What Is Slippage in Trading? Your Guide to Smart Trades

If you’ve ever placed a trade, you’ve probably experienced slippage. It’s that frustrating (or sometimes, surprisingly pleasant) moment when the price you thought you were getting isn't the price you actually got.

Think of it like this: you see a pair of limited-edition sneakers online for $200. You quickly click "Buy Now," but by the time your payment processes a few seconds later, the confirmation email says you paid $205. That $5 difference? That's slippage in a nutshell. It’s the gap between the expected price of a trade and the real, executed price.

Understanding What Slippage in Trading Really Means

At its core, slippage is just a natural side effect of trading in dynamic, fast-moving markets. There’s a tiny delay—sometimes just milliseconds—between the instant you hit the "buy" or "sell" button and the moment the exchange or broker actually fills your order. In that brief window, the price can tick up or down.

This isn’t necessarily a good or bad thing; it's simply a reality of how markets breathe. It can even work in your favor sometimes. Let's break down the three different ways slippage can show up in your trading account.

The Three Faces of Slippage

-

Negative Slippage: This is the one every trader knows and dislikes. It happens when the executed price is worse than you expected. You place a buy order for a stock at $100.00, but the market ticks up, and it gets filled at $100.05. That extra $0.05 you paid is negative slippage.

-

Positive Slippage: This is the happy accident. It’s when the price moves in your favor during that execution delay. You place that same buy order at $100.00, but it actually fills at $99.95. You just got a better deal than you bargained for!

-

Zero Slippage: This is exactly what it sounds like—your order fills at the precise price you clicked. This is most common in very stable, liquid markets or when you use specific order types designed to lock in a price.

Slippage is essentially the market's way of telling you that prices are not static. They are dynamic, constantly shifting based on the real-time push and pull of buyers and sellers.

This idea is critical for anyone learning to trade, since it directly impacts your entry and exit points. Getting a handle on what drives these tiny price shifts is a massive part of mastering price action trading.

Where Does Slippage Come From?

Slippage really boils down to two main market conditions: high volatility and low liquidity.

When a market is volatile, prices are jumping around like crazy. The more they move, the higher the chance your order gets filled at a different price than the one you saw a split-second ago.

On the other hand, when liquidity is low, it means there aren't many buyers and sellers active at that moment. In a "thin" market like this, even a normal-sized order can be enough to nudge the price, causing slippage because there isn't enough opposing volume to absorb your trade instantly.

For instance, in the Forex market, slippage is measured in "pips," the smallest move a currency pair can make. A major pair like EUR/USD is incredibly liquid, so slippage is usually minimal. But if you're trading a less common, "exotic" pair, the order book is much thinner, and you can expect to see much larger gaps.

Slippage at a Glance: Key Concepts

To wrap your head around these core ideas quickly, here’s a simple table breaking down the basics.

| Concept | Brief Explanation | Example |

|---|---|---|

| Slippage | The difference between your trade's expected price and its actual execution price. | You click to buy a stock at $50.00, but the order fills at $50.02. The $0.02 is slippage. |

| Negative Slippage | The trade executes at a less favorable price, costing you more (on a buy) or earning you less (on a sell). | Your sell order for $150.00 gets filled at $149.90. |

| Positive Slippage | The trade executes at a more favorable price, saving you money (on a buy) or earning you more (on a sell). | Your buy order for $150.00 gets filled at $149.90. |

| High Volatility | Prices are changing rapidly and unpredictably, increasing the likelihood of slippage. | A surprise news announcement causes a stock's price to jump several percent in seconds. |

| Low Liquidity | There are fewer buyers and sellers in the market, making it harder to execute trades at the current price. | Trading an obscure crypto asset or a minor stock outside of main market hours. |

Understanding these distinctions is the first step. Once you know what slippage is and why it happens, you can start to build strategies to manage its impact on your trading performance.

Why Your Trade Price Slips: Uncovering the Causes

Slippage isn't some random market quirk; it’s a direct response to specific conditions. The first step to getting a handle on it is understanding what actually causes that gap between the price you clicked and the price you got. The biggest culprits are market volatility and liquidity, but other factors like your order size and even your tech setup play a big part.

