8 Critical Trading Mistakes to Avoid in 2025

Trading offers a path to financial freedom, but it's a journey filled with pitfalls that can derail even the most promising traders. The difference between consistent profitability and a blown account often comes down to avoiding a handful of critical errors. Many believe success lies in a secret indicator or complex algorithm, but seasoned professionals know the truth: mastery is about discipline, process, and sidestepping common psychological and strategic blunders.

This article moves beyond generic advice to dissect the most destructive trading mistakes to avoid. We will provide a clear, actionable framework to help you navigate the markets with precision. Each point is grounded in the proven, indicator-free price-action principles taught by Colibri Trader, designed to build robust habits.

You will learn not just what the mistakes are, but why they happen and how to implement practical countermeasures immediately. Prepare to transform your approach from inconsistent results to confident, methodical execution. By understanding these hidden traps, you can protect your capital, refine your strategy, and build a sustainable trading career. Let's begin.

1. Revenge Trading

Revenge trading is one of the most destructive trading mistakes to avoid, driven entirely by emotion rather than strategy. It happens when a trader, stung by a recent loss, makes impulsive and irrational decisions to try and win back their money from the market. This emotional state overrides logic, leading to a dangerous cycle of escalating risk and compounding losses.

Instead of adhering to a proven trading plan, a revenge trader might suddenly double their position size on a whim or jump into a highly volatile asset they haven't researched. The goal is no longer to execute a high-probability setup; it’s a desperate attempt to "get even" with the market, an entity that is completely indifferent to your profits or losses.

How to Prevent Revenge Trading

To combat this emotional pitfall, you need a systematic, non-negotiable set of rules. The key is to create a buffer between the emotional impact of a loss and your next trading decision.

- Implement a Mandatory "Cool-Down" Period: After a significant loss or a string of losing trades, step away from your charts. A mandatory break of at least one hour, or even for the rest of the trading day, allows the emotional charge to dissipate.

- Set and Enforce a Daily Loss Limit: Before you even open a chart, determine the maximum amount you are willing to lose in a single day. If you hit that limit, you are done trading. No exceptions. This rule acts as a circuit breaker, preventing a bad day from turning into a catastrophic one.

- Journal Your Emotions: Maintain a trading journal that tracks not just your trades but also your emotional state. Note how you felt before, during, and after each trade. This practice helps you identify the specific triggers that lead to revenge trading, making you more self-aware.

By focusing on disciplined execution and emotional control, you can neutralize the impulse to chase losses. As Colibri Trader emphasizes, successful trading is about patiently waiting for high-probability price action signals, not forcing trades out of frustration.

2. Overtrading

Overtrading is another critical trading mistake to avoid, driven by the flawed belief that constant activity translates to higher profits. It occurs when a trader executes too many positions, trades too frequently, or uses excessive leverage without sound strategic reasoning. This often stems from impatience, a fear of missing out (FOMO), or a simple lack of a disciplined trading plan, leading directly to diminished returns and heightened emotional stress.

Instead of patiently waiting for high-probability setups that align with their strategy, an over-trader might scalp minor price fluctuations or jump into multiple markets they haven't adequately researched. The focus shifts from quality of execution to quantity of trades, accumulating transaction costs and exposing capital to unnecessary risk. Legendary trader Jesse Livermore warned against this impulse, highlighting that the big money was made not in the constant action, but in the sitting and waiting.

How to Prevent Overtrading

To overcome the urge to overtrade, you must build a framework that prioritizes discipline and strategic patience over constant market engagement. The goal is to act as a sniper, not a machine gunner.

- Establish Strict Trade Limits: Define a maximum number of trades you are allowed to take per day or week and write it into your trading plan. Once you hit that limit, you are finished, regardless of the outcome. This forces you to be more selective with your trade setups.

- Focus on Quality Over Quantity: Before entering any trade, ask yourself if it meets all your predefined criteria for a high-probability setup. If even one condition isn't met, you must have the discipline to pass on the trade. This mindset shift is fundamental to long-term success.

