Mastering Trading with the Trend

When you trade with the trend, you're doing exactly what it sounds like: aligning your trades with the market's current direction. Instead of trying to fight the momentum, you learn to ride the wave. This simple shift in perspective can dramatically increase your probability of success.

It's all about figuring out which way the market is moving—up or down—and placing trades that go along for the ride.

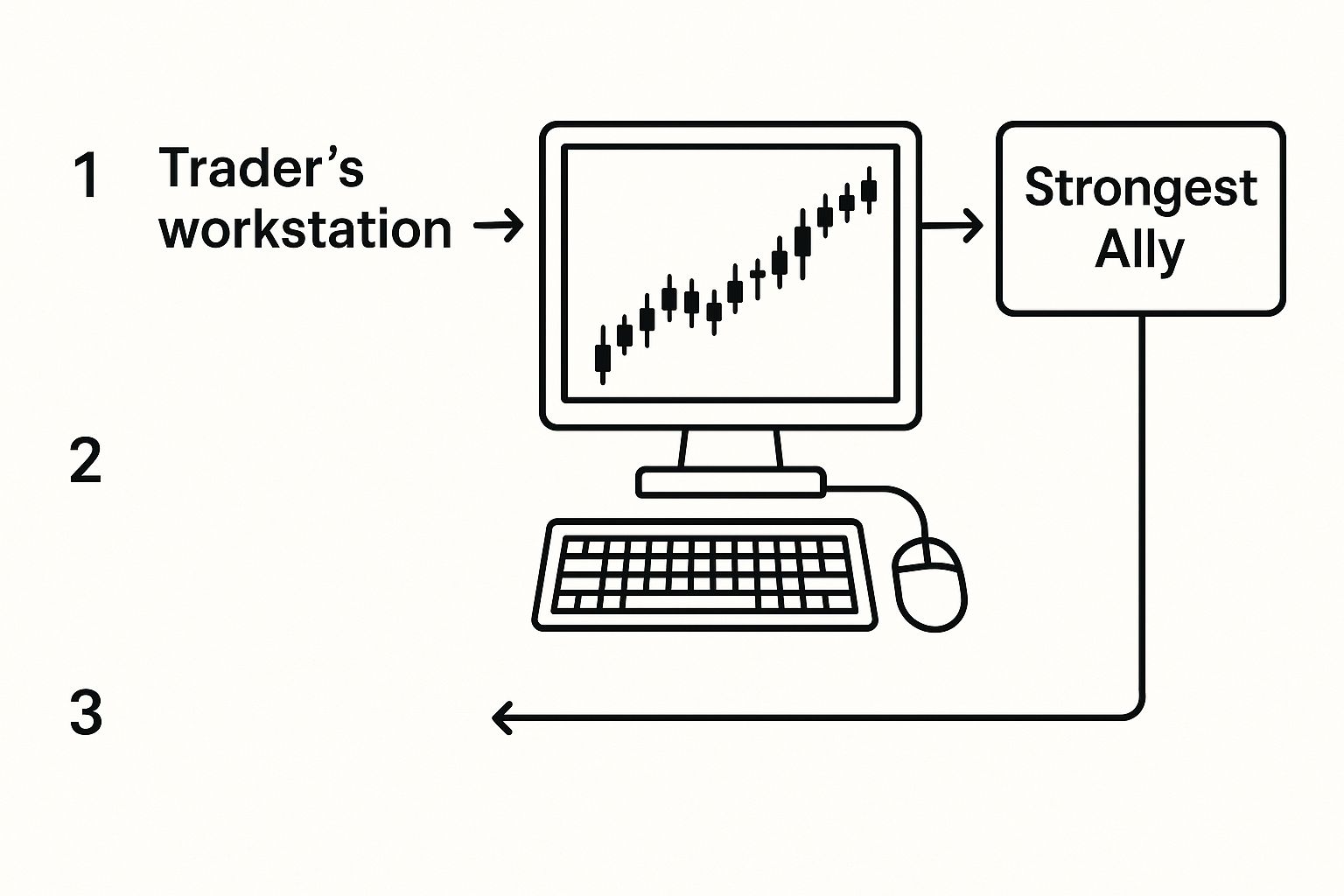

Why Trading With The Trend Is Your Strongest Ally

So many traders get fixated on predicting exact market tops and bottoms. It’s a tempting game, but it’s one that often leads to a lot of frustration and unnecessary losses.

The reality is that powerful forces, like big institutional money and collective human psychology, are what drive markets. They create sustained momentum that is incredibly difficult to fight. Trying to go against it is like swimming against a strong current—you'll just wear yourself out and get nowhere fast.

When you align yourself with the primary trend, you put all that market weight behind your trades, not against them. This infographic shows just how many entry opportunities a clear uptrend can offer. It becomes your single greatest strategic advantage.

