Master Your Price Action Trading Strategy: A Complete Guide

Understanding Price Action Trading Strategy Fundamentals

A price action trading strategy centers around the natural price fluctuations of an asset. Instead of depending on indicators or news, traders analyze patterns and trends directly from the price data. It's like deciphering a map – the price movements tell a story of market activity, revealing the behavior of buyers and sellers. This method helps traders anticipate future price shifts and make well-informed decisions.

Key Principles of Price Action Trading

Price action trading isn't based on intuition; it relies on a set of established principles, providing a structure for evaluating market dynamics and finding high-probability trading opportunities.

-

Support and Resistance: These are price levels where the market has historically struggled to move past. Support acts as a bottom, and resistance acts as a top. Recognizing these levels is vital for setting entry and exit points.

-

Trend Analysis: This involves figuring out the current market trend direction. Traders search for higher highs and higher lows in an uptrend, and lower lows and lower highs in a downtrend.

-

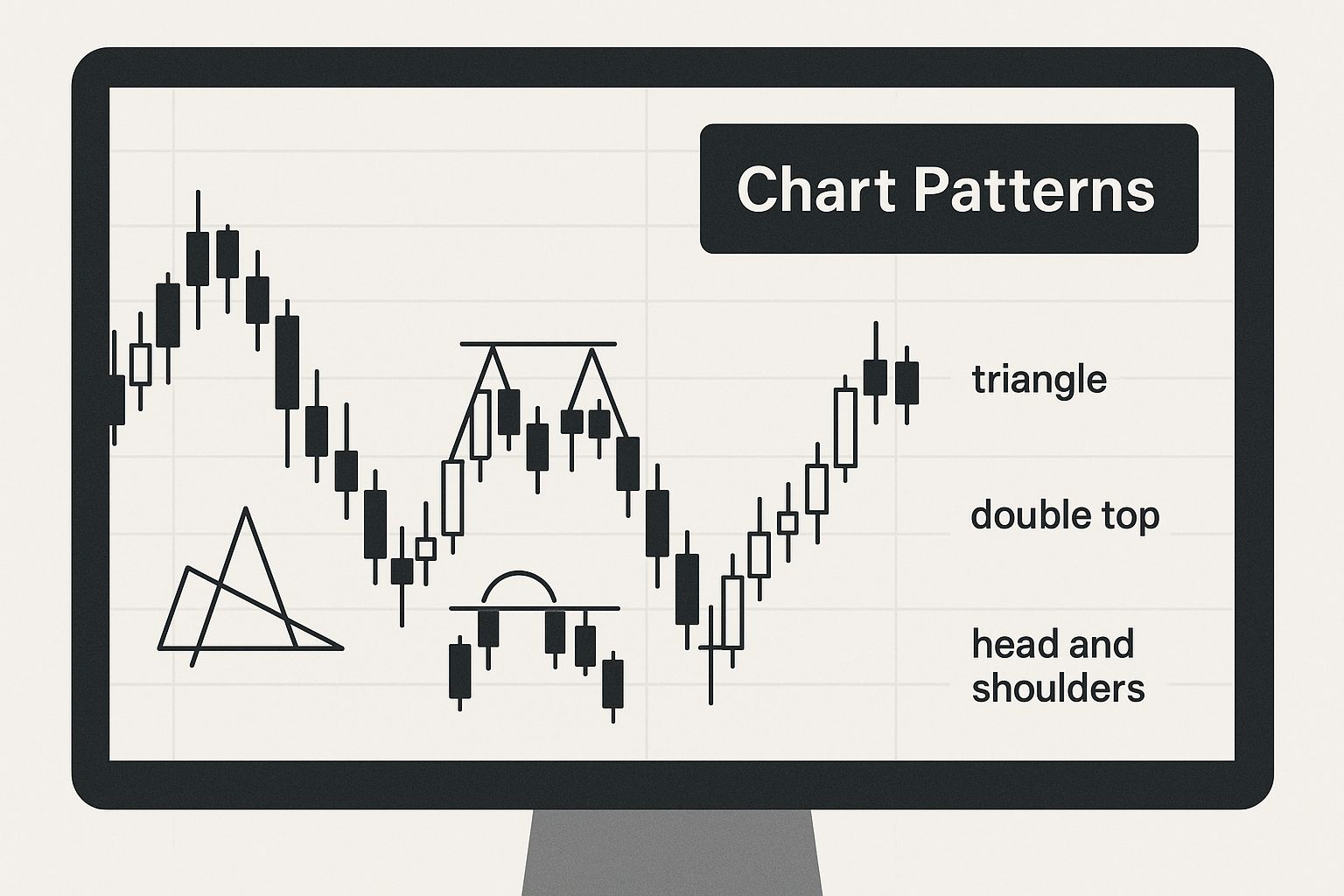

Chart Patterns: Recognizable patterns, such as head and shoulders, triangles, and flags, can often indicate future price changes.

-

Candlestick Analysis: The form and length of individual candlesticks give valuable insights into buying and selling pressure. A long green candlestick suggests strong buying, while a long red candlestick indicates strong selling.

The Power of Historical Data

Price action trading has a rich history, originating in 17th-century Japan in the rice markets. Learn more about the history of price action trading. It has since evolved with technological advancements, allowing traders access to extensive data and personalized strategy creation. Influential figures like Al Brooks and Steve Nison have contributed significantly to its development. Historical data is invaluable for price action traders, allowing them to study past patterns and apply them to current markets.

Identifying High-Probability Setups

The aim of price action trading is to identify high-probability setups, or situations where combined factors indicate a strong chance of a profitable trade. For example, a breakout from a well-defined chart pattern, coupled with increased volume, can be a strong indicator. However, no trading strategy is perfect. Risk management is crucial, even with the best setups.

Advantages of a Price Action Trading Strategy

Price action trading offers several benefits. It allows traders to analyze market dynamics directly, avoiding reliance on potentially lagging indicators. This provides a clearer grasp of market sentiment, leading to more effective price movement anticipation. Price action trading is adaptable to any market and timeframe, providing flexibility across various trading approaches. Focusing on raw price data provides a pure view of market forces, enabling faster reactions to shifting market conditions.

