Master Your Trading Mindset for Market Success

A winning trading mindset is your psychological armor. It’s the framework you build to make calm, rational decisions when real money is on the line, forged from resilience, discipline, and emotional steel. This isn't some innate gift; it's a skill you develop, and frankly, it's what separates consistently profitable traders from the crowd.

Why Your Trading Mindset Is Your Greatest Asset

So many traders get stuck on the strategy treadmill. They spend months, even years, hunting for the "perfect" indicator or a Holy Grail system, only to end up right back at break-even or worse. The missing piece of the puzzle isn't a better strategy—it's the psychological muscle to actually execute that strategy when the market is trying its best to shake you out.

Let's be blunt: even the most profitable trading plan is completely worthless if you can't stick to it. This is where your mindset takes center stage. Think of it as your internal operating system, the code that dictates how you react to market noise, a hot winning streak, or an inevitable string of losses.

The Core Pillars of a Winning Mindset

A rock-solid trading mindset isn't just a vague idea. It’s built on a few core pillars—practical skills you can sharpen through deliberate practice.

- Emotional Regulation: This is about feeling fear or greed without letting those emotions hijack your mouse finger. You learn to acknowledge the feeling, take a breath, and act on your plan, not your gut impulse.

- Disciplined Execution: It’s simple but not easy. You stick to your pre-defined rules for entries, exits, and risk management. No exceptions. No "just this once." Discipline is the bridge that connects your strategy to your P/L.

- Probabilistic Thinking: This is a game-changer. You truly understand that any single trade can be a loser, and you stop caring about it. Your focus shifts to the long-term profitability of your system over hundreds of trades, which detaches your ego from every little outcome.

