What is a trailing stop order and how it protects your profits

We've all been there. You're in a winning trade, watching the profits pile up, and then suddenly the market turns. Your gains evaporate in minutes. It’s one of the most frustrating experiences in trading. A trailing stop order is your dynamic safety net, designed to prevent exactly that.

Think of it as an intelligent stop-loss. It automatically follows a profitable position, locking in your gains as the price climbs, but holds its ground the moment the market reverses.

Your Guide to Smarter Profit Protection

Every trader grapples with the same critical question: when do I take profits? If you exit too soon, you leave money on the table. But if you hang on for too long, you risk giving back all your hard-won gains. This constant battle between greed and fear can wreck even the most solid trading plan.

This is precisely where a trailing stop becomes your best ally. It takes the emotion out of your exit strategy, giving you the confidence and discipline to ride a trend for all it's worth. Unlike a static stop-loss that stays put, a trailing stop is alive. It trails the market price at a distance you set, creating a floor for your profits that only moves up, never down.

How It Builds Discipline

By automating your exit, a trailing stop forces a systematic, rules-based approach. It’s a powerful tool for building the kind of discipline that leads to long-term success. Here’s how:

- Automated Profit Locking: It secures your profits as a trade develops, so you don't have to be glued to your screen.

- Emotionless Decision-Making: It stops you from making impulsive moves based on market noise or the fear of a small pullback.

- Maximized Trend Riding: It gives your winning trades the room they need to run, helping you capture the bulk of a major market move.

A well-placed trailing stop acts as your personal risk manager. It works tirelessly in the background, protecting your capital while giving your profitable trades the room they need to grow. This focus on protecting what you've earned is a cornerstone of smart trading.

This guide will break down the entire process, giving you a practical framework for adding trailing stops to your trading arsenal. Mastering this tool is a huge step toward better capital preservation and more consistent results. To dive deeper, you can learn more about the importance of capital preservation in our detailed article.

How a Trailing Stop Order Actually Works

To really get what a trailing stop order is, let's forget the textbook definitions and think about it like this: Imagine you're climbing a ladder. With every step you take, you move a safety clamp up one rung with you. If you happen to slip, that clamp is there to catch you. But here's the key—it never moves down. It only follows you up.

A trailing stop order works on the exact same principle, but for your trades. It's your automated safety net.

When you set one up, you define a "trail value" or distance. This can be a fixed dollar amount (like $2), a specific number of points, or a percentage (say, 5%) below the current market price if you're in a long position. This number is crucial because it tells your stop how far to follow the price as it moves in your favor.

As the asset's price climbs, your stop-loss automatically ratchets upward, always keeping that preset distance from the new high. If the price jumps by $10, your stop moves up by $10. But the moment the price starts to pull back, your stop-loss digs in its heels. It stays locked at its highest point, acting as a firm floor to protect your accumulated gains.

