The Psychology of Trading Your Mental Edge

Success in the markets isn't just about charts and strategies; it's about mastering the internal battle in your own mind. This is the core of the psychology of trading. Unchecked emotions and mental blind spots are the real reasons most traders fail, no matter how much technical knowledge they have.

Why Your Mindset Is Your Greatest Trading Asset

Think of a skilled pilot. Their technical knowledge is crucial, of course. But what really ensures a safe landing during heavy turbulence is their ability to stay calm and make decisive, clear-headed choices under pressure. It's the same in trading. Your mindset, emotions, and ingrained biases directly steer every single buy and sell decision you make.

Many traders will spend thousands of hours learning chart patterns and technical analysis but completely ignore the engine driving their decisions—their own psychology. This is a massive mistake. The market is just a giant reflection of collective human emotion, constantly swinging between fear and greed. Without understanding your own internal landscape, you become a puppet to these powerful forces.

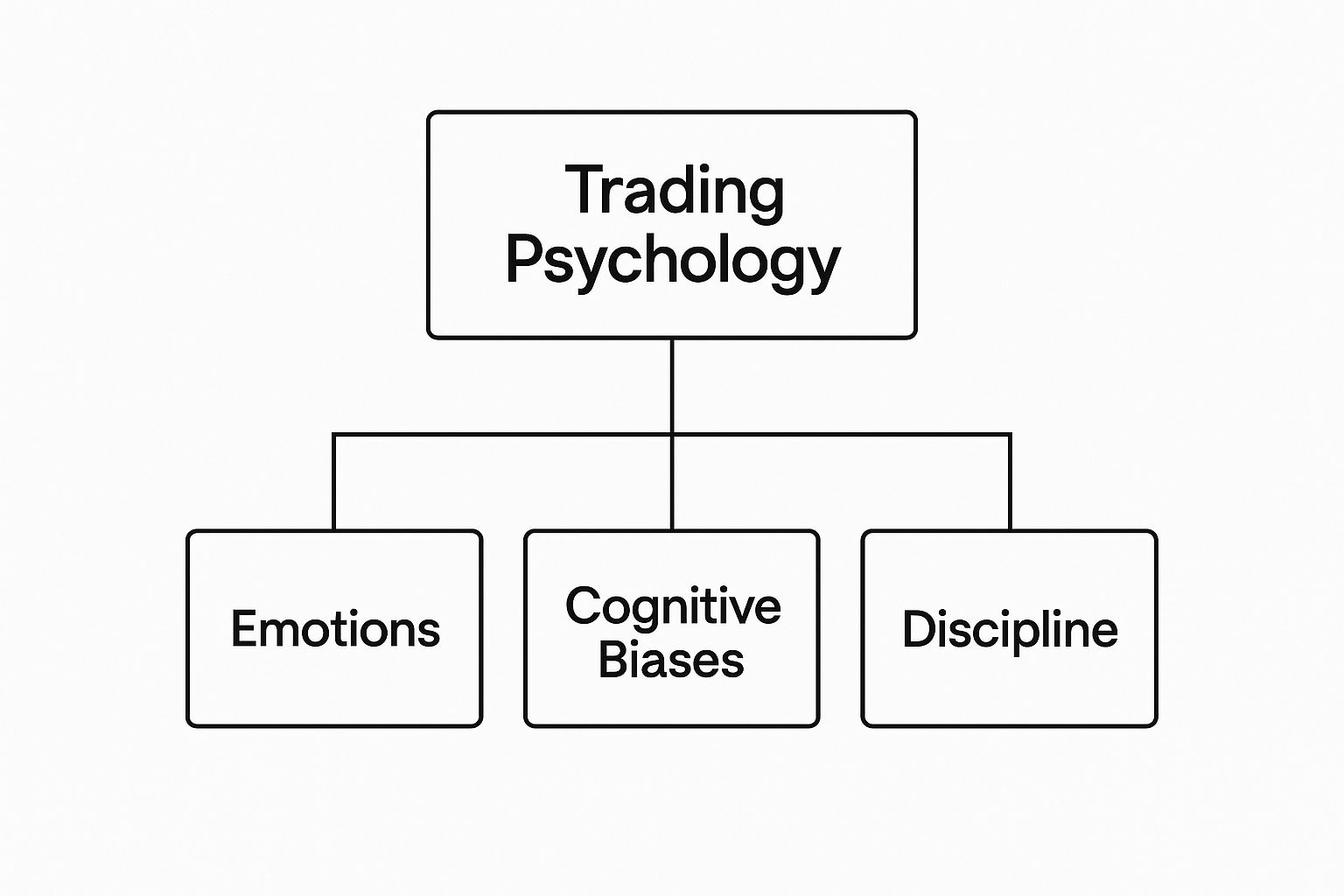

The Core Pillars of Trading Psychology

When you boil it down, trading psychology is about managing three key areas. Each one presents its own challenge, but also a huge opportunity for growth.

This diagram shows how true trading mastery is built on a foundation of managing emotions, recognizing cognitive biases, and building rock-solid discipline.

As you can see, it's not about technical skill alone. Success comes from actively managing these three interconnected mental components.

"The key to trading success is emotional discipline. If intelligence were the key, there would be a lot more people making money trading.” – Victor Sperandeo

This quote hits the nail on the head. Being smart isn't enough. A trader's ability to stick to a plan and manage their mental state under fire is what ultimately separates the consistent winners from everyone else. The journey to profitable trading is an internal one.

The Two Sides of the Trading Brain

To really grasp the difference a solid mindset makes, it helps to see the two approaches side-by-side. One is a recipe for disaster, driven by raw, unfiltered emotion. The other is the path of a professional, guided by a disciplined strategy.

| Attribute | Emotional Mindset (The Unseen Enemy) | Disciplined Mindset (The Strategic Ally) |

|---|---|---|

| Decision Driver | Fear, greed, hope, impulse | Pre-defined trading plan, logic |

| Reaction to Losses | "Revenge trading," panic selling | Sticking to stop-loss, reviewing the trade |

| Reaction to Wins | Overconfidence, taking bigger risks | Sticking to the plan, analyzing the win |

