Three Black Crows – 7 Key Pro Tips

Traders use the the three black crows to increase the odds of winning in the trading game.

What started as an individual invention in the 18th century grew into the adopted worldwide way to view asset prices.

The Japanese rice trader, Munehisa Homma, thought up an efficient way to interpret the market psychology using so-called candlesticks.

Let’s look at one of the candlestick patterns with a rather oriental name – the Three Black Crows (TBC).

Initially, each Japanese candle was meant to represent one trading day or longer.

It would be pretty tough to gather intraday rice pricing data in the 18th century!

You got the point.

So, throughout the article, we will use traditional timeframes – one day and above.

Read on to discover seven tips to get the most of the Three Black Crows setup.

Contents in this article

- Japanese Candlestick Structure

- What Is The Three Black Crows Pattern

- Look ath The Three Black Crows Correctly

- The Market Specifics

- The Three Black Crows Entry Tactics

- Set the Risk and Reward

- Use Different Timeframes to Trade the Three Black Crows

- Combine the Three Black Crows With Other Tools

- Automate the Three Black Crows Searche

Japanese candlestick structure

First, let’s have a brief of what the candlestick is.

Each candlestick represents a specific trading period and consists of 4 parts: open, high, low, and close.

Open and close are the period’s first and last transaction prices, respectively.

High and low represent the highest and the lowest prices during the trading time.

The color of the candle highlights the overall sentiment of the period.

If the close is above the open, the period is bullish, and the candle turns white.

Conversely, when the close is lower than the open, bears are in control, and the candle is black.

Clear so far?

As the market fluctuates due to the forces of supply and demand, the candlesticks’ shapes vary.

Check out the example below.

Traders look for candlestick patterns to increase the odds of profitable trades controlling the risk and reward.

Patterns may include up to five candles.

What is the Three Black Crows pattern?

Here is a bearish setup that forms after the market has been in an uptrend.

Let’s look at the pattern’s properties in the list below.

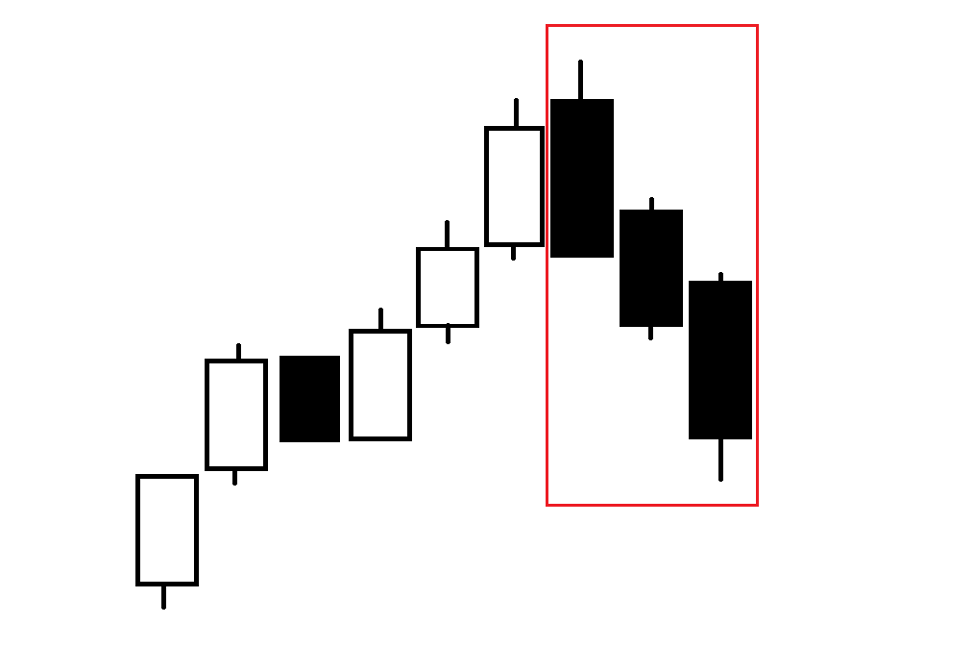

- It consists of the three bearish big-body candles in a row.

