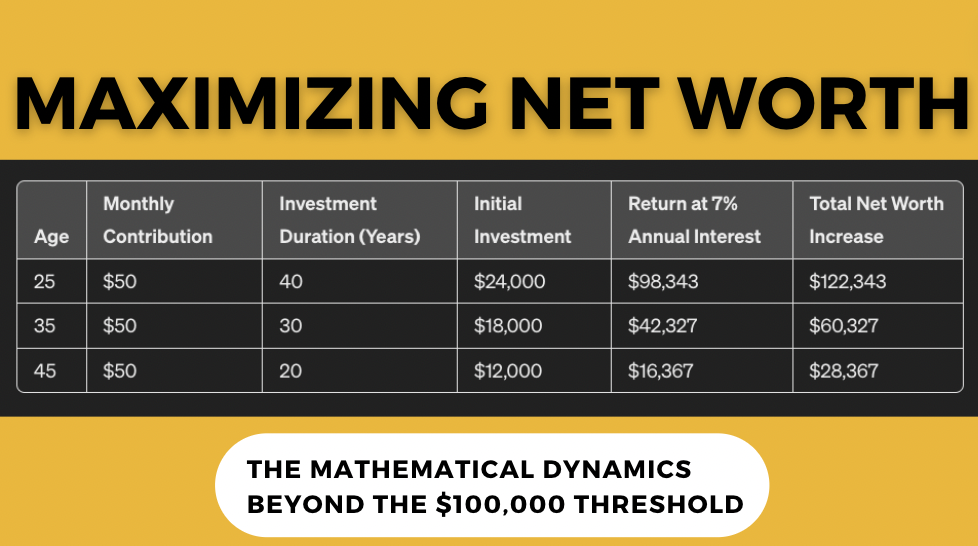

The $100,000 Leap underscores the impact of minor, consistent financial adjustments that can lead to significant wealth accumulation over time. Take, for instance, the effect of setting aside $50 each month:

This table shows how an identical monthly investment can yield dramatically different outcomes based on the start time.

By adopting strategies such as boosting income, minimizing expenses, and smart investing, even modest amounts can grow into significant wealth over decades.

III. Strategies for Achieving the $100,000 Leap

Boosting Income

- Initiate a Side Project: Utilize your talents and spare time to earn additional income through freelance work, consulting, or online sales.

- Enhance Your Skills: Invest in further education and professional growth to access better-paying positions and advancement opportunities.

- Advocate for Salary Increases: Understand your industry’s salary standards and be ready to negotiate your worth and contributions at performance reviews.

Minimizing Expenses

- Review Spending Patterns: Monitor your spending for a month to pinpoint unnecessary expenditures, like eating out, subscriptions, or spontaneous buys.

- Adopt Cost-Reduction Measures: Lower bills through negotiation, cut down on non-essentials and prioritize essential needs to decrease your spending.

Investment Wisdom

- Investigate Investment Avenues: Get to know the risks and benefits of various investment options, including stocks, bonds, and real estate, and diversify accordingly.

- Capitalize on Compound Interest: Begin investing early and consistently to take advantage of compound interest, which can exponentially increase your wealth over time.

Automation and Optimization

- Automate Savings and Investments: Direct a portion of your paycheck to retirement accounts and set up automatic transfers to your savings and investment accounts.

- Use Financial Management Tools: Employ budgeting applications, investment tracking, and other financial technologies to simplify and enhance your financial management.

IV. Implementing the $100,000 Leap

To make the $100,000 Leap a reality:

- Monitor Expenses: Employ a budgeting tool or spreadsheet to keep track of your spending and identify potential savings.

- Reduce Unnecessary Spending: Cut or lower recurring costs that don’t support your financial objectives.

- Elevate Your Income: Seek outside gigs, negotiate for higher pay, or pursue skill development for income growth.

- Automate Financial Contributions: Arrange for automatic savings and investment contributions, including into retirement accounts.

- Broaden Investment Horizons: Spread your investments across various asset types to mitigate risk and optimize returns.

- Review and Adjust: Periodically assess your financial progress, tweak your approach as necessary, and celebrate your achievements.

V. Navigating Obstacles and Maintaining Motivation

To reach the $100,000 Leap, confront common hurdles like:

- Debt: Create a repayment strategy focusing on high-interest debts to increase available funds for saving and investing.

- Delaying: Establish SMART goals and maintain accountability through regular check-ins.

- Impulse Buying: Recognize triggers for unnecessary spending and develop strategies to resist them.

Stay motivated by connecting with a community that shares your financial goals. Participate in online forums, and local groups, or partner with a financial buddy to exchange experiences and encouragement.

VI. Conclusion

The $100,000 Leap illustrates the profound effect of consistent, strategic financial practices on wealth accumulation. By enhancing your income, curbing expenses, making informed investments, and automating your financial processes, you can tap into compound growth and significantly alter your financial future.

Embracing the $100,000 Leap demands dedication and the flexibility to adapt strategies to your evolving needs. Yet, with determination, persistence, and a strategic mindset, you can hasten your journey to financial independence, ensuring a life of abundance and security.

Begin today by downloading our comprehensive budgeting template and setting up automated financial contributions. Your future self will be grateful for the strategic decisions and actions that culminate in the $100,000 Leap.