Money Management in Trading: Your Complete Success Blueprint

Why Smart Money Management Beats Perfect Trading Signals

Many traders start out searching for the perfect trading signal, thinking it's the secret to steady earnings. The hard fact is, even the best entry points can lead to a wiped-out account if strong money management in trading isn't in place. This core principle is frequently missed, but it's the foundation for lasting market participation.

Indeed, professional traders grasp this idea well, focusing more on capital preservation than just the next "hot" strategy. While many newer traders get drawn to high-reward possibilities, seasoned professionals put protecting their current funds first. They understand that longevity in trading depends on carefully managing risks, a key distinction between consistent earners and those who find it difficult.

Market history and trader results clearly show how vital disciplined risk control is. Looking back over the last twenty years, careful money management in trading often marks the line between steady gains and significant losses. For instance, during the 2007–2009 financial downturn, the S&P 500 fell from about 1,550 in late 2007 to near 666 by early 2009, a drop exceeding 57%.

Traders who navigated this period successfully, or even grew their accounts, were those who applied strict risk rules, typically risking only 1–2% of their funds on any one trade. Research indicates that although a large portion of day traders, possibly over 90%, end up losing money, those with solid money management plans—like set stop-loss and take-profit points they stick to—have a much better chance of sustained profitability. Explore this topic further with CBOE historical data. Understanding how good risk management separates winners is a crucial insight. Find out more in our piece on How to Become a Profitable Trader.

The Psychological Battle for Sound Money Management

So, if effective money management is so crucial, why do so many traders fail to implement it consistently? The answer often lies in common psychological traps. Emotions like fear and greed can easily derail even the best-laid plans. For instance, after a series of losses, a trader might engage in revenge trading, taking oversized risks to recoup losses quickly, a surefire path to further financial damage.

Conversely, a winning streak can breed overconfidence, leading traders to believe they can't lose and encouraging them to abandon their risk rules. Fear of missing out (FOMO) can also compel traders to enter positions without proper setup or sizing, purely based on market hype. These psychological hurdles prevent many from sticking to life-saving practices like consistent position sizing and respecting stop-losses. The key takeaway is that mastering your emotions is as important as mastering your strategy.

This disciplined approach to money management in trading is precisely what allows successful traders to remain profitable even if their win rate isn't exceptionally high. Consider a scenario where a trader wins on only 50% of their trades. If they consistently aim for trades where the potential profit is at least twice the potential loss (a 2:1 risk-reward ratio), they can still be profitable.

For example, with a strategy risking $100 to make $200, ten trades with five wins and five losses would result in ($200 * 5 wins) – ($100 * 5 losses) = $1000 – $500 = $500 profit. This demonstrates that you don't need to be right all the time; you just need to manage your money wisely when you are right and when you are wrong. This power of positive expectancy, driven by sound risk control, is what separates enduring careers from fleeting attempts in the trading world.

Master The 1% Rule And Position Sizing Like A Pro

Smart money management in trading really boils down to getting your position sizing right. This isn't just about picking how much to bet on one trade; it's the foundation of your survival in the markets. It’s about giving your trading strategy enough runway—enough time and chances—to actually show its positive results. If you get your sizing wrong, you can burn through your account quickly, even if you have a great strategy. On the flip side, intelligent sizing acts as a shield for your capital, especially when those unavoidable losing streaks hit.

The Bedrock of Trading Survival: The 1% Rule

One of the most respected principles for protecting your trading capital is the 1% rule. Many professional traders treat this as a non-negotiable standard. The rule is simple: don't risk more than 1% of your total trading funds on any single trade. So, if you have $20,000 in your trading account, the absolute most you should risk on one idea is $200.

This straightforward guideline packs a punch with several key advantages:

- Capital Preservation: It significantly cuts down the danger of wiping out your account. Imagine hitting a rough patch with ten losses in a row; you'd only be down about 10% of your capital (actually a bit less, since that 1% is on a slightly smaller balance after each loss).

- Emotional Stability: When you know that no single trade can cripple your account, it’s much easier to keep your cool. This helps you avoid making rash decisions driven by panic.

