What Is Capital Preservation a Trader’s Most Critical Rule

In trading, there's one rule that trumps all others: protect your capital. This isn't just a passive idea; it's an active strategy focused on shielding your trading account from the kinds of losses that can knock you out of the game for good.

You can think of it as defensive driving. You’re not avoiding the road (the market) altogether, but you're managing risk so intelligently that you can navigate the traffic, avoid the pile-ups, and keep moving toward your destination.

Why Capital Preservation Is Your Most Important Trading Tool

Picture a master carpenter. Their tools are everything. They keep their saws sharp, their chisels organized, and everything protected from rust. Why? Because without those tools, they can't work. They can't build anything, and they certainly can't earn a living.

For a trader, your capital is your entire toolkit. Every single dollar is a tool you need to do your job.

Losing a little capital is like chipping a chisel—annoying, but fixable. A catastrophic loss, however, is like snapping your best saw in half. It renders you ineffective. This is why understanding capital preservation means treating your trading account with the same respect a master craftsman has for their tools.

This mindset is an active, ongoing process, not something you just set and forget. It boils down to a few core disciplines:

- Disciplined Risk Management: Sticking to a strict set of rules to limit how much you can lose on any single trade. No exceptions.

- Strategic Patience: Realizing that knowing when not to trade is just as powerful as knowing when to pull the trigger.

- Emotional Control: Making decisions based on a logical plan, not the highs of greed or the lows of fear.

The goal isn't to never lose—losing is just a cost of doing business in the markets. The goal is to make sure that no single loss, or even a string of them, can ever take you out of the game. Your ability to trade tomorrow depends entirely on how well you protect your capital today.

This principle isn’t unique to trading. Financial strategies for retirees, for instance, often center on a critical shift from wealth accumulation to capital preservation as they look to protect their nest egg.

But for a trader, this defensive mindset isn't something you adopt later in your career. It has to be the foundation you build from day one. Every strategy you develop and every position you take must start with one simple question: "How am I protecting my capital first?"

The Unforgiving Math of Trading Losses

Most new traders get completely fixated on how much they could win. They see the chart, they see the potential profit, and that’s all they think about. But if you talk to any trader who’s been in the game for a while, they’ll tell you a much harsher truth: the math behind your losses is brutal.

The entire road to profitability is paved not with huge, glorious wins, but with the careful, almost boring, management of your losses. This is where a concept called asymmetrical returns comes into play, and it’s a game-changer once you grasp it.

Put simply, the percentage you need to make back after a loss is always bigger than the percentage you lost in the first place. Lose 10%? You need an 11.1% gain just to get back to even. That might not sound too bad, but the numbers get out of hand incredibly fast.

A 25% loss demands a 33% gain to break even. A 50% loss requires a staggering 100% gain. A 75% loss? You need a 300% gain just to get back to zero.

This punishing math is precisely why capital preservation isn't just a "nice to have" defensive tactic; it's the only way to survive long-term. Every major loss you take digs a financial hole that gets exponentially harder to climb out of. In trading, we call this hole a drawdown. We’ve written a whole guide on this, which you can check out here: what drawdown is in trading.

The Psychological Toll of Deep Drawdowns

Beyond the cold, hard numbers, big drawdowns do serious psychological damage. Once your account is chopped in half, your brain just doesn't work the same. Rational decision-making goes out the window.

- Revenge Trading: You get that desperate feeling that you need to "win it back" right now. This leads to impulsive, oversized trades that almost always make the situation worse.

- Fear of Execution: On the flip side, a big hit can paralyze you with fear. You start second-guessing every valid setup, missing out on real opportunities to claw your way back slowly and correctly.

- Shattered Confidence: Your belief in your strategy—and, frankly, in yourself—can be completely wrecked. It's almost impossible to trade with the objective clarity you need to succeed when you feel like this.

