Master Discipline in Trading for Lasting Success

Why Discipline in Trading Makes or Breaks Your Career

The trading world often attracts those seeking quick riches and market dominance. But the truth is, even the most complex strategies can crumble without discipline. It's more than just following a plan; it's about conquering your emotions and making rational choices under pressure. This disciplined mindset is the cornerstone of lasting success in trading. Interested in learning more? Check out this resource: How to master trading discipline.

The Dangers of Undisciplined Trading

Imagine a trader abandoning their carefully crafted plan after a few losses. They might increase their position size, hoping to recoup losses quickly. This impulsive, emotionally-driven behavior can create a devastating cycle, potentially wiping out their account. Emotional control is paramount in the volatile trading arena.

Chasing hot tips or succumbing to FOMO (Fear Of Missing Out) without proper analysis are other hallmarks of undisciplined trading. These often lead to buying high and selling low – the exact opposite of successful trading strategies.

Moreover, discipline prevents catastrophic losses. The 2012 Knight Capital Group incident serves as a stark reminder. A software glitch in their automated trading system caused a $440 million loss in just 45 minutes. This highlights the critical need for robust risk management and disciplined practices. Trading failures and their lessons offer valuable insights. This event emphasizes the importance of strict controls and monitoring.

The Benefits of Disciplined Trading

Consistent profitability isn't solely about a good strategy; it's about consistent application, regardless of market swings. Disciplined traders possess key traits:

-

Sticking to their trading plan: They define entry and exit points, position sizing, and risk tolerance, adhering to these rules even under pressure.

-

Managing risk effectively: They prioritize preserving capital over chasing big wins, knowing that weathering downturns positions them for future opportunities.

-

Controlling emotions: They acknowledge and manage emotional reactions to market events, avoiding impulsive decisions fueled by fear or greed.

-

Continuously learning and adapting: They analyze trades, pinpoint areas for improvement, and refine their strategies based on market feedback.

By embracing these principles, disciplined traders build a foundation for sustained success. They navigate market volatility and emerge stronger, turning inconsistent results into reliable profitability. This approach not only protects capital but cultivates a growth mindset. For a deeper dive, read: 7 Steps to become more disciplined in your trading. Ultimately, discipline is the key differentiator between consistently successful traders and those who struggle.

Mastering Your Mind: The Psychology of Disciplined Trading

Discipline in trading isn't simply about following a plan. It's about understanding and managing your emotions, recognizing the psychological pitfalls that can derail even the best strategies. This means understanding how your emotions can influence trading decisions and developing mental safeguards against impulsive actions.

Emotional Landmines in Trading

Several psychological triggers can negatively impact a trader's performance. The dopamine rush of potential profits can fuel excessive risk-taking. On the other hand, the fear of missing out (FOMO) can push traders into poorly planned entries. The pain of a loss can also trigger emotional responses, leading to revenge trading and further losses. These emotional responses are perfectly normal, but uncontrolled reactions can be harmful.

Building Mental Resilience

Successful traders learn to recognize their personal emotional patterns. They understand their individual responses to market volatility and develop strategies to mitigate impulsive decisions. This involves developing mental resilience, the ability to recover from setbacks and maintain focus during market swings. Just as athletes train their bodies, traders must train their minds.

-

Mindfulness practices: Techniques like meditation can help traders stay present, reducing anxiety and improving concentration.

-

Journaling: Recording trades and emotional responses can uncover hidden biases and patterns, allowing traders to identify and address weaknesses.

-

Cognitive reframing: This technique involves challenging negative thoughts and replacing them with more constructive perspectives. For instance, rather than viewing a loss as a personal failure, a disciplined trader might see it as a valuable learning experience.

Practical Techniques for Emotional Control

Traders can use several techniques to bolster their mental discipline. Establishing clear pre-trade routines can foster a calm and focused mindset. Regular breaks can prevent emotional burnout and maintain objectivity. It's important to remember that discipline isn't about suppressing emotions entirely; it's about managing them effectively. By understanding and addressing the psychological aspects of trading, you can improve decision-making and enhance long-term performance. Much like a disciplined athlete follows a strict training regimen, a disciplined trader adheres to their mental and emotional strategies. This mental fortitude creates a crucial buffer against market fluctuations, allowing for consistent and rational trading decisions. This mental discipline is the bedrock of consistent trading success.

