Top 10 Best Trading Platforms for Beginners in 2024

When you search for the Best Trading Platforms for Beginners, names like SoFi Invest, Vanguard, and Ally Invest come up again and again. They combine low fees with clear layouts that ease you into the investment world.

Finding The Right Launchpad For Your Trading Journey

Stepping into trading can feel like navigating a maze. Your chosen platform is more than a tool—it’s the cockpit of your financial flight. It helps you chart a path, adjust course, and refine your skills over time.

This guide strips away the noise and zeroes in on what really matters for a beginner. We'll walk through the core features that boost confidence and simplify each trade.

Key Elements Of A Beginner-Friendly Platform

A good platform should demystify trading. That means clear data, straightforward menus, and supportive resources. Before diving into fees and tools though, it’s wise to learn the basics. For a step-by-step rundown, see these easy steps for beginners to start investing.

Keep an eye out for:

- Intuitive Design: A dashboard that feels effortless, not overwhelming.

- Low Costs and Fees: Transparent pricing with minimal or no commissions.

- Educational Resources: Tutorials, articles, and glossaries at your fingertips.

- Practice Accounts: Demo or “paper trading” accounts to test strategies risk-free.

A risk-free learning environment is like a flight simulator for the market. It lets you practice maneuvers before you ever commit real capital.

Top Beginner-Friendly Trading Platforms At A Glance

Below is a quick look at some leading platforms for new investors, highlighting their key strengths.

| Platform | Best For | Key Feature | Commission Structure |

|---|---|---|---|

| SoFi Invest | Social Investing | Fractional Shares | $0 on stocks & ETFs |

| Vanguard | Long-Term Planning | Low-Cost Index Funds | $0 on Vanguard ETFs |

| Ally Invest | Active Trading | Robust Research Tools | $0 on stocks & ETFs |

| Webull | Mobile-First Experience | Advanced Charting Tools | $0 on U.S. equities |

Use this snapshot to match features with your goals.

The Rise Of Commission-Free Trading

Zero-commission trading broke down a major barrier. For instance, Webull launched its mobile app in 2017 with no fees on U.S. stocks, ETFs, or options. Today, over 15 million users rely on its sleek, app-first approach.

On top of that, many platforms now include practice modes—an essential way to learn order types and position management. For a deeper look at virtual trading, check out our guide on what is paper trading.

Looking Under the Hood at Trading Platform Costs

The phrase "commission-free trading" is plastered everywhere these days. It’s a powerful marketing hook, and for good reason—who doesn’t love free? But hold on a second. Before you jump in, it’s worth remembering there's rarely a free lunch, especially in finance.

Think of it like those budget airline tickets. The base fare looks like a steal, but then you get hit with fees for your bag, for picking a seat, even for a bottle of water. Trading platforms can be similar. "Commission-free" is just the sticker price; you need to understand the full cost of ownership to protect your hard-earned capital.

The Real Story Behind "Commission-Free"

So, if a platform isn’t charging you a commission for every trade, how are they keeping the lights on? They have a few clever ways to make money, and it’s crucial you know what they are.

One of the most common methods is the bid-ask spread. This is simply the tiny difference between what buyers are willing to pay for a stock (the bid) and what sellers are willing to accept (the ask). It might only be a few pennies per share, but when you multiply that by millions of trades every single day, it adds up to a serious revenue stream for the platform. We have a great guide that breaks this down further if you're curious about what is bid-ask spread.

A platform's fee structure is like its DNA; it tells you everything about how it operates and where its priorities lie. A transparent schedule is a sign of a trustworthy partner for your trading journey.

Another income source is payment for order flow (PFOF). This one sounds complicated, but the idea is simple. Your broker sends your trade to a massive market-making firm instead of directly to the stock exchange. That firm then pays your broker a small fee for the business. While it's a standard and legal practice, critics argue it can sometimes result in a slightly worse execution price for you, the retail trader.