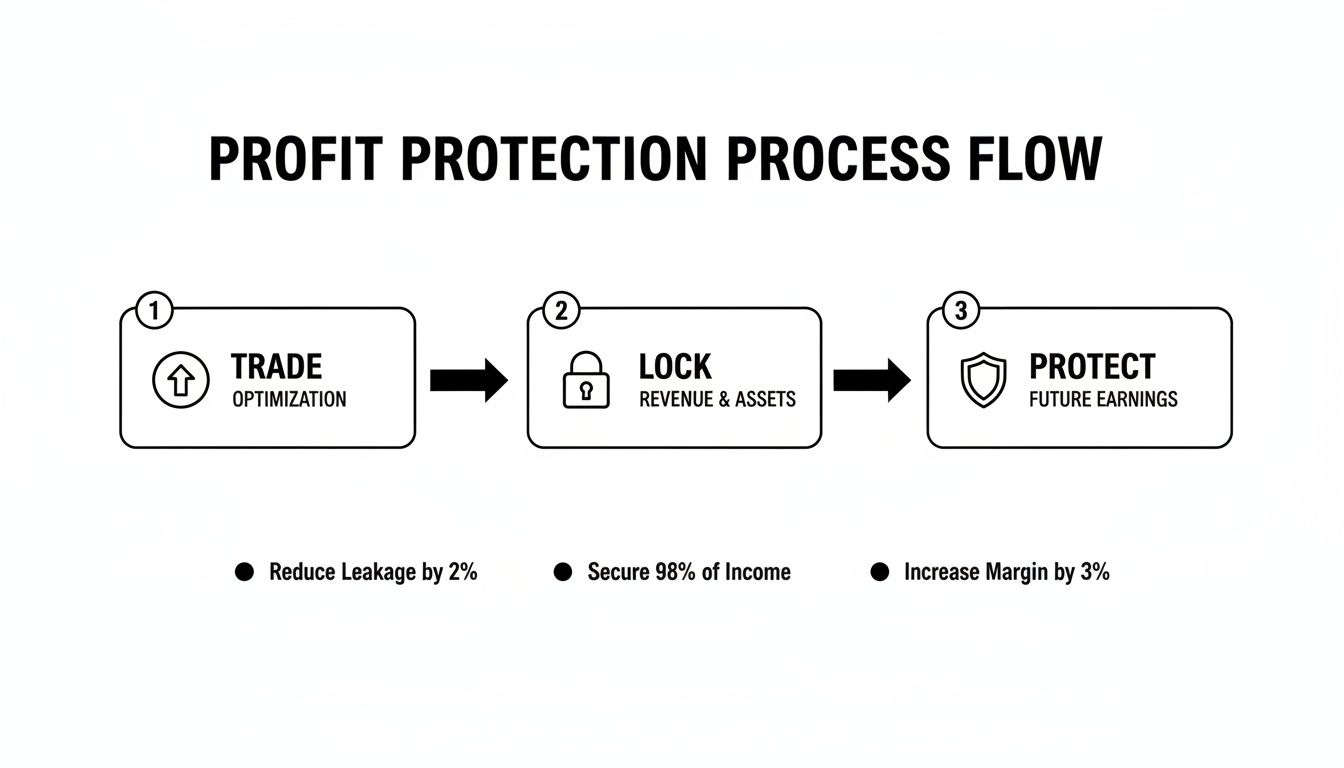

This visual shows the simple yet powerful flow of how a trailing stop locks in and protects your profits.

This whole process is automated. It lets a winning trade run while standing guard against a sudden, nasty reversal.

The Automated Adjustment in Action

Let’s walk through a real-world example. Say you buy a stock at $100 a share and set a 10% trailing stop. Here’s how it plays out:

- Initial Setup: Right away, your stop-loss is placed at $90 ($100 – 10%). If the stock immediately tanks, you’re out at $90, capping your loss. Simple enough.

- Price Rises: The stock does well and climbs to $120. Your trailing stop automatically moves up with it, recalculating to $108 ($120 – 10%). You've just locked in at least an $8 profit per share without lifting a finger.

- Further Gains: The momentum continues, and the price hits a new peak of $150. Your stop-loss is now trailing right behind at $135 ($150 – 10%). At this point, you've secured a minimum profit of $35 per share.

- Market Reversal: Now, the stock hits a bit of turbulence and pulls back to $140. Your trailing stop doesn't budge. It stays firmly planted at its highest point of $135.

- Order Execution: If the price keeps falling and touches $135, your trailing stop order is triggered. A market order is instantly sent to sell your position, and you exit the trade, banking that $35 profit.

This automated mechanism is a game-changer. It takes the emotional guesswork out of deciding when to close a winning trade. It’s a very different beast from other order types, and you can explore the differences between a stop-limit and stop-loss order in our detailed guide.

