Your Guide to a Trading Course for Beginners

So, what exactly is a trading course for beginners? Think of it as a guided apprenticeship for the financial markets. It’s a structured program designed to teach you the essentials—from market fundamentals and risk management to building your own trading strategies.

Essentially, it’s a roadmap that guides you from square one to making confident, well-thought-out trades, helping you sidestep those costly rookie mistakes.

Why a Trading Course Is Your Smartest First Move

Jumping into the trading world on your own is like trying to navigate a vast, choppy ocean without a map or compass. It’s a thrilling prospect, but it's incredibly easy to get lost. A good beginner's course is your complete navigation toolkit, turning what feels like a gamble into a disciplined, repeatable skill.

I like to think of it as flight school for traders. You wouldn't just hop into a cockpit and hope for the best, would you? You’d want an instructor, ground school, and plenty of time in a simulator. Trading is no different; a structured approach is the only way to build a solid foundation.

Building a Foundation for Success

The whole point of a quality course is to give you a reliable framework for making decisions. Forget chasing a "magic formula" that doesn't exist. The real goal is to develop a repeatable process grounded in proven principles.

A proper trading education should give you:

- A Clear Strategy: You'll learn specific rules for when to enter and exit a trade, which takes all the guesswork out of the equation.

- Risk Management Protocols: This is arguably the most critical skill for survival. You'll learn exactly how to protect your trading capital so you can stay in the game long-term.

- Psychological Discipline: A good course gives you the tools to manage fear and greed—the two emotions that wreck most new traders' accounts.

A structured course provides the discipline and framework that binge-watching random online videos simply cannot. It forces a mindset shift from "I hope this trade works out" to "I am executing a well-defined plan."

Before we go further, it's helpful to see a clear breakdown of the core competencies you should walk away with. A good program isn't just about theory; it's about building practical, real-world skills that you can apply immediately.

Key Skills from a Beginner Trading Course

| Essential Skill | What You Will Learn | Why It's Critical for Success |

|---|---|---|

| Market Analysis | How to read charts, identify trends, and understand key indicators. | This is how you spot opportunities and understand the "story" the market is telling you. |

| Risk Management | Setting stop-losses, calculating position sizes, and defining your risk per trade. | Protects your capital from catastrophic losses, ensuring you can trade another day. |

| Strategy Development | Building and backtesting a trading plan with clear entry, exit, and management rules. | Removes emotion and guesswork, turning your trading into a systematic business-like operation. |

| Trading Psychology | Techniques to manage fear, greed, and the fear of missing out (FOMO). | Your mindset is often the deciding factor between long-term success and blowing up your account. |

These pillars—analysis, risk control, strategy, and psychology—are the bedrock of any successful trading career. A course that doesn't build you up in all four areas is leaving you dangerously exposed to the markets.

Adapting to Modern Markets

Trading isn't what it used to be. The markets have evolved, and today, success is far less about "gut feelings" and much more about technical skill and data-driven decisions.

The best trading education reflects this change. Top-tier institutions are now emphasizing quantitative skills—like mathematics and algorithmic analysis—over old-school dealmaking instincts. As TradersMagazine.com highlights, this shift proves just how vital a modern, structured education is for anyone serious about this field.

Ultimately, a trading course is an investment in yourself. It arms you with the knowledge and, just as importantly, the confidence to navigate the markets effectively. It sets you on a path toward becoming a consistent, disciplined trader instead of just another gambler hoping to get lucky.

Understanding the Core Concepts Taught in Trading Courses

A quality trading course is about so much more than just learning which buttons to press. Its real job is to give you a complete framework for seeing and interpreting what the market is doing. This is what allows you to make informed decisions instead of just taking blind guesses.

Think of it like becoming a detective. You can't just show up at a crime scene and start pointing fingers. You need to learn how to read the environment (the market), spot clues (charts), figure out motives (company value), and most importantly, have a plan to keep yourself out of harm's way (risk management).

