The Risk Reward Ratio Guide for Smart Trading

The risk reward ratio is a simple but incredibly powerful metric every trader needs to know. It measures the potential profit of a trade against its potential loss.

At its core, it answers a single, crucial question: "For every dollar I'm willing to risk, how many dollars do I stand to gain?" This fundamental calculation is a cornerstone of disciplined, professional trading.

What Is the Risk Reward Ratio in Trading

Picture a professional gambler sizing up a bet. They wouldn't just throw money down on a whim; they'd be laser-focused on the potential payout versus the odds of losing. The risk reward ratio is a trader's version of that exact calculation. Think of it as your GPS for navigating the wild, unpredictable terrain of the financial markets. It's not just a formula; it's a mindset.

Getting a handle on this concept is non-negotiable if you want to survive and thrive in the long run. It forces you to hit pause before jumping into any position and ask the most important question of all: Is the potential upside truly worth the potential downside?

By answering this honestly, you start to systematically weed out the low-quality, emotionally-driven trades. You're left with only the high-potential opportunities that make sense.

The Foundation of Smart Decisions

Think of the risk reward ratio as the bedrock upon which all your other trading decisions are built. Without it, your strategies for position sizing, setting stop-losses, and managing your portfolio are just floating in the wind, lacking a logical anchor. It’s the single most important tool for instilling discipline, turning trading from a speculative gamble into a structured business.

By consistently taking trades with a favorable risk reward ratio, you begin to stack the odds in your favor. Here’s the magic: even if you win less than half of your trades, you can still be wildly profitable over time. This is the mathematical edge that separates the pros from the amateurs.

To help you get a quick grasp of these ideas, here's a simple table breaking down the key concepts.

Key Risk Reward Ratio Concepts at a Glance

| Concept | What It Means | Why It's Important |

|---|---|---|

| Risk | The amount of money you could lose if the trade goes against you, defined by your stop-loss. | Defines your potential downside and helps you size your position correctly. |

| Reward | The amount of money you could gain if the trade hits your profit target. | Establishes the potential upside and justifies taking the risk in the first place. |

| The Ratio | The relationship between your potential reward and your potential risk (e.g., 2:1, 3:1). | Provides a quick, objective measure to assess whether a trade is worth taking. |

| Favorable Ratio | A ratio where the potential reward is greater than the potential risk (e.g., greater than 1:1). | Ensures your winning trades make more than your losing trades cost you, leading to long-term profitability. |

This table is just a starting point, but it highlights how these simple elements come together to form a powerful decision-making framework.

Capital Preservation and Long-Term Viability

At the end of the day, a trader's number one job is to protect their capital. A consistently applied risk reward ratio is your best line of defense. This isn't just for day traders, either; it’s a foundational concept in long-term investing.

For instance, studies of the classic 60/40 stock-and-bond portfolio from 1901 to 2022 confirmed a clear link: higher returns were historically tied to accepting higher, but measured, risk. You can find more on this research over at the CFA Institute's site.

This proactive approach is a critical piece of your overall trading plan. It ensures that no single loss can ever cripple your account, which means you can stay in the game long enough for your winning trades to work their magic and compound. For a deeper dive, check out our complete guide on trading risk management strategies.

How to Calculate Your Risk Reward Ratio Step by Step

Figuring out your risk-reward ratio isn't about complex math or fancy spreadsheets. Honestly, it all comes down to making three simple decisions before you even think about placing a trade.

Think of it like a pilot's pre-flight checklist for your capital. It makes sure you know exactly where you're headed and, more importantly, what your emergency exit plan is. This quick calculation turns a vague trading idea into a hard number, giving you a clear, objective look at a trade's real potential.

Step 1: Identify Your Three Key Prices

The entire formula hangs on just three numbers. Nailing these is the most critical part of the whole process, as they literally define the best- and worst-case scenarios for your trade.

- Entry Price: This one's easy—it's the exact price where you plan to buy or sell.

- Stop-Loss Price: This is your line in the sand. It's your pre-determined exit point if the trade goes against you, representing the absolute maximum loss you're willing to take. Once you set it, it should be non-negotiable.

