When Is the Best Time of Day to Trade?

If you're trying to figure out the absolute best time of day to trade, you're not alone. With the markets buzzing 24 hours a day, five days a week, it can feel like you're looking for a needle in a haystack. But here’s the secret: not all hours are created equal.

The market has a natural rhythm, a pulse of activity that seasoned traders learn to anticipate and ride. It has its quiet moments and its periods of intense, high-energy action.

I like to think of the market's daily cycle like the life of a big city. The Asian session is like the dead of night—the streets are quiet, and the traffic is predictable and steady. Then, as the London session kicks off, it's like the morning rush hour begins. The city wakes up, and the volume and energy start to build.

But the real magic? That happens when New York opens its doors while London is still in full swing. This is the city at its absolute peak—a bustling, chaotic, and opportunity-rich marketplace.

For most traders, the sweet spot is the 8:00 AM to 12:00 PM EST window. This is when the high-volume London and New York sessions overlap, creating a surge in liquidity and volatility. It’s during this four-hour period that the majority of the day's most significant price moves happen.

This overlap is so powerful because two of the world's financial behemoths are operating at the same time. Major economic news from both Europe and the US is often released during these hours, pouring fuel on the fire and driving strong, decisive trends. If you want to dive deeper into this, check out our detailed guide on the best time to trade forex.

Understanding this daily flow is key. It allows you to sync your strategy with the market's natural energy instead of fighting against it.

To help you visualize this, I've put together a quick summary of the major sessions and their characteristics. Think of this as your map to the market's 24-hour city.

Global Market Sessions and Key Overlaps

Here is a simple breakdown of the three major trading sessions, their operating hours in GMT, and the key overlap periods that create the most powerful trading opportunities.

| Trading Session | GMT Operating Hours | Key Characteristics | Major Market Movers |

|---|---|---|---|

| Tokyo | 12:00 AM – 9:00 AM | Lower liquidity, calmer trends | JPY, AUD, NZD |

| London | 8:00 AM – 5:00 PM | High liquidity, high volatility | EUR, GBP, CHF |

| New York | 1:00 PM – 10:00 PM | Highest liquidity, peak volatility | USD, CAD |

| London/NY Overlap | 1:00 PM – 5:00 PM | Peak activity, tightest spreads | All major pairs |

By focusing your efforts on these high-activity windows, especially the London/New York overlap, you place yourself right in the middle of the action where the biggest moves are likely to unfold.

Why Market Overlaps Are a Trader's Best Friend

Think about a quiet little street in your town. Now, imagine that same street when the big weekly farmer’s market rolls in. All of a sudden, it’s buzzing with energy, packed with vendors and shoppers. That's exactly what happens during a market session overlap—it’s where all the action is.

When two major financial centers are open for business at the same time, the number of active traders simply skyrockets. This convergence creates a perfect storm of liquidity and volatility, the two key ingredients every trader needs for real opportunities. The most powerful of these overlaps, without a doubt, is the London-New York session.

During this window, you have two economic titans trading at full throttle. This isn't just about more people clicking buy or sell; it’s about the massive flow of institutional capital and the flood of major economic data and corporate news coming from both sides of the Atlantic.

The Power of High Liquidity and Volatility

High liquidity simply means there are a ton of buyers and sellers for any given asset. For you as a trader, this translates into one massive benefit: tighter spreads. The spread is that tiny cost you pay on every single trade, and when it shrinks, your trading gets a whole lot more efficient.

It’s like trying to buy a popular new gadget. If only one store has it, they can set a high price. But when dozens of stores are competing for your business, the price gets much more competitive. It's the same principle.

At the same time, all this activity fuels volatility, which makes prices move with more purpose and conviction. Instead of just drifting sideways aimlessly, price action becomes much more decisive. This makes it far easier to spot clear trends and, more importantly, act on them. This one-two punch of tight spreads and clear moves is what makes these overlaps the best time of day to trade for so many of us.

The London-New York overlap, which usually happens between 8:00 AM and 12:00 PM EST, is hands-down the most active and liquid period in the global markets. This is when you have the highest probability of catching significant price moves.

This period is especially explosive right at the beginning. In fact, some statistical analysis shows that the 30-minute window from 8:30 AM to 9:00 AM EST can account for a staggering 7% of the entire day's trading volume, even though it's just 2% of the trading day. That's a direct result of the overlap kicking into high gear. If you want to dig deeper into how these peak periods affect volume, you can explore more insights on OANDA.

