What Is a Pip in Trading? Your Complete Guide

A pip is like the “cent” to a currency’s “dollar”: it’s the smallest increment a forex quote can move and it underpins how you measure profit and loss. Think of it as your common language in a market full of traders—no matter where you are, a pip speaks the same way to everyone.

Your Quick Answer To What Is A Pip In Trading

Before you place your next order, wrap your head around pips. They’re more than jargon—they’re your built-in risk meter and profit calculator. Whether you’re setting stop-losses or sizing up potential gains, mastering pips is non-negotiable.

A pip stands for “percentage in point” (or sometimes “price interest point”). It was invented to standardize the tiniest price swing you’ll see on a forex chart. Here’s the quick breakdown:

- For most major pairs (think EUR/USD, GBP/USD), 1 pip = 0.0001

- For Japanese Yen pairs (like USD/JPY, EUR/JPY), 1 pip = 0.01

Dig deeper into how pips drive your trades on TIO Markets.

By mastering the concept of a pip, you move from guessing about profits and losses to calculating them with precision. It is the bedrock of disciplined trading.

Pip Fundamentals At A Glance

Below is a quick-reference table. Keep it handy next time you log into your trading platform.

| Concept | Description |

|---|---|

| Definition | The smallest unit of price movement in a currency pair. |

| Standard Value | For most major pairs (e.g., EUR/USD), 1 pip = 0.0001. |

| JPY Pair Value | For Japanese Yen pairs (e.g., USD/JPY), 1 pip = 0.01. |

| Primary Function | It underlies profit/loss calculations and defines the spread on each trade. |

Armed with this snapshot, you’ll translate price shifts into real-world dollars—and steer clear of trading by gut feel alone. Keep practicing, and you’ll soon judge position sizes and potential gains with the confidence of a seasoned pro.

How to Read a Standard Forex Quote

Before you can start counting pips, you first have to know where to find them. Think of a forex quote as a story about the relationship between two currencies.

Every currency pair, like EUR/USD, tells you something important. The first currency (EUR) is the base currency, and the second one (USD) is the quote currency. The price you see is simply how many units of the quote currency it takes to buy one single unit of the base currency.

But when you pull up your trading platform, you won't see just one price. You'll see two: the bid and the ask. This two-sided quote is crucial for understanding how forex trading works, and the tiny gap between them is your cost of doing business.

Breaking Down the Bid and Ask Price

It can feel a little backward at first, but the prices are always shown from the broker's point of view.

Here's a simple way to keep it straight:

- Bid Price: This is what the broker will buy the base currency from you for. It’s the price you get when you sell.

- Ask Price: This is what the broker will sell the base currency to you for. It's the price you pay when you buy.

You'll always notice the ask price is a touch higher than the bid. That little difference is called the spread. Think of it as the broker's commission for handling your trade.

So, if you see EUR/USD quoted as 1.1050 / 1.1052, the spread is just 2 pips.

The fourth decimal place is where the magic happens—that's the pip. In our example (1.1050), that final "0" is the pip digit. If it moves up or down by one, that's a one-pip move.

You might also see some brokers add a fifth decimal place for even greater precision. This tiny fraction is called a pipette, and it's worth one-tenth of a standard pip. While it's handy for certain high-frequency strategies, the good old pip is still the main unit of measurement for most traders.

Calculating Pip Value And Why It Matters

Grasping the concept of a pip is one thing; turning it into a tangible dollar amount is another. When you nail this calculation, you swap guesswork for a clear picture of potential gains and losses.

Pip value isn’t set in stone—it changes based on two main factors:

- Currency Pair: Each cross moves differently.

- Position Size: Bigger trades amplify each pip’s impact.

