Calculate Risk Reward Ratio for Smart Trading

Understanding Risk Reward Ratio

Every trade you take is its own little business plan. To figure out if it’s worth your time, you need to weigh what you could gain against what you might lose. That’s exactly what the risk/reward ratio does: Potential Reward / Potential Risk. So, if you risk $100 hoping to pocket $300, you land at a 1:3 ratio. Simple, yet powerful.

Why Risk Reward Is A Trader's Best Friend

Put aside the fancy indicators for a moment. What truly divides consistent winners from gamblers is this: knowing your downside before you ever pull the trigger. You decide on a maximum loss (your risk) and set a realistic profit target (your reward). That upfront clarity locks in discipline and keeps knee-jerk reactions at bay.

The Foundation Of Long-Term Success

Once you make the risk/reward ratio your guiding star, everything else snaps into place.

- Filters Out Poor Setups: You’ll only consider trades offering, say, a 1:2 ratio or better. No more chasing mediocre odds.

- Takes Emotion Off The Table: Fear and greed lose their grip when you have a clear, mathematical threshold.

- Lets You Be Human: Even if you win just 30% of the time with a 1:3 ratio, you can still come out ahead.

Quick Guide to Risk Reward Ratios

This table breaks down what different risk reward ratios mean in practical terms, helping readers quickly grasp the concept.

| Ratio | Potential Profit per $1 Risked | What It Means for Your Trade |

|---|---|---|

| 1:1 | $1 | Breakeven if you’re right half the time |

| 1:2 | $2 | You can win just 34% of your trades and still profit |

| 1:3 | $3 | Even a 25% win rate delivers overall gains |

| 1:4 | $4 | High-reward setups; low win rates OK, but harder to find |

Keep this snapshot on hand next time you size up a setup—your future self will thank you.

You’re comparing exactly what you could lose against what you aim to gain. Risking $1 to chase $3 is a classic 1:3 ratio. If you want a deeper dive, check out IG’s Risk Management Insights.

Ultimately, mastering risk/reward isn’t about complex math. It’s about forging habits that protect your capital and let your big wins shine. Incorporate it into your overall strategy for managing trading risk effectively and you’ll see how even inevitable losses can fuel long-term profitability.

The Simple Math Behind the Ratio

To figure out the risk/reward ratio, you only need three key pieces of information. Don't worry about complex formulas; the logic here is straightforward and designed to be done in seconds before you even think about entering a trade.

First, you need to identify the three price points that define your trade's structure. These are the absolute pillars of your calculation:

- Entry Price: The exact price at which you plan to buy or sell the asset.

- Stop-Loss Price: Your pre-determined exit point if the trade moves against you. This is what caps your potential loss.

- Take-Profit Price: Your target price for exiting a profitable trade and cashing out.

Breaking Down the Calculation

With these three numbers in hand, you can figure out your potential risk and your potential reward. The "risk" is simply the monetary value you stand to lose per share if your stop-loss gets triggered. It’s the distance between your entry price and your stop-loss price.

On the flip side, your "reward" is the potential profit you'll make if the trade hits your take-profit target. This is the distance from your entry to your profit goal. You can find both values with basic subtraction.

Key Takeaway: The entire calculation boils down to one simple division:

Potential Reward / Potential Risk. This gives you a clear, objective ratio that strips emotion from your decision-making.

Let’s put this into action with a real-world scenario. Imagine you're looking to buy a stock at $50. You decide your absolute limit for a loss is $45, so you place your stop-loss there. Your analysis suggests the stock could hit $65, so that becomes your take-profit target.

- Potential Risk: $50 (Entry) – $45 (Stop-Loss) = $5 per share

- Potential Reward: $65 (Take-Profit) – $50 (Entry) = $15 per share

Now, just divide the reward by the risk: $15 / $5 = 3.

This gives you a risk/reward ratio of 1:3. In plain English, for every single dollar you risk, you stand to gain three. That's a trade worth considering.

Calculating Risk Reward in Real Markets

Theory is one thing, but putting the formula into practice is where you really start to see its power. Let's crunch the numbers on three different trades across three different markets. You'll quickly notice that the core logic doesn't change, whether you're eyeing a volatile crypto coin or a blue-chip stock.