| Risk Management | Ignored or improvised | Strict stop-losses and position sizing |

| Outcome | Inconsistent results, large drawdowns | Consistent performance, protected capital |

Thinking this way makes it clear: every decision you make falls into one of these two columns. Your job is to consciously choose the "Strategic Ally" every single time.

The Measurable Impact of a Disciplined Mind

The benefits of strong trading psychology aren't just feel-good concepts; they show up in your account balance. Research consistently shows that emotional biases, like the fear of taking a loss or impulsive entries, wreak havoc on trading outcomes.

For instance, traders who consistently follow a trading plan and use stop-loss rules—the hallmarks of a disciplined mindset—have been shown to improve their outcomes by 20-30% over those who act on impulse. You can explore how discipline impacts trading results on Investopedia.com.

By cultivating this mental resilience, traders can handle the inevitable drawdowns without panicking and avoid the rash decisions that turn small losses into catastrophic ones.

Developing this mental edge allows you to build a sustainable approach focused on consistency, realistic goals, and controlled risk. It is the true foundation for lasting success in any market.

Conquering the Twin Giants: Fear and Greed

In the trading arena, two primal emotions stand taller than all others. They have the power to dictate your decisions and, ultimately, the health of your trading account. These are the twin giants of the market: Fear and Greed. Getting a handle on how they influence you is one of the first, and most important, steps in mastering your trading psychology.

Fear is that frantic voice in your head screaming at you during a minor dip in the market. It’s that gut-wrenching urge to dump your position right now to stop the bleeding, often duping you into selling just before the price was about to turn around. This feeling comes from our deepest survival instincts, but in trading, it's a recipe for disaster, pushing you to make irrational moves like selling at the absolute bottom.

On the other side of the spectrum, you have Greed. This is the sly, seductive whisper telling you to hold on to a winning trade for "just a bit more," long after it has reached your planned profit target. Greed is a master manipulator, convincing you to abandon your exit strategy in a chase for fantasy gains, which all too often leads to you watching all your paper profits vanish on a sudden reversal.

How Fear Hijacks Your Trading Plan

For a trader, fear shows up in a few particularly destructive ways. The most infamous is the Fear of Missing Out (FOMO). This is the impulse that makes you chase a move, jumping into a trade way too late just because you see a chart rocketing up without you.

