7 Unbreakable Trading Risk Management Strategies for 2025

In the fast-paced world of trading, the allure of massive profits can overshadow the single most critical element of long-term success: preserving your capital. Many traders focus exclusively on finding the perfect entry, neglecting the disciplined defensive game that separates professionals from amateurs. This is where robust trading risk management strategies become non-negotiable. It's not about eliminating risk; it's about controlling it, so you can stay in the game long enough to let your edge play out.

This article moves beyond generic advice to deliver actionable frameworks tailored for price-action traders. We will dissect seven essential strategies designed to protect your account and build lasting consistency. You will learn how to implement practical techniques like precise position sizing, intelligent stop-loss placement, and setting firm loss limits. By mastering these defensive principles, you transform trading from a gamble into a calculated business, ensuring market volatility doesn't dictate your survival. These are the tools that empower you to manage uncertainty and trade with confidence.

1. Position Sizing Strategy

Position sizing is arguably the most critical component of any successful trading plan. It's not about predicting the future; it's about controlling your exposure so that a single bad trade, or even a string of losses, doesn't cripple your account. This foundational technique dictates the exact quantity of an asset you should trade based on your account size and how much you are willing to risk on that specific trade.

Many traders mistakenly believe that a high win rate is the key to profitability. However, legendary traders like Van Tharp and Ed Seykota emphasize that how you size your positions has a far greater impact on long-term success. A trader with a 50% win rate and excellent position sizing will almost always outperform a trader with a 70% win rate and poor risk control. This is a core pillar of effective trading risk management strategies.

How Position Sizing Works

The core idea is to risk a small, predetermined percentage of your trading capital on any single trade, typically 1-2%. This percentage defines your maximum acceptable loss if the trade hits your stop-loss.

Here’s a practical example for a price-action trader:

- Account Size: $50,000

- Risk per Trade: 1% ($500)

- Trade Idea: Buy EUR/USD at 1.0850 based on a bullish pin bar at a key support level.

- Stop-Loss Placement: 1.0800 (50 pips below entry, placed just under the support zone).

- Pip Value: $10 per pip for a standard lot.

To calculate the position size, you divide your maximum risk ($500) by your trade risk (50 pips * $10/pip = $500). The result is 1 standard lot. By adjusting your position size based on where your stop-loss needs to be for technical reasons, you maintain a consistent risk profile across all trades.

