Market Order vs Limit Order A Trader’s Guide

When you boil it down, the difference between a market order and a limit order is really about choosing between speed and price.

A market order is all about getting your trade executed immediately. It blasts your order into the market and fills it at whatever the best price is at that exact moment. Speed is the priority. On the other hand, a limit order puts you in control of the price. You tell the market the exact price you’re willing to pay (or sell for), but there's no guarantee the trade will ever happen.

Choosing Your Trade Execution Method

At its core, every trade you make forces you to decide: do I get in or out of this position right now, or do I wait for the perfect price? This is the heart of the market order vs. limit order debate. Of course, before placing any trade, you need a firm handle on Stock Market Basics, as this knowledge is the bedrock for these kinds of tactical decisions.

I like to think of it like buying a house in a hot market. A market order is like walking in and offering the seller's full asking price on the spot. You're almost certain to get the house, no questions asked. A limit order is like putting in a lower offer; you might get a better deal, but you also run the very real risk of the seller ignoring you completely and selling to someone else.

The Trade-Off Between Certainty and Control

Market orders give you certainty of execution. When you hit that button, you’re in. In fact, data from major exchanges shows that over 90% of market orders get filled within milliseconds during normal hours. It's incredibly fast.

Limit orders give you price control, but that comes at a cost. You might set your price and the market never quite gets there. Studies have shown that a surprising 40% to 60% of limit orders on big, popular stocks never get filled simply because the price condition isn't met. If you want to dig deeper into these numbers, you can find more execution statistics on dabafinance.com.

To make this even clearer, let's break down the key differences side-by-side.

Market Order vs Limit Order At a Glance

This table cuts right to the chase, highlighting what truly matters when you're deciding which order type to use for your next trade.

| Feature | Market Order | Limit Order |

|---|---|---|

| Primary Goal | Speed and immediate execution. | Price control and precision. |

| Execution | Guaranteed, as long as there is liquidity. | Not guaranteed; only if the price is met. |

| Price | Filled at the best current market price. | Filled only at your specified price or better. |

| Best For | Highly liquid stocks, urgent trades. | Volatile assets, strategic entry/exit points. |

Ultimately, neither order type is "better" than the other. They are just different tools for different jobs. Your job as a trader is to know which tool to pull out of the toolbox for the situation at hand.

How Market Orders Execute in Real Time

When you hit the button on a market order, you're sending a simple, urgent message to your broker: "Get me into this trade now, at whatever the best price is." This command vaults your order to the front of the line, giving it top priority over almost any other order type waiting for a specific price.

The system doesn't hesitate. It instantly scans the order book to fill your request. If you're buying, it finds the lowest available ask price. If you're selling, it snaps up the highest available bid price. This all happens in a blink, getting your position opened or closed without a moment's delay.

The Journey Through the Bid-Ask Spread

The secret to a market order's speed lies in its willingness to cross the bid-ask spread. Think of this as the gap between the highest price a buyer is willing to pay (the bid) and the lowest price a seller is willing to accept (the ask). A market order doesn't wait for the price to come to it; it jumps right across this gap to find an immediate match.

If you want to get a better handle on this crucial concept, we have a helpful guide explaining exactly what the bid-ask spread is and how it affects every trade you make.

By accepting the current price, whatever it may be, a market order guarantees execution. But this guarantee comes with a critical risk that every trader needs to fully appreciate.

Key Insight: A market order is all about the certainty of execution. You are guaranteed to get your order filled, but in exchange, you completely give up control over the price you get.

This trade-off introduces a phenomenon known as slippage.

Understanding and Managing Slippage

Slippage is the difference between the price you thought you were getting when you clicked the button and the actual price where your order filled. It’s most common in fast-moving, volatile markets where prices can flicker and change in the milliseconds between placing your trade and its execution.

Let's look at a couple of real-world scenarios:

- Volatile Markets: Picture this: a major news event breaks, and you place a market order to buy a stock showing a price of $50.00. In that split second, the lowest ask price leaps to $50.15. Your market order doesn't care—it fills at the new, higher price, resulting in $0.15 of negative slippage for every share.

