Silver Trading Analysis 06.02.2026

Dear traders,

Last time I wrote about EURUSD.

Here is where the price was:

Here is where the price is now:

EURUSD went 500+ pips up and then it consolidated.

This demand zone proved to be such a powerful catalyst.

There were fundamental reasons, too but without technicals I would not have had the same conviction.

Silver Trading Analysis 06.02.2026

Today I’m watching Silver closely.

It already made a powerful run – but strong trends rarely end with a single expansion.

With markets turning turbulent and geopolitical risk becoming the norm rather than the exception, capital naturally looks for protection.

Gold gets the headlines. Silver gets overlooked.

Yet silver sits at a rare intersection:

monetary metal + industrial necessity.

When safety demand collides with real economic demand, price moves can become aggressive.

2026 may not be about chasing equities. It may be about owning volatility before the crowd notices.

So, the technicals? Here they are:

The Technicals: Silver

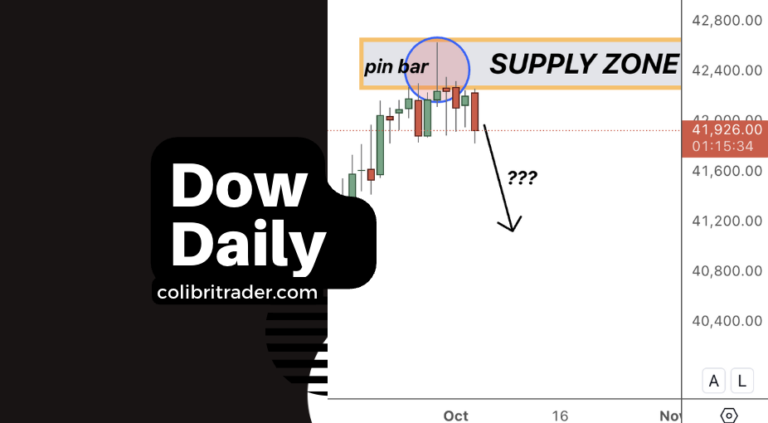

There is a strong demand zone sitting just below the current price.

The daily chart is attempting to print a pin bar, but it’s best to wait for the candle to close before drawing conclusions.

I’ll be watching for a potential retest of the $70 level, ideally followed by confirmation on the 4H chart.

That confirmation could come in the form of another pin bar or a bullish engulfing pattern.

So, ideally I would like to see a re-test here:

But, let’s see 🙂

Happy Friday,

Atanas