What is Lot Size? A Complete Guide to Trading Sizes

When you hear traders talk about "lot size," what exactly do they mean? Think of it this way: when you go to the store, you don't buy a single egg; you buy a carton of a dozen. A lot size is the trading equivalent—it’s the standard quantity of an asset you're buying or selling in a single transaction.

The Building Blocks of Every Trade

Imagine you're building a house. You wouldn't think about it one brick at a time. Instead, you'd think in terms of pallets of bricks. A lot size is your pallet. It’s a standardized bundle of units that defines the scale of your trade, your financial commitment, and, ultimately, your potential profit or loss.

Honestly, without a solid grasp of this concept, trying to control your risk is a lost cause.

This isn't just about convenience, either. Standardized units are fundamental to how markets function. They ensure consistent pricing, predictable risk exposure, and smooth trade execution on exchanges all over the world. Whether you're trading currencies, stocks, or commodities, the lot size you choose is the main lever you pull to decide just how much market exposure you want to take on.

The Three Main Forex Lot Sizes

In the currency market, this idea is broken down into three main tiers, each designed for different account sizes and appetites for risk. These are the "carton sizes" you'll work with every day:

- Standard Lot: This is the big one, representing 100,000 units of the base currency. It's the go-to for institutional players and traders with very large accounts.

- Mini Lot: A much more manageable size, the mini lot contains 10,000 currency units. This makes it a favorite among intermediate traders who have some experience under their belts.

- Micro Lot: The smallest of the trio, a micro lot is just 1,000 units. It’s the perfect starting point for beginners who want to trade with real money but keep the stakes low.

To make this even clearer, here's a quick breakdown of how these common lot sizes compare.

Quick Guide to Common Forex Lot Sizes

| Lot Type | Units of Base Currency | Typical User |

|---|---|---|

| Standard Lot | 100,000 | Institutional traders, hedge funds, professional traders |

| Mini Lot | 10,000 | Intermediate retail traders, small to mid-sized accounts |

| Micro Lot | 1,000 | Beginners, traders testing new strategies, small accounts |

This table shows at a glance who typically uses each lot size, giving you a better feel for where you might fit in.

A trader's ability to manage risk is directly tied to their understanding of lot sizes. Choosing the wrong size is like taking a speedboat into a hurricane—you’re simply not equipped for the conditions. Proper position sizing is the first line of defense for your trading capital.

Getting a handle on the difference between these lot types is your first real step toward smart money management. Each one has a dramatically different impact on what a tiny price fluctuation—what we call a "pip"—is worth in actual money.

For instance, a one-pip move on a standard lot has 100 times the financial impact of that same move on a micro lot. This direct link between lot size and financial outcome is precisely why mastering this concept is non-negotiable. It truly sets the stage for every single decision you make, from where you place your stop-loss to how you calculate your take-profit targets.

Standard, Mini, and Micro Lots in Action

It’s one thing to know the definitions of different lot sizes, but it’s another to see how they actually play out with your own money on the line. The lot size you select is what turns tiny market wiggles into real dollars and cents hitting—or leaving—your account.

Let's break down how each of the three main lot types—standard, mini, and micro—behaves in the real world. Think of it like this: a small price move with a large lot size has a massive financial impact, just like a small turn of the wheel in a semi-truck has a much bigger effect than in a compact car.

The Powerhouse: Standard Lot

A standard lot is the heavyweight champion, controlling 100,000 units of the base currency. This is typically the territory of institutional players, banks, and serious professionals with deep pockets. Because of its sheer size, even the smallest price tick can translate into a major gain or loss.

On most major pairs like the EUR/USD, a single pip of movement when trading a standard lot is worth $10. A tiny 10-pip move against you? That’s a $100 loss, just like that. This scale makes it a dangerous game for most retail traders unless you’re working with a very large account and have a stomach for serious risk.

The Sweet Spot: Mini Lot

The mini lot is where things get more practical for most experienced traders. It represents 10,000 currency units, offering a great balance between profit potential and risk management. It's the go-to choice for traders who have moved beyond the basics and are working with a moderately sized account.