- Thinly Traded Assets: Now, imagine a stock with very low trading volume. A large market order can completely wipe out the shares available at the best price. The order then has to move down to the next-best price level, which could be significantly worse, causing major slippage.

Slippage isn't always a bad thing. You can get positive slippage if the price moves in your favor, but that's far less common. The main takeaway is that a market order accepts the full risk of slippage to achieve that immediate, guaranteed execution.

The Strategic Patience of a Limit Order

Trading doesn’t always have to feel like a sprint. A limit order is your way of stepping back. Instead of chasing the best available price, you decide your entry and wait.

When you choose a market order, speed is everything—you trade at the next available price. A limit order flips this on its head.

It says, “Only execute if the market hits my exact number.” This approach delivers precision in a way a market order simply can’t.

Your limit order then sits on the exchange’s order book—the transparent ledger of all buy and sell orders. Every time the market price hovers near your level, your order is primed for action, but it won’t fire unless conditions match. It’s perfect for traders who refuse to settle on price.

The Anatomy of a Limit Order

Breaking a limit order down reveals two critical settings. Mastering these gives you pinpoint accuracy in your trades.

- Limit Price: The heart of the order. For buyers, it’s the maximum price you’re ready to pay. For sellers, it’s the minimum price you’ll accept. Your trade only executes at your price or better, protecting you from unwanted slippage.

- Order Duration: How long your order remains live. A Day Order automatically expires at trading close if unfilled. A Good-til-Canceled (GTC) order hangs around until you cancel it or it finally fills.

A limit order guarantees your price but never guarantees execution. If the market never touches your limit price, your order will simply sit on the book, unfilled.

Back when electronic trading took off, limit orders gained traction. Platforms made it simple to fine-tune entries and exits. By 2015, roughly 45% of U.S. equity trades were driven by limit orders—evidence of the balance between speed-focused and price-focused strategies. For a deeper dive, see these order type dynamics on AnalystPrep.

Why a Limit Order Might Not Fill

Even if the market briefly tags your limit price, you’re not guaranteed execution. Here’s why:

- The market never actually reaches your target price.

- Orders follow a first-in, first-out queue. If others arrived before you at that level, they fill first.

- Limited liquidity at your price can leave you with a partial fill.

In practice, partial fills are common. Suppose you want 1,000 shares at $50, but only 600 shares trade at that level before the price shifts. You end up with 600 shares filled and the rest unexecuted.

Understanding these trade-offs can shape your overall strategy. It helps you decide when to sit back and wait—and when to push the trigger.

Comparing Critical Trading Factors

When you're on the trading floor, the decision between a market order and a limit order really comes down to a choice: do you need speed or do you need a specific price? To make the right call in the heat of the moment, you've got to understand how each order type performs under pressure, especially when it comes to execution certainty, price control, and the real cost of your trade.