Why This Matters for Your Strategy

When you understand these dynamics, you can stop wasting your time and focus your energy where it actually counts. Instead of staring at charts during low-volume "dead zones," you can zero in on the exact hours where your trading strategy has the greatest chance of succeeding.

For a price action trader like myself, this means:

- More Reliable Patterns: Candlestick patterns, support levels, and resistance zones become far more meaningful when they're backed by high volume.

- Faster Trade Execution: High liquidity means your orders get filled instantly and at the price you expect, without any nasty slippage.

- Clearer Directional Moves: The huge influx of capital can ignite powerful trends that are much easier to ride.

By aligning your trading with these peak periods, you aren't just trading smarter. You're literally putting the market's own momentum to work for you.

Trading the EUR/USD During Peak Volatility

Alright, let's move from theory to the real-world trading floor with the EUR/USD. This isn't just any currency pair; it's the most traded financial instrument on the entire planet. Because of this, its behaviour offers a perfect case study for applying what we've learned about timing.

If you're serious about trading forex, getting a feel for the unique rhythm of the EUR/USD is essential.

The pair's personality shifts dramatically throughout the trading day, but it truly comes alive during the London-New York session overlap. For anyone asking, this is the best time of day to trade EUR/USD. Why? Because you have a flood of liquidity from two of the world's biggest financial hubs, which usually leads to clearer, more decisive price movements.

Think of it like a heavyweight boxing match. When both London and New York are in the ring, the punches (price swings) are faster and hit harder. This is the high-energy environment where many of the price action patterns I use become most reliable.

Pinpointing the Prime Trading Window

To consistently find high-probability setups, you have to know the exact hours when the EUR/USD is most active. For this specific pair, my experience shows the window between 1:00 PM and 4:00 PM GMT is typically the most volatile.

This period lines up perfectly with that market overlap, when trading volume and activity are at their absolute peak.

But it's not just about the time of day; the day of the week matters, too. Some data suggests that Fridays often see the largest price swings, sometimes averaging around 70 pips of movement compared to a daily average of 57 pips. This extra juice is often driven by major U.S. economic data releases, like the monthly Non-Farm Payrolls report, which can light a fire under the market.

A trader's edge isn't just about what they trade, but when they trade it. By focusing on the EUR/USD during its peak volatility window, you're aligning your strategy with the market's most powerful currents. This naturally increases the potential for significant moves.

Adapting Your Strategy to the Clock

The strategy you bring to the table must match these time-based dynamics. The fast-paced, high-volatility environment of the London-New York overlap is an ideal hunting ground for short-term approaches. Understanding the difference between these methods is key, and you can learn more by exploring our guide on swing trading vs. day trading.

Here’s a quick breakdown of how you might adapt:

- For Day Traders: This is your time to shine. Focus your energy exclusively on the overlap. Look for breakout patterns or trend continuations that are fueled by high volume.

- For Scalpers: The tight spreads and rapid-fire price action during these hours are perfect. This is where you can get in and out, capturing small, quick profits.

- For News Traders: Keep your economic calendar glued to your screen. Major releases scheduled during this window can provide fantastic opportunities to trade the initial market reaction.

By creating a specific playbook for the EUR/USD, you're no longer just working with abstract timing concepts. You're building a concrete, actionable strategy for one of the world's most dynamic markets.

Trading The Opening Bell

While forex traders live for the market overlaps, stock and futures traders have their own main event. It's a daily ritual of pure electricity known as the opening bell.

The first hour after the U.S. stock market opens at 9:30 AM ET is where the action is. This window is so packed with opportunity that many professional day traders make their money here and then simply walk away for the day.

This initial explosion isn't just random noise; it's the market digesting a full night's worth of information all at once. Picture a dam breaking. Overnight news, corporate earnings reports, and pre-market trading all build up immense pressure. When that bell rings, the pressure releases in a massive wave of buying and selling.

This concentrated reaction often creates huge price gaps, where a stock opens significantly higher or lower than its previous close. It also fuels some of the strongest, clearest directional moves you'll see all day, typically in the first 30 to 60 minutes. For a trader who has done their homework, this is a goldmine.