The Other Fees Lurking in the Fine Print

Beyond the clever, behind-the-scenes stuff, many platforms have a straightforward menu of other potential charges. Getting familiar with these will help you dodge any nasty surprises.

Keep an eye out for these usual suspects:

- Account Maintenance Fees: Some brokers will charge you a monthly or yearly fee just for having an account, especially if your balance dips below a certain amount or you're not trading very often.

- Deposit and Withdrawal Fees: You shouldn't have to pay a toll to move your own money around. Double-check if there are costs for bank transfers or other methods of funding or cashing out your account.

- Inactivity Fees: Life gets busy. If you don't place a trade for a while (say, 90 days or a year), some platforms will hit you with an inactivity fee. This can be an unexpected drain, particularly for long-term investors who don't trade frequently.

- Fees for Premium Data and Tools: The basic charts and quotes are almost always free. But if you want access to more powerful tools, professional-grade research, or real-time Level II data, you might have to pay a monthly subscription.

How to Find a Genuinely Low-Cost Platform

Protecting your trading capital starts with a bit of detective work. Before you even think about funding an account, hunt down the platform’s pricing page. You’re looking for a document often called "Fee Schedule" or "Pricing Details." Read it. Every single line.

This is where you'll find the truth. Are there any conditions tied to their "free" offerings? A platform might shout about free stock trades but quietly charge an arm and a leg for options or mutual funds. As you dig into these platform-specific costs, it’s also smart to broaden your financial literacy. Getting a handle on understanding investment management fees can give you a much wider perspective on how costs can impact returns in different scenarios.

At the end of the day, your goal is to find a platform that’s upfront and fair with its pricing and that matches your personal trading style. A little research now will save you a lot of money and headaches down the road.

Must-Have Features for New Traders

If you’re stepping into the market for the first time, your trading platform should feel like a trusted companion, not a maze of confusing menus. The best trading platforms for beginners do more than execute trades—they guide you from your very first buy order all the way to managing a growing portfolio.

Every feature you see on the screen is a stepping-stone in your learning journey. They should break down complex ideas into bite-sized insights and give you a safe playground for practice. Below, we’ll explore the non-negotiable building blocks that make a platform truly beginner-friendly.

An Intuitive And Clean User Interface

Navigating a trading platform should be as natural as reading a well-designed website. If the moment you log in feels like entering a crowded trading pit, you’ve lost your focus before you even start.

A top-tier platform prioritizes clear labels, an uncluttered dashboard, and logical menu layouts. You want to locate your portfolio summary in seconds, place a trade with one click, and find historical data without digging through endless sub-menus.

Think of it like a car dashboard: speed, fuel, and navigation are presented front and center so you can focus on driving—rather than wrestling with confusing controls.

With a clean user interface (UI), your learning curve shrinks. You spend less time wrestling with the software and more time making informed decisions.

The Power Of Paper Trading Accounts

Before you risk a single dollar, you need a flight simulator for your money. A paper trading account—sometimes called a demo account or virtual simulator—lets you trade with $100,000 in fake currency, using real-time market data.

- Practice Makes Perfect: Try out market, limit, and stop-loss orders until you’re comfortable with their mechanics.

- Strategy Testing: Have a hunch about a new approach? Test it risk-free and refine your entry and exit rules.

- Building Confidence: Those first live trades can be nerve-racking. Virtual trading helps you develop the emotional control you’ll need when real money is on the line.

Spending a few weeks in a paper trading environment can save you costly mistakes later. This tool is often the single biggest reason why the best trading platforms for beginners stand out.

Real-Time Data And Essential Charting Tools

A delayed price quote is like driving with an outdated map—you’ll miss turns and opportunities. Beginners need real-time market data so that the prices you see match the prices you get.

On top of live quotes, your platform should include charting tools that are powerful yet straightforward:

- View Price History: Toggle between intraday, daily, weekly, and yearly timeframes to spot trends.

- Use Simple Indicators: Apply moving averages or volume overlays to see momentum shifts.

- Customize Your View: Switch seamlessly between line charts and candlestick charts for deeper insight.

