What is Swing Trading? Your Ultimate Guide to Profitable Strategies

Swing trading lets you chase short- to medium-term gains over a few days to several weeks. Picture a surfer paddling for a single clean wave instead of trying to conquer the whole ocean. The idea is to ride the market’s natural ups and downs and exit before the tide turns.

Understanding The Swing Trading Philosophy

Swing trading sits neatly between the adrenaline rush of day trading and the marathon of long-term investing. You’re not glued to every tick, nor are you waiting years for a payoff. Instead, you spot a likely “swing” in price and hold just long enough to grab the lion’s share of that move.

This style leans heavily on market trends and chart patterns. You’re not studying a company’s five-year plan or reacting to every headline. Technical analysis guides your entries and exits.

Swing Trading At A Glance

Before we dive deeper, here’s a quick summary of swing trading’s core traits:

| Characteristic | Description |

|---|---|

| Time Horizon | Few Days to Several Weeks |

| Key Focus | Riding short- to medium-term price swings |

| Primary Analysis | Chart patterns and technical indicators |

| Risk Management | Using tight stop-loss orders |

| Trader Profile | Part-time or full-time participants with other commitments |

These highlights underscore what swing trading is all about—balanced risk, measured timeframes, and an emphasis on structured setups.

Capturing Market Volatility

Volatility is where swing traders thrive. Think of it as the playground that offers wider swings and bigger profit windows.

Between January 2020 and June 2023, the S&P 500 plunged to 2,237.40 at the pandemic low and climbed back up to 4,796.56. A swing trader’s mission would be to map out those sharp moves, pinpoint entry and exit levels, and ride the wave up—or down. You can explore more about market behavior during this period in this detailed analysis.

The essence of swing trading is not to catch the absolute bottom or sell at the absolute top. It’s about capturing a significant portion of the price move in between, managing risk, and moving on to the next opportunity.

This approach appeals for several reasons:

- Time Flexibility: You don’t need to watch every second of the session.

- Significant Gains: Capturing a full swing can yield more profit per trade than a quick scalp.

- Reduced Stress: A steadier pace allows for thoughtful analysis instead of frantic decisions.

Finding Your Fit: Swing Trading vs. Other Styles

To really get a handle on what is swing trading, it helps to see where it fits in the bigger picture. The trading world is huge, but most strategies boil down to one of three main camps, each defined by its time horizon and how hands-on it is. Figuring out which one is for you is all about your personality, your schedule, and what you want to achieve financially.

Day trading is the absolute sprint of the financial markets. Traders jump in and out of positions all day long, trying to skim profits off tiny price moves. They never hold a trade overnight, which means no exposure to after-hours risk. It’s a high-octane style that demands your full attention and lightning-fast decisions.

At the other end of the spectrum is long-term investing, which feels more like planting a tree and watching it grow. Investors buy assets based on their fundamental strength and potential for growth over years, sometimes even decades. They’re playing the long game, riding out the daily market noise and focusing on the big picture.

Swing trading carves out a unique sweet spot right in the middle. It strikes a balance that’s often perfect for people who can't be glued to their screens all day but still want to be more active than a set-it-and-forget-it investor.

Swing Trading vs Day Trading vs Investing

The best way to see the contrasts is to lay them out side-by-side. The core differences really come down to how long you hold a trade, how much time you need to commit, and the type of analysis you rely on.

This table breaks down the three main approaches to the market:

| Attribute | Swing Trading | Day Trading | Investing |

|---|---|---|---|

| Holding Period | Days to weeks | Minutes to hours | Years to decades |

| Time Commitment | Moderate (a few hours per week) | High (several hours per day) | Low (periodic reviews) |

| Analysis Focus | Technical analysis, chart patterns | Intra-day technical analysis | Fundamental analysis |

| Goal | Capture a single price "swing" | Small, frequent profits | Long-term capital growth |

| Psychology | Patience, discipline | Quick decisions, stress tolerance | Patience, long-term vision |

As you can see, swing trading occupies a unique middle ground, blending elements of both sprinting and marathon running. It's about strategic patience, not just constant action or passive waiting.

It's a common myth that trading more means you'll profit more. The truth is, success comes from finding a style that actually clicks with your personality and lifestyle. That’s what allows for the consistent, disciplined execution needed to win.