Then there's the raw fear of taking a loss. This can manifest in two opposite but equally damaging ways. It might cause you to set your stop-losses so tight that you get shaken out of perfectly good trades by normal market noise. Or, it can paralyze you completely, making you unable to cut a losing trade because clicking that button makes the loss "real." Acknowledging and managing these fears is critical. You can learn more about how to conquer your trading fears in our detailed guide.

The Seductive Pull of Greed

Greed is often much trickier to spot than fear because, frankly, it feels good. It masquerades as confidence, ambition, even skill. This is the emotion that fuels overtrading—piling on more and more positions because a winning streak has you feeling untouchable.

It also pushes traders to take on way too much risk, maybe by using excessive leverage or betting the farm on a single "can't-miss" trade. Piece by piece, greed dismantles the logical framework of your trading plan, replacing smart risk management with little more than a hopeful gamble.

The market is a device for transferring money from the impatient to the patient. – Warren Buffett

This classic wisdom from Buffett gets right to the heart of it. Patience is the ultimate antidote to both fear and greed, while impatience is the engine that drives emotional decisions.

If you look at market history, these two emotions have been far more powerful in moving prices than any economic report. Think about the 2008 global financial crisis; it was driven by sheer panic and herd behavior, showing how fear can turn a downturn into a full-blown collapse. Sentiment indicators like the VIX (Volatility Index) always spike during these periods. It hit an all-time high of around 82.7 in March 2020 during the Covid-19 market panic.

In the end, your success as a trader boils down to your ability to build and follow a set of rules that shield you from your own worst impulses. When you can recognize the voices of fear and greed, you can learn to tune them out and stick to the plan you made when you were calm and thinking clearly. That's the only path to consistency.

Navigating Your Mental Minefield of Biases

Beyond the raw emotions of fear and greed, your mind is riddled with hidden traps. These cognitive biases are mental shortcuts. While they might help you navigate daily life, they are absolute account-killers in the trading world. They operate silently in the background, undermining even the best strategies without you even noticing.

Think of your brain as being hardwired with a few faulty circuits. This isn't a personal flaw; it’s just part of being human. The problem is that in the high-stakes game of trading, these glitches can consistently trick you into making the wrong moves for all the wrong reasons. A huge part of mastering trading psychology is learning to spot these mental tripwires in real-time.

The Echo Chamber of Confirmation Bias

Have you ever decided you like a particular stock, and then suddenly, all you seem to find is good news about it? That’s Confirmation Bias in action. It's our natural tendency to seek out, believe, and recall information that supports what we already think, while conveniently ignoring anything that challenges it.

It's a sneaky but powerful force that builds a dangerous echo chamber around your decisions. You end up constructing a case for your trade based on completely one-sided evidence, fooling yourself into thinking there's no way you can be wrong.

- What It Sounds Like: "This stock is definitely going to the moon. All the analysts I follow and the articles I'm reading are super bullish!"

- The Damage: You hold onto a losing trade for way too long, filtering out all the flashing red signals that your initial idea was wrong. Worse, you might even add to the losing position, convinced your biased research has uncovered a "golden opportunity."

The Crippling Pain of Loss Aversion

Psychologically, the sting of losing money is far more intense than the pleasure of making the same amount. Research suggests that a $100 loss can feel twice as painful as a $100 gain feels good. This powerful imbalance is called Loss Aversion, and it’s one of the most common biases that systematically drains trading accounts.

This bias makes traders act irrationally just to avoid taking a loss. The simple act of closing a losing trade makes the loss "real," and our brain will do almost anything to avoid that moment of pain.

The real damage from loss aversion isn't the small losses themselves; it's the catastrophic decisions you make to avoid them. It transforms a manageable paper cut into a gaping financial wound.

This is what causes traders to cling to losing positions, just hoping they'll "come back to breakeven." Hope is not a strategy. It's a refusal to accept a small, defined loss, which all too often snowballs into a much larger, account-crippling one. Getting a handle on these mental errors is crucial, as they're the root cause of the 10 fatal mistakes that traders often make.

The Danger of Unchecked Overconfidence

A string of winning trades feels incredible. It can also be incredibly dangerous. Overconfidence Bias is the tendency to overestimate your own skills, leading you to believe you have more control over the market's outcome than you actually do.