Building Your Bulletproof Trading Plan

Discipline in trading begins with a solid, detailed plan. This plan helps you avoid making impulsive, emotional decisions. Think of it as your compass, navigating you through the unpredictable nature of the market. It’s the structure that keeps successful traders on track, regardless of market ups and downs.

Defining Clear Entry and Exit Criteria

Your trading plan needs clearly defined entry and exit criteria. These predetermined rules take the emotion out of trading decisions. Your entry criteria, for example, might be based on a specific price action pattern combined with a particular volume indicator. Your exit strategy should include both profit targets and stop-loss levels. This ensures you secure profits when your goals are met and limit losses if a trade moves against you.

Position Sizing and Risk-Reward Parameters

Position sizing is another critical component. It determines how much of your capital you're risking on each trade, safeguarding you from substantial losses. This could mean risking a consistent percentage of your account on each trade, no matter how promising the opportunity seems. Along with position sizing, defining your risk-reward ratio is key. This involves evaluating the potential profit against the potential loss for each trade. A good risk-reward ratio could be 2:1, aiming for a profit twice the size of your potential loss.

Transforming Strategies into Actionable Checklists

Experienced traders convert broad strategies into specific, actionable checklists. This involves writing down every step of your trading process, from pre-market analysis to post-trade review. This approach creates consistency and eliminates the temptation to second-guess yourself mid-trade. Planning for different market situations is also crucial. This prepares you for unexpected market shifts and helps you stay disciplined even when the market throws you a curveball.

For example, Paul Tudor Jones demonstrated impressive discipline and profited during the market crash of Black Monday in 1987 by shorting the market. This type of discipline comes from understanding market dynamics and taking advantage of market inefficiencies. Discover more insights about Paul Tudor Jones. His success highlights how essential discipline is in maintaining focus and making smart decisions, even in challenging market conditions.

Pressure-Testing Your Plan

Before using real money, it's essential to test your plan thoroughly. This can involve using a trading simulator or backtesting your strategy against past market data. This process helps you find any weak points in your plan and improve it before live trading. Think of it like a pilot using a flight simulator before flying a real plane – it ensures you're prepared for various scenarios.

To help illustrate the key components of a well-structured trading plan, let's look at the following table:

Table: Components of a Disciplined Trading Plan

This table outlines the essential elements that should be included in a comprehensive trading plan to maintain discipline

| Component | Purpose | Implementation Example |

|---|---|---|

| Entry Criteria | Defines when to enter a trade based on specific market conditions. | Price breaks above a key resistance level with increased volume. |

| Exit Criteria | Defines when to exit a trade, both for profit taking and loss limitation. | Profit target at 10% gain, stop-loss at 5% loss. |

| Position Sizing | Determines the amount of capital to risk on each trade. | Risk 1% of account balance per trade. |

| Risk-Reward Ratio | Assesses the potential profit relative to the potential loss. | Aim for a minimum 2:1 risk-reward ratio. |

| Contingency Plans | Outlines actions for different market scenarios, including unexpected events. | If volatility spikes unexpectedly, reduce position size or pause trading. |

This structured approach, summarized in the table above, transforms your trading from guesswork into a methodical process. This, in turn, can lead to more reliable results and sustained success over time.

Risk Management: The Discipline That Saves Traders

The attraction of high trading profits can often obscure a critical factor: risk management. While the pursuit of gains is enticing, capital preservation is essential for long-term success.

In fact, it is the discipline of managing risk that distinguishes consistently profitable traders from the majority who experience losses. This involves understanding your personal risk tolerance – how much you can comfortably lose on each trade – and implementing strategies to mitigate potential losses. For a deeper dive into effective risk management, check out this helpful resource: How to master risk management.

Position Sizing: Limiting Your Exposure

A cornerstone of risk management is position sizing. This refers to the proportion of your capital allocated to any given trade. Professional traders often employ specific formulas to determine position size.

These formulas help ensure that no single trade can severely damage their overall account. A standard practice is to risk only a small percentage, such as 1% or 2%, of your total trading capital on any individual trade. This measured approach limits potential downside, even if a series of trades result in losses.