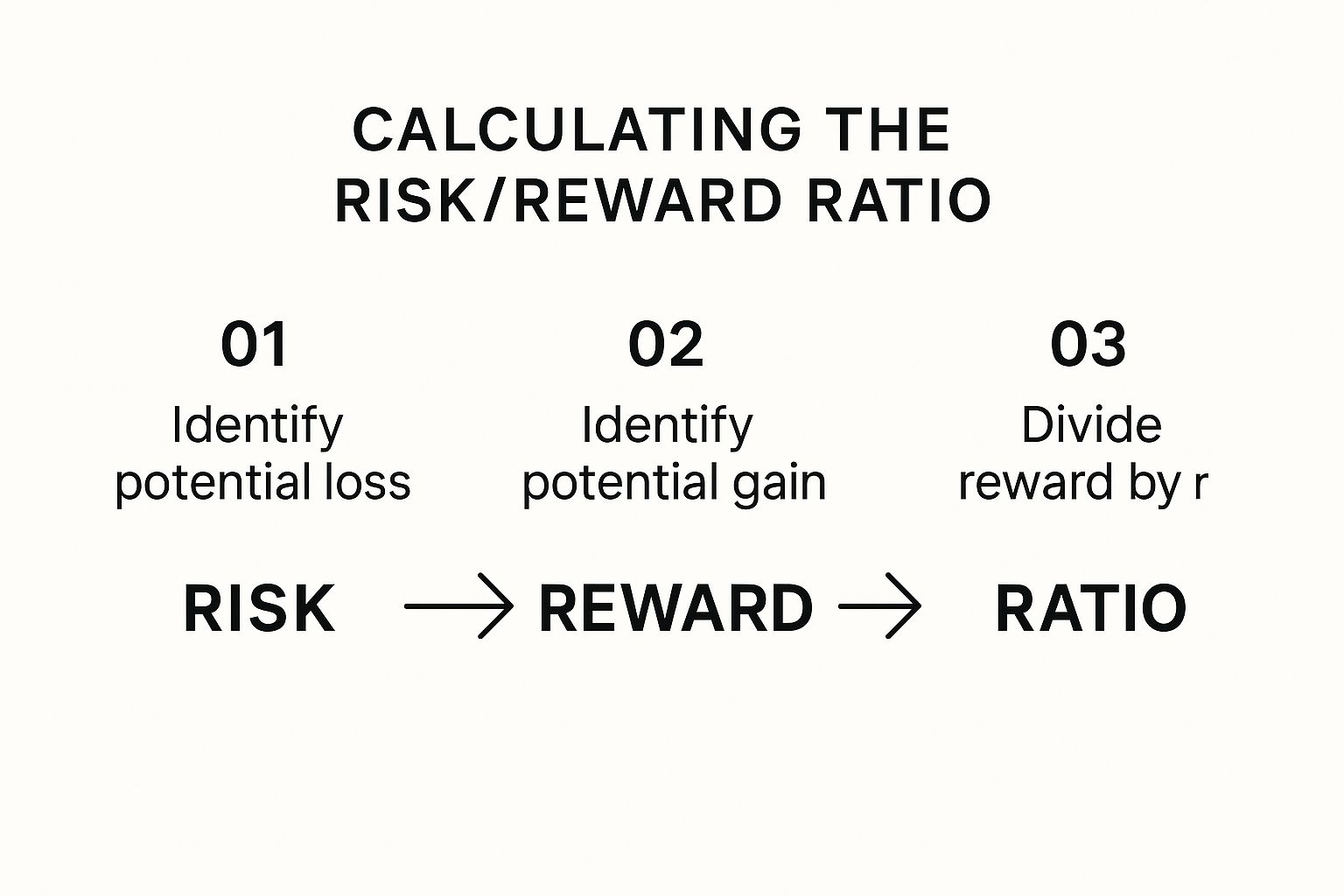

The process always boils down to the same simple steps: figure out your potential loss (risk), figure out your potential gain (reward), and then divide the reward by the risk. That’s your ratio. This little infographic nails the three essential steps.

As you can see, it's a straightforward flow. This mental checklist should become second nature before you ever put a single dollar on the line.

Of course, to even begin calculating, you need to know your exit points before you enter. This means having a rock-solid stop-loss and a clear profit target. A predefined plan is non-negotiable, and it's a crucial part of mastering your exit strategy.

Scenario 1: A Stock Trade on NVDA

Let's say you've spotted a potential long trade on NVIDIA (NVDA) bouncing off a key support level. Before you even think about clicking "buy," you define your trade parameters.

- Entry Price: You plan to buy at $900.

- Stop-Loss Price: To protect your downside, you set your stop just below that support at $870.

- Take-Profit Price: Your analysis points to a resistance area up ahead, making $990 a realistic target.