After a few wins, it's easy to start feeling invincible, like you've finally "cracked the code" of the market. That feeling is a massive red flag. It's the point where traders often abandon the very rules and discipline that led to their success in the first place.

Here's how overconfidence silently tears down a disciplined approach:

- Increased Risk-Taking: You start using much larger position sizes because you're "certain" about the next trade.

- Ignoring Rules: You ditch your stop-losses because you can't imagine the trade possibly going against you.

- Overtrading: You begin seeing "setups" everywhere, taking trades that don't even meet your carefully crafted criteria.

This bias is so destructive because it strikes when you feel most successful. It convinces you that your recent hot streak was pure skill, completely ignoring the role that luck or just favorable market conditions might have played. The market has a brutal way of humbling anyone who gets too sure of themselves.

The first step to disarming these biases is simply to know they exist. Just being able to put a name to what you're feeling is half the battle.

Escaping the Social Media Comparison Trap

Let’s talk about a new and particularly nasty psychological trap that has sprung up for traders in our hyper-connected world: social media comparison. Platforms like X (what we used to call Twitter), Instagram, and even Reddit are absolutely swimming with posts showing off huge wins and picture-perfect trading records. This creates a reality that's not just distorted—it's downright dangerous for your account.

This firehose of other people's success is a breeding ground for terrible trading decisions.

It all taps into a powerful psychological trigger called upward social comparison. It’s just a fancy term for our natural, human habit of measuring ourselves against people we think are doing better. When you see some trader flashing a five-figure profit from one trade, your brain conveniently ignores their years of pain, their learning curve, or the string of losses they’re not showing you. All it sees is their win versus your current P/L.

That comparison almost always kicks off a toxic cocktail of emotions: envy, feeling like you're not good enough, and a whole lot of frustration. It can make your own slow, steady, disciplined progress feel like a total failure. This emotional fallout is precisely where the real danger to your trading capital begins.

The High Cost of Keeping Up

These feelings of inadequacy are a fast track to impulsive, high-risk moves as you desperately try to "catch up." You might suddenly ditch your well-thought-out strategy to chase a wild "meme stock" just because you saw someone else bank on it. Or maybe you'll crank up your position size way too high, praying for that one lottery-ticket trade to make you feel as successful as the gurus you follow.

This is what I call reactive trading, and it's the polar opposite of the logical, process-driven mindset you need to survive. You're no longer trading your plan; you're trading to soothe a bruised ego. That's one of the quickest ways I know to burn through your hard-earned capital.

Your trading journey is yours and yours alone. Comparing it to someone else’s highlight reel is a guaranteed path to frustration, poor decisions, and ultimately, financial loss. Focus on your own lane.

Don't just take my word for it. Research into trading psychology has confirmed just how powerful this is. A recent study showed that when retail investors were exposed to the results of top-performing traders, they started taking on way more risk and trading far more frequently. They loaded up on riskier assets and churned their accounts, driven purely by the emotional kick of seeing others win. But here's the kicker: despite taking on more risk, these same investors reported lower satisfaction with their own results. It's a lose-lose. You can read the full research on social comparison effects in trading to see the hard data for yourself.

Taking Back Control of Your Mindset

Getting out of this trap takes a real, conscious effort. You have to curate your information diet and completely reframe how you see things. It’s not about logging off forever, but about using these platforms as tools for learning, not for ego validation.

Here are a few strategies I personally use to protect my own mindset:

- Curate Your Feed Mercilessly: If an account is mostly posting PnL screenshots or bragging about monster wins, unfollow them. Period. Instead, find experienced traders who share their process. Follow the ones who talk about risk management and break down both their winners and their losers with real analysis.

- Focus on Your Own Metrics: The only comparison that truly matters is you today versus you yesterday. Are you sticking to your plan? Is your risk management on point? Is your win rate improving? Track your own progress in a trading journal—it’s your best friend in this business.

- Set a "No-Comparison" Rule: Make it a hard-and-fast rule: you will never enter a trade just because you saw it on social media. Use these platforms for ideas, sure. Use them for education. But every single trade must be filtered through your own strategy and your own risk rules before you even think about clicking the buy or sell button.

