What Is Position Trading A Guide to Long-Term Market Success

At its core, position trading is a long-term game. It involves holding onto assets for weeks, months, or in some cases, even years, all to capture a single, major market trend. While day traders get caught up in the minute-by-minute noise, position traders think more like investors, patiently waiting to ride one big wave from start to finish.

Understanding the Position Trading Philosophy

Think of it like being a captain on an ocean voyage. You wouldn't obsess over every small wave that rocks the boat. Instead, your focus is on the powerful, underlying currents and prevailing winds that will guide you to your destination. That’s the very essence of position trading—it's all about patience and seeing the big picture, a stark contrast to the rapid-fire moves of shorter-term styles.

The entire philosophy is built on a simple but powerful idea: spot a major trend as it begins to form and stay with it until it plays out. To do this, position traders lean on a mix of fundamental analysis (like economic health or big industry shifts) and technical analysis (long-term chart patterns) to develop a strong directional bias.

Core Principles of Position Trading

The aim isn't to scalp every tiny price swing. Far from it. Position trading is a disciplined approach guided by a few key principles that set it apart from just holding an asset and hoping for the best. To see how this approach stacks up against others, it's worth exploring the different types of traders and their unique psychologies.

This methodology really boils down to a few key traits:

- Low Trade Frequency: A position trader might only pull the trigger on a few highly-vetted trades over an entire year.

- Macro Focus: Forget the daily news cycle. Decisions are driven by things like long-term economic cycles, interest rate changes, and major industry disruptions.

- Wider Stop-Losses: To avoid getting shaken out by normal market volatility, stop-losses are set much further away from the entry point.

- Patience and Discipline: The real skill is having the stomach to hold a winning trade through the inevitable pullbacks along the way.

To give you a quick snapshot, here’s what defines the position trading style.

Position Trading At a Glance

| Characteristic | Description |

|---|---|

| Typical Holding Period | Weeks, months, or even years. |

| Trade Frequency | Very low; a handful of trades per year. |

| Analysis Focus | Long-term fundamental and technical trends. |

| Key Skill | Patience and emotional discipline. |

| Risk Management | Wider stop-losses to accommodate volatility. |

In short, this is a patient person's game.

The core mindset is to let your profits run while cutting losses short. This requires emotional detachment and unwavering confidence in your initial analysis, allowing a major trend to fully mature over an extended period.

Ultimately, position trading is less about constant action and more about strategic patience. It’s built for those who want to grow their capital from significant market movements without being glued to a screen all day, every day.

The Patient Mindset and Timeframes of a Position Trader

If you're looking for quick thrills and fast profits, position trading isn't for you. This style is all about playing the long game. It demands a deliberate, patient mindset and the guts to trust your analysis for weeks or even months at a time, ignoring all the distracting noise from daily market chatter.

Position traders get their edge by stepping back and looking at the big picture. They live on the high-level charts—think daily, weekly, and even monthly views. These timeframes act like a satellite map of the market, revealing the huge, overarching trends while filtering out the meaningless blips of short-term volatility. This is where strategic, profitable decisions are born.

Adopting a Long-Term Outlook

So, how long are we talking? A typical position trade can last anywhere from several weeks to many months. In some cases, it might even run for years. The beauty of this is that it doesn't require you to be glued to your screen.

Instead of constant monitoring, you might check your positions once a day or even just once a week to make sure the underlying trend is still in your favor. This makes position trading a perfect fit for people with full-time jobs or other major commitments. You can build wealth without being chained to a desk, focusing only on the major price action and the economic tides that truly move the markets. We talk more about the importance of patience in trading in another article.

This long-term strategy is nothing new; it's been a pillar of successful trading for almost a century. The legendary Jesse Livermore, often considered one of the original position traders, is a classic example. Before the Great Crash of 1929, he used fundamental analysis and raw price action—much like the indicator-free methods we teach here—to build massive short positions. He held on and walked away with a fortune of over $100 million. You can dig into historical market reports on net position changes to see how big players operate.

