Your Guide to an Online Trading Academy

So, you're hearing a lot about online trading academies. What exactly are they?

Let's use an analogy I like. Imagine you wanted to learn how to fly a plane. You wouldn’t just watch a few videos on YouTube, jump in the cockpit, and hope for the best, right? Of course not. You’d go to flight school. You'd get structured lessons, hours in a simulator, and real-time guidance from a pilot who's seen it all.

An online trading academy is your flight school for the financial markets. Simple as that.

What Is an Online Trading Academy

These academies are educational platforms built to turn absolute beginners into traders who know what they're doing. They do this through a clear, step-by-step process. I have to be clear here: these are not get-rich-quick schemes. If you see that promise, run the other way.

A real academy is a school. Its goal is to teach you discipline, strategic thinking, and most importantly, a repeatable process you can use no matter what the market is throwing at you.

Core Components of a Modern Academy

A top-tier trading academy is so much more than a folder of video lessons. It's a complete ecosystem designed to help you learn and apply what you've learned. The best ones I've seen always blend theory with a heavy dose of practical, hands-on experience.

So, what should you be looking for? Here's a quick rundown of the essentials.

The table below breaks down what I consider the absolute must-haves for any trading education program worth your time and money.

Core Components of a Reputable Online Trading Academy

| Component | What It Provides |

|---|---|

| Structured Curriculum | A clear path from basic ideas (like how markets work) to advanced skills (like technical analysis and building your own strategies). |

| Expert Instructors | Access to seasoned traders who don't just teach but also mentor you, sharing insights from their own wins and losses. |

| Community Support | A network of other students and mentors. This is huge for accountability and navigating the tough psychological side of trading. |

| Practical Tools & Simulators | A safe place, like a demo account, to practice your strategies with fake money before you even think about risking your own capital. |

Think of these components as the pillars of your trading education. Without any one of them, the whole structure can get a bit wobbly.

The real goal of a trading academy isn't to hand you hot stock picks. It's to teach you a process for finding your own opportunities, managing your risk, and keeping your emotions in check.

Moving Beyond Simple Definitions

At the end of the day, an online trading academy gives you a framework for consistency. The markets are chaotic, full of noise and emotional traps that wipe out most new traders. I've seen it happen more times than I can count.

By teaching a rule-based approach, these schools help you build the mental and strategic armor you need to survive long-term.

It's like building a house. You need a solid foundation (market principles), a strong frame (your trading plan), and the right tools (analysis techniques). A good academy gives you the blueprint and shows you how to use every single tool, making sure the house you build can stand up to any storm the market sends your way.

The Evolution of Trading Education

It wasn't that long ago that trading knowledge was a secret handshake, something you could only learn on the loud, chaotic floors of the New York and Chicago exchanges. Real strategies were passed down through tight-lipped apprenticeships and hushed advice. Getting in was more about who you knew than what you could do.

That old boys' club created an impossibly high wall for most people. The thought of learning to trade like a pro from your own home? Pure fantasy. Then the internet flickered to life and started to change everything.

This digital wave began tearing down the old walls around financial knowledge, bit by bit. What was once a private club started opening its doors to the public, setting the stage for a completely new way of learning.

From Trading Pits to Digital Classrooms

The late 1990s kicked off this new era. As we moved from screeching dial-up modems to high-speed internet, the first real online learning platforms began popping up. This wasn't just a tech upgrade; it was a fundamental shift in the whole philosophy of who deserved to learn to trade.

The new idea was simple but powerful: anyone with a computer and the drive to learn should get access to the same quality of education once saved for the financial elite. This was the core mission that fueled the very first online trading academy platforms.

A key player in this movement was Online Trading Academy (OTA). Kicking off in 1997, they were one of the first to really connect the professional trading floor with the individual learner sitting at home. For nearly three decades, OTA has been honing a model that mixes proven educational principles with powerful online tools. They put a massive focus on both the technical skills and the all-important psychological side of trading. It's worth a look into their long history and educational approach to see what’s given them such staying power.