- Longevity: It keeps you in the trading game long enough to learn the ropes, adjust your approach, and eventually find a path to consistent profits. As many seasoned traders will tell you, a strategy you can stick with consistently is often far better than some "perfect" strategy you ditch when things get tough.

Calculating Your Position Size: A Practical Guide

Once you've decided on your maximum risk for a trade (say, that 1% of your capital), the next job is figuring out what that means for the actual size of your position in the asset you're looking at. To do this, you absolutely need to know where your stop-loss order will be placed.

Here’s how you can break it down:

- Determine Your Account Risk: Figure out what 1% (or whatever percentage you've chosen) of your trading capital amounts to in dollars. This is the maximum cash you're prepared to lose on this specific trade.

- For instance: If your Account Capital = $10,000, then your 1% Risk = $100.

- Determine Your Trade Risk (Per Share/Unit): Pinpoint where your stop-loss will go. The difference between your entry price and your stop-loss price is your risk per share (or per unit, depending on what you're trading).

- For instance: If the Stock Entry Price = $25 and your Stop-Loss Price = $23, then your Trade Risk per Share = $2.

- Calculate Position Size: Now, just divide your Account Risk (from step 1) by your Trade Risk per Share/Unit (from step 2).

- For instance: Position Size = $100 / $2 per share = 50 shares.

Using this approach ensures that if your trade hits your stop-loss, your loss is capped at the amount you decided on beforehand.

To give you a clearer picture of how this works in practice, the table below shows how maximum position sizes change based on different account balances and stop-loss distances, using both the 1% and 2% risk rules for the risk amount. The position sizes are then calculated based on the 1% risk amount.

Position Sizing Comparison by Account Size

Comparison of maximum position sizes using 1% and 2% risk rules across different account balances. The "Max Position" columns are calculated using the "1% Risk Amount".

| Account Size | 1% Risk Amount | 2% Risk Amount | Max Position with $10 Stop | Max Position with $50 Stop |

|---|---|---|---|---|

| $5,000 | $50 | $100 | 5 units | 1 unit |

| $10,000 | $100 | $200 | 10 units | 2 units |

| $25,000 | $250 | $500 | 25 units | 5 units |

| $50,000 | $500 | $1,000 | 50 units | 10 units |

| $100,000 | $1,000 | $2,000 | 100 units | 20 units |

This table highlights that your actual trade size isn't fixed, even if your percentage risk stays the same. It adjusts depending on how far away your stop-loss is, which is a key part of setting up any trade. A tighter stop means you can trade a larger size for the same dollar risk.