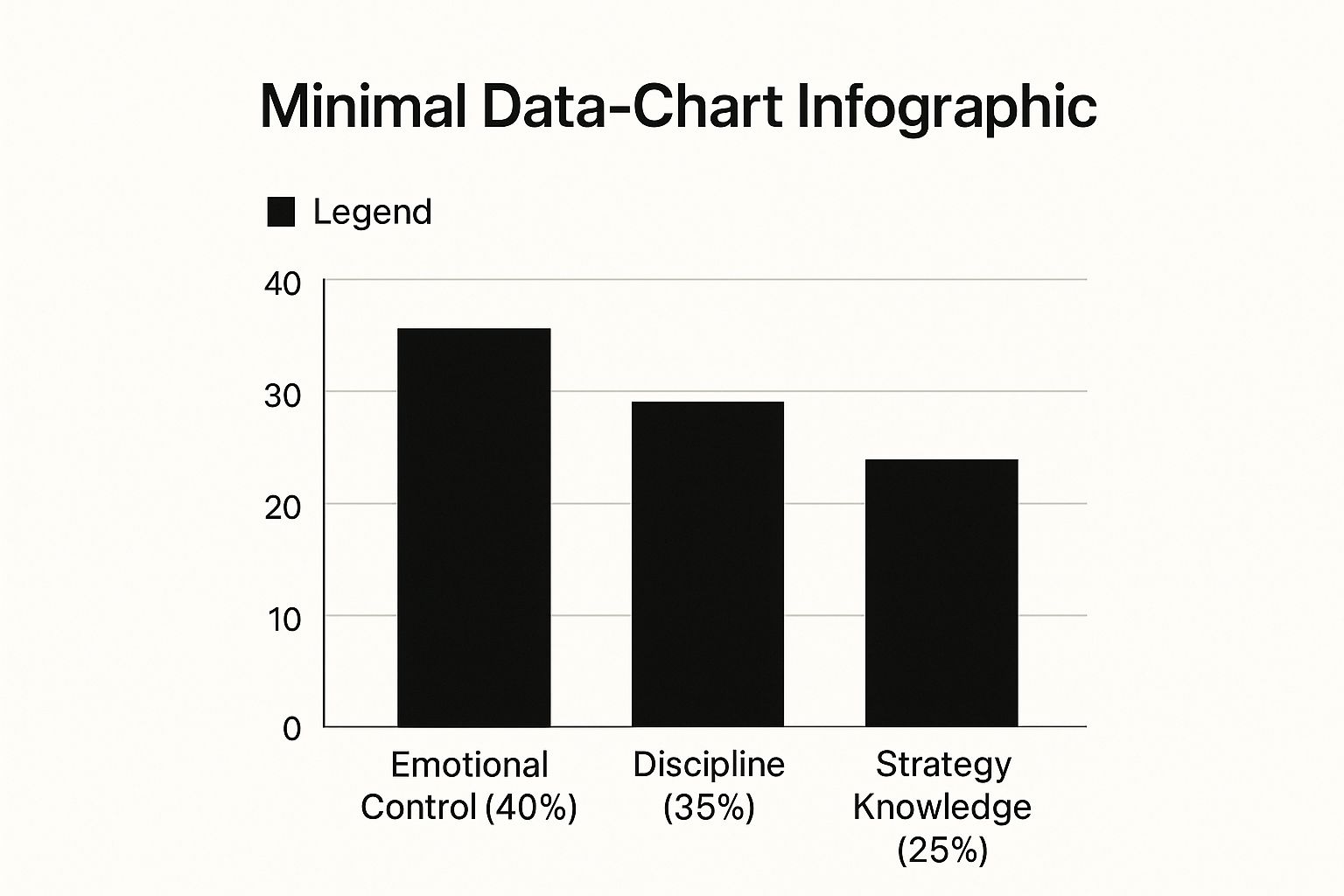

The breakdown of what really drives trading success might surprise you.

The data makes it crystal clear. While a good strategy is necessary, it's dwarfed by the psychological components. Emotional control and discipline together make up a massive 75% of a trader's success equation.

Winning vs Losing Mindset at a Glance

The real difference between a pro and an amateur often boils down to their internal self-talk and how they process what the market throws at them. One sees objective data and opportunity; the other sees personal attacks and reasons to panic.

The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system. – Ed Seykota

This really hits home that a winning mindset and disciplined risk management are two sides of the same coin. You can't have one without the other.

To see how stark the contrast is, let’s put the two psychological frameworks side-by-side.

| Characteristic | Winning Trading Mindset | Losing Trading Mindset |

|---|---|---|

| View on Losses | Sees losses as a normal business expense and a source of valuable data. | Takes losses personally, which triggers anger and revenge trading. |

| Focus | Concentrates on executing the trading process flawlessly, regardless of outcome. | Obsesses over the profit or loss of every single trade. |

| Decision Making | Based on a pre-defined, backtested trading plan with clear rules. | Driven by raw emotions like Fear Of Missing Out (FOMO), hope, or greed. |

| Confidence | Comes from deep preparation, trusting their tested edge, and disciplined practice. | Relies on wishful thinking, recent wins, or what others are saying. |

| Reaction to Wins | Stays humble and sticks to the plan, knowing a big win can lead to overconfidence. | Becomes euphoric and reckless, immediately increasing risk and position size. |

Looking at this table, it becomes obvious which column you want to be in. The losing mindset is reactive and emotional, while the winning mindset is proactive, systematic, and treats trading like the serious business it is.

Conquering Fear and Greed in Volatile Markets

Fear and greed are the twin wrecking balls of trading. They’re primal, powerful, and responsible for more blown accounts than any flawed strategy could ever be. A winning trading mindset isn’t about becoming a robot who feels nothing—that’s impossible. It’s about building a mental fortress to keep these emotions from hijacking your decisions.

Think about a sudden market crash. The red on your screen is overwhelming, and every news alert screams “SELL!” Fear grabs you by the throat, urging you to dump your positions to make the pain stop, even if it completely contradicts your trading plan. That’s a purely emotional reaction, not a strategic one.

On the flip side, picture a FOMO-inducing rally where an asset is rocketing to the moon. Greed whispers that you’re missing out on the easiest money of your life, pushing you to chase the price and buy near the top, ignoring all of your entry rules. Both scenarios usually end the same way: with impulsive, costly mistakes.