The Modern Educational Advantage

Fast forward to today, and trading education is a different beast altogether. The journey from basic text-based lessons to the rich, interactive experiences we have now has been incredible.

Modern platforms have completely refined the learning process, packing in features that were once pure science fiction:

- Live Online Sessions: You can jump into a session with a pro instructor, ask questions, and get feedback on the spot. It’s like having a real classroom, but without the commute.

- On-Demand Video Libraries: Got a massive library of lessons you can binge-watch at your own pace. If a concept doesn't click, you can just rewind and watch it again.

- Advanced Trading Simulators: This is where you get your hands dirty. These tools let you test-drive your strategies with real market data but without risking a single penny of your own money. It’s the perfect way to build confidence before you go live.

The real game-changer in modern trading education is its structure. It takes the wild, often scary world of financial markets and breaks it down into a logical, step-by-step process that anyone can actually learn and follow.

This structured methodology is what truly separates a formal online trading academy from trying to stitch together a strategy from random YouTube videos and blog posts. Instead of a pile of disconnected tips, you get a complete system that's been built and tested over years. It’s the difference between following a Michelin-star recipe and just tossing ingredients in a pan, hoping for something edible. Understanding this history is crucial because it shows the time-tested foundation that strong trading education is built on today.

What You Will Actually Learn

Jumping into an online trading academy is like someone handing you the blueprint to a complex machine you've been trying to figure out by yourself. What once looked like a confusing mess of gears and levers is suddenly broken down, with a structured guide explaining how every single piece works together.

A good curriculum is designed to build your skills layer by layer, so you never feel like you're in over your head. It all starts with the absolute bedrock of market knowledge—not complex strategies, but the simple, powerful forces that move every single market.

Mastering the Market Fundamentals

Your first lessons will be laser-focused on the non-negotiable principles of how financial markets actually operate. Think of it like learning grammar and vocabulary. Without the basics, you can't form a coherent sentence, let alone understand what other people are saying.

You'll cover core concepts like:

- Market Mechanics: Who are the players? From individual retail traders like us to massive financial institutions, you'll learn the role each one plays in the ecosystem.

- Supply and Demand Dynamics: This is the engine that drives everything. You'll learn to see the market as a constant auction, where price moves based on the ongoing battle between buyers and sellers.

- Essential Terminology: You'll finally get clear, practical definitions for terms you've probably heard a thousand times, like "pips," "leverage," "spread," and "margin."

This foundation is critical. It’s the solid ground you need before you can start building your trading house.

Learning the Trader’s Toolkit

Once you understand why the markets move, it's time to learn how to analyze those movements. This is where you get your hands on the practical tools for making trading decisions. A proper online trading academy will introduce you to two very different, but equally important, analytical methods.

The first is technical analysis, which is really the art and science of reading price charts. You’ll learn to spot trends, identify key support and resistance levels, and recognize repeatable price formations. These visual cues are the market’s language for telling you what it might do next.

Technical analysis isn't about gazing into a crystal ball to predict the future. It’s about identifying high-probability setups based on how the market has behaved in the past, giving you a statistical edge.

At the same time, you'll dig into fundamental analysis. This is all about looking under the hood to assess an asset's true value by examining economic factors, financial reports, and industry news. For a stock, that could mean digging into a company's earnings report. For a currency, it might involve studying a country's interest rates and economic health.

The Two Pillars of Analysis

| Analysis Type | Focus Area | Key Question It Answers |

|---|---|---|

| Technical Analysis | Price charts, patterns, and market indicators. | "When is the right time to enter or exit a trade?" |

| Fundamental Analysis | Economic data, news events, and company health. | "What is this asset actually worth and why?" |

A great education doesn't just teach these in isolation. It shows you how to blend them, giving you a much more complete and robust view of any trading opportunity.

