Top Trading Strategies for Beginners to Start Investing Today

Kickstart Your Trading Journey: A Beginner's Guide to Smart Investing

Want to learn effective trading strategies for beginners? This listicle provides seven proven methods to confidently navigate the markets and achieve your financial goals. Discover core strategies like buy and hold, dollar-cost averaging (DCA), and index fund investing for long-term growth. Explore swing trading, value investing, and momentum trading for more active approaches. We'll also cover the importance of paper trading to practice risk-free. Master these trading strategies for beginners and start investing smarter in 2025.

1. Buy and Hold Strategy

For beginner investors navigating the often-turbulent waters of the stock market, the buy and hold strategy offers a beacon of simplicity and stability. This long-term investment strategy involves purchasing stocks or other securities and holding them for extended periods, often years or even decades, regardless of short-term market fluctuations. It's a passive approach that relies on the historical upward trend of the market, allowing investments to grow steadily over time. This strategy is particularly well-suited for beginners who are new to trading strategies, as it requires minimal time, expertise, and active management.

The buy and hold strategy operates on the principle that over the long term, the market tends to appreciate. While there will undoubtedly be periods of decline and volatility, the overall trajectory is upwards. By holding investments for extended periods, investors can ride out these short-term fluctuations and benefit from the cumulative growth over time. This approach stands in stark contrast to active trading, which involves frequent buying and selling in an attempt to time the market and capitalize on short-term price movements. The buy and hold strategy acknowledges the difficulty, and often futility, of consistently predicting short-term market behavior.

The strength of the buy and hold strategy lies in its simplicity and resilience. It’s an ideal starting point for novice traders seeking foundational techniques, and can even serve as a valuable anchor for experienced traders looking for stability amidst more complex strategies. Its passive nature also resonates with those desiring flexible, location-independent income streams, as it requires minimal daily monitoring.

One of the most compelling arguments for buy and hold is the power of compounding. As dividends are reinvested and the value of the underlying assets appreciates, the returns generated in later years build upon the gains of earlier years, creating a snowball effect. This exponential growth is a key driver of long-term wealth creation.

Numerous examples illustrate the success of this strategy. Warren Buffett’s long-standing investment in Coca-Cola, initiated in 1988, is a classic example. Similarly, investors who recognized the potential of Amazon and held their stock from its IPO in 1997 have reaped enormous rewards. Even more broadly, investors who consistently held positions in an S&P 500 index fund over the past 30 years have seen significant returns, demonstrating the effectiveness of a diversified, long-term approach. These examples highlight the potential for substantial gains when employing a buy and hold strategy.

Here are some actionable tips for implementing a buy and hold strategy:

- Start with broad market index funds or ETFs: This provides instant diversification and reduces risk.

- Set up automatic monthly investments to dollar-cost average: This strategy helps mitigate the risk of investing a lump sum at a market peak.

- Focus on companies with strong fundamentals and competitive advantages: Look for companies with a history of profitability, strong balance sheets, and a sustainable business model.

- Ignore short-term market noise and media hype: Don't be swayed by daily market fluctuations or sensational news headlines. Stay focused on the long-term perspective.

- Reinvest dividends to maximize compound growth: This allows your returns to generate even more returns over time.

- Review holdings annually, but avoid frequent changes: Regular reviews help ensure your investments still align with your long-term goals, but resist the urge to make impulsive trades based on short-term market movements.

While the buy and hold strategy offers numerous advantages, it's crucial to acknowledge its drawbacks. It requires patience and discipline, particularly during market downturns. Investors must be prepared to withstand periods of volatility and resist the urge to sell when prices fall. It also means potentially missing out on short-term profits that might be captured through active trading. Furthermore, capital is tied up for extended periods, limiting access to funds for other opportunities.

Despite these potential downsides, the buy and hold strategy remains a cornerstone of successful investing. Its simplicity, combined with the power of compound growth and the historical upward trend of the market, makes it a compelling choice, especially for beginners. It offers a solid foundation for long-term wealth creation while minimizing the time, effort, and emotional stress associated with more active trading strategies. This approach is particularly valuable for those new to trading strategies for beginners, allowing them to build a solid portfolio without the need for constant monitoring and adjustments.

2. Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a popular trading strategy for beginners, particularly those new to investing in volatile markets. It offers a systematic and disciplined approach to investing, making it an excellent choice for building long-term wealth. Instead of trying to time the market and invest a lump sum at the "perfect" moment, DCA involves investing a fixed dollar amount at regular intervals, regardless of the asset's price. This strategy reduces the impact of market volatility and can lead to a lower average cost per share over time. This is especially beneficial for novice traders navigating the uncertainties of market fluctuations. It's a core component of many successful long-term investment plans and a powerful tool for building a solid financial foundation.

Here’s how DCA works: Let's say you decide to invest $500 every month in an S&P 500 index fund. Some months, when the market is down, your $500 will buy you more shares. Other months, when the market is up, your $500 will buy you fewer shares. Over time, this approach averages out the price you pay per share, reducing the risk of investing a large sum just before a market downturn. This systematic approach removes the emotional element of trying to time the market, a common pitfall for beginners. For intermediate traders struggling with inconsistency, DCA offers a structured method that can improve overall portfolio performance. Even experienced traders can refine their approach by incorporating DCA for specific asset allocations, enhancing risk management and diversification strategies.

The beauty of DCA lies in its simplicity and accessibility. It works with a variety of investment vehicles, including stocks, exchange-traded funds (ETFs), mutual funds, and even cryptocurrencies. This flexibility makes DCA adaptable to diverse investment goals and risk tolerances. Furthermore, DCA can be combined with other investment strategies, such as buy-and-hold, to maximize long-term gains. The automatic nature of DCA makes it an ideal strategy for professionals with limited time or those seeking a more passive approach to investing.

Examples of Successful DCA Implementation:

- Consistent Retirement Contributions: Automatic contributions to a 401(k) or other retirement plan are a classic example of DCA. A fixed percentage of each paycheck is invested, regardless of market conditions, allowing for steady growth over time.

- Building a Crypto Portfolio: Investing a set amount in Bitcoin or other cryptocurrencies weekly, regardless of price fluctuations, can be an effective way to accumulate assets in this volatile market.

- Investing in Index Funds: Regularly investing in a broad market index fund, such as the S&P 500, allows investors to participate in overall market growth while mitigating risk through diversification.

Actionable Tips for Implementing DCA:

- Automate the Process: Set up automatic transfers from your bank account to your brokerage account to remove emotional decision-making and ensure consistent investing.

- Start Small and Consistent: Begin with an investment amount you can comfortably afford and maintain consistently, even during periods of financial strain.

- Consider Increasing Investments During Downturns: While DCA is about consistent investment, consider increasing your investment amount during market downturns to take advantage of lower prices.

- Track Your Average Cost Basis: Monitoring your average cost per share allows you to measure the effectiveness of your DCA strategy and make adjustments as needed.

- Diversify Your Investments: Choose broad market index funds or ETFs to diversify your portfolio and reduce risk.

Pros and Cons of DCA:

Pros:

- Eliminates the need to time the market.

- Reduces the average cost per share over time.

- Builds disciplined investment habits.

- Reduces the emotional impact of market volatility.

- Accessible to investors with limited capital.

- Can be automated through most brokerages.

Cons:

- May result in lower returns during strong bull markets.

- Doesn't protect against prolonged declining markets.

- Opportunity cost if a lump sum investment would have performed better.

- Requires consistent cash flow for regular investments.

- May accumulate losses in consistently declining assets.

DCA deserves a place on this list of trading strategies for beginners because it offers a simple, yet effective, way to enter the market and build long-term wealth. By removing the complexities of market timing and promoting disciplined investing, DCA empowers beginners to navigate market volatility and achieve their financial goals. While not without its drawbacks, the benefits of DCA, especially for those new to trading, make it a valuable strategy to consider.