Think of the market as an ocean. Some days, it's calm and predictable. Other days, it's a raging storm. To navigate either, you need to know what’s happening just beneath the surface. Let's dive into the core reasons your trade price can slip.

The Force of Market Volatility

In simple terms, market volatility is how fast and dramatically prices are changing. When volatility is high, prices can jump wildly in milliseconds—often much faster than your trade order can travel from your computer to the exchange to get filled.

Imagine you're trying to step onto a moving train. If the train is moving slowly and steadily (low volatility), you can easily get on right where you planned. But if that train suddenly lurches forward at high speed (high volatility), you're probably going to land a few feet from where you were aiming.

That's exactly what happens during major economic news, company earnings reports, or unexpected geopolitical events. These moments inject a massive dose of uncertainty into the market, causing prices to swing like crazy.

A study of systematic trading strategies found that during the initial market crash in March 2020, slippage rates doubled or even tripled compared to normal conditions. This is a perfect example of how extreme volatility directly blows up the potential for slippage.

In these turbulent windows, the price you see on your screen is practically ancient history. By the time your order is processed, the market may have already blasted past that point, leading to either negative or positive slippage.

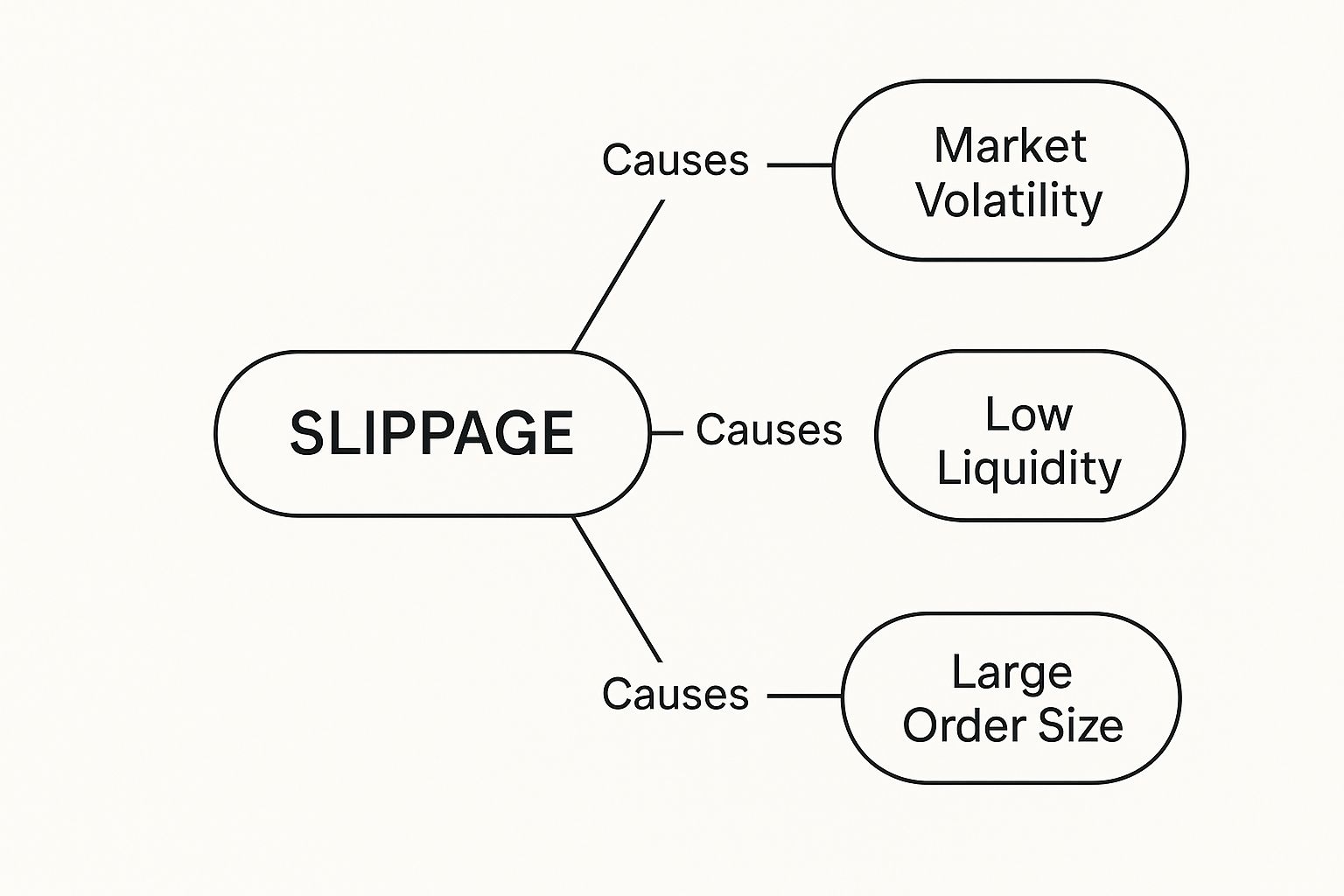

This infographic breaks down how these core causes—volatility, liquidity, and your order size—are all tangled together.

As the visual shows, these three factors are the pillars that determine whether your trade price holds steady or slips away.

The Challenge of Low Liquidity

Liquidity is all about how easily you can buy or sell something without moving the price. It boils down to a simple question: How many buyers and sellers are active in the market right now?

A highly liquid market is like a bustling city farmer's market. There are hundreds of vendors selling apples and hundreds of customers looking to buy them. If you want to buy 10 apples, no problem. You can do it without impacting the going rate because there’s just so much supply.

Now, picture a market with low liquidity. It’s like a single, remote roadside fruit stand with just one seller who has a handful of apples. If you try to buy all 10 of their apples at once, you can bet the seller is going to jack up the price for the last few. Why? Because your big order is wiping out their entire inventory.

This is precisely what happens in financial markets. When there aren't many people trading (low liquidity), even a medium-sized order can shove the price around because there just aren't enough orders on the other side to absorb it smoothly. This is a common problem in:

- Lesser-known cryptocurrencies or "altcoins" with small trading communities.

- Small-cap stocks that aren't on the radar of big institutional investors.

- Major markets when trading outside of their main hours (like trading European stocks in the middle of the night).

In these "thin" markets, your order essentially has to go searching for someone to trade with, and you often have to accept a worse price to get the whole thing filled.

How Order Size and Speed Contribute

Beyond the big-picture market conditions, factors specific to your own trade can create slippage, too.

Large Order Size: The sheer size of your order can be its own worst enemy. Trying to buy 100,000 shares of a stock is going to have a much bigger market impact than buying just 100 shares. A huge order eats up all the available shares at the best price, forcing the rest of your order to be filled at progressively worse prices further down the list.

Execution Speed (Latency): The time it takes for your order to get from your trading platform to the exchange is called latency. We're talking milliseconds here, but in a fast-moving market, that's more than enough time for prices to change. A slow internet connection or a broker with poor routing technology can stretch out that delay, bumping up your slippage risk. When volatility is high, every single millisecond counts.

Seeing Slippage Happen in Real-World Trading

Theory is one thing, but seeing slippage chew up your profits in a live trade is where the lesson really sticks. It’s not just some abstract fee or a tiny cost of doing business. Slippage is a real, live event that can flip the script on your trade in a split second.

To really get a feel for how it works, let’s walk through three classic scenarios from different markets. Each one shows just how fast that gap between the price you think you’re getting and the price you actually get can widen.

Scenario 1: Stock Trading During an Earnings Report

Meet Alex. He's glued to his screen, watching TechCorp Inc. (TCORP). The company is about to drop its quarterly earnings report, and Alex is betting on a blockbuster. He's expecting the stock to pop.

The report hits the wire, and it’s even better than anyone dreamed. TCORP, which closed at $150.00, goes wild in after-hours trading. Alex sees the price flashing at $158.00 and, feeling that classic trader FOMO, he slams the button on a market order to buy 100 shares.

- Intended Price: $158.00 per share

- Order Type: Market Order

- Shares: 100

But here’s the problem: thousands of other traders and their high-speed bots saw the same news. A tidal wave of buy orders hits the market, creating insane volatility and sucking up every available share at $158. By the time Alex’s order actually gets filled—maybe a second later—the price has already been shoved higher.

