Day Trading Courses for Beginners Find Your Edge

Your first move in the trading world shouldn't be buying a stock. It should be investing in your own education. A solid day trading course for beginners gives you the playbook—strategy, risk management, and discipline—that turns blind luck into a calculated craft.

Why a Trading Course Is Your Most Important First Trade

Diving into the markets without any real training is a bit like trying to fly a plane after watching a movie about it. The dream of quick profits is a powerful one, but the markets are absolutely brutal to the unprepared. The smartest investment you can make right now isn't in some hot stock; it's in yourself.

Think of a structured day trading course as your personal flight school. It's the simulator, the instructor, and the safety net you need before you even think about risking real capital in a live environment. This is where you learn the core principles that make markets tick and, just as importantly, how to control your own reactions when the pressure is on.

Building a Foundation Beyond Buzzwords

Too many aspiring traders think they can get by just by watching a few free videos on chart patterns. While that's a start, it's dangerously surface-level. A proper course doesn't just show you what to look for; it teaches you why it matters, building a complete skill set from the ground up.

This foundational knowledge is non-negotiable. It includes:

- Market Mechanics: Getting a real feel for how orders actually get filled, what liquidity is, and the forces that truly move prices.

- Repeatable Strategies: Learning a defined, testable system for getting in and out of trades, so you're not just guessing and hoping.

- Iron-Clad Risk Management: This is everything. Mastering the rules that protect your capital is the single biggest factor in whether you'll survive long enough to succeed.

- Trading Psychology: Building the mental toughness to stick to your plan, sidestep emotional blunders, and handle wins and losses like a professional.

A great course doesn't just show you the perfect winning setups. It steels you for the losing trades that are an inevitable part of the game. You learn how to cut losses, protect your account, and keep the right mindset to trade another day.

Confronting the Hard Numbers

The stats for new traders are pretty grim, which is exactly why a formal education is so critical. The data paints a clear picture: a huge number of new traders are gone almost as soon as they start.

For example, studies show that around 40% of rookie day traders quit within just one month. Fast forward three years, and only about 13% are still in the game. You can find more on these numbers over at Quantified Strategies.

These figures aren't meant to scare you off. They're meant to ground you in reality. A quality course tackles these challenges head-on by drilling discipline and risk management into you from day one. It helps you see trading not as a get-rich-quick lottery ticket, but as a professional skill that demands study and practice.

By understanding where everyone else goes wrong, you're in a much better position to avoid those same traps. You can see how these critical topics are woven into a professional curriculum by exploring a well-structured trading course for beginners.

Deconstructing a High-Value Day Trading Course

What really separates a powerful learning experience from just another folder of video files? When you're looking for the right day trading course for beginners, you have to look past the flashy promises and get down to what actually builds successful traders. A top-tier course is a complete training system, not just a content library.

This means getting beyond simple definitions. A great course teaches you how to read the market's behavior in real-time, how to handle your own emotions when things get intense, and how to stick to a plan with professional discipline. It’s all built on three pillars you simply can't do without if you want a sustainable trading career.

The Three Cornerstones of a Great Curriculum

Any course worth your time and money has to deliver more than just theory. It needs to give you a practical, actionable framework for navigating the live markets. These are the three essential pillars to look for.

-

A Repeatable Trading Strategy: The course must teach a clear, rules-based strategy for finding opportunities, getting into trades, and getting out. This can't be some vague idea; it needs to be a specific methodology, like price action trading, that gives you a concrete plan for every single move you make.

-

Iron-Clad Risk Management Protocols: This is probably the most important piece of the puzzle. A huge part of the curriculum should be dedicated to protecting your capital. This means learning how to calculate your position size, where to set your stop-loss, and how to think in terms of risk-to-reward so that one bad trade never blows up your account.

-

Practical Trading Psychology: Making decisions with money on the line is an emotional game. A quality course tackles this head-on. It gives you real tools and techniques to manage the fear, greed, and impatience that trip up so many new traders. It's about building the discipline to follow your plan, even when the market is doing everything it can to shake your confidence.