As you can see, the goal is to focus on these high-probability setups, not try to catch every unpredictable reversal.

The Power of Market Momentum

Momentum is a beast. Once a stock or asset starts moving in a clear direction, it naturally attracts more and more traders, which just adds fuel to the fire. It’s a self-reinforcing cycle, and it’s why trends often last much longer than anyone expects.

Think about how markets react to major economic news. A big part of trend trading is catching the momentum from these large-scale movements. For instance, the 2025 stock market crash, set off by new tariffs, created massive global volatility. Despite the panic selling, markets eventually recovered. By June 27, 2025, the S&P 500 and NASDAQ both closed at all-time highs, showing the incredible gains that are possible when you align with a powerful recovery trend. You can always explore more details on major market shifts and their aftermath.

The core principle is simple: An object in motion tends to stay in motion. Prices are far more likely to continue on their current path than to suddenly reverse course. By trading with the trend, you are positioning yourself on the side of probability.

Putting Probability on Your Side

At the end of the day, successful trading is a game of odds. No strategy is going to give you a 100% win rate, but following the trend stacks the odds firmly in your favor.

It gives you a logical framework for your decisions. This helps you steer clear of emotional traps like FOMO (fear of missing out) or trying to perfectly time a reversal. Instead of guessing where the market might go, you're reacting to what it's actually doing.

How To Read Trends Using Pure Price Action

Forget the lagging indicators and confusing signals for a moment. If you really want to understand where the market is headed, you have to learn to read the chart itself. This is the heart of price action trading—letting the raw movement of price tell you the story of the battle between buyers and sellers.

At its core, identifying a trend with price action is surprisingly straightforward. You're just looking for a clear, repeating pattern of peaks and troughs. Learning to see this structure is a fundamental skill for any trend trader.

Decoding Market Structure

An uptrend isn’t just price moving up; it's a specific series of higher highs and higher lows. Think of it like walking up a staircase. Each step up (a new high) is followed by a small rest (a higher low) before the next climb. This rhythm shows you that buyers are in control, consistently pushing prices to new levels and defending any pullbacks.

On the flip side, a downtrend is a series of lower highs and lower lows. This is the market telling you that sellers have the upper hand. They're aggressively pushing prices down, and any rallies are quickly sold off, creating those successively lower peaks.

To get a clearer view, many traders draw trendlines. Simply connect two or more major swing lows in an uptrend, or two or more major swing highs in a downtrend. This visual aid does more than just confirm the trend's direction; it helps you gauge its steepness and strength. A steep trendline signals strong momentum, while a flatter one might suggest the trend is losing steam.

Key Takeaway: A trend is not just a general direction; it's a specific sequence of price movements. A confirmed uptrend requires at least two higher highs and two higher lows. Anything less is just a potential trend forming.

For a quick reference, here’s a simple breakdown of what to look for on your charts.

Identifying Trend Characteristics with Price Action

This table helps you quickly identify the direction and strength of a market trend based on its price action.

| Trend Type | Key Price Action Signal | Trader's Approach |

|---|---|---|

| Uptrend | A consistent series of higher highs and higher lows. | Look for buying opportunities on pullbacks to new support levels (previous highs). |

| Downtrend | A consistent series of lower highs and lower lows. | Look for shorting opportunities on rallies to new resistance levels (previous lows). |

| Ranging | Price is contained between horizontal support and resistance, creating similar highs and lows. | Trade the bounces off support and resistance or wait for a clear breakout. |

Ultimately, these visual cues are your best guide. They show you who is in control—buyers or sellers—without the noise of lagging indicators.

Confirming Trends Across Multiple Timeframes

Here’s a classic mistake I see all the time: a trader spots a perfect trend on one chart but ignores the bigger picture. That beautiful uptrend on the 15-minute chart? It might just be a minor pullback within a monster downtrend on the daily chart.

This is exactly why multi-timeframe analysis is a non-negotiable part of my process.

Before you even think about entering a trade, zoom out. Always check the higher timeframe to understand the primary market direction.

- Long-Term Trend (Weekly/Daily Charts): This shows you the market's main trajectory. Is the tide coming in or going out?

- Medium-Term Trend (4-Hour/1-Hour Charts): This is usually where you’ll hunt for your actual trade setups that align with the long-term trend.

- Short-Term Trend (15-Minute Chart): Use this to really nail your entry point with precision.

By making sure the trend is aligned across at least two of these timeframes, you stack the odds in your favor. It’s the single best way to avoid getting steamrolled by a powerful, larger-degree move you didn't see coming.

For a deeper dive into these concepts, our complete guide on how to trade with price action covers more advanced strategies. This layered approach gives your trend trades a much stronger foundation to build from.