- Take-Profit Price: This is your goal. It's the target price where you plan to cash out with a profit. Make sure it's grounded in solid market analysis, not just wishful thinking.

Once you have these three prices locked in, the math is incredibly straightforward.

Step 2: Apply the Simple Formula

The formula itself is just basic subtraction and division. First, you need to calculate the two sides of the equation: your potential risk and your potential reward.

- Your Potential Risk: Entry Price – Stop-Loss Price

- Your Potential Reward: Take-Profit Price – Entry Price

With those two values figured out, you can plug them into the final formula.

The Formula: Risk-Reward Ratio = Potential Reward / Potential Risk

That's it. This simple calculation gives you a clean, objective number to judge the trade by. For instance, if you stand to make $100 and are only risking $50, your ratio is $100 / $50, which simplifies to a 2:1 ratio.

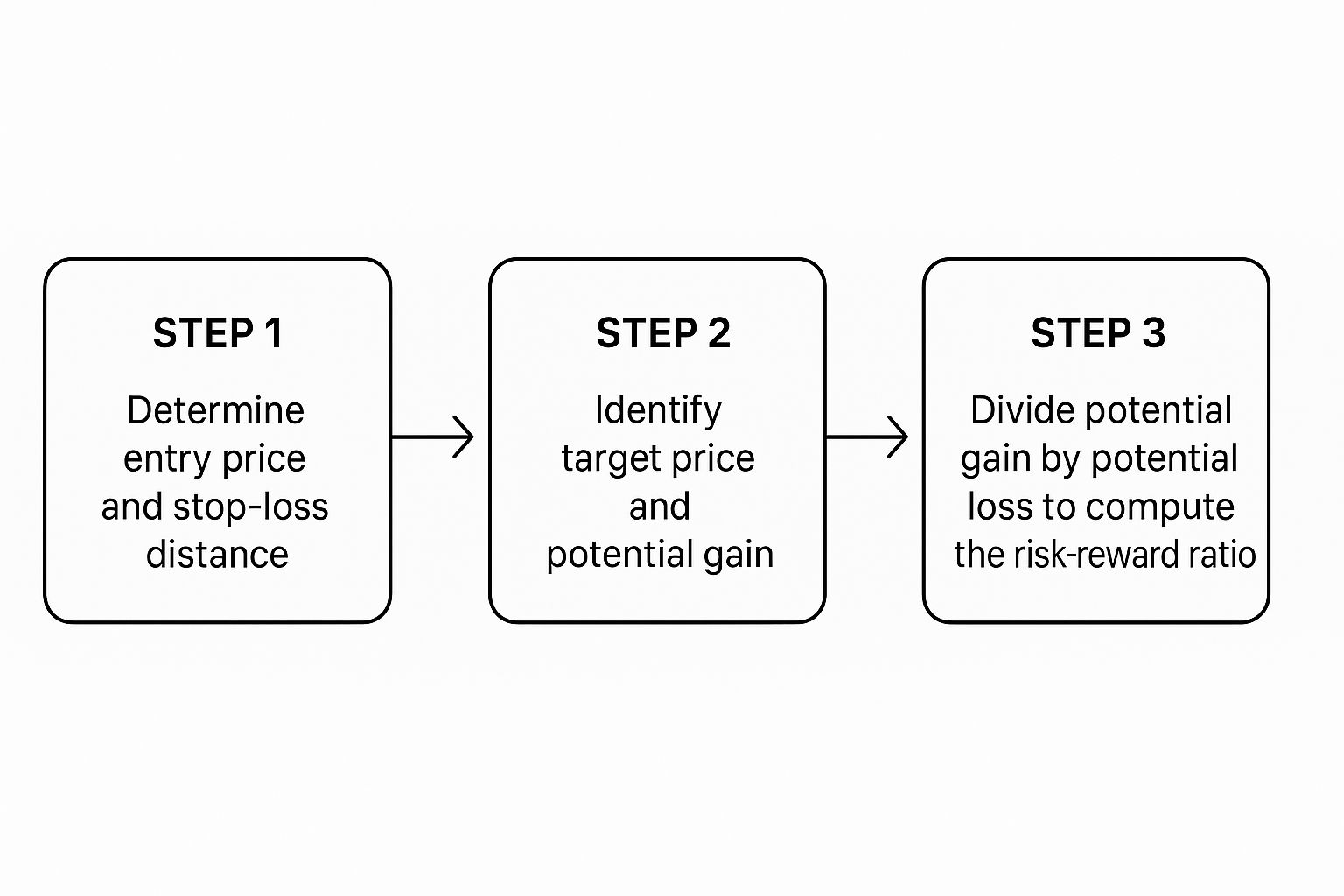

This infographic breaks down the calculation process into three clear steps.