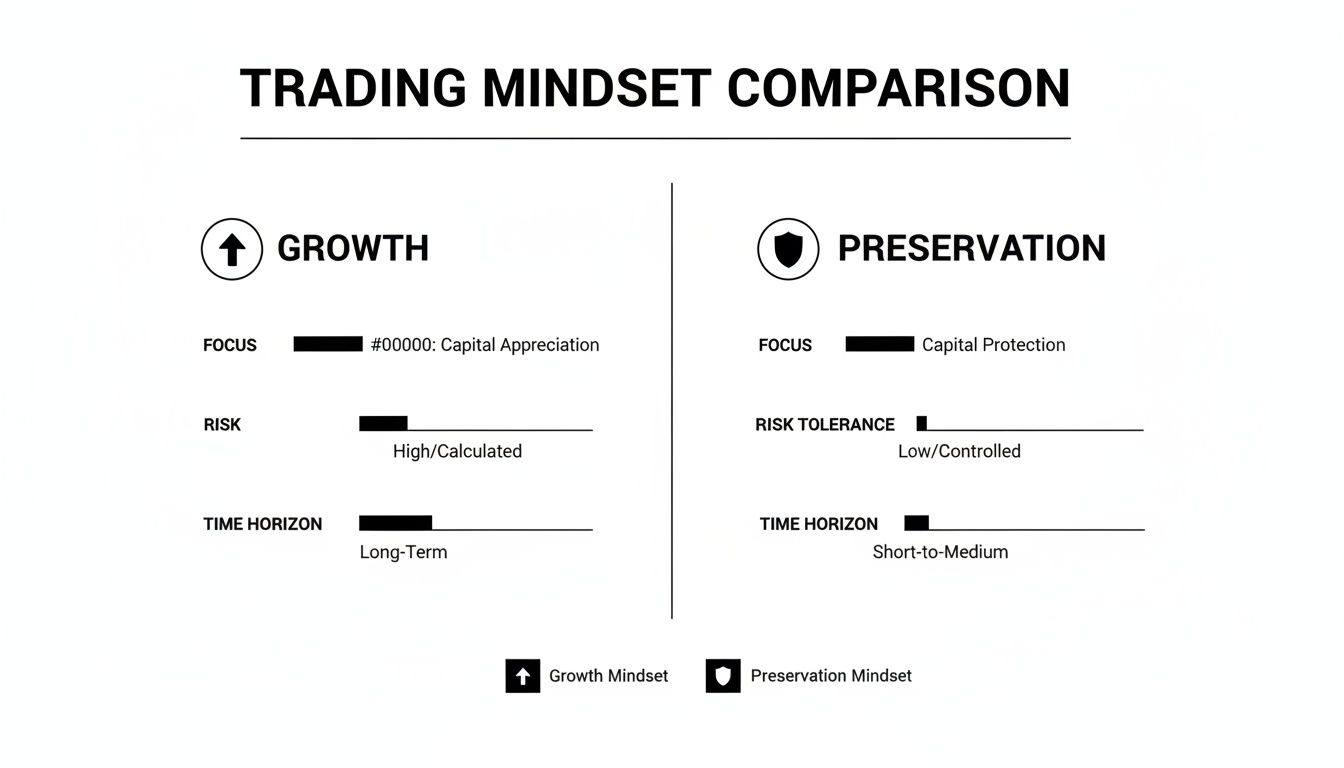

This infographic does a great job of contrasting the all-out growth mindset with a more professional, preservation-first approach.

As you can see, it’s all about consistency and survival, not chasing jackpots.

Staying in the Game Is the Only Way to Win

Look at the history—the data doesn't lie. One study analyzing global stock markets from 1921 to 1995 found that markets that eventually failed completely plunged by an average of 27% in their final year. A 27% loss requires a 37% gain just to recover. Good luck finding that kind of return in a collapsing market.

The lesson here is simple: you have to protect your capital to survive the inevitable storms so you're still around to participate in the recovery. Your number one job as a trader isn't hitting home runs. It’s simply to stay in the game long enough for your edge to play out over a large sample of trades.

By making capital preservation the absolute bedrock of your trading plan, you give yourself the financial and mental breathing room to trade another day. And another day after that. That's how you win.

Building Your Personal Capital Preservation Rules

Alright, so you get it. You understand the unforgiving math of taking a big loss. Now, let’s turn that knowledge into a set of rock-solid, non-negotiable rules for your trading account.

Think of these rules as your first line of defense. They aren't just vague ideas; they're the concrete laws that will govern your trading plan, protecting you from your own worst impulses.

The most fundamental of these is the 1-2% Rule. This is simple but powerful: never risk more than 1% to 2% of your entire account on a single trade. If you're trading with a $10,000 account, your absolute maximum loss on any one position is just $100 to $200. That's it.

This small, fixed risk means no single trade can ever blow up your account. One loss won't sting. Even a string of five consecutive losses only results in a manageable 5-10% drawdown, which is something you can recover from. This rule works hand-in-hand with proper position sizing. You can see exactly how to calculate your trade size based on your risk in our guide on what lot sizing is.

Establishing Your Circuit Breakers

Beyond single-trade risk, you need to set up personal "circuit breakers." These are hard stops designed to pull you out of the market when a losing streak hits, stopping emotional, revenge-trading dead in its tracks.

Your main circuit breakers should be:

- Maximum Daily Loss: A hard stop for the day once your losses hit a specific percentage, usually around 3-4% of your account.

- Maximum Weekly Drawdown: A rule that forces you to step away for the rest of the week if your account balance drops by a set amount, typically 5-7%.

Think of these limits as the emergency brake in your car. When you hit them, you don't just slow down—you stop. Completely. This forces a mental reset, giving you the space to review what went wrong and come back to the market with a clear head.