Staying Grounded When Markets Get Wild

The trick is to have a pre-planned toolkit of techniques ready to go when you feel your emotional control slipping. This isn’t about sheer willpower; it’s about having a system to fall back on when your brain’s fight-or-flight response kicks into high gear.

One of the simplest yet most effective methods I use is the 'pause and assess' technique. The moment you feel fear or greed bubbling up, physically step away from your screen for just two minutes. During this brief pause, ask yourself these three critical questions:

- Is this trade idea based on my pre-defined plan or is it just an emotional impulse?

- What is my maximum acceptable risk for this position according to my rules?

- Does this setup meet all the criteria on my checklist for a high-probability trade?

This short break disrupts the emotional circuit, forcing your logical brain to re-engage. It shifts your focus from the chaotic market action back to your own process—the only thing you actually have control over.

Practical Exercises for Emotional Resilience

Building a strong trading mindset is an active process. You have to train your mind just like an athlete trains their body. This means daily routines designed to strengthen your emotional regulation and self-awareness.

Pre-Market Mindfulness: Before the opening bell chaos begins, spend five minutes in quiet reflection. Just focus on your breathing. Visualize yourself executing your plan flawlessly, accepting both wins and losses with a calm, neutral mindset. This anchors you in a state of calm before the market tries to pull you in every direction. Diving into how daily meditation can improve your trading can give you a deeper framework for this.

Emotional Trade Journaling: Your trade log shouldn't just be about the numbers. It needs to capture your psychological state. After every single trade, win or lose, write down the answers to these prompts:

- What was my primary emotion when I entered this trade? (e.g., confident, anxious, greedy, bored)

- Did I hesitate or act impulsively at any point? If so, why?

- How did I feel right after closing the position?

Reviewing this journal weekly is like watching game tape. It will reveal your emotional patterns and show you exactly where the leaks are in your mental game.

A critical part of a winning trading mindset is reframing how you see losses. Stop seeing them as failures. Instead, view them as tuition paid directly to the market—an investment in your trading education. Every loss contains a valuable lesson, but only if you're willing to look for it.

Extreme market volatility offers priceless lessons on trading psychology. For instance, during periods of high stress when the Volatility Index (VIX) spikes, it creates a perfect storm of fear. These moments lead to massive losses for traders who don't have a rock-solid risk plan. In contrast, those with a clear trading mindset and capital ready to deploy often find incredible opportunities.

Ultimately, conquering fear and greed means learning to trust your system more than you trust your feelings. By implementing these practical techniques, you build a mental buffer that allows you to act on your plan, not your impulses, even when the market is screaming at you to do the exact opposite.

Forging Unbreakable Trading Discipline

If a winning strategy is the engine of your trading business, then discipline is the fuel that keeps it running. Without it, even the most powerful engine will just sit there, silent and useless. Discipline is what connects a solid plan to actual, consistent profits.

It’s that conscious, daily decision to follow your rules—especially when your emotions are screaming at you to do the exact opposite.

A lot of traders think discipline is about gritting your teeth and white-knuckling your way through a trade. But that’s a quick path to burnout. Real, sustainable discipline isn't about willpower at all. It's about building systems and routines that make following your plan the easiest option. It's about engineering your trading day to eliminate guesswork and cut down on opportunities for emotional mistakes.

The Blueprint for a Non-Negotiable Trading Plan

Think of your trading plan as your personal constitution. It's a written document outlining exactly how you'll operate in the markets. During market hours, its rules are non-negotiable. A vague plan is an open invitation for emotion to take over, so yours must be brutally specific, objective, and clear.

At a bare minimum, your plan has to include these components:

- Entry Criteria: What precise conditions must be met for you to even think about entering a trade? This needs to be a checklist, not a gut feeling. For great examples of rules-based entries, study a daily price action setup on a major pair.

- Exit Criteria (for Profits and Losses): Where will you take profit? Even more critical: where is your stop-loss that invalidates the trade idea and protects your capital? This has to be defined before you enter.