Risk Management: The Cornerstone of Survival

Listen closely, because this is the most important subject you will ever learn in your trading journey. Any online trading academy worth its salt will drill this into you relentlessly. You can have the best strategy in the world, but without ironclad risk management, you will eventually fail. It’s a statistical certainty.

Here, you'll learn the practical math and discipline needed to protect your capital. This includes:

- Position Sizing: Calculating exactly how much of your account to risk on a single trade. This one skill ensures that no single loss can wipe you out.

- Setting Stop-Loss Orders: Learning the technical art of placing automated orders that get you out of a bad trade before the damage gets out of control.

- Risk-to-Reward Ratios: Understanding how to size up a potential trade to make sure the potential profit is worth the risk you're taking.

Tailoring Strategies for Different Markets

Finally, you’ll discover that what works in one market doesn't always work in another. The strategies for trading stocks can be quite different from those used for forex, options, or futures. A comprehensive program shows you how to adapt your skills to the unique personality of each asset class.

You'll explore how things like volatility, liquidity, and trading hours change your approach, allowing you to either specialize or diversify your trading. You’ll also be introduced to various chart patterns that can signal potential market moves. To get a head start, you can learn more about the top 10 chart patterns every trader should know and begin recognizing these important formations.

The ultimate goal is to equip you with a complete toolkit. By the time you're done, you won't just be following someone else's signals—you'll have the skills and the confidence to build, test, and execute your very own trading plan.

How to Choose the Right Online Trading Academy

Picking an online trading academy is a big deal. It's not just a course; it's more like a partnership where your potential for success is directly linked to the quality of the teaching you get. You have to look past the flashy marketing and dig into what the program really offers.

Think of it like buying a car. You wouldn't just be wowed by the shiny paint job. You’d want to pop the hood, check the engine, and take it for a serious test drive. The same idea applies here. You need to investigate the instructors, the curriculum, and the real-world results of past students.

Evaluate Instructor Credibility and Experience

The heart and soul of any academy are its teachers. In trading, you need instructors who have actually "walked the walk," not just talked about it. Look for educators with a proven track record of trading with real money, especially through different market conditions.

But a great trader doesn't automatically make a great teacher. They also need to be able to break down complex ideas into simple, bite-sized concepts. If an academy is vague about its instructors' backgrounds or you can't find any verifiable trading history, that's a major red flag.

A truly valuable instructor doesn't just show you their winning trades. They share the hard lessons learned from their losses, giving you an honest, realistic picture of what it really takes to make it in the markets.

Scrutinize the Curriculum and Learning Path

A solid curriculum should offer a clear path, starting with the basics and logically building up to more advanced strategies. It should feel like a well-planned journey, not just a random collection of videos.

A top-tier online trading academy will build its curriculum around these key areas:

- Foundational Knowledge: A deep dive into how markets work, supply and demand, and essential jargon.

- Technical and Fundamental Analysis: Comprehensive training on both reading charts and understanding an asset's real value.

- Risk Management: This needs to be a core principle woven throughout the entire program, not just a single lesson.

- Trading Psychology: Dedicated material on handling fear and greed and developing the discipline to stick to your plan.

- Practical Application: Chances to practice in a simulator or demo account, ideally with feedback from an instructor.

