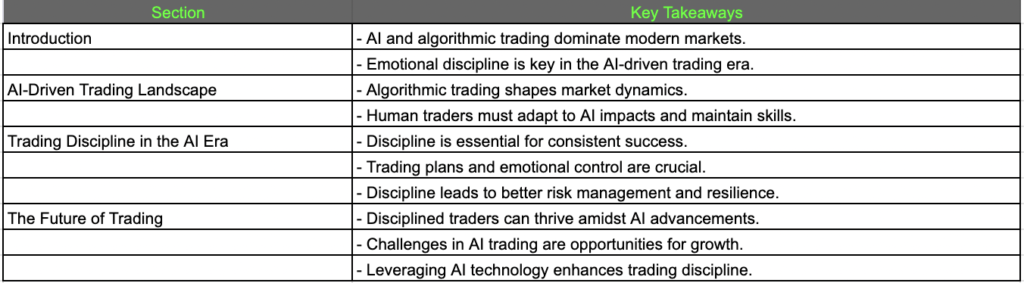

The AI Era: Why Trading Discipline Matters More Than Ever

Over the last decade, algorithmic trading has exploded in financial markets.

Spurred by exponential advances in technology, computerized trading systems now account for over 70% of activities across major exchanges worldwide.

This ascendance shows no signs of slowing down.

Behind the disruption lies powerful artificial intelligence technology parsing vast datasets to recognize obscured patterns and capture profits within market movements in milliseconds.

The sophistication and scale achievable surpasses individual human capabilities.

However, easy profits remain elusive for most adopters.

The reasons trace back primordially to limitations in emotional discipline that algorithms don’t share rather than computational horsepower alone.

This gap exposes why evolving markets now mandate ever greater mental rigor from traders regardless of cutting-edge tools incorporated.

Part 1: Navigating the AI-Driven Trading Landscape

AI Trading in Action: Unveiling the Algorithmic Approach

Defining Algorithmic Trading

Algorithmic trading is at the heart of the AI-driven approach to trading.

This sub-section provides a comprehensive definition and explores the distinguishing characteristics of algorithmic trading.

Exploring Algorithmic Trading Strategies

Various types of algorithmic trading strategies play a pivotal role in the AI era.

Here, we delve into the intricacies of these strategies, shedding light on their mechanics and execution in the markets.

The Impact of AI Trading on Market Dynamics

The Rise of High-Frequency Trading (HFT)

Today, predatory high-frequency algorithms utilize direct data links to react across global markets simultaneously faster than humans can biologically absorb headlines or input orders manually.

Volatility accordingly surges in outsized swings as transaction volumes hit hyperspeed levels.

Vast troves of historical data empower complex machine learning models to gain predictive edges by deducing obscure correlations.

They capitalize on market movements even before the catalysts become apparent.

Implications for Human Traders

The ever-growing presence of AI trading raises questions about its implications for human traders.

Rapid innovations on the horizon across artificial intelligence, machine learning and predictive analytics should spark eager anticipation rather than existential angst for traders focused on capacitating human excellence.

Each breakthrough lifts potential accomplishments exponentially when appropriated judiciously to augment rather than replace discretionary self-mastery that separates consistent winners from transient speculators over the long term.

Part 2: The Cornerstone of Success: Trading Discipline in the AI Era

Defining Trading Discipline: The Foundation for Consistent Success

The Essence of Trading Discipline

The essence of trading discipline, emphasizing its role in achieving consistent and profitable outcomes in the AI era.

Cultivating an unflappable mindset sustaining consistency through market turbulence begins with laying strong psychological foundations.

Adhering to a Trading Plan

The importance of adhering to a pre-defined trading plan is a must.

Establish realistic outcomes expected from the trading system over various timeframes based on historical backtesting during diverse cycles.

This frames performance analysis objectively.

Mastering Emotional Control

Emotional control is a key aspect of trading discipline.

Adopt mindset emphasizing probability over prediction for any single trade.

Outcomes become non-events, neither celebrated nor agonized emotionally—consistency compounds over long horizons.

The Benefits of Trading Discipline: A Path to Sustainable Profits

Enhanced Consistency and Predictability

Disciplined execution leads to enhanced consistency and predictability in trading outcomes.

Cultivate the mindset and abilities separating consistent winners from transient participants across eras.

Commit to strengthening psychological resilience forfeited easily during recent decades of passive technological dependence.

Reduced Risk Exposure and Improved Risk Management

Effective risk management is a byproduct of trading discipline.

Disciplined traders reduce risk exposure, ensuring long-term financial stability.

Balance passions for disruptive technology with wisdom guarding against undiscovered risks.

Foster skills, communities and support systems bolstering anti-fragility to thrive amidst uncertainty.

Increased Confidence and Resilience

Discipline fosters increased confidence and resilience in navigating market fluctuations.

One must acquire the psychological requirements of a disciplined approach.

Comprehensive Trading Plan

Creating a comprehensive trading plan is akin to crafting the blueprint for disciplined execution in the intricate world of trading.

This foundational document encapsulates key components that serve as the guiding principles for every trade.