Essential Price Action Patterns That Actually Work

Stop wasting time on patterns that don't deliver. This section reveals the high-probability price action formations that professional traders actually use for consistent profits as part of their price action trading strategy. We'll explore the most reliable setups, from simple support and resistance breaks to more complex reversal patterns like head and shoulders, rising wedges, and engulfing candles. The key, however, lies in understanding the market context.

Understanding Context Is Key

Simply recognizing patterns isn't enough. A rising wedge, for instance, could be a bearish signal in a downtrend, but signify a pause in an uptrend. Similarly, engulfing candles gain reliability at key support or resistance levels. Context is crucial. A doji at the peak of a rally could signal a reversal, while a mid-trend doji might be insignificant. For more practical tips, see 7 Price Action Tips That Work.

Trending Vs. Ranging Markets

Recognizing market conditions is critical. In trending markets, flags and pennants offer entries in the trend's direction. However, in ranging markets, breakouts from support or resistance, combined with double tops and double bottoms, are often more reliable.

The image below shows how these formations appear in real-time trading on candlestick charts.

This visual emphasizes pattern recognition within a specific market context. Price action trading strategies provide market insights through historical data analysis. For example, a study on the Global X Robotics & Artificial Intelligence ETF (BOTZ) showed a successful trade using a rising wedge, a bearish engulfing pattern, and a breakout below the lower wedge trend line. The stop-loss was set at $32.76 and the target at $31.80. Learn more about price action trading strategies here.

To help summarize key price action patterns and their effectiveness, let's look at the following table:

Key Price Action Patterns and Success Rates

Comparison of major price action patterns showing reliability, risk-reward ratios, and optimal market conditions

| Pattern Name | Success Rate | Best Market Condition | Risk-Reward Ratio | Time Frame |

|---|---|---|---|---|

| Support and Resistance Breaks | Varies greatly depending on context | Trending and Ranging | 1:2 or higher | Any |

| Head and Shoulders | Relatively high, especially on higher timeframes | Primarily Reversal Patterns | 1:3 or higher | Daily or Weekly |

| Rising Wedge | Moderate to High, especially with confirmation | Bearish in downtrends, caution in uptrends | 1:2 or higher | Any |

| Engulfing Candles | Moderate, higher at key levels | Reversal and Continuation | 1:2 or higher | Any |

| Flags and Pennants | High in strong trends | Trending | 1:3 or higher | Any |

| Double Tops and Bottoms | High | Ranging | 1:3 or higher | Daily or Weekly |

This table provides a general overview. The actual success rate depends heavily on other factors like volume, momentum, and overall market sentiment. Remember, no pattern guarantees success.