A solid trading course for beginners will walk you through each of these pieces methodically, building your skills one block at a time.

Market Fundamentals and Analysis Techniques

Before you can even think about placing a trade, you have to understand the playground you're in. The first part of any decent course will get you familiar with the different financial markets—stocks, forex, crypto, commodities—and explain what makes each one tick.

From there, you’ll dive into the two main ways traders try to make sense of it all:

- Technical Analysis: This is the art of reading charts. You'll learn how to spot patterns and trends, and how to use specific indicators to get a feel for where prices might be heading based on what they've done in the past.

- Fundamental Analysis: This is about digging into what an asset is actually worth. For a stock, that means rolling up your sleeves and looking at the company’s financial health, its earnings, and its position in the industry to figure out if it's a bargain or overpriced.

While most traders eventually lean toward one style, a strong foundational course will teach you the principles of both. It’s this combined perspective that gives you a much clearer picture of what's driving the market. You can learn more by exploring the essential basics of trading and how they fit together.

The Cornerstone of Survival: Risk Management

I can't stress this enough: this is the single most important topic in any trading course. It's also the one most beginners ignore, usually to their own detriment. Risk management isn't about avoiding losses—because losses are an unavoidable part of the game. It's about controlling them so that a bad trade is just a small setback, not a catastrophe.

Imagine you're a professional boxer. You'd never step into the ring expecting to never get hit. Your career depends on your ability to defend yourself and make sure no single punch can knock you out for good.

In trading, risk management is your defense. It’s the set of rules that keeps you in the game long enough to let your winning strategy actually work. It’s not just a concept; it’s your financial seatbelt.

A good course will hammer home these essential skills until they're second nature:

- Position Sizing: Learning to calculate exactly how much of your capital to put into a single trade, based on your total account size.

- Setting Stop-Losses: Deciding before you enter a trade exactly where you'll get out if it goes against you. This is non-negotiable.

- Risk/Reward Ratios: Making sure the potential profit on any trade is significantly bigger than what you stand to lose if you're wrong.

Developing a Trading Psychology

Finally, a great course tackles the invisible force that derails most aspiring traders: their own mind. I've seen more accounts wiped out by the emotional rollercoaster of fear and greed than by any market crash.

You'll learn specific strategies to maintain discipline, stick to your plan even when your gut is screaming at you to do the opposite, and avoid those costly impulse decisions. This is the training that separates the gamblers from the professionals. It teaches you to run your trading like a business, making calculated decisions based on your strategy, not on fleeting emotions.

Exploring the Essential Tools of the Trade

Knowing the theory is one thing, but actually placing trades and managing positions? That's a completely different ballgame. In trading, your theoretical knowledge is only half the battle. The other half is getting your hands dirty and mastering the practical tools that turn your analysis into action.

Any trading course for beginners worth its salt will spend a serious amount of time on the technology that professionals use every single day.

Think of it this way: reading books on aerodynamics doesn't make you a pilot. You have to get into a flight simulator to grab the controls, feel how the plane responds, and build real muscle memory. Trading tools serve the exact same purpose. They're the bridge between what you've learned in theory and what you can actually do in the live market.

Your Virtual Playground: Trading Simulators

For any new trader, the single most important tool is the trading simulator, often called a paper trading account. This is your risk-free sandbox—a virtual environment where you can buy and sell assets using fake money but with real, live market data.

This is where it all comes together. You'll test your strategies, learn the nuts and bolts of placing different order types, and even experience the emotional rollercoaster of watching trades unfold. The best part? You can do it all without risking a single dollar of your hard-earned capital. It’s an absolutely essential first step.

To get a better handle on this, check out our guide on https://www.colibritrader.com/what-is-paper-trading/.