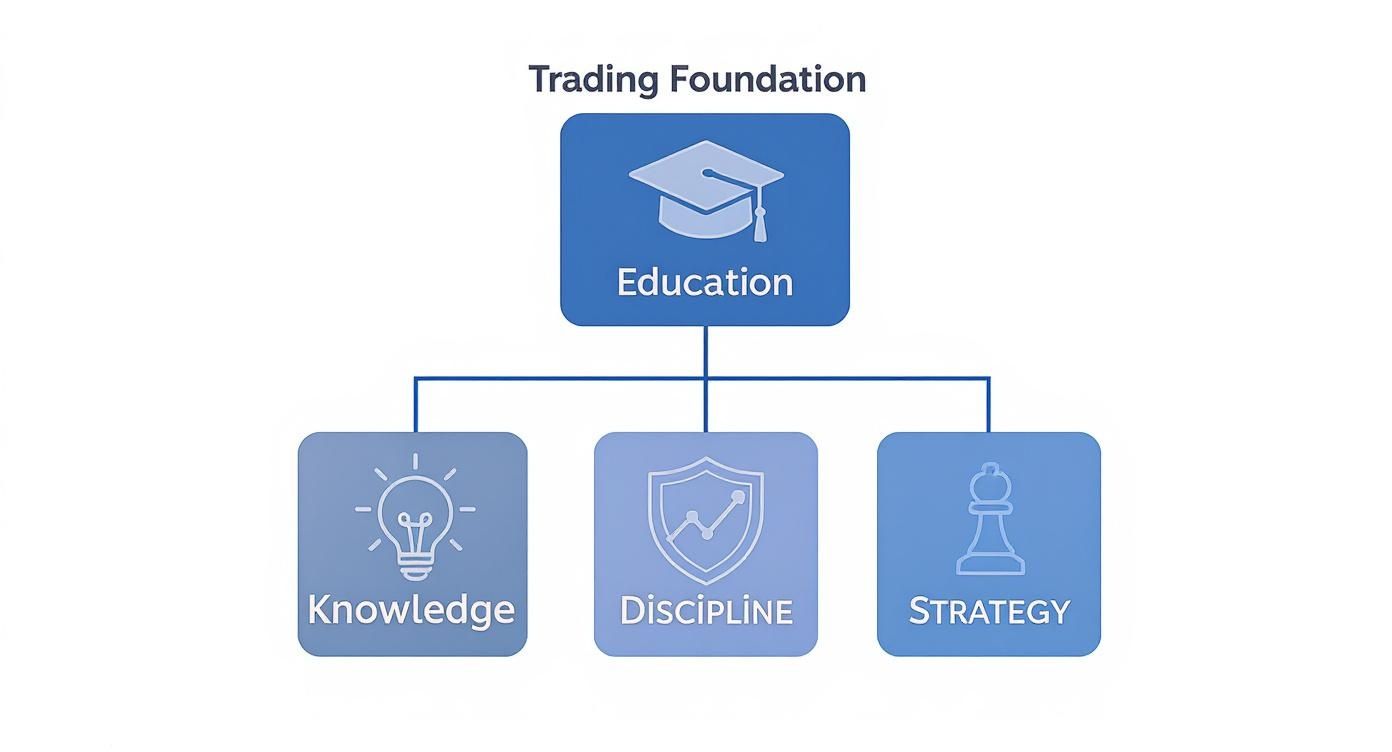

This visual shows how these crucial elements stack up.

As you can see, a solid education is the bedrock. It supports the essential skills of strategy, discipline, and market knowledge that are the foundation of trading success.

To give you a clearer picture, I've broken down what a beginner's course should absolutely cover. Think of this as your checklist.