Mastering Entry and Risk Management

Timing your entries is vital. Entering too early increases risk, while entering too late means missed profits. Look for confirmation, such as a breakout on increased volume or a trendline retest, to improve your win rate. Patience and discipline are key. Equally crucial is risk management, including stop-loss orders and take-profit targets.

By analyzing real trades, you'll learn which patterns work best in different market conditions, how to time your entries, and why some setups fail. This helps you avoid costly mistakes and consistently capitalize on profitable opportunities.

Leveraging Historical Data For Consistent Profits

The difference between amateur and professional traders often boils down to one key factor: the ability to learn from the past. Beginners might chase the latest hot stock tip, but seasoned price action traders recognize the cyclical nature of markets. They understand that patterns and behaviors often repeat, making historical data a powerful tool for building a robust trading strategy.

This repetition isn't confined to a single timeframe or market condition. It occurs across various periods and circumstances. For example, analyzing how an asset performed during previous recessions can provide valuable clues about its potential future behavior in similar economic downturns. Understanding historical context is essential for effective price action trading.

Backtesting and Avoiding Statistical Pitfalls

One of the most important uses of historical data is backtesting, which allows traders to test their strategies against past market data. This helps evaluate potential effectiveness before risking real capital. However, backtesting comes with potential pitfalls. It's crucial to avoid common statistical traps like over-optimization and curve fitting. These errors can create a misleading impression of profitability, leading to disappointing results in live trading.

Another trap to watch out for is survivorship bias. This occurs when backtested data excludes companies that have gone bankrupt or been delisted. The resulting data set paints an overly rosy picture of past performance. A reliable backtesting process must account for these biases to accurately simulate real-world market conditions.

Identifying Key Levels and Volume Confirmation

Historical data can also help identify support and resistance levels. These are price points where the market has historically struggled to break through, either upwards or downwards. By studying past price action, traders can pinpoint these levels and use them to anticipate potential future price movements. For instance, a stock consistently bouncing off a specific price point may indicate strong support at that level. For more on specific tools, you can research How to Draw Fibonacci Retracement.

Volume data provides an additional layer of confirmation. High volume accompanying a breakout from a key level strengthens the signal, suggesting a genuine price move. Conversely, low volume during a breakout can indicate a false signal, hinting at a potential price reversal.

Building Your Own Historical Analysis System

Developing a personalized historical analysis system is essential for any serious price action trader. This involves carefully choosing relevant data sources, selecting suitable timeframes, and developing a consistent analytical methodology. Modern tools like charting software and market replay platforms can be invaluable in this process. Remember, though, that these are simply tools. Your analytical skills and grasp of market dynamics are paramount.

Avoid analysis paralysis by focusing on the most relevant data and patterns. Continuously refine your system based on ongoing observations and real-world trading experience. Learn from your successes and mistakes to improve your strategy over time. This continuous learning process is key to long-term trading success. A deeper understanding of market history can be gained by exploring resources like this comprehensive guide.

Modern Tools That Enhance Your Price Action Analysis

Mastering the fundamentals of price action remains essential. However, utilizing the right tools can significantly improve both the efficiency and accuracy of your trading. These tools won't predict market movements, but they can streamline your analytical process and help you execute your price action trading strategy more effectively. Think of it like a craftsman: basic hand tools get the job done, but power tools enhance speed and precision.

Powerful Charting Platforms

Modern charting platforms provide features beyond basic price plotting. Key features to look for include:

- Advanced Pattern Recognition: Some platforms automatically identify price action patterns, such as head and shoulders or wedges. This feature helps traders quickly scan charts and identify potential opportunities.