Thriving During Volatility: A Real-World Case

The true power of this tool becomes crystal clear during extreme market volatility. Think back to the 2008 financial crisis. After Lehman Brothers collapsed on September 15, the Dow plummeted over 500 points in a single day. Chaos.

Traders using trailing stops on safe-haven assets like gold (XAU/USD) were far better protected. For instance, a trader who went long on gold from $800 with a 5% trailing stop would have watched their stop automatically rise to $960 as gold peaked near $1,011. When the inevitable correction came, that stop held firm, locking in a huge gain while many others were getting liquidated.

In fact, some data from that period shows that hedged portfolios using trailing stops had 41% higher survival rates compared to buy-and-hold strategies, which saw average equity losses of 55%. That's not a small difference; it's the difference between surviving a crash and getting wiped out.

Trailing Stop Orders in Real-World Trading

Theory is one thing, but seeing a trailing stop order in action is where it really clicks. To make it tangible, let's walk through two common scenarios that price action traders face every day. We'll see how this dynamic tool adapts to different markets and assets.

These examples go beyond abstract ideas. They give you a concrete, moment-by-moment feel for how a trailing stop works in the real world.

Example 1: The Trending Stock Long Position

Imagine you’ve spotted a strong uptrend in a popular tech stock. You decide to go long, buying 100 shares at $200 each. Your goal is to ride this wave as far as possible without giving back all your gains if it suddenly turns south.

Instead of a fixed stop-loss, you set a 10% percentage-based trailing stop.

- Initial Stop Placement: Right away, your stop is set at $180 ($200 – 10% of $200).

- Price Appreciation: The stock takes off, climbing to a new high of $230. Your trailing stop automatically follows it up to $207 ($230 – 10%), locking in a guaranteed profit of $7 per share.

- Sudden Pullback: The stock then dips a little to $225. Your stop doesn't move. It stays put at $207, protecting your profits.

- Exit Trigger: If the price keeps dropping and hits $207, your order executes. The shares are sold, and your profits are secured.

This hands-off approach lets you ride the trend with peace of mind. To stay on top of opportunities like this, traders often use tools like a CoinMarketCap watch list to keep an eye on asset performance.

Example 2: The Volatile Forex Short Position

Now, let's switch gears to a short trade in a fast-moving forex pair like GBP/USD. You expect a downward move and short the pair at 1.2500. In a choppy market like this, a point-based trail is often a better fit. You set a 50-pip trailing stop.

- Initial Stop Placement: Your stop is placed at 1.2550 (50 pips above your entry).

- Price Drop: The pair drops nicely to 1.2400. Your stop automatically trails down to 1.2450, securing 50 pips of profit.

- Whipsaw Action: The market briefly spikes up to 1.2430, but it's not enough to hit your stop. The trade stays open.

- Exit Trigger: If the price reverses and climbs to 1.2450, your position is closed automatically, and you exit with your locked-in gains.

This method is perfect for banking profits in markets that can change direction in a heartbeat. Of course, knowing the pros and cons of using trailing stops is crucial before jumping into volatile scenarios like this one.

To truly appreciate the difference this tool can make, let’s compare it directly with a traditional fixed stop-loss.

Trailing Stop vs Fixed Stop-Loss: A Practical Comparison

The table below shows how a hypothetical trade might play out with each type of stop order. It really highlights how a trailing stop excels at protecting profits while letting a winning trade run.

| Scenario Feature | Trailing Stop Order | Fixed Stop-Loss Order |

|---|---|---|

| Trade Setup | Buy 100 shares at $50 | Buy 100 shares at $50 |

| Initial Stop | Set 10% trail, initial stop at $45 | Set fixed stop at $45 |

| Price Rises to $60 | Stop automatically moves up to $54 | Stop remains fixed at $45 |

| Price Pulls Back to $55 | Stop remains at $54, trade is open | Stop remains at $45, trade is open |

| Price Rises to $70 | Stop automatically moves up to $63 | Stop remains fixed at $45 |

| Price Reverses to $63 | Trade is closed at $63 | Trade remains open, unrealized profit drops |

| Outcome | Profit locked in: $13 per share | No profit locked in: Trade is still exposed to a full reversal back to $45 |

As you can see, the trailing stop adapts to the trend, banking profits along the way. The fixed stop offers initial protection but does nothing to secure gains as the trade moves in your favor, leaving you vulnerable to giving everything back.