Spotting the trend is a huge first step, but the real money is made—or lost—in the next move: knowing exactly when to get in and when to get out. Just jumping into an uptrend because it's going up isn't a strategy; it's a hope and a prayer. What separates the consistently profitable traders from the gamblers is a repeatable, methodical approach to entries and exits.

Let's break down two of the most reliable entry techniques I use when trading with the trend. Each one has its own feel and risk profile, so learning both will give you the flexibility you need to adapt to different market conditions.

The Pullback Entry Strategy

This is a classic for a reason. You’ve probably heard the phrase "buy the dip." That's exactly what this is. In an uptrend, you wait for the price to temporarily pull back against the main direction. In a downtrend, you'd be selling the rally.

The whole idea is to get in at a better price, right as the market seems to be catching its breath before continuing the dominant trend.

Think about a strong uptrend making a series of higher highs and higher lows. When it pulls back, it often comes down to a previous resistance level, which now flips to become new support. This zone is a high-probability area to enter. You're essentially catching the trend on sale before it takes off again.

This method requires patience. I can't stress this enough. Chasing a big green candle is how you end up buying the absolute top. Waiting for that pullback gives you a much better entry with a more defined risk, since you can tuck your stop-loss just below the recent swing low.

The Breakout Entry Strategy

The other side of the coin is the breakout entry. Instead of waiting for a dip, you enter the moment the price smashes through a key resistance level (in an uptrend) or a support level (in a downtrend). A clean breakout is a powerful signal that momentum is kicking into high gear and the trend is picking up steam.

This approach is for traders who want to see confirmation. They want proof that the buyers have completely overpowered the sellers before they commit.

Imagine a stock has been trending up but keeps getting rejected at the $50 mark. When it finally blows past $50 with conviction, especially on higher volume, breakout traders pile in, betting on a quick follow-through move. The trick here is learning to spot a real breakout versus a "fakeout" that quickly reverses.

Don't Forget Your Exit Plan

Your entry is only part of the story. If you don't manage the trade, a great entry can still turn into a loss. You need a clear plan for protecting your capital and taking profits.

- Set a Hard Stop-Loss: This is your non-negotiable exit if the trade goes against you. For a pullback entry in an uptrend, a logical spot is just below the swing low that formed during the pullback. For a breakout, you might place it back below the level that was broken.

- Have Profit Targets: Know where you plan to get out in profit. Look at the chart for the next major resistance level or use a measured move objective based on the size of the last price swing.

- Use a Trailing Stop in Strong Trends: When a trend is really running, a trailing stop is your best friend. It automatically moves your stop-loss up as the price climbs, locking in profits while still giving the trade space to breathe. You can learn more about how to do this effectively in our trailing stop loss in our detailed guide.

When you combine a smart entry with a solid exit plan, you move from just spotting trends to actually trading them like a pro.

Capitalizing on Global Market Trends

While it’s essential to get lost in the details of individual charts, the truly powerful trends—the ones that can define your year—often come from major global shifts. These are the big-picture currents that can lift entire sectors or regions for months, sometimes even years.

Learning to spot and tap into these macro trends gives you a serious edge. It helps you find those massive opportunities that most day-to-day traders, focused only on the 15-minute chart, are bound to miss.

Think about the explosive growth we've seen in the tech sector, or the recent surge in renewable energy stocks. These aren't random blips; they're driven by deep-seated economic and geopolitical forces. By keeping a finger on the pulse of these global drivers, you position yourself to ride much larger, more sustained waves of momentum. This is what it really means to trade with the trend on a grander scale.

A dead-simple way to spot these shifts is just by comparing different market indices. If you notice the tech-heavy NASDAQ consistently outperforming the broader S&P 500, that’s a flashing neon sign of sector strength.

Riding International Tides

A fantastic example of this in action is the performance of emerging markets (EM). In 2025, EM stocks proved incredibly resilient, outperforming developed markets like the S&P 500 even with ongoing trade tensions. China, which makes up a hefty 30% of the MSCI EM Index, was a key engine behind this trend. This just goes to show the immense growth potential in these regions, especially when global economic conditions find their footing. You can dig into more details in this international stock market outlook.

So, how do you actually use this in your day-to-day trading? It's not as complicated as it sounds.

- Follow Key Economic News: Keep an eye on big announcements like interest rate decisions, inflation data, and major policy shifts from central banks. These are the catalysts.

- Monitor Geopolitical Events: Things like trade agreements, regional conflicts, and political stability can create or completely derail long-term trends.

- Use Index Comparisons: Make it a habit to regularly compare major indices (e.g., S&P 500 vs. MSCI Emerging Markets). This shows you exactly where the big institutional money is flowing.

The goal isn't to become a macroeconomist. It's about recognizing the powerful undercurrents that are already shaping the charts you trade every single day. A strong global tailwind can turn a good setup into an unstoppable one.