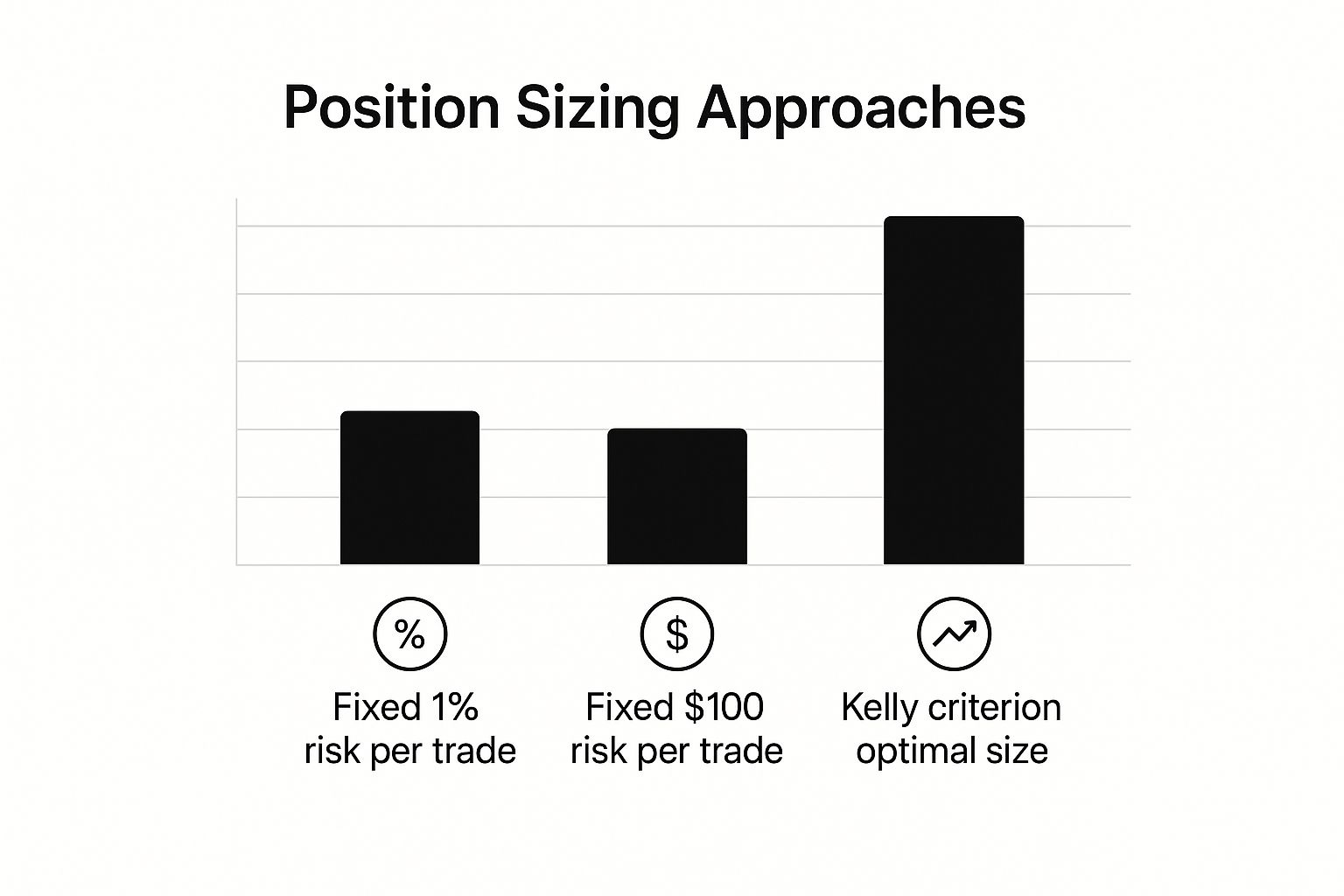

To get a visual sense of how different position-sizing approaches can affect trade sizes, check out the chart below. It compares three common methods: a fixed 1% risk per trade, a fixed dollar risk, and the Kelly Criterion.

The chart shows that the Kelly Criterion can sometimes suggest much larger positions. While this might lead to higher returns, it also ramps up the risk. The 1% rule, on the other hand, offers a more conservative and steady way to manage your capital exposure in your overall money management in trading plan.

Exploring Advanced Position Sizing Techniques

While the 1% rule (which is a type of fixed fractional position sizing) is fantastic for its simplicity and how well it protects your capital, some traders like to explore more complex methods. One of these is the Kelly Criterion. This is a mathematical formula designed to figure out the ideal percentage of your capital to put into a trade to maximize your long-term capital growth.

However, the Kelly Criterion needs you to have pretty accurate estimates of your win probability and your average win/loss ratio. If you overestimate these, you could end up taking on dangerously large position sizes. Because it's complex and very sensitive to how accurate your inputs are, many traders, especially those still honing their trading edge, find that a simpler fixed fractional method like the 1% rule is more dependable and easier to stick with consistently. If you're curious about other methods, you might find this interesting: 6 Position Sizing Strategies to Consider gives a good overview.

Dynamic Adjustments: Tailoring Size to Market Conditions

Good position sizing isn’t a set-it-and-forget-it deal; it needs to be flexible. Within your main risk rules, several things should prompt you to adjust your sizing:

- Volatility: When markets are whipping around wildly, price swings are bigger. To keep your dollar risk the same (e.g., that 1% of your account), you might need to trade smaller sizes because your stop-loss will likely need to be placed further away from your entry.

- Account Balance: As your account grows, that 1% risk translates to a larger actual dollar amount. Conversely, if you hit a losing streak and your account shrinks, 1% becomes a smaller dollar amount, which naturally helps to reduce your risk.

