Best Trading for Beginners Books to Start Your Journey

Picking the right trading for beginners books means finding ones that really nail the fundamentals, risk management, and practical strategies. A great example is A Beginner's Guide to the Stock Market by Matthew R. Kratter. Think of a good book as your personal roadmap, guiding you from the absolute basics to making your first confident trades.

How to Choose Your First Trading Book

Jumping into the trading world without some guidance is like trying to navigate a new city without a map. It’s easy to get lost. You're bombarded with countless strategies, indicators, and market theories all screaming for your attention. The right book cuts straight through that noise and gives you a clear, structured path to follow.

Choosing your first trading book is a massive first step. It’s not just about grabbing the most popular title off the shelf; it's about finding a resource that clicks with your learning style and builds a rock-solid educational foundation. The wrong book can leave you more confused than when you started, leading to bad habits. The right one? It can shave months, or even years, off your learning curve.

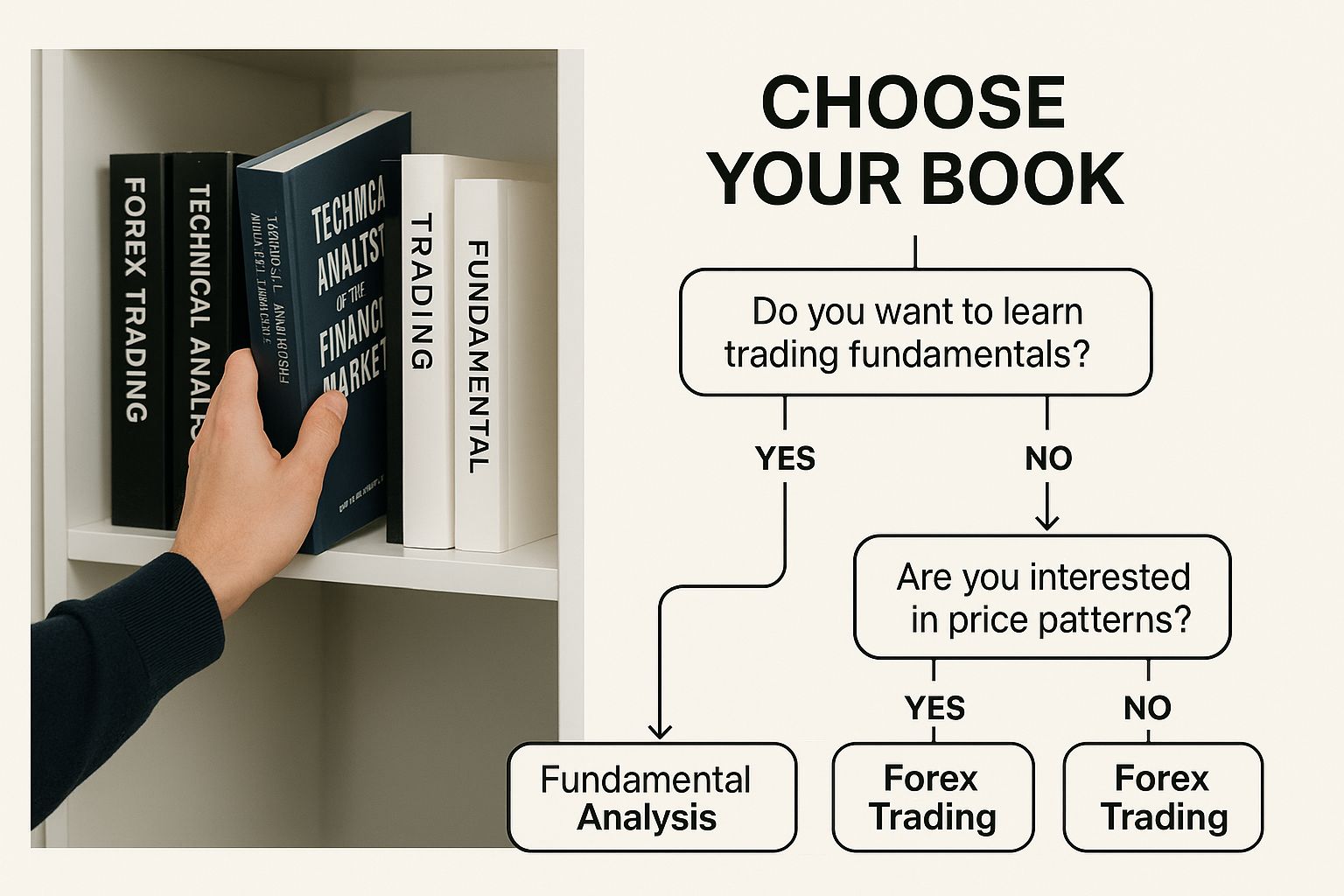

This decision tree breaks down how to pick a trading book that truly fits your needs and goals.

As the visual shows, your choice really comes down to where you're starting from and what kind of trading interests you. This helps point you toward foundational texts, strategy guides, or books focused on the all-important psychological side of trading.

Key Qualities of a Great Beginner Book

A top-tier book for a new trader does more than just throw facts at you—it builds a mental framework for how to think about the markets. It should feel less like a dense textbook and more like you're getting advice from an experienced mentor. One of the biggest signs of a great author is their ability to explain complex ideas with simple, clear analogies.

If you're looking for more perspectives, you can learn more about picking the best trading for beginners book in this helpful guide.

When you're sizing up potential books, keep an eye out for these crucial elements:

- Emphasis on Risk Management: The book must spend a lot of time on how to protect your capital. This is the absolute number one rule of trading, period.

- Clear Foundational Concepts: It needs to explain how markets work, what different order types are, and basic terminology without drowning you in confusing jargon.

- Actionable Strategies: The content should bridge the gap between theory and practice, showing you how to actually apply what you're learning in real-world scenarios.

A truly effective trading book for beginners prioritizes the 'why' behind market movements over simply listing patterns. It teaches you to think like a trader, focusing on probability, discipline, and emotional control from day one. This psychological grounding is often what separates successful traders from the rest.