With a mini lot, that same one-pip move is now worth $1. That 10-pip adverse move that cost $100 before? It’s now a far more manageable $10 loss. This gives you much more breathing room for your strategies and stop losses without the fear of one bad trade blowing up your account.

The Training Wheels: Micro Lot

If you're just getting your feet wet, the micro lot is your best friend. At just 1,000 currency units, it’s the perfect tool for learning the ropes with real money on the line but without the heart-pounding risk. The psychological pressure is dramatically lower, which allows you to focus on building good habits and a solid strategy.

Trading a micro lot means each pip is worth a mere $0.10. That 10-pip move against your position now stings for just $1. This low-stakes environment is invaluable for testing new ideas, getting a feel for market volatility, and developing the discipline you need to succeed long-term.

Choosing your lot size is the most direct way you control your risk on any given trade. A new trader opening a standard lot is making a mistake that could wipe out their entire account in minutes. Starting small with micro lots is a sign of a disciplined, process-oriented trader.

Let's put this into a simple chart to see just how much your decision on what is lot size can impact your trade's bottom line.

How Lot Size Affects Pip Value and Risk

The table below gives you a clear, at-a-glance comparison of how your chosen lot size scales up the risk and reward.

| Lot Size | Units | Value per Pip (EUR/USD) | Example Required Margin |

|---|---|---|---|

| Standard Lot | 100,000 | $10.00 | ~$4,000 |

| Mini Lot | 10,000 | $1.00 | ~$400 |

| Micro Lot | 1,000 | $0.10 | ~$40 |

Note: Required margin can vary based on your broker and leverage.

As you can see, the relationship is crystal clear: a bigger lot means a bigger financial swing for every single pip the market moves. It also means you need to commit more of your capital just to open the position.

How Lot Sizes Evolved in the Stock Market

The idea of a "lot size" isn't exclusive to the forex world; it actually has deep roots in the stock market. For many decades, the gold standard for trading shares was the round lot, which was always a neat bundle of 100 shares.

This wasn't just a random number. In the days before high-speed computers, trading in clean, 100-share blocks made life easier for everyone. It created an efficient, orderly system for brokers and exchanges to match up buyers and sellers.

If you wanted to trade anything less than 100 shares, that was called an odd lot. Frankly, these trades were often a headache for the old guard—they could come with higher fees or slower execution times. They were the exception, not the norm.

Fast-forward to today, and that entire world has been turned upside down. The explosion of online brokers, commission-free trading, and the introduction of fractional shares has completely rewritten the rules.

The New Norm: Odd Lot Trading

The odd lot isn't just an oddity anymore; it's the main event. Finance has become far more accessible, allowing millions of everyday investors to jump into the market with whatever cash they have on hand. You no longer need a small fortune to buy a round lot of a pricey stock. Now, you can buy a single share—or even a tiny slice of one.

This isn't just a small change. It's a massive, data-driven trend that's fundamentally altering how the market works. The combined force of all these smaller retail trades has injected a new type of liquidity and participation that was simply unimaginable a generation ago.

The rise of the odd lot tells a powerful story about market access. What was once a system built for institutions has been fundamentally altered by the individual investor, proving that small, consistent actions can collectively reshape the entire financial landscape.

The numbers don't lie. Recent analysis from Cboe Global Markets shows a clear picture of this incredible shift. Trades of fewer than 100 shares now make up the majority of all trading activity.

In fact, these small trades now account for around 54.8% of all trades in US financial markets. That's a huge leap from just 43% at the start of 2020.

This surge proves that individual investors, who often trade with smaller amounts, have become a major force driving market volume. The old concept of a "standard" lot size is no longer set in stone. Instead, it’s a fluid idea that changes with technology and, more importantly, with who is actually trading. The small trader is no longer a bystander; they're right in the thick of it.

How to Calculate Your Perfect Lot Size

Knowing the difference between lot sizes is one thing. Actually using that knowledge to make smart, repeatable decisions is what separates traders who last from those who don't. Calculating your ideal lot size before every single trade isn’t just a good idea—it's the bedrock of disciplined risk management. This is where we leave guesswork and emotion at the door and use a simple formula to protect our capital.