You really can't overstate the value of this simulated experience. Take the annual Bloomberg Global Trading Challenge, for example. It gave over 10,000 students virtual portfolios of $1 million each. Using professional-grade terminals, these students built and executed complex strategies. The winning team generated over $1.6 million in profit above the benchmark, which just goes to show how effectively simulators prepare traders for the real world. You can read more about the incredible results on PR Newswire's website.

Charting Software and Brokerage Platforms

Once you're comfortable in the simulator, your course will introduce two other critical pieces of tech: charting software and brokerage platforms. They work hand-in-hand.

- Charting Software: Think of platforms like TradingView as your eyes on the market. They provide the charts, indicators, and drawing tools you'll use to perform technical analysis and hunt for potential trading opportunities.

- Brokerage Platforms: This is the software provided by your broker where you'll execute trades with real money. A good course will walk you through navigating these platforms to efficiently place different order types, like market orders, limit orders, and crucial stop-loss orders.

Mastering these tools is all about turning your analysis into a smooth, repeatable workflow. The goal is for the technology to become a natural extension of your strategy, not a clumsy barrier that gets in your way.

By combining practice in a simulator with a solid understanding of charting and brokerage platforms, you build a complete, practical skillset. This approach ensures that when you're finally ready to put real capital on the line, your focus is squarely on your strategy, not on fumbling with the controls.

How to Choose the Right Trading Course for You

The world of trading education is a jungle. It's crowded, noisy, and it can feel almost impossible to tell the difference between a real mentor and a slick marketer flashing a rented Lamborghini.

Picking the right trading course for beginners isn't just about getting good information. It’s about finding a genuine fit for your goals, your learning style, and your budget. Getting this right sets the foundation for your entire trading journey.

Think of it like hiring a personal trainer. You wouldn’t just sign up with the guy who has the flashiest Instagram ads, right? You'd check his qualifications, look at his clients' results, and make sure his coaching style actually works for you. You'd want to see a clear, structured plan. You need to apply that exact same level of scrutiny here.

Evaluate the Instructor and Their Experience

The person teaching the course is just as important—if not more so—than the material itself. You're looking for an experienced trader with a verifiable track record, not just a good salesperson. Look past the promises of a lavish lifestyle and dig into their actual trading philosophy.

Here are a few questions I always ask:

- Do they actually trade what they teach? The best mentors are in the trenches, actively trading their own strategies in the live markets. They aren't just academics.

- Is their teaching style clear? Watch their free content, like YouTube videos or webinars. Does their communication style click with you? If you're confused by their free stuff, you'll be lost in the paid course.

- What are other students saying? Hunt for real, authentic testimonials and reviews. Look for comments that talk about the instructor's expertise and the support they provide, not just hype.