3. Index Fund Investing

For beginners venturing into the world of trading strategies, index fund investing stands out as a powerful yet remarkably simple approach. It's a passive investment strategy centered around buying and holding index funds or ETFs (Exchange-Traded Funds). These funds are designed to mirror the performance of a specific market index, such as the S&P 500, which comprises 500 of the largest publicly traded companies in the U.S. By investing in an S&P 500 index fund, you instantly own a small piece of each of those 500 companies, providing immediate diversification across multiple sectors. This diversification is a cornerstone of risk management, as it spreads your investment across a broad spectrum, reducing the impact of any single company's poor performance on your overall portfolio. This approach is a solid foundation for any beginner looking to build long-term wealth within a "trading strategies for beginners" framework.

Index fund investing operates on the principle of mirroring market performance. Instead of trying to "beat the market" by picking individual stocks, you aim to match the returns of the chosen index. This is achieved by the fund automatically adjusting its holdings to reflect the index's composition. For instance, if a company is added or removed from the S&P 500, the corresponding index fund will automatically buy or sell shares of that company to maintain its alignment. This automated approach eliminates the need for extensive research and active stock picking, making it a particularly attractive strategy for beginners who may lack the time or expertise to analyze individual companies.

One of the most compelling arguments for index fund investing is its remarkably low cost. Expense ratios, which represent the annual cost of managing the fund, typically range from a mere 0.03% to 0.20% for index funds. This is significantly lower than the fees charged by actively managed funds, which often exceed 1%. Over time, these lower fees can translate into substantial savings and contribute significantly to your overall returns. Moreover, the historical performance of index funds further strengthens their case. Studies have consistently shown that index funds outperform the vast majority (80-90%) of actively managed funds over the long term.

While index fund investing offers numerous advantages, it's essential to be aware of its limitations. By design, an index fund cannot outperform the market it tracks. While this provides stability and predictable returns, it also means you won't experience the potential gains of successfully picking individual winning stocks. Furthermore, index funds offer no protection during broad market declines. If the market falls, your index fund will fall with it. Finally, index funds, by mirroring the market, will inevitably include some poorly performing companies.

For beginners looking to implement index fund investing as part of their trading strategies, several practical tips can enhance their approach. Start by investing in broad market funds like the S&P 500 or total market index funds. These provide comprehensive market exposure and serve as a solid foundation for your portfolio. Carefully compare expense ratios between similar funds to minimize costs. Consider diversifying further by including both domestic and international index funds. Choose ETFs for greater trading flexibility, allowing you to buy and sell them throughout the trading day, or opt for mutual funds if you prefer automatic investing plans. Regularly rebalance your portfolio, perhaps annually, to maintain your desired asset allocation between different index fund categories. Finally, prioritize funds with significant assets under management (at least $1 billion), as these tend to be more stable and liquid. Examples of popular index funds include Vanguard S&P 500 ETF (VOO), SPDR S&P 500 ETF Trust (SPY), Vanguard Total Stock Market Index (VTI), and iShares Core MSCI Total International Stock ETF (IXUS).

Index fund investing, popularized by figures like John Bogle (Vanguard founder), Burton Malkiel (author of 'A Random Walk Down Wall Street'), and embraced by modern robo-advisor platforms, represents a cornerstone of sound, long-term investing. Its simplicity, low cost, and consistent performance make it an ideal starting point for beginners seeking effective trading strategies and a reliable path towards building wealth.

4. Paper Trading: Your Risk-Free Sandbox for Trading Strategies

For beginners venturing into the exciting world of trading strategies, paper trading is an indispensable tool. It’s essentially a simulated trading environment where you can practice buying and selling assets using virtual money, mirroring real market conditions without risking your hard-earned capital. This makes it an ideal starting point for anyone looking to understand how trading works, test different trading strategies for beginners, and gain confidence before putting real money on the line. Whether you're exploring day trading, swing trading, or long-term investing, paper trading provides a valuable risk-free sandbox to hone your skills.

So, how does it work? Most brokerage platforms and trading software offer paper trading features. You'll be given a virtual account with a set amount of "play money." You can then use this virtual capital to trade stocks, options, futures, forex, or any other asset class offered by the platform. You'll see real-time market data and pricing, allowing you to experience the fluctuations and dynamics of the market firsthand. The platform's functionality, including charting tools, technical indicators, and order entry systems, remains fully accessible, providing a truly immersive and realistic simulation. This hands-on experience allows you to develop practical trading skills and test strategies based on technical analysis, fundamental analysis, or a combination of both.