Execution Price: $158.75 per share

Total Cost: $15,875 (instead of his planned $15,800)

Negative Slippage: $0.75 per share, or $75 total

That $75 difference is pure, unadulterated negative slippage. Alex got his shares, sure, but the chaos of the moment forced him to pay a premium, putting him in a hole right from the start.

Scenario 2: Forex Trading on a Central Bank Decision

Now let’s look at Maria, a forex trader with her eyes on the EUR/USD pair. The head of the European Central Bank (ECB) is at the podium, and the market is hanging on every word. The EUR/USD is trading calmly at 1.0750.

Suddenly, the ECB president hints at a surprise interest rate cut. That’s bearish news for the Euro. Maria reacts instantly, placing a market order to short 1 standard lot (100,000 units) of EUR/USD.

- Intended Price: 1.0750

- Order Type: Market Order

- Position Size: 1 Standard Lot

The market explodes. In the blink of an eye, the price gaps down, skipping over several price points entirely. For a moment, liquidity vanishes as the big banks pull their quotes to figure out what just happened.

- Execution Price: 1.0742

- Slippage Type: Positive

- Financial Impact: The price rocketed 8 pips in her favor before her order was filled.

This is the flip side of the coin: positive slippage. Maria wanted to sell at 1.0750, but the market moved so violently in her direction that her broker filled her order at a better price. She just got an instant, free cushion on her trade. It doesn't happen often, but when it does, it's a beautiful thing.

Scenario 3: Cryptocurrency and a Whale Trade

Last up is Ben, a crypto trader messing with a new altcoin, NovaToken (NVT), on a decentralized exchange (DEX). The market for NVT is pretty thin, meaning there isn't a lot of liquidity. Ben wants to scoop up 10,000 NVT and sees the price sitting at $0.50.

Just as he's about to click "buy," a "whale"—somebody holding a massive bag of the token—decides to dump millions of NVT on the market. This one massive sell order wipes out all the buy orders at the top of the order book in an instant.

When Ben's market order for 10,000 NVT finally goes through, it has to scrape the bottom of the barrel, filling at progressively worse prices because the whale already took all the cheap supply.

- Intended Price: $0.50 per NVT

- Actual Average Execution Price: $0.54 per NVT

- Total Cost: $5,400 (instead of the expected $5,000)

- Negative Slippage Cost: A painful $400

This is a textbook example of how low liquidity pours gasoline on the slippage fire. Ben’s relatively small order got steamrolled by a much bigger player, showing just how dangerous thin markets can be. These scenarios aren't just hypotheticals; they happen every day and prove that slippage is a constant force all traders have to learn to deal with.

How Slippage Silently Bleeds Your Trading Account

Slippage isn't just a minor annoyance or some small cost of doing business. Not at all. It's a quiet, relentless force that can systematically eat away at your trading profits over time. A few cents here and there might seem like nothing on a single trade, but the combined effect can be absolutely devastating, especially if you're an active trader.

Think of it as a slow, tiny leak in a tire. One little puncture won't stop your car immediately, but over a long road trip, it'll eventually leave you stranded. In the same way, consistent negative slippage slowly drains your trading account, turning what looked like a profitable strategy on paper into a losing one in the real world.

The Shrinking Margin Effect on Active Traders

For anyone running high-frequency strategies like scalping or day trading, the profit margins are already razor-thin. A scalper might be trying to capture just a handful of pips or a few cents on each trade. In that kind of environment, slippage isn't just a cost—it can wipe out your entire profit margin.

Imagine a scalper who makes 50 trades in a day, shooting for a $10 profit on each one. If they consistently get just $2 of negative slippage on every entry and exit, their expected daily profit of $500 is immediately slashed by $200. Just like that, their strategy is 40% less profitable than their backtesting showed. This is exactly how a winning system can quickly turn into a break-even or, worse, a losing game.

Slippage is the invisible tax on every single transaction. Forgetting to account for it is like calculating your business revenue without subtracting the cost of your products—it gives you a dangerously misleading picture of your actual performance.

This silent bleeding gets even worse when you factor in compounding. The profits you lose to slippage are profits you can't reinvest to grow your account. This slows down your progress and makes it that much harder to hit your financial targets.

