Master Your Trades With a Risk Reward Ratio Calculator

A risk-reward ratio calculator isn't just another trading gadget; it's a simple but incredibly powerful tool that shows you exactly how much you stand to win versus how much you could lose on any trade. This calculation is the absolute core of disciplined trading. It helps you make decisions based on cold, hard math, not gut feelings or market hype.

By clearly defining your risk and reward upfront, you can finally start building a trading strategy that can actually last.

Why The Risk-Reward Ratio Is Your Trading Compass

If you're still trading on gut feelings or chasing hot tips, it's time for a reality check. The single most important metric for consistent, long-term success in the markets is the risk-reward ratio.

Why? Because it forces you to do one thing before you ever click "buy" or "sell": plan.

This simple calculation is what separates the pros from the amateurs. It systematically pulls emotion out of your trading and acts as a logical filter, stopping you from jumping into a trade out of greed or bailing out of fear. Every position becomes a calculated business decision with a predefined exit strategy for both winning and losing.

Protecting Your Most Important Asset

Let’s be clear: your trading capital is your business's lifeblood. The risk-reward ratio is your number one defense for protecting it.

By setting a stop-loss (your maximum acceptable risk) and a take-profit target (your potential reward) before you enter a trade, you immediately put a hard cap on your potential downside. No exceptions.

This is the polar opposite of how most people trade, where one bad decision can lead to a spiraling loss that blows up an account. A defined ratio means no single trade can ever be a catastrophe. It’s the difference between having a bad day and going out of business.

The goal of a successful trader isn't just to make money. It's to make the best trades. When you focus on a sound process with solid risk management, profitability often follows.

The Math of Long-Term Success

This is where the magic really happens. You don't need to win every trade to be profitable. You don't even need to win most of them.

Think about these two traders:

- Trader A has a great win rate of 70%. But their risk-reward ratio is a dismal 1:0.5 (they risk $100 to make just $50).

- Trader B only wins 40% of their trades. But they stick to a healthy 1:3 ratio (risking $100 to make $300).

After ten trades, Trader A, the one who "wins" more often, is actually in the red. Meanwhile, Trader B, who lost more than half their trades, is sitting on a comfortable profit. This shows a critical truth: your profitability is a function of both your win rate and your risk-reward ratio.

This isn't just theory. As electronic trading made these tools available to everyone, the data became clear. A 2021 study found that over 75% of professional traders use some form of risk-reward calculation on every single trade. Better yet, other research shows that portfolios maintaining a ratio above 1:2 achieved positive annual returns in 70% of cases—even with win rates below 50%. You can dive deeper into the data on how risk management drives performance to see for yourself.

To help you get a feel for this, here's a quick breakdown of some common ratios and what they mean in practice.

A Quick Look at Common Risk Reward Ratios

This table gives you a snapshot of different ratios, what they imply, and where you might see them used.

| Ratio | Meaning | Best For |

|---|---|---|

| 1:1 | Risking $1 to make $1 | Scalping or strategies requiring a very high win rate. Often a break-even proposition. |

| 1:2 | Risking $1 to make $2 | A common minimum for swing and day traders. Allows profitability with a sub-50% win rate. |

| 1:3 | Risking $1 to make $3 | A strong ratio favored by trend-followers. One win can erase three losses. |

| 1:5+ | Risking $1 to make $5+ | Excellent for long-term position trading or catching major market moves. Requires patience. |

As you can see, the higher the potential reward for the risk taken, the less you need to be "right" to make money over the long haul. This is the foundation of a professional mindset.