The benefits of paper trading are numerous. First and foremost, it eliminates financial risk. You can make mistakes, experiment with different approaches, and learn from your errors without any monetary consequences. This fosters a learning environment where you can explore various trading strategies for beginners, such as trend following, mean reversion, or breakout trading, without the fear of losing your capital. Secondly, paper trading allows you to familiarize yourself with the intricacies of trading platforms. You can learn how to place orders, manage your portfolio, and interpret market data within a comfortable, risk-free setting. This is crucial for building confidence and avoiding costly mistakes when you eventually transition to live trading. Thirdly, it helps develop emotional discipline. Trading involves managing emotions like fear and greed, which can significantly impact decision-making. Paper trading allows you to experience the emotional rollercoaster of trading without the added pressure of real financial implications.

While the advantages are clear, it's essential to acknowledge the limitations of paper trading. Since there's no real money involved, you won't experience the same emotional pressures and psychological impact of real trading. This can lead to overconfidence and a distorted perception of risk. You might take on larger positions or employ riskier strategies than you would with real money. Another drawback is that paper trading cannot perfectly replicate real market conditions. Factors like slippage (the difference between the expected price of a trade and the actual execution price) and order fills are often simplified in simulated environments.

Despite these limitations, the educational value of paper trading is immense. To maximize its benefits, treat your paper trades as seriously as you would real money trades. Practice with realistic position sizes that align with your actual risk tolerance and capital. Meticulously track your trades, including entry and exit points, rationale for each trade, and the outcome. This detailed record-keeping will allow you to analyze your performance, identify strengths and weaknesses, and refine your trading strategies.

Learn more about Paper Trading

Examples of platforms offering robust paper trading functionalities include TD Ameritrade's thinkorswim, Interactive Brokers' paper trading platform, TradingView's paper trading feature, and E*TRADE's virtual trading simulator. These platforms provide comprehensive tools and features that mirror real market conditions, making them excellent resources for practicing trading strategies for beginners.

Before transitioning to live trading, aim for consistent profitability and a thorough understanding of your chosen strategies in your paper trading account. Remember, consistent success in a simulated environment doesn't guarantee success in real trading, but it significantly increases your chances of navigating the market effectively and achieving your financial goals. Paper trading is a stepping stone, a crucial preparatory phase that empowers you with the knowledge, skills, and confidence to tackle the complexities of the financial markets. It's an investment in your trading education, paving the way for a more informed and potentially profitable trading journey.

5. Swing Trading

Swing trading represents a compelling strategy for beginners venturing into the world of trading strategies. It occupies a sweet spot between the rapid-fire action of day trading and the long-term patience of buy-and-hold investing, offering a balanced approach with the potential for significant returns without demanding constant market monitoring. This makes it an ideal choice for those seeking more active involvement in their investments without the pressure of intraday trading. If you're looking for trading strategies for beginners, swing trading is definitely worth considering.

Swing trading involves holding positions for several days to several weeks, aiming to capitalize on the "swings" or short-term price fluctuations within a stock's overall trend. Unlike day traders who close all their positions before the market closes, swing traders are comfortable holding overnight and through weekends, weathering minor market noise to capture a larger portion of the price move. This approach allows for a more thorough analysis and informed decision-making process, reducing the need for split-second reactions.

Swing traders primarily rely on technical analysis to identify promising trading opportunities. They study chart patterns, indicators like moving averages and Relative Strength Index (RSI), and volume trends to pinpoint stocks exhibiting short-term momentum. They also often incorporate fundamental analysis to confirm the underlying strength of the chosen asset and assess its long-term potential. For instance, a swing trader might identify a stock with a bullish chart pattern but also confirm its strong earnings growth and positive industry outlook before entering a trade. Support and resistance levels are crucial for swing traders, serving as entry and exit points to maximize profits and minimize losses.

Here are some examples of swing trading in action:

- Earnings Dip: Buying Apple stock after a temporary dip following its earnings announcement, anticipating a recovery over the next 2-3 weeks.

- Biotech Catalyst: Trading biotech stocks around anticipated FDA approval announcements, capitalizing on the expected volatility.