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading." – Van Tharp

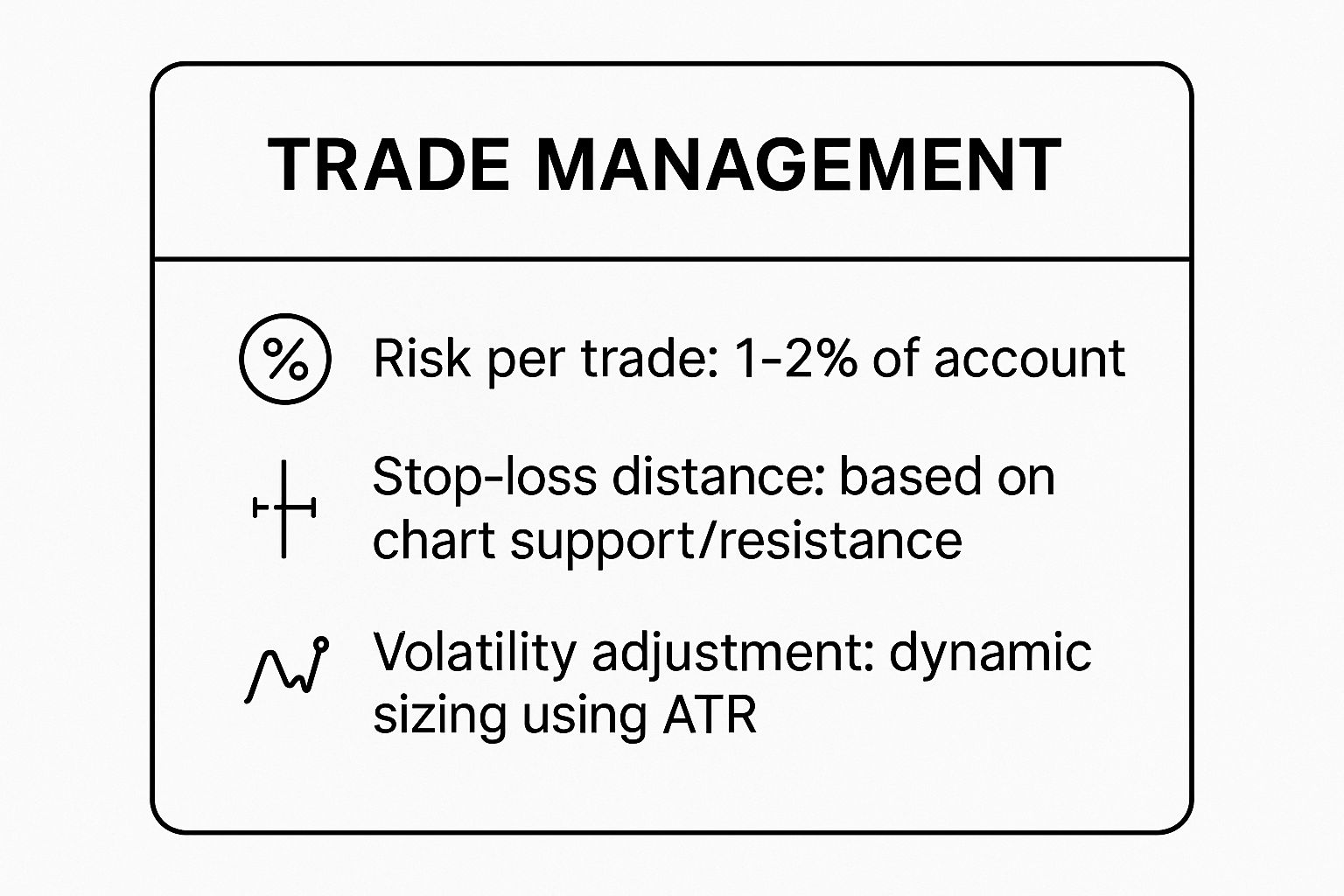

This infographic summarizes the essential inputs for a dynamic position sizing model.

These three elements form a powerful feedback loop, ensuring your risk remains constant even as market conditions and trade setups change. For a deeper exploration of this concept, you can learn more about how effective money management transforms trading.

Actionable Tips for Implementation

- Use a Calculator: Don't do the math in your head. Use a dedicated position sizing calculator to ensure accuracy and avoid costly errors.

- Factor in Volatility: In highly volatile markets, your stop-loss distance will naturally be wider. Your position size must shrink accordingly to keep the dollar risk constant. Consider using the Average True Range (ATR) to help set dynamic stop-losses.

- Account for Correlations: If you open multiple positions that are highly correlated (e.g., long AUD/USD and long NZD/USD), your total effective risk is higher than 1% per trade. Reduce position sizes on correlated assets to manage overall portfolio exposure.

The video below provides a visual walkthrough of the mechanics behind calculating your position size correctly.

2. Stop-Loss Orders

A stop-loss order is a non-negotiable tool for any serious trader, acting as an automated safety net for your capital. It is a pre-set instruction given to your broker to automatically close a trading position when the price reaches a specific, predetermined level against you. This critical mechanism ensures that a losing trade is cut short before it can inflict catastrophic damage on your trading account, making it a cornerstone of disciplined trading.

Pioneering traders like Jesse Livermore championed the idea of cutting losses early, a principle that remains just as relevant today. The primary purpose of a stop-loss is not just to limit financial loss but also to remove emotion from the decision-making process. By defining your exit point before entering a trade, you prevent fear or hope from dictating your actions when you are under pressure. This is a vital component of all effective trading risk management strategies.