Essential Components of a Beginner Day Trading Course

| Curriculum Pillar | What You Should Learn | Why It's Critical for Beginners |

|---|---|---|

| Market Foundations | How markets work, key terminology (pips, leverage, spreads), and choosing a broker. | You can't play the game if you don't know the rules. This is the absolute baseline. |

| Chart Analysis | Reading candlestick patterns, identifying support/resistance, and understanding trends. | Charts are the language of the market. Learning to read them is like learning to read a map. |

| A Core Strategy | A specific, step-by-step methodology for entries, exits, and trade management. | A strategy removes guesswork and emotion. It's your plan of attack for any market condition. |

| Risk Management | Position sizing, setting stop-losses, and calculating risk-to-reward ratios. | This is what keeps you in the game long enough to become profitable. Without it, you're just gambling. |

| Trading Psychology | Techniques for managing fear, greed, and the discipline to follow your rules. | Your mindset is 50% of the battle. The best strategy in the world is useless if you can't execute it. |

| Practical Application | Using a trading simulator, backtesting strategies, and developing a trading plan. | This is where theory meets reality. You need to build confidence and experience without risking real money. |

If a course is missing any one of these pillars, you're getting an incomplete education. It's that simple.

Beyond the Videos: Application and Community

Just watching videos has its limits. Seeing someone else trade is a world away from managing your own position with your own money on the line. The best day trading courses recognize this and build a bridge between knowing something and actually being able to do it.

First, look for access to a trading simulator. This is your sandbox. It's a risk-free environment where you can practice the strategies from the course using live market data. You get to build muscle memory and make all your rookie mistakes without the financial pain. It’s where you prove to yourself that your strategy works before you ever risk a single dollar.

A course should feel like an apprenticeship. It's not just about absorbing information; it’s about doing, getting feedback, refining your process, and slowly building the confidence and competence required to perform in a live environment.

Second, a supportive community is a huge advantage. Trading can be a lonely game, and having a network of other traders and mentors is priceless. A community forum or a live trading room gives you a place to ask questions, share chart ideas, and learn from what others are seeing and doing. This kind of collaboration can shorten your learning curve dramatically.

Finally, the quality of the teaching itself is make-or-break. The content needs to be clear, engaging, and structured to build your knowledge one step at a time. When you're checking out an online course, understanding what makes for good instruction—like the principles behind how to create educational videos that engage students—can help you judge the materials. Are the lessons well-paced? Do they use real-world charts to explain complex ideas? The goal is practical understanding, not dry, academic theory.

Choosing the Right Course for Your Goals and Budget

Let's be honest: not all trading education is created equal. The sheer number of day trading courses for beginners can feel overwhelming, and it's easy to get lost in the noise. The trick is to treat this decision like a serious business investment—because that's exactly what it is.

You have to look past the price tag to find a program that truly lines up with your personal goals, learning style, and financial reality. Your choice here sets the entire foundation for your trading career, so it's a decision worth getting right.

Comparing Investment Models: Subscription vs. One-Time Fee

The cost and structure of beginner day trading courses are all over the map. You'll find everything from affordable ongoing programs to premium, all-in-one packages. One of the most common models is a budget-friendly subscription. For instance, a provider like Bullish Bears offers a monthly membership for around $69.97, giving you ongoing access to trade alerts, live streams, and a library of courses.

On the other end of the spectrum, you have premium programs that come with a higher, one-time investment. A provider like Humbled Trader, for example, offers an intensive, mentorship-focused program for around $990 annually. This includes a deep dive into video lessons and one-on-one coaching. This model is built for traders who want a complete, A-to-Z system without the hassle of monthly payments.

So, which one is better? That depends entirely on you.

- Subscription Model: This is a great fit for traders who want to test the waters without a huge upfront commitment. It’s flexible, but it might not offer the structured, finite curriculum of a premium course.

- One-Time Investment: This is ideal for those who are fully committed and want a comprehensive program they can own for life. It's a bigger first step, but it often delivers much deeper value in the long run.

Evaluating the True Value Beyond Price

A higher price tag doesn't automatically mean higher quality, and a cheap course isn't always a bargain. The real value of any course is measured by the resources it provides and, more importantly, how well they match what you actually need.