- Market Conditions: In markets that are trending strongly, some traders might feel more confident using their full 1% risk. But if the market is choppy and just bouncing around in a range, they might choose to trade a bit smaller or just wait for clearer signals.

The High Cost of Ignoring Sizing Principles

These position sizing principles aren't just friendly suggestions; they are absolutely vital parts of responsible money management in trading. Breaking them – perhaps by risking 5% or even 10% of your capital on what feels like a "sure thing" – is a very common way traders blow up their accounts. Just one or two oversized losses can completely undo weeks, or even months, of careful, steady gains.

Always remember, the main aim isn't just to make money on any one trade. It's to protect your capital so you can keep trading effectively for the long haul. Sticking to sensible position sizing rules is what will save your skin during those inevitable strings of losses that can crush traders who are unprepared or lack discipline. Applying these rules consistently is a true mark of a professional trader.

Stop-Loss Strategies That Actually Protect Your Money

Managing your exits is a key piece of money management in trading, going beyond just deciding your risk for each trade. It’s not enough to just place any stop-loss; creating orders that truly protect your money takes skill and solid discipline. Think of these stops as essential components of your trading strategy, not just arbitrary lines.

Seasoned traders use a range of stop order types, picking the right one for specific market situations to better manage their funds. Understanding these choices can make a big difference in shielding your capital from sudden market shifts.

Types of Stop-Loss Orders Professionals Use

Selecting the appropriate stop-loss is fundamental for good risk control. Experienced traders don't rely on a single method; they adjust their stop-loss tools based on the individual trade and current market feel. This flexibility is crucial for protecting capital over time.

Common types include:

- Percentage Stops: These are straightforward, set at a specific percentage below your entry price. This method ties directly into risk rules, like the common 1% risk rule. For example, if you buy a stock at $100 and use a 2% stop, your stop-loss order would be at $98, clearly defining your maximum potential loss on that trade.

- Volatility Stops (e.g., ATR-based): These stops adjust based on how much the market is swinging, often using the Average True Range (ATR) as a guide. This smart technique gives your trades more space to move during choppy periods and pulls stops tighter when the market is quiet.

- Trailing Stops: These are active stops that help you secure profits when a trade is going your way. You set them at a certain percentage or dollar amount beneath the current market price. They move up if the price increases but stay put if the price drops, making them great for protecting gains while still allowing profitable trades to grow.

- Time Stops: Occasionally, a trade just doesn't pan out as hoped within a specific period. A time stop closes your position if it hasn't hit your profit goal or been stopped by price movement after a set amount of time. This helps free up your capital from trades that aren't going anywhere.

The Art of Stop-Loss Placement

Finding the right spot for your stop-loss is a balancing act. You want it far enough to avoid getting knocked out by normal market fluctuations or "whipsaws," but close enough to cut losses if the trade turns sharply against you. A common pitfall is setting stops too close, which can lead to a string of small losses that eat away at your trading funds.

Good money management in trading means giving your trades enough "breathing room" to unfold. This usually involves looking closely at support and resistance areas, chart formations, and recent price swings before settling on a stop-loss point. The aim is to find a strategic spot that fits your risk limits while respecting the market's natural movements.

The Psychology Behind Sticking to Your Stops

A very damaging habit for traders is shifting a stop-loss further away when a trade starts to lose money. This move, usually fueled by wishful thinking or the dread of taking a loss, immediately changes a measured risk into a wild bet. Discipline is paramount here; your stop-loss is a decision you made with a clear head, not one to be altered in the heat of a losing trade.

This kind of discipline in money management in trading is even more crucial in markets where leverage is high. Take the foreign exchange (FX) markets, for example; smart money management is vital because leverage boosts both potential gains and losses. As of May 2025, currency pairs such as AUD/USD at 0.6441 and USD/JPY at 143.77 can see big price moves within a single day. The global FX market sees daily trading volumes over $7 trillion, making it the biggest financial market worldwide. Yet, studies show that as many as 70% of retail FX traders end up losing money, frequently due to using too much leverage and not sticking to stop-loss orders. You can find more detailed statistics on global currency markets on Trading Economics.