The true test for a position trader is not in finding the perfect entry, but in having the discipline and emotional control to weather the inevitable short-term pullbacks that occur within a larger, profitable trend.

Cultivating Discipline and Emotional Control

At its core, this trading style boils down to two things: discipline and emotional grit. When you hold a trade for months, you’re guaranteed to face periods of drawdown where the position moves against you. It's inevitable. This is where most traders crack.

An undisciplined trader will panic and cut the trade, only to watch it turn around and hit their original target. A successful position trader, on the other hand, has the conviction to stick with the plan as long as their initial analysis holds true. They understand that markets don't move in straight lines. This disciplined patience is what allows them to ride a trend all the way to its conclusion, capturing the kind of massive profits that short-term traders can only dream of.

Position Trading Compared to Other Trading Styles

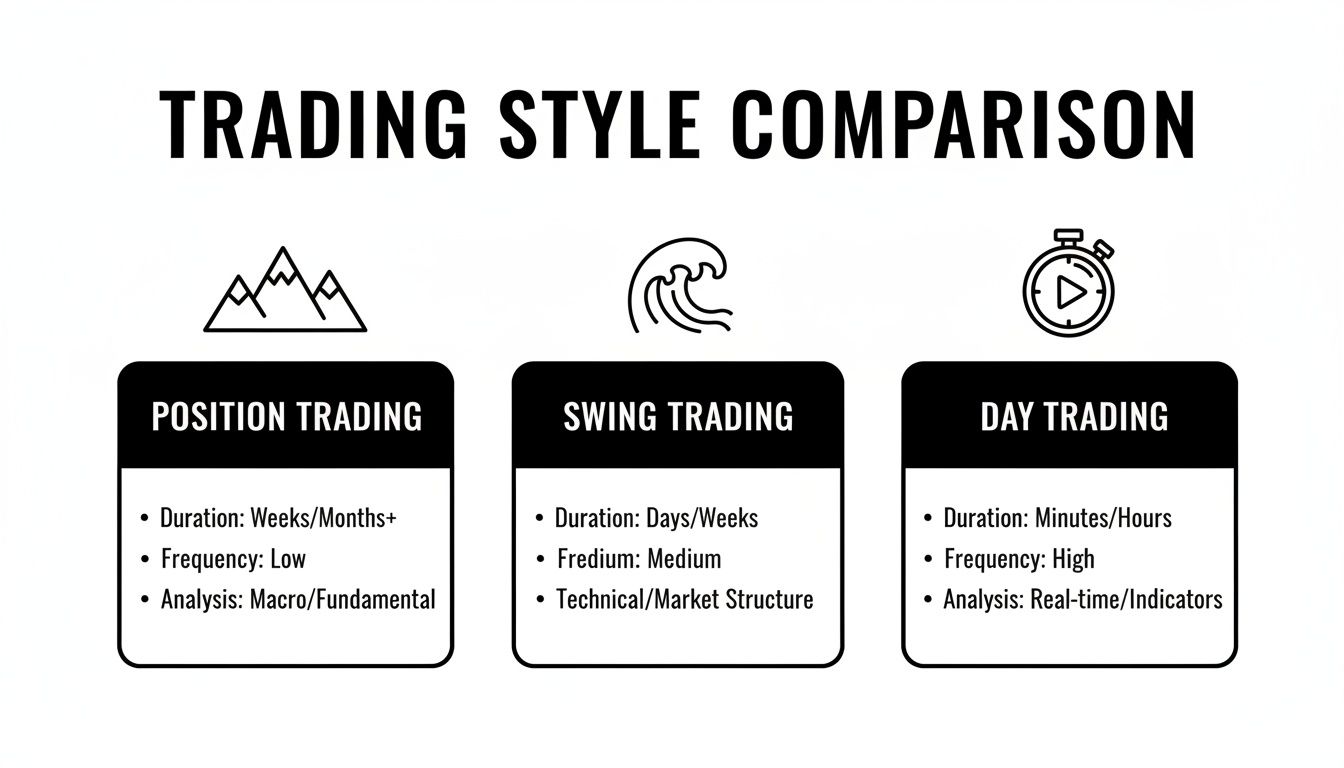

To really get a feel for what position trading is all about, it helps to line it up against other ways people approach the market. Every style marches to the beat of a different drum, demanding its own unique strategy and mindset. The biggest tells are how long a trade is held, what charts are used, and the kind of psychological grit required.

Think of the market as a massive ocean. A day trader is like a jet skier, darting across the surface to catch every tiny ripple. They live on minute-by-minute charts and might jump in and out of dozens of trades a day, skimming small, quick profits off the intraday chop.

Contrasting Time Horizons and Goals

Now, a swing trader is more like a surfer. They’re looking for a proper wave to ride—a market swing that could last a few days or even a couple of weeks—and they hold on for a much bigger move. These traders are usually glued to daily or 4-hour charts, trying to time those medium-term swings. For a closer look, our guide on day trading vs. swing trading breaks this down even further.

Position trading zooms out even more. This is the deep-sea exploration of the trading world, where you're not just riding waves but charting a course along major, powerful ocean currents. Position traders analyze daily, weekly, and sometimes even monthly charts to spot huge trends that can play out over several months or even years.

Position traders aren’t reacting to the daily market noise. They're making calculated moves based on deep fundamental analysis and big-picture technical patterns, aiming to capture the entire life of a major trend.