The whole process really just comes down to three things: how much money is in your account, what percentage of it you’re willing to risk on this one trade, and where your stop-loss needs to go. Once you have those pieces, you can figure out the exact lot size that fits your plan, making sure no single loss can ever blow up your account.

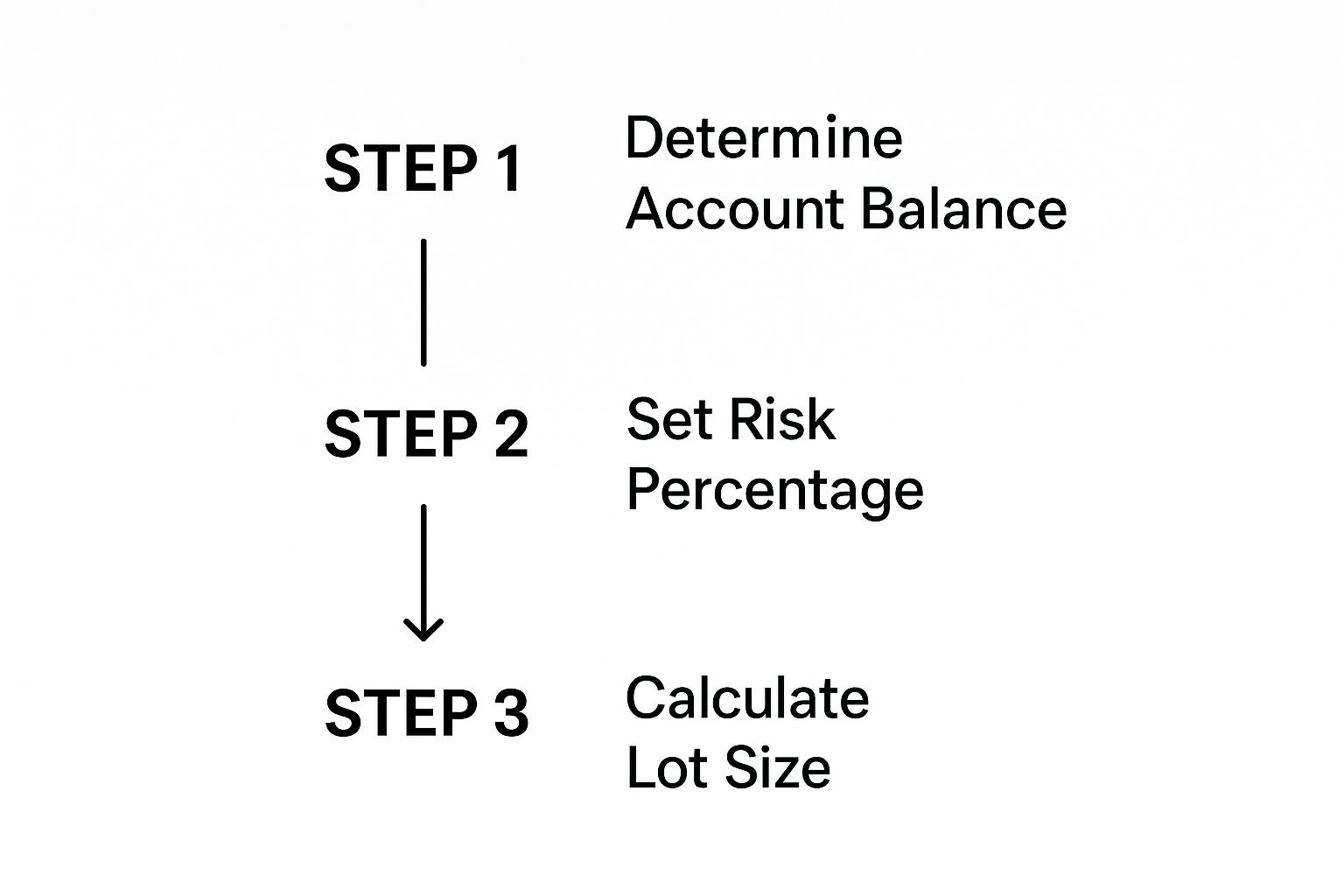

The Three Steps to Position Sizing

The math here is simple, and it should become a non-negotiable part of your pre-trade checklist. It’s a habit that builds the foundation for long-term consistency. To make it even clearer, this diagram breaks down the entire process into three easy stages.