Profitable traders often have several exit plans within their broader money management in trading framework. While hard stops (orders you actually place with your broker) are usually recommended because they execute automatically, some very seasoned traders might use mental stops in certain highly active markets. This method, though, calls for intense discipline and isn't advisable for most people, as feelings can easily cloud judgment. The best practice generally means adjusting your stop strategy to fit the current market and the particular asset you're trading, always putting the safety of your capital first.

Adapting Your Risk Management Across Different Markets

Smart money management in trading isn't a rigid set of rules; it needs to bend and flex with the market you're in. Think of it like this: a sailor uses different techniques for a calm lake versus a stormy sea. Each financial market has its own weather patterns, and your risk plan needs to match. If you try to use the same approach everywhere, a good plan can quickly lead to trouble.

Navigating Forex: Leverage and Correlations

The Forex market, where currencies are traded, draws many people in with its easy access and the option to use leverage. Now, leverage can be a powerful friend, making your potential profits bigger. But it’s a double-edged sword; it can also make losses much larger, which is why careful money management in trading is a must here.

Beyond just leverage, you've got to watch out for currency correlations. Imagine you're trading both EUR/USD and GBP/USD, thinking you've spread your risk. If the US dollar's movements cause both pairs to move together, your actual risk might be much higher than you thought, setting you up for a nasty surprise. Good money management in Forex means being smart about leverage and understanding how these correlations can stack up your risk.

Crypto Markets: Taming Extreme Volatility

Trading cryptocurrencies brings its own set of hurdles for money management in trading, mainly because of their wild price jumps and the fact that these markets never sleep. With volatility often going through the roof, being cautious with your money is more important than ever.

For example, Bitcoin has seen yearly volatility shoot past 80% multiple times. Compare that to something like the S&P 500, which usually sits around 15–20%. Just look at 2021: Bitcoin's price swung from under $30,000 to above $60,000, then back down into the $30,000s. Those are swings of over 100% both ways! You can explore more data on market volatility from S&P Global to see the bigger picture. In this kind of environment, ultra-conservative position sizing is key, and you need to be ready to change your exposure quickly because big price moves can happen anytime.

Futures Trading: Understanding Margin and Gaps

When you trade futures contracts, you'll encounter specific risks like margin calls and overnight gaps. Futures trading uses margin, which means you only put down a small part of the contract's full value to open a position. If the market turns against you, that initial margin can disappear, triggering a margin call from your broker. This is a demand for more money to keep your trade alive; fail to provide it, and your position could be forcibly closed, often at a big loss.

Another thing to watch for in futures is overnight gaps. This happens when the market opens at a price quite different from where it closed the previous day. Such gaps can wreak havoc on your stop-loss orders, either filling them at a much worse price than you planned or skipping them altogether. This can lead to losses much bigger than you were prepared to take on a single trade.

Options Trading: Unique Risk Dynamics

Options trading comes with its own peculiar risk factors, so your money management tactics need to be specially designed. Some of the main ones to get a handle on include:

- Time Decay (Theta): Options are like ice cream on a hot day – they melt over time. This "melting" is Theta, or time decay. As an option gets closer to its expiry date, its time value shrinks. This means an option buyer can lose money even if the price of the actual asset doesn't budge.

- Volatility Changes (Vega): An option's price is also really sensitive to shifts in expected future choppiness, known as Vega. If implied volatility spikes, option prices can shoot up, which is great for buyers. If it drops, prices can fall, which is good for sellers.

Proper money management in trading options means you really need to understand these "Greeks" like Theta and Vega. This knowledge helps you build trades that can work with, or protect against, their effects. For instance, some strategies aim to make money from time decay, while others are set up to benefit from anticipated swings in volatility.

In the end, no matter which market you're trading, the fundamental ideas of solid money management in trading don't change. Things like setting your risk for each trade and focusing on keeping your capital safe are always vital. The real skill is in applying these timeless rules smartly to the specific environment of each market you decide to enter.

