7 Best Stock Trading Course for Beginners in 2025

Stepping into the world of stock trading can feel like navigating a complex maze. With countless strategies, endless data, and the high stakes of your own capital, it's easy to feel overwhelmed and unsure where to begin. What if you could bypass the initial confusion and learn a clear, effective approach from the start? A high-quality stock trading course for beginners is the single most important investment you can make in your financial future, providing the structured knowledge needed to trade confidently and avoid costly rookie mistakes.

This guide is designed to help you find that perfect starting point. We’ve meticulously analyzed the top platforms to bring you the definitive list of the best courses available today. Whether you're a novice trader seeking foundational skills, an intermediate trader frustrated with inconsistency, or even a professional looking to refine your strategy, this roundup has an option for you.

We'll break down the unique teaching methods of each platform, from pure price action analysis on Colibri Trader to the gamified learning experiences at Wall Street Survivor. For each course, you'll find key details, pros, cons, pricing, and who it's best for, complete with screenshots and direct links. This isn't just a list; it's a roadmap to help you select the ideal program to launch your trading journey with clarity and confidence.

1. Colibri Trader: Best for a No-Nonsense, Price Action Approach

For beginners seeking a direct, uncluttered path to understanding market movements, Colibri Trader offers an exceptional stock trading course for beginners grounded in the discipline of price action. This platform cuts through the noise of complex indicators and overwhelming fundamental analysis, focusing instead on teaching you how to read and interpret the story told by price charts alone. This singular focus empowers new traders to build a robust, transferable skill set that is effective in any market condition, whether it's trending upwards, downwards, or moving sideways.

The educational journey begins with immediate, tangible value. Before committing to a full course, you can take a free, personalized Trading Potential Quiz to gauge your current mindset and strengths. You also gain instant access to the first two chapters of an Amazon bestselling book on price action, providing a solid, no-cost introduction to the platform’s core philosophy. This "try-before-you-buy" model demonstrates a clear confidence in the quality of the material and helps you make an informed decision.

Key Features and Learning Philosophy

Colibri Trader distinguishes itself with a curriculum that is both structured and highly practical. The platform is built around transforming students into confident traders, not just certificate holders.

- Core Focus on Price Action: The entire methodology revolves around identifying high-probability trading setups by analyzing candlestick patterns, support and resistance levels, and market trends. This eliminates "analysis paralysis" often caused by juggling dozens of lagging indicators.

- Structured Learning Paths: The platform offers a clear progression from foundational concepts to advanced strategies. Courses include a beginner-friendly Basic plan, a more comprehensive Premium plan, and specialized programs like Supply & Demand and Day Trading for those looking to deepen their expertise.

- Emphasis on Trading Psychology: A significant portion of the material is dedicated to discipline, risk management, and maintaining emotional control. Colibri Trader understands that a winning strategy is useless without the right mindset to execute it consistently.

- Strong Community and Mentorship: With a track record of over 8,000 students and hundreds of positive testimonials, the platform fosters a supportive learning environment. The high-touch support from the mentor is frequently highlighted as a key factor in student success.

Who Is It Best For?

This platform is ideally suited for self-motivated learners who value a proven, straightforward system. If you are frustrated by overly complicated strategies or want to build a foundational skill that will serve you throughout your trading career, Colibri Trader’s price-action-centric approach is a powerful starting point. It's particularly effective for those who want actionable lessons they can apply directly to live charts.

| Feature Analysis | Description |

|---|---|

| Course Structure | Progressive modules from basics to advanced, with real-world chart examples. |

| Primary Method | Pure price action, focusing on candlestick patterns and market structure. |

| Support System | Direct access to mentorship and a community of fellow traders. |

| Accessibility | Free introductory materials and quiz; full course costs require inquiry. |

Practical Tips for Success

To maximize your learning on Colibri Trader, start by thoroughly absorbing the free chapters to ensure the price action methodology resonates with you. As you progress through a course, practice identifying the patterns and setups discussed on a demo trading account. This hands-on application is crucial for building the pattern-recognition skills the course aims to develop.