Stop-Loss Orders: Your Protective Shield

Another vital technique is the use of stop-loss orders. These are predetermined exit points that automatically close a trade if the market moves unfavorably. Calculating suitable stop-loss levels necessitates understanding both your risk tolerance and the specific characteristics of the asset being traded.

Stop-loss orders help protect your capital by limiting losses before they escalate. It is also crucial to adhere to your stop-loss levels, avoiding the temptation to adjust them in hopes of a market reversal. Maintaining consistency in your trading plan is vital. Checklists can be powerful tools for this. Explore this article on checklist implementation for some practical examples: GitHub Pull Request Template Checklist.

Diversification: Avoiding Concentration Risk

Diversification is a fundamental principle of sound risk management. It involves spreading your capital across various assets to avoid concentrated risk. Essentially, this means not putting all your investment into a single asset.

Instead of investing all your capital in one stock, for example, you might diversify across different stocks, industry sectors, or even different asset classes. Day Trading Statistics highlight the significant role of discipline in maintaining profitability, especially in the fast-paced world of day trading. Many day traders, for instance, neglect to implement stop-losses or deviate from their trading plans, often incurring significant losses. A disciplined, diversified approach helps safeguard your portfolio from substantial losses should one investment underperform.

Case Studies: Learning From Success

Examining the experiences of traders who have navigated significant market downturns reveals the importance of disciplined risk management. These traders were able to recover and ultimately prosper because their risk management protocols prevented catastrophic losses.

Their stories demonstrate that disciplined risk management is not solely about minimizing losses; it’s about preserving capital to exploit opportunities that others, due to excessive risk-taking, may miss. These real-world examples underscore the importance of well-defined risk management strategies for sustained trading success.

Staying Disciplined When Markets Go Haywire

Market turmoil can shake even the most experienced traders. When fear and greed take control, maintaining discipline becomes absolutely essential. This section explores proven strategies from volatility traders and market veterans for navigating turbulent markets without compromising your trading plan.

Adapting to Volatility

During periods of high volatility, staying disciplined means adapting. This doesn't mean abandoning your trading plan altogether. Instead, it means adjusting specific parameters. For example, you might tighten your stop-loss orders to protect your capital during sudden price swings. You might also reduce your position sizes to manage the increased risk that comes with volatility. Effective risk management is key for disciplined trading. For more on this topic, take a look at Risk Management Frameworks.

Recognizing When to Step Back

Sometimes, the most disciplined action is to simply step away from the market. When emotions are running high, recognizing the need for a break can protect both your capital and your mental well-being. This pause allows you to regain your objectivity and come back to trading with a clear perspective. Think of it like a ship's captain waiting out a storm – a strategic retreat to protect the vessel.

Pre-Established Protocols for Different Market Environments

Successful traders develop specific protocols for different market conditions. They create clear decision trees to guide their actions based on the current market environment. This structured approach helps them distinguish between real opportunities and potentially risky trades. For example, they might have different entry and exit criteria for ranging markets versus trending markets.

