EURUSD at a Crossroad

Last time I shared my thoughts about Gold.

Since then, Gold has been on a bullish trajectory.

Over the past week, gold was driven mainly by the U.S. Federal Reserve’s 25 bps rate cut, paired with Jerome Powell’s cautious “meeting-by-meeting” guidance.

Softer U.S. jobs data boosted expectations of further easing, which supported gold prices. However, a stronger U.S. dollar and firmer Treasury yields weighed on sentiment, limiting gold’s rally after fresh highs.

At the same time, ongoing geopolitical and economic uncertainty kept safe-haven demand alive.

Central banks, especially in emerging markets, continued heavy buying, providing a solid floor for prices.

Overall, gold stayed elevated but volatile, balancing bullish rate-cut momentum with dollar strength and yield pressures.

Nothing unusual behind this move.

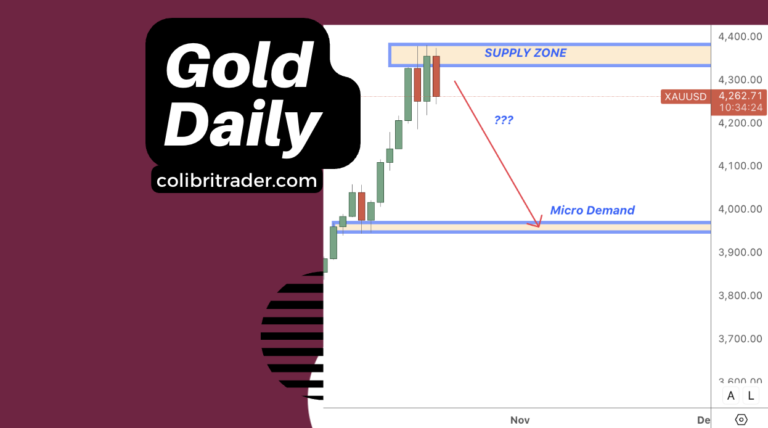

The technicals?

Well, looks like Gold might be slowing down.

There was a bearish engulfing on the daily and this for me is not a very positive sign in the short-medium term.

But let’s see.

EURUSD at a Crossroad

EURUSD looks ready to take a break, too.

I am looking at the daily chart and it seems we’ve reached a minor supply zone.

There is an inside bar on the daily and the combination of those two makes things even more bearish.

Will I be shorting this pair outright?

Probably not.

I would like to see a 4H rejection of the supply zone.

From a fundamental point of view, things look like we are at a crossroad, too.

EUR/USD climbed somewhat as expectations mounted that the U.S. Federal Reserve is nearing rate cuts, which tends to weaken the dollar.

Meanwhile, the European Central Bank held rates steady and signalled a cautious stance, in part suggesting that its rate-cut cycle may be over for now.

U.S. inflation data was mixed, giving markets conflicting signals on how fast and how much the Fed will ease; that added volatility to the pair.

On the Eurozone side, inflation is near the ECB’s target but there’s concern over growth slowing, which limits how strong the euro can get.

Bottomline?

I will be patiently waiting for a potential shorting opportunity and a rejection from the 4H chart.

Happy trading,

Colibri Trader