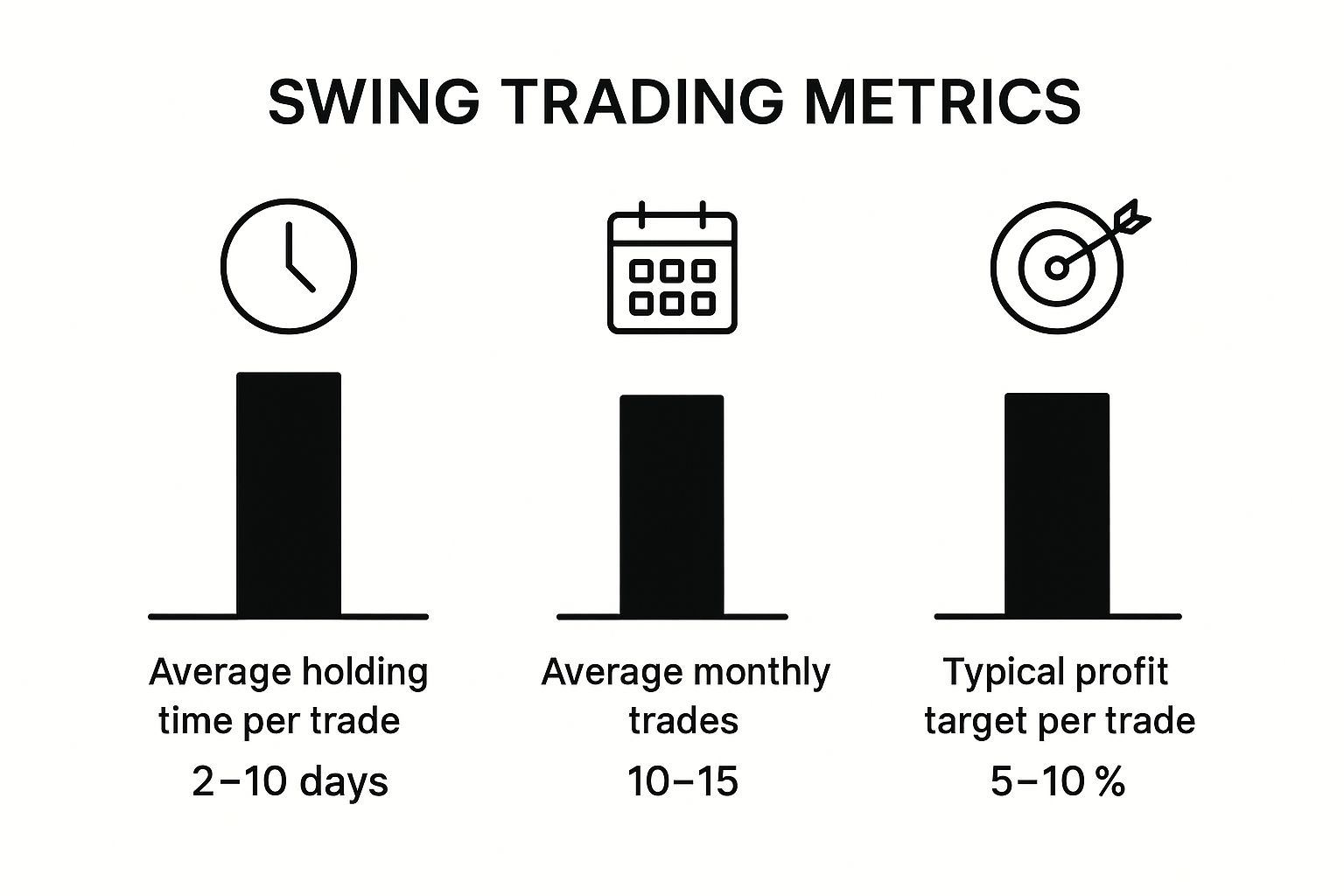

This infographic does a great job of breaking down the typical metrics for a swing trader. It really highlights the moderate frequency and realistic profit targets that define this style.

The numbers make it clear: swing trading is a game of patience and precision. The focus is always on quality setups, not just a high volume of trades.

Which Trading Style Is Right for You?

Choosing your path starts with some honest self-reflection. Are you craving fast-paced action, or are you in it for a slow and steady journey? Do you have hours to dedicate every single day, or just a few hours a week? Answering these questions is your first step.