- Each candle closes lower than the previous one.

- Each open is above the previous candle’s close in the classic variant of the formation.

Below is the Three Black Crows sketch (see the red rectangle).

Often, traders use volume to confirm the setup’s validity.

How?

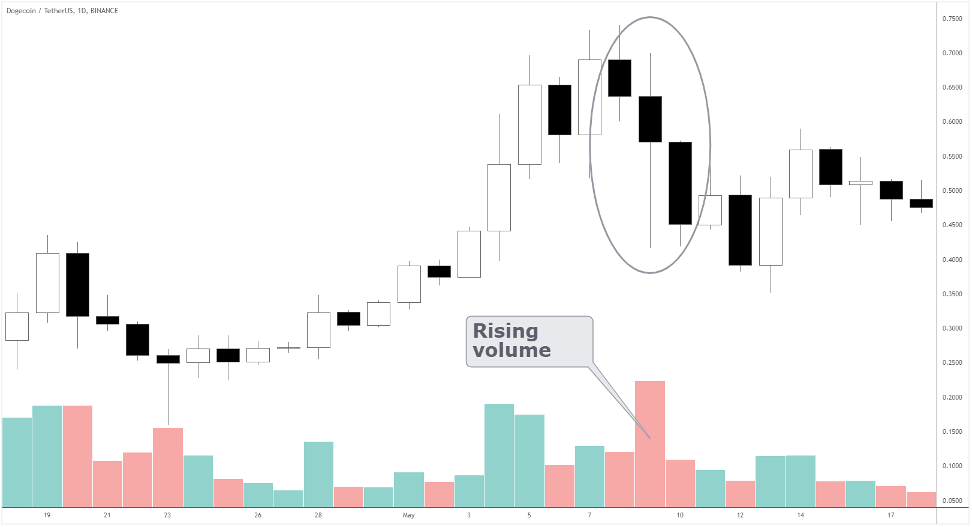

Pro tip: If the volume during the formation is relatively higher than throughout the preceding trend, the pattern is more reliable.

The psychology behind the Three Black Crows

Ready for a story?

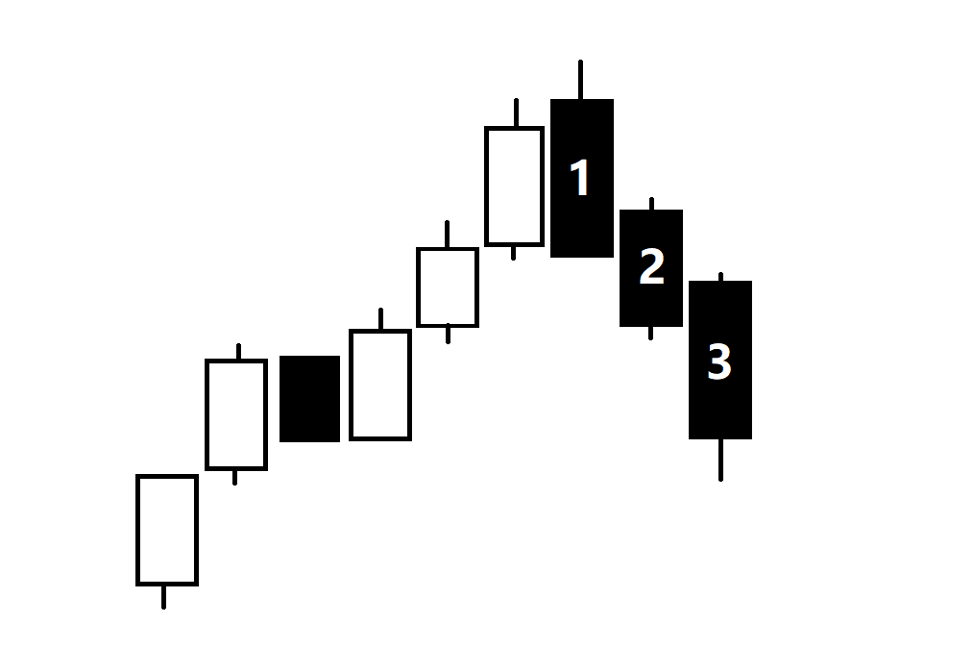

Sharp uptrend pullbacks make investors nervous – such as the first candle of the TBC (see the illustration below).