Riding the Morning Rush

Historically, the first hour after the 9:30 AM ET open consistently shows much higher volatility and trading volume than the rest of the day. This is a direct result of everyone reacting to overnight news, pre-market moves, and fresh economic data. If you want to dig deeper into why the morning is so potent, NinjaTrader offers some great insights.

So, how do you get in on this daily explosion? It's all about preparation. You can't just roll up to your desk at 9:29 AM and expect to come out ahead. The pros start their work long before the market even thinks about opening, mapping out a detailed plan of attack.

This prep work usually boils down to a few key steps:

- Scanning Pre-Market Movers: You're looking for stocks that are already showing unusual volume and price action before the bell. These are the names that will likely lead the charge.

- Identifying Key Price Levels: Mark out the critical support and resistance levels from the previous day's chart. These levels often act like magnets or pivot points once the market opens.

- Building a Watchlist: Create a short, manageable list of stocks you want to focus on. Trying to watch the whole market is a surefire way to get overwhelmed. A handful of high-potential candidates is much more effective.

The goal isn't to predict the chaos of the open, but to prepare for it. By having a plan, a watchlist, and key levels already marked, you can react decisively to the opportunities the market presents instead of being paralyzed by the volatility.

By treating the open as a specific event that requires its own strategy, you can turn what looks like unpredictable noise into a reliable source of high-probability setups. It's a major reason why so many pros consider it the best time of day to trade stocks.

Aligning Your Strategy with the Market's Rhythm

The truth is, there’s no single “best” time of day to trade. It’s not about finding some universal golden hour. It’s about matching your personal trading style to the natural energy of the market. A strategy that absolutely crushes it in one market environment might completely fall apart in another.

Think of it like a pro surfer. They don't just grab their board and paddle out whenever they feel like it. No, they study the tide charts and weather reports, waiting for the perfect set of waves that fits their style. Your job as a trader is exactly the same: find the market conditions that create the best waves for your trading approach.

For example, scalpers who live for quick price bursts and tight spreads should be focusing all their energy on the high-octane London-New York overlap. This is when volatility is cranked to the max, creating the fast-paced environment they need to get in and out of trades. On the other hand, a swing trader looking for calmer, more defined trends might find the Asian session a much better fit for their longer-term analysis.

Finding Your Perfect Trading Window

The real key here is to consciously sync up your strategy with the market's daily ebb and flow. Are you trading based on technical patterns, or are you reacting to big news announcements?

- News-Based Trading: If your strategy is built around economic releases, you have to be at your screen when that data is released. This almost always happens during the London or New York sessions.

- Technical Trading: If you rely on chart patterns and price action, you need enough volume in the market to make those patterns reliable. This again points you toward the peak hours, like the market open or those powerful session overlaps.