| Pros & Cons | |

|---|---|

| Pros | Cons |

| Practical, price-action based approach. | No formal certifications awarded. |

| Free introductory content provides immediate value. | Upfront pricing details are not readily available. |

| Wide range of courses for different skill levels. | |

| Strong mentorship and positive community feedback. | |

| Cost-effective alternative to expensive programs. |

Website: https://www.colibritrader.com

2. Udemy

Udemy stands out as a global online learning marketplace offering an unparalleled variety of courses, making it an excellent starting point for anyone looking for a stock trading course for beginners. Unlike platforms dedicated solely to finance, Udemy provides access to thousands of courses on every conceivable topic, including a massive library dedicated to stock trading, investing, technical analysis, and financial markets. This allows beginners to find a course that perfectly matches their specific learning style, budget, and time commitment.

The platform's key advantage is its accessibility and affordability. You can find comprehensive courses like "The Complete Foundation Stock Trading Course," which covers everything from market fundamentals to risk management, often at a significant discount during site-wide sales. This low barrier to entry empowers new traders to start their education without a substantial financial investment.

Why Udemy Is a Great Choice for Novice Traders

Udemy’s model is built on flexibility. Once purchased, you get lifetime access to the course materials, including all future updates. This allows you to learn at your own pace and revisit complex topics whenever you need a refresher, a feature that is invaluable when learning the intricate details of trading.

Courses are taught by a diverse range of instructors, from professional traders to financial analysts. This variety means you can choose an instructor whose teaching style resonates with you. While this diversity is a strength, it also requires due diligence.

Pro Tip: Always check a course's rating, read recent reviews, and watch the preview videos before purchasing. Look for instructors with real-world trading experience and a high number of student enrollments to ensure you are getting quality, actionable content.

Course Structure and What to Expect

Most Udemy stock trading courses are structured with video lectures, downloadable resources, and sometimes quizzes or assignments to test your knowledge. The self-paced nature is ideal for those balancing learning with a full-time job.

- Pros: Highly affordable with frequent sales, massive selection of courses, lifetime access to content, flexible self-paced learning.

- Cons: Course quality can be inconsistent, limited direct interaction with instructors.

- Best For: Self-motivated beginners on a budget who want to explore various trading topics and learn from different instructors.

- Website: Udemy

3. Coursera

Coursera brings university-level education directly to your screen, offering a unique opportunity to learn from world-renowned institutions. For those seeking a stock trading course for beginners grounded in academic theory and rigorous analysis, Coursera is an exceptional choice. The platform partners with top universities like Yale, Stanford, and the University of Michigan to provide courses on financial markets, investment strategies, and portfolio management, delivering a level of authority and credibility that is hard to match.

The standout feature is the academic pedigree of its content. Instead of learning from individual traders, you gain insights from tenured professors and leading financial experts. For instance, Yale University’s "Financial Markets" course, taught by Nobel laureate Robert Shiller, is available on the platform, offering a deep dive into the real-world mechanics of the financial system. This approach provides a robust, theoretical foundation that is crucial for long-term investing success.

Why Coursera Is a Great Choice for Novice Traders

Coursera’s primary strength lies in its blend of accessibility and academic rigor. Many courses can be audited for free, giving you full access to video lectures and reading materials. This allows you to absorb high-quality knowledge without any financial commitment, which is perfect for beginners who are still exploring their interest in trading and investing.

If you want to earn a shareable certificate to showcase your skills on a resume or LinkedIn profile, you can opt for the paid track. This often includes graded assignments, peer-reviewed projects, and instructor feedback, providing a more structured and interactive learning experience.

Pro Tip: Take advantage of the audit option first. It allows you to review the course content and instructor's teaching style to ensure it meets your needs before you decide to pay for the certificate. Financial aid is also available for those who qualify, making these premier courses even more accessible.

Course Structure and What to Expect

Coursera courses are typically structured into weekly modules containing video lectures, readings, and quizzes. This self-paced format is ideal for fitting education around a busy schedule. The curriculum is meticulously planned, guiding learners from foundational concepts to more complex topics in a logical, easy-to-follow progression.

- Pros: Access to reputable academic content from top universities, well-structured and in-depth courses, option to audit many courses for free.

