NASDAQ is at a Precipice (Market Update 20 Nov 2025)

Dear traders,

Today I wanted to share a market update because I think we might be at an inflection point.

Since last time I wrote a market analysis on Gold, the market has gone up significantly.

Here is when I wrote about it:

Could this be the beginning of a new leg up?

Absolutely!

Will I take a long trade now?

Probably not.

Why?

Because you only take a trade when you have a favourable position and currently the price is a little elevated.

What I would do instead is wait for the price to come lower and possibly give me an indication that there are more buyers coming.

This is usually when we have a confluence of two factors:

- Major zone or level

- Candlestick confirmation or rejection

What do I do in the meantime?

I trade with my day trading strategy that is independent of bias.

I like to look at markets as an unpredictable mass of market participants that gives you market opportunities very rarely.

And when those opportunities come along, it allows you to take trades like those two trades we took in the day trading room this month:

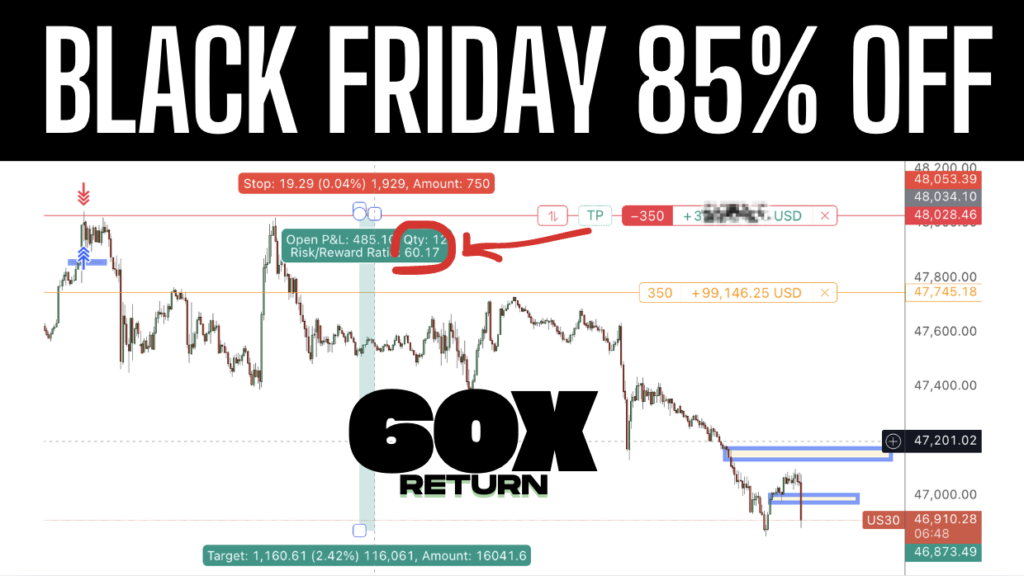

1:40 risk:reward ratio NASDAQ trade

1:60 risk:reward ratio Dow Jones trade

You don’t predict those moves- you need to system to GET INTO such trades.

If you don’t have a proven, consistent system, you won’t be able to psychologically sustain such big winners.

Now, back to where I started…

Why Are the Markets At a Precipice?

Looking at the NASDAQ chart is quite revealing.

Yesterday’s NVIDIA announcement came in stronger than expected, giving tech stocks a solid lift and pushing the NASDAQ noticeably higher.

But half of this push has already been erased.

Market participants appear to be digesting the news and recognising that the rally may not have the legs to last.

So, what’s left on the table?

Probably just enough for the smart players to cash out before someone sweeps the pot.

And with that a possible leg down.

The Technicals

Here is where we are at the moment from a technical point of view:

Looks like we are between a hammer and a rock.

The main question is, where will the sparkles come from?

There is a micro supply zone just above us and a major demand zone below.

One possible scenario is if price goes into the micro supply zone and forms a rejection.

This will give us a hint that we might see sellers pushing the price lower.

If price revisits the major demand zones and breaks through, it could signal trouble ahead.

I would like to wait and see.

In the meantime, if we get an intraday signal, I might enter in a daily position, which in some cases turns into longer-term trades as you can see from the examples above.

Both the 60X and 40X trades began as simple day trades, with minimal initial risk, and snowballed into massive outcomes.

In both trades, there was no prediction involved.

I simply reacted to what the market gave me.

Happy Trading,

Atanas