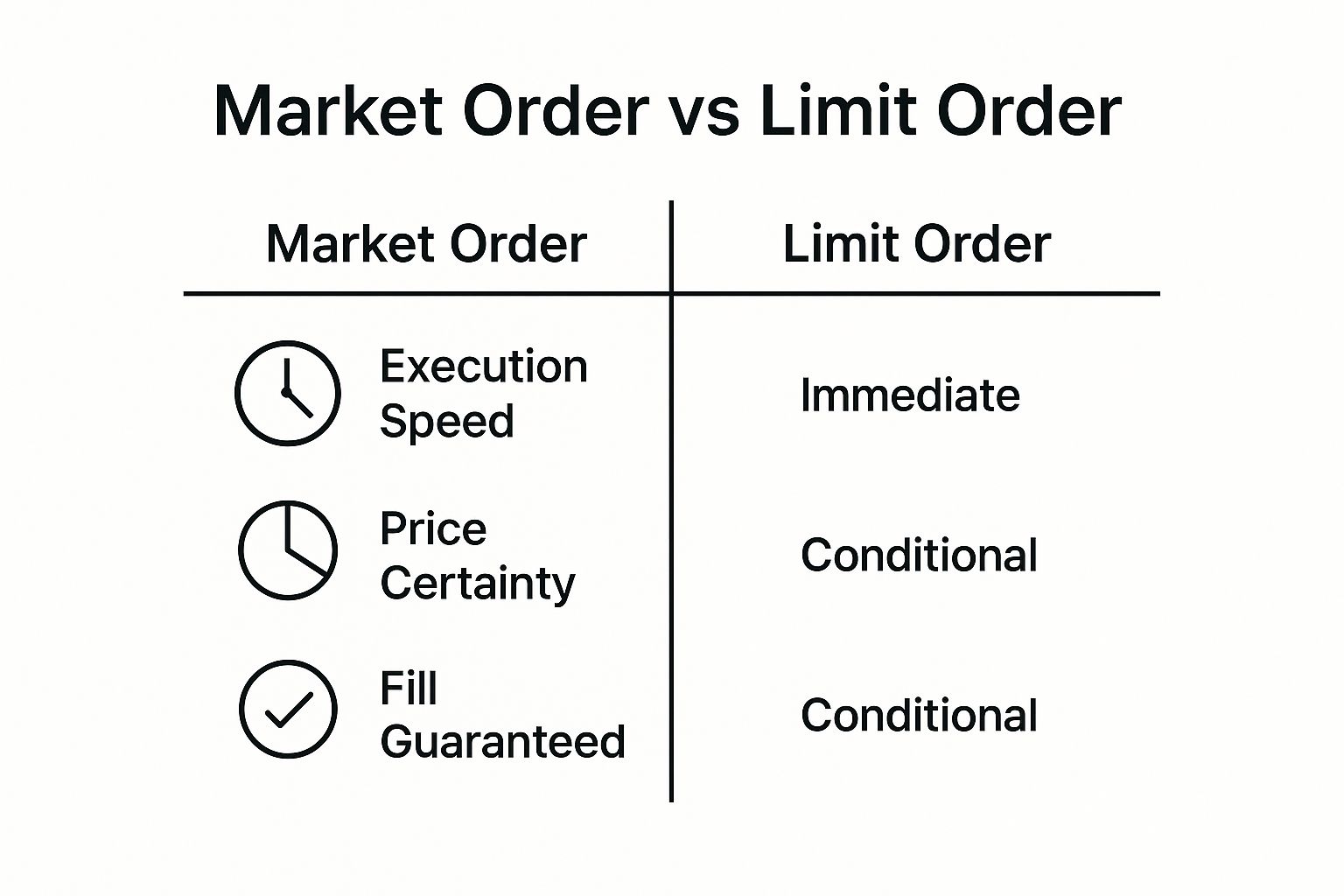

This chart breaks down the fundamental trade-offs you're making every time you choose one over the other.

As you can see, market orders get you in or out now, but the price is out of your hands. Limit orders flip that script, giving you price precision but no guarantee your trade will ever happen.

Certainty of Execution

The single biggest selling point of a market order is its near-ironclad guarantee of execution. When you place a market order, you're telling your broker, "Get me into this position immediately, whatever it takes." As long as there are buyers and sellers, your trade is going through almost instantly.

A limit order, on the other hand, comes with no such promise. Your order only gets filled if the market price actually hits your specified limit. If the price never gets there, your order just sits there, unfilled, and you could miss the move entirely. This is a massive distinction when you're reacting to breaking news or trying to manage a position that's moving against you fast.

Precision in Price Control

While market orders are the undisputed champions of speed, they give you absolutely zero control over your price. You get the best available price at that exact second, which can sometimes be a nasty surprise in a volatile market. That difference between the price you expected and the price you got is called slippage.

It’s a concept every trader needs to master. Our detailed guide explains more about what slippage is in trading and the damage it can do to your account.