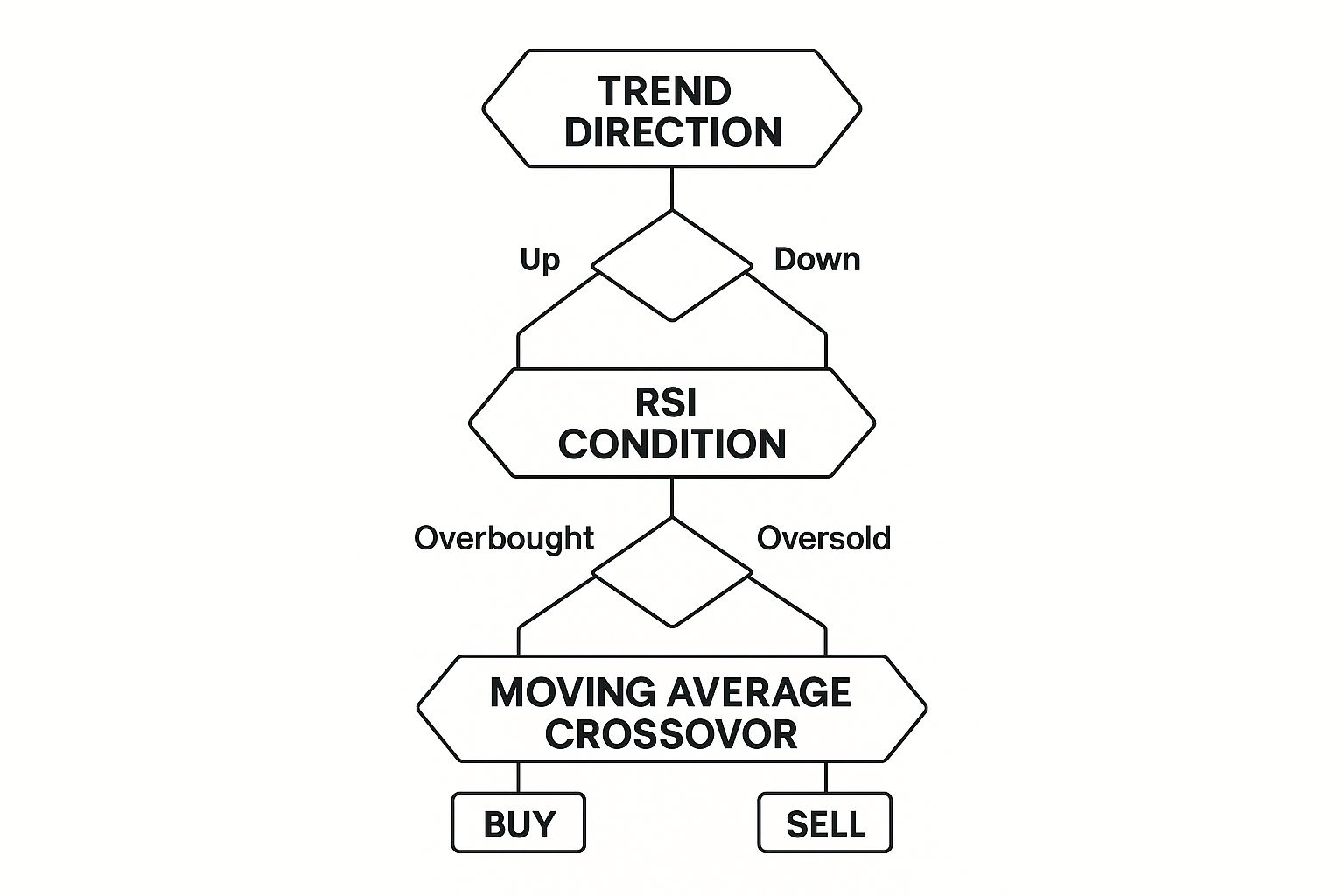

This infographic gives you a glimpse into the kind of logical, step-by-step decision-making process you'll learn through proper technical analysis.

This is a great example of how a trader combines multiple indicators—like trend direction, RSI, and moving averages—to get a clear "Buy" or "Sell" signal. It's about building a case for a trade, not just guessing.

Scrutinize the Curriculum and Support System

A truly great course is much more than a random collection of video lessons. It needs to be a complete, structured learning path that builds your knowledge logically, from the ground up. Always ask to see a detailed syllabus or curriculum overview.

Here’s a quick checklist I use when sizing up a program’s structure:

- Comprehensive Content: Does it cover all the essential pillars? I'm talking about market fundamentals, technical and fundamental analysis, rock-solid risk management, and trading psychology.

- Practical Application: Does the course push you to apply what you've learned? Look for practical exercises, real trade examples, and simulator practice. Theory is useless without application.

- Ongoing Support: Is there a community? A forum, a chat group, or something similar where you can ask questions and connect with the instructor and other students is non-negotiable.

A course without a strong community and ongoing support is like a textbook without a teacher. The ability to ask questions and get timely feedback is what truly accelerates your learning and helps you power through the inevitable roadblocks.

If you want to see what a well-structured curriculum looks like in the real world, check out the program offered by a proven online trading academy.