If you're trying to decide between the two more active styles, this detailed comparison of day trading vs. swing trading can help you figure out which one is a better fit.

Ultimately, there’s no single "best" approach—only the one that works for you. Understanding where swing trading fits into the landscape is the key to deciding if its balanced, methodical approach is the right one for your journey in the markets.

The Anatomy of a Successful Swing Trade

Alright, let's move from theory to action and walk through what a real swing trade looks like from start to finish. This isn't about chasing hot tips or making emotional guesses. It's a disciplined, repeatable process designed to find high-probability setups and keep risk in check.

A successful trade is planned out meticulously before a single dollar is ever on the line.

The whole thing kicks off with scouting for opportunities. Think of yourself as a detective, scanning the charts for specific clues that suggest a price move is coming. Swing traders use a core set of tools to build their case, looking for multiple signals that all point in the same direction and confirm their trading idea.

This initial analysis is the bedrock of the entire trade. Without a solid reason to enter, you're just gambling.

Step 1: Identifying a Potential Setup

First things first, you need to find an asset with the potential for a decent swing. We use technical indicators and classic chart patterns to spot these moments.

- Moving Averages: These smooth out all the noise in the price data to show you the real underlying trend. A classic signal is when a stock's price pulls back to a key moving average, like the 50-day, and then "bounces" off it. This often suggests the trend is ready to resume.

- Support and Resistance Levels: These are simply zones on the chart where price has historically struggled to break through—either to the upside (resistance) or downside (support). A trader might watch for a stock dropping to a strong support level, expecting it to act as a floor and bounce higher.

- Relative Strength Index (RSI): This is a momentum tool that tells you if a stock is getting a bit ahead of itself (overbought) or if it's been beaten down too much (oversold). An RSI reading below 30 can be a great clue that a stock is oversold and might be due for a rebound.

A truly great setup often combines these elements. For instance, you might spot a stock in a clear uptrend that has pulled back to its 50-day moving average. If that moving average also lines up with a known support level, and the RSI is dipping into oversold territory… now you have a compelling case for a trade.

A-grade setups rarely rely on just one indicator. The real magic happens when multiple, independent signals all point to the same conclusion, dramatically increasing the probability of a successful outcome.

Step 2: Defining Your Trade Plan

Once you've found a promising setup, the next phase is to map out a precise plan of attack. This is where you take all emotion and guesswork out of the equation by defining exactly how you'll manage the trade. And this has to be done before you enter the position.

Your plan needs three non-negotiable parts:

- Entry Point: The exact price where you'll get in. This could be when the price touches that support level you identified or breaks just above a small, short-term resistance area.

- Stop-Loss: The price where you'll get out if the trade goes against you. This is your safety net, the one thing that protects your capital from a big hit. A stop-loss is an absolute must.

- Profit Target: The price where you'll sell to lock in your gains. This is often set just below a major resistance level where the price has turned back before.

This structured approach is what turns trading from a reactive guessing game into a strategic business. To get a better handle on finding these crucial price zones, you can learn more about how to identify support and resistance in our detailed guide. Every single successful swing trade is built on this framework.

Three Core Strategies to Get You Started

Once you've got a handle on how a swing trade works from start to finish, you can begin digging into actual strategies. You'll find there are countless ways to trade, but the most successful traders I know didn't learn them all. Instead, they mastered just a few core approaches that really clicked for them.

Don't feel like you need to become an expert in everything overnight. The goal is to find a couple of strategies that make sense to you and practice them until they become second nature. Think of these as the foundation of your trading playbook.

Let’s walk through three of the most popular and reliable methods that are perfect for traders just finding their footing.

1. Trading with Support and Resistance

This is one of the absolute fundamentals of trading, and for good reason—it's incredibly powerful. The whole idea is built on a simple observation: price often struggles to break through certain levels. It's almost like the market has a memory.

A support level acts like a floor where buyers tend to jump in and prop up the price. On the flip side, a resistance level is a ceiling where sellers usually take control and push the price back down.

The strategy itself is beautifully simple:

- Look to buy near a solid support level. When a stock pulls back to an area where it has bounced multiple times before, that's your cue. It's a potential low-risk entry point.

- Look to sell near a strong resistance level. As the price climbs toward a known ceiling, that's a logical spot to take your profits or even think about a short trade.