When you're comparing your options, keep an eye out for these critical components.

One-on-One Coaching and Mentorship

Having direct access to an experienced trader is invaluable. It’s the difference between just watching a video and having an expert look over your shoulder, pointing out mistakes, and offering guidance that's specific to you. This is often the biggest thing that separates a basic course from a premium one.

A Supportive Trading Community

Trading can feel like a lonely pursuit. A course that plugs you into a private forum or a live trading room gives you a network. Sharing ideas, asking questions, and learning from your peers can accelerate your progress and keep you from burning out when things get tough.

Think of it this way: The course content gives you the map, but the community and mentors are your experienced guides who help you navigate the tricky terrain.

Matching the Course to Your Personal Style

At the end of the day, the best course for you is the one that fits your life. Before you pull the trigger, take a moment for an honest self-assessment.

- Your Learning Style: Do you learn best by watching videos and reading on your own? Or do you need interactive sessions and direct feedback to really get it? The difference between online learning vs classroom-style mentorship is massive, and choosing the right format for your personality is key.

- Time Commitment: Realistically, how many hours a week can you dedicate to studying and practice? A self-paced course gives you flexibility, while a structured program with live sessions might require you to stick to a more rigid schedule.

- Financial Situation: Set your educational budget before you start looking. Investing in a great course is crucial, but it should never put you under financial stress or eat into the capital you need to actually start trading.

Choosing your course is your first major decision as a trader. If you take the time to evaluate the format, the true value of the resources, and how it fits your personal needs, you'll find a program that truly equips you for long-term success.

The Hard Truth About Day Trading Failure Rates

Before we dive into the nuts and bolts of day trading, we need to have a serious talk about some sobering numbers. It’s a step most aspiring traders skip, thinking they'll be the exception. But here's the thing: understanding the massive failure rate isn't meant to scare you off—it’s actually your biggest strategic advantage.

Knowing why most traders blow up their accounts is the very first step toward building a plan that actually works. The market is an intensely competitive arena, and profits are never just handed out. They are earned, day in and day out, through discipline, a solid strategy, and a healthy respect for risk.

Why Most Beginner Traders Lose Money

Let's get one thing straight: the overwhelming majority of new traders don’t fail because of bad luck. They fail because they make the same predictable, emotionally-charged mistakes over and over again. This is precisely where a quality day trading course for beginners comes in—it’s designed to be your shield against these self-destructive habits.

The most common traps include:

- Overleveraging: This is using too much borrowed cash to chase a home-run trade. It feels great when it works, but it magnifies your losses just as quickly and can wipe you out in a single bad move.

- Revenge Trading: Immediately jumping back into the market after a loss to try and "win it back." This is a purely emotional reaction that almost guarantees you’ll dig an even deeper hole.

- Trading Without a Plan: Making buy or sell decisions based on a gut feeling, a hot tip, or social media hype. This is gambling, not trading.

These behaviors are really just symptoms of a much bigger problem: a total lack of education in risk management and trading psychology. Without a structured framework to guide their decisions, new traders are simply rolling the dice. And we all know the house usually wins.

A professional trader and a gambler might both take risks, but only the professional has a system to manage those risks and ensure long-term survival. The gambler relies on hope, while the trader relies on a plan.

The Numbers Behind Success and Failure

The statistics on day trading profitability are pretty stark, and they really hammer home just how steep the learning curve is. The path to becoming a consistently profitable trader is a marathon, not a sprint, and it demands incredible dedication.

Take the findings from one proprietary trading firm that trained roughly 2,000 people. After putting them through intensive daily training for six months or more, only about 4% could consistently make a living from day trading. Even when you include those who were slightly profitable but couldn't quit their day jobs, the success rate only bumped up to between 10% and 15%. You can learn more about these trading success rate statistics and what they really mean for you.