By defining these rules before you ever place a trade, you take emotion out of the equation. There’s no room for debate, no "just one more trade" mentality. Once a limit is hit, the decision has already been made for you. You just follow the plan.

Of course, a holistic approach to preserving your wealth goes beyond just the trading day. Building robust capital preservation rules also means understanding and using smart investment tax strategies to protect your long-term gains from being eaten away by taxes.

These personal rules—the 1-2% rule, daily loss limits, and weekly drawdown stops—are what capital preservation looks like in practice. They provide the structure you need to stay disciplined, manage risk like a professional, and make sure you stay in the game long enough to find consistent success.

Practical Price Action Strategies for Capital Preservation

Alright, you've got your personal rules down. Now it's time to put them to work on the actual charts. Real capital preservation isn't some abstract idea; it's about making smart, live decisions based on what the market is doing right in front of you. Price action is what gives you the objective map you need to manage your risk like a professional.

These strategies will shift your entire mindset. You'll stop guessing where the market might go and start defining exactly where your trade idea is proven wrong. That's the heart of professional risk management.

Use Intelligent Position Sizing

So many traders fall into this trap: they pick a random position size, like one standard lot, for every single trade they take. This is a massive mistake. It completely ignores that every trade setup has its own unique risk profile.

Intelligent position sizing flips that script. You start with your risk, not a gut feeling about how much you could make.

Here’s how it works:

- Define Your Max Risk in Dollars: Using your 1-2% rule, figure out the absolute maximum cash you're willing to lose. On a $10,000 account, 1% is $100. That's your line in the sand.

- Find Your Stop-Loss Level: Let the chart tell you where your trade is invalidated. This isn't a guess; it's a technical level, like just below a key support zone or above a recent swing high.

- Calculate Your Position Size: Now, your trade size is simply a function of the distance between your entry and your stop. The goal is to make sure that if you get stopped out, you lose exactly your predefined dollar amount (e.g., $100) and not a penny more.

With this method, your dollar risk stays constant, even when market volatility is all over the place. A wider stop means you take a smaller position. A tighter stop lets you take a larger one. But the amount of capital you have on the line never changes.

Place Your Stop-Loss Strategically

The stop-loss is your single most important tool for preserving capital, but where you place it makes all the difference. Put it too close, and you'll get knocked out by random market noise. Put it too far, and you're just taking on more risk than you need to.

A strategic stop isn't based on some arbitrary number of pips or points. It's placed based on market structure—the objective price levels that invalidate your reason for getting into the trade in the first place.

Your stop-loss should mark the point of no return for your trade idea. If price hits that level, your analysis was wrong. It’s time to get out with a small, managed loss and move on.

Great spots for strategic stops include:

- Behind a clear supply or demand zone.

- Just below a major swing low for a long trade.

- Just above a significant swing high for a short trade.

By anchoring your stop to what the market is actually doing, you give your trade room to work while keeping a hard-line defense on your account balance. To get deeper into this, check out our guide on the best ways to set your stop-loss and take-profit levels in our detailed guide.

Treat Cash as a Defensive Position

Here’s one of the most powerful—and most overlooked—capital preservation strategies out there: just sit on your hands. Staying out of the market is a move in itself.

Cash isn't just the absence of a trade; it's a strategic position. When the market is choppy, unpredictable, or just not offering any clean, high-probability setups, the best trade you can make is no trade at all.

History backs this up. One study of major bear markets found that while US equities cratered by a median of 42.6%, cash actually returned a median of 8.1%. Holding cash wasn't just about dodging bullets; it was a position that actively generated a positive return while everything else was burning down. You can dig into these historical market performance findings for yourself.

Forcing trades in bad conditions is one of the fastest ways to destroy your account. When you learn to be patient and see cash as a valid tool, you protect your capital from needless damage and keep your powder dry for the A+ opportunities that will eventually come along.

Common Trading Mistakes That Destroy Your Capital

Knowing the right strategies is only half the battle. To really protect your account, you have to recognize the common psychological traps that lure traders into making devastating mistakes.

These aren't technical errors. They're behavioral flaws that can incinerate even the most well-funded accounts if you're not careful.

The fastest way to drain your trading account is to deviate from your disciplined, rule-based plan. Let’s break down the three most destructive behaviors that traders fall victim to.

The Trap of Revenge Trading

We’ve all been there. You take a loss, and the sting is immediate. Revenge trading is that desperate, emotional urge to jump right back in and "win back" what you just lost.

It’s a purely impulsive reaction where logic gets tossed out the window. A trader takes a planned, acceptable loss, feels that sting, and then immediately forces another trade—often with a bigger position or a worse setup—determined to erase the red from their P&L.

This almost never ends well. It’s the trading equivalent of a poker player going "on tilt" and shoving all their chips in on a terrible hand. Revenge trading turns a small, manageable loss—a normal cost of doing business—into a catastrophic one.