Finally, you have long-term investing. This is like owning the entire ship, believing in its value no matter the weather. Investors buy into a company's fundamental worth, planning to hold on for years—sometimes decades—to let compound growth and dividends do the heavy lifting.

A Side-by-Side Breakdown

To make these differences stick, let's lay them out side-by-side. Seeing the core characteristics of each approach can be a real lightbulb moment, helping you figure out which style fits your personality, schedule, and goals.

Trading Styles Compared

| Style | Typical Holding Period | Primary Charts | Trade Frequency | Psychological Focus |

|---|---|---|---|---|

| Position Trading | Months to Years | Daily, Weekly, Monthly | Very Low (Few per year) | Patience, Conviction |

| Swing Trading | Days to Weeks | 4-Hour, Daily | Low to Moderate | Timing, Discipline |

| Day Trading | Minutes to Hours | 1-Min, 5-Min, 15-Min | Very High (Multiple per day) | Quick Reflexes, Stress Mgt |

| Investing | Years to Decades | Monthly, Yearly | Extremely Low | Long-Term Vision, Belief |

Grasping these distinctions is a game-changer for many aspiring traders. A lot of people burn out trying to day trade or swing trade, fighting stress and inconsistent results, only to realize their temperament was a total mismatch. For them, position trading offers a much calmer, more sustainable way to navigate the markets.

Actionable Price Action Strategies for Position Traders

Theory is great, but a real trading plan is built on practical strategies. Position traders often find their edge in simplicity, cutting through the noise of complex indicators to focus purely on what the price itself is telling them. This is the heart of price action trading—a clean, powerful way to spot high-probability setups on long-term charts.

The name of the game is finding major trend continuations or turning points where you can define your risk clearly and aim for a substantial reward. You're not reacting to the daily chatter; you're acting on massive patterns that have taken months, or even years, to form. Two of the most reliable and time-tested strategies for this are trading breakouts and capitalizing on key market zones.

Trading Long-Term Breakouts

Markets love to go sideways. They'll often spend long periods consolidating in what's known as a "range-bound" pattern, where buyers and sellers are stuck in a stalemate. A breakout is the moment that equilibrium shatters—price smashes decisively through the range's resistance (the ceiling) or support (the floor). This is a huge signal that one side has finally won, and a new trend is likely just getting started.