- Calculate Your True Trading Costs: Actively track how much you spend on commissions and spreads. Seeing the tangible impact of excessive trading on your bottom line can be a powerful deterrent and reinforces the need for more selective, high-quality entries.

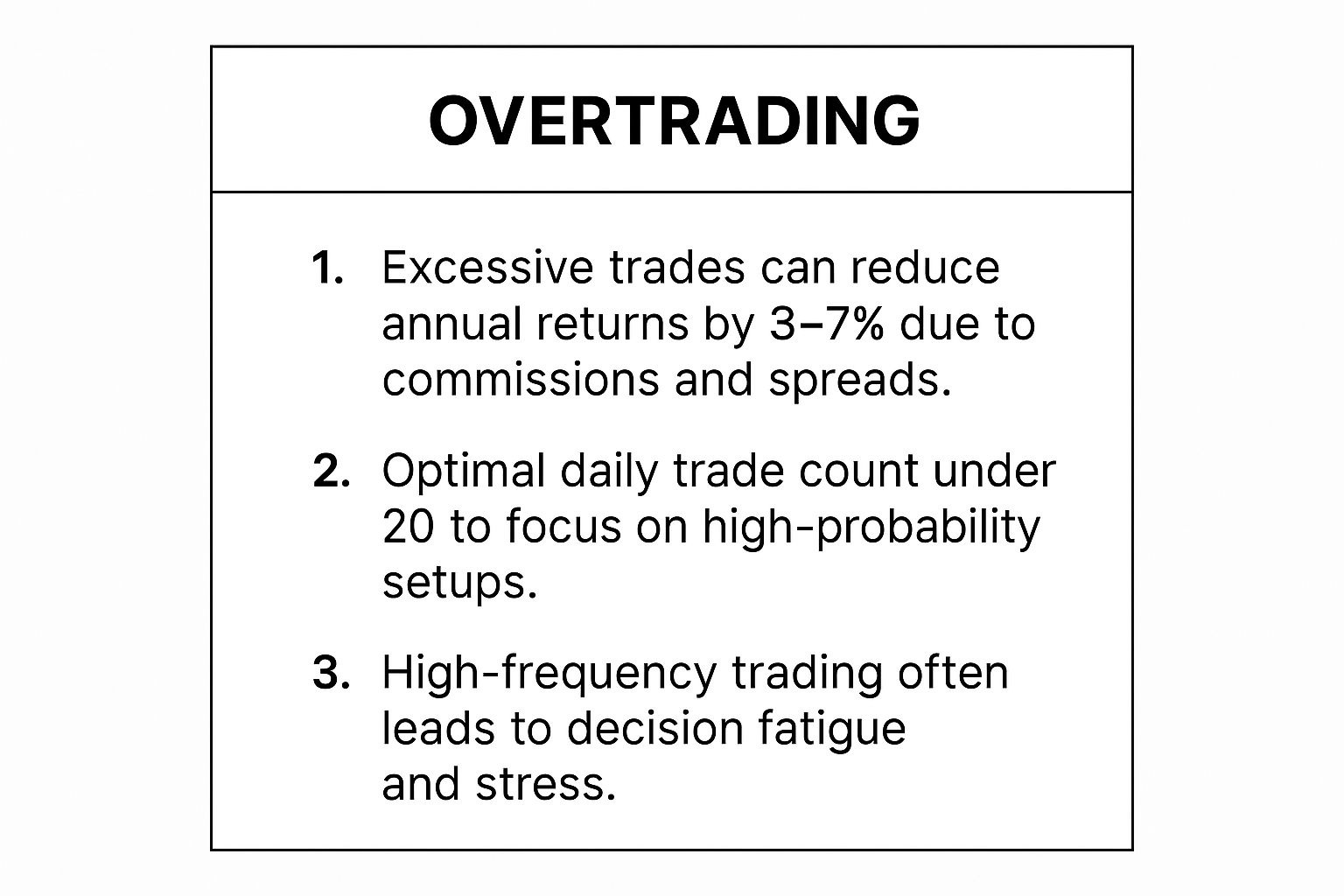

This infographic summarizes the hidden costs and consequences of excessive trading activity.