These charts transform raw numbers into a visual story, giving you the context to place smarter trades.

A Seamless Mobile App Experience

Modern traders need freedom—whether that’s sipping coffee at your favorite café or waiting in line at the post office. A full-featured mobile app keeps you connected to your portfolio wherever you are.

The best mobile versions mirror the desktop platform’s functionality: research stocks, monitor performance, and execute trades in seconds. No more scrambling to find a laptop when a sudden market move occurs. With a polished app, you won’t miss your moment to act.

The Power of Education and Customer Support

Picking the right trading platform isn't just about finding the one with the lowest fees or the slickest app. Far from it. What you’re really looking for is a complete ecosystem built to help you grow as a trader.

Think of it this way: you wouldn't try to climb a treacherous mountain without a guide, a map, and a reliable radio. In the world of trading, your platform’s educational resources and customer support are your guide, map, and radio—all rolled into one.

These elements are what turn a simple transaction tool into a powerful learning environment. The best platforms anticipate your questions and provide answers before you even know what to ask. That proactive support is what separates a frustrating experience from a confident journey to becoming a skilled trader.

Your Platform as Your Digital Mentor

The best platforms take their role as educators seriously. They know that a knowledgeable trader is a successful one, which is why they invest heavily in building out comprehensive learning hubs. These aren't just dusty FAQs; they are active, engaging resources built to shorten your learning curve.

Look for a platform that offers a variety of learning formats to suit your style:

- Video Tutorials: Short, digestible videos that can walk you through placing your first trade or setting up a stop-loss.

- Webinars and Live Sessions: Interactive classes hosted by market experts, covering everything from basic concepts to advanced strategies.

- In-depth Articles and Glossaries: Clear explanations of complex financial jargon, turning confusing terms like "leverage" or "margin" into concepts you can actually use.

- Structured Learning Paths: Guided modules that build your knowledge progressively, making sure you master the fundamentals before moving on.

A platform that prioritizes education is investing in your long-term success. It's a clear signal that they want to empower you, not just profit from your trades.

By offering these tools, a platform helps you build a solid foundation. If you're looking for an even more structured way to begin, supplementing your platform's resources with a dedicated beginner trading course can provide a focused path from novice to confident market participant.

Comparing Educational Offerings on Popular Platforms

When you're just starting, having access to the right learning tools can make all the difference. Some platforms offer extensive video libraries, while others focus on interactive webinars or one-on-one coaching. It's crucial to find one that matches your learning style.

Here’s a quick comparison of what you might find on some of the top platforms for beginners:

| Platform | Educational Formats | Demo Account | Support Channels |

|---|---|---|---|

| eToro | Articles, videos, webinars, and the eToro Academy. | Yes, with $100,000 virtual funds. | Live Chat, Email/Ticket |

| TD Ameritrade | In-depth articles, videos, webcasts, in-person workshops. | Yes, paperMoney® simulator. | Phone, Live Chat, Email |

| Fidelity | Extensive library of articles, webinars, and coaching sessions. | No dedicated demo account for all features. | Phone, Live Chat, Email |

| Webull | Basic articles, tutorials, and a community feed. | Yes, paper trading feature. | Phone, Email |

As you can see, the depth and breadth of educational resources vary significantly. A platform with a robust demo account and multiple support channels is often the best place for a new trader to start building confidence without risking real capital.

The Lifeline of Responsive Customer Support

No matter how user-friendly a platform is, you will eventually have a question or run into a technical glitch. It’s inevitable. When that happens, you need to know that a real human is ready to help—and quickly.

Waiting days for an email response when your money is on the line is simply not an option.

Imagine you’re trying to close a trade, but a button isn't working or you get an error message you don't understand. This is where responsive customer support becomes a non-negotiable feature. Think of it as your safety net, providing peace of mind and immediate solutions when you need them most.

A platform's commitment to its users is often most visible in its support channels. Look for multiple ways to get in touch, especially live chat and phone lines, to ensure you're never left in the dark. This accessibility is a crucial part of the learning process, allowing you to resolve issues quickly and get back to focusing on your strategy.