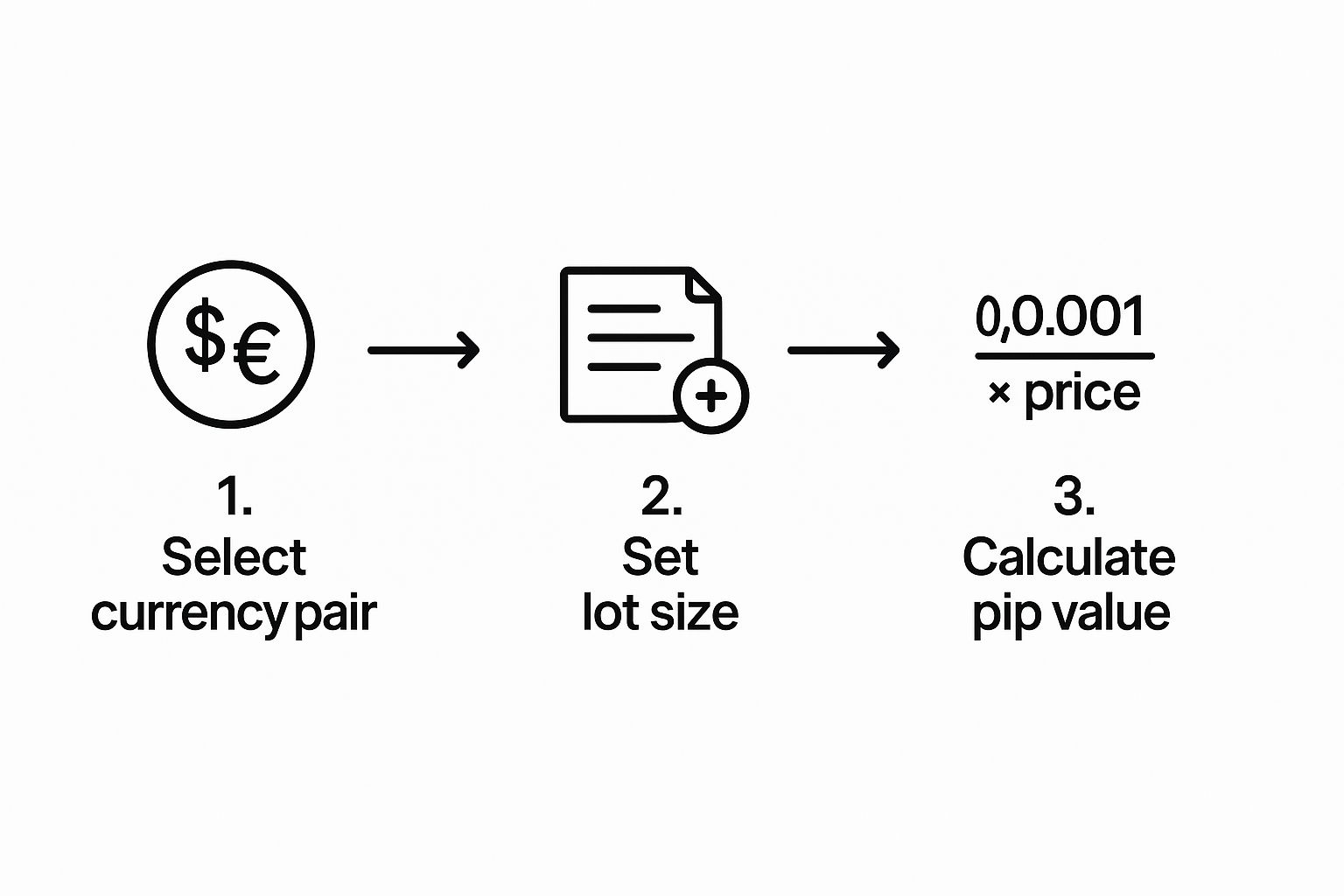

At its core, you pick your pair, define your lot size, then plug the numbers into a simple formula. The image below lays out these steps in a visual format.

This graphic shows how price and lot size come together to give you a straightforward dollar figure per pip. With that number in hand, every trade becomes a data-driven decision.

The Formula And Practical Examples

To see this in action, consider the basic formula:

Pip Value = (0.0001 / Current Exchange Rate) × Trade Size

Now, let’s break that down with real numbers.

Here’s how pip values stack up when trading EUR/USD at a 1.2500 rate:

Pip Value Examples Across Different Lot Sizes (EUR/USD)

| Lot Size | Units | Approximate Value per Pip |

|---|---|---|

| Standard | 100,000 | $10 |

| Mini | 10,000 | $1 |

| Micro | 1,000 | $0.10 |

Notice how as position size climbs, each pip move hits your account harder. A standard lot swing of just 5 pips translates to a $50 gain or loss, while a micro lot move barely nudges $0.50.

Understanding these differences is key, so don’t forget to explore our full guide on what a lot size is in trading.

Knowing your pip value before you pull the trigger turns trading into a calculated business move, not a gamble.

Armed with this calculation, you can set stop-loss and take-profit levels in dollars, not just pips. For example, a 20-pip stop on a mini lot means risking exactly $20—no surprises, no second-guessing.

The Role of Pips in the Global Forex Market

It’s easy to get lost in what a pip means for our own trades, but let's zoom out for a second. Pips are the universal language of the entire foreign exchange market. Think of it as a massive ecosystem where big banks, institutions, and regular traders like us are constantly moving trillions of dollars.

These tiny increments aren't just numbers on a screen; they are the very pulse of the market. Every single pip movement, no matter how small it seems, reflects a shift in global supply and demand, investor mood, and powerful economic forces.

In a market where the average daily turnover topped $7.5 trillion in 2022, even a fractional price change can mean billions of dollars are changing hands.

A single pip might seem insignificant, but collectively, millions of these tiny movements create the major trends and volatility that traders seek to profit from.

How Pips Connect to Different Trading Styles

The importance of a single pip changes drastically depending on how you trade. Your personal strategy really dictates how you interact with these price movements and how many you need to catch for a trade to be a success.

Here’s a quick look at how different traders might think about their pip targets:

- Scalpers: These traders live life in the fast lane, operating on the shortest timeframes to grab profits from tiny price changes. A scalper might be in and out of a trade in minutes, aiming for a quick gain of just 5 to 10 pips.