The data clearly shows that frequent, low-quality trades directly erode your capital through costs and lead to decision fatigue, hindering your ability to spot genuine opportunities. As Colibri Trader consistently teaches, profitability comes from disciplined patience and waiting for the market to present a clear, high-probability price action signal.

3. Lack of Risk Management

A failure to implement proper risk management is one of the most common and devastating trading mistakes to avoid. This mistake isn't about making a bad trade; it's about having no system to protect your capital when trades inevitably go wrong. Traders who neglect risk management might risk a huge portion of their account on one idea or hold losing positions indefinitely, turning small, manageable losses into account-destroying events.

Without a defined risk strategy, every decision becomes a gamble. You might see a trader risk 50% of their capital on a single "sure thing" without a stop-loss, only to watch it move against them. The core of trading success isn't just picking winners; it's about ensuring the losers don't take you out of the game. Effective risk management is the bedrock upon which a sustainable trading career is built.

How to Prevent Poor Risk Management

Building a robust risk management framework is non-negotiable. It requires discipline and a set of predefined rules that you follow on every single trade, without exception. This turns trading from a game of chance into a game of probabilities.

- Implement the 1-2% Rule: Never risk more than 1-2% of your total trading capital on a single trade. If you have a $10,000 account, your maximum risk per trade should be between $100 and $200. This rule ensures that a string of losses won't significantly deplete your capital.

- Always Use a Stop-Loss: A stop-loss is a pre-determined price at which you will exit a trade to cap your loss. You must set your stop-loss before you enter the position. This is your primary defense mechanism against catastrophic losses and emotional decision-making.

- Focus on Favorable Risk-to-Reward Ratios: Only take trades where the potential profit is at least twice the potential loss (a 1:2 risk-to-reward ratio or better). This means that even if you are right less than 50% of the time, you can still be profitable.

- Use Proper Position Sizing: Your position size should be calculated based on your entry price, your stop-loss level, and your maximum risk per trade (the 1-2% rule). This ensures your dollar risk is consistent across all trades, regardless of the asset's volatility.

Mastering these defensive techniques is a critical step. To explore more about the foundational habits that define profitable traders, learn how to become a successful trader on ColibriTrader.com.

4. Ignoring Market Trends

One of the most fundamental trading mistakes to avoid is ignoring the prevailing market trend. Popularized by legendary traders like Jesse Livermore, the saying "the trend is your friend" holds immense weight because fighting against powerful market momentum is a recipe for consistent losses. When you trade against the trend, you are essentially swimming against a strong current, making it incredibly difficult to profit.

Traders who ignore trends might continuously try to short a stock during a strong bull market rally or buy into an asset that is clearly in a long-term downtrend. Instead of waiting for a high-probability setup that aligns with market direction, they bet against overwhelming market forces, draining their capital on low-probability trades. Acknowledging and respecting the trend is a cornerstone of disciplined trading.

How to Align with Market Trends

To avoid this common pitfall, you must learn to identify and trade in harmony with the market's primary direction. This involves using simple yet effective tools to gauge momentum and confirm trend strength before entering a position.

- Use Moving Averages for Direction: Simple moving averages (like the 50-day and 200-day) are excellent visual guides. When the price is consistently above these moving averages, it indicates an uptrend, presenting buying opportunities. When the price is below them, it signals a downtrend, favoring short positions.

- Analyze Higher Timeframes First: Start your analysis on a higher timeframe (e.g., daily or weekly chart) to establish the dominant trend. Then, move to a lower timeframe (e.g., 4-hour or 1-hour) to find entry points in the same direction. This top-down approach ensures you are not trading against the bigger picture.

- Wait for Trend Confirmation: Don't jump into a trade just because the price has moved slightly. Wait for clear confirmation, such as a breakout above a key resistance level in an uptrend or a breakdown below support in a downtrend. Patience is key to avoiding false signals.