Limit orders are the complete opposite. They put you in total command of your execution price. A buy limit order will only execute at your price or lower, while a sell limit order executes only at your price or higher. For traders who build their strategies around precise entry and exit points, this level of control is non-negotiable.

The Trader's Dilemma: A market order accepts the risk of price uncertainty (slippage) to gain execution certainty. A limit order accepts the risk of execution uncertainty (an unfilled order) to gain price certainty.

Impact on Total Trading Costs

The choice between a market vs. limit order goes straight to your bottom line, affecting your implicit trading costs. Your commission might be the same, but the price you actually pay for the asset can be worlds apart.

Research on highly liquid US stocks reveals that blasting in with market orders often costs you more. The effective spreads traders pay can be 20% to 40% higher than the quoted spread simply because they demand immediate execution. In contrast, a patient trader using limit orders can slash those costs—or even get a better price than intended.

This cost gap gets even wider when you're trading less liquid assets or during a high-volatility news event when bid-ask spreads blow out. A market order will barrel right through that wide spread, costing you dearly. A limit order, however, patiently waits for a more reasonable price, protecting your capital. Choosing the right order isn't just about getting your trade filled; it's a fundamental part of managing risk.

Here’s a practical breakdown of how these two order types stack up under different trading scenarios.

Situational Performance Market Order vs Limit Order

This table provides a comparative analysis of how each order type performs based on key trading criteria and market conditions.

| Criteria | Market Order Performance | Limit Order Performance |

|---|---|---|

| Speed of Execution | Excellent. Executes almost instantly at the best available price. | Poor to Fair. Execution is not guaranteed and depends on the market reaching a specific price. |

| Price Control | None. You get whatever the market offers at that moment, risking slippage. | Excellent. You have complete control over the execution price (or better). |

| Execution Guarantee | Very High. Fills as long as there is liquidity in the market. | Low. The order may never be filled if the price doesn't reach your limit. |

| Best for Volatile Markets | Risky. Ideal for getting out fast, but slippage can be severe. | Safer. Protects against paying too much or selling for too little during price swings. |

| Best for Illiquid Assets | Very Risky. Wide bid-ask spreads can lead to extremely poor execution prices. | Recommended. Essential for ensuring a fair price on assets with low trading volume. |

| Use in Scalping | Often Used. Speed is critical for entering and exiting trades quickly. | Sometimes Used. Useful for setting precise profit targets or entry points. |

| Use in Swing Trading | Less Common. Typically used only for urgent exits or entries based on news. | Standard Practice. Perfect for planning entries at support or exits at resistance. |

Ultimately, this table shows there's no single "best" order type—it all depends on what you're trying to achieve, the asset you're trading, and what the market is doing at that very moment.

When a Market Order Is Your Best Bet

While a limit order offers precision, there are critical moments when speed and certainty are far more valuable. In these situations, a market order isn't just an option; it's often the most effective tool for the job.

Knowing when to prioritize getting your trade filled right now over getting a specific price is a key skill that separates novice traders from seasoned pros. The decision really hinges on one central question: Is the cost of delay higher than the potential cost of slippage? If waiting around could mean missing a great long-term entry or letting a losing trade get much worse, then a market order is your go-to.

For the Long-Term Investor

If you're a long-term investor accumulating shares in a stable, blue-chip company like Apple or Microsoft, agonizing over a few cents is just counterproductive. Your entire strategy is based on the company's value over years, not minor price jitters today.

Using a market order to buy shares in a highly liquid stock like that ensures you get into the position without delay. Any minimal slippage you might see on a stock with a tight bid-ask spread is insignificant compared to the long-term growth you're anticipating. Here, execution certainty is everything.

Strategic Takeaway: For buy-and-hold investors in high-volume stocks, the opportunity cost of missing an entry almost always outweighs the minor price difference caused by slippage from a market order.

When Exiting a Losing Trade

Every trader, and I mean every trader, faces losing positions. The most crucial goal in this scenario is to stop the bleeding immediately, before a small, manageable loss snowballs into a catastrophic one. This is absolutely not the time for patient, precise orders.