- Customizable Indicators: A pure price action approach typically minimizes the use of indicators. However, some traders find value in incorporating select indicators for confirmation. Choose platforms that allow customization and flexibility with indicators.

- Multi-Timeframe Analysis: Analyzing price action across different timeframes is essential for understanding market context. A good platform will allow you to switch between timeframes seamlessly.

Customizable Alert Systems

Continuously monitoring charts can be tiring and inefficient. Customizable alert systems notify you based on pre-set conditions, such as specific price levels, identified patterns, or indicator triggers. This allows traders to step away from their screens, especially valuable for those with limited time or who trade across multiple markets. For example, set an alert for when an asset’s price breaks through a key resistance level, ensuring you don’t miss potential trade setups.

Sophisticated Backtesting Capabilities

Backtesting is crucial for developing and refining a successful price action trading strategy. Modern backtesting tools simulate real market conditions using historical data. This allows you to:

- Identify Strengths and Weaknesses: Backtesting reveals how your strategy performs in various scenarios, highlighting areas for improvement.

- Optimize Parameters: Refine your entry and exit rules, stop-loss levels, and other parameters for maximized profitability.

- Manage Risk Effectively: Quantify potential risks associated with your strategy to develop a robust risk management plan.

Mobile Solutions for the Modern Trader

Staying informed about market movements is essential. Mobile trading apps allow traders to monitor positions and execute trades on the go. However, small screens limit in-depth analysis. Mobile trading is best suited for quick checks and order management, not comprehensive chart study.

These tools represent a significant step forward in price action trading, offering capabilities that were previously unavailable. However, remember that the trader’s skill remains paramount. Focus on mastering the principles of price action analysis first, then use these tools to enhance your existing expertise.

Risk Management Strategies That Protect Your Capital

Even the best price action trading strategies aren't foolproof. Market fluctuations are a given, and sometimes even well-planned trades don't work out. That's why risk management is so vital for long-term trading success. It's the safeguard that protects your capital and helps you navigate through inevitable market downturns.

Position Sizing: The Foundation of Risk Control

One of the most important aspects of risk management is position sizing. This refers to how much of your capital you allocate to a single trade. A common guideline is to risk no more than 1% to 2% of your trading account on any given trade.

For example, if you have a $10,000 account, risking 1% translates to a maximum loss of $100 per trade. This strategy limits your potential downside and prevents a single bad trade from significantly impacting your capital. For a deeper dive into risk management, check out this resource: How to master risk management.

Stop-Loss Orders: Your Protective Shield

Stop-loss orders are another essential tool in risk management. These are automated orders that close a trade at a predefined price, effectively limiting potential losses. The trick is to place your stop-loss strategically.

It needs to be close enough to protect your capital, but not so tight that typical market movements trigger it prematurely. Finding the right balance requires an understanding of the asset's volatility and the specific price action setup.

Scaling Techniques: Maximizing Winners and Minimizing Losers

Scaling involves adjusting your position size as a trade unfolds. Scaling in means increasing your position as the trade moves in your favor, boosting potential profits. Conversely, scaling out involves reducing your position as a trade moves against you, minimizing potential losses.

Both techniques require discipline and a deep understanding of your trading strategy.

The Psychology of Risk Management

Risk management is not just about numbers and technical analysis; it's also about mindset. Fear and greed are powerful emotions that can sabotage even the best trading plans. Fear can lead to early exits from winning trades, while greed can tempt you into oversized positions and devastating losses.

Maintaining emotional discipline and sticking to your risk management plan, especially when emotions run high, is crucial for long-term trading success.

Common Mistakes and How to Avoid Them

Traders often fall into common risk management traps. Here are a few key mistakes to avoid:

- Risking too much per trade: This can quickly deplete your capital.

- Not using stop-loss orders: This exposes you to unlimited losses.

- Moving stop-losses further away from entry: This negates the purpose of a stop-loss.

- Ignoring market volatility: Adapting to changing market conditions is key.

- Letting emotions dictate trading decisions: Impulsive decisions based on fear or greed can be detrimental.

Risk Management Rules of Professional Trading Firms

Professional trading firms prioritize risk management and implement strict rules to protect their capital. Here are some common practices:

- Predefined risk limits per trade and per day/week/month.