- The first step of the pattern usually erases most, if not all, of the gains of the previous uptrend day.

At this point, the shortest-term bulls would seek to join the sellers’ camp.

Most of those bought on (1) and the previous day would see losses.

- The pattern’s second day (2) opens with a gap-up, as buy-the-dip enthusiasts rush in to enter at the first print.

However, the wave of disappointment is already big enough to negate the initial buying pressure.

The gap is quickly closed, and sellers drive the prices lower, closing the day in an aggressive bearish manner.

- On the third day, the scenario repeats, frustrating even the most patient remaining bulls.

Thus, more sales close the day negative, completing the Three Black Crows.

As a result, the short-to-medium-term bullish sentiment is severely damaged as too many buyers suffered losses.

1. Look for the Three Black Crows correctly

Although the TBC is promising, it’s just one part of the puzzle.

We should use the setup in the proper context to get the best odds.

The truth is many things that we see in the chart that we consider “patterns” are mere meaningless shapes.

What makes a difference is the circumstances in which the formations appear.

There’s nothing special about it if you see rainclouds above a tropical forest – no climate shifts or other serious stuff.

However, the same clouds over the Sahara Desert should make one think.

Let’s talk about it.

Identify an uptrend

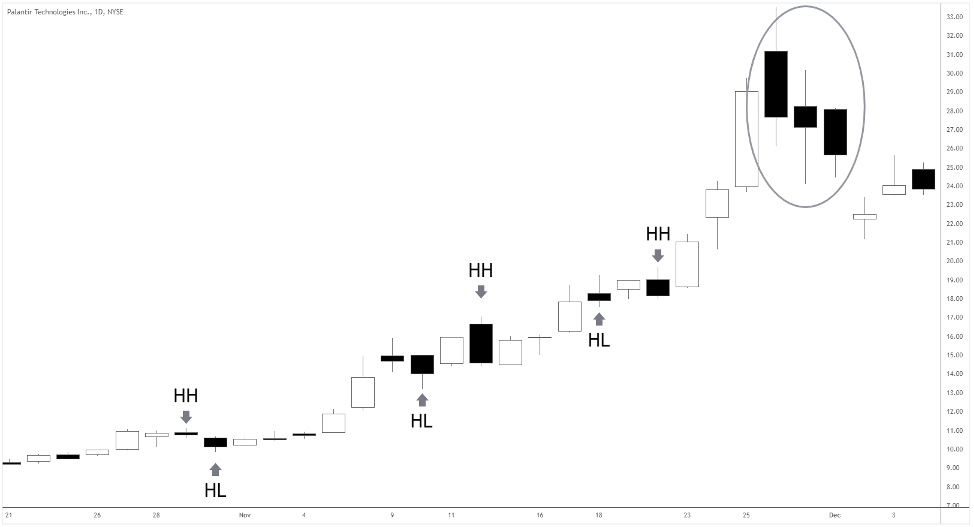

The Three Black Crows appear in an obvious uptrend.

How to find one?

The standard Dow theory tells us that prices keep making higher highs (HH) and higher lows (HL) in an uptrend.

Also, the trend should last for a considerable time compared to the period of forming the Three Black Crows.

It must look dead clear that it’s been an established uptrend, and it’s correcting in the form of the TBC.