By putting these boundaries in place, you stop being a passive spectator of someone else’s success story and become the active driver of your own growth. This is an absolutely critical step in building the tough, resilient trading psychology you need to not just survive, but actually thrive in the markets.

Building Your Mental Fortress with Practical Strategies

It’s one thing to understand the biases and emotions that can mess with your trading. That's a great first step. But knowledge without action is just trivia. To really get a handle on the psychology of trading, you have to turn that understanding into rock-solid daily habits.

This means building a mental fortress—a set of practical, non-negotiable systems that shield you from your own worst impulses. These aren't complex secrets. They are the simple, powerful tools that professional traders use to forge discipline and keep their cool, day in and day out. Think of these as the essential pillars of your entire trading business.

Create and Follow a Trading Plan

Your trading plan is your constitution. It's a detailed, written document you create when you are calm, rational, and objective—long before the market opens and your emotions are running high. This plan is your ultimate defense against fear, greed, and impulsive decisions.

Without one, you’re just gambling with your feelings. A proper trading plan must be your single source of truth for every decision you make in the market. No exceptions.

Your plan needs to definitively answer these key questions:

- What markets will I trade? Get specific. Define your area of focus and stick to it.

- What are my exact entry criteria? List the precise conditions that must be met before you even think about entering a trade.

- What are my exact exit criteria? Define your rules for taking profits and, more importantly, for cutting your losses.

- How much will I risk per trade? Set a fixed percentage of your capital you're willing to lose on any single trade. This is non-negotiable.

Implement Unbreakable Risk Management Rules

The single most effective way to manage your trading emotions is to manage your risk before you even enter a trade. It's that simple. When you know your maximum possible loss is small and survivable, the crippling fear of ruin just vanishes. This frees you up mentally to execute your plan without the constant anxiety.

The most powerful rule here is the 1% Rule. This means you never, ever risk more than 1% of your total trading capital on a single trade. If you have a $10,000 account, your maximum loss on any given position is just $100. This rule single-handedly prevents the catastrophic losses that wipe out most new traders. It turns a potential financial disaster into a minor, manageable business expense.

A trading plan is your objective guide in the heat of battle. It's the pre-written script you follow when your emotions are trying to convince you to improvise. Sticking to it is the purest form of trading discipline.

By defining your risk upfront, you strip the emotional weight from your decisions. You're no longer just hoping a trade works out; you're executing a well-defined strategy with a predefined, acceptable level of risk.

Use a Trading Journal for Self-Awareness

A trading journal is your psychological mirror. It goes way beyond just logging wins and losses; its main purpose is to track your mental and emotional state. This is the practice that separates the amateurs from the pros. It forces you to confront your decision-making process, warts and all, and identify those recurring behavioral patterns.

Your journal is where you become your own trading coach. Over time, you'll see clear patterns emerge, allowing you to spot your unique psychological triggers before they can cause any real damage.

To make your journal truly effective, answer these questions for every single trade you take:

- Why did I take this trade? Was it actually based on my trading plan, or was it an impulse? Be honest.

- What was my emotional state at entry? Was I calm, anxious, excited, or just bored and looking for action?

- Did I follow my plan exactly? If not, what specific rule did I break, and why?

- What was my emotional state at the exit? Did I get out based on my rules, or did fear or greed take over the controls?

- What is the one lesson I can learn from this trade? Find one actionable takeaway, whether the trade was a winner or a loser.

Consistently answering these questions builds a powerful database of your own behavior. This self-awareness is the bedrock of strong trading psychology, giving you the tools to refine your process and build the mental resilience needed for long-term success.

Cultivating a Professional Trader's Mindset

Mastering the psychology of trading isn’t a finish line you cross once. It’s an ongoing commitment, much like a professional athlete who never stops working on their mental game. The traders who last and build real careers are the ones who cultivate specific, long-term traits that become the very foundation of their trading.

This professional mindset isn't about the adrenaline rush of a single winning trade. It's about building a sustainable career by focusing on the consistency of your process, not just a few lucky wins.

Shifting Focus From Outcomes to Process

Over years of deliberate practice, winning traders develop a handful of core traits. These aren't just personality quirks; they are skills built through conscious, daily effort.

What are these traits?

- Discipline: This is your ability to stick to your trading plan without compromise, especially when your emotions are screaming at you to do the opposite.