As you can see, your account balance and risk percentage flow directly into the final lot size calculation. It turns a vague idea about "risk" into a concrete action.

Let's walk through it step-by-step.

Step 1: Define Your Risk in Dollars

First things first, decide what percentage of your account you're comfortable losing if the trade goes south. Most pros I know live by the 1-2% rule.

Let’s say you have a $5,000 account. If you stick to a 1% risk rule, the absolute most you can lose on any single trade is $50. That number is your line in the sand.

Step 2: Determine Your Stop-Loss in Pips

Next, look at your chart and find a logical place for your stop-loss. This decision has to be based on technical analysis—maybe just below a recent swing low or a key support level—not on how much money you wish you would lose.

For this example, let's say your analysis tells you the right spot for your stop is 25 pips away from your entry price.

Step 3: Calculate the Final Lot Size

Alright, you have all the pieces. You know your maximum dollar risk ($50) and the distance to your stop-loss (25 pips). The last step is to figure out the lot size where a 25-pip move against you costs you exactly $50.

Your stop-loss placement should dictate your lot size, not the other way around. Never, ever move your stop just to trade a bigger size. Instead, adjust your lot size to fit your strategic stop.

Putting It All Together With an Example

Let’s stick with our scenario to nail down the right lot size.

-

Calculate the Value Per Pip: Just divide your max dollar risk by your stop-loss in pips.

- $50 / 25 pips = $2.00 per pip

-

Determine the Lot Size: So, for this trade to fit your risk rules, each pip movement needs to be worth exactly $2. We know that one mini lot (10,000 units) has a pip value of about $1 (for most major pairs). To get to $2 per pip, you'd simply trade 2 mini lots.

By following this simple process, you've systematically found the perfect position size. A 25-pip move against you will trigger a planned $50 loss, keeping you safely within your 1% risk rule.

If you want to dig deeper into the mechanics, you might find our guide on the fundamentals of Forex order types, margin, leverage, and lot size really helpful. This isn't just theory; it’s how you turn risk management into a precise, actionable skill.

How Small Trades Reshape Market Dynamics

When you decide on your lot size, it feels like a personal calculation—just you, your account, and your risk tolerance. But zoom out, and you'll see that when millions of traders make that same choice, their combined actions are powerful enough to reshape the entire market.

The explosion of retail trading has ushered in a new era. It’s a period defined by smaller, more frequent trades, creating a fascinating paradox: market volumes have skyrocketed, yet the average size of each individual trade has actually shrunk. This isn't just a quirky stat; it’s a sign of a fundamental shift in who is trading and how.

The New Market Landscape

The collective force of traders using smaller lot sizes has completely changed the nature of market liquidity. The old model of large, infrequent block trades from big institutions is no longer the whole story. Now, markets are fed by a constant, high-frequency stream of smaller orders.

This has a real-world impact on how everything works, from market-making algorithms to where trades even get executed. A massive chunk of these smaller retail orders never even hits a public exchange like the NYSE. Instead, they're routed to off-exchange venues—private platforms built to handle millions of tiny trades with incredible efficiency. Their rise is direct proof of the retail trader's growing influence.

The modern market is no longer just a story of big institutions. It's a tale of millions of individual traders, whose collective actions create the liquidity and volume that define today's financial world. Your small trade matters because it's part of a much larger, market-moving force.

Data from the New York Stock Exchange paints a clear picture of this transformation. Look at the intense volatility in 2020. Average daily volume in the S&P 500 surged, climbing a staggering 76% from January to June.

At the very same time, the average trade size dropped. And where did all that new volume go? Off-exchange venues saw their market share for S&P 500 stocks swell to over 40%. You can dig deeper into the NYSE’s insights on market volume and off-exchange activity to see the numbers for yourself.