- Cons: Certificates and graded assignments require payment, less focus on short-term "day trading" tactics.

- Best For: Beginners who value a strong theoretical foundation and want to learn the principles of finance from academic experts.

- Website: Coursera

4. TD Ameritrade

TD Ameritrade provides a comprehensive educational ecosystem that is one of the most robust offerings from any major brokerage, making it an ideal place to find a stock trading course for beginners. Instead of just being a platform to execute trades, it has integrated a vast library of free educational resources directly into its offering. This content is designed to guide traders from the novice stage to advanced levels, all backed by the credibility of a leading financial institution.

The key draw for new traders is the sheer volume and quality of the free content available. After completing a simple account registration, which does not require any initial funding, you gain access to a treasure trove of articles, videos, interactive courses, and even live webinars. This model removes the financial barrier to high-quality education, allowing you to learn the fundamentals of stock trading from a reputable source before risking any capital. For those exploring various educational paths, you can learn more about how TD Ameritrade's educational platform compares to other dedicated training programs like the Online Trading Academy.

Why TD Ameritrade Is a Great Choice for Novice Traders

TD Ameritrade's strength lies in its structured learning paths. The educational content isn't just a random collection of articles; it includes interactive courses with progress tracking and quizzes that help solidify your understanding. This guided approach ensures you build a strong foundation, covering essential topics like stock selection, technical analysis, and portfolio management in a logical sequence.

The platform also provides access to live webinars hosted by trading professionals, offering timely market insights and strategy discussions. This blend of on-demand courses and live events creates a dynamic learning environment that caters to different learning preferences and helps keep you engaged with current market trends.

Pro Tip: Take full advantage of the "paperMoney" virtual trading simulator on their thinkorswim platform. After going through the educational courses, use this tool to practice your strategies with virtual funds. This is the perfect risk-free environment to apply what you've learned and build confidence before trading with real money.

Course Structure and What to Expect

The educational offerings are well-organized within the platform, making it easy to find materials relevant to your skill level. You can progress through structured courses, tune into daily webcasts, or even attend in-person events at local branches for a more hands-on experience.

- Pros: No cost for education after registration, reputable brokerage providing reliable content, wide range of materials including courses, webinars, and articles.

- Cons: Must open an account to access content, limited personalized one-on-one support.

- Best For: Beginners who want free, high-quality education from a trusted source and plan to use an integrated trading platform.