Imagine a stock that has repeatedly bounced off the $50 mark but just can't seem to break below it. That tells you $50 is a major support level. Traders will be watching that price like a hawk, ready to buy if it dips back down there again. These levels work because they are psychological battlegrounds where a ton of orders are often clustered.

:max_bytes(150000):strip_icc():format(webp)/SupportandResistance-2f5a092822c7473787a275b318d4512c.png)

2. Following the Prevailing Trend

Instead of trying to be a hero and call the exact top or bottom of a move, this strategy is all about joining the party that's already in progress. You’ve probably heard the old market saying, "the trend is your friend," and this approach takes that to heart.

You're simply identifying an asset that's clearly moving up or down and looking for a safe way to jump aboard.

Here's how you'd play a solid uptrend:

- Identify the Trend: First, confirm the market is in a real uptrend. A simple way is to see if the price is consistently staying above a key indicator like the 50-day moving average.

- Wait for a Pullback: No market moves in a straight line forever. You have to be patient and wait for the price to take a breather and dip back toward that moving average. This is your opportunity.

- Enter on Confirmation: Once the price touches that level, finds its footing, and starts to climb again, that's your trigger to enter the trade.

This method keeps you from the classic mistake of "chasing" a stock after it’s already shot up. You’re waiting for a discount—a lower-risk entry point within the context of a much bigger move.

The point of trend-following isn't to be a psychic and catch the perfect bottom of a dip. It's about joining the dominant momentum at a logical spot, which gives you a much better chance that the broader trend will do the heavy lifting for you.

3. Using Moving Average Crossovers

If you prefer a more mechanical approach, this strategy uses technical indicators to give you clear, objective signals to buy or sell. A moving average (MA) is just a line on your chart that smooths out the price action to show you the underlying trend. A "crossover" is exactly what it sounds like—it's when a shorter-term MA crosses over a longer-term one.

This event can signal a major shift in market momentum. There are two famous patterns to watch for:

- The Golden Cross (A Bullish Signal): This is the big one for bulls. It happens when a short-term MA (like the 50-day) crosses above a long-term MA (like the 200-day). It's widely seen as a sign that a new, powerful uptrend might be kicking off.

- The Death Cross (A Bearish Signal): On the other hand, when the short-term MA crosses below the long-term MA, it’s a warning sign. This suggests the momentum has shifted, and a long-term downtrend could be starting.

Swing traders use these signals to time their moves. A Golden Cross can be a great confirmation to go long, while a Death Cross might be a trigger to sell your position or even look for short-selling opportunities. It’s a great way to take some of the guesswork and emotion out of your trading decisions.

Weighing The Real Risks And Rewards

No trading style comes with a guarantee. To truly grasp what is swing trading, you need to shine a light on both its high points and its drawbacks before putting any real money on the line.

Swing trading earns praise for its flexible rhythm. You’re not chained to your screen; most of your decisions happen after the closing bell. Riding a multi-day price swing often allows for larger gains on a single trade compared to the frenetic pace of day trading.

Key Attractions:

- Time Freedom: Analyze charts in the evening, execute orders at the next open.

- Deeper Swings: Capture moves unfolding over several days or even weeks.

- Balanced Routine: Fits nicely around a full-time job or other commitments.

The Inherent Challenges You Will Face

Flexibility isn’t free. The market might close, but your positions stay exposed. Overnight and weekend risk means a sudden headline can send prices jumping past your stop-loss before you even see it.

Holding trades for days demands emotional steel. One session you’re in the green; the next you’re watching profits evaporate. Staying disciplined when fear and greed tug at you is half the battle.

The real challenge isn’t just finding a winning trade; it's having the mental fortitude to stick with your plan through the inevitable ups and downs that occur over a multi-day holding period.

Understanding Realistic Profit Expectations

Let’s talk numbers. Experienced swing traders often report win rates around 35% to 50%. A disciplined approach can turn a $100,000 account into $110,000–$130,000 over a year.

For deeper insights, see swing trading success rates on TraderLion.

At the end of the day, your success hinges on whether this risk–reward profile aligns with your financial goals—and, just as importantly, your temperament.

Your Essential Toolkit and Risk Management Rules

Getting into swing trading without the right gear and a firm set of rules is like trying to fly a plane without a pre-flight checklist. You’re just winging it, and that’s a recipe for disaster. The pros know that success isn't just about good picks; it’s about having a repeatable process. Your tools give you clarity, and your rules protect your capital.