Checklist for Selecting Your First Trading Book

To make things even easier, I've put together a quick checklist. Use this table as a scorecard when you're comparing different books to make sure you're getting the solid foundation you need.

| Selection Criterion | Why It Matters for Beginners | What to Look For |

|---|---|---|

| Focus on Fundamentals | You can't build a strategy on a shaky foundation. Understanding the basics is non-negotiable. | Chapters dedicated to market structure, order types, and key terminology explained in simple language. |

| Risk Management First | Your primary job as a new trader is to stay in the game. Protecting your capital is everything. | Detailed sections on position sizing, setting stop-losses, and understanding risk-to-reward ratios. |

| Practical, Not Just Theoretical | Theory is great, but you need to know how to apply it. The book should connect concepts to action. | Real-world chart examples, case studies, and clear, step-by-step strategic frameworks. |

| Author's Experience | You want to learn from someone who has actually been in the trenches, not just an academic. | Look for authors who are active or former professional traders with a proven track record. |

| Clarity and Readability | If a book is dense and full of jargon, you'll struggle to absorb the information. | Simple analogies, a conversational tone, and a logical flow from one topic to the next. |

Choosing the right book is your first winning trade. It sets the tone for your entire journey, so take your time and pick a guide that will empower you with the right knowledge and mindset from the very beginning.

Building Your Foundation with Core Trading Concepts

Before you ever look at a price chart or even think about clicking the "buy" button, you have to learn the rules of the game. The best trading for beginners books don’t just throw strategies at you; they build your knowledge from the ground up, starting with the absolute core concepts that make the markets tick.

Without this foundation, any strategy you learn is like a house of cards. It might look good for a moment, but it's destined to collapse at the first sign of trouble.

Think of the market as a massive, ongoing auction. At any given second, you have buyers willing to pay a certain price (the bid) and sellers willing to accept another price (the ask). The constant tug-of-war between these two sides is what moves prices. A great book will make this feel real—not like some dusty economic theory, but a living process driven by human psychology.

Understanding Market Orders and Mechanics

One of the very first hurdles is simply knowing how to get into and out of a trade. This is where order types come in. They’re just instructions you give your broker, but they are critically important. Your book needs to spend some serious time here.