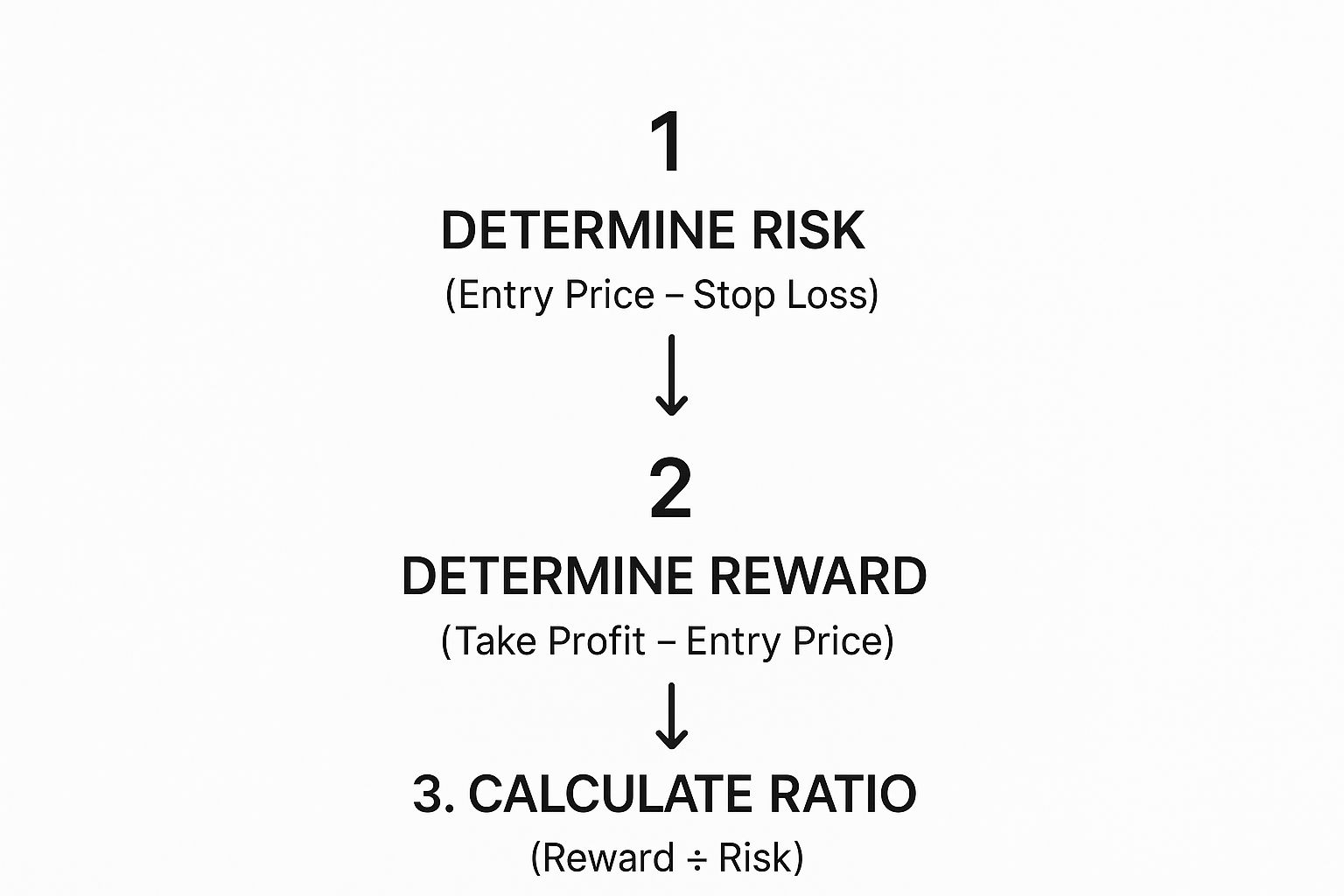

Sure, a good risk-reward calculator is a handy tool, but knowing how to crunch the numbers yourself is absolutely essential. When you do it manually, the logic really sticks. It forces you to internalize the relationship between what you're putting on the line and what you could potentially walk away with.

The good news? The math is incredibly simple. It all comes down to just three key prices for any trade you're considering. At its heart, the formula is just: Potential Reward / Maximum Risk.

Let's walk through how you'd find these numbers before ever hitting the "buy" button.

Defining Your Maximum Risk

First things first: what are you willing to lose if this trade goes south? This isn't just a number you pull out of thin air. Your risk is a concrete value defined by the distance between your planned entry price and your stop-loss price.

A stop-loss is that pre-set order you place to automatically bail you out of a position at a specific price, capping your losses. A smart stop-loss is placed at a technical level that, if broken, completely invalidates your original reason for taking the trade in the first place. For example, if you're buying a stock because it just bounced hard off a strong support level, your stop-loss should sit just below that support.

- Risk per Share = Entry Price – Stop-Loss Price

Let's make this real. Imagine you're eyeing a tech stock currently trading at $150. You've spotted a solid support zone at $145 and decide to place your stop-loss at $144. This gives the trade a little bit of wiggle room. In this case, your risk per share is $6 ($150 – $144).

Identifying Your Potential Reward

Now for the fun part. Your potential reward is your best-case scenario—the profit you'll pocket if the trade plays out just as you've planned. This is measured by the distance between your entry price and your take-profit target.

Just like your stop-loss, your take-profit target needs to be based on logic, not hope. A great place for it is a known resistance area where the price has historically struggled to push through.