Is My Money Actually Safe Here? A Beginner's Guide to Platform Security

Before you ever click "buy" on your first stock, there's a much more fundamental question you need to ask: "Is my money safe?" When you're just starting out, picking a platform isn't just about cool features or low fees—it's about trust. You're handing over your hard-earned cash, and you need to be absolutely certain it’s protected.

Think of your trading platform as a digital bank vault. It's not just a tool; it's the guardian of your capital. It needs to be fortified from every angle, with both regulatory oversight and tough-as-nails technical security. Without that, even the most brilliant trading strategy is built on a house of cards.

The Guardians of Your Capital

The first line of defense isn't a fancy password; it's regulation. In the U.S., any brokerage worth its salt is governed by strict regulatory bodies. Their entire job is to protect investors like you. Choosing a regulated platform is the single most important security decision you'll make.

Here are the two big names you absolutely need to see:

- The Securities and Exchange Commission (SEC): This is the federal government's watchdog. The SEC's primary mission is to protect investors and keep the markets fair and orderly. They're the ones who enforce the laws against market manipulation.

- The Financial Industry Regulatory Authority (FINRA): Think of FINRA as the industry's own self-policing organization. It oversees pretty much all brokerage firms in the U.S., writing and enforcing the rules that dictate how they have to behave.

When you see that a platform is registered with the SEC and is a member of FINRA, it's a huge green flag. It tells you they're being held to a high standard for ethical conduct and financial honesty.

Your Financial Safety Net

But what if, despite all the rules, a brokerage firm goes bust? It's rare, but it can happen. This is where investor protection programs come in, acting like an insurance policy for your money.

For investors in the United States, the most important program by far is the Securities Investor Protection Corporation (SIPC). If your SIPC-member brokerage fails, SIPC steps in to get your cash and securities back to you.

SIPC insurance is a game-changer. It protects your portfolio for up to $500,000 total, and that includes a $250,000 limit for cash held in your account. This coverage means your investments are safe even if the brokerage itself hits the wall.

Now, it’s critical to understand what SIPC doesn't do. It doesn't protect you from bad trades. If you buy a stock and its price drops, that’s just the risk of investing. SIPC is there specifically to protect you from the failure of your brokerage firm.

Fortifying Your Digital Vault

Beyond the big regulatory picture, the platform itself needs rock-solid technical security to keep hackers out of your account. Your personal data and your money are prime targets for cybercriminals, so don't settle for anything less than top-tier protection.

Here are the non-negotiable security features you should look for:

- Two-Factor Authentication (2FA): This is a must-have. 2FA adds a second layer of security on top of your password. When you log in, the platform sends a one-time code to your phone. Without that code, no one gets in—even if they somehow steal your password.

- Data Encryption: All of your sensitive info, from your social security number to your trading history, needs to be encrypted. This essentially scrambles the data into an unreadable code as it travels between your computer and the platform's servers, making it useless to anyone who might intercept it.

By making sure your chosen platform checks all these boxes—regulation, insurance, and technical security—you can start your investing journey with confidence, knowing your capital is in safe hands.

Making Your Final Platform Choice with Confidence

So, you’ve waded through the details on fees, features, education, and security. Now it's time to pull it all together and actually pick the best trading platform for you. This isn't about finding some mythical "perfect" platform; it's about finding the one that fits your personal financial DNA like a glove.

Think of it like picking a workout partner. The best one isn't necessarily the strongest or the fastest. It's the one who gets your pace, understands your goals, and actually keeps you motivated. Your ideal platform will do exactly that for your trading journey.

Clarifying Your Personal Trading Style

Before you can make a solid choice, you need to get brutally honest about what you're trying to accomplish. A long-term investor socking money away for retirement has completely different needs than someone wanting to actively trade stocks a few times a week.

Take a minute and answer these questions. Seriously, write them down.

- What’s the main goal here? Are you playing the long game for retirement? Trying to generate some side income? Or just dipping your toes in to learn how the markets work?