- Market Order: This is the most basic instruction: "Get me in now at the best price available." It guarantees you'll get into the trade, but you have no control over the exact price, which can be a huge risk when the market is moving fast.

- Limit Order: This gives you back control. You're telling your broker, "I'm only willing to buy at this specific price or better." It’s essential for making sure you don't overpay or sell for too little.

Getting a handle on these is non-negotiable. It’s the difference between shouting, "Just get me in the game!" versus calmly stating, "Get me in, but only on my terms."

The heart of good trading isn’t about perfectly predicting the future. It’s about understanding the present—the mechanics of supply and demand—so you can make educated bets where the odds are in your favor. Your first book has to teach you how to read the field before you ever try to score a goal.

The Two Pillars of Analysis

Once you understand how the market works, you need to learn why it moves. This is where analysis comes in. Trading analysis is really broken down into two major schools of thought. A solid beginner's book will teach you both, because they offer different, yet complementary, ways of looking at an asset.

1. Fundamental Analysis (The 'Why')

This approach is all about playing detective. You dig into a company's financial health, its management team, its position in the industry, and the broader economic climate to figure out its "intrinsic value." A fundamental analyst is always asking, "Is this company actually strong, and is its stock priced fairly right now?"

2. Technical Analysis (The 'When' and 'What')

This is the art and science of reading charts. Technical analysts work from the belief that all known information is already baked into an asset's price. They use price patterns, trends, and trading volume to forecast where the price might go next. Their question is, "What is the market's mood right now, and what does the price history suggest will happen next?"

Many of the most successful traders I know use a hybrid approach. They might use fundamental analysis to find what to buy—a great company—and then use technical analysis to pinpoint the exact best time when to buy it. The best books for new traders explain these two pillars clearly, helping you build a well-rounded skill set right from the start.

Learning To Read The Market With Technical Analysis

Fundamental analysis shows you what to trade by digging into a company’s financial health. Technical analysis picks up where fundamentals leave off—it helps you decide when to enter or exit a position by interpreting price charts.

Think of a price chart as the market’s heartbeat. Every rise and fall reveals the tug-of-war between buyers and sellers. That’s why the best trading for beginners books spend so much time teaching this visual language. Trade without it, and you’re basically flying blind.

Decoding Price Charts And Key Patterns

At its foundation, technical analysis is about spotting trends and repeating shapes on a chart. A trend simply means the general direction prices are moving. In an uptrend, you’ll see higher highs and higher lows. In a downtrend, it’s lower highs and lower lows.

Inside those swings, certain price levels keep popping up:

- Support: A “floor” where buying pressure historically overcomes selling, causing prices to bounce.

- Resistance: A “ceiling” where selling pressure tends to win, stalling or reversing rallies.

Pinpointing these zones helps you choose where to open a trade, set a stop-loss, or lock in profits. To explore this in more depth, check out this guide on how to read stock market charts for a step-by-step walkthrough.

Using Indicators To Confirm Your Analysis

Price action should always be your starting point, but indicators can offer a helpful second opinion. They’re mathematical tools based on price, volume, or open interest that shine a light on trend strength or potential reversals. A solid beginner’s book will introduce just a handful—never so many that you feel overwhelmed.

An indicator simply provides another layer of information. It should never be the sole reason for a trade but should instead be used to confirm what the price action is already telling you. Relying on indicators alone is a common beginner mistake.

Here are two of the most beginner-friendly indicators:

-

Moving Averages (MA): By smoothing out erratic price data into a flowing line, MAs make it easier to see the underlying trend. A short-term MA crossing above a long-term MA often signals bullish momentum, and vice versa.

-

Relative Strength Index (RSI): This oscillator measures the speed and change of price moves. It runs from 0 to 100 and highlights overbought levels (typically above 70) or oversold levels (typically below 30).

When you combine clear chart patterns with a couple of well-chosen indicators, you’ll build a strong, probability-based approach—one that helps you trade with the market’s rhythm, not against it.