For a position trader, these are golden opportunities. Here's a simple framework for trading them:

- Spot the Range: Pull up a weekly or monthly chart and look for obvious horizontal support and resistance levels. You want to see price contained within these boundaries for at least a few months.

- Wait for the Snap: This is where patience pays off. A true breakout isn't timid; it's a strong, decisive candle that closes well outside the established range. Don't jump the gun.

- Set Your Entry and Stop: You could enter as the breakout candle closes or, for a more conservative entry, wait for a retest of the level that just broke. Your stop-loss goes on the other side of the old consolidation range, giving the trade plenty of room to work without getting stopped out by random noise.

- Project Your Target: A classic technique is to measure the height of the range (from support to resistance) and project that same distance from the breakout point. This gives you a logical first target for taking profits.

This infographic really drives home how a position trader's bird's-eye view differs from shorter-term approaches.

As you can see, position trading isn't about catching small waves. It's about capturing the entire mountain of a trend, something swing and day traders simply can't do.

Trading from Supply and Demand Zones

Another incredibly effective price action strategy is trading from major supply and demand zones. Think of these as the footprints left behind by the "big money"—areas on a chart where institutional buying or selling was so aggressive it created a massive price imbalance.

- Demand Zone: This is an area of intense buying pressure. You'll often see it as a base from which a sharp, explosive rally began. When price eventually wanders back to this zone, a flood of unfilled buy orders can ignite the next move up.

- Supply Zone: The opposite of demand, this is an area where sellers overwhelmed buyers, causing a steep price drop. If price revisits this zone, you can bet there are still sell orders waiting to be filled, which can push the price back down.

These zones are especially potent on weekly and monthly charts because they represent truly significant institutional positioning. A position trader simply identifies these critical areas and waits patiently for the market to come to them, offering a low-risk, high-probability entry point.

The power of holding through a major trend that starts from one of these zones is legendary. Just look at the S&P 500's recovery after the 2008 financial crisis. The market bottomed out near 666 in March 2009—a textbook, massive demand zone. Position traders who had the conviction to enter there and simply hold on captured a mind-boggling 177% gain by the time the trend peaked near 1,850 four years later.

This is a perfect example of letting a trend run, a core principle of the Colibri Trader methodology that can produce truly outsized returns. You can discover more about supply and demand trading insights and see these concepts in action on real market charts.

Mastering Risk and Money Management for the Long Term

When you take on position trading, preserving capital becomes your north star. Finding an ideal entry point is thrilling, but it’s the quiet discipline of risk controls that keeps you in the game month after month.

Because position traders hold trades for weeks or even months, normal price swings will test your stop-loss levels. That’s why position sizing is the cornerstone of your plan. You want each trade to carry just enough weight to matter—without ever threatening your entire account.

The cardinal rule of professional trading is to risk only a small, predefined percentage of your capital on any single idea. For most, this means risking no more than 1-2% of their total account balance.

Whether your stop sits tight or drifts wide, you adjust the number of shares or contracts so that your maximum loss never exceeds that 1-2% band. Over time, this discipline prevents one bad day from wiping out weeks of gains.

The Power of Asymmetric Risk and Reward

Position traders often hunt setups where the upside dwarfs the downside. In practice, you look for trades with at least a 3:1 ratio, meaning you’re willing to risk $1 for the chance to earn $3.

Focusing on these high-odds scenarios means:

- You don’t need to win every trade to grow your balance.

- A string of small losses won’t derail your progress.

- Each successful swing becomes a building block for long-term growth.

Advanced Techniques for Managing Long-Term Trades

Holding a position for months opens the door to specific tactics that both amplify winners and guard your profits:

- Scaling In: Start with a partial position, then add more after the trend proves itself—say, once price breaks a key resistance or support level. This way you only commit full size when the market confirms your thesis.

- Trailing Stop-Loss: Instead of a fixed stop, trail your exit behind the price as it moves in your favor. You lock in gains dynamically, giving a trend room to breathe while minimizing the risk of a sharp reversal.