Taming Leverage Before It Destroys Your Account

Adjusting your risk strategies for different markets is certainly important. However, there's one factor that can ramp up danger across the board: leverage. It's often misunderstood and, sadly, misused. If not handled with great care, leverage has a nasty habit of quickly wiping out trading accounts. This is why getting a grip on leverage is a fundamental part of solid money management in trading.

But don't think leverage is automatically a bad thing; it's simply a financial tool. Used wisely, it can boost your capital efficiency. This means you can control a bigger position with less of your own money. The key is to see leverage as a way to make well-thought-out trades work better, not as a fast track to getting rich quick—a common pitfall for many traders.

Understanding Your Actual Exposure: Effective Leverage

So, how do you start to control leverage? First, you need to understand your effective leverage. This isn't just the maximum your broker might offer you. It’s the leverage you're actually using on a trade or across all your trades. For example, if your account has $5,000 and you open a position worth $50,000, your effective leverage is 10:1. Knowing this number shows you exactly how much your potential profits—and crucially, your potential losses—are magnified.

This highlights a really important point: available leverage (what brokers offer) and optimal leverage (what you should use) are very different things. A broker might dangle leverage like 100:1 or even more, but using such high levels is almost never a good idea for sensible money management in trading. Seasoned traders know their best leverage level is usually much lower, based on their own risk comfort, trading strategy, and what the market is doing.

How Professionals Approach Leverage

Many retail traders might be surprised to learn that professionals often use far less leverage. Their main goal is consistent profitability and capital preservation over time. They're not trying to hit massive jackpots with highly leveraged bets. Professionals understand that recovering from big losses is incredibly tough, and too much leverage makes those kinds of losses much more likely.

A sneaky risk with leverage, even if your positions seem diverse, is correlation risk. When markets get stressed or panic sets in, assets that usually act independently can suddenly start moving together in the wrong direction. If these positions are leveraged, the losses can stack up fast and eat away at your capital. Good money management in trading means thinking about how your different investments might react together under pressure.

Frameworks for Controlling Leverage

To sidestep these dangers, you need some solid rules for managing your overall exposure. This means setting limits not just on the risk for each trade, but also on the total effective leverage across all your open positions. When you're tweaking your risk management for various markets, looking into different Risk Management Frameworks can give you a good structure.

The leverage trap is a notorious career-ender for traders. It usually starts with a couple of winning leveraged trades, which builds overconfidence. Then, traders start taking on bigger and bigger leveraged positions until an unexpected market shift causes a devastating loss. If you want to truly get money management in trading right, you have to see this trap for what it is and consciously avoid it. You might find our article on how risk management can help you keep money always left in your account useful.

Warning Signs of Over-Leverage

It's vital to spot the early warning signs of using too much leverage before serious damage is done. These signs often show up in how you trade and how you feel, signaling that your money management in trading is under serious pressure.

Keep an eye out for these red flags:

- Feeling anxious every time you check your profit/loss.

- Your emotions swinging wildly with small market moves.

- Losing sleep because of your open trades.

- Making your positions bigger to chase losses or because you think you're on a "hot streak."

- Ignoring your own money management in trading rules because high leverage seems too tempting.

The key takeaway here is simple: leverage should support your trading plan, not control it. By understanding how it works, respecting its potential, and putting strict controls in place, leverage can be a helpful tool. Otherwise, it can quickly become a shortcut to an empty account.

Building Your Personal Money Management System

Alright, we've talked about specific threats like leverage. Now, let’s get to the heart of the matter: building your own complete system for money management in trading. Knowing a bunch of tactics is one thing, but real strength comes from weaving them together, adding some smart automation, and most importantly, sticking to the plan. This system is your trading compass, keeping you on track.

Crafting Your Comprehensive Risk Framework

Think of a solid risk framework as the master plan for your money management in trading. This isn't something you can just copy; it needs to fit you perfectly. It must align with your specific trading style – are you a scalper, day trader, or swing trader? It also depends on your capital base and, crucially, your psychological makeup. Some folks thrive on frequent, small-risk trades, while others prefer fewer, bigger setups. Your framework has to match these personal preferences.

When thinking about your capital base, don't just look at your trading account. True financial security means understanding all your assets. A stable overall financial picture can take a lot of psychological weight off your trading decisions. For example, knowing how to protect your retirement savings from potential IRS issues contributes to this bigger picture, supporting a trader's stability and focus.

