NASDAQ Trading Analysis 02.07.2025

Dear traders,

Last time I shared my thoughts with you on EURUSD.

The price could not pierce through this 4H demand zone that I was looking at.

In fact, it printed a pin bar which led to more buyers rushing in and continuing the uptrend.

Here is what happened:

This was a pretty strong bullish signal.

If you are interested to know more about the way I utilise those supply and demand zones, you can watch my latest video on them:

NASDAQ Trading Analysis 02.07.2025

Today, I am looking at NASDAQ.

It looks like the price has reached a new high and we might be about to see some selling in the coming sessions.

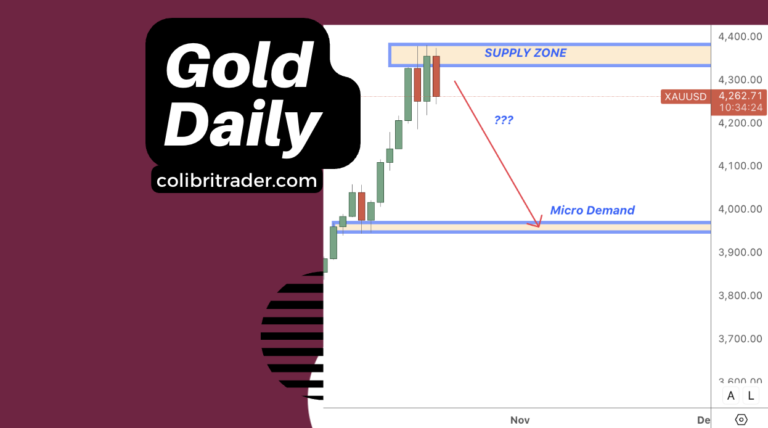

There is a major supply zone that coincides with that.

All of that is looking really bearish.

Will price take some more time at these heights or not would be a combination of technicals and fundamentals.

For now, we’ve got pretty strong technicals that are looking very bearish.

The trigger might come from a fundamental shift.

If that occurs, it could pave the way for a broad-based selloff.

I will be looking for a 4H bearish confirmation, too.

If I see such, I might take a short position.

Alternatively, some of my best short or long trades have started from the lower timeframes.

If I manage to catch a double-digit move on NAS, I’ll likely hold it a bit longer — this one could have real legs.

Time will tell.

Happy trading,

Colibri Trader