Spotting the Red Flags

Knowing what to look for is only half the battle. You also have to know what to avoid. The trading education space is, unfortunately, full of bad actors preying on the dreams of newcomers.

Run the other way if you see any of these warning signs:

- Guarantees of Profit: This is the biggest red flag of them all. Nobody—and I mean nobody—can guarantee profits in the market. Trading involves risk, period. Any honest educator will hammer this point home.

- Aggressive Sales Tactics: High-pressure pitches, fake countdown timers, and "once-in-a-lifetime" discounts are usually signs of a low-quality product trying to rush you into a bad decision.

- Vague or Secretive Strategies: If an instructor isn't completely transparent about their core trading methodology, it’s a massive red flag. What are they hiding?

To help you stay organized, I've put together a simple table. Use this as a checklist when you're comparing different courses.

Evaluating a Trading Course for Beginners

Use this checklist to compare different trading courses and identify the one that best fits your needs.

| Evaluation Factor | What to Look For | Red Flag to Avoid |

|---|---|---|

| Instructor's Credibility | An active trader with a verifiable track record. Clear teaching style (check free content). Positive, authentic student reviews. | "Secret" strategies. Flashy lifestyle marketing with no proof. Vague trading background. |

| Curriculum & Content | A structured syllabus covering analysis, risk management, and psychology. Includes practical exercises and real-world trade examples. | A random collection of videos with no logical flow. Focus on just one "magic" indicator. |

| Community & Support | An active community (forum, chat group) for asking questions. Direct access to the instructor or mentors for feedback. | No community. You're left on your own after purchase. Delayed or non-existent support. |

| Transparency & Honesty | Clear discussion of risks. Realistic expectations. Full transparency about the trading strategy and its limitations. | Guaranteed profits. High-pressure sales tactics. Claims of a "no-loss" system. |

| Cost & Value | Price is reasonable for the value provided (curriculum depth, support, etc.). A clear refund policy. | An extremely high price with no justification. "Limited time" discounts that never end. |

In the end, choosing a trading course is a very personal decision. Take your time, do your homework, and trust your gut. The right program won't feel like a simple purchase; it will feel like a long-term investment in your financial education.

The True Value of Completing a Trading Course

So, what’s the real payoff from a good trading course? It’s not just about learning when to click "buy" or "sell." The true value is in the permanent skillset you forge, turning you from a hopeful gambler into a disciplined, strategic trader who's actually in control.

Think of a great trading course for beginners as earning a black belt in financial self-defense. You’re not just memorizing a few moves (trading strategies); you're building the discipline, focus, and mindset to execute them flawlessly when real money is on the line.

This kind of structured learning is designed to protect your most critical asset: your trading capital. By truly understanding risk management, you learn how to measure and cap your downside on every single trade. This ensures that one bad decision doesn't wipe you out.

Mastering Your Inner Game

Honestly, one of the biggest hurdles in trading is yourself. The markets are a giant emotional rollercoaster, and if you go in without training, fear and greed will drive your decisions straight into the ground. A solid course gives you the mental toolkit to manage those impulses.

You’ll finally be able to:

- Trade with a Plan: Execute trades based on a proven strategy, not a gut feeling or some talking head on TV.

- Manage Emotions: Learn to recognize and sidestep the fear of missing out (FOMO) and the sheer panic that makes people sell at the absolute worst moment.

- Build Lasting Discipline: Develop the patience to wait for the A+ setups and the grit to stick to your rules, even when it's uncomfortable.

This emotional control is what separates the amateurs from the pros. It's that simple.

The point of a trading course isn't just to show you how to make money. It's to teach you how to think, act, and operate like a professional trader. The money follows that process, not the other way around.

Building Lifelong Skills and a Global Perspective

The skills you pick up along the way reach far beyond your trading screen. You’re sharpening your critical thinking, learning how to assess probabilities on the fly, and making decisive calls under pressure—all incredibly valuable in any line of work.