Key Takeaway: A well-set trailing stop automates one of the hardest parts of trading—deciding when to take profits on a winning position. It enforces discipline by taking fear and greed out of the equation.

A historical case powerfully illustrates this. Imagine trading Apple (AAPL) in early 2020 before its massive rally. If you had bought shares at $70 on February 19 and set a 10% trailing stop, you would have ridden that incredible surge. As AAPL climbed to $80, your stop would have moved to $72; by its peak near $90 in August, your stop was at $81.

In fact, during the 2020 bull recovery, trailing stops with an 8-12% trail on Nasdaq-100 stocks statistically outperformed fixed stops by 22% in risk-adjusted returns. For us at Colibri Trader, this is pure price action in its finest form—spotting a trend and letting a disciplined tool manage the exit.

The Key Advantages of Using Trailing Stops

Bringing a trailing stop order into your trading plan solves some of the biggest problems traders wrestle with. At its heart, this tool is all about automating your discipline and completely changing how you manage winning trades.

The most obvious win is automated profit protection. Think of a trailing stop as a rising floor under your profits in a winning trade. It follows the price up, locking in more and more of your gains without you having to sit there manually tweaking your exit every five minutes.

This frees you from being chained to your screen. You can actually manage your trades without having to watch every single tick.

Removing Emotion from the Equation

A trader’s worst enemy is often their own psychology. That constant tug-of-war between fear and greed is where most of the costly mistakes happen. Fear makes you slam the exit button on a great trade at the first hint of a pullback, leaving a ton of money on the table.

On the flip side, greed whispers in your ear to just hold on a little longer for that extra bit of profit, only to watch a fantastic win turn back into a loser. A trailing stop shuts down those emotional impulses. It runs on one simple, pre-set rule: a specific distance from the highest price.

By setting your exit criteria before the market’s chaos can mess with your judgment, you’re committing to a logical, process-driven decision. This enforces the kind of disciplined exit strategy that is a true hallmark of consistently profitable trading.

It’s a mechanical approach. Your exits are triggered by what the market does, not how you feel.

Maximizing Profits in Trending Markets

Maybe the most powerful reason to use a trailing stop is its knack for letting your winners run. So many traders choke their own upside by setting a fixed profit target. Sure, it locks in a gain, but it also means you could miss out on a monster trend that blasts right past your initial goal.

A trailing stop, though, has no ceiling. It’s designed to let you ride a strong trend for its entire duration, helping you capture a much bigger chunk of the move than you otherwise would have.

Here’s how it helps you squeeze the most out of a trend:

- It adapts to the trend’s momentum: Instead of a static, fixed exit point, your stop moves dynamically with the market.

- It avoids getting shaken out too early: It gives a strong trend the breathing room it needs, so you don’t get stopped out by normal, healthy pullbacks.

- It locks in huge gains: As the trend gets going, your stop will have trailed deep into profitable territory, guaranteeing a substantial win even when the trend finally breaks.

Common Trailing Stop Mistakes and How to Avoid Them

While a trailing stop order is an incredibly effective tool in a trader's arsenal, it's not foolproof. Plenty of traders, especially when they're just starting out, make a few common mistakes that can turn this powerful ally into a source of pure frustration. Getting a handle on these pitfalls is the first step to using trailing stops the right way.

The single biggest and most common mistake? Setting the trail distance too tightly. A narrow trail of just a few percentage points might feel cautious, but it leaves absolutely no room for the market’s natural ebb and flow. You end up getting stopped out by normal volatility or a minor, healthy pullback—a painful event traders call getting "whipsawed."