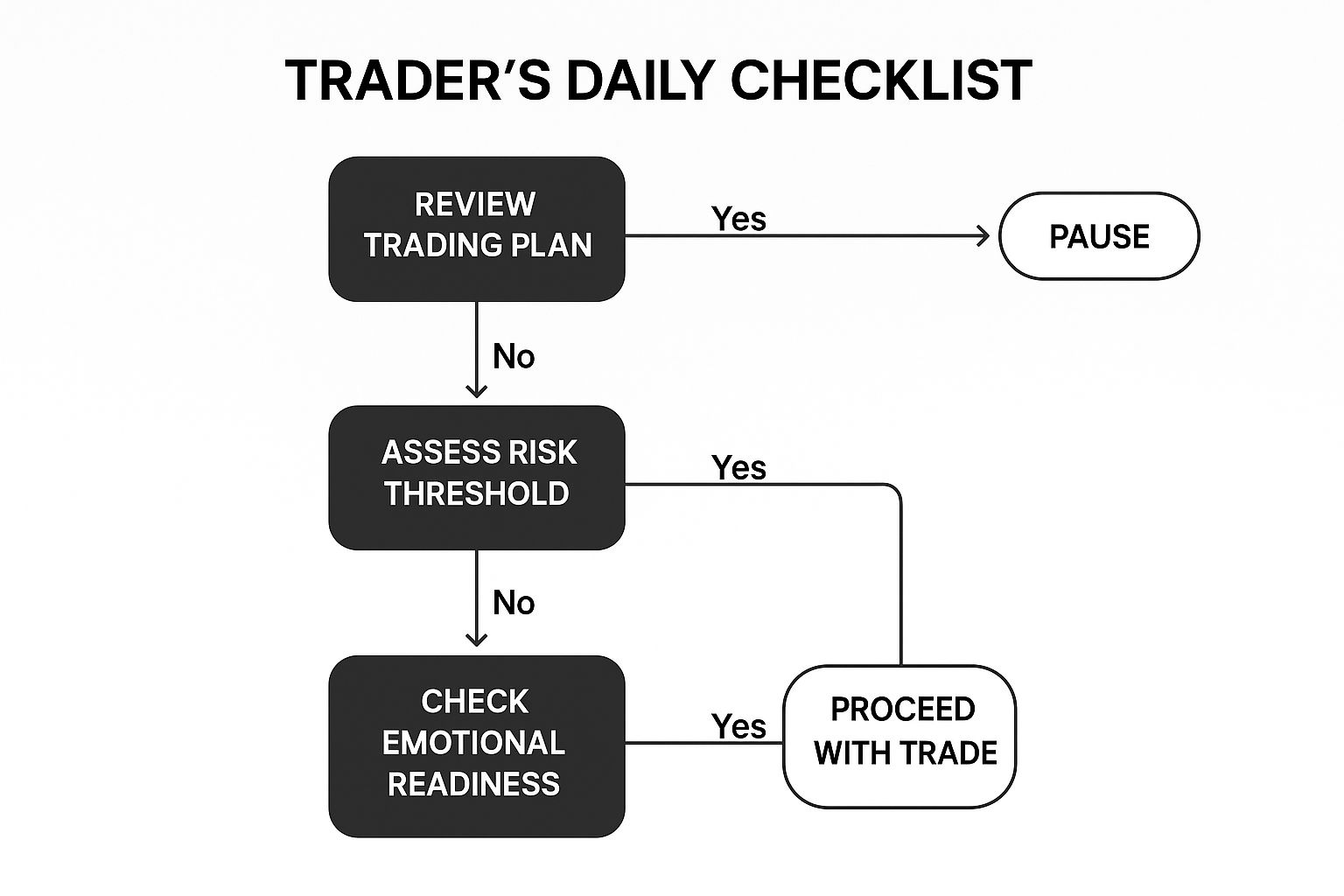

The decision tree above shows a trader’s daily checklist for maintaining discipline. It highlights the importance of reviewing the trading plan, assessing risk tolerance, and evaluating emotional state before entering any trade. This structured approach guards against impulsive decisions. Following these steps ensures traders approach the market with a disciplined, prepared mindset. This prevents emotionally-driven actions. This structured approach, visualized in the decision tree, acts as a buffer against impulsive trading.

To further illustrate the differences between disciplined and undisciplined traders, let's examine the following table:

Disciplined vs. Undisciplined Trading Behaviors

A comparison showing how disciplined and undisciplined traders respond to different market situations.

| Market Situation | Disciplined Trader Response | Undisciplined Trader Response | Typical Outcome |

|---|---|---|---|

| Sudden Market Drop | Tightens stop-loss orders, reduces position sizes, potentially pauses trading | Panics, sells off positions at a loss, makes emotional decisions | Capital preservation for disciplined trader, significant losses for undisciplined trader |

| Unexpected News Event | Consults pre-established protocols, assesses the situation rationally | Reacts impulsively, chases the news, enters trades without analysis | Disciplined trader minimizes risk and potentially finds opportunities, undisciplined trader likely incurs losses |

| Period of High Volatility | Adapts trading plan parameters, focuses on risk management | Overtrades, increases position sizes, ignores risk management | Consistent returns for disciplined trader, large swings and potential wipeout for undisciplined trader |

| Extended Period of Losses | Reviews trading plan, seeks mentorship if needed, maintains emotional control | Blames the market, increases risk to recoup losses, abandons trading plan | Disciplined trader identifies weaknesses and improves, undisciplined trader experiences further losses |

This table highlights the importance of discipline in navigating various market scenarios. Disciplined traders, by adhering to their plans and managing risk effectively, are more likely to achieve consistent results, while undisciplined traders often succumb to emotional reactions, leading to significant losses.

