GOLD Trading Analysis 23.07.2025

Dear traders,

Last time I shared my thoughts about NASDAQ and it looks like the price has been doing one thing:

Going UP!

Well, I am not sure how long this bull can run sustain momentum.

It is hard to say since we are at an all-time high.

So, I guess it is a matter of time and news to slow down the bullish momentum.

I am seeing a bearish engulfing candle on the daily, which gives me a short-term hesitance and we are in fact short NAS in the day trading room:

At the time of writing, this is a risk-free trade.

So the worst case scenario for me is a break-even trade.

So, what am I looking at today?

GOLD Trading Analysis 23.07.2025

I have been looking at this bullish Gold run.

Today, we are kind of locked between a rock and a hard place.

At the moment, I see two key scenarios unfolding — and both could shape what happens next.

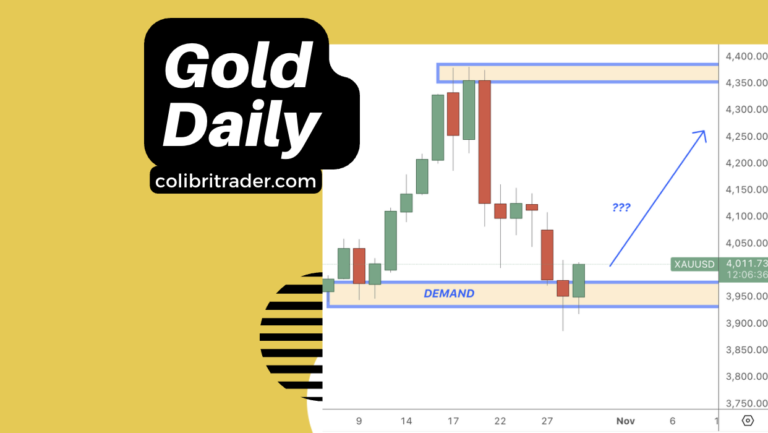

Scenario 1: Follow the BLUE lines

If Gold goes lower and re-tests the minor demand zone, I will be looking for a bullish confirmation such as an inverted pin bar or a bullish engulfing pattern.

If this happens, I will be more likely to position myself in a long trade.

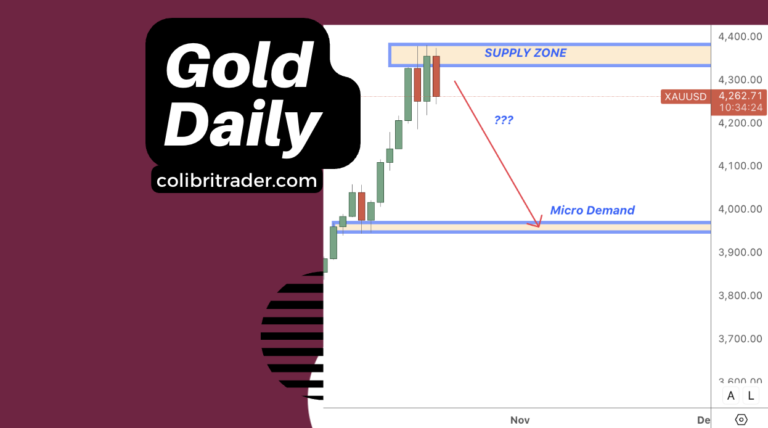

Scenario 2: Follow the RED lines

If Gold goes higher and makes a new high in the supply zone I have marked, I will very likely be looking to short Gold.

There needs to be a candlestick confirmation from the Daily and ideally a second bearish confirmation from the 4H chart.

If this happens, I will feel more at ease shorting Gold.

All in all, time will help us decide which way to take.

Until then, I will patiently wait.

Happy trading,

Colibri Trader