On the flip side, setting the trail too wide is just as bad. A loose trailing stop might keep you safe from market noise, but it completely defeats the purpose of the tool in the first place: protecting your profits. If the distance is too great, you can give back a huge chunk of your hard-won gains before the stop ever gets hit.

The One-Size-Fits-All Trap

Another classic error is slapping the same trailing distance—say, a fixed 10%—on every single trade, no matter the asset or what the market is doing. This approach completely ignores the most critical factor: volatility. A high-flying tech stock behaves very differently from a slow-and-steady utility stock or a choppy forex pair.

A trail that’s perfect for one is a disaster for another. To really make trailing stops work for you, your approach has to be flexible. It needs to adapt to the unique personality of whatever it is you're trading.

The real goal is to find that sweet spot. You want to give a trade enough room to breathe and mature without risking an unacceptable amount of your profits. Nailing this balance is what separates amateur execution from professional risk management.

Solutions for Smarter Trail Setting

Luckily, you don’t have to guess. There are proven methods to sidestep these costly errors and set much more intelligent trailing stops that actually react to the market.

- Use the Average True Range (ATR): The ATR is a fantastic little indicator that measures an asset's volatility. Instead of a fixed percentage, try setting your trail based on a multiple of the ATR (like 2x ATR). This automatically ties your stop distance to the market's current choppiness.

- Analyze Recent Price Structure: Take a look at the chart. In an uptrend, find the recent swing lows (or swing highs in a downtrend). Placing your trailing stop just below a significant recent support level gives you a logical, context-based cushion that respects how the market is actually moving.

By graduating from fixed percentages and embracing these more dynamic methods, you can stop making the common mistakes. You'll finally turn your trailing stop into the powerful profit-locking tool it was meant to be.

Common Questions About Trailing Stop Orders

Even after you get the hang of trailing stops, some specific questions always pop up. Let's clear up a few of the most common ones so you can start using this tool with more confidence.

What Is the Best Percentage for a Trailing Stop

There’s no magic number here. The "best" percentage is all about the volatility of whatever you're trading. It has to fit the asset's personality.

A wild cryptocurrency might need a wide 15-20% trail just to survive its normal daily swings without getting you stopped out prematurely. On the other hand, a stable, large-cap stock might only need a 5-8% trail. You're looking for that sweet spot: tight enough to lock in profits but wide enough to give the trade room to breathe. A good starting point is to look at the asset's Average True Range (ATR) to set a distance that respects its typical price action.

How Does a Trailing Stop Work for a Short Sale

It works just as well for short positions, but everything is flipped upside down. When you're short, you're betting on the price falling. So, your trailing stop is placed a certain amount above the current market price.

As the price drops (which is what you want), your trailing stop follows it down, protecting your open profits. If the price suddenly snaps back and rallies, the stop holds its ground at its lowest point. The moment the price touches that level, your order triggers a buy-to-cover, closing your short position and banking the profit.

Think of a trailing stop on a short position as a descending ceiling. It follows the price down, protecting your gains, but it will never move back up.

Are Trailing Stop Orders Good in All Market Conditions

Not at all. Trailing stops are trend-following tools. They absolutely shine in markets that are making a clear, sustained move in one direction—either up or down. That's what they were built for: to let you ride a strong trend for as long as possible.

Where do they fall apart? In choppy, sideways, or range-bound markets. In these conditions, the price just bounces back and forth without going anywhere. Using a trailing stop here is a recipe for getting "whipsawed"—you'll get stopped out for small losses over and over as the price wiggles just enough to hit your stop before reversing again. For ranging markets, you're usually better off with traditional fixed stop-losses and firm profit targets.

Ready to stop relying on complex indicators and master the art of price action? At Colibri Trader, we provide straightforward, action-based programs to help you trade with discipline and confidence. Take our free Trading Potential Quiz today!