These numbers aren't a joke. They prove that just wanting to be a trader is not enough. You have to commit to a serious educational process if you want to avoid becoming another statistic.

How a Course Flips the Script

This is where a high-quality education changes the entire game. A well-designed day trading course is built to directly counteract the very behaviors that cause 90% of beginners to lose their capital.

- Risk Management Modules teach you exactly how to calculate your position size, where to set your stop-loss, and how to define your maximum risk on any single trade. This replaces reckless gambling with calculated, professional risk control.

- Trading Psychology Lessons give you the mental tools to manage the fear and greed that derail so many. This is what helps you avoid revenge trading and stick to your plan with discipline, even when you're on a losing streak.

- Strategy Development Sections guide you through building and backtesting a specific, rules-based trading plan. This gets rid of impulsive decisions and makes sure every trade you take has a clear, logical reason behind it.

In the end, understanding the tough odds actually empowers you. It reframes your education not as an expense, but as a critical investment in your survival and eventual success. It shifts your focus from chasing quick profits to building the skills that create a sustainable, long-term trading career. Preparation is what separates the pro from the amateur.

Why Price Action Trading Simplifies the Market

In a world filled with complex indicators, confusing algorithms, and non-stop market noise, what if you could learn to read the market in its purest form? This is the core promise of price action trading, a powerful methodology focused on interpreting the story that price charts tell all on their own.

For beginners, this approach is a game-changer.

Imagine trying to understand a conversation by listening to a dozen translators all shouting at once. That’s what trading with too many indicators feels like. Price action, on the other hand, is like learning the language directly from the source. You learn to read the market’s body language—the raw movements of price—to make clean, confident decisions.

Cutting Through Analysis Paralysis

One of the biggest hurdles for new traders is "analysis paralysis." This happens when your charts are so cluttered with indicators like RSI, MACD, and Bollinger Bands that you get hopelessly conflicting signals. One indicator screams "buy" while another whispers "sell," leaving you frozen and unable to act.

Price action trading strips all of that away. It declutters your charts and your mind, allowing you to focus on the only thing that truly matters: what the price is actually doing right now. This builds a deep, intuitive understanding of supply and demand dynamics, creating a robust foundation that will serve you for your entire trading career.

The goal is to make decisions based on what the market is doing, not what a collection of lagging indicators suggests it might do. This shift from reactive to proactive analysis is a cornerstone of consistent trading.

By focusing on candlesticks, trends, and key support and resistance levels, you learn to see the psychological battle between buyers and sellers playing out in real-time. This is precisely why a quality day trading course for beginners will often center its curriculum around this pure, effective approach.

The Language of the Market

Learning price action is like learning to read a map. Instead of relying on a GPS that might be outdated or wrong, you learn to read the terrain for yourself. It's a universal and timeless skill, applicable to any market, from forex and stocks to crypto.

Key elements you'll learn to read include:

- Candlestick Patterns: These are the "words" of the market, showing the opening, closing, high, and low prices over a specific period. Patterns like pin bars and engulfing candles provide powerful clues about potential turning points.

- Support and Resistance: Think of these as the historical price levels where buying or selling pressure has consistently shown up. Identifying these zones helps you anticipate where the market is likely to stall or reverse.

- Market Structure: Understanding trends—whether the market is making higher highs and higher lows (an uptrend) or lower highs and lower lows (a downtrend)—provides the essential context for all your trades.

Mastering these simple but powerful concepts builds a trading strategy that is both adaptable and resilient. You are no longer dependent on a specific "magic" indicator that might stop working when market conditions inevitably change. You can find a more detailed explanation of how to trade with price action in our complete guide.

Building Lasting Skill and Confidence

Ultimately, the biggest advantage of price action is the confidence it builds. When you can look at a clean chart and understand the story it's telling, you trade with clarity and conviction. You stop second-guessing yourself or getting distracted by conflicting information.

This approach forces you to develop a true "feel" for the market, a skill that separates successful traders from those who perpetually hunt for a perfect, automated system. Instead of relying on complex strategies that can feel like a black box, you're making decisions based on clear, observable market behavior.