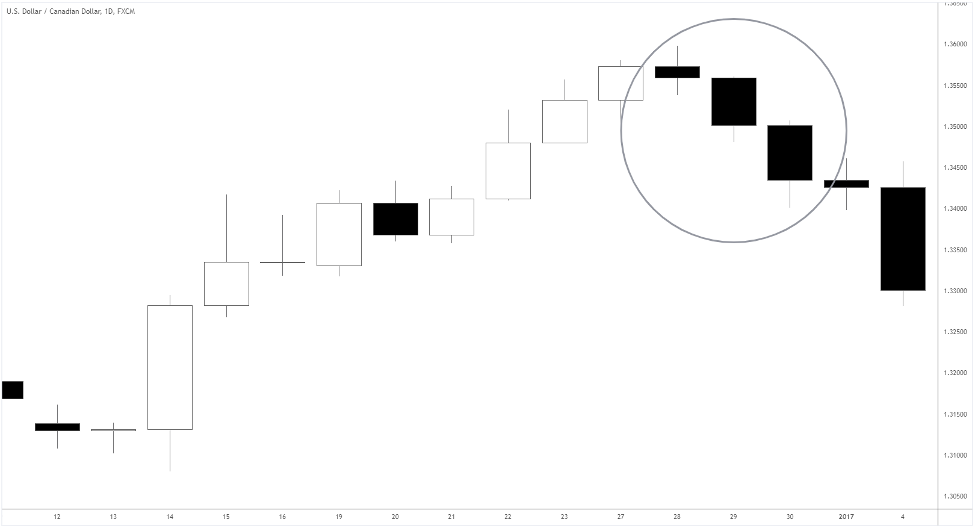

The example below shows an uptrend and the Three Black Crows (see the circled area).

Note the structure of the trend and its duration relative to the TBC.

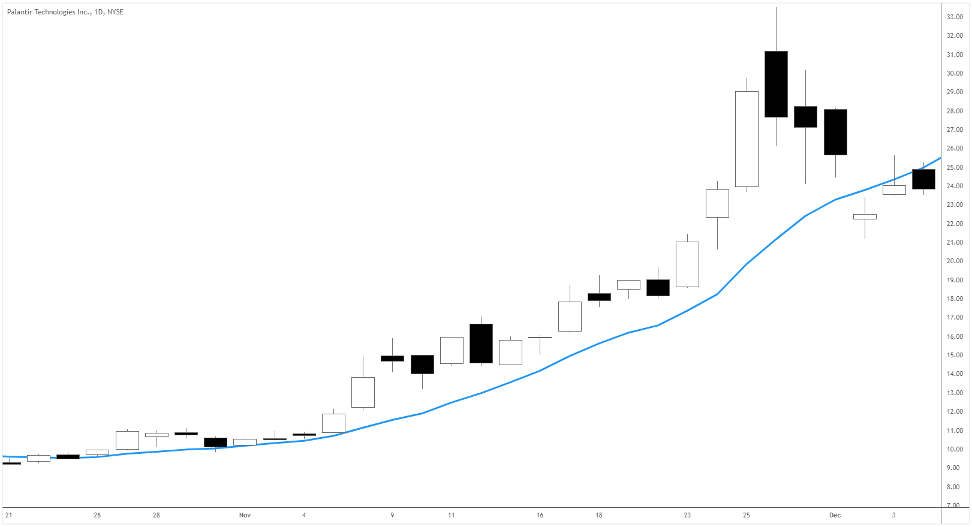

Confirm the trend with an indicator

Technical tools help us to perceive the price dynamics more objectively.

You might feel a certain way about the market.

However, the indicator’s formula will show the market from a statistical perspective.

Consider the Moving Average; the market is on an uptrend when the prices are above the MA (see the illustration below).

Conversely, the downtrend forms when the prices dip under the MA.

Here is an example.

Did you see those prices staying above the blue line?

After such a confirmation, you can be confident you’re looking for the Three Black Crows in the right place.

2. The market specifics

It matters where you’re looking for the Three Black Crows.

The setup’s distinct feature is more than one consecutive gap-up, which is almost impossible in 24-hour markets like Forex.

The classical pattern properties described above are likelier in centralized markets like stocks or futures.

Why is that?

Frequent gaps happen where trading is conducted in distinct sessions – during the working hours of the exchange.

In Forex, you can usually expect significant gaps only on Monday, as banks start operating in New Zealand first.