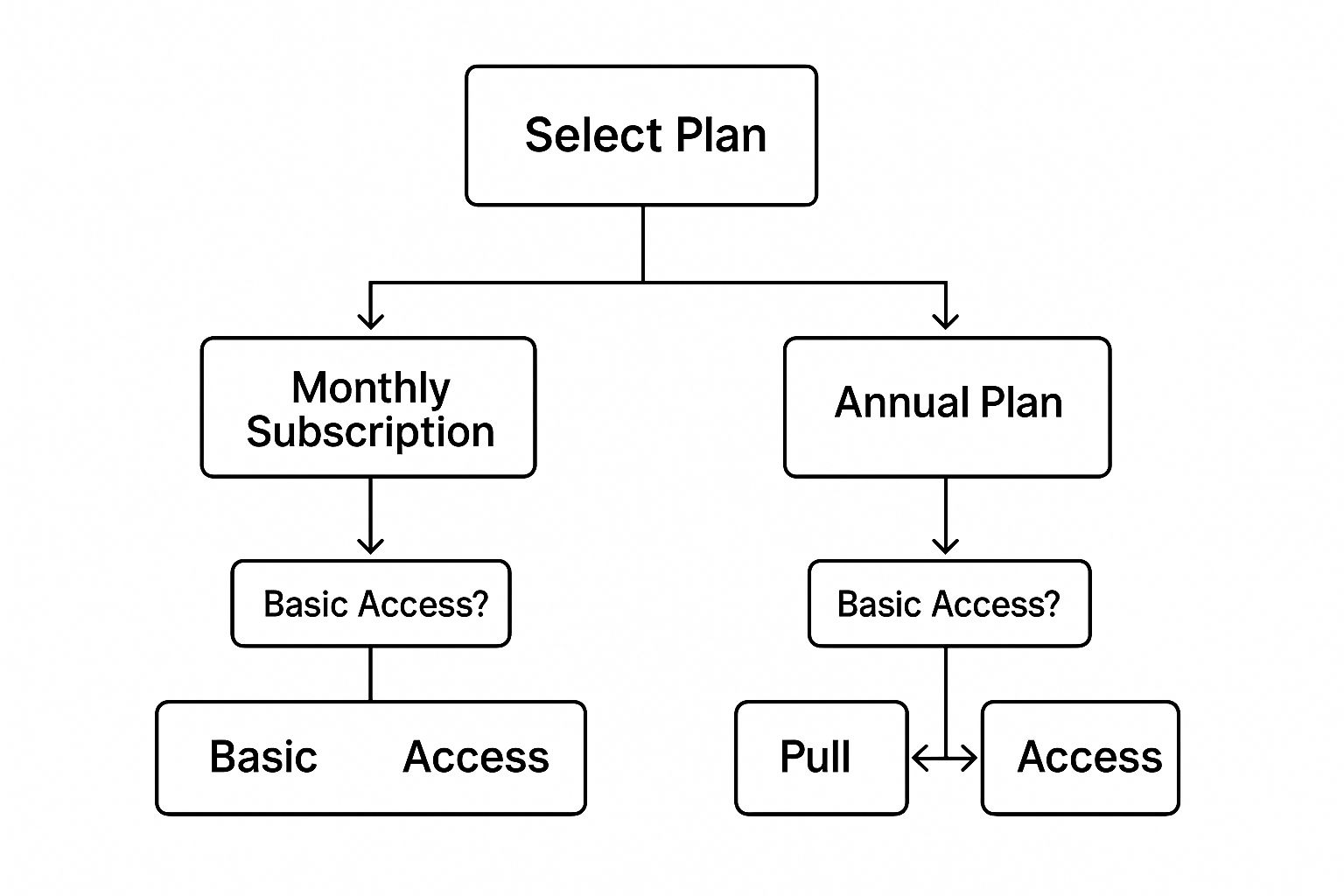

This visual shows how some academies structure their courses, giving you an idea of the educational path.

Seeing a flow like this helps you understand how different access levels or payment plans might shape your experience from day one.

To help you vet potential trading academies, I’ve put together a checklist. Use it to compare different providers and find the one that truly fits your goals.

Online Trading Academy Evaluation Checklist

| Evaluation Criterion | What to Look For | Potential Red Flags |

|---|---|---|

| Instructor Credibility | Verifiable real-money trading experience; transparent professional history; ability to teach complex topics simply. | Vague instructor bios; focus only on profits with no mention of losses; no verifiable track record. |

| Curriculum Structure | A logical progression from beginner to advanced topics; covers analysis, risk management, and psychology. | A random assortment of topics; lack of a clear learning path; key areas like risk management are overlooked. |

| Student Reviews | Testimonials focusing on the learning process, skill development, and community support, not just profit claims. | Unverifiable testimonials; promises of guaranteed profits; reviews that sound like paid advertisements. |

| Community & Support | An active forum or community; access to mentors or instructors for questions; peer support network. | No community features; limited or non-existent access to instructors; a sense of isolation in your learning. |

| Transparency & Value | Clear pricing with no hidden fees; value is justified by the depth of content, tools, and support offered. | High-pressure sales tactics; unclear pricing structures; costs that seem too high for the value provided. |

Think of this checklist as your own "inspection" tool. A great academy will check all the right boxes, giving you confidence that you're making a solid investment in your trading education.