By incorporating these practices, you position yourself to ride the wave of market momentum rather than fight it. For a deeper dive into this crucial skill, you can learn more about analyzing market trends on colibritrader.com.

5. Chasing Hot Tips and Rumors

Chasing hot tips and rumors is a classic trading mistake that lures traders into making decisions based on hype rather than sound analysis. This occurs when traders act on unverified information from social media, chat rooms, or financial news, often entering positions without any independent research. This behavior is rooted in the fear of missing out (FOMO) and the allure of a "sure thing."

Whether it’s a meme stock trending on Reddit or a cryptocurrency recommendation from a Twitter influencer, acting on these tips means you're likely the last to know. By the time the news reaches you, the smart money has already taken its position, and you risk buying at the peak just before an inevitable price collapse. This reactive approach abandons your strategy in favor of someone else's unproven agenda.

How to Avoid Chasing Tips

To sidestep this common pitfall, you must cultivate discipline and trust in your own analytical process. The goal is to become a proactive analyst, not a reactive follower.

- Conduct Independent Analysis: Before entering any trade, perform your own due diligence. Use your price action strategy to analyze the chart and identify high-probability setups, regardless of what the "gurus" are saying. Your own analysis should always have the final say.

- Be Skeptical of Hype: Treat every tip, especially those promising quick riches, with extreme skepticism. Understand that the source of the tip often has a vested interest in driving the price in a certain direction. As Peter Lynch advised, it's far better to "invest in what you know" through your own research.

- Stick to Your Trading Plan: Your trading plan is your ultimate defense against market noise. It defines your entry criteria, risk management, and exit strategy. If a tip doesn't align with your pre-established plan, ignore it. There is no exception.

Building the confidence to rely on your own skills is a cornerstone of long-term success. By focusing on your proven strategy, you can avoid becoming exit liquidity for others and make this one of the trading mistakes to avoid in your career.

6. Letting Emotions Drive Trading Decisions

Letting emotions drive trading decisions is a fundamental mistake that separates struggling traders from consistently profitable ones. When feelings like fear, greed, or hope dictate your actions, you abandon your strategy and start gambling. This emotional hijacking leads to classic blunders like panic selling at market bottoms, holding losing trades too long in blind hope, or chasing parabolic moves out of fear of missing out.

This error is so common because markets are designed to evoke strong emotional responses. A sharp drop can trigger intense fear, while a fast rally can ignite powerful greed. As Mark Douglas explains in "Trading in the Zone," the key isn't to eliminate emotions, but to operate from a mental framework where they don't influence your strategic execution. Failing to do so is a primary reason why many traders underperform.

How to Prevent Emotional Trading

The goal is to build a systematic, rule-based process that minimizes the influence of in-the-moment feelings. By externalizing your decisions into a concrete plan, you can trade with objectivity and discipline.

- Create and Follow a Written Trading Plan: Your trading plan is your constitution. It must clearly define your entry criteria, position sizing rules, and exit strategy for both wins and losses. Before entering any trade, confirm it aligns perfectly with your pre-written plan.

- Set Predetermined Entry and Exit Points: Never enter a trade without knowing exactly where you will take profit and where you will cut your loss. Setting these levels before you have money at risk removes the emotional guesswork from managing the trade.

- Keep an Emotional Journal: Dedicate a section of your trading journal to document your psychological state. Note your feelings before, during, and after a trade. This practice will reveal patterns, such as a tendency to get greedy after a win or fearful after a loss, helping you anticipate and manage them.

By focusing on a disciplined mindset, you can navigate the markets logically. For a deeper exploration of this topic, you can master your trading mindset with Colibri Trader.

7. Inadequate Research and Analysis

One of the most fundamental trading mistakes to avoid is entering the market with inadequate research and analysis. This error occurs when traders bypass the necessary groundwork, making decisions based on tips, hype, or incomplete information rather than a solid analytical foundation. Such trades are essentially gambles, disconnected from the underlying factors that drive market movements, and often result in predictable losses.