- Patience: True patience means waiting for the high-probability setups that meet every single one of your criteria, rather than forcing a trade because you're bored or anxious to be in the market.

- Adaptability: The markets change. Adaptability is about recognizing these shifts and adjusting your strategy, rather than rigidly sticking to something that's no longer working.

- Humility: You must accept that you will be wrong—often. Humility is about learning from every mistake and never, ever believing you're smarter than the market itself.

This mental shift is profound. Instead of obsessing over the profit or loss of your last trade, you obsess over how well you executed your plan. Did I follow my rules? Did I manage my risk correctly? When your focus is on perfecting the process, positive results become a natural byproduct. You can dig deeper into this with these seven practical tips on trading psychology.

A crucial mental shift occurs when a trader stops viewing losses as personal failures and starts seeing them as tuition paid to the market—an essential investment in their education.

This reframing is absolutely vital for longevity. Every single loss contains a lesson, but only if you have the humility to actually look for it. Was it a flaw in your analysis? A moment of impatience? Or was it simply the random nature of the markets? A pro analyzes the loss objectively, extracts the lesson, and applies it to improve their process for the next trade.

The ultimate goal isn't to land one massive, brag-worthy win. The real objective is to achieve consistent, repeatable results over hundreds and thousands of trades. It's about building a stable equity curve through disciplined execution. In the end, mastering your own mind isn't just part of the game; it is the only real competitive edge you can ever hope to have.

Trading Psychology: Your Questions Answered

Let's wrap things up by tackling some of the most common questions I hear from traders about the mental game. Think of this as a quick-fire round to solidify what we've covered and give you some practical takeaways for your own trading.

Can I Succeed at Trading If I’m a Very Emotional Person?

Absolutely. Let's get one thing straight: being emotional doesn't disqualify you from trading. It just means you're human. The goal was never to become a trading robot, completely devoid of feelings.

The real key is to build a firewall between those emotions and the "buy" and "sell" buttons. Your success hinges on creating systems that force you to act on logic, not impulse. This is where your trading plan becomes your best friend—it's the set of rules you wrote when you were calm and objective. Following it, especially when things get heated, is what separates the pros from the amateurs.

How Long Does It Take to Master Trading Psychology?

This is a journey, not a destination. Mastering trading psychology is a career-long commitment, something you practice and refine every single day you sit down at your charts. There’s no final exam or certificate to hang on the wall. The real reward is seeing your P/L become more consistent.

You'll likely see a major shift in your decision-making within a few months of disciplined practice—using a journal, sticking to your plan, and reviewing your trades. But the market will always find new ways to test you. The goal isn't perfection; it's continuous self-awareness and improvement, day in and day out.

The most important psychological trait for a trader isn't natural talent; it's the relentless commitment to self-improvement and adherence to a proven process.

What Is the Single Most Important Psychological Trait for a Trader?

If I had to boil it all down to one thing, it would be discipline. Hands down. Discipline is the steel bridge that connects your trading plan to your account balance. You can have the most brilliant, back-tested strategy in the world, but it's completely worthless if you don't have the discipline to execute it flawlessly when the pressure is on.

Discipline is what makes you:

- Cut a losing trade the second it hits your stop-loss, without a moment's hesitation.

- Take profits at your target instead of getting greedy and watching a winner turn into a loser.

- Sit on your hands and stay out of the market when there are no high-quality setups that match your rules.

Knowledge is one thing, but discipline is what turns that knowledge into actual profit.

Is a Trading Plan Really That Important for Psychology?

Yes. It's not just important; it's non-negotiable. Think of your trading plan as your anchor in the middle of an emotional hurricane. It's your pre-defined set of rules, created by the calm, rational you, far away from the heat of a live trade.

When the charts are flying and emotions like fear and greed start screaming in your ear, your plan is the only thing tethering you to logic. Following it builds confidence and reinforces good habits. Ignoring it is just giving in to the same old impulsive behaviors that blow up accounts. A trader without a plan isn't trading—they're just gambling with their emotions.

Ready to stop gambling on feelings and start trading with a proven, disciplined process? At Colibri Trader, we teach a straightforward, price-action based approach that builds the skills and mindset you need for consistent results. Take our free Trading Potential Quiz and start your journey today.