- Website: TD Ameritrade

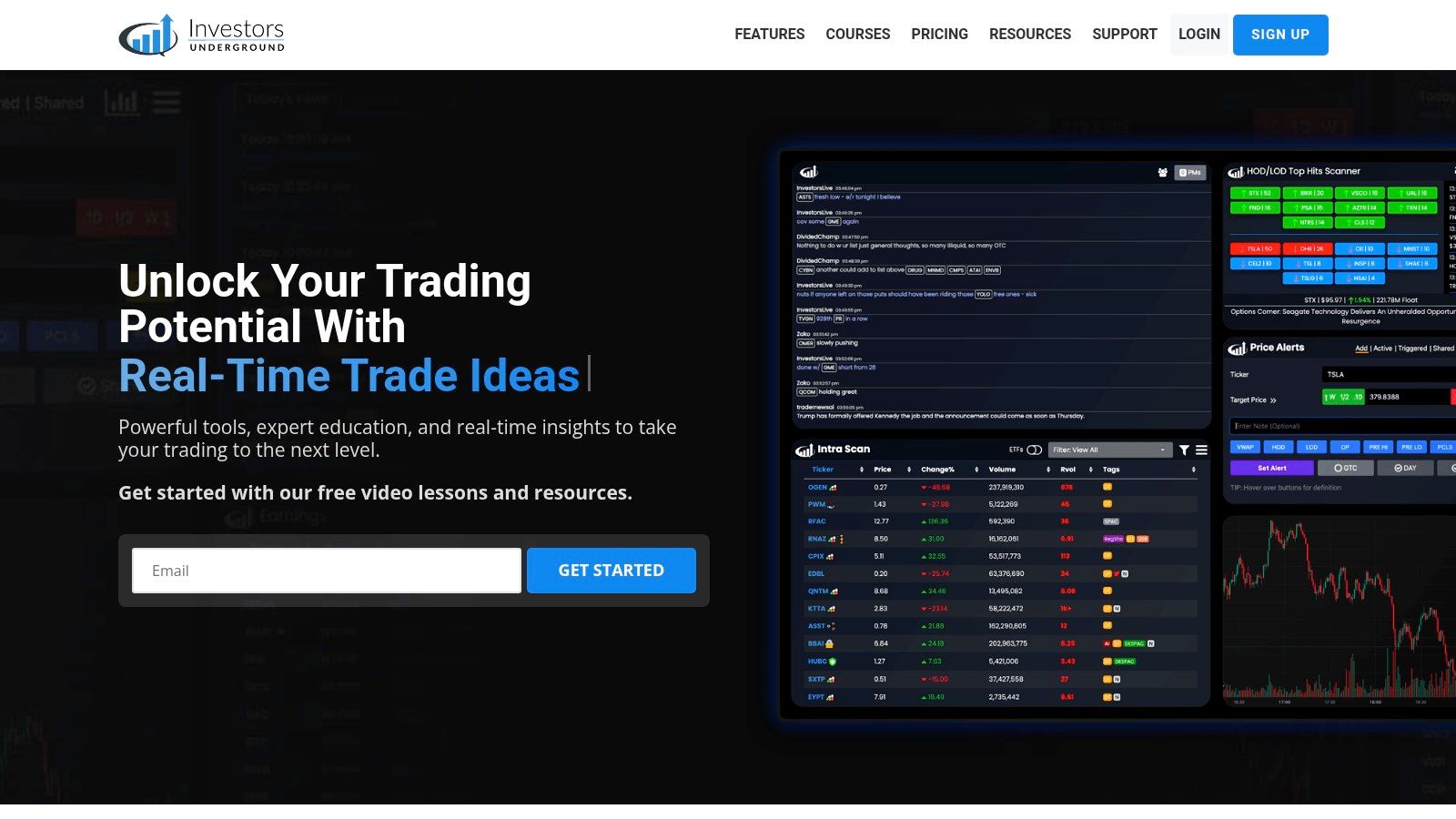

5. Investors Underground

Investors Underground is a premier community and educational platform that provides an immersive stock trading course for beginners through its highly-regarded "Textbook Trading" and "Tandem Trader" courses. Unlike broad learning marketplaces, this platform is hyper-focused on day trading, delivering in-depth strategies rooted in real-world application. It’s designed for those who want to move beyond basic theory and learn directly from the pros in a live, interactive environment.

The core of the Investors Underground experience is its combination of comprehensive video lessons and a vibrant trading community. Members gain access to an active chat room where professional traders share their screens, call out trades in real time, and explain their strategies as the market moves. This direct exposure to professional decision-making offers an unparalleled learning opportunity that is difficult to find elsewhere.

Why Investors Underground Is a Great Choice for Novice Traders

Investors Underground excels by emphasizing practical, actionable trading strategies. The "Textbook Trading" course, for instance, includes over 25 hours of detailed video content that breaks down specific setups, risk management techniques, and the psychology needed to succeed. The real value, however, comes from combining this knowledge with the daily live trading chat rooms and webinars.

This dual approach helps bridge the gap between learning and doing. You can study a concept in the course and then see it applied live by experienced moderators the very next day. This active community support system is crucial for building confidence and accelerating the learning curve.

Pro Tip: New members should dedicate time to watching the daily trade recap videos. These recaps break down the day's biggest moves and moderator trades, providing critical context and reinforcing the strategies taught in the foundational courses.

Course Structure and What to Expect

The educational offerings are primarily centered around two flagship courses, which are sold separately from the community membership. "Textbook Trading" covers the foundational strategies, while "Tandem Trader" features live trading examples from multiple moderators. A monthly or annual subscription is required for access to the live chat rooms and daily webinars.

- Pros: Direct access to experienced traders, strong community engagement, emphasis on practical, real-world trading.

- Cons: Higher cost compared to other platforms, courses are sold separately from the chat room membership.