Finding Books with Practical Trading Strategies

Knowing market theory is one thing, but actually putting your money on the line is a whole different ball game. All the technical analysis in the world won't help if you can't translate that knowledge into a real, live trade. This is exactly where books focused on practical, actionable strategies come in. They’re the bridge from abstract ideas to the concrete steps of placing and managing a trade.

The best books in this category don't just throw a bunch of strategies at you; they give you a complete blueprint. They’ll walk you through the exact criteria for entering a trade, show you where to set your protective stop-loss, and point out the signals you should be watching for to take profits. Think of it like having a seasoned mentor looking over your shoulder, explaining their thought process for every single move.

From Theory To Trade Execution

A truly great strategy-focused book does more than just show you patterns; it helps you build your own trading plan. This is your personal set of rules that governs every single decision you make in the markets, and it's absolutely critical for developing the discipline and consistency that separates the pros from the amateurs.

Look for titles that hammer home the importance of a structured approach, not just chasing random chart patterns. They should clearly explain:

- Entry Triggers: What specific market conditions must be met before you even think about entering a trade?

- Position Sizing: How much capital should you risk on a single trade? This is key to making sure a losing streak doesn’t wipe you out.

- Exit Rules: What are your predefined conditions for closing a position—for both a win and a loss?

This kind of structured thinking is what takes emotion out of the equation. It replaces gut feelings and guesswork with a logical, repeatable process.

An Example Of An Actionable Guide

As more people get into trading, some excellent, beginner-friendly books have popped up that prioritize clarity and real-world application. A standout example is A Beginner's Guide to Day Trading Online by Toni Turner. It's earned a stellar rating of 4.6 out of 5 on sites like Amazon for a reason. It excels at breaking down complex day trading tactics into simple, understandable steps, covering everything from market mechanics to risk management in an engaging way.

The goal of a strategy book isn't to give you a "holy grail" system that never loses. Instead, its purpose is to provide you with a tested framework that has a positive expectancy over time, teaching you to manage probabilities effectively.

While you're hunting for books on active trading, you might also want to look into established investment techniques like the dollar-cost averaging strategy. It’s a different beast from active trading, but understanding various market approaches broadens your financial toolkit. It helps you figure out what truly fits your own personality, risk tolerance, and long-term goals. At the end of the day, the right book empowers you to stop just learning and start doing—with a clear plan in hand.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert in the style of the provided examples.

Gaining Timeless Wisdom from Trading Legends

Charts, patterns, and modern strategies are all well and good, but some of the most powerful lessons you'll ever learn come from the old masters. The best trading for beginners books almost always include classics that share the kind of wisdom you only get from decades in the market trenches. Think of these not as history lessons, but as a direct look into the psychology and discipline that separates the winners from the losers.

Learning from the legends is like getting a backstage pass to see how a market genius really thinks. Forget rigid, one-size-fits-all strategies. These books pull back the curtain on the diverse philosophies and mindsets that build lasting careers. What you quickly realize is there’s no single "right" way to trade, but there are universal truths—like discipline, adaptability, and emotional control—that every single successful trader masters.

Learning from the Market Wizards

If there's one book that belongs on every trader's shelf, it's Market Wizards: Interviews With Top Traders by Jack Schwager. First hitting the scene back in 1989, this classic is a collection of interviews with 16 absolute titans of trading. It's packed with incredible insights into how they approach the markets. The book is legendary for its focus on practical, core principles like risk management and trading psychology, breaking down complex ideas in a way that just clicks.

Schwager’s work drives home one critical point: the psychological game is everything. You can discover more about why Market Wizards is so highly recommended for beginners and see just how relevant its lessons remain today.

This book proves that top traders aren't robots who just crunch numbers. They are masters of their own minds who have built systems to protect themselves from their own worst instincts.

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading." – Victor Sperandeo, interviewed in Market Wizards

Key Takeaways from Trading Classics

When you dive into the stories of these legends, you start absorbing lessons that go way beyond simple chart patterns. You start to see the bigger picture and the timeless truths that don't change, no matter what the market is doing.

- Adaptability is Crucial: The market is a living, breathing thing that's always shifting. The legends teach you that a winning strategy today can be a loser tomorrow. The ability to pivot is non-negotiable.