How Stop-Loss Orders Work

The concept is to place your stop-loss at a logical price point that, if reached, would invalidate your original trading thesis. This isn't just an arbitrary percentage; it's a strategic decision based on market structure and technical analysis.

Here's a practical example for a price-action trader:

- Trade Idea: Short GBP/JPY at 198.50, anticipating a rejection from a daily resistance level.

- Technical Justification: The resistance level has held multiple times, and a bearish engulfing candle has formed.

- Stop-Loss Placement: 199.10 (60 pips above entry). This is placed just above the high of the bearish candle and the resistance zone, giving the trade room to breathe without invalidating the setup.

- Outcome: If the price rallies to 199.10, the trade is automatically closed, limiting the loss to a predefined amount.

"The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance." – Ed Seykota

This strategy ensures you live to trade another day by systematically protecting your capital from unexpected market volatility or flawed analysis. For a comprehensive guide on setting exit points, you can explore the nuances of how to use stop loss and take profit.

Actionable Tips for Implementation

- Use Technical Levels: Place your stop-loss based on market structure, such as above a resistance level for a short trade or below a support level for a long trade. Avoid setting it based on an arbitrary dollar amount.

- Avoid Obvious Prices: Don't place stops at obvious round numbers (e.g., 1.1000) or major highs/lows where stop-hunting often occurs. Place them slightly above or below these key levels.

- Implement Trailing Stops: For trades in strong trends, use a trailing stop-loss that moves in your favor as the price moves. This protects accrued profits while still giving the trade room to run.

- Consider Volatility: In volatile markets, a wider stop is necessary. Use indicators like the Average True Range (ATR) to help determine an appropriate distance based on current market conditions.

3. Portfolio Diversification

Portfolio diversification is a cornerstone risk management strategy that involves spreading investments across various assets, markets, or strategies. The core principle, often summarized as "don't put all your eggs in one basket," is to mitigate the impact of poor performance in any single asset on your overall capital. This is accomplished by holding a mix of assets that are not perfectly correlated, helping to smooth out returns and reduce portfolio volatility.

While traders often focus on individual trade setups, legendary investors like Ray Dalio and Jack Bogle built their success on the power of diversification. A well-diversified portfolio can weather different economic seasons, such as inflation or recession, far better than one concentrated in a single sector or asset class. For traders, this concept extends beyond just holding different stocks; it can mean trading different currency pairs, commodities, and indices, or even employing different strategies (e.g., trend-following and mean-reversion). This is a vital component of advanced trading risk management strategies.

How Portfolio Diversification Works

The goal is to construct a portfolio where the individual components react differently to the same market event. If one position moves against you, another uncorrelated or negatively correlated position may move in your favor, offsetting the loss.

Here’s a practical example for a retail trader:

- Initial Portfolio: Heavily concentrated in long positions on tech stocks like AAPL and NVDA.

- The Problem: An industry-specific downturn or negative regulatory news could devastate the entire portfolio simultaneously.

- Diversified Approach: The trader reallocates capital to include a mix of assets.

- New Portfolio:

- Tech stocks (AAPL)

- A broad market ETF (SPY)

- A commodities ETF (GLD for gold)

- A position in a defensive sector like consumer staples (XLP)

Now, if the tech sector experiences a sell-off, the potential gains or stability from gold and consumer staples can help cushion the blow, protecting the trader's overall capital.

"The only investors who shouldn't diversify are those who are right 100% of the time." – John Templeton

This approach shifts the focus from the outcome of a single trade to the resilient performance of the entire portfolio, which is critical for long-term consistency.

Actionable Tips for Implementation

- Monitor Correlations: Regularly check how your assets move in relation to one another. Tools within most trading platforms can show correlation matrices. High positive correlation (above 0.7) means assets move together, reducing diversification benefits.