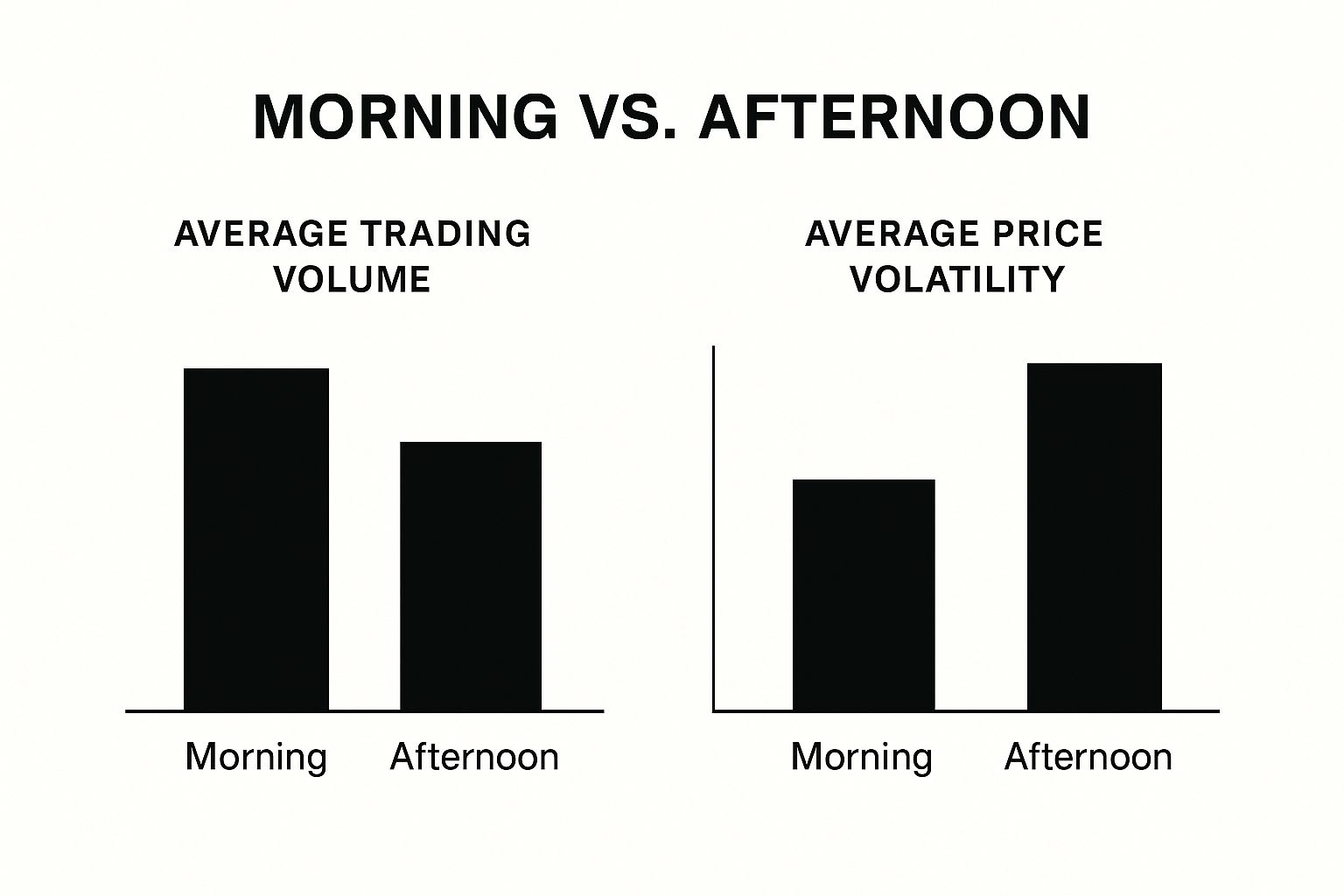

The infographic below shows just how different the market dynamics are between the morning and afternoon sessions. It’s a great visual of how volume and volatility shift throughout the day.

As the chart clearly shows, both trading volume and price volatility are much higher in the morning. This creates a far more dynamic playing field for short-term traders.

Aligning Trading Styles with Market Times

A common mistake I see traders make is trying to force a strategy onto the wrong market conditions. It's like trying to scalp a slow, drifting market in the middle of the afternoon lull. This is a recipe for frustration, over-trading, and losses.

It's far better to let the market's rhythm guide your actions.

| Trading Style | Primary Goal | Ideal Time of Day | Preferred Market Condition |

|---|---|---|---|

| Scalping | Small, frequent profits | London-New York Overlap | High Volatility, High Liquidity |

| Day Trading | Profits from intraday moves | First 2-3 hours of London or NY | High Volume, Clear Direction |

| Swing Trading | Catching multi-day trends | Asian Session, End-of-Day | Lower Volatility, Clear Trends |

| Position Trading | Long-term portfolio growth | Any (analysis done weekly/monthly) | Major long-term trends |

By understanding these relationships, you can pick your battles more effectively, applying the right approach at the right time.

The most effective traders don't fight the market; they align with it. They understand when to be aggressive during high-volatility periods and when to be patient during quiet times. This discipline is a cornerstone of consistent profitability.

To put this into practice, you must have a crystal-clear understanding of what your strategy needs to thrive. If you're a day trader, for example, you have to master techniques specifically designed for intraday price swings. For those looking to sharpen their skills, our guide on 5 day trading strategies that work offers practical methods you can start applying today.

By choosing the right strategy for the right time, you put yourself in the best possible position to succeed. It's as simple as that.

When to Sit on Your Hands and Avoid Trading

Figuring out the best time of day to trade is only half the battle. Knowing when to do absolutely nothing—to just sit on your hands—is just as crucial.