Time for some quick math. Your risk per share is the gap between your entry and your stop-loss, which is $30 ($900 – $870). Your potential reward is the distance from your entry to your take-profit, which is $90 ($990 – $900).

Divide the reward ($90) by the risk ($30), and you get a 1:3 ratio. For every dollar you're risking, you stand to make three. That’s a trade worth considering.

Scenario 2: A Forex Trade on EUR/USD

The exact same logic applies to the forex market. Imagine you're eyeing a short opportunity on the EUR/USD pair.

- Entry Price: You decide to sell at 1.0850.

- Stop-Loss Price: You place your stop just above a recent high at 1.0880.

- Take-Profit Price: You're targeting a previous low at 1.0760.

In this case, your risk is 30 pips (1.0880 – 1.0850), and your potential reward is 90 pips (1.0850 – 1.0760). The calculation is the same: 90 pips / 30 pips = 3. Another solid trade setup with a 1:3 risk/reward ratio.

Scenario 3: A Crypto Trade on Ethereum

Finally, let's take this to the wild west of crypto with a long trade on Ethereum (ETH).

- Entry Price: You jump in and buy at $3,500.

- Stop-Loss Price: Your safety net is a stop-loss set at $3,300.

- Take-Profit Price: You're shooting for the $4,000 mark.

Here, your risk is $200 per coin ($3,500 – $3,300), while your potential reward is a nice $500 per coin ($4,000 – $3,500).

Let's run the numbers: $500 / $200 = 2.5. This gives you a 1:2.5 risk/reward ratio. Still a very attractive setup that most traders would happily take.

To make this crystal clear, here’s how the numbers for all three scenarios stack up side-by-side.

Example Trade Calculations

| Asset Class | Entry Price | Stop-Loss | Take-Profit | Risk/Reward Ratio |

|---|---|---|---|---|

| Stock (NVDA) | $900 | $870 | $990 | 1:3 |

| Forex (EUR/USD) | 1.0850 | 1.0880 | 1.0760 | 1:3 |

| Crypto (ETH) | $3,500 | $3,300 | $4,000 | 1:2.5 |

Seeing them all together, it's obvious that the underlying formula—(Take-Profit – Entry) / (Entry – Stop-Loss)—is a universal tool for any market.

Finding a Risk Reward Ratio That Fits You

A lot of traders get fixated on finding the "perfect" risk/reward ratio. You’ll often hear that 1:2 or 1:3 is the holy grail. While those are great benchmarks, I'm here to tell you there’s no single magic number.

The best ratio for you is personal. It hinges entirely on your trading strategy and, crucially, your historical win rate.

Think about it. A scalper who jumps in and out of the market, winning 70% of their trades, can be incredibly profitable with a simple 1:1 ratio. Their edge isn't from massive winners; it's from a high frequency of small, consistent gains.

On the other hand, a trend-following trader might only win 40% of the time. For them, a 1:3 or even 1:4 ratio isn't just nice—it's essential for survival. They need those few big wins to more than make up for all the small losses they take along the way.

Aligning Ratio with Strategy

Your trading style naturally dictates the types of setups you're looking for, which in turn sets the stage for your potential reward.

- High-Frequency Strategies (Scalping): Here, your win rate is everything. A lower ratio is perfectly fine because you're banking on being right more often than you're wrong.

- Medium-Term Strategies (Day/Swing Trading): This is all about finding a balance. A ratio between 1:2 and 1:3 is often the sweet spot, giving you a good mix of winnability and meaningful profit potential.

- Long-Term Strategies (Position Trading): You need to be compensated for holding positions through all the market noise. That means aiming for big wins, making a ratio of 1:3 or higher a must for long-term success.

This core principle of balancing risk with reward isn't just for active trading. Even in long-term investing, smart risk management is what creates stability. Research on globally diversified portfolios shows that proper risk management can deliver steady returns, with a 60/40 portfolio averaging around 6.8% annually since 1997. You can see how Vanguard approaches this on their corporate blog.

The goal isn't to find a universal ratio but to discover the ratio that makes your specific strategy profitable over hundreds of trades. It's about math, not magic.

Once you have a target ratio in mind, the next step is figuring out exactly how much capital to put on the line for each trade. A great tool to get started is our handy position size calculator, which helps make sure every trade you take aligns with your risk rules.

Common Risk Reward Mistakes Traders Make

Knowing how to crunch the numbers for your risk/reward ratio is one thing. Actually sticking to it in the heat of the moment is another beast entirely. The real battle is avoiding the psychological traps and technical goofs that sink otherwise solid trade ideas.

