What Is Risk Reward Ratio A Guide for Smarter Trading

At its core, the risk reward ratio is a simple but incredibly powerful tool. It measures how much potential profit you expect for every single dollar you put on the line.

Put simply, if you’re aiming for a $300 profit and you're willing to accept a $100 loss, your risk reward ratio is 1:3. This one number is a true cornerstone of disciplined trading.

Decoding the Risk Reward Ratio in Trading

Think of the risk reward ratio as the one crucial question you must ask before committing any capital: "Is the potential upside really worth the potential downside?" It’s less about a complicated formula and more about a strategic way of thinking.

Just like a chess master weighs sacrificing a pawn to take a more valuable piece, a trader uses this ratio to make calculated decisions, not emotional gambles.

This approach gives your trading plan some much-needed structure. By clearly defining your maximum loss (your risk) and your target profit (your reward) before you even enter a trade, you create a solid framework. This is what keeps you from making impulsive moves based on fear or greed—common traps that snare far too many traders.

Historically, the most successful traders have built their long-term profitability on a foundation of favorable risk reward ratios. It's a fundamental concept you'll see discussed often. You can find more insights on historical trading strategies at quantifiedstrategies.com.

Risk Reward Ratio At a Glance

Before we get into the nitty-gritty of the calculation, let's quickly break down the key parts of the risk reward ratio. Getting a handle on these components is the first step to using this tool effectively in your own trading.

| Component | What It Means | Example |

|---|---|---|

| Risk | The maximum amount of money you are willing to lose on a single trade. | Setting a stop-loss order $10 below your entry price. |

| Reward | The amount of profit you aim to make if the trade moves in your favor. | Setting a take-profit order $30 above your entry price. |

| Ratio | The comparison between your potential risk and your potential reward. | A $10 risk for a $30 reward creates a 1:3 ratio. |

As you can see, the concept is straightforward. The real skill comes in applying it consistently to every single trade you take.

Calculating Your Risk Reward Ratio Step By Step

Turning the abstract idea of a risk/reward ratio into a practical tool for your trading is surprisingly simple. You just need three key numbers for any trade you're thinking about taking. This quick process gives you a clear, objective picture of what's at stake and what you stand to gain before you put a single dollar on the line.

The calculation itself is just basic arithmetic, so you don't need to be a math whiz. To nail down the "reward" side of the equation, it helps to know how to calculate your potential return on investment (ROI). Once you've got a handle on that, the rest is a piece of cake.

The Three Core Numbers

Before you can crunch the numbers, you have to define the trade's parameters. This isn't about guesswork; it's about having a solid plan.

- Entry Price: The exact price where you'll buy (or sell) the asset.

- Stop-Loss Price: Your exit point for a small, acceptable loss if the market turns against you.

- Take-Profit Price: The target price where you'll exit the trade to lock in your profit.

These three points on a chart define your entire trade. They are your plan of attack.