- Best For: Aspiring day traders who are serious about learning professional strategies and want an immersive, community-driven experience.

- Website: Investors Underground

6. Bear Bull Traders

Bear Bull Traders offers a highly structured and community-centric approach, making it an exceptional stock trading course for beginners who thrive on real-time engagement and support. Unlike self-contained video courses, this platform is built around a live trading community, providing an immersive learning environment focused primarily on day trading. Members gain access to comprehensive educational materials, including the "Essentials Course & Day Trading Strategies," designed to build a strong foundation in market mechanics, technical analysis, and risk management.

The platform's greatest strength lies in its active community and hands-on learning tools. Members can join live trading chat rooms to watch experienced moderators analyze the market and execute trades in real-time. This practical exposure, combined with access to professional-grade trading simulators, allows novices to practice their strategies in a risk-free setting before committing real capital. The emphasis is on learning by doing, supported by a network of fellow traders.

Why Bear Bull Traders Is a Great Choice for Novice Traders

Bear Bull Traders excels at bridging the gap between theory and practice. The daily webinars, mentorship sessions, and real-time analysis provide continuous learning opportunities that are difficult to find elsewhere. A significant portion of the curriculum is dedicated to trading psychology, a critical component often overlooked by other courses. Understanding the emotional and mental discipline required for trading is vital for long-term success.

The community aspect provides accountability and support, helping new traders navigate the steep learning curve. The subscription model ensures that content and resources are consistently updated to reflect current market conditions.

Pro Tip: Fully engage with the chat rooms and simulators. Don't just watch; ask questions, follow the moderators' thought processes, and use the simulator to test the strategies being discussed. This active participation will dramatically accelerate your learning.

Course Structure and What to Expect

The platform operates on a monthly subscription model, granting access to its full suite of resources. This includes foundational courses, advanced strategy lessons, the live chat room, and weekly mentorship. This all-in-one approach is ideal for beginners who want a complete ecosystem for their trading education.

- Pros: Comprehensive day trading resources, active and helpful trading community, hands-on learning with simulators.

- Cons: Requires a monthly subscription, limited content on long-term investing strategies.

- Best For: Aspiring day traders who want an immersive, community-driven learning experience with direct access to mentors.