This professional mindset starts with building your core toolkit. These aren’t just nice-to-haves; they are the absolute essentials for making smart, informed decisions day in and day out.

The Trader's Non-Negotiables

To get a real handle on the markets, every swing trader leans on a few key resources.

- Charting Platforms: This is your command center. A solid platform lets you watch price action unfold, slap on indicators like moving averages, and draw trendlines to spot potential trades.

- Stock Screeners: You can't possibly sift through thousands of stocks by hand. Screeners do the heavy lifting, acting as powerful filters to find stocks that match your exact criteria—like a stock breaking above a key resistance level or showing unusually high trading volume.

- A Trading Journal: This might be the most powerful learning tool you ever use. It’s where you log every single trade: your entry, exit, stop-loss, and most importantly, why you took the trade in the first place. Going back through it is how you find your patterns, both good and bad.

The point of a toolkit isn't to chase some magical, always-right signal. It's about building a consistent process that gives you a statistical edge over the long haul. A consistent process is what leads to consistent results.

The Bedrock of Your Trading Career

Far more important than any piece of software is how you handle risk. This is the single biggest thing separating seasoned pros from amateurs. Professionals protect their capital first and look for profits second. Without airtight risk management, one bad trade can wipe out a whole string of winners.

This is where you need to get strict with yourself and set some hard-and-fast rules. One of the most critical is the 1% Rule. It’s simple: never risk more than 1% of your total trading capital on any single trade. Quantitative studies on systematic strategies often show win rates in the 60-65% range, with average holding periods of around 30 days. You can explore how a rules-based system can maximize swing trading gains on Tickeron.com.

This rule is tied directly to position sizing—calculating the exact number of shares to trade so that a potential loss doesn't exceed your 1% risk limit. Getting these two concepts down is non-negotiable, and our guide on essential trading risk management strategies dives much deeper into how to do it. Think of these principles as the guardrails that keep you in the game long enough to actually become profitable.

Answering Your Swing Trading Questions

As you get closer to pulling the trigger on your first trade, a lot of practical questions start to bubble up. That’s perfectly normal. Getting the logistics right is just as important as nailing the strategy itself.

Let's clear the air and tackle some of the most common questions I hear from new traders. The goal here is to get rid of any lingering doubts so you can move forward with confidence.

How Much Money Do I Need to Start Swing Trading?

There isn't a single magic number here, but the golden rule is to only start with capital you're genuinely prepared to risk. Forget what you read elsewhere—this is non-negotiable.

While some brokers will let you open an account with a few hundred dollars, a more realistic starting point is somewhere between $2,000 and $5,000.

Why that amount? It's enough to let you manage your risk properly (like sticking to the 1% rule) and open a few different positions without putting all your eggs in one basket. Just as importantly, it keeps you under the $25,000 Pattern Day Trader (PDT) rule in the US, which makes swing trading a much more accessible starting point.

Can I Swing Trade While Working a Full-Time Job?

Absolutely. In fact, this is one of the biggest reasons people are drawn to swing trading in the first place. Your trades last for days or even weeks, so there's no need to be glued to your screen all day.

Most of the heavy lifting—your analysis and trade planning—can be done in the evenings or over the weekend.

Once you've entered a position with your stop-loss and profit target already set, all it takes is a quick check-in each day to see how things are progressing. It's the perfect approach for anyone wanting to be active in the markets without quitting their day job.

Which Markets Are Best for Swing Trading?

The beauty of swing trading is that its principles can be applied to almost any market. The key is to find markets with plenty of liquidity and consistent volatility—that's where the opportunities are.

- Stock Market: This is the most common playground for swing traders, simply because of the vast number of companies to choose from.

- Forex Market: Extremely popular with swing traders. The market is open 24 hours a day during the week, which offers incredible flexibility no matter your schedule.

- Cryptocurrencies: Major digital assets like Bitcoin and Ethereum are also great candidates for capturing multi-day price swings.

Ultimately, it’s less about the market itself and more about finding assets within that market that show clear trends and predictable price movements. Think large-cap stocks or major currency pairs—they tend to provide the cleanest charts to work with.

Ready to stop relying on complex indicators and master the art of price action? At Colibri Trader, we provide the clear, no-nonsense guidance you need to trade with confidence. Take our free Trading Potential Quiz to discover your strengths and start your journey to consistent profitability today.