- Rebalance Periodically: Market movements will shift your portfolio's original allocations. Set a schedule (e.g., quarterly or semi-annually) to rebalance your holdings back to their target weights.

- Consider Asset Class Diversification: Think beyond just different stocks. Incorporate different asset classes like commodities, bonds (via ETFs), real estate (via REITs), and different international markets to achieve true diversification.

- Avoid Over-Diversification: While diversification is key, holding too many positions (e.g., 50+) can dilute the impact of your winning trades and make portfolio management unwieldy. Aim for a manageable number where each position can still make a meaningful contribution.

4. Risk-Reward Ratio Management

Alongside position sizing, managing your risk-reward ratio is a crucial pillar of long-term trading profitability. This strategy involves evaluating the potential profit of a trade relative to its potential loss before you even consider placing an order. By establishing a minimum acceptable ratio, you ensure that your winning trades are powerful enough to more than compensate for the inevitable losses, creating a positive mathematical expectancy over time.

Many traders focus solely on their win rate, but a high win rate with a poor risk-reward ratio can still lead to a losing account. Conversely, a trader can be profitable with a win rate below 50% if their winning trades are significantly larger than their losing ones. This is a core concept championed by legendary traders like Richard Dennis and Linda Raschke, who understood that one good trade can erase several small losses. This principle is a cornerstone of effective trading risk management strategies.

How Risk-Reward Ratio Works

The core idea is to only take trades that offer a potential reward that is a multiple of your potential risk. A common minimum standard is a 1:2 risk-reward ratio, meaning for every $1 you risk, you aim to make at least $2 in profit.

Here’s a practical example for a swing trader:

- Trade Idea: Short GBP/JPY at 198.50 based on a bearish rejection at a weekly resistance level.

- Stop-Loss Placement: 199.00 (50 pips above entry, placed just beyond the resistance zone).

- Profit Target: 197.00 (150 pips below entry, targeting the next key support level).

- Risk: 50 pips.

- Potential Reward: 150 pips.

In this scenario, the risk-reward ratio is 1:3. If the trade works out, the profit will be three times the size of the potential loss. This favorable asymmetry is what allows professional traders to remain profitable even if they are wrong on a significant number of their trades.

"I learned that a trading strategy is only as good as the risk management that is built around it. Without that, it’s just gambling." – Kristjan Kullamagi

By systematically filtering out trades with poor risk-reward profiles, you stack the odds in your favor and move from a gambling mindset to a professional, business-like approach to trading.

Actionable Tips for Implementation

- Calculate Before Entry: Always determine your risk (stop-loss) and reward (profit target) before you enter a trade. If the ratio doesn't meet your minimum criteria, skip the trade, no matter how tempting it looks.

- Use Technical Levels: Base your stop-loss and profit targets on logical technical structures like support/resistance, swing highs/lows, or Fibonacci levels. Avoid setting arbitrary targets just to meet a desired ratio.

- Be Realistic: A 1:10 risk-reward setup might seem appealing, but if the market has no realistic chance of reaching your profit target, it's a poor trade. Your targets must be probable.

- Track Your Ratios: Keep a journal of your planned vs. your actual achieved risk-reward ratios. This will reveal if you are closing winning trades too early or letting losing trades run too far, allowing you to make data-driven improvements. To dive deeper into this, you can learn more about how to do a risk-reward ratio calculation on colibritrader.com.

5. Hedging Strategies

Hedging is an advanced risk management technique used to protect a trading account from adverse price movements. It involves opening a strategic position designed to offset potential losses in an existing one. Instead of simply closing a trade that might be temporarily moving against you, a hedge acts as a form of insurance, allowing you to mitigate downside risk while potentially staying in your original position.

While it may seem complex, the concept was popularized by figures like Alfred Winslow Jones and Paul Tudor Jones, who demonstrated its power in navigating volatile markets. For a price-action trader, hedging isn't about eliminating risk entirely but about strategically neutralizing it during periods of high uncertainty, such as before a major news event or an earnings release. This approach is a cornerstone of sophisticated trading risk management strategies.