Engaging in this behavior means ignoring crucial data. This could be anything from buying a stock without understanding its financial health or competitive position to trading a forex pair while being unaware of an upcoming central bank announcement. The market rewards preparation and punishes impulse, making diligent research a non-negotiable part of a professional trading process.

How to Prevent Inadequate Research and Analysis

A systematic approach to research ensures you only enter trades that you fully understand and have a justifiable reason to take. The goal is to move from guessing to making educated decisions based on evidence.

- Develop a Pre-Trade Research Checklist: Before executing any trade, work through a standardized checklist. This should include verifying key technical signals, checking for major economic news events, and understanding the overall market sentiment. This forces a deliberate, analytical process.

- Integrate Technical and Fundamental Views: While price action is key, a basic understanding of the fundamental context provides a significant edge. For a stock, this means knowing its sector; for a currency, it means being aware of the country's economic health. You don't need to be an expert, but context is critical.

- Use a Multi-Timeframe Analysis: Never make a decision based on a single chart timeframe. A setup might look perfect on the 15-minute chart but could be trading directly into major resistance on the 4-hour or daily chart. Analyzing multiple timeframes provides a more complete picture of the market structure.

By adopting a structured research routine, you build a barrier against impulsive, low-probability trades. As trading pioneers like Benjamin Graham and Peter Lynch have shown, informed decisions are the bedrock of long-term success.

8. Unrealistic Expectations

Setting unrealistic expectations is one of the most common and damaging trading mistakes to avoid, especially for newcomers. It happens when traders believe they can achieve phenomenal returns, like doubling their account monthly, with little effort or experience. This mindset, often fueled by social media hype, leads to frustration, over-leveraging, and poor decision-making when the market doesn't meet their lofty goals.

A trader with unrealistic expectations might risk a huge portion of their capital on a single trade, convinced it's their ticket to instant wealth. Instead of methodically building their account, they chase lottery-like wins. This approach ignores the reality that professional trading is a marathon, not a sprint, and that sustainable success is built on consistency and patience, not get-rich-quick fantasies.

How to Prevent Unrealistic Expectations

To combat this pitfall, you must ground your trading journey in realism and focus on the process, not just the profits. This shift in perspective is crucial for long-term survival and growth in the markets.

- Establish Realistic Goals: Understand that even professional traders often aim for consistent, moderate gains. A realistic target for a skilled retail trader might be 10-20% annually, not 100% monthly. Set process-oriented goals, such as "follow my trading plan for 20 consecutive trades," rather than purely financial ones.

- Focus on Skill Development, Not Profits: Your primary goal as a new trader should be learning, not earning. Concentrate on mastering your strategy, managing risk, and controlling your emotions. Profits are a byproduct of well-executed trades, not the primary objective at the start.

- Embrace the Journey: As highlighted in Jack Schwager's Market Wizards series, real trading mastery takes years of dedicated effort, not weeks. Accept that losses are a normal and necessary part of the business. Study the markets, refine your strategy, and treat trading as a professional skill to be developed over time.

By aligning your expectations with the realities of the market, you can avoid the emotional roller coaster that derails so many aspiring traders. As Ed Seykota famously stated, the goal is to have a methodology that is sound and that you can follow consistently.

Top 8 Trading Mistakes Comparison

| Trading Mistake | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Revenge Trading | Low – impulsive, unplanned trades 🔄 | Low – driven by emotion, no extra tools ⚡ | Consistent losses, account blow-ups 📊 | None – always detrimental 💡 | None – avoids quick loss compounding |

| Overtrading | Moderate – requires self-discipline 🔄 | Moderate – frequent market monitoring ⚡ | Reduced returns due to costs, fatigue 📊 | Avoid – only high-probability trades 💡 | Focus on quality trades improves ROI ⭐ |