Review Student Outcomes and Community Support

Ultimately, an academy's worth is proven by its students' success. No legitimate school will promise you profits, but they should be able to share verifiable testimonials or case studies. Look for reviews that talk about the educational journey, the supportive community, and how they learned to build a structured trading approach.

A strong community is an asset that's easy to overlook. Trading can feel like a solo mission, but having a network of peers and mentors provides crucial accountability and support. It’s a place to ask questions, share your struggles, and celebrate wins with people who get it. The goal is to learn the skills needed to create a robust and personalized strategy. For a deeper look into this process, you can find a complete guide on how to make a trading plan that aligns with a disciplined approach.

Finally, weigh the total cost against the value you're receiving. Don't just look at the price. Consider the depth of the content, instructor access, the quality of any included tools, and the ongoing support. A higher price can be worth it if it delivers a premium educational experience that sets you up for long-term success.

Understanding The Business Of Trading Education

Before you can really trust an educator, it helps to understand how they operate as a business. The world of financial education isn't some tiny corner of the internet; it's a massive industry with some very serious, well-established companies. Taking a look at an academy's business model can tell you a lot about its stability, size, and whether it’s in it for the long haul.

When you pull back the curtain, you’ll find that the top players are sophisticated, well-run organizations. They’re managing global operations, generating significant revenue, and plowing that money back into their platforms and their people. This is a good thing. It confirms you're dealing with a legitimate institution, not some fly-by-night online course.

Sizing Up The Industry Leaders

A great way to see just how robust this industry is is to look at one of the heavyweights. Take Online Trading Academy (OTA), for example. They are a major force in the trading education space.

As of 2025, OTA is pulling in an estimated annual revenue of around $158.6 million with a team of about 809 employees. You can actually dig into the specifics of their operational scale to see the full breakdown.

This works out to an impressive revenue per employee of about $196,000. That number tells a story. It points to a highly efficient and scalable business model, one that juggles a physical presence across 48 global locations with a powerful online learning system. This isn't just a business; it’s a well-oiled educational machine.

Understanding these numbers helps you see an online trading academy as a serious, long-term business. Their financial stability and operational efficiency are strong indicators that they have the resources to support students effectively over time.

This hybrid approach—blending physical campuses with a solid online platform—lets them reach a huge audience without sacrificing quality. It's a structure built to last, showing they are seriously invested in their educational mission.

Why Business Viability Matters To You

So, why should you care about an academy's revenue or how many people they employ? Simple. A financially healthy company is one that can afford to hire top-tier instructors, develop better learning tools, and provide real, ongoing support to its students. Their stability is your gain.

A stable business is also better prepared to guide you through the chaos of the financial markets, which are constantly reacting to major global events. Getting a handle on these market-moving factors is a non-negotiable part of becoming a trader. If you want a deeper dive, check out our guide on the 5 fundamental events every serious trader should know about.

When you can see that an academy is built on a solid business foundation, it gives you peace of mind. You know they aren’t going to vanish into thin air, leaving you high and dry. You're investing in a partner for your trading journey, and making sure their business is sound is just smart due diligence.

Common Questions About Online Trading Academies

As you get closer to picking an online trading academy, it's perfectly normal for some big questions to pop up. This is a major decision, and it’s smart to have doubts or need more clarity before you jump in. Let’s tackle the most common questions I hear from aspiring traders, with some straight-up answers to help you move forward.