How Hedging Works

The goal of a hedge is to take a position that moves in the opposite direction of your primary trade. This can be done using different assets or instruments. If the market moves against your main position, your hedge will gain in value, partially or fully offsetting the loss.

Here’s a practical example for a stock trader:

- Primary Position: Long 100 shares of Apple (AAPL) before its quarterly earnings report.

- Identified Risk: The stock could fall sharply if earnings disappoint.

- Hedge Idea: Buy put options on AAPL. A put option gives you the right, but not the obligation, to sell a stock at a predetermined price.

- Outcome 1 (Stock Falls): Your primary stock position loses value, but the put options increase significantly in value, cushioning the blow to your portfolio.

- Outcome 2 (Stock Rises): Your stock position profits. The cost of the put options (the premium paid) is lost, but this small cost is your "insurance premium" for protecting against a large loss.

"The secret to being a successful trader is to have an indefatigable and an undying and unquenchable thirst for information and knowledge." – Paul Tudor Jones

This method allows traders to hold core positions through volatile events without exposing their entire account to unpredictable gaps in price.

Actionable Tips for Implementation

- Hedge Selectively: Hedging has costs (like option premiums or spreads). It should not be a constant practice but a strategic tool used during specific, high-risk periods.

- Understand the Costs: Be aware of the direct and indirect costs of your hedge. For options, this includes the premium paid and time decay (theta), which erodes the option's value over time.

- Match the Duration: Ensure the duration of your hedge aligns with the timeframe of the risk you are trying to mitigate. A short-term hedge for a long-term investment may not be effective.

- Consider Natural Hedges: Sometimes your portfolio has natural hedges. For example, if you are long an oil company stock, being short a currency of an oil-importing nation could act as a partial, natural hedge.

6. Maximum Daily/Weekly Loss Limits

Even with perfect position sizing, a series of consecutive losses can inflict significant psychological and financial damage. Maximum daily or weekly loss limits act as a crucial circuit breaker, forcing you to step away from the markets when you are clearly out of sync with them. This strategy involves setting a predetermined capital-loss threshold that, once hit, triggers a complete halt to all trading activities for a set period.

This is a non-negotiable rule widely enforced by professional proprietary trading firms and hedge funds. They understand that the biggest trading disasters don't come from a single bad trade but from a "death by a thousand cuts" scenario, where a trader, driven by emotion, tries to "win back" losses and digs a deeper hole. Implementing this rule is a cornerstone of professional-grade trading risk management strategies, protecting you from your worst enemy: yourself.

How Maximum Loss Limits Work

The principle is to define a maximum drawdown on your account equity for a given period, typically a day or a week. This limit is usually expressed as a percentage of your total account balance. Once your net losses for that period reach the limit, you close all open positions and are forbidden from opening new ones until the next session or week begins.

Here is a practical example for a day trader:

- Account Size: $25,000

- Maximum Daily Loss Limit: 2% ($500)

- Morning Session: The trader takes two trades. The first is a small winner for +$150. The second hits its stop-loss for -$400. The net loss is now -$250.

- Afternoon Session: The trader takes a third trade that also stops out for -$300.

- Limit Reached: The total net loss for the day is now -$550, exceeding the $500 limit. The trader must immediately cease all trading activity for the remainder of the day.

"The elements of good trading are: (1) cutting losses, (2) cutting losses, and (3) cutting losses. If you can follow these three rules, you may have a chance." – Ed Seykota

This hard stop prevents the emotional spiral of revenge trading, where disciplined analysis is replaced by a desperate gamble to break even. It forces a mandatory cooling-off period, allowing you to reassess your strategy and market conditions with a clear head.

Actionable Tips for Implementation

- Set Limits in Advance: Define your daily, weekly, and even monthly loss limits before the trading session begins. Writing them down as part of your trading plan makes them tangible and harder to ignore.