When Risk Management Gets Blown Apart

Maybe the most dangerous thing about slippage is its power to completely wreck your risk management plan. A stop-loss order is a trader's most vital safety net, put in place to cap losses at a specific level. But a stop-loss isn't some magic guarantee.

A stop-loss is simply a market order that gets triggered once a certain price is hit. In a market that's moving like a freight train or doesn't have much liquidity, the price can blow right past your stop-loss level before your order even has a chance to execute.

Take a look at this all-too-common scenario:

- You buy a stock at $50 and set a stop-loss at $49, planning to limit your loss to $1 per share.

- Some bad news breaks, and the stock price nosedives.

- By the time your stop-loss at $49 triggers and sends the order out, the best available price to sell is now $48.25.

Instead of your planned, controlled $1 loss, you've just taken a $1.75 loss per share—that's a 75% bigger loss than you planned for. A single event like this can wipe out the profits from a bunch of your winning trades, showing you exactly how slippage can turn a disciplined strategy into a pure gamble.

The Amplifying Effect of Major Market Events

History has shown us that slippage becomes a huge problem during chaotic market periods. For instance, during the initial COVID-19 market crash in March 2020, slippage rates reportedly doubled or even tripled for many systematic trading strategies. Managed futures funds saw their entries slipping away and their stop-losses getting hit far from where they intended, which hammered their performance. This event was a stark reminder of how backtested models that don't account for real-world slippage can fail spectacularly under stress. You can dive deeper into how systematic funds handle these issues in detailed market analyses from specialist financial publications.

The psychological damage from slippage is also a big deal. When you keep getting hit with negative slippage, it leads to frustration, hesitation, and a loss of faith in your strategy. This can make you second-guess good trade setups or ditch your plan entirely, which only leads to worse results. For all these reasons, building a realistic slippage estimate into your trading plan is completely non-negotiable if you want to succeed long-term.

Practical Ways to Protect Your Trades from Slippage

Look, slippage is just a part of the trading game. It’s unavoidable. But that doesn’t mean you have to be a victim. With a bit of strategic thinking, you can shield your trades and protect your capital from getting chipped away.

Think of it like defensive driving. You can't control every other car on the road, but you can definitely use techniques to navigate the chaos and get to your destination safely.

These aren't complicated theories, but real, battle-tested methods you can start using today. Getting these down will give you far more control over your entries and exits, and a much clearer picture of your actual trading performance.

Use Limit Orders as Your First Line of Defense

Your single most powerful weapon against slippage is the limit order. A market order screams, "Get me in now, I don't care about the price!" A limit order, on the other hand, says, "Get me in at this exact price or better." This simple switch gives you total control over what you pay.

When you place a limit order to buy a stock at $50, you’re drawing a line in the sand. You will not pay a single cent more. If the price jumps to $50.05 before your order is hit, it just waits patiently. The trade-off? Execution isn't guaranteed. If the price never comes back to your level, you miss the trade.

A limit order prioritizes price control over immediate execution. It is the single most effective way to prevent negative slippage on your entries and exits, making it a cornerstone of disciplined trading.

Set Maximum Slippage Tolerance on Your Platform

Many modern trading platforms have a fantastic safety net: maximum slippage tolerance. This feature lets you define precisely how much slippage you’re willing to stomach on a market order. It’s like a hybrid, giving you the speed of a market order with the protection of a limit order.

For example, a lot of pros will set a slippage tolerance of 0.05% on stock trades. If you place a market order to buy a stock at $100 with that setting, your broker will only fill it if the price is between $100 and $100.05. If the price gaps beyond that, the order is automatically cancelled, saving you from a bad fill.

Avoid Trading During Extreme Volatility

High volatility is the biggest cause of slippage, period. It's incredibly tempting to dive in during massive news events like earnings reports or Fed announcements, but this is when slippage is at its absolute worst. Prices are moving so erratically that getting filled anywhere near where you clicked is a pipe dream.

The smart move? Just stay on the sidelines. Let the dust settle. Wait for the crazy initial move to exhaust itself and for liquidity to come back to the market. A little patience here can save you a lot of money.