When a trade has clearly gone against you and broken through a key support level, a market order provides the fastest possible exit. Trying to use a sell limit order to squeeze out a few extra pennies could be a costly mistake if the price continues to plummet, leaving your order unfilled and your losses mounting. A market order in this context is a vital risk management tool.

Trading Highly Liquid ETFs

Index funds and major ETFs, like the SPDR S&P 500 ETF (SPY), are some of the most liquid assets in the world. They trade millions of shares daily, which results in extremely narrow bid-ask spreads—often just a single cent.

When you're trading assets like these, the risk of significant slippage from a market order is incredibly low. The sheer volume ensures your order can be filled instantly without making a noticeable dent in the price. For traders needing to quickly jump into or out of a broad market position, a market order in a liquid ETF is both efficient and safe.

Strategic Scenarios for Using a Limit Order

While market orders are all about speed, disciplined trading often calls for the surgical precision you can only get from a limit order. Using a limit order is a conscious decision to prioritize price over an instant fill.

It's the tool you pull out when you have a specific plan and you're willing to wait for the market to come to you. This patient approach is absolutely essential when you're dealing with assets where slippage can eat away at your capital.

Trading Volatile or Low-Liquidity Stocks

Trying to use a market order on a volatile stock or one with thin liquidity is like walking through a minefield blindfolded. The bid-ask spread on these assets can be massive, and a market order will simply grab the next available price—which could be miles away from what you expected.

A limit order is your safety net. By setting a maximum buy price or a minimum sell price, you shield yourself from paying too much or selling for too little. It ensures that a sudden, wild price swing doesn't wreck your trade from the get-go.

Key Takeaway: For volatile and illiquid assets, a limit order isn't just a nice-to-have; it's a critical risk management tool. It prevents costly execution mistakes and protects your account balance.

Establishing Precise Entry and Exit Points

Solid trading is built on a foundation of discipline and a well-thought-out plan. Limit orders are your go-to for putting that plan into action with precision, letting you set your entry and exit points ahead of time based on your technical analysis.

This strategy plays out in a few common ways:

- Buying at Support: If your chart work points to a key support level, you can place a buy limit order right at that price to get into a position if the stock pulls back.

- Taking Profits at Resistance: On the flip side, you can set a sell limit order at a known resistance level to automatically cash in your profits when your target price is reached.

This approach takes emotion out of the driver's seat. It automates your strategy and stops you from making impulsive moves. You're trading proactively, letting your plan work for you even when you're not glued to the screen.

It's also crucial to understand the subtle differences between various conditional orders. A limit order sets a price boundary, but a stop order, for instance, triggers a market order once a certain price is hit. Taking the time to explore the difference between stop and limit orders will only sharpen your risk management skills.

Got Questions? Let's Talk Orders.

When you're getting into the weeds of market vs. limit orders, a few practical questions always pop up. I get these all the time, so let's tackle the most common ones traders ask when they're figuring out which order type to use.

Can a Limit Order Fill at a Better Price?

Yes, it absolutely can. Think of the price you set on a limit order as the worst-case scenario you’re willing to accept.

A buy limit order will execute at your price or lower, while a sell limit order will execute at your price or higher. This is one of the biggest advantages—it guarantees you won't get a worse deal than you planned for.

What Happens if a Limit Order Is Partially Filled?

A partial fill is pretty common, especially if you're trading a larger position or an asset that doesn't have a ton of volume. It just means a fraction of your order got executed.

The rest of your order doesn't just disappear. The unfilled portion stays active on the order book, waiting for the market to come to your price. It'll stay there until it's either completely filled, you manually cancel it, or it expires (like at the end of the day, depending on your settings).

A Quick Tip for New Traders: Be very careful with market orders, especially when a stock is moving fast. Slippage can be a real account-killer, making you pay way more than you ever expected. It's almost always safer to start with limit orders to control your entry and exit prices while you're still learning the ropes.