- How often will you really trade? Will you be a classic "buy-and-hold" investor making just a handful of trades a year, or an active trader clicking "buy" or "sell" every week?

- What are you trading? Are you sticking to plain-vanilla stocks and ETFs, or are you curious about things like options or crypto?

- What’s your stomach for risk? Can you handle the rollercoaster of high volatility for a shot at higher returns, or do you prefer a slow-and-steady, conservative path?

Your answers act as an instant filter, cutting down your list of options. For instance, a frequent trader should be obsessed with finding a platform with rock-bottom commissions and killer charting tools. A long-term investor? They might care way more about low-cost index funds and forget the rest.

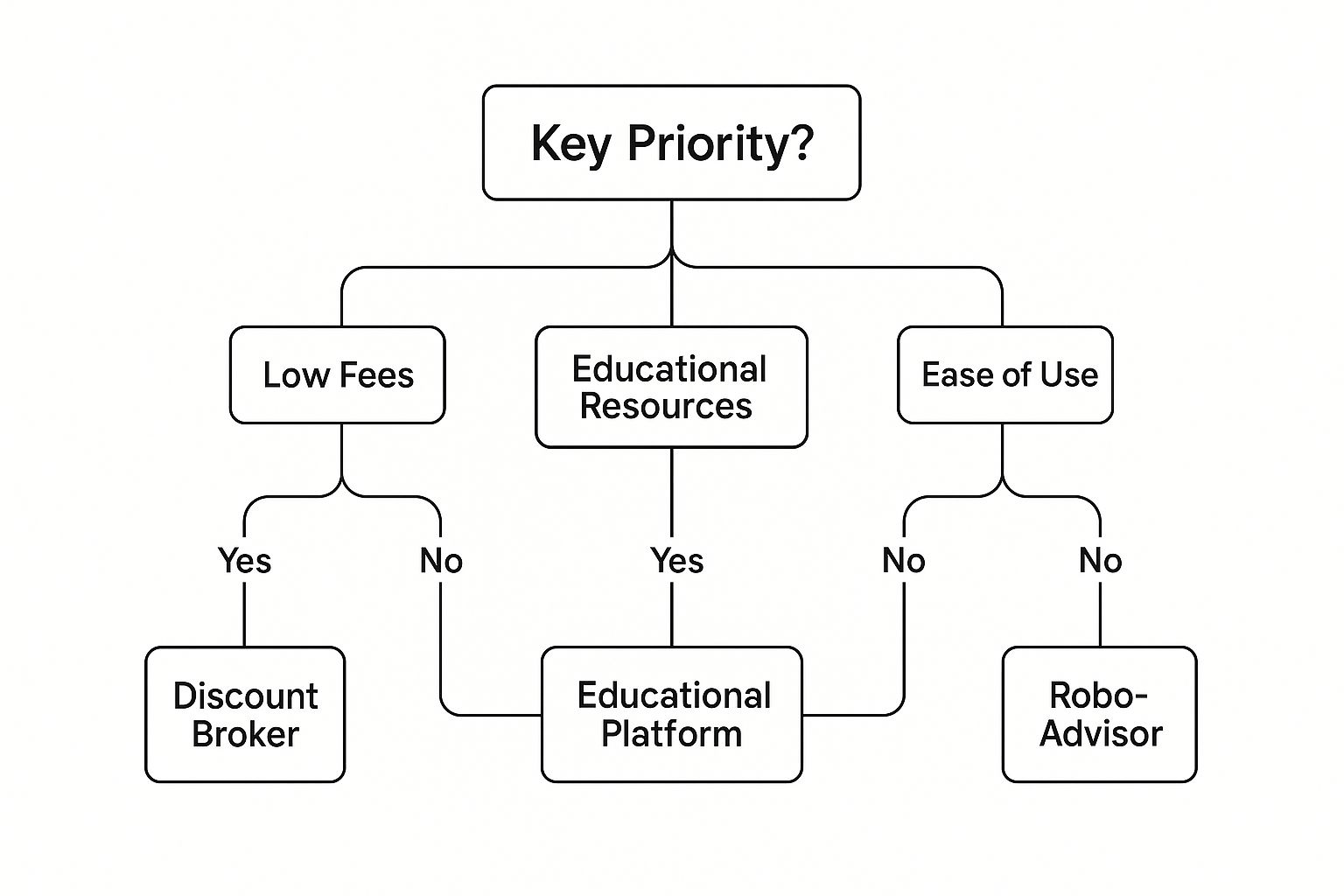

This decision tree gives you a visual for how your priorities point you toward the right kind of platform.

As you can see, if low fees are your biggest driver, you're probably looking at zero-commission brokers. If you feel like you need more hand-holding, platforms with heavy-duty educational resources are a much better fit.

Your Final Decision Checklist

Okay, with your trading style locked in, use this checklist to tie everything together. It's a simple framework to make sure you’re making a balanced choice that works for you now and down the road.

A great platform doesn't just meet your needs today; it provides a clear path for you to grow as an investor tomorrow.

- Costs: Are the fees totally transparent? Do they make sense for how often you plan to trade?

- Features: Does it have the non-negotiables, like a paper trading account to practice with and a mobile app that doesn't suck?

- Education: Does it give you the learning tools and support you need to feel confident, not confused?

- Security: Is the platform regulated by FINRA/SEC and insured by SIPC? (This one's a deal-breaker).

By running through this self-assessment, you turn what feels like an overwhelming decision into a clear, logical next step. You're now ready to pick a platform with real confidence, knowing it’s the right launchpad for your financial journey.

Got Questions? Let's Clear Things Up

Dipping your toes into the trading world for the first time? It’s completely normal to have a few questions swirling around. Getting straight answers is the first step toward trading with confidence. Let's tackle some of the most common ones I hear from new traders.

How Much Money Do I Really Need to Start?