- Position Sizing Rules: How much capital are you risking on any single trade? This should be a fixed percentage, like 1% or 2%, of your account. This ensures no single loss can ever knock you out of the game.

- Risk-to-Reward Ratio: What’s the minimum potential reward you need for the risk you're taking? A common and solid baseline is 1:2, meaning you're aiming to make at least double what you're risking.

This plan isn't a friendly suggestion; it's your boss. Once the market opens, you're not the CEO making creative decisions. You're the employee whose only job is to execute the plan. Flawlessly.

Creating Your System of Accountability

A plan is worthless if you don't stick to it. Accountability systems are what turn good intentions into disciplined actions. This is where you really build the muscle of a strong trading mindset.

The simplest, most powerful tool here is a pre-market checklist. Before you even think about placing a trade, you run through a quick list to confirm you're ready, both mentally and technically.

| Pre-Market Checklist Item | Purpose |

|---|---|

| Review Major News Events | Avoid getting blindsided by scheduled high-impact news. |

| Confirm Trading Plan Rules | Re-read your entry, exit, and risk rules. Bring them top-of-mind. |

| Check Emotional State | Are you calm and objective? If you're angry, euphoric, or distracted, don't trade. |

| Verify Technical Setups | Scan your markets for setups that perfectly match your plan's criteria. |

This simple routine anchors your entire session in logic and process, not gut feelings or greed. Your rule becomes dead simple: if a setup doesn't tick every single box on your checklist, you do nothing. Honestly, the hardest part of trading is often just sitting on your hands. This system gives you the structure to do just that.

"Discipline is choosing between what you want now and what you want most." – Abraham Lincoln

This quote nails the very essence of a winning trading mindset. You might want the cheap thrill of a random trade right now, but what you most want is long-term, consistent profitability. Your discipline system is what bridges that gap.

Finally, you absolutely must conduct a post-market review. This is where you track how well you followed your plan. Your journal isn't just for P/L; its most important metric is your discipline score. Ask yourself one question for every single trade: "Did I follow my plan 100%?" Answering that honestly is how you forge unbreakable discipline, one trade at a time.

Using Historical Data to Build Real Confidence

Real, unshakeable trading confidence isn't something you get from a lucky hot streak. It’s forged in the fires of preparation, built on a mountain of evidence, and cemented by a deep understanding of probability. This is where historical market data becomes your single greatest asset for building a professional trading mindset.

This process moves you from hoping a trade works out to knowing your strategy has a positive expectancy over hundreds of trades.

A lot of traders think historical data is just for simple backtesting to see if a strategy was profitable in the past. That's a huge mistake. Its real power is psychological. It conditions your mind for the chaos of live markets, turning abstract risks into tangible events you can study, dissect, and mentally prepare for.

When you see how a market has actually behaved—its gut-wrenching drawdowns, its explosive volatility, its weird correlations—you build a mental library of what’s possible. This grounds you in reality and strips away the fear of the unknown that paralyzes so many. To dig deeper into this, check out this guide on how traders use historical data to confirm their analysis and boost confidence.

Internalize Your System's True Behavior

The whole point of this data-driven review is to internalize your strategy’s personality. You need to know its quirks so well that nothing the market throws at you comes as a surprise. This is how you develop the calm, ice-in-your-veins mindset required for disciplined execution.

Here's an exercise. Manually scroll back through years of charts on your chosen asset. But don't just look for winning trades. Actively hunt for the moments your strategy would have failed miserably. Pinpoint the exact periods where it would have hit its maximum drawdown.

This exercise is powerful for two reasons:

- It builds realistic expectations. You'll see with your own eyes that losing streaks are a normal, unavoidable part of the game.

- It hardens you emotionally. Experiencing these drawdown periods in a simulated way prepares you to handle them calmly when real money is on the line.

Once you’ve seen your system take ten losses in a row in historical data and still come out profitable over the long haul, you won’t flinch when it happens in real-time. You'll just recognize it for what it is: a statistical inevitability of your edge playing out.