This direct approach simplifies trading, reduces emotional decision-making, and puts you firmly in control. It’s about building a real skill, not just following signals.

Common Questions About Day Trading Courses

Stepping into the world of trading is exciting, but it definitely brings up a lot of questions. If you're thinking about investing in a day trading course for beginners, it's smart to get some clarity first. Let's tackle the most common questions head-on to clear up any doubts you might have.

This is all about building the confidence you need to take that first, crucial step. Let’s dive in.

Can I Genuinely Learn Day Trading from an Online Course?

Absolutely, but with one huge catch: the course has to be built on a repeatable strategy, strict risk management, and tons of practical application. A great online course is like a structured apprenticeship. It gives you the essential knowledge that would otherwise take years of painful, expensive trial-and-error to learn on your own.

The trick is to find a program that's more than just a library of videos. Look for courses that include hands-on exercises, real-world chart walkthroughs, and a community you can lean on.

A course gives you the roadmap and the car, but you’re the one who has to drive. Success comes from dedicated study, relentless practice in a demo account, and the discipline to stick to your plan when real money is on the line.

The right education provides the blueprint, but you still have to build the house.

How Much Capital Do I Need After Finishing a Course?

While a course provider can't give you personal financial advice, a good one will teach you the practical realities of funding a trading account. For instance, in the United States, traders labeled as "pattern day traders" are required by law to keep a minimum balance of $25,000.

But the far more important lesson is learning to risk only a tiny piece of your capital—usually 1-2%—on any single trade. This is the golden rule of risk management. It means your starting capital has to be big enough to place trades that are worth your while, all while staying inside these strict safety limits.

Starting with too little money is one of the main reasons new traders fail. It forces them to take huge risks just to see a decent return, which is a recipe for blowing up an account. A solid education helps you match your trading strategy to the capital you actually have, so you can stay in the game for the long haul.

What Is the Most Important Skill a Course Should Teach?

Without a doubt, it's risk management. You can have the most brilliant trading strategy in the world, but it's completely worthless if one bad trade can wipe out weeks of hard-won profits. Learning how to protect your capital is the foundation of a long and successful trading career.

A top-tier course will hammer home the principles of capital preservation over and over again. It’s not just a single lesson; it should be woven into every single part of the curriculum.

Key risk management skills you need to master include:

- Setting Stop-Losses: Learning where to place your stop-loss based on technical logic to invalidate a trade idea and protect your account from a disaster.

- Calculating Position Sizes: Knowing how to adjust your trade size based on your account balance and the risk of a specific setup. This ensures every trade has a controlled, predefined risk.

- Mastering Risk-to-Reward Ratios: Consistently taking trades where the potential reward is much bigger than the risk. This is how you stay profitable even if you don't win every single trade.

Learning to play defense is what keeps you in the game long enough for your offense to score. It is the single most important skill you will ever learn as a trader.

How Long Until I Become Profitable After a Course?

Be extremely skeptical of any program that promises you'll be profitable in a specific amount of time. Finishing a course is just step one—it’s like graduating from flight school. You have the knowledge, but you still need to log a lot of hours in the cockpit to become a real pilot.

The road to consistent profitability is a marathon, not a sprint. It takes serious screen time, disciplined execution, and a ton of emotional resilience. Some traders might find their groove within a year, but for many others, it takes longer. There's no magic timeline.

A quality day trading course is designed to shorten your learning curve dramatically. It helps you avoid the catastrophic beginner mistakes that cost people a lot of money and puts you on the right path from day one. But true mastery is earned through dedicated practice and real-world experience navigating live markets.

At Colibri Trader, we focus on building real, lasting skills through our price-action-based curriculum. Our courses are designed to give you the strategic framework and psychological discipline needed to navigate the markets with confidence. If you're ready to stop guessing and start trading with a clear plan, explore our programs today.

Discover how Colibri Trader can transform your trading approach