- Reward per Share = Take-Profit Price – Entry Price

Sticking with our example, you notice a major resistance level sitting at $168. This seems like a perfectly reasonable target for your trade. Your potential reward per share, then, would be $18 ($168 – $150).

Pro Tip: I can't stress this enough—always set your stop-loss and take-profit levels based on actual market structure (support, resistance, trendlines, etc.), not arbitrary dollar amounts or percentages. This grounds your entire trading plan in observable market behavior, not just wishful thinking.

This simple graphic really helps visualize how these three pieces—risk, reward, and the final ratio—all fit together.

As you can see, each step builds on the last. You're taking abstract price levels and turning them into a concrete, measurable opportunity.

Bringing It All Together

Okay, you've done the hard work of defining your risk and reward. The final calculation is a breeze. You just divide your potential reward by your maximum risk.

- Risk-Reward Ratio = ($18 Reward) / ($6 Risk)

- Risk-Reward Ratio = 3

This is usually expressed as a 1:3 ratio. What this means is that for every $1 you're risking on this particular setup, you stand to make a potential profit of $3. This is the kind of favorable ratio that can keep you profitable even if you don't win every single trade. It’s a true cornerstone of any solid trading plan.

Putting Your Risk Reward Ratio Calculator to Work

Sure, calculating your ratio by hand builds great discipline. I did it for years. But in the heat of the moment, you need to be fast and precise. A good risk reward ratio calculator automates the math, freeing you up to focus on what really counts—your actual trading strategy.

Knowing the theory is one thing, but applying it flawlessly in a live market is a different beast entirely.

You don't need to hunt for some exotic piece of software. These tools are standard issue in most modern trading platforms. While you can find standalone web apps, their real power comes from being integrated directly into charting software like TradingView or MetaTrader. This way, you're not fumbling with another window; you're planning your trade right on the price chart.

Integrated Tools for Seamless Planning

Look for a "Long Position" or "Short Position" tool in your platform. This feature is a game-changer. It lets you draw a box right over your potential trade setup, and as you drag the edges to your entry, stop-loss, and take-profit levels, it instantly spits out the risk-reward ratio.

This visual feedback is incredibly powerful. It takes an abstract number and makes it a concrete, visual plan that you can see in relation to the live price action. You can tell in a split second if a trade meets your minimum criteria (like a 1:2 ratio) without doing any math.

The screenshot above from TradingView shows this perfectly. The green area is your potential profit, the red is your potential loss, and the ratio is displayed right there in the middle. Seeing this overlay on the chart gives you immediate context and clarity.

How to Use These Tools Effectively

Using an integrated calculator is straightforward, but you have to be precise for it to mean anything. Here’s how I make sure I’m using it correctly on every single trade:

- Pin Your Entry Price: I anchor the tool exactly at the price where I plan to get in. No "close enough."

- Define Your Stop-Loss: I drag the bottom edge (for a long trade) to my pre-determined stop-loss level. This isn't a guess; it's based on market structure, like a recent swing low or a key support zone.

- Set Your Profit Target: Then, I adjust the top edge to my take-profit level, usually aiming for a logical resistance area or a measured price target.

By making this visual planning a mandatory step before every trade, you build a powerful habit of disciplined risk management. It becomes a non-negotiable part of your routine.

The widespread use of these tools tells you everything you need to know about their importance. Data from platforms like MetaTrader 4 and 5—which are used by an estimated 10 million traders—reveals the risk-reward tool is the second most used feature right after price charts. It's not just a nice-to-have.

In fact, some brokerage reports have shown that traders who consistently use a risk-reward calculator see a 30% reduction in unprofitable trades compared to those who just trade on gut feeling. You can read more about how these tools impact trader performance and see the data for yourself. The proof is in the numbers.

Advanced Risk Management Strategies

Once you’ve got the hang of the basic calculation, you'll quickly find that a static risk-reward ratio doesn't really cut it in the live markets. The market is fluid, always changing, and so should your risk management. I see so many new traders get stuck on a fixed 1:3 ratio, but seasoned pros treat their risk framework as something dynamic.

Your approach has to evolve based on what you trade, how you trade, and when you trade.

A 1:3 ratio might be perfect for a stock that's clearly trending, but what about a wickedly volatile crypto pair or a fast-paced scalping setup? Context is everything. Different market conditions and trading styles demand different risk parameters if you want to stay in the game.

For example, a scalper chasing tiny, rapid-fire profits might happily accept a 1:1 or even a 1:0.8 ratio. Their edge comes from a very high win rate, not from massive winners. On the flip side, a swing trader holding a position for weeks will need a much higher ratio, maybe 1:4 or 1:5, to justify locking up their capital for that long.