It instills a sense of structure and foresight essential for maintaining discipline in the face of market uncertainties.

At the heart of a robust trading plan lie meticulously defined entry and exit strategies.

These components delineate the conditions under which a trade is initiated and, conversely, the circumstances that warrant its closure.

By establishing clear criteria for entering and exiting positions, disciplined traders eliminate ambiguity and emotional decision-making from their trading process.

This precision not only streamlines the execution of trades but also reinforces the trader’s commitment to a predefined strategy.

The Challenges of Maintaining Trading Discipline: Overcoming Human Biases

Influence of Emotions and Biases

Human biases and emotions can influence trading decisions.

The potential for irrational behavior and ways to overcome these challenges will teach you how to become a successful trader.

Temptation to Deviate from the Plan

Traders often face the temptation to deviate from their plans in pursuit of short-term gains or to avoid losses.

The challenges posed by such temptations are ever-present considering the volatility of the market.

Psychological Pressure in the Face of Uncertainty

Market uncertainty, losses, and the judgment of others can exert psychological pressure on traders.

One can overcome such pressures by accepting the laws of cause and effect.

They do take their losses with the idea that losses are just part of the plan, as long as they stick with this plan.

A Call to Action: Embracing Discipline for Trading Success

At its core, disciplined trading is a proactive approach that involves adhering to a predefined set of rules, strategies, and risk management protocols.

Encouraging traders, irrespective of their experience level, to embrace this discipline is a call to prioritize long-term success over short-term gains.

By doing so, traders cultivate a mindset focused on consistency, risk management, and strategic planning—elements crucial for navigating the intricacies of the financial markets, especially in an era dominated by technological advancements.

The Future of Trading: Discipline in an Evolving Landscape

Acknowledging the ongoing evolution of AI trading is an acknowledgment of the continuous metamorphosis within the financial landscape.

In particular, this can be seen in how artificial intelligence shapes market dynamics.

It involves an astute recognition of the perpetual refinement and advancement of algorithms, marking a trajectory toward increasing sophistication and accelerated trading speeds.

In the context of AI trading, algorithms are the bedrock of decision-making processes, and their refinement is a testament to the relentless pursuit of efficiency and effectiveness in executing trades.

As technology progresses, algorithms evolve from rudimentary models to intricate and nuanced strategies, capable of processing vast datasets and identifying nuanced patterns at unprecedented speeds.

Optimism for Disciplined Traders in the AI Era

Expressing optimism for the future of disciplined traders in the AI era reflects a positive outlook on their ability to not only navigate but also excel in the rapidly evolving market environment shaped by artificial intelligence.

This optimism is grounded in the belief that disciplined traders, equipped with a unique set of skills, a resilient mindset, and adaptability, are well-positioned to thrive amidst the challenges and opportunities presented by advancing technologies.

In Conclusion: A Dynamic Future for Disciplined Traders

The conclusion reinforces the indispensable role of discipline in the ever-evolving AI era.

It emphasizes the dynamic nature of the future, where disciplined traders will continue to shape the landscape, adapting and thriving in the face of technological advancements.

As the trading world evolves, disciplined traders remain at the forefront, navigating challenges and seizing opportunities in this dynamic and complex landscape.

Additional Insights: Nurturing Discipline for Long-Term Success

Embracing Challenges as Opportunities

The challenges posed by the integration of artificial intelligence into trading strategies are myriad.

Algorithmic complexities, high-frequency trading, and the potential for market manipulations create an environment where adaptability becomes a prized asset.

Disciplined traders, by embracing these challenges, leverage them as avenues for growth rather than impediments.

Building a Resilient Mindset

Resilience stands as a foundational and indispensable attribute for traders immersed in the intricate and swiftly evolving terrain of AI-driven markets.

In the context of trading, resilience refers to the ability to adapt, recover, and thrive despite the multifaceted challenges posed by artificial intelligence and its influence on market dynamics.

Leveraging Technology for Discipline

While the integration of advanced technology into trading introduces its own set of challenges, it concurrently provides a repertoire of sophisticated tools that have the potential to significantly enhance and fortify trading discipline.

In the dynamic landscape where artificial intelligence and algorithms reign supreme, these technological tools act as a double-edged sword, presenting obstacles but also delivering innovative solutions to bolster the discipline of traders.

Summary

In summary, the AI era has ushered in a new paradigm for trading, where technology and human discipline intersect.

Traders who embrace both the power of AI and the importance of discipline position themselves for success in an ever-changing market environment.

By understanding the challenges posed by AI trading, recognizing the significance of trading discipline, and implementing practical strategies for cultivation and sustainability, traders can thrive in the exciting and dynamic landscape of AI-driven markets.

Traders standing at the nexus of AI prowess and disciplined trading are poised to unlock a realm of success within the market.

The symbiosis between advanced algorithms and human acumen creates a synergy that is greater than the sum of its parts.

Those who adeptly leverage the power of AI while upholding the core tenets of discipline establish a solid foundation for sustained success amid the dynamic shifts in the financial markets.

Have you already taken Supply and Demand Secrets?