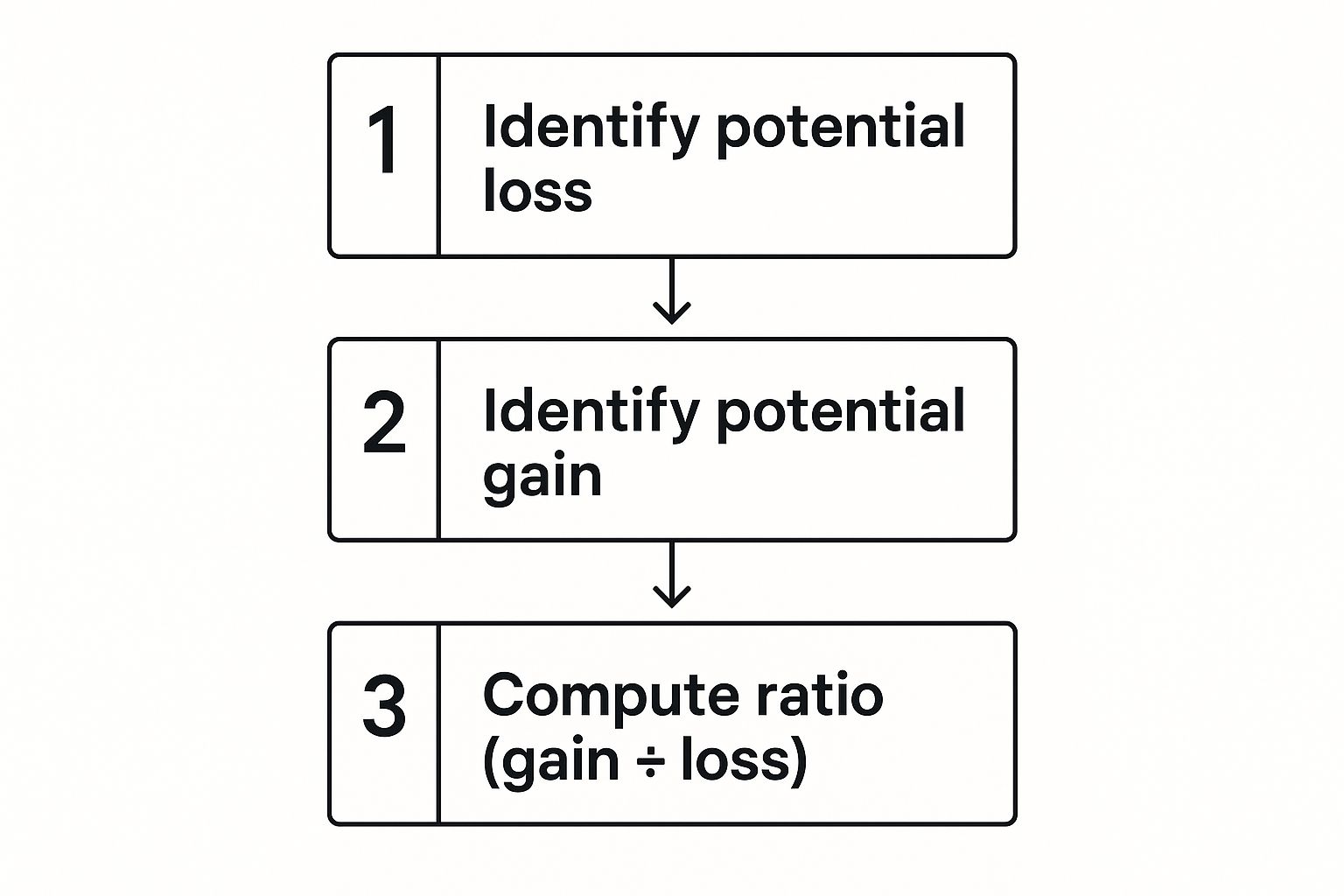

This infographic breaks down the calculation into three simple stages.

As you can see, calculating your ratio is just a logical sequence: figure out your potential loss, then your potential gain, and finally, divide one by the other.

The formula is: Risk/Reward Ratio = (Take-Profit Price – Entry Price) / (Entry Price – Stop-Loss Price)

Let's walk through a real-world example. Imagine you want to buy a stock at $50. You decide to set your stop-loss at $45 and your take-profit target at $65.

- Your potential risk is $5 per share ($50 – $45).

- Your potential reward is $15 per share ($65 – $50).

So, the ratio is $15 / $5, which simplifies to 3. This gives you a risk/reward ratio of 1:3. Simple.

For traders who want an even quicker way, you can always use a dedicated risk/reward ratio calculator to speed things up.

Why This Ratio Is Your Most Important Trading Tool

Understanding the risk/reward ratio and how to calculate it is just the opening act. The real transformation happens when this metric reshapes your mindset—turning you into a methodical decision-maker rather than an emotional gambler.

Every trade becomes a clear-cut business choice. By defining your maximum loss and anticipated gain upfront, you sideline fear and greed, the two wildcards that can derail your account.

Here’s what a solid risk/reward framework delivers:

- Clarity on each trade’s purpose

- Discipline to stick with your plan

- Protection against devastating drawdowns

A Pathway To Long-Term Profitability

In my experience, a well-managed risk/reward ratio links directly to lasting gains. You don’t need an 80% win rate to prosper—many newcomers struggle to accept that fact.

By consistently taking trades with a favorable risk/reward ratio, you can be profitable even if you lose more trades than you win. A ratio of 1:3, for example, means one winning trade can erase the losses of three losing trades.

That straightforward math is your safety net. It guards your capital from big setbacks and allows your account to grow steadily. Suddenly, it’s not about winning every single trade but ensuring your average winner dwarfs your average loser.

| Win Rate | Risk/Reward Ratio | Net Outcome |

|---|---|---|

| 70% | 1:1 | Breakeven |

| 40% | 1:3 | Profitable |

Embracing this approach builds the kind of discipline that fuels consistent success. Each entry feels intentional, every exit follows a plan, and you trade with the confidence of someone who knows exactly where they’re headed. Without this structure, you’re simply wandering through the markets without a map.