Professional trading isn't about non-stop action; it's an exercise in disciplined patience. It's about sidestepping those ugly market conditions that can quickly eat away at your capital.

Think of it like being a lifeguard. A lifeguard's job isn't just to jump in and save people. It's also knowing when the currents are so treacherous that they have to order everyone out of the water. Your job as a trader is to recognize these "no-swim" zones in the market, those periods where risk shoots up and good opportunities dry up completely.

One of the most common traps for new and even experienced traders is the midday lull. After the morning fireworks of the London or New York open, volume often vanishes. This period, usually between 12:00 PM and 2:00 PM EST, can be a minefield of choppy, directionless, and utterly unpredictable price action.

Recognizing Market Dead Zones

Beyond the daily lulls, there are other specific times when it’s just plain smart to keep your powder dry. Remember, your number one job is to protect your capital, and a huge part of that is staying out of low-probability environments.

Here are a few times when I personally avoid the markets:

- Major Bank Holidays: If the big financial hubs like London, New York, or Tokyo are on holiday, liquidity evaporates. This creates thin markets that are prone to sudden, erratic spikes on very little volume.

- Around Major News Releases: The minutes just before and right after a massive report like Non-Farm Payrolls can be pure chaos. It's almost always better to let the dust settle and see where the market wants to go, rather than gambling on the number.

- Low-Volume Sunday Opens: The market open on Sunday evening is notoriously thin and prone to gaps. It’s rarely a good time to be putting on fresh positions for the week.

Mastering the art of sitting on your hands is a professional habit. It’s the ultimate form of risk management. It stops you from taking pointless losses driven by boredom or a nasty case of FOMO (fear of missing out).

Finally, there’s a massive psychological trap you have to learn to avoid: late-day "revenge trading."

We've all been there. You take a loss, and the urge to jump straight back in to "make it back" before the market closes is incredibly strong. This is almost always a losing game because you're trading from a place of emotion, not strategy. When you feel that urge creeping in, the best trade you can possibly make is to shut down your platform and walk away for the day.

Common Questions About Trading Times

Even after you get a handle on the major sessions and overlap periods, a few practical questions always pop up. It's one thing to know the theory, and another to apply it when you're sitting in front of your charts.

So, let's tackle a few of the most common things traders ask about timing the market. Think of this as a quick-reference guide to clear up any lingering confusion.

Does Daylight Saving Time Affect Trading Hours?

Yes, absolutely. This is a classic tripwire for new and even experienced traders.

Financial hubs like New York and London observe Daylight Saving Time (DST), but they don't switch on the same dates. This means the all-important session overlap times will actually shift by an hour during certain weeks of the year.

That powerful four-hour London-New York overlap can suddenly shrink or start later than you expect, which can throw your entire trading day off. The smart traders I know are always aware of the upcoming DST changes. A good world clock tool is your best friend here—it ensures you're showing up for the party, not an hour after it's over.

Can I Be a Profitable Trader Outside Peak Hours?

You can, but it requires a totally different mindset and strategy. You can't force a high-volatility breakout strategy onto a quiet, sleeping market. While the peak hours offer the biggest and fastest price swings, the calmer periods, like the middle of the Asian session, are perfect for other approaches.

Success comes from trading in harmony with the market's current energy. A quiet market calls for a quiet strategy, like range-trading or mean-reversion, not a high-octane breakout approach.

The key is to adapt. If you can only trade during slower times, your strategy must be designed for low-volatility conditions. Trying to hunt for big, explosive moves when the market is drifting sideways is a recipe for frustration and a string of unnecessary losses. It's all about fitting your method to the moment.

How Does My Local Time Zone Matter?

Your local time zone is just for your personal schedule; the market couldn't care less where you live. It operates on global time, with all major events and session opens timed to their local clocks, which we usually track in GMT/UTC or EST.

Your job is simple: translate these critical market hours into your local time.

The London-New York overlap, for example, is from 8:00 AM to 12:00 PM EST. That's the "market time" when liquidity and volatility are peaking. Whether you're in California or Australia, that moment in the market is the same. Your location only determines what time you need to set your alarm to be at your desk to trade it.

At Colibri Trader, we teach you how to master the market's rhythm using proven, price-action based strategies. Forget indicators and complex analysis; learn to read the charts and trade with confidence, no matter the time of day. Find out how we can transform your trading at https://www.colibritrader.com.