- Earnings Season Momentum: Swing trading momentum stocks during earnings season, riding the wave of increased trading activity and potential price surges.

- Sector Rotation: Trading ETFs based on sector rotation patterns, moving capital into sectors expected to outperform in the near term.

Pros of Swing Trading:

- Flexibility: Doesn't require full-time market monitoring, making it suitable for individuals with other commitments.

- Profit Potential: Offers the potential for higher returns compared to buy-and-hold strategies.

- Market Agnostic: Can profit in both bull and bear markets by capitalizing on price swings in either direction.

- Reduced Stress: Less stressful than day trading, allowing for more considered decisions.

- Analytical Approach: Provides ample time for analysis and research before entering and exiting trades.

Cons of Swing Trading:

- Time Commitment: Requires more time and effort than passive investing strategies.

- Transaction Costs: Higher transaction costs than buy-and-hold due to more frequent trading.

- Gap Risk: Subject to overnight and weekend market gaps, which can impact open positions.

- Technical Skills: Requires a solid understanding of technical analysis principles.

- Tax Implications: Profits are typically subject to short-term capital gains taxes.

- Emotional Control: Can be emotionally challenging due to more frequent position changes.

Tips for Beginner Swing Traders:

- Start with Liquidity: Begin with liquid, large-cap stocks to ensure smooth execution and minimize slippage.

- Manage Risk: Always use stop-loss orders to limit potential losses and protect your capital. Learn more about Swing Trading

- Focus and Simplicity: Concentrate on 2-3 stocks maximum when starting to avoid information overload.

- Learn Technicals: Study basic technical analysis patterns and indicators, such as moving averages, support/resistance, and candlestick patterns.

- Position Sizing: Keep position sizes small (1-2% of portfolio per trade) to manage risk effectively.

- Avoid News: Avoid trading around major news events initially, as these can create unpredictable market volatility.

Swing trading, while requiring more engagement than passive strategies, provides an excellent entry point for those seeking to actively participate in the markets. By leveraging technical analysis, managing risk effectively, and adhering to a disciplined approach, beginners can harness the power of swing trading to build a profitable and sustainable trading career. It's a powerful strategy within the broader spectrum of trading strategies for beginners and offers a pathway to financial independence for those willing to dedicate the time and effort to master it.

6. Value Investing

Value investing, a time-tested strategy popularized by investing giants like Benjamin Graham and Warren Buffett, focuses on identifying undervalued stocks. It's a trading strategy for beginners that emphasizes fundamental analysis over short-term market fluctuations. Instead of chasing the latest hot stock tip, value investors meticulously analyze a company's financial health, seeking businesses trading below their intrinsic worth. This discrepancy between market price and intrinsic value creates a "margin of safety," offering the potential for substantial returns when the market eventually recognizes the true value. This approach is especially relevant for those new to trading, as it encourages a disciplined, long-term perspective.

Value investing works by identifying companies with strong fundamentals that the market has temporarily underpriced. This mispricing can occur for various reasons, such as short-term negative news, industry downturns, or general market pessimism. By conducting thorough research and analyzing financial statements, value investors aim to uncover these hidden gems. They look for companies with sustainable competitive advantages, also known as "moats," which protect their market share and profitability over the long run. Examples of moats include strong brand recognition, proprietary technology, or exclusive access to resources. Once a suitable investment is identified, the value investor purchases the stock at a discounted price, anticipating future appreciation as the market corrects the mispricing.

History is replete with examples of successful value investing. Warren Buffett's investment in Bank of America during the 2011 crisis, when the market was panicking, showcases the potential of this strategy. Similarly, Benjamin Graham's investment in GEICO in the 1940s demonstrates the long-term benefits of identifying undervalued, high-quality businesses. The 2008 financial crisis provided another opportunity for value investors to buy quality stocks at significantly depressed prices. More recently, purchasing dividend aristocrats during temporary setbacks has proven to be a fruitful value investing strategy.

To get started with value investing, consider these actionable tips:

- Learn to read and analyze financial statements thoroughly. Understanding a company's balance sheet, income statement, and cash flow statement is crucial for determining its intrinsic value.

- Focus on companies with strong competitive advantages (moats). These advantages provide a buffer against competition and enhance long-term profitability.