Seeing The Risk Reward Ratio In Real-World Trades

Theory is one thing, but seeing the risk reward ratio in action is what really makes the concept click. Let's walk through two completely different trade setups, side-by-side. This will highlight how this simple metric can be the difference between a disciplined strategy and a wild, speculative guess.

This comparison will make it crystal clear why chasing trades with a favorable ratio is absolutely essential for long-term survival in the markets. It all starts with knowing where to place your orders, a topic we cover in-depth in our guide to stop-loss and take-profit levels.

Scenario 1: A Favorable 1:3 Ratio Trade

Let's imagine you're watching a stock trading at $100. Your analysis of the chart shows a rock-solid support level down at $95 and a clear ceiling of resistance up at $115. Right there, you have the three key numbers you need to build a high-quality trade.

- Entry Price: You buy at $100.

- Stop-Loss: You place your stop just below support at $95, risking $5 per share.

- Take-Profit: Your target is just before resistance at $115, giving you a potential $15 profit per share.

The math here is simple: your potential reward ($15) divided by your potential risk ($5) equals 3. That gives you a risk reward ratio of 1:3.

For every single dollar you put on the line, you stand to make three. This is the kind of setup that builds accounts because a single winner can completely wipe out the losses from three failed trades. It gives you a powerful mathematical edge over time.

A favorable ratio isn't just about the numbers; it's a mindset. It forces you to be patient and selective, ensuring the potential upside dramatically outweighs the downside before you ever risk your capital.

Scenario 2: An Unfavorable 2:1 Ratio Trade

Now, let's flip the script and look at a much less appealing setup. Another stock is trading at $50, and you've got a hunch it might pop up to $55. The problem? The only logical place to hide your stop-loss is way down at $40, below a recent swing low.

- Entry Price: You buy at $50.

- Stop-Loss: Your stop goes at $40, meaning you're risking a hefty $10 per share.

- Take-Profit: Your target is $55, for a potential gain of just $5 per share.

In this trade, your potential risk ($10) is double your potential reward ($5). This creates an ugly risk reward ratio of 2:1. To make money with a strategy like this, you'd have to win an incredibly high percentage of the time—something that's nearly impossible for even the best traders to sustain.

This kind of risk analysis is just as critical in volatile markets like crypto. When looking at things like Bitcoin price predictions, the massive price swings can create huge opportunities, but the risk side of the equation must be managed just as carefully. Weak setups like this are what slowly drain trading accounts, as the losses systematically dwarf the wins.

Comparing Favorable vs Unfavorable Risk Reward Scenarios

Looking at these two trades in a table makes the difference incredibly stark. It's not about whether a single trade wins or loses; it's about which setup gives you a sustainable edge over hundreds of trades.

| Metric | Trade A (Favorable Ratio) | Trade B (Unfavorable Ratio) |

|---|---|---|

| Entry Price | $100 | $50 |

| Stop-Loss | $95 | $40 |

| Take-Profit | $115 | $55 |

| Potential Risk | $5 per share | $10 per share |

| Potential Reward | $15 per share | $5 per share |

| Risk Reward Ratio | 1:3 | 2:1 |

| Long-Term Outlook | Sustainable; one win covers three losses. | Unsustainable; requires an unrealistic win rate to be profitable. |

Ultimately, Trade A puts the odds in your favor, allowing you to be wrong more often than you are right and still come out ahead. Trade B forces you into a corner where you have to be right almost all the time just to break even—a recipe for disaster.

Finding the Right Risk Reward Ratio for Your Style

So many traders get hung up searching for a single, magical risk/reward ratio that will solve all their problems. But here’s the reality: it doesn't exist. The "best" ratio is deeply personal and has everything to do with your trading style, your timeframe, and even your personality.

What works for a scalper jumping in and out of the market for tiny profits is worlds away from what a long-term swing trader needs to succeed.

For instance, a day trader might find their sweet spot with a lower 1:1.5 ratio. They're looking for quick, high-probability setups they can close out within the session. A swing trader, on the other hand, might hold a position for days or weeks. For them, a 1:3 ratio (or even higher) makes more sense, giving the trade enough breathing room to capture a much larger market move.

The real goal is to find a balance that feels right for you and, most importantly, aligns with your strategy's actual performance.

The Win Rate and Ratio Connection

You can’t just look at your risk/reward ratio in a vacuum. It’s locked in a critical dance with your win rate, and these two metrics together are what determine if you'll be profitable over the long haul.

Think of it like a seesaw. When one side goes up, the other often comes down.