As the visual shows, figuring out your key prices flows logically into the final ratio, making the whole thing a clear, repeatable workflow for every trade.

Putting It All Together: A Practical Example

Let’s walk through how this looks in the real world.

Imagine a trader decides to buy shares at $130. They set a stop-loss at $110, capping their potential loss at $20 per share.

At the same time, they've analyzed the chart and set a realistic take-profit target of $200, which would be a $70 gain per share.

If this trader buys 10 shares, their maximum risk is $200 ($20 loss x 10 shares), and their potential reward is $700 ($70 gain x 10 shares).

This works out to a risk-reward ratio of 1:3.5. In plain English, it means the trader stands to gain $3.50 for every single $1 they're putting on the line. You can dive deeper into more risk management principles and see other examples over at IG.com.

Finding a Good Risk Reward Ratio for Your Strategy

So, what's the magic number? What’s a "good" risk-reward ratio?

If you're looking for a one-size-fits-all answer, you won't find one. The most honest answer is: it depends entirely on your trading strategy. A 1:2 ratio isn't automatically better than a 1:5 without one critical piece of context—how often you actually win.

The real secret sauce is understanding the unbreakable link between your risk-reward ratio and your win rate. These two metrics are locked in a mathematical dance. Finding their harmony is what keeps you in the game long-term. You simply can't look at one without the other.

This relationship defines whether your entire trading approach is viable. A strategy with a high win rate can get away with a lower ratio, but a strategy with a low win rate absolutely requires a higher one to survive.

The Win Rate and Ratio Connection

Picture two completely different traders. First, a high-frequency scalper who aims for small, quick profits, winning 70% of their trades. Their game is all about consistency, not hitting home runs.

On the other side, you have a long-term trend follower who might only win 35% of their trades. Their strategy is a waiting game—enduring a string of small losses to catch that one massive trend that pays off big time.

Let's see how their required ratios shake out:

- High Win Rate Trader (Scalper): With a 70% win rate, they can be profitable even with a 1:1 risk-reward ratio. Out of 10 trades, 7 wins might net them $700, while 3 losses cost them just $300. That's a $400 net profit.

- Low Win Rate Trader (Trend Follower): A 1:1 ratio would be a disaster for this trader. To succeed with a 35% win rate, they need a much higher ratio, maybe 1:4. Over 10 trades, 3.5 wins would bring in $1,400, while 6.5 losses would cost $650. The result? A healthy $750 profit.

As a general rule of thumb, many traders find that an acceptable risk-to-reward ratio falls somewhere between 1:2 to 1:3. This means your potential reward should be at least double or triple what you stand to lose.

Finding Your Ideal Balance

To strike the right balance for your own trading, you have to get brutally honest with your strategy's historical performance. This isn't about guesswork; it's about diving deep into your data. Just like sports bettors are leveraging statistics to refine your strategy, traders need to crunch their numbers.

Start by analyzing your past trades to find your average win rate. Once you have that number, you can calculate the absolute minimum risk-reward ratio your strategy needs just to break even.

Any ratio above that breakeven point is where your profits live. This data-driven approach pulls you out of the world of hope and into the world of probabilities, helping you build a sustainable trading model that fits your style.

Applying the Ratio in Real Market Scenarios

Theory is one thing, but applying the risk reward ratio under the pressure of a live market is where a trader's discipline is truly tested. Let's move from abstract concepts to concrete examples and see how this actually works, transforming chart analysis into a calculated, justifiable trade.

We'll walk through two different scenarios: a stock breakout and a forex reversal. The goal is to see how to visually pinpoint the three key prices—entry, stop-loss, and take-profit—based on real market structures like support and resistance.