- Day Traders: With a slightly longer view, day traders open and close all their positions within the same day. They’re often looking to capture intraday trends, targeting anywhere from 20 to 50 pips on a trade.

- Swing Traders: These traders are more patient, holding positions for several days or even weeks to ride larger market swings. A solid swing trade could bring in 100 to 250 pips, sometimes even more.

Understanding this helps you see where your own strategy fits into the grand scheme of things. No matter the style, every trader uses pips as the fundamental building block for setting profit goals and, just as importantly, stop-losses.

The real power of these small units gets amplified by your trade size and, for many traders, the smart use of leverage. To get a better handle on this relationship, take a look at our guide on what leverage is in forex. At the end of the day, every trading strategy is really just a unique game of stacking up these small, but critical, increments.

How to Use Pips in Your Trading Strategy

Knowing what a pip is is one thing. Actually putting that knowledge to work is where the magic happens in trading. Instead of just passively watching prices wiggle on a chart, you can use pips as a real tool to bring structure and discipline to every single trade. This is how you shift from simply reacting to the market to proactively planning your every move.

The most powerful way to use pips is in managing your risk. Plain and simple. Before you even think about clicking the "buy" or "sell" button, you should know exactly where you'll cut your losses if the trade goes south. You do this with a stop-loss order, which is basically your financial safety net.

Let's say you decide the most you're willing to lose on a particular trade is 20 pips. You’d place your stop-loss order exactly 20 pips away from your entry price. Just like that, you’ve taken the emotion out of the painful decision to close a losing trade.

Setting Profit Targets with Pips

On the flip side, pips are just as crucial for cashing in on your winners. A take-profit order does the heavy lifting for you by automatically closing your position once the price hits a level you've already decided on. This makes sure you actually bank your profits before the market decides to turn around.

It works the same way as a stop-loss. If your analysis tells you there's a good chance for a 60-pip move in your favor, you set your take-profit order right at that level. This kind of structured approach keeps greed from clouding your judgment and forces you to stick to your original game plan.

When you use both of these orders together, you build a solid, logical framework for every trade you take.

Using pips to set stop-loss and take-profit levels transforms trading from a speculative gamble into a calculated strategy with defined risk and reward parameters.

Building a Risk-to-Reward Ratio

This brings us to one of the absolute cornerstones of trading: the risk-to-reward ratio. By defining your stop-loss and take-profit in pips, you can figure out this ratio before you ever risk a single dollar.

Let's stick with our last example:

- Your Risk: A 20-pip stop-loss

- Your Potential Reward: A 60-pip take-profit target

In this scenario, your risk-to-reward ratio is 1:3. This is huge. It means for every one dollar you're putting on the line, you stand to make three. Consistently finding and taking trades with a healthy ratio like this is a fundamental secret to long-term profitability, because it means your winning trades will far outweigh the sting of your losing ones.

Common Questions About Pips in Trading

Even after you get the hang of what a pip is, a few common questions tend to pop up. It's smart to tackle these head-on because letting small points of confusion slide can lead to bigger, more expensive mistakes down the road. Let's clear up a few of the most frequent ones I hear from traders.

Do Other Assets Besides Forex Use Pips?

While "pip" is almost exclusively a forex term, the basic idea—a standardized minimum price change—is something you'll find in every financial market. They just call it something different.

- Stocks: The smallest move is a penny, or $0.01. Simple as that.

- Futures & Commodities: Here, the minimum price change is called a "tick." The value of a tick changes depending on the specific contract you're trading, so it can vary quite a bit.

So, you won't hear a stock trader worrying about pips, but they're dealing with the same concept: a defined, smallest unit of price movement. It's all about speaking the right language for the right market.

How Does Leverage Affect My Pip Value?

This is a big one, and it trips up a lot of new traders. Let's be crystal clear: leverage does not change the actual value of a pip. A pip on a standard EUR/USD lot is always going to be worth around $10, no matter how much leverage you're using.

What leverage does do is magnify the impact of that $10 pip on your trading account. For example, with 50:1 leverage, you're controlling a $100,000 position with just $2,000 of your own money. The profit or loss per pip is still $10, but because your personal investment is so much smaller, the percentage gain or loss is amplified 50 times over. This is exactly why you need to have a rock-solid grasp of pip value before you even think about using leverage.

A pip's value is constant for a given trade size, but leverage acts as a multiplier on your profits and losses, making each pip's movement feel much larger relative to your account equity.

What Is The Difference Between a Pip and a Pipette?

Think of a pipette as just a fraction of a pip. For most currency pairs, a standard pip is the fourth decimal place (0.0001). A pipette is simply the fifth decimal place (0.00001), which is one-tenth of a regular pip.

Many brokers now offer this fractional pricing to give traders a bit more precision. However, when it comes to the industry standards for calculating things like spreads, profit, and loss, everything is still based on the good old-fashioned full pip.

Ready to stop relying on complex indicators and start trading with clarity? At Colibri Trader, we teach a straightforward, price-action based approach that works in any market. Take our free quiz to find your trading potential and start your journey toward consistent results today at https://www.colibritrader.com.