The adjusted version of the Three Black Crows in the FX doesn’t have gaps (see the example below).

Instead, each bearish candle would open around the same price as the previous close (see the USDCAD above).

The same goes for cryptocurrencies, where trading doesn’t stop even on weekends.

Look at the Three Black Crows in Dogecoin below.

The advantage of cryptos is that you can confirm the pattern’s validity with the real volume, unlike in Forex.

Note: you can still apply such a simplified version of the TBC to stocks and futures.

The adjusted version is more common and carries almost the same meaning.

3. The Three Black Crows entry tactics

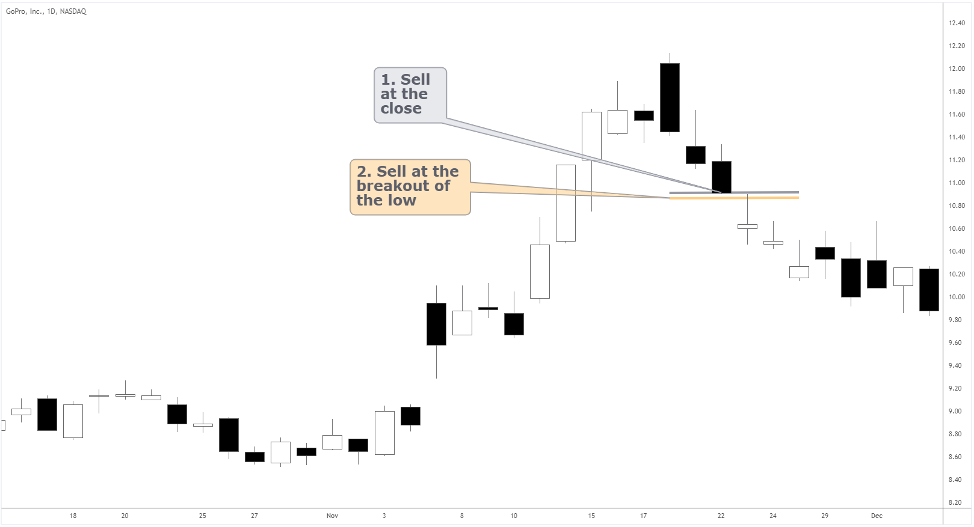

There are two main entry techniques for the setup.

- Sell at the close of the third candle

- Enter at the third day’s breakout of the low

Here they are.

Often, entering at the breakout provides a short-term impulse in your favor as bulls’ stops are triggered.

Note that in the case of the second entry in GoPro, you might not get a fill due to the gap.

Pro tip: You could still try to short it at the post/premarket; the volume is typically thin, though.

You won’t have such challenges in Forex, cryptos, and even future contracts.

4. Set the risk and reward

An average gain and the winning rate depend greatly on how you handle your stop losses and profit targets.

Handle with care!

A low risk-reward ratio typically offers a higher win rate.

Conversely, tighter stops will diminish your hit rate but let you gain several risks per trade.

Let’s look at several ways to set stop losses and targets with the Three Black Crows.