| Lack of Risk Management | Moderate – needs planning & rules 🔄 | Moderate – stop-loss, position sizing ⚡ | Prevents catastrophic losses, improves consistency 📊 | Essential for all traders 💡 | Protects capital, enables longevity ⭐ |

| Ignoring Market Trends | Moderate – needs trend analysis skills 🔄 | Low to moderate – chart tools required ⚡ | Higher loss probability, missed moves 📊 | Trend-following traders benefit 💡 | Aligns trades with market momentum ⭐ |

| Chasing Hot Tips and Rumors | Low – impulsive based on external info 🔄 | Low – minimal research required ⚡ | Poor timing, increased market manipulation risk 📊 | Avoid; focus on research-driven trades 💡 | Builds independent analysis discipline ⭐ |

| Letting Emotions Drive Trading | Low – emotional override of strategy 🔄 | Low – psychological resilience needed ⚡ | Impulsive trades, stress, inconsistency 📊 | Avoid by following strict plans 💡 | Enhances discipline and consistency ⭐ |

| Inadequate Research and Analysis | Moderate – requires learning analysis methods 🔄 | Moderate – research tools and time ⚡ | Poor trade selection and unexpected losses 📊 | Critical for informed trading 💡 | Identifies high-probability setups ⭐ |

| Unrealistic Expectations | Low – mindset-driven but impacting decisions 🔄 | Low – no special resources needed ⚡ | Excessive risk-taking, frustration 📊 | Beginners need realistic goal setting 💡 | Encourages sustainable trading growth ⭐ |

From Mistakes to Mastery: Your Path Forward

Navigating the financial markets is a journey marked by continuous learning, and recognizing the most common trading mistakes to avoid is the foundational first step toward building a sustainable and profitable career. We have explored the critical pitfalls that derail countless traders, from the emotional whirlpool of revenge trading to the structural failure of inadequate risk management. Each error, whether it's overtrading in a volatile market or chasing unsubstantiated hot tips, represents a crucial learning opportunity rather than a permanent setback.

The central theme connecting these blunders is a disconnect from a disciplined, systematic approach. The key isn't to strive for a flawless record of never making a mistake; that’s an unrealistic expectation. Instead, the goal is to build robust systems, habits, and a psychological framework that prevent these errors from becoming catastrophic. Your objective is to learn from each misstep, refine your strategy, and ensure the same mistake doesn't undermine your progress twice.

The Power of a Process-Driven Approach

The principles of price action provide the most effective antidote to these common trading mistakes. By focusing directly on what the chart tells you, you can strip away the distracting noise of lagging indicators, conflicting news headlines, and baseless market gossip. This clarity is your greatest asset. It allows you to:

- Trade with a Plan: A price-action strategy defines your entry, exit, and stop-loss points before you ever place a trade, neutralizing emotional decision-making.

- Manage Risk Systematically: Understanding key support and resistance levels allows you to place stops logically, protecting your capital from unexpected market swings.

- Maintain Emotional Equilibrium: When your decisions are rooted in objective chart data rather than fear or greed, you can execute your plan with confidence and discipline.

Your Actionable Path to Trading Mastery

True mastery is not a final destination but an ongoing process of refinement and adaptation. Moving forward, your focus should be on internalizing these lessons and translating them into consistent action. Start by honestly assessing your own trading history. Do you see patterns of overtrading after a loss? Do you consistently risk too much on a single position? Identifying your specific weaknesses is the first step toward correcting them.

The journey from recognizing trading mistakes to avoid to achieving consistent profitability is built on a foundation of education, practice, and unwavering discipline. Embrace the process, commit to your rules, and view every market session as an opportunity to sharpen your skills. Your potential is immense, but it is your process that will ultimately determine your performance. Transform that potential into a tangible edge.

Ready to build a rock-solid trading foundation and systematically eliminate these costly errors? The Colibri Trader program is designed to equip you with a proven price-action methodology that fosters discipline and clarity. Take the Colibri Trader Trading Potential Quiz today and receive the first two chapters of our bestselling book to start building your professional edge in the market.