The good news is, the barrier to entry has pretty much vanished. A lot of modern platforms have no minimum deposit, so you could technically open an account with just $1 and start clicking around. It's a great way to get a feel for the interface without any real financial pressure.

But to actually start trading? A more practical starting point is somewhere between $100 and $500. This gives you enough runway to buy a few shares of different stocks or ETFs. It lets you get a real-world feel for building a small, diversified portfolio without putting too much skin in the game right away.

Are "Commission-Free" Platforms Actually Free?

This is a big one. When a platform says it’s "commission-free," it just means you aren't paying a specific fee for each individual trade you place. But that doesn't mean it's completely free—they have to make money somehow.

"Commission-free" is a fantastic marketing hook, but you have to look past the headline. The true cost of any platform is buried in the full fee schedule, especially in things like spreads and other less-obvious charges.

So, how do they do it? It usually comes down to a few key things:

- The Bid-Ask Spread: This is the tiny difference between the highest price a buyer will pay for an asset (the bid) and the lowest price a seller will accept (the ask). Brokers can profit from this spread.

- Payment for Order Flow (PFOF): This is a bit more complex. Your broker might send your trade to a large third-party market maker to execute, and that market maker pays your broker for the business.

- Premium Subscriptions: Many platforms offer a free basic version but charge a monthly fee for more advanced tools, real-time data, or in-depth research.

What's the Difference Between a Broker and a Platform?

It's easy to get these two mixed up. The best way to think about it is with a simple car analogy.

The broker is the actual engine. They are the licensed, regulated financial firm with the legal authority to go out and execute your trades in the market. They do all the heavy lifting behind the scenes.

The trading platform, on the other hand, is the dashboard. It’s the software or website you log into—your steering wheel, gauges, and pedals. You use the platform to tell the engine (the broker) what to do, but it's the broker that actually makes it happen.

Ready to stop guessing and start trading with a proven strategy? Colibri Trader offers action-based programs that teach you how to read the market using pure price action—no confusing indicators required. Find out if our approach is right for you. Take our free Trading Potential Quiz today!