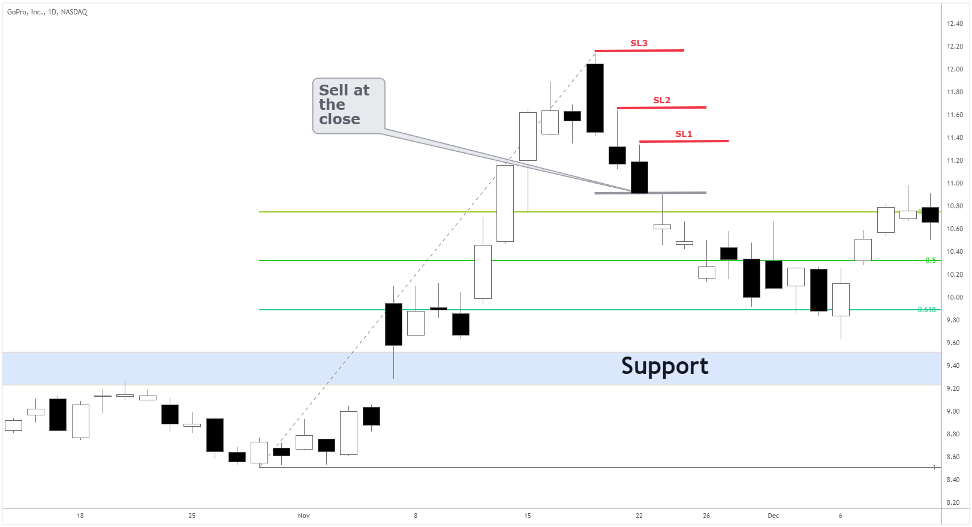

In the following illustration, we have three possible spots for the stop loss above the day’s high – SL1, SL2, and SL3.

Suppose we enter at the close of the pattern’s third day.

In that case, we can use Fibonacci retracements 0.5 and 0.618 as targets.

Ultimately, we aim to exit at the support area at 9.20-9.50, especially if our protective stop is SL3.

5. Use different timeframes to trade the Three Black Crows

Are you bold for a challenge?

Go to the lower timeframe to get your surgical entry with the minimum risk.

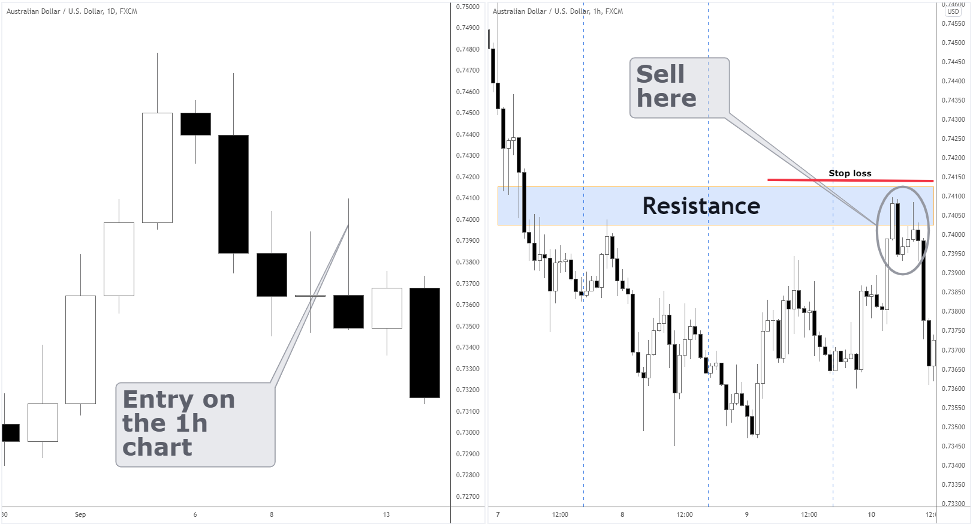

In the AUDUSD charts below, we have the TBC on the daily and a resistance rejection entry on the 1-hour chart.

The stop loss would be right above the local supply zone.

Looks cool?

Indeed, you can get the highest R/R ratio entering on the lower timeframes.

However, make sure you’re able to monitor the market intraday and get enough screen time to recognize those entries.

6. Combine the Three Black Crows with other tools

Is that Three Black Crows for real?

How do we make sure the setup has the best odds of success?

Use other tools along with the Three Black Crows to confirm the validity of the pattern.

Classic support and resistance, like in examples before, help filter out the best opportunities.

Makes sense?

The most reliable Three Black Crows form around such levels.

Indicators showing crossovers and overbought/oversold conditions when the pattern appears also can help.

7. Automate the Three Black Crows search

Here is some shortcut.

Market analysis services like Investing.com provide candlestick scanners for free!

So, you can instantly find even the rarest patterns, such as the Three Black Crows.