The Danger of Over-Leveraging

Leverage is a double-edged sword. Yes, it can amplify your gains, but it multiplies your losses with terrifying speed. Over-leveraging is what happens when a trader gets greedy and uses far too much borrowed capital, making their account hypersensitive to the smallest market flickers.

Imagine you risk 10% of your account on a single trade using high leverage. A minor dip against your position, something that would be mere noise on a properly sized trade, can suddenly trigger a margin call and wipe you out completely.

Over-leveraging is a bet against probability. You are essentially hoping the market doesn't make a small, random move against you before it goes your way. This isn't trading; it's gambling with the worst possible odds.

Ignoring Your Stop-Loss

This is perhaps the most fatal mistake of all. You set a stop-loss for a reason: it’s the objective line in the sand where your trade idea is proven wrong.

Yet, so many traders watch the price creep toward their stop and then cancel it, thinking, "I just feel like it's going to turn around."

That "feeling" is pure hope talking, not your strategy. By ignoring your stop, you’re turning a small, defined risk into an unknown, potentially unlimited one. One single trade left to run wild without a stop can undo weeks or even months of disciplined, profitable work. It’s the single fastest way to violate the core principle of capital preservation.

Your Pre-Flight Trading Checklist

All this theory is great, but turning it into action is what actually protects your account. This checklist is your pre-flight routine. It's a simple but powerful tool to make sure you’re guarding your capital before the market even opens. Use it every single day to build the discipline that long-term trading demands.

That discipline is more important than ever. In 2024, global equity markets ballooned to a staggering $126.7 trillion, hitting some breathtaking new highs. While that growth is fantastic, it also hints at potential fragility. That’s precisely why a laser-focus on preservation is so critical right now. You can read more about current capital market trends to get a feel for the landscape.

Your Daily Trading Checklist

Before you even think about placing a trade, run through this list. Have you clearly defined the following?

- Maximum Risk Per Trade: Have I set my position size to risk no more than 1-2% of my total account?

- Daily Loss Limit: Do I have a hard stop for the day (e.g., 3%)? If I hit it, I walk away. No exceptions.

- Weekly Loss Limit: Is my weekly hard stop in place (e.g., 5%)? If I hit this, I'm done until next week.

- Strategic Stop-Loss: Is my stop-loss at a logical price-action level? It should be placed where my trade idea is clearly proven wrong, not just at a random percentage.

- Cash-as-a-Position Rule: Are the market conditions actually clear enough to put capital at risk, or is staying in cash the smarter play today?

Got Questions About Capital Preservation?

Even the best-laid plans can bring up questions. When you're dealing with something as important as protecting your trading capital, it's natural to have a few things you want to clarify. Let’s tackle some of the most common ones I hear from traders.

Does Focusing on Capital Preservation Limit My Profit Potential?

Absolutely not—in fact, it's quite the opposite. A laser focus on capital preservation actually enhances your long-term profit potential.

It might stop you from taking those high-risk, low-probability "jackpot" trades that blow up accounts, but that's a good thing. It keeps you in the game, ready and funded, so you can consistently take advantage of the high-quality setups that align with your trading edge.

Real, sustainable wealth in trading isn't built on a volatile boom-and-bust cycle. It's built on steady compounding and the disciplined avoidance of catastrophic losses. By protecting your account, you guarantee you have the firepower you need when your best opportunities finally show up.

How Do I Stick to My Stop Loss When I Feel a Trade Will Turn Around?

This is a classic head game, a battle every single trader fights. The secret is learning to trust the cool, objective analysis you did before you ever put your money on the line.

Your stop loss isn't just some random price. It’s the specific level where your original trade idea is proven wrong. Hitting your stop isn't a sign of failure; it's a mark of professional discipline. It means your system is working.

A practical tip: Set automated stop-loss orders with your broker the moment you enter a trade. If you find yourself tempted to move it, physically step away from the screen. Consistently honoring your stops is infinitely more valuable to your career than the outcome of any single trade.

What Is the Difference Between Capital Preservation and Just Not Trading?

This is a great question, and the difference is huge. It’s the difference between being active and being passive.

Capital preservation is an active risk management strategy. It means you’re constantly scanning the market, doing your analysis, but only deploying capital when conditions perfectly match your strict criteria for a high-probability setup.

Just not trading is simply sitting on the sidelines, often out of fear or indecision, without any real plan.

A trader practicing capital preservation understands that cash is a strategic position. They’re not avoiding the market; they are patiently waiting for the right pitch. It's an act of intelligent capital deployment, not a fearful retreat.

At Colibri Trader, we teach you the price action skills to identify high-probability setups and the discipline to protect your account. Our action-based programs transform your trading by focusing on what works. Take our free Trading Potential Quiz to start your journey.