The Power of Documented Rules: Your Trading Constitution

The real test of any money management in trading plan comes when the market gets wild or your emotions are running high. It's during these times that clearly documented rules become your anchor. As many seasoned money managers will tell you, a good strategy that you can consistently stick with is far more valuable than a theoretically perfect strategy that you abandon when pressure mounts.

Your written system needs to be crystal clear, leaving no room for guesswork when you're in the thick of a trade – like a pilot's pre-flight checklist. Make sure to document:

- Your maximum risk per trade (the often-mentioned 1% of trading capital is a common starting point).

- The exact methods for your position sizing calculations.

- Specific criteria for stop-loss placement, including any rules for trailing stops.

- Clear conditions for taking profits on winning trades.

- Defined maximum daily, weekly, or monthly drawdown limits that tell you when to take a trading break.

Leveraging Automation for Emotional Discipline

One of the biggest enemies of good money management in trading is making decisions based on feelings. Fear can make you bail out of good trades too early, while greed can tempt you to overstay or take on too much risk. Smartly used automation techniques can be a great defense against these impulses.

This isn't about handing everything over to robots, but about using tools to enforce the rules you’ve already set. For instance:

- Place hard stop-loss orders with your broker the moment you enter a trade.

- Use limit orders for both your entry points and profit targets to stop yourself from chasing prices.

- Set up price alerts or notifications for when important levels are hit or your risk limits are approaching.

This kind of system helps build emotional discipline in trading by cutting down chances for impulsive, in-the-moment mistakes.

Core Components of Your Money Management System

A strong system for money management in trading is made up of several key parts that work together. Each one is vital for protecting your capital and helping you perform consistently. The table below breaks down these essential elements, what they do, and gives you an idea of how tricky they are to set up and how much impact they can have.

Money Management System Components

Essential elements of a comprehensive trading risk management system with implementation priorities

| Component | Purpose | Implementation Difficulty | Impact Level | Recommended Priority |

|---|---|---|---|---|

| Risk per Trade Definition | Limits potential loss on any single trade, crucial for capital preservation. | Low | Very High | Immediate |

| Position Sizing Rules | Determines appropriate trade size based on risk % and stop-loss distance. | Medium | Very High | Immediate |

| Stop-Loss Strategy | Pre-defines exit point for losing trades to enforce risk limits. | Medium | Very High | Immediate |

| Overall Portfolio Exposure | Manages total risk across all open positions to avoid over-concentration. | Medium | High | High |

| Trading Journal & Review | Tracks performance, identifies strengths/weaknesses, aids systematic improvement. | Medium | High | High |

| Psychological Plan | Outlines strategies to manage common emotional pitfalls like FOMO or revenge trading. | High | High | Medium |

| Regular System Audits | Ensures the system remains effective and adapts to changing market conditions or account size. | Medium | Medium | Ongoing |

Putting these pieces together into a working system takes real effort. However, the payoff in terms of account longevity and reduced trading stress is huge. Think of these as the building blocks of the financial plan that supports all your trading.

Continuous Improvement: Audits and Adjustments

Your personal system for money management in trading isn't a one-and-done deal; it’s a living framework that needs to grow with your experience and as markets change. Conducting regular risk audits is an essential part of this. This means regularly looking back at your trading, how well you stuck to your rules, and how effective your system is overall.

As your trading account balance changes or market volatility shifts, your rules might need some careful tweaks. For example, a 1% risk on a $10,000 account is a different dollar amount than on a $50,000 account, and your comfort level might change. Using checklists and monitoring tools can really help you stay disciplined and make sure your system stays current. The main goal is to build a money management system so solid and clear that following it becomes second nature, giving you stability even when the markets are at their craziest.

Avoiding The Money Management Mistakes That Kill Accounts

Even when traders grasp the basics of managing their funds, many still stumble into common traps. These frequent missteps can chew through trading capital surprisingly fast, and sometimes, they can even wipe out an entire account. Solid money management in trading isn't just about knowing what to do; it's about doing it consistently, especially when your emotions are trying to take the wheel.