- Use Technology to Enforce Rules: If your trading platform allows it, set up an automated alert or even an account lock-out when your loss limit is breached. This removes the temptation to override the rule in the heat of the moment.

- Implement a Mandatory Break: After hitting a loss limit, don’t just stop trading. Physically step away from your screens. Go for a walk, read a book, or do something completely unrelated to the markets to reset your mindset.

- Review and Adjust Periodically: As your account grows, your loss limits in dollar terms should also increase to reflect the new account size, while the percentage remains constant. Review these limits monthly or quarterly.

7. Correlation Analysis

Correlation analysis is a sophisticated statistical method that reveals how different assets or positions in your portfolio move in relation to one another. Understanding these relationships is crucial for effective risk management, as it helps prevent unintended overexposure. Simply put, if you hold multiple positions that move in the same direction, your actual risk is much higher than you might realize.

Many traders, particularly those focused on a single asset class like forex or stocks, can inadvertently stack highly correlated trades. For instance, being long on both the Australian dollar (AUD/USD) and the New Zealand dollar (NZD/USD) is not two separate trades; it's effectively one large bet on commodity currency strength against the US dollar. Pioneered in portfolio theory by Harry Markowitz, this analysis is a cornerstone of modern trading risk management strategies.

How Correlation Analysis Works

Correlation is measured on a scale from -1 to +1. A correlation of +1 means two assets move perfectly in sync, while -1 means they move in opposite directions. A correlation of 0 indicates no relationship. The goal is to build a portfolio where your positions are not all highly positively correlated.

Here’s a practical example for a forex trader:

- Trade Idea 1: Long EUR/USD based on a technical breakout.

- Trade Idea 2: Short USD/CHF based on a bearish reversal pattern.

- Correlation Check: The trader consults a currency correlation matrix and finds that EUR/USD and USD/CHF have a strong negative correlation (e.g., -0.85).

- Analysis: Both trades are essentially a "short dollar" bet. If the US dollar strengthens unexpectedly, both positions will likely move into a loss simultaneously, doubling the intended risk.

- Decision: The trader decides to either take only one of the trades or reduce the position size on both to keep the total portfolio risk in check.

"The fundamental law of investing is the uncertainty of the future. The most important thing is to have a method of dealing with that uncertainty." – Peter Bernstein

This highlights the need to look beyond individual setups and view your positions as an interconnected portfolio.

Actionable Tips for Implementation

- Use a Correlation Matrix: Many trading platforms and financial websites offer free correlation matrices. Check these regularly, especially before placing multiple trades in the same session.

- Be Aware of Shifting Correlations: Correlations are not static. During periods of high market stress, a "risk-off" environment can cause traditionally uncorrelated assets to move together as investors flock to safety.

- Optimize Position Sizing: If you must take correlated trades, adjust your position size accordingly. If two pairs have a +0.80 correlation, consider halving the size of each position to maintain your standard risk exposure.

- Seek Negative Correlation for Hedging: Smart traders use negative correlation to their advantage. For example, if you have a large portfolio of tech stocks, you might buy a negatively correlated asset like gold or a volatility index (VIX) ETF to hedge against a market downturn.

7 Trading Risk Management Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Position Sizing Strategy | Moderate 🔄🔄 | Low to Moderate ⚡⚡ | Consistent risk exposure 📊📊 | Risk management across all trading styles | Protects capital, prevents over-leverage ⭐⭐ |

| Stop-Loss Orders | Low 🔄 | Low ⚡ | Limits loss per trade 📊 | Traders needing automated loss control | Automates exits, reduces emotional errors ⭐ |

| Portfolio Diversification | Moderate to High 🔄🔄🔄 | Moderate ⚡⚡ | Reduced portfolio volatility 📊📊📊 | Long-term investors, multi-asset portfolios | Smooths returns, limits drawdowns ⭐⭐ |