- Look for low P/E ratios, high dividend yields, and strong balance sheets. These are common indicators of undervaluation.

- Avoid companies in declining industries despite low valuations. A low price doesn't always signify a good value.

- Be patient – value recognition can take years. The market doesn't always correct mispricing quickly.

- Diversify across multiple undervalued positions. This mitigates the risk associated with individual stock picks.

Value investing deserves a prominent place on any list of trading strategies for beginners for several reasons. It promotes a long-term, disciplined approach, emphasizing fundamental analysis over speculative trading. It provides a margin of safety against losses, reducing the emotional impact of market volatility. Moreover, value investing teaches valuable financial analysis skills, empowering investors to make informed decisions.

Value investing does have its drawbacks. It requires significant time for research and analysis, making it unsuitable for those seeking quick profits. Value traps, companies that appear undervalued but are actually facing fundamental problems, can lead to prolonged underperformance. Furthermore, value investing may underperform during growth-oriented bull markets.

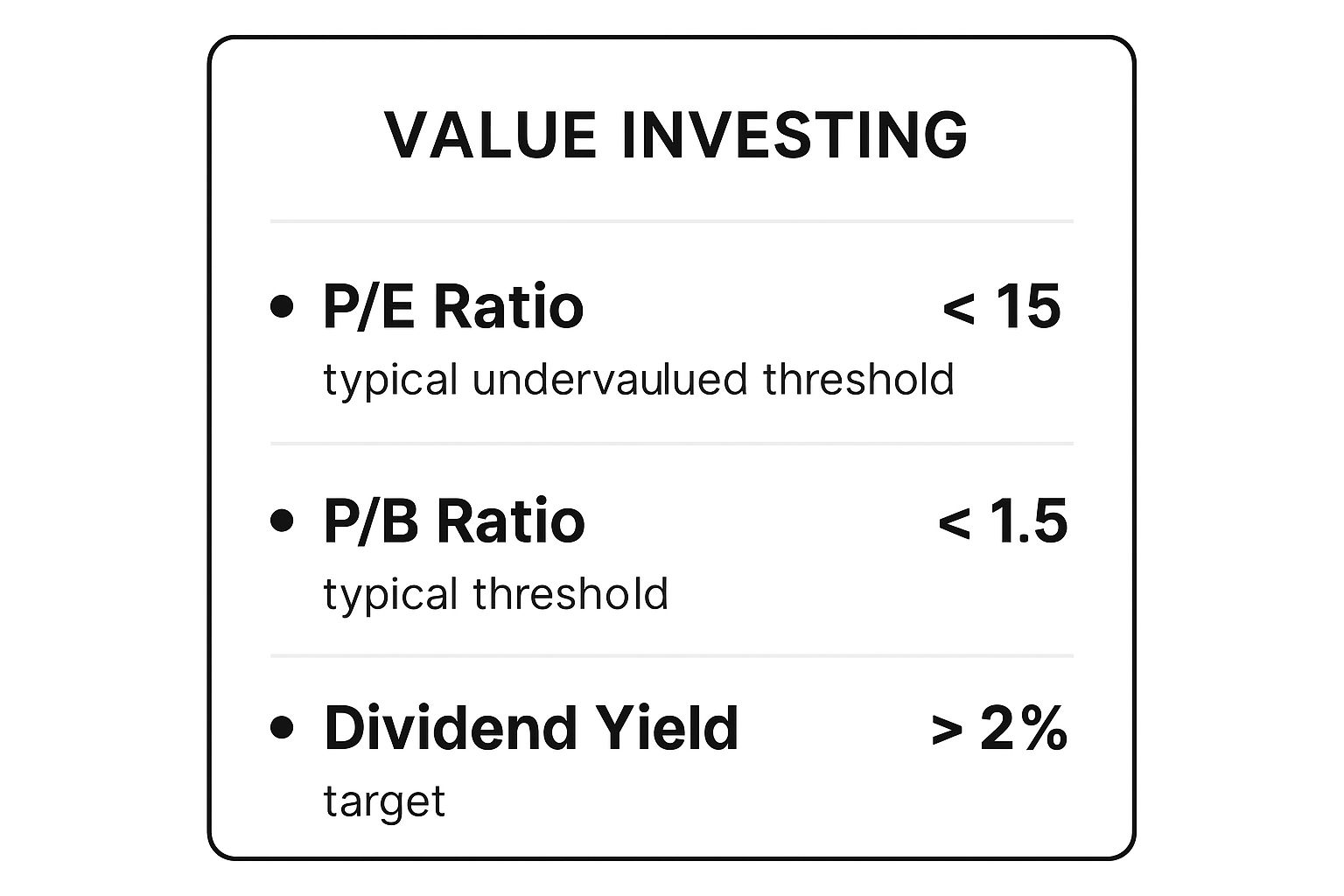

The following infographic summarizes three key metrics commonly used in value investing:

This infographic provides a quick reference for identifying potentially undervalued stocks. While these metrics are valuable starting points, they shouldn't be the sole basis for investment decisions. A thorough analysis of the company's overall financial health and competitive landscape is essential. As a budding value investor, understanding and applying these metrics, along with the principles outlined above, can set you on a path towards long-term financial success. Remember, value investing is not about timing the market, but about timing your entry into great businesses.

7. Momentum Trading

Momentum trading is a dynamic strategy that capitalizes on the tendency of assets to continue moving in their current price direction. It's a popular choice among active traders, especially those seeking quick profits in trending markets. This technical analysis-based strategy involves identifying securities experiencing upward price trends and buying them, or selling securities demonstrating downward trends. Essentially, momentum traders aim to "ride the wave" of established price movements, profiting from the continuation of these trends. This makes it a valuable addition to any beginner's arsenal of trading strategies for beginners.

Momentum trading works on the principle that "the trend is your friend." It relies on the belief that stocks exhibiting strong price momentum are likely to continue moving in that direction, at least for a short period. This approach doesn't delve into the fundamental analysis of a company's financial health or intrinsic value. Instead, it focuses solely on the price action and utilizes technical indicators to identify and exploit ongoing trends.