- Mindset Over Everything: You'll hear it again and again from almost every successful trader: your mental game is far more important than any specific setup or strategy.

- Consistency Trumps Occasional Brilliance: Anyone can get lucky with a big, flashy win. But long-term profitability? That comes from a boringly disciplined and consistent process, day in and day out.

Reading about the journeys of those who came before you provides priceless context. It shows you the mistakes they made so you don't have to, the hard lessons they learned, and the sheer resilience it takes to thrive. It’s a powerful blueprint for building your own path in the markets.

Mastering the Mental Game of Trading Psychology

You could have the most statistically perfect trading strategy in the world, but if your head isn't right, you're setting yourself up for failure. This is a hard lesson, but one of the most crucial: trading is as much a psychological battle against yourself as it is an analytical challenge against the market.

The best trading for beginners books drive this point home with force. They know that for new traders, the biggest hurdles are almost always internal.

Emotions like fear of missing out (FOMO), greed that convinces you to hold a winning trade way too long, and an ego that refuses to accept a small loss—these are the real account killers. What good is a brilliant strategy if your emotions hijack your decision-making and prevent you from executing it with discipline?

Developing a Probabilistic Mindset

This is exactly where books on trading psychology become so critical. They teach you to untangle your self-worth from the outcome of any single trade and start thinking in probabilities, not certainties. The goal isn't to be right on every trade; it's to have a system that makes money over a large series of trades.

A cornerstone text here is Mark Douglas's Trading in the Zone. Even though it was published back in 2000, its lessons on overcoming the mental roadblocks that plague traders are timeless. It’s a masterclass in tackling fear, building discipline, and managing emotional swings, helping you develop a mindset that can actually handle the chaos of volatile markets.

The market doesn't know or care about your positions. To achieve consistency, traders must learn to accept risk, detach from outcomes, and think in probabilities. This mental shift is the foundation of professional trading.

Core Principles of Trading Psychology

Books on this topic help you internalize the habits of successful traders. They aren't just about "feeling good"; they provide concrete, actionable frameworks for building the mental resilience and discipline required to last in this game.

If you want to go deeper, you might be interested in our guide on essential trading psychology books.

Here are a few of the key lessons you’ll learn:

- Accepting Risk: This means truly understanding that any trade can be a loser and being okay with that possibility before you even click the buy or sell button.

- Maintaining Discipline: Sticking to your pre-defined trading plan—your entry, your exit, your stop-loss—no matter what your gut is screaming at you to do in the heat of the moment.

- Building Resilience: Learning how to take a hit from a losing streak without letting it crush your confidence or tempt you to abandon your strategy altogether.

Mastering these psychological skills is what separates the amateurs from the pros. It's the final—and most important—piece of the trading puzzle, allowing you to execute your strategy flawlessly over the long run.

Your Trading Book Questions, Answered

Jumping into the world of trading books can feel a bit overwhelming, and it definitely brings up some questions. I get these all the time.

One of the big ones is, "How many books do I really need to read before I can start trading?" There's no magic number here. The goal isn't to burn through a dozen books as fast as you can. Instead, really digest the core ideas from one or two solid, foundational books first.

Another one I hear a lot is about older books. Are classics from decades ago still useful? When it comes to books on market psychology or timeless principles—like those in Market Wizards—the answer is a definite yes. The emotions that drive markets haven't changed. Fear and greed are timeless.

Can a Single Book Make Me a Profitable Trader?

This is the million-dollar question, isn't it? Many new traders hope one book will hold all the secrets to profitability. While the best trading books give you an essential roadmap, they are just the starting line.

Real skill comes from taking what you've learned and putting it into practice. It's about opening a demo account and getting your hands dirty, making mistakes, and building your own feel for the market.

Think of a trading book like a recipe. It gives you all the ingredients and instructions, but you still have to learn the hands-on skill of cooking. The book provides the "what" and "why," but you develop the "how" through consistent practice and review.

Success in trading is a marathon, not a sprint.

Ready to move from theory to action with a proven price action strategy? At Colibri Trader, we provide the clear, no-nonsense guidance you need to build real trading skills. Learn more about our approach and start your journey today.