Fine-Tuning Your Ratio in Live Markets

Adjusting your strategy starts with the simple recognition that no two trades are identical.

Think about a high-volatility environment, like right after a major news announcement. You'll probably need a wider stop-loss just to avoid getting shaken out by the noise. That naturally means you need a larger profit target to keep your risk-reward ratio favourable.

Here’s how a few different factors can influence your thinking:

- Asset Type: Stocks, forex, and crypto each have their own personality and volatility profile. Crypto markets, famous for their 24/7 action and gut-wrenching swings, often require wider stops. Consequently, your reward targets have to be higher to make the trade worthwhile.

- Market Conditions: In a strong, trending market, you have the luxury of letting your winners run and aiming for those bigger ratios. But in a choppy, range-bound market? It’s often smarter to bank smaller, quicker profits with a more modest ratio.

- Trading Style: As I mentioned, your holding period is a massive factor. Short-term day traders and scalpers live and die by their speed and win rate. Long-term position traders, however, are all about the sheer size of their winning trades.

Different trading styles call for different risk-reward philosophies. What works for a scalper would be disastrous for a swing trader, and vice versa. It's all about aligning your risk parameters with your strategy's core logic.

Adjusting Ratios for Different Trading Styles

| Trading Style | Typical R:R Ratio | Rationale |

|---|---|---|

| Scalping | 1:0.8 to 1:1.5 | Relies on high win rates and capturing very small, frequent profits. Risk is tightly controlled. |

| Day Trading | 1:1.5 to 1:3 | Aims for larger intraday moves. A balanced R:R ratio helps offset a moderate win rate. |

| Swing Trading | 1:3 or Higher | Justifies holding positions for days or weeks. Winners need to be significantly larger than losers. |

The goal isn't to find one "perfect" ratio, but to understand the logic behind why certain ratios fit certain styles. A swing trader with a 50% win rate and a 1:3 R:R is consistently profitable. A scalper with an 80% win rate can be profitable even with a 1:0.8 ratio. It’s all about the math.

The real skill isn't just plugging numbers into a risk-reward calculator; it's knowing when to deviate from the textbook 1:2 or 1:3. A professional trader looks at a specific setup and asks, "What ratio is the market realistically offering me right now?"

Advanced Techniques for Managing Positions

Beyond just setting your entry, stop, and profit target, the real pros use more fluid techniques to manage trades that are already live. This moves you beyond a simple "set it and forget it" mentality.

One of my favourite techniques is scaling. Instead of jumping in with your full position size at once, you might enter with a smaller piece and add to it as the trade moves in your favour. This allows you to confirm the trade's direction while improving your average entry price. Conversely, you can scale out of a winning position by taking partial profits at key levels, which helps lock in gains and reduces your stress.

Another indispensable tool is the trailing stop-loss. This is a dynamic stop that automatically moves up as the price rises in a long trade (or down in a short). It’s a brilliant way to protect your accumulated profits while still giving the trade room to run further. It’s the perfect blend of capital protection and profit maximization. Learning more about these unbreakable trading risk management strategies for 2025 can give you a much deeper understanding of these professional-grade tactics.

Ultimately, the psychological battle is half the challenge. Sticking to your plan when a trade goes against you or fighting the urge to snatch a tiny profit is what separates consistent traders from everyone else. These advanced strategies give you a logical framework to overcome those emotional impulses and trade more like a pro.

Common Mistakes Traders Make with Risk Reward Ratios

Knowing how to punch numbers into a risk reward ratio calculator is only half the battle. The real test—the one that separates consistently profitable traders from the rest—is avoiding the costly mistakes that can turn this powerful tool against you.

I've seen it countless times. A trader understands the concept in theory but completely fumbles the application, leading to nothing but frustrating losses and, in the worst cases, blown accounts.

One of the most common traps is trying to force a "good" ratio onto a bad trade. A trader might spot what looks like a textbook 1:3 opportunity. But to get that number, they'll place their profit target miles beyond any logical resistance level. This is just wishful thinking disguised as strategy. The trade has almost zero real-world chance of hitting its target.

Another classic blunder? Setting your stop-loss way too tight. In a desperate attempt to shrink the "risk" part of the equation, traders choke their trades. They place stops so close to their entry that the normal market "noise"—the everyday ebb and flow—takes them out of what could have been a perfectly good trade. This leads to a slow, painful death by a thousand cuts.