Stock Breakout Example: A Winning Trade

Imagine you're watching a stock that has been consolidating, bumping its head against a clear resistance level at $150. After a few failed attempts, the price finally punches through with strong volume. This is a classic signal that an upward move could be starting.

A trader seeing this decides to go long. Here’s the thought process:

- Entry Price: Jump in at $151, just above the old resistance, to make sure the breakout has legs.

- Stop-Loss: To guard against a "fakeout," the stop-loss goes at $148. This is just below the old resistance level, which should now act as a new floor of support.

- Profit Target: Looking at the chart, the next major hurdle—or resistance area—is around $160. That becomes the logical place to take profits.

Now, let's run the numbers.

- Potential Risk: $151 (Entry) – $148 (Stop-Loss) = $3 per share

- Potential Reward: $160 (Target) – $151 (Entry) = $9 per share

- Risk Reward Ratio: $9 / $3 = 3. This gives us a 1:3 ratio.

For every single dollar risked, the potential reward is three dollars. That’s a high-quality setup and exactly the kind of trade a disciplined trader looks for.

Forex Reversal Example: A Losing Trade

Now for a trade that doesn't pan out. Seeing how the ratio protects your capital on a loss is just as important as seeing it work on a win. A trader spots a potential reversal in the EUR/USD forex pair. The price has been tumbling but is now showing signs of hitting a bottom at a major support level of 1.0700.

Believing the downtrend is out of steam, the trader plans a long trade.

- Entry Price: 1.0710, right as the price bounces off that support level.

- Stop-Loss: 1.0680, tucked just below the major support.

- Profit Target: 1.0770, aiming for a previous minor resistance level.

Let's do the math one more time.

- Potential Risk: 1.0710 – 1.0680 = 30 pips

- Potential Reward: 1.0770 – 1.0710 = 60 pips

- Risk Reward Ratio: 60 pips / 30 pips = 2. That's a solid 1:2 ratio.

Even with a favorable ratio, the market had other plans and the downtrend continued. The price sliced right through the support level and hit the stop-loss at 1.0680.

The trade resulted in a controlled loss of 30 pips. This outcome isn’t a failure; it’s a demonstration of the system working exactly as it should. The stop-loss did its job, preventing a much larger drawdown and preserving capital for the next high-quality opportunity.

This is the real power of the risk reward ratio. It ensures that even when you’re wrong—and you will be—your losses are small and manageable, while your wins are significantly larger. Mastering the placement of your stop-loss and take-profit levels is absolutely fundamental to making this entire process work.

Integrating The Risk Reward Ratio Into Your Trading Plan

Turning the risk reward ratio into a hard rule is the moment you move from amateur impulse to professional consistency. It’s not just a quick mental calculation—it’s a non-negotiable clause in your written plan.

By insisting on a clear, minimum ratio for every single trade, you create an objective filter. Emotional whims and half-baked ideas get tossed out before you even place an order.

Establishing A Minimum Standard

Decide on your floor ratio and write it down. For example:

- “No trade below 1:2.”

- “Risk per trade capped at 1% of equity.”

This simple line in your plan does wonders:

- It shields you from FOMO and panic

- It forces you to discipline your entries and exits

- It ensures every setup meets your quality criteria

When a potential trade dips below your baseline, you walk away. No exceptions.

Connecting The Ratio To Your Trading Infrastructure

Your ratio doesn’t operate in isolation—it ties directly into position sizing and cash management.

- Calculate the right number of shares using a reliable position size calculator.

- Align your stop-loss (maximum risk) with your minimum reward target.

- Manage your liquidity and funding with strong cash flow management for small business practices.

Extending The Principle To Your Portfolio

On a broader scale, this single-trade logic mirrors time-tested portfolio approaches. Think of the classic 60/40 stock-bond blend. Vanguard reports that its 10-year rolling annualized returns average around 6.8%—proof that disciplined risk control fuels steady gains. Explore more on Vanguard’s 60/40 findings.

In your plan, each position isn’t just “a trade.” It’s a building block in a system designed for long-term success. By weaving the risk reward ratio into every decision, you ensure each trade contributes positively to your overarching goals.