- Website: Bear Bull Traders

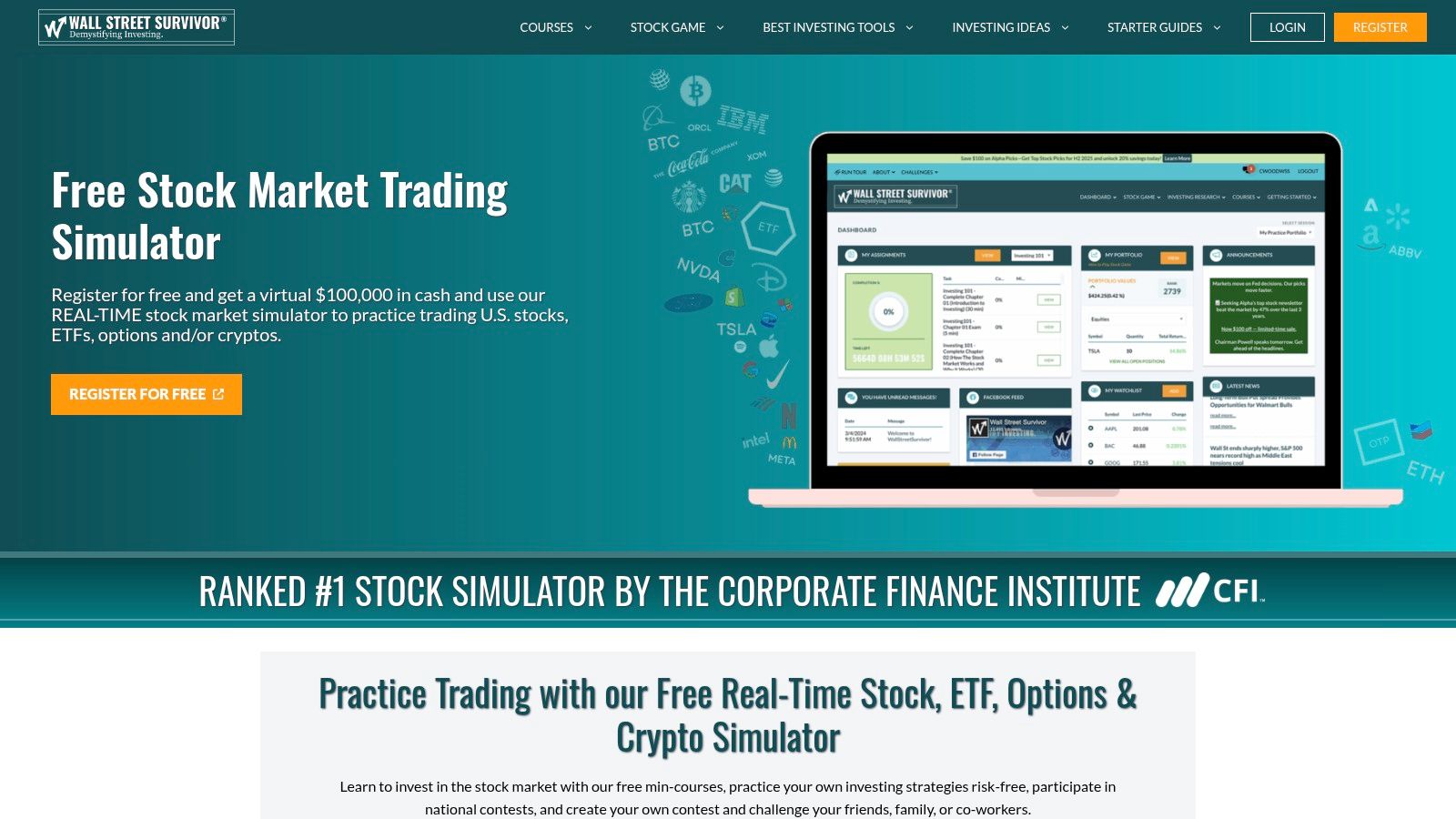

7. Wall Street Survivor

Wall Street Survivor transforms stock market education into an engaging game, making it an ideal platform for those who want a fun and interactive stock trading course for beginners. It uniquely combines free educational courses with a powerful virtual trading simulator, allowing novices to learn foundational concepts and immediately apply them in a risk-free environment. The platform gamifies the learning process with missions, quizzes, and competitions, which helps build confidence and reinforce key principles.

The core of its offering is the stock market simulator, which provides you with $100,000 in virtual cash. This feature is invaluable for practicing how to place trades, manage a portfolio, and understand market movements without the fear of losing real money. This hands-on approach bridges the gap between theoretical knowledge and practical application, a critical step for any new trader.

Why Wall Street Survivor Is a Great Choice for Novice Traders

Wall Street Survivor excels at making complex financial topics accessible and enjoyable. The gamified learning path motivates users to complete modules and test their knowledge, turning what could be a dry subject into a compelling challenge. This method is especially effective for beginners who may feel intimidated by the stock market.

The platform encourages learning by doing. After completing a lesson on a topic like "How to Read a Stock Quote," you can jump directly into the simulator to find a stock and analyze its quote in real-time. This immediate feedback loop is crucial for solidifying your understanding.

Pro Tip: Start by following the guided "missions" within the platform. These missions walk you through fundamental tasks like buying your first stock or diversifying your portfolio, providing a structured and practical introduction to trading mechanics.

Course Structure and What to Expect

The educational content on Wall Street Survivor is organized into clear, concise courses, articles, and tutorials. The experience is self-paced, allowing you to learn whenever it's convenient. You can progress through lessons on everything from basic terminology to fundamental analysis, all while earning virtual achievements.

- Pros: Engaging and interactive gamified learning, Completely risk-free virtual trading practice, Free access to a wealth of educational resources.

- Cons: Limited depth on advanced trading strategies, less personalized support compared to paid courses.

- Best For: Absolute beginners who want a fun, interactive, and free way to learn the basics of trading and practice with a simulator.