Successful position traders pair these tools with broader strategies for wealth protection to keep their nest egg safe as the years add up.

Determining If Position Trading Fits Your Personality

Choosing a trading style is a lot like choosing a career—it has to be a good fit for your personality, lifestyle, and financial goals. So, how do you know if position trading is for you? It's a powerful approach that offers some huge advantages, like drastically lower stress and minimal screen time, freeing you up to focus on your job, family, or other passions.

The real prize for a position trader is the chance to catch those massive, game-changing market trends that play out over months or even years. By zooming out, you tune out all the distracting daily noise and can make much clearer, more strategic decisions.

But let's be honest, the challenges are just as real. This style demands an almost unbelievable amount of patience. You have to be disciplined enough to hold a trade through uncomfortable pullbacks that might last for weeks without hitting the panic button. It also requires enough capital to set the wider stop-losses needed to ride out that short-term volatility.

A Quick Self-Assessment

Be honest with yourself and ask these questions to see if your temperament is a match:

- Do I have real patience? Can I truly set a trade and only check on it once in a while, trusting my original homework?

- Am I a long-term thinker? Does the idea of capturing a massive move over the next year excite me more than grabbing a small profit this week?

- Can I handle the heat? How will I react if my position is in the red for a few weeks, even if the bigger picture still looks good?

- What's my lifestyle like? Do I need a trading method that doesn't chain me to a screen all day?

If you found yourself nodding "yes" to most of these, position trading could be a fantastic fit. It rewards a calm, analytical, and patient mindset—traits that often get traders into trouble in the faster-paced worlds of day trading or swing trading.

Ultimately, choosing this path means signing up for a marathon, not a sprint. It's built for the trader who prefers deep, thoughtful analysis over the constant action and adrenaline rush of the daily charts.

A Few More Questions On Position Trading

Let's wrap things up by tackling a few of the most common questions I hear from traders who are just getting started with this long-term approach.

How Much Capital Do I Need for Position Trading?

There isn't a magic number, but position trading generally requires more capital to get started than something like day trading. It comes down to your stop-loss placement.

Because you’re holding trades for weeks or months, your stops need to be wider to give the trade room to breathe and absorb the normal ebbs and flows of the market. A larger account ensures you can place these wider stops while still adhering to a safe 1-2% risk per trade. Many experienced traders recommend starting with at least a few thousand dollars so you can manage risk properly without being forced into taking on too much leverage.

Can I Use Technical Indicators in Position Trading?

Of course. Some position traders do find a place for long-term moving averages, like the 50-week or 200-day, to get a quick read on the overall health of a major trend. Think of it as a simple visual guide.

However, a lot of professional traders—myself included—lean towards a pure price action strategy. When you focus on the raw chart, looking at patterns and key supply and demand zones, you get a much cleaner view of what the market is actually doing. This helps you avoid the "analysis paralysis" that comes from trying to make sense of a dozen lagging indicators all telling you different things.

It's all about reacting to what price is telling you directly, not relying on derivative data that often sends conflicting signals and clutters your decision-making.

What Are the Best Markets for Position Trading?

Position trading works best in markets that have a strong history of producing clear, sustained trends. You're looking for assets that can move in one direction for months, or even years, at a time.

This makes the strategy a great fit for:

- Major Forex Pairs (like EUR/USD or GBP/USD)

- Stock Market Indices (the S&P 500 is a classic example)

- Large-Cap Stocks with solid fundamentals and growth potential

- Key Commodities like gold, silver, or crude oil

Ultimately, the specific market is less important than its character. You need an asset that trends well and has enough liquidity so you can get in and out of your trades without any trouble.

Ready to master the art of price action and build a sustainable trading career? The strategies at Colibri Trader are designed to give you a clear, indicator-free approach to the markets. Start your journey and take our free Trading Potential Quiz today!