One of the key aspects of momentum trading is its focus on shorter holding periods, often ranging from a few days to several weeks. This contrasts with long-term investment strategies where positions are held for months or even years. The faster pace requires constant market monitoring and a disciplined approach to managing risk. Momentum traders typically prefer high-volume stocks, as these offer better liquidity and make it easier to enter and exit positions quickly without significantly impacting the stock's price.

Several technical indicators are employed in momentum trading to identify stocks with strong price momentum. These include:

- Relative Strength Index (RSI): This oscillator measures the speed and change of price movements, helping to identify overbought and oversold conditions.

- Moving Average Convergence Divergence (MACD): The MACD helps identify changes in the strength, direction, momentum, and duration of a trend.

- Moving Averages: These indicators smooth out price data over a specific period, highlighting the underlying trend and filtering out noise.

By analyzing these indicators in conjunction with chart patterns like breakouts and flags, momentum traders aim to pinpoint optimal entry and exit points for their trades. This technical approach allows them to capitalize on market psychology and trends.

There are numerous advantages to incorporating momentum trading into your arsenal of trading strategies for beginners:

- Potential for Quick Profits: In strongly trending markets, momentum trading can generate significant returns in a short period.

- Clear Signals: The use of technical indicators provides relatively clear entry and exit signals, reducing subjectivity.

- Adaptable to Market Conditions: This strategy can be profitable in both bull and bear markets, as it simply follows the prevailing trend.

- No Fundamental Analysis Required: Momentum trading doesn't necessitate deep dives into company financials, making it accessible to traders who prefer a purely technical approach.

However, like any trading strategy, momentum trading has its drawbacks:

- High Risk: Sudden trend reversals can lead to substantial losses if not managed effectively.

- Constant Monitoring: This strategy demands constant market monitoring, which can be time-consuming and demanding.

- High Transaction Costs: Frequent trading can result in higher transaction costs, eating into profits.

- Emotional Stress: The rapid pace and volatility associated with momentum trading can be emotionally taxing.

Examples of successful momentum trading include:

- Trading growth stocks during earnings momentum: Capitalizing on the increased volatility and price movements following earnings announcements.