- Website: Wall Street Survivor

Beginner Stock Trading Courses Comparison

| Platform | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Colibri Trader | Moderate – Structured courses, mentorship | Moderate – Affordable, courses & quizzes | Consistent skill transformation, confident trading | Price-action based trading education, all levels | Practical, no-fluff approach; strong mentorship |

| Udemy | Low – Self-paced, variable course quality | Low – Affordable, one-time payments | Variable depending on course quality | Flexible beginner to intermediate learning | Wide course selection; lifetime access |

| Coursera | Moderate – University-level content | Moderate – Free audit or paid certificates | Academic knowledge with optional certification | In-depth theoretical learning, certification seekers | Reputable institutions; well-structured courses |

| TD Ameritrade | Low – Access after free account registration | Low – Free educational resources | Broad foundational knowledge across levels | Beginners seeking free, comprehensive education | Extensive free content; reputable broker |

| Investors Underground | High – Intensive courses and live chat rooms | High – Paid membership plus courses | Practical, real-time trading skill enhancement | Active traders wanting direct mentorship and chat | Live trading rooms; strong community |

| Bear Bull Traders | Moderate – Subscription with live simulations | Moderate to High – Subscription model | Hands-on day trading skill development | Day traders focused on psychology and live practice | Simulators and live chat; strong community |

| Wall Street Survivor | Low – Gamified, beginner friendly | Low – Mostly free access | Basic market understanding, risk-free practice | Beginners wanting interactive learning and practice | Gamified learning; virtual trading simulator |

Choosing Your Path to Profitable Trading

Navigating the world of online education to find the right stock trading course for beginners can feel as complex as the market itself. We've explored a diverse landscape of options, from the structured, academic approach of Coursera to the hands-on, community-driven environment of Bear Bull Traders. Your journey from novice to confident trader is deeply personal, and the ideal educational tool must align with your individual goals, learning preferences, and financial commitment.

Remember, the ultimate objective isn't merely to consume information; it's to internalize a robust methodology that you can apply consistently. The courses detailed in this article, like Investors Underground's deep dive into day trading or Wall Street Survivor's risk-free gamified platform, each provide a distinct framework for achieving this.

From Knowledge to Action: Your Next Steps

The most significant takeaway is that passive learning yields passive results. True progress in trading comes from active participation, practice, and refinement. As you weigh your options, move beyond simply comparing features and pricing. Instead, focus on finding the platform that will most effectively empower you to take action.

Your next steps should be strategic and deliberate:

- Define Your "Why": Are you aiming for a supplementary income, a full-time career, or long-term wealth building? Your core motivation will heavily influence your choice. For instance, a career-focused individual might gravitate towards the intensive mentorship of Investors Underground, while a long-term investor might find TD Ameritrade's extensive library sufficient.

- Assess Your Learning Style: Do you thrive with structured video lectures (Udemy, Coursera), live interaction and community (Bear Bull Traders), or a self-paced, mentor-led program (Colibri Trader)? Be honest about what keeps you engaged.

- Utilize Free Resources: Almost every platform offers a trial, free content, or a blog. Dive into these resources. This "test drive" is the single best way to gauge if a mentor's teaching style and trading philosophy resonate with your own intuition.

- Commit to One Methodology First: Avoid the common beginner pitfall of "strategy hopping." Select one course and commit to mastering its methodology before seeking out conflicting information. This focused approach is the fastest path to building a consistent, repeatable skill.

The Foundation of Success

Choosing a stock trading course for beginners is your first major investment, not in a stock, but in yourself. The principles you learn, whether it's understanding pure price action from Colibri Trader or fundamental analysis from TD Ameritrade's resources, will become the bedrock of every trade you place. The market is a dynamic and often unforgiving environment; a solid educational foundation is your non-negotiable tool for navigating it with discipline and confidence. Your trading career begins not with your first trade, but with your commitment to education. Choose wisely, practice diligently, and you will be well on your way.

If you're looking for a proven, action-based program that cuts through the noise and focuses purely on what moves the market, consider Colibri Trader. Their price action mastery course is designed to give beginners a clear, repeatable system for reading charts without a confusing array of indicators. Explore the program and start your journey to consistent trading at Colibri Trader.