How Much Does an Online Trading Academy Cost?

This is usually the first thing on everyone's mind, and the honest answer is: it varies. A lot. You can find introductory courses for a few hundred dollars, while a comprehensive, multi-year program with one-on-one mentorship might run into the thousands.

It helps to stop thinking of it as a "cost" and start seeing it as an investment in a career skill—much like you would a professional certification or a university degree. A rock-bottom price can actually be a red flag. Instead of getting hung up on the sticker price, your focus should be on the value you're getting.

So, what does a high-value program look like? It usually includes:

- Direct access to experienced instructors for real questions and feedback.

- An active and supportive community of fellow students.

- A deep library of resources, like recorded live sessions and practical exercises.

- Quality trading simulators and tools to practice with.

Be very wary of any program that seems too cheap to be true, or one that makes wild promises to justify a sky-high price. The right choice is an investment where the educational return—the knowledge, the skills, the support—clearly justifies the financial one.

Will a Course Make Me a Successful Trader?

Let's be blunt: no, a course alone won't make you successful. An academy gives you the map, the car, and the driving lessons, but you're the one who has to get behind the wheel. It provides a proven framework and the essential knowledge to navigate the markets without crashing and burning.

Your success, however, depends entirely on you. It comes down to your discipline, your commitment to practice, and your ability to keep your head straight when real money is on the line. Think of it like a world-class music school. It can give you the best instructors and flawless music theory, but only you can put in the hours of focused practice to become a concert pianist.

An online trading academy is a powerful catalyst, not a magic button. It gives you the strategy and the rules, but you have to bring the discipline and patience to execute them perfectly, day in and day out.

The curriculum is just the foundation. Your work ethic and emotional strength are what will build your trading career on top of it.

How Long Until I See Real Results?

This is a huge question, and the answer requires a bit of a mindset shift. There's no set timeline for becoming a profitable trader. Anyone who tells you something like, "you'll be making money in 90 days," is selling you a fantasy, not an education.

Most new traders should plan on spending several months, or even a year or more, in a demo account. The point of this phase isn't to make fake money. It's to fine-tune your strategy, prove it works consistently, and build rock-solid discipline in a completely risk-free environment.

Your first "real results" aren't measured in dollars. They are measured by your ability to consistently:

- Follow your trading plan to the letter, no matter what.

- Manage your risk on every single trade, based on your rules.

- Execute your strategy flawlessly, even when you feel fear or greed creeping in.

Profitability is the byproduct of a sound, disciplined process. It’s a lagging indicator of your consistency. You have to embrace patience as a core part of your strategy. A long-term mindset isn't just helpful; it's essential for survival.

How Do I Know if an Academy Is Legitimate?

Knowing how to spot genuine educators versus slick marketers is absolutely crucial. A legitimate online trading academy is focused on teaching you a skill, not giving you investment advice or "hot stock tips." They sell education, not get-rich-quick promises.

Here are the key signs of a credible program:

- A Long Track Record: Companies that have been operating for a decade or more have proven their value and staying power.

- Transparent Pricing: All costs are laid out clearly from the start. No hidden fees, no high-pressure sales tactics to upgrade later.

- Verifiable Instructors: You should be able to easily find information about the instructors' real-world trading experience and professional backgrounds.

- A Heavy Focus on Risk Management: A good school will talk more about how to manage and contain losses than they do about hitting home runs.

- Process-Oriented Reviews: Look for testimonials that talk about the learning journey, the supportive community, and skill development—not just claims about profits.

On the flip side, be on high alert for red flags. These include guarantees of high returns, pressure to use a specific broker, a vague curriculum, or a lack of real student success stories you can verify. A real school empowers you to think for yourself; a scam wants to make you dependent on them.

Ready to stop guessing and start learning a proven, indicator-free trading method? At Colibri Trader, we provide the clear, action-based education you need to build real skills and trade with confidence. Discover your trading potential and transform your performance. Learn more and get started today.