Common Mistakes to Avoid When Using the Ratio

Knowing what the risk-reward ratio is and actually using it flawlessly in the heat of the moment are two completely different things. It’s a classic case of theory vs. reality. Too many traders understand the concept on paper but fall into predictable traps that completely derail their results.

These aren't complex strategic errors; they're the simple, unforced mistakes that can turn a perfectly good trading plan into a losing one.

One of the most common blunders I see is forcing a trade just to meet a specific ratio. A trader will set some wildly optimistic profit target—with zero basis in the actual market structure—just to make the numbers look good. This isn't strategy; it’s just wishful thinking, and it almost always ends in frustration when the market, unsurprisingly, doesn't hit your arbitrary price level.

Another killer is getting emotional and tweaking your stop loss or target once the trade is live. That's a recipe for disaster.

Ignoring Your Own Data

Maybe the single biggest pitfall is failing to connect your chosen risk-reward ratio to your actual, historical win rate. It's a critical disconnect.

For instance, a trader might decide they will only take 1:3 setups because they heard it was some kind of golden rule. But if their personal trading history shows their strategy actually wins 60% of the time, they could be leaving a ton of money on the table by passing up perfectly good 1:2 trades.

Your trading history is your personal playbook. Ignoring what it tells you about your real-world performance is like a quarterback ignoring his own stats. The "right" ratio for someone else might be wrong for you. The only ratio that matters is the one that is mathematically profitable with your specific win rate.

To sidestep these common issues, you have to build discipline. It’s all about sticking to a strict, rules-based approach.

- Never Move a Stop-Loss Further Away: Widening your stop because a trade is going against you is a cardinal sin of trading. It instantly invalidates your original risk-reward calculation and opens the door to huge, unplanned losses. Your initial stop placement must be final.

- Base Targets on Market Structure: Your take-profit shouldn't be a random number plucked from thin air. It needs to be placed at a logical area on the chart, like a clear resistance level or a previous swing high. Let the chart tell you where the probable exit is, not your hopes.

- Calculate Your Break-Even Rate: Use your trading journal and historical win rate to figure out the minimum risk-reward ratio you need to be profitable over the long run. This data-first approach pulls emotion out of the equation and ensures you’re always trading with a mathematical edge.

By consciously avoiding these mistakes, you can turn the risk-reward ratio from a simple number into a powerful tool for building consistency and growing your account over the long haul.

Frequently Asked Questions

Even when you've got a handle on the risk reward ratio, a few questions always seem to pop up when it's time to actually apply it. Let's clear up some of the most common ones I hear from traders.

Is a 1 to 2 Risk Reward Ratio Good?

Yes, a 1:2 risk reward ratio is an excellent starting point and a solid benchmark for most trading strategies. It simply means you're aiming to make twice as much as you're willing to lose on any given trade.

Think about it: with that kind of edge, you only need to be right about 34% of the time to break even. That makes it a much more sustainable and psychologically forgiving target for most traders.

Can a Risk Reward Ratio Be Negative?

The ratio itself isn't written as a negative number, but you can certainly have a "negative" or unfavorable setup. This happens when the ratio is below 1:1, like 1:0.5.

This means you’re risking more money than you could possibly make. It's a losing proposition from the start and a trade you should almost always walk away from. There's no good reason to risk $100 to make $50.

How Does Win Rate Affect the Ratio?

Your win rate and your risk reward ratio are two sides of the same coin; you can't really talk about one without the other. They are completely intertwined.

- High Win Rate: If your strategy is highly accurate and wins, say, 60% of the time, you can get away with a lower ratio like 1:1 and still be quite profitable.

- Low Win Rate: Trend-following strategies, which often have lower win rates around 40%, absolutely need a higher ratio like 1:3 to survive. Those bigger winning trades are essential to cover the more frequent small losses.

The real magic happens when you find the right balance for your specific strategy. The goal is simple: make sure your winners more than pay for your losers over a long series of trades. Dig into your trading history to see what combination works for you.

Ready to stop relying on indicators and master the markets with pure price action? Colibri Trader offers proven, action-based programs to transform your trading performance. Unlock your trading potential today.