From Single Trade Outcome to Probabilistic Thinking

This data-first approach is the bedrock for shifting your focus from the nail-biting outcome of one trade to the mathematical expectancy of your process over hundreds of trades. It’s the ultimate mental hack for detaching your ego from your P&L.

A professional trader doesn't guess; they prepare. They use historical data not to predict the future, but to understand the probabilities and to build a robust mindset that can withstand the full spectrum of market behavior.

Let's make this practical. Go back and review your asset's biggest historical drawdowns over the past decade. How far did it fall from its peak before recovering? Knowing that a 30% drawdown has happened three times before gives you a data-backed anchor for setting your risk.

It helps you answer crucial questions with hard data, not gut feelings:

- Is my current stop-loss wide enough to survive normal, messy volatility?

- Is my position size sane, given this asset's history of pain?

- How long have past losing streaks lasted before my edge kicked back in?

Answering these with historical precedent builds a foundation of genuine confidence. It's a confidence rooted in evidence, not hope. This is the trading mindset that allows you to pull the trigger without hesitation, navigate the inevitable storms, and achieve the mental toughness required for long-term success.

Adopting a Process Over Profit Mentality

This is where all the lessons on discipline, confidence, and emotional control really get put to the test. If there's one massive shift that can turn a struggling trader's career around, it's this: stop measuring success by your daily P&L.

Instead, you have to learn to measure it by one thing and one thing only: the flawless execution of your trading process.

I’ve seen it time and time again. The truly successful traders I know have completely detached their self-worth from the outcome of a single trade. They know that if they just stick to their tested plan with absolute discipline, the profits will eventually take care of themselves. It's the ultimate antidote to emotional trading.

Why Process and Timing Trump Everything

Even the most brilliant market thesis is worthless if you don't have a solid process for execution. I remember a perfect real-world example of this. The psychological part of trading—what we call the trading mindset—is a huge piece of the puzzle.

One trader I knew spent months building a mechanical system back in early 1999. He was spot-on about the bullish trend, but he was smart enough to know that just being right doesn't pay the bills. Timing is everything. With a sloppy process, his bullish view could have easily led to catastrophic losses on every little pullback. But because he focused on timing and execution, he saw significant gains.

This focus on how you trade, not just what you think, is what separates the pros from the amateurs. You can learn more about how the top traders of a new era approach this at Scribd. It’s this exact mindset that acts as a shield, protecting you from classic mistakes like boredom trading, revenge trading, or taking a desperate gamble to "make it all back."

Building Your Performance Loop

So, how do you make this mindset a practical reality? You need a framework. The most effective way I've found to build a process-driven approach is by using a simple but powerful performance loop: Plan, Execute, Review, and Adapt.

- Plan: This is all pre-market prep. Before the opening bell, you define your setups, entry rules, exit points, and exactly how you'll manage risk.

- Execute: When the market is open, your only job is to follow that plan. You're an operator, not a market pundit.

- Review: After the close, you analyze your performance. Critically, you're not judging your profits; you're judging your adherence to the plan.

- Adapt: Based on what you found in your review, you make small, calculated tweaks to your process for the next session.

This loop forces you to concentrate on what you can actually control (your actions) instead of what you can't (where the market zigs and zags).

A "good trade" is not one that made money. A good trade is one that was executed precisely according to your rules, regardless of the outcome. Internalizing this redefines your entire approach to the market.

The Post-Trade Review: Your Secret Weapon

That "Review" phase is where the real magic happens. This is your accountability session. For every single trade, you have to ask yourself some brutally honest questions. The P&L is the very last thing you should even glance at.

Your review should be all about questions like these:

- Did I follow my entry rules perfectly? Was this an A+ setup from my playbook, or was it a gut feeling?

- What was my emotional state? Was I calm and objective, or was I feeling anxious, greedy, or scared?

- Did I manage the trade according to plan? Did I respect my pre-defined stop-loss and profit targets, or did I move them around?