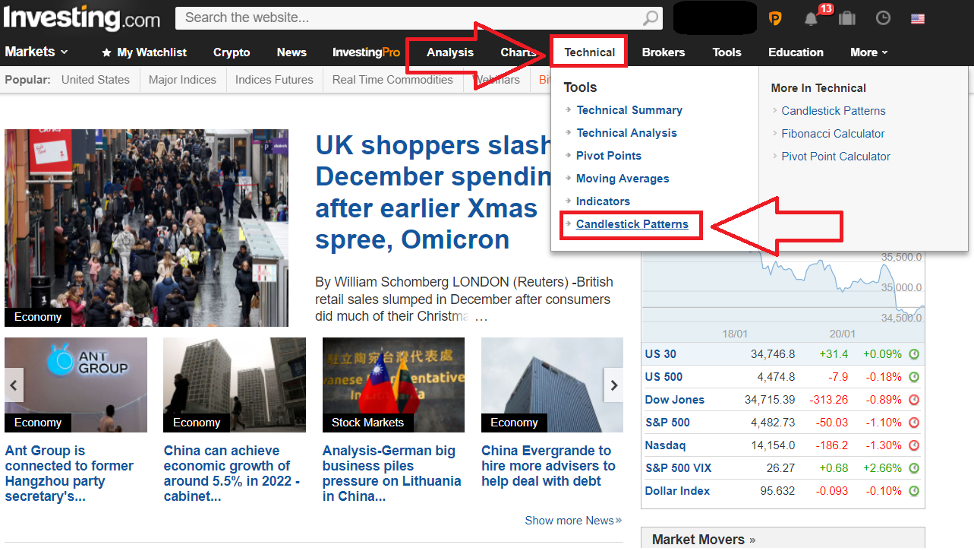

Here is how to use the scanner on Investing.com.

On the main page, go to Technical, and then click Candlestick Patterns.

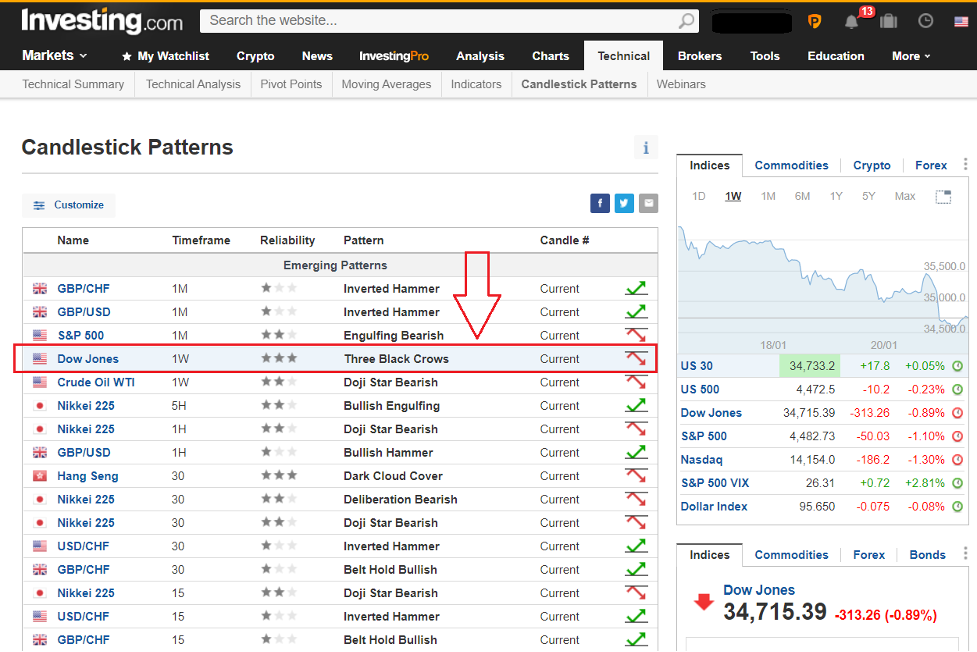

Next, you’ll see the comprehensive list of patterns in various assets and timeframes.

Look, Dow Jones is forming the Three Black Crows on the weekly!

Happy trading,

Colibri Trader

P.S.

Did you read my other article on What Are the 7 Skills the Pro Breakout Traders Share?