- High Ratio, Lower Win Rate: A trader who only takes setups with a 1:5 risk/reward might only win 30% of their trades. But that’s okay, because their big winners more than cover the smaller losses.

- Lower Ratio, Higher Win Rate: Someone using a tighter 1:2 ratio will need to be right more often, probably closer to 40-50% of the time, to see their account grow steadily.

The goal isn’t to chase the “best” ratio. It's about finding the right combination of ratio and win rate that gives you a positive expectancy over a large series of trades.

This balance is absolutely fundamental. Even analyses of the global market portfolio, representing a staggering $150 trillion in assets, show that the risk component is just as crucial as the potential reward when you're evaluating performance.

Ultimately, the answer lies in your trading journal. Dig into your own data. What’s your average win rate? Once you know that number, you can figure out the minimum risk/reward ratio you need just to break even, and then build your strategy from there. This simple step turns a generic trading "rule" into a powerful, personalized tool.

This also directly informs your position sizing. Getting your stake right for each trade becomes much simpler when you use a reliable position size calculator that does the heavy lifting for you.

https://www.colibritrader.com/position-size-calculator/

Common Mistakes Traders Make with This Ratio

Knowing the risk/reward ratio is one thing. Applying it correctly when your money is on the line and the market is moving against you? That’s a completely different ballgame.

It’s a classic story: a trader understands the concept on paper but falls into common traps that completely sabotage their results. These errors often turn a powerful tool into a source of constant frustration and, worse, losses.

One of the biggest mistakes I see is forcing a good ratio onto a bad trade idea. A trader spots a mediocre setup but then artificially stretches their profit target way beyond any logical resistance level, just to make the numbers look good. This isn't strategy; it’s just wishful thinking.

Another huge pitfall is simply ignoring what the market is telling you. Price action tells a story, and setting a stop-loss or take-profit target without respecting key support and resistance levels is a recipe for getting stopped out needlessly. The market doesn’t care about your desired 1:3 ratio; it only cares about supply and demand.

Moving the Goalposts Mid-Trade

This is perhaps the most destructive habit of all: emotionally changing your plan once the trade is live. It usually looks like one of two things:

- Widening your stop-loss: The trade starts moving against you and panic sets in. You drag your stop further away to "give it more room," completely blowing up your original risk calculation.

- Cutting your winner short: The trade moves in your favor, but the fear of giving back profits takes over. You snatch a small gain and get out, ruining the entire "reward" side of the equation.

A risk/reward ratio is only meaningful if you have the discipline to honor it. The moment you move your stop-loss or take profits prematurely, the entire logical foundation of the trade collapses.

Ultimately, these mistakes boil down to a lack of discipline. The solution? Treat your pre-trade analysis like a binding contract with yourself. Define your entry, stop, and target based on what the chart tells you, calculate your position size, and then—this is the hard part—let the trade play out without emotional interference. Your long-term success depends on it.

Answering Your Key Questions

As you start working the risk/reward ratio into your trading, you're bound to have some questions. It's only natural. Getting a solid handle on these concepts from the start will give you the confidence to apply them correctly when it really counts. Let's dig into a few of the most common ones I hear.

What Is a Good Risk Reward Ratio for Beginners?

If you're just starting out, a great baseline to aim for is a 1:2 risk/reward ratio. Simple as that.

This means for every dollar you're willing to risk, you're targeting a two-dollar profit. Sticking to this simple rule does something incredibly important: it forces you to build the habit of only taking trades where the potential reward is clearly bigger than the potential loss. It’s a foundational discipline.

Can My Risk Reward Ratio Be Too High?

Absolutely. It's easy to get lured in by the idea of a massive payout. A 1:10 ratio, for example, looks incredible on paper. But you have to ask yourself: how likely is the price to actually travel that far?

Setups with extremely high ratios often have a very low probability of hitting your profit target. In my experience, a trade that never reaches its target is just a frustrating waste of time and capital.

The sweet spot in trading is finding that balance between a great risk/reward ratio and a realistic chance of the trade actually playing out. Chasing lottery-ticket ratios is a recipe for disappointment.

How Does Volatility Affect My Ratio?

Volatility is a game-changer and directly impacts how you structure your trades. When the market is whipping back and forth, you’ll likely need to use a wider stop-loss to avoid getting knocked out of a good trade by a random price spike.

But widening your stop increases your risk. To keep your desired ratio (let's say 1:2), you now have to push your profit target further away, too. The real question then becomes whether that new, higher target is still a realistic level based on the chart. You always have to adapt your plan to what the market is doing right now.