This data isn't just academic; it confirms that the market is adapting to a new reality powered by people like you. When you choose a smaller lot size, you’re not just managing your own risk. You're participating in a movement that has redefined market dynamics from the ground up.

To connect your personal strategy to this large-scale market behavior, mastering position sizing is essential. You can dive deeper by exploring our guide on calculating Forex lot size with smart strategies.

Understanding Lot Sizes in Futures Trading

If you're coming from the forex or stock world, you're used to picking and choosing your trade size. The futures market plays by a different set of rules. Here, the lot size isn't a variable you adjust; it's a fixed, standardized quantity that's baked right into the contract itself.

This standardization is what makes the entire futures market tick. It ensures that everyone is trading the exact same unit, which creates incredible liquidity and transparency. For example, when you trade one standard contract of Crude Oil futures (CL), you’re not just trading an idea. You are trading a specific commitment for 1,000 barrels of physical oil. No more, no less.

Standardized Contracts Mean Standardized Risk

This rigid structure simplifies some things but puts a massive emphasis on position sizing. Since you can't decide to trade a "mini" version of a crude oil contract, your account must be large enough to handle the risk that comes with a full 1,000-barrel position.

In futures, the lot size is the market. It’s a universal agreement that allows a farmer in Iowa and a financial firm in London to trade corn with absolute clarity on the quantity being exchanged. This standardization is what makes global commodity trading possible.

This level of uniformity also offers some powerful insights. Regulators and analysts watch the number of open contracts (lots) held by major players like a hawk. The Commodity Futures Trading Commission (CFTC), for instance, publishes weekly reports that break down these positions. By looking at what the biggest traders are doing, you can get a real sense of market sentiment. You can see this data for yourself in the official CFTC Commitments of Traders reports.

Ultimately, getting a handle on these fixed contract sizes is fundamental to identifying meaningful supply and demand zones in trading and navigating the unique landscape of the futures markets.

Common Questions About Lot Size

As you start wrapping your head around lot sizes, a few questions always seem to pop up. Let's tackle some of the most common ones to clear up any lingering confusion and make sure these concepts really stick.

Can I Trade With Less Than a Micro Lot?

You bet. The trading world has opened up tremendously, and brokers have followed suit. Many now offer nano lots, which are just 100 units of a currency.

Some platforms even let you punch in a specific number of units, giving you incredibly precise control over your position size. This is a game-changer for traders with smaller accounts or anyone who wants to test a new strategy with minimal skin in the game.

How Does Lot Size Affect My Trading Strategy?

Think of your lot size as a critical gear in your trading engine, not just some add-on. It has to mesh perfectly with your overall approach.

For instance, a scalper who jumps in and out of the market for tiny pip gains will probably use a larger lot size. Why? Because it’s the only way to make those small, quick wins add up to anything meaningful.

On the flip side, a long-term trend trader might use a much smaller lot size. Their strategy involves wider stop-losses to ride out the market’s inevitable bumps over weeks or even months.

The right lot size makes sure the risk you're taking on a trade actually matches what your strategy is trying to accomplish. Getting this wrong is one of the quickest ways to blow up an otherwise solid trading plan.

How Do I Choose the Right Lot Size?

This is the most important question of all, and the answer is simple: always start with risk, not profit. Forget about how much you could make and focus on how much you’re willing to lose.

The most disciplined way to do this is by risking a small, fixed percentage of your trading account on every single trade. Most seasoned traders stick to 1-2%.

Just follow the formula we covered earlier:

- Figure out your maximum risk in dollars (e.g., 1% of your account).

- Determine where your stop-loss needs to go based on your technical analysis.

- Calculate the lot size that respects those two numbers.

This approach keeps you in the game. It ensures that one bad trade—and you will have them—won't cripple your account.

At Colibri Trader, we focus on teaching traders how to master price action and manage risk for consistent results. Our programs are designed to give you the practical, no-fluff guidance you need to trade with real confidence. Start your journey with Colibri Trader today!