Dealing with Unprecedented Events

When the unexpected happens, having established protocols is crucial. While a trading plan can't anticipate every scenario, it provides a framework for responding to market shocks. This structure allows traders to make rational decisions, even during unprecedented volatility. Just as a pilot uses checklists during emergencies, a disciplined trader refers to pre-determined protocols during market crises. This helps maintain control and prevents impulsive reactions that could lead to substantial losses. By staying disciplined in turbulent times, you protect your capital and position yourself to capitalize on opportunities arising from the chaos. This disciplined approach separates consistently profitable traders from those who succumb to emotional trading, which often results in devastating losses.

Measuring and Strengthening Your Trading Discipline

Trading discipline isn't some elusive, abstract idea. It's a practical skill you can measure and strengthen over time. Like any skill, it takes dedicated practice, consistent effort, and a structured approach. This section provides actionable strategies for tracking your discipline, setting realistic goals, and continually improving your trading practices.

Quantifying Your Discipline: Key Metrics

To bolster your trading discipline, you first need a clear understanding of your current standing. This means tracking specific metrics that reflect how well you adhere to your trading plan. Here are some vital metrics to consider:

-

Plan Adherence Rate: This crucial metric measures how consistently you follow your pre-defined trading rules. Calculate it by dividing the number of trades taken according to your plan by your total number of trades. A high adherence rate suggests strong discipline.

-

Emotional Decision Frequency: Keep track of how often emotions like fear or greed influence your trades, instead of your plan. While this can be difficult to measure precisely, honest self-assessment and regular journaling can make it easier.

-

Discipline-Related Drawdowns: Carefully analyze your trading losses. How many resulted from straying from your plan, such as impulsive entries or exits? Identifying these losses helps you pinpoint weak spots in your discipline.

You might be interested in: How to master trading discipline with these 7 steps.

Building a Trading Journal That Works

A comprehensive trading journal is indispensable for measuring and improving discipline. It's more than just a record of wins and losses. A truly effective journal includes:

-

Pre-Trade Analysis: Before entering a trade, document your reasoning, including the specific criteria that align with your trading plan.

-

Emotional State: Note your emotional state before, during, and after each trade. This can reveal emotional patterns that affect your decision-making.

-

Post-Trade Review: Analyze every trade, win or lose. Did you follow your plan? If not, why? What adjustments could you make in the future?

Accountability Systems for Long-Term Success

Just as athletes benefit from coaches, traders can improve their discipline through accountability. This might involve working with a fellow trader for mutual feedback and support, or seeking guidance from a mentor. Regularly reviewing your trading journal with an accountability partner can help identify areas for improvement and reinforce your commitment to disciplined trading.

Exercises for Progressive Improvement

Improving trading discipline requires consistent practice. Here are some helpful exercises:

-

Simulated Trading: Use a trading simulator to practice your plan in a risk-free setting. This allows you to refine your skills without risking real capital.

-

Small Position Sizing: Start by trading with smaller position sizes than your plan typically allows. This minimizes the emotional impact of trades and helps you focus on executing your rules.

-

Post-Trade Analysis Review: Schedule dedicated time each week to thoroughly examine your trading journal. Identify recurring patterns in your behavior and adjust your plan accordingly.

Technology Tools to Enforce Discipline

Several technology tools can enhance your discipline. Automated trading systems can execute trades based on pre-defined rules, eliminating emotional impulses. Trade management software helps you monitor performance and alerts you to any deviations from your plan.

Mentorship and Peer Support

Connecting with seasoned traders or joining trading communities can provide valuable accountability and support. Mentors can offer personalized guidance and share their experience in maintaining discipline. Peer support groups offer a platform to discuss challenges and learn from others' experiences. By combining these strategies – tracking key metrics, maintaining a detailed journal, establishing accountability, and using technology – you can create a structured approach to building unshakeable trading discipline. This, in turn, establishes a solid foundation for consistent success in the markets.

Ready to enhance your trading with a disciplined, price-action focused approach? Visit Colibri Trader and explore our programs designed to help you master the markets. Take our free Trading Potential Quiz to find the program that’s best suited to your trading journey.