- Position sizing models based on volatility and market conditions.

- Mandatory stop-loss orders for every trade.

- Regular performance reviews and risk assessments.

- Emphasis on trader psychology and emotional control.

By learning from professional firms, individual traders can enhance their risk management skills and safeguard their capital. This focus, combined with a strong trading strategy, is the pathway to consistent trading success.

To help illustrate best practices, let's look at some specific risk management guidelines based on account size. The table below offers recommended position sizing and risk parameters for different account levels and trading styles.

Risk Management Guidelines by Account Size

| Account Size | Max Risk Per Trade | Position Size | Stop Loss Range | Monthly Risk Limit |

|---|---|---|---|---|

| $5,000 | 1% ($50) | Adjusted to risk $50 | Based on asset volatility | 5% ($250) |

| $10,000 | 1.5% ($150) | Adjusted to risk $150 | Based on asset volatility | 6% ($600) |

| $25,000 | 2% ($500) | Adjusted to risk $500 | Based on asset volatility | 8% ($2000) |

This table demonstrates how position sizing, stop-loss ranges, and overall risk limits can be tailored to different account sizes. Remember, these are guidelines and should be adjusted to your individual risk tolerance and trading strategy. The key takeaway is to have a well-defined risk management plan in place before entering any trade.

Building Your Personal Trading System

A successful price action trading strategy isn't about simply spotting patterns; it's about systematically applying that knowledge. This means developing a personalized trading system reflecting your individual circumstances, risk tolerance, and trading objectives. This structured approach is key for lasting success in the markets. Just like constructing a house, a solid blueprint is crucial for a strong, stable result.

Defining Your Market and Timeframe

First, choose markets that fit your lifestyle and expertise. If your time is limited, focusing on daily charts of major currency pairs might be more suitable than scalping five-minute charts of volatile stocks. If you possess specialized knowledge of a specific sector, like commodities, concentrate your efforts there.

Selecting the right timeframe is equally important. A day trader, for example, might prioritize shorter timeframes, such as 15-minute or hourly charts. Conversely, a swing trader would likely focus on daily or weekly charts. Your chosen timeframe should complement your trading style and the time you can devote to market analysis.

Setting Clear Entry and Exit Rules

A well-defined price action trading strategy includes precise entry and exit rules. These rules help remove emotion from trading decisions, a vital aspect of consistent profitability. Your entry rules could involve specific candlestick patterns, breakouts from important levels, or a combination of factors aligned with your strategy.

For exits, predefined profit targets and stop-loss levels are essential. Determined before entering a trade, these levels depend on your risk tolerance and the specific trade setup. This method avoids impulsive decisions fueled by fear or greed, two significant obstacles for traders.

The Importance of a Trading Journal

A trading journal is much more than a record of profits and losses; it's a tool for continuous improvement. Document not only the financial outcome of each trade, but also the rationale behind the trade, the specific setup, and any emotional influences on your decisions. Regularly reviewing your journal helps identify patterns in your trading, both successful and unsuccessful, allowing you to refine your strategy, avoid repeating mistakes, and enhance your trading performance.

Adapting to Changing Market Conditions

Markets are dynamic. A price action trading strategy that performs well in a trending market may struggle in a ranging market. Adaptability is essential. Continuously monitor market conditions and adjust your strategy as needed. For instance, in a volatile market, you might tighten your stop-loss levels to preserve capital. In a calmer market, you might widen them to give trades more room.

Managing the Psychological Aspects of Trading

Even with a structured system, trading can be emotionally taxing. Losses are unavoidable, and even winning streaks can lead to overconfidence. Develop methods for managing these psychological aspects. This could involve taking breaks after a series of losses, practicing mindfulness techniques to maintain focus, or seeking guidance from a trading mentor or coach.

Building a successful price action trading strategy requires time, effort, and discipline. However, the potential benefits justify the commitment. By integrating a structured approach with a thorough understanding of price action, you can substantially improve your trading consistency and achieve your financial goals.

Ready to enhance your trading with a proven price action trading strategy? Visit Colibri Trader today and explore how our comprehensive training programs can help you master the markets: https://www.colibritrader.com