By zooming out, you add a crucial layer of confirmation to your trading decisions. This is one of the most effective ways of analyzing market trends from a top-down perspective, making sure you’re not just trading a minor wiggle in a much bigger story.

Common Mistakes That Wreck Trend Traders (And How to Fix Them)

Even a solid trend trading strategy can fall apart if you make a few classic, unforced errors. I see it all the time. These are the mental traps and technical slip-ups that often separate the traders who just break even from those who are consistently profitable.

Knowing what they are is the first, most important step to building better habits.

One of the biggest culprits? Chasing a move that has already taken off. You spot a monster green candle and, paralyzed by the fear of missing out (FOMO), you pile in right at the very top. This is almost always a high-risk entry, and what usually follows is a sharp pullback that stops you out for a quick, frustrating loss.

The fix sounds simple, but it takes a ton of discipline. Instead of chasing, you have to patiently wait for a proper, structured entry. That could be a pullback to a key support level or waiting for a confirmed breakout. No chasing. Ever.

Setting Your Stops Way Too Tight

Here's another one I see constantly: placing stop-loss orders so close to the entry point that the trade has no room to breathe. I get it, it feels safer, but it's a trap. Normal market volatility—the natural ebb and flow of price—can easily knock you out of a perfectly good trade moments before it rips in your favor.

The way to correct this is to base your stop on market structure, not some random percentage or dollar amount you feel comfortable with. The logical spot is just below the most recent swing low in an uptrend. This way, your trade only gets stopped out for a valid reason: the trend structure has actually broken down.

A huge part of trend trading isn't just finding the trend, it's surviving its natural volatility. Your stop-loss is there to protect you from a trend reversal, not from normal price wiggles.

Ignoring a Dying Trend

Trends don't last forever. A really costly mistake is clinging to a position long after the trend has shown clear signs of running out of steam. If you forget to monitor the bigger picture, you risk giving back all of your hard-won profits.

This is where understanding how the major indices are behaving becomes crucial. For example, the S&P 500 showed powerful upward momentum in 2025, climbing 13.72% year-to-date by September. Ignoring a strong tailwind like that would be a mistake, but so would ignoring signs of it slowing down. It pays to understand the factors driving the market, and you can learn more about U.S. equities performance from S&P Global.

Your Top Trend Trading Questions Answered

When you're starting out with trend trading, a lot of practical questions pop up that the textbooks don't always cover. Getting real, straightforward answers is the key to building the confidence you need to actually pull the trigger on your trades.

Let's dive into some of the most common questions I hear from traders.

How Long Does a Typical Market Trend Last?

This is the million-dollar question, and the honest answer is: it depends. There's no magic number. A trend can be a flash in the pan, lasting just a few hours on an intraday chart, or it can be a secular trend that grinds on for years.

The most important thing isn't the trend's lifespan, but how it aligns with your trading.

A day trader might latch onto a strong push on the 4-hour chart to find their entries for the day. A long-term investor, on the other hand, couldn't care less about the 4-hour; they're looking at the weekly or monthly charts to guide their entire portfolio. Your timeframe is everything.

What Happens When a Trend Ends?

Sooner or later, every trend runs out of steam. When that happens, the market tends to do one of two things. It either slides into a consolidation phase, where price just chops sideways in a range, or it completely reverses into a new trend heading in the opposite direction.

You can usually spot the warning signs. An uptrend that keeps failing to make new highs is a huge red flag. A clean, decisive break of a trendline that's held for weeks or months is another. This is your cue to start thinking about taking profits and moving to the sidelines until the next clear opportunity shows itself.

Can I Trade Trends with a Small Account?

Absolutely. You don't need a massive account to be a trend follower. The principles of trading with the trend work the same whether you have $500 or $500,000.

What truly matters is rock-solid risk management. With a smaller account, you just have to be more disciplined. That means using smaller position sizes to make sure one bad trade doesn't wipe you out.

Focus on mastering one or two high-probability setups and never, ever violate your risk rules. With a small account, consistency and capital protection are the name of the game, not swinging for the fences.

It’s a common misconception that you need a large account to follow trends. The reality is that a solid risk management plan is far more important than the amount of capital you start with.

Is It Ever a Good Idea to Trade Against the Trend?

Trying to pick tops and bottoms is a classic beginner's mistake. While some advanced traders do it, counter-trend trading is a high-risk game that I don't recommend for anyone still finding their footing. It's an incredibly difficult skill to master and usually just leads to a string of frustrating losses.

For anyone still developing their edge, the highest-probability path is always to stick with the dominant trend. Get really, really good at following the market's momentum first. Once you've mastered that, you can think about exploring other, more difficult strategies.

Ready to stop fighting the market and start trading with clarity and confidence? At Colibri Trader, we teach a straightforward, price-action based approach that works. Take our free Trading Potential Quiz today and see how you can improve your results.