Break Large Orders into Smaller Chunks

Trying to shove a single, massive order into a market with average liquidity is a guaranteed recipe for slippage. It’s like dropping a boulder in a small pond—the splash pushes the water (and the price) away from you. The pros use a technique called "iceberging" to avoid this.

Instead of one giant order for 10,000 shares, break it into smaller chunks of 500 or 1,000 shares each. This does two things for you:

- Reduced Market Impact: Smaller orders get soaked up by the market easily without moving the price against you.

- Fly Under the Radar: It keeps you from tipping your hand to high-frequency trading bots that are programmed to hunt for large orders and front-run them.

This tactic is all about smart position sizing, a core skill for any serious trader. To really nail this down, it’s worth exploring different proven position sizing strategies which can give you a significant edge.

Choose a Broker with Quality Execution

Finally, remember that not all brokers are created equal. Your broker's tech, their order routing, and their liquidity connections play a massive role in how much slippage you face. A broker with slow, sloppy execution will consistently cost you money with bad fills.

When you’re shopping for a broker, look for one that’s open about their execution quality and is known for low-latency infrastructure. A "zero-commission" broker might look cheap on the surface, but if you’re constantly getting bad fills and high slippage, it can end up being far more expensive in the long run.

Answering Your Key Questions About Slippage

As you get your feet wet in the trading world, you'll naturally start bumping into some specific questions about slippage. Getting the hang of these finer points is what separates a nervous trader from a confident one. Let's tackle some of the most common questions head-on.

We'll start with one that catches a lot of new traders by surprise.

Can Slippage Ever Be a Good Thing?

Yes, absolutely. While most traders see slippage as a threat, it's not always a bad thing. When the market moves in your favor between the time you place an order and when it actually executes, you’ve just experienced positive slippage.

Imagine you want to buy a stock and place a market order at $50.00. In that split second, the price actually ticks down, and your order gets filled at $49.95. That's a better price than you expected! It's a welcome bonus when it happens, even if it is less common than its negative cousin.

Which Markets Are Most Prone to Slippage?

Slippage can pop up in any market, but it’s a much bigger problem in certain environments. The two main ingredients for slippage are high volatility and low liquidity. So, any market with those traits is a hotspot.

- Cryptocurrencies: These are the wild west of finance. Smaller "altcoins," in particular, are known for their wild price swings and thin order books, making them a prime spot for major slippage.

- Small-Cap Stocks: Unlike blue-chip giants, these stocks don't have a deep pool of buyers and sellers. That means even a moderately sized order can nudge the price.

- Exotic Forex Pairs: A major pair like EUR/USD is incredibly liquid. But exotic pairs like USD/ZAR have far less trading volume, which cranks up the risk of slippage.

- Any Market During News Events: Nothing throws a market into chaos like a surprise announcement. Even the most liquid markets can see volatility spike, causing a temporary surge in slippage for everyone involved.

Is It Possible to Achieve Zero Slippage?

Yes, it is, but it comes with a trade-off. The key is to use a specific tool: the limit order. A limit order is your way of telling the market, "I will pay this price and not a penny more." If you set a limit order to buy at $100, you are guaranteed to never pay more than that.

The catch is that execution isn't guaranteed. If the price zips past your limit and never comes back, your order won't get filled. You could miss out on the move entirely.

This is a critical decision every trader faces: do you use a market order for guaranteed execution (but risk slippage) or a limit order for a guaranteed price (but risk missing the trade)? Not understanding this choice is one of the 10 fatal mistakes traders make when they're just starting out.

How Can I Find My Broker’s Slippage Policy?

Any good broker should be completely upfront about how they handle your orders. You can usually find this information in a document called an "Order Execution Policy" or something similar, typically tucked away in the legal section of their website.

Look for specifics on how they handle price improvements (that's positive slippage) and their general approach to filling orders when the market gets choppy. If you can't find it easily, just ask them. A quick email or chat with their customer support should clear things up.

At Colibri Trader, we teach you the price action strategies needed to navigate market realities like slippage. Our programs focus on discipline and proven techniques to help you trade with confidence, no matter the market conditions. Discover your trading potential with our free quiz.