Sadly, the journey to steady profits is often cut short for accounts that fall victim to blunders that could have been sidestepped. Spotting these potential pitfalls is your first line of defense in protecting your trading funds and aiming for a lasting trading career.

Three Costly Blunders That Can Drain Your Account

Some mistakes are particularly damaging to trading accounts, frequently born out of psychological stress. One of the most common is revenge trading. After a few losses, that powerful urge to "win it back" from the market can push traders into making rash decisions, like taking on far too much risk or deviating from their established plan. This almost always leads to more, and often bigger, losses, as emotional reactions override sensible money management.

Another frequent slip-up happens during a hot streak. A string of wins can make anyone feel a bit too confident, leading to the belief that they've somehow mastered the market. This frequently results in position sizing errors, where risk per trade is increased too quickly. Successful, careful money management rules get tossed aside, with the trader thinking their luck makes them invincible. But markets have a knack for humbling everyone, and one oversized loss can erase all the hard-won gains from that winning period.

Lastly, premature risk increases pose a serious threat. Traders might grow impatient with the gradual account growth that good risk practices deliver. They then decide to increase their risk before their strategy has truly proven itself over time, or before their account size can safely handle it. This chase for quick profits can turn a normal run of losses, which would have been no big deal with proper risk, into a major setback. These three errors – revenge trading, overconfidence from wins, and impatience – are a dangerous combination that frequently leads to financial pain.

The Mental Game: Why We Stray From Our Trading Rules

Figuring out why traders abandon their carefully crafted money management rules is key. It's rarely due to a lack of understanding; more often, it's a breakdown in discipline, particularly after a couple of unsuccessful trades. As financial commentator Ben Carlson points out, emotional intelligence – the knack for keeping those destructive impulses in check – is much more vital than sheer brainpower in investing. He also wisely states, "The good strategy you can stick with…is preferable to the perfect strategy you can’t stick with." This perfectly describes the hurdle many traders face.

The psychological forces pushing traders toward poor money management choices are strong:

- Fear: The dread of more losses can make traders cut winning trades short or, conversely, cling to losing ones for too long, hoping for a turnaround.

- Greed: The chase for fast, large profits can tempt traders into taking on too much risk or pursuing trades that don't align with their plan.

- Confirmation Bias: Traders might unconsciously look for information that supports their current actions, overlooking red flags that their money management is slipping.

Imagine a trader who, after diligently sticking to a 1% risk rule for months, hit three losses in a row. Frustrated, they decided to double their risk on the next trade to recover quickly. That trade also lost. Now even more emotional, the trader doubled down again. In just a few days, a small, easily handled drawdown spiraled into a substantial account hit, all because they abandoned their rules.

Building Resilience: How to Stick to Your Plan

Developing unwavering discipline, especially when the market gets tough, is the foundation of successful money management in trading. This means creating specific habits to combat those unhelpful psychological tendencies. The initial step is to spot the early warning signs of deteriorating risk control. Are you veering off your trading plan? Are your feelings making your trading decisions? Are you finding ways to justify taking on more risk than usual?

To put corrective actions in place before real damage is done:

- Keep a Detailed Trading Journal: Write down every trade, including why you took it, how you felt, and whether you followed your money management rules. Looking this over regularly can reveal patterns of unhelpful behavior.

- Set Firm Limits and Adhere to Them: Decide on your maximum loss for the day, week, and month. If you reach these limits, step back from trading to regroup and reassess.

- Practice Mindfulness and Emotional Control: Techniques like meditation, or even just taking a break from your screen during busy market times, can help you keep your cool.

- Find an Accountability Partner: Share your trading rules and objectives with a mentor or a trusted fellow trader who can help you stay disciplined.

By actively working on these areas, traders can build the mental toughness required to follow their money management plan, even when dealing with inevitable losses or alluring market movements. This disciplined behavior is what truly distinguishes short-lived wins from consistent, long-term profitability.

Ready to master the art of price action and transform your trading results with disciplined money management? Discover your trading potential with Colibri Trader's straightforward, effective strategies. Take our free Trading Potential Quiz and start your journey today!