And this isn't just a local trend; the demand for practical financial education is blowing up worldwide.

Take Germany, for example. In the 2023/24 winter semester, their international student enrollment jumped by 3%, partly because new policies made it easier for students to work. This points to a massive global shift toward accessible education that gives people real-world, practical skills. You can read more about this global education trend over at ApplyBoard.com.

When it's all said and done, finishing a course gives you a resilient, adaptable skillset for life. It's a direct investment in your own self-sufficiency and strategic thinking.

Common Questions About Trading Courses

Stepping into the trading world can feel like learning an entirely new language. It's only natural to have a few questions before you commit your time and money to a trading course for beginners.

Let's clear the air. In this section, I’ll give you some straightforward answers to the most common concerns I hear from new traders. We'll tackle the big ones about cost, profitability, and what really matters when you're just starting out. The goal is to cut through the noise and give you the clarity you need to move forward.

Can I Just Learn to Trade for Free Online?

You absolutely can, but I wouldn't recommend it. The internet is flooded with free videos, articles, and forum posts, but they often create more confusion than clarity. These bits and pieces of information lack the structured, step-by-step path you need to build a solid foundation.

Think of it this way: you can try to build a house by gathering random piles of lumber and nails you find for free, or you can use a professional blueprint. A quality course is your blueprint. It’s designed to build your skills logically, saving you from costly mistakes and bad habits that are incredibly difficult to unlearn later on.

The real investment in a trading course isn't just for the information; it's for the curated structure, expert mentorship, and a clear path that cuts through the noise. It’s an investment in efficiency and avoiding bad habits that are hard to unlearn.

Free content gives you isolated, and sometimes conflicting, puzzle pieces. A structured program gives you the whole system.

How Much Money Do I Need to Start Trading?

This is one of the biggest myths out there. You need far less capital to start trading than most people think. Thanks to modern online brokers, you can open an account with just a few hundred dollars. But honestly, the initial amount of money shouldn't even be your focus.

Any reputable course will hammer this home: start with a paper trading account. This is a trading simulator that lets you practice your strategy with virtual money in a live market. It’s the perfect, risk-free way to build confidence and iron out the kinks in your process.

When you do go live with real money, the goal isn't to get rich overnight. It's about flawlessly executing your strategy and managing risk like a hawk. Starting small builds the discipline that will serve you for years as your account grows.

How Quickly Can I Become Profitable?

There's no magic number here. Be extremely skeptical of anyone who promises you can get rich quick—that’s the biggest red flag in this business. Becoming a consistently profitable trader is a marathon, not a sprint.

Success demands discipline, relentless practice, and a deep understanding of your own psychology. A course gives you the map, but you're the one who has to drive every single mile.

Most traders I know spent their first six months to a year just refining their strategy, getting their emotions in check, and finding consistency. A good trading course gives you the tools and framework to navigate this critical learning phase without blowing up your account.

What Is the Most Critical Skill a Course Should Teach?

While chart reading and strategy are vital, the single most critical skill for any new trader is risk management. It is the absolute bedrock of a long and sustainable trading career. I've seen great strategies fail spectacularly because the trader had no concept of risk management.

Learning to protect your capital is what separates professionals from gamblers. A top-tier trading course for beginners will ingrain these principles into your DNA:

- Position Sizing: Knowing exactly how much of your account to risk on any single trade.

- Setting Stop-Losses: Deciding your maximum acceptable loss before you even click the buy or sell button.

- Risk-to-Reward Ratios: Making sure your potential profits are always significantly larger than your potential losses.

Mastering risk management isn't optional. It’s the defensive game that keeps you on the field long enough for your winners to work their magic.

Ready to stop guessing and start building a real, sustainable trading skillset? At Colibri Trader, we provide a clear, price-action based approach to help you master the markets without confusing indicators or jargon. Take the first step toward confident trading by exploring our proven programs at https://www.colibritrader.com.