- Following sector ETFs during rotational trends: Identifying and riding the wave of资金 rotating between different market sectors.

- Trading breakouts from consolidation patterns: Entering trades when a stock's price breaks out of a defined trading range, signaling a potential new trend.

- Momentum plays on merger and acquisition announcements: Taking advantage of the price surges that often accompany M&A activity.

To mitigate the risks associated with momentum trading, consider these essential tips:

- Always Use Stop-Loss Orders: This is crucial for limiting potential losses when trends reverse unexpectedly.

- Look for High Volume Confirmation: Increased trading volume validates price movements and increases the likelihood of a sustained trend.

- Start with Highly Liquid, Large-Cap Stocks: This reduces the risk of slippage and ensures easier entry and exit.

- Learn Key Technical Indicators: Mastering the use of RSI, MACD, and moving averages is essential for identifying momentum opportunities.

- Practice Identifying Trend Reversals and False Breakouts: This skill is crucial for avoiding losses and maximizing profits.

- Never Chase Stocks That Have Already Moved Significantly: The potential for further gains diminishes significantly after a large price run-up.

Learn more about Momentum Trading to understand the psychological aspects of this fast-paced strategy. It’s important to manage emotions effectively and maintain discipline in the face of market volatility. Pioneers of momentum trading include Richard Driehaus, William O'Neil (known for the CANSLIM method), Mark Minervini, and Jesse Livermore. Their work provides valuable insights into the principles and practical application of this powerful trading strategy.

7 Trading Strategies Comparison

| Strategy | 🔄 Implementation Complexity | 🛠️ Resource Requirements | 📊 Expected Outcomes | 💡 Ideal Use Cases | ⭐ Key Advantages |

|---|---|---|---|---|---|

| Buy and Hold Strategy | Low – passive, minimal trading | Low – time, basic research | Long-term market appreciation | Beginners, long-term wealth building | Compound growth, low cost, tax benefits |

| Dollar-Cost Averaging | Low – systematic, automated | Low – regular cash flow needed | Smooths purchase price over time | Investors lacking market timing skills | Reduces timing risk, builds discipline |

| Index Fund Investing | Low – purchase and hold funds | Low – minimal research | Market-average returns minus fees | Diversification, passive broad market exposure | Low fees, instant diversification, transparency |

| Paper Trading | Low to Medium – learning tools | Low – simulated trading | Skill development, risk-free learning | Beginners practicing trading skills | No financial risk, tests strategies safely |

| Swing Trading | Medium – requires technical analysis | Medium – time for daily monitoring | Potential medium-term profits | Active part-time traders | More control than passive, profits in various markets |

| Value Investing | High – detailed fundamental analysis | High – time and research | Long-term outperformance | Long-term investors with analytical skills | Margin of safety, data-driven, strong returns |

| Momentum Trading | High – intense monitoring & analysis | High – time, technical skills | Quick profits in trending markets | Active traders skilled in technical analysis | Clear signals, exploits market trends |

Level Up Your Trading: Resources and Next Steps

This article has equipped you with seven foundational trading strategies for beginners, ranging from the long-term approach of buy and hold and value investing to the more active strategies like swing and momentum trading. We've also covered the importance of dollar-cost averaging, index fund investing, and the invaluable practice of paper trading. Mastering these core concepts is crucial for building a solid foundation for your trading journey, whether you're aiming for long-term financial growth or seeking a flexible, location-independent income. The key takeaway is that consistent learning, combined with disciplined application of these trading strategies for beginners, is what separates successful traders from the rest.

As you progress, remember that developing a personalized trading plan is paramount. This plan should reflect your individual financial goals, risk tolerance, and preferred trading style. The ability to adapt and refine your strategies as markets evolve will further enhance your chances of consistent profitability. These foundational trading strategies for beginners lay the groundwork for a successful trading career, providing you with the tools to navigate market complexities and achieve your financial aspirations.

Ready to take your trading to the next level? Colibri Trader offers comprehensive resources, from price action strategies to advanced risk management techniques, designed to help beginners and experienced traders alike refine their skills and achieve consistent results. Explore their educational platform and discover how Colibri Trader can help you master the art of trading. Colibri Trader