Probably the most common mistake I see is setting a stop-loss that’s just way too close to the entry price.

It might look great on paper, creating an amazing R:R, but a super-tight stop gives a trade zero room to breathe. Everyday market noise and normal volatility can easily knock you out of a good position before it ever gets a chance to move your way.

A great risk reward ratio is useless if your stop-loss is placed in a technically weak spot. Always anchor your stops to logical market structures, like below a key support level, not just an arbitrary dollar amount.

Setting Unrealistic Profit Targets

The flip side of the coin is just as dangerous: placing your take-profit target in fantasy land. Sure, aiming for a 1:10 ratio gets the blood pumping, but if the price has never even sniffed that level before, you're not trading—you're gambling on a miracle.

Your profit target has to be grounded in reality. Look for tangible evidence, like a major resistance zone or a previous swing high. An unrealistic target just means the trade is far more likely to reverse well before your goal, turning what could have been a nice winner into a break-even trade or even a loss.

The Problem with On-the-Fly Adjustments

Finally, we have the cardinal sin of risk management: moving your stop-loss mid-trade just to dodge a loss. We've all been tempted. But giving in to that fear completely torpedoes your initial plan and is the fastest way I know to blow up an account. Your pre-trade analysis is your most objective thinking; trust it.

Even the big-money, long-term investors live and die by managing their downside. A historical study of 60/40 portfolios showed that the U.S. version had a maximum drawdown of -44.88% since 1901. That was the smallest among major markets, which really drives home how critical disciplined risk rules are for survival. You can read more about the findings on risk-adjusted returns here.

Putting It All Into Practice

Alright, let's bring this all together. Theory is great, but what matters is how you use this concept right before you click the buy or sell button. Think of this as your final, non-negotiable pre-trade checklist.

This simple process is what stands between you and a bad trade. It’s your last line of defense, making sure you only risk your hard-earned capital on setups that are truly worth it. This is the bedrock of disciplined trading.

First things first: you spot a valid trade setup that fits your strategy. Before you even think about how much to risk, you need to define three non-negotiable price points.

- Your exact entry price.

- Your stop-loss level (where you admit you're wrong).

- Your take-profit target (where you'll cash out).

The Final Check

Once you have these three levels clearly marked on your chart, it's time to calculate your risk/reward ratio. You simply divide your potential reward by your potential risk.

If that number doesn't hit the minimum you've set in your trading plan—maybe that's 1:2, maybe it's 1:3—you walk away. That's it. No exceptions, no "what ifs." For those who want to speed this up, a dedicated risk reward ratio calculator can be a lifesaver.

This isn't about being rigid; it's about being professional. This one step filters out emotional decisions and the low-quality setups that slowly bleed an account dry.

This isn't just a formula; it's a new way to approach your trading career. Making this process a habit is what builds a consistent edge in the market over the long term.

A huge part of making any strategy work is keeping meticulous records. It's not the most exciting part of trading, but mastering tracking units won and lost is what allows you to accurately see what's working and what isn't. This is how you turn trading from a gamble into a structured business.

Common Questions

Still have a few things you're wondering about? Let's tackle some of the most common questions traders have when they first start using the risk/reward ratio.

So, What's a "Good" Risk to Reward Ratio?

This is the big question, isn't it? While a lot of trading books will tell you to aim for 1:2 or 1:3, there's really no magic number that works for everyone. The best ratio for you is tied directly to your strategy's win rate.

Think about it this way: a scalper who wins very frequently might do just fine with a 1:1.5 ratio. But a trend-following trader, who might lose on a lot of small trades before catching a massive runner, absolutely needs something like 1:3 or higher to stay profitable in the long run. It's all about what makes sense for your specific approach.

Should I Change My Ratio Once a Trade Is Live?

In a word: no. Your clearest, most objective thinking happens before you put your money on the line.

Once a trade is live, emotions like fear and greed start to creep in. Moving your stop-loss further away because the trade is moving against you is one of the quickest ways I've seen traders blow up their accounts. On the flip side, getting greedy and pushing your take-profit target further out often leads to the market reversing just shy of your new goal.

Make a plan when you're thinking clearly, and then have the discipline to stick to it.

The only real exception here is using a trailing stop-loss to lock in profits as a trade moves in your favour. But never, ever increase your initial risk once the trade is active.

Ready to stop gambling and start trading with a clear, disciplined approach? Colibri Trader provides the price action education you need to build a profitable strategy from the ground up. Find your trading potential today.