Ignoring The Win Rate Connection

A great risk-to-reward ratio is absolutely meaningless in a vacuum. I can't stress this enough. The single most overlooked mistake is failing to connect your R:R with your personal win rate.

You could take nothing but beautiful 1:4 R:R trades, but if you only win 15% of the time, you are still going to bleed money. It's simple math.

Your strategy’s historical win rate tells you the minimum risk-reward ratio you need just to break even, let alone turn a profit. Ignoring this is like trying to drive a car by only looking at the speedometer while ignoring the fuel gauge. Sooner or later, you're going to grind to a halt on the side of the road.

Key Takeaway: A high risk-reward ratio cannot save a flawed trading strategy with a terrible win rate. Profitability comes from both metrics working together, not one trying to make up for the other's shortcomings.

The pros get this. It's why they succeed. For instance, data shows institutional investors who stick to strict risk-reward criteria of 1:2 or better have managed to outperform the market by an average of 8% annually. They pair solid ratios with proven, high-probability strategies. You can see more about how the big players use these ratios for long-term performance on luxalgo.com.

Being Too Rigid In a Fluid Market

Finally, a massive mistake I see is being completely inflexible. Markets breathe, they shift, they are dynamic. Trying to slap the same 1:3 ratio onto every single trade, no matter the market condition, is a recipe for failure.

A quiet, sideways, range-bound market might only offer realistic 1:1.5 opportunities. Forcing a higher ratio in those conditions is just setting yourself up to lose.

Great traders adapt. They take what the market is giving them. They assess the current environment and adjust their risk parameters to fit. The goal isn't just finding high-ratio trades; it's finding high-probability trades that also offer a favourable risk profile.

Avoiding these common errors is often far more important than just learning the initial calculation. You can find a deeper dive into these and other 10 fatal mistakes traders make in our related guide.

Frequently Asked Questions About Risk Reward

Once you get the basics down, you'll find that real-world trading always throws up some practical questions. It’s one thing to understand the risk-reward ratio in theory, but using it on the fly when your money is on the line is a different game entirely.

Let's walk through some of the most common questions I hear from traders. These are the queries that help bridge the gap from knowing the concept to actually applying it with confidence.

What Is a Good Risk Reward Ratio for a Beginner?

If you're just starting out, a 1:2 risk-reward ratio is an excellent baseline to build your strategy around. What that means is simple: for every dollar you risk, you're aiming to make two dollars in profit.

Why is this such a solid starting point? It forces you to be disciplined from day one and instantly puts the math on your side. With a 1:2 ratio, you only need to be right more than 33% of the time to stay profitable, which is a very reasonable target. It trains you to hunt for quality setups instead of just taking any trade that comes along.

How Does Win Rate Connect to Risk Reward?

This is probably the most critical relationship in all of trading. Your risk-reward ratio and your win rate are two sides of the same coin. One is almost useless without knowing the other, as they work hand-in-hand to determine whether you make money or lose it.

Think of it like this:

- High R:R Ratio: If you consistently look for trades with high ratios like 1:3 or 1:4, you can afford to have a low win rate and still be profitable. Just one big winner can wipe out the losses from three or four small losers.

- High Win Rate: On the other hand, if your strategy is a winner most of the time (say, 70% or more), you can get away with taking trades at lower ratios, even 1:1, and still come out ahead.

The real magic happens when you find a strategy that balances both. Your job isn't to chase a perfect number for either one, but to understand how they combine to make your personal trading style profitable.

A trader with a 40% win rate and a 1:3 risk-reward ratio will be far more profitable over time than a trader with a 70% win rate and a 1:0.5 ratio. It's all about the math.

Can I Use This for Long-Term Investing?

Absolutely. While you often hear about risk-reward in the fast-paced world of short-term trading, the core principle is universal. For a long-term investor, the logic is identical—it’s just the time horizons and the inputs that change.

Instead of setting stops based on technical support and resistance levels, your "stop-loss" might be a fundamental event, like a company's earnings dropping below a specific threshold. Your "take-profit" target wouldn't be a chart level but a valuation target derived from a long-term financial model.

The central idea of risking a calculated amount to chase a much larger potential gain is the very cornerstone of sound investing. Applying these principles is essential to master your trading mindset for market success, no matter if you hold positions for days, weeks, or years.

At Colibri Trader, we teach you how to build a trading career on the solid foundation of price action and disciplined risk management. We don't offer shortcuts, just proven strategies to help you become consistently profitable. Take our free Trading Potential Quiz to get started.