| Risk-Reward Ratio Management | Moderate 🔄🔄 | Low to Moderate ⚡⚡ | Positive expectancy trades 📊📊 | Tactical trade entries with risk focus | Enhances trade profitability, discipline ⭐⭐ |

| Hedging Strategies | High 🔄🔄🔄🔄 | High ⚡⚡⚡ | Downside protection 📊📊 | Volatile markets, portfolio insurance | Flexibility, downside risk reduction ⭐ |

| Maximum Daily/Weekly Loss Limits | Low to Moderate 🔄🔄 | Low ⚡ | Prevents catastrophic losses 📊 | High-frequency traders, emotionally prone | Stops losses early, enforces discipline ⭐ |

| Correlation Analysis | Moderate to High 🔄🔄🔄 | Moderate ⚡⚡ | Better diversification, risk-adjusted returns 📊📊 | Portfolio construction and risk management | Reveals hidden risks, optimizes diversification ⭐⭐ |

From Strategy to Second Nature: Integrating Risk Management Into Your Daily Routine

Navigating the financial markets without a robust framework for risk management is like setting sail in a storm without a rudder. Throughout this guide, we have explored a suite of powerful trading risk management strategies, each designed to act as a critical component of your trading vessel, protecting your capital and guiding you toward consistent performance. From the mathematical precision of position sizing and risk-reward ratios to the disciplined application of stop-loss orders and daily loss limits, these tools are not merely suggestions; they are the pillars of a sustainable trading career.

We moved beyond isolated tactics to examine how a holistic view, incorporating portfolio diversification, correlation analysis, and even sophisticated hedging techniques, creates a multi-layered defense. The goal is to build a system so robust that no single trade, market event, or emotional impulse can inflict catastrophic damage on your account. Mastering these strategies transforms trading from a game of chance into a business of calculated probabilities.

Turning Knowledge into Instinct

The true differentiator between amateur and professional traders lies not in knowing these concepts, but in their unwavering execution. The most brilliant analysis is worthless if a single oversized loss, driven by hope or fear, wipes out a month of diligent gains. Your objective now is to internalize these principles until they become second nature-an instinctual part of your trading process.

Key Takeaway: Effective risk management is not a passive checklist you review occasionally. It is an active, continuous process that must be integrated into every single decision you make, from pre-market analysis to post-trade review. It is the very foundation upon which a profitable trading edge is built.

Your Action Plan for Implementation

Making this transition requires deliberate, focused effort. Instead of attempting to implement all seven strategies at once, which can lead to paralysis, adopt a methodical, incremental approach.

- Start with the Foundation: For the next 30 days, commit to mastering just one or two core strategies. The most impactful starting points are Position Sizing (like the 1% rule) and Stop-Loss Orders. Apply them to every trade without exception.

- Document and Review: Maintain a detailed trading journal. For each trade, log your planned risk, your stop-loss level, the calculated position size, and the outcome. At the end of each week, review your journal specifically through the lens of risk management. Did you adhere to your rules? Where did you deviate? Why?

- Layer in Complexity: Once the foundational rules feel automatic, begin integrating the next layer. Start calculating and enforcing a minimum Risk-Reward Ratio for new positions. Then, introduce a Maximum Daily Loss Limit to protect your mental and financial capital on difficult days.

- Expand Your Perspective: As your discipline solidifies, begin incorporating broader portfolio concepts like Correlation Analysis and Diversification to ensure you are not unknowingly concentrating risk in highly related assets.

This structured, step-by-step process transforms abstract knowledge into ingrained skill. By consistently applying these trading risk management strategies, you are not just preventing losses; you are building a fortress around your capital, giving your trading edge the security and time it needs to compound and flourish.

Ready to build a professional-grade trading routine with risk management at its core? The programs at Colibri Trader are designed to instill the discipline and price action skills necessary for long-term success. Explore our comprehensive courses and community to see how we transform traders at Colibri Trader.