- If I broke a rule, why? You have to pinpoint the exact psychological trigger that made you deviate from your plan.

This kind of deliberate practice completely reframes what a "win" means in trading. A win is no longer about the money; it's about perfect discipline. Once you truly embrace a process-over-profit mentality, you start building the foundation for genuine, long-term consistency and finally get off the emotional rollercoaster that derails most traders.

Common Questions About Trading Psychology

Even with the best trading plan in the world, the mental side of trading is where most battles are won or lost. Sooner or later, every trader hits a psychological wall.

This section is like a tactical debrief, tackling the most common questions and sticking points I see traders struggle with. We're moving past the theory to give you clear, practical answers for when you feel stuck.

How Long Does It Take to Build a Strong Trading Mindset?

This is probably the question I get asked most often. The honest answer? Developing a professional trading mindset is a journey, not a destination. The market is a master at finding new ways to test your psychological armor.

But that doesn't mean you won't see real results quickly. Most traders who truly dedicate themselves to the process report a major shift in their emotional control and discipline within 3 to 6 months.

The real key isn't the calendar, but consistent, daily practice. This means actively reinforcing good habits every single day.

- Structured Journaling: Don't just log P/L. Document your emotional state before, during, and after each trade. Were you calm? Anxious? Greedy? Be brutally honest.

- Process-Oriented Reviews: Your review should focus on one thing: did I follow my plan? The outcome (profit or loss) is secondary to the quality of your execution.

- Pre-Market Routines: Before the opening bell chaos, ground yourself. Review your plan, your watch list, and your rules. Start the day from a place of logic, not emotion.

It’s this commitment to small, daily improvements that builds a real mental edge.

What Is the Best Way to Handle a Long Losing Streak?

Losing streaks are not a matter of if, but when. They are a statistical certainty for every single trader, no matter how good their strategy is. Panicking and ditching a solid plan during a drawdown is a classic, costly mistake that separates the pros from the amateurs.

Instead of freaking out, you need a pre-planned, structured response. Here’s what I do:

- Stop the Bleeding: The first move is always to step away from live trading. Immediately. This could be for the rest of the day or even the rest of the week. You need to create emotional distance to stop the cycle of fear and revenge trading.

- Conduct a Process Audit: Open your trading journal. Your only job here is to answer one question: Was I following my rules, or was I deviating? If you executed your plan flawlessly, the streak is likely just a normal statistical drawdown. If you were breaking rules, the problem is your discipline, not your system.

- Reset and Rebuild: Once you know the cause, you can return with a clear head. If the issue was discipline, recommit to your rules. I always recommend cutting your position size way down when you come back. This lowers the emotional stakes and helps you rebuild confidence by focusing on perfect execution, not the money.

The goal isn’t to avoid losing streaks—that's impossible. The goal is to have a robust psychological playbook that protects your capital and your confidence when they inevitably show up.

Can I Succeed If I Am an Emotional Person?

Absolutely. This is a huge misconception that holds so many potentially great traders back.

Success in trading isn't about eliminating your emotions—that’s an unnatural and impossible task. A healthy trading mindset is about building systems and processes that prevent those emotions from hijacking your decisions.

Trading is an emotional business by its very nature. Your brain is wired to feel fear when facing loss and excitement at the prospect of a big win. The goal isn’t to become a robot; it’s to become an expert at managing those feelings. For more on this, you can check out some excellent trading psychology tips that hammer this point home.

Your success hinges on your ability to trust your process more than your fleeting feelings. A rock-solid trading plan, non-negotiable risk rules, and disciplined reviews are the tools that create a firewall between your emotions and your trading account. The feelings can still be there, but they no longer get to call the shots.

At Colibri Trader, we build these exact skills. Our entire approach is grounded in proven price action strategies that take out the guesswork, helping you develop the discipline and confidence required for consistent performance. We offer practical, action-based programs that can transform your trading without relying on confusing indicators or fundamentals. Take our free Trading Potential Quiz to see how our no-nonsense guidance can help you unlock your full potential.