How to Trade in Forex A Practical Guide

Learning how to trade forex is all about exchanging one currency for another, trying to profit from the constant ebb and flow of their values. The basic idea is simple: you buy a currency pair you think will go up or sell one you expect to drop. Actually succeeding, though? That comes down to knowing the market, having a solid strategy, and being disciplined about managing your risk.

Decoding the Forex Market

Before you even think about placing your first trade, you have to get your head around the world you're stepping into. The foreign exchange (or forex/FX) market isn't a building on Wall Street; it’s a massive, decentralized network of banks, institutions, and individual traders like us. Because it's global, it runs 24 hours a day across different time zones.

The sheer size of it is hard to wrap your head around. We're talking about the largest, most liquid financial market on the planet. As of early 2025, the daily trading volume is hovering around $7.51 trillion. That's not a typo. This incredible liquidity means there’s almost always someone on the other side of your trade, making it easy to get in and out of positions. For a deeper dive into these numbers, the foreign exchange industry statistics from CoinLaw are a great resource.

Core Forex Concepts

At its heart, forex trading is really just speculating on how one currency's value will change against another's. For example, if you buy the EUR/USD pair, you're buying euros and selling U.S. dollars at the same time. If the euro gets stronger compared to the dollar, you make a profit.

To really get anywhere, you need to speak the language. It can feel like alphabet soup at first, but a few key terms will get you started on the right foot.

Essential Forex Terms You Need to Know

To help you get grounded, here’s a quick-reference table covering the absolute must-know terms. You’ll see these on every platform and in every analysis, so it’s crucial to understand what they mean from day one.

| Term | Definition | Example |

|---|---|---|

| Currency Pair | The two currencies being traded. The first is the "base" currency, and the second is the "quote" currency. | In EUR/USD, the Euro is the base, and the U.S. Dollar is the quote. |

| Pip | "Percentage in Point," the smallest unit of price movement for a currency pair. | If EUR/USD moves from 1.0850 to 1.0851, that's a one-pip increase. |

| Leverage | A tool that lets you control a large position with a small amount of capital from your broker. | With 100:1 leverage, you can control a $100,000 position with just $1,000. |

| Spread | The difference between the buy (ask) price and the sell (bid) price of a currency pair. | If the bid for EUR/USD is 1.0850 and the ask is 1.0852, the spread is 2 pips. |

| Lot Size | The number of currency units you are buying or selling. A standard lot is 100,000 units. | Trading one standard lot of EUR/USD means you are controlling €100,000. |

Getting these terms down is your first real step. They are the building blocks for understanding everything else that follows, from reading charts to managing your trades effectively.

A key takeaway for beginners is that you are not just trading currencies; you are trading the economic health and policy decisions of entire countries. An interest rate hike by the Federal Reserve can send the USD soaring, while political instability can cause a currency to plummet.

Understanding these basics is the first real step in learning how to trade in forex. It shifts your perspective from seeing random price wiggles to recognizing the forces of global economics at play. This foundation connects market theory to the practical decisions you'll soon be making, like analyzing a chart or placing your first trade.

Building Your Trading Toolkit

Once you've got a handle on the basics, it's time to build out your trading toolkit. This isn't just about software—it's about picking the right partners and platforms to be your command center as you learn how to trade in forex. Your success really hinges on the quality and reliability of these foundational pieces.

The first, and arguably most important, choice you'll make is your forex broker. The broker is your direct gateway to the market; they're the ones executing your buy and sell orders. Don't rush this. Look for brokers who are heavily regulated by top-tier authorities like the FCA in the UK or ASIC in Australia. Regulation is your first line of defense.

Selecting the Right Broker

When you're comparing brokers, zero in on a few key things that will directly hit your trading costs and overall experience:

- Spreads: This is the difference between the buy and sell price. Tighter spreads mean lower costs for you on every single trade.

- Commissions: Some brokers charge a flat fee per trade, either instead of or on top of the spread.

- Platform Options: Most brokers offer the big players like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These are the industry standards for a reason.

The forex brokerage market is massive. It was valued at $5.2 trillion in 2023 and is projected to hit $13 trillion by 2032. This growth means more choices for traders like us, but it also means we have to do our homework. For more data on this expansion, you can explore these forex trading statistics from BestBrokers.

Mastering the Demo Account

After you've picked a broker, your very next step is to open a demo account. This is non-negotiable. A demo account is your ticket to trading with virtual money in a live market environment. It's how you practice without risking a single dollar of your own capital.

A demo account is your personal trading sandbox. It’s where you test strategies, learn the mechanics of your trading platform, and build the muscle memory for executing trades under pressure—all without financial consequence.

Use this risk-free period to really get comfortable. Practice placing different order types (market, limit, stop), learn how to manage your open positions, and get used to reading the charts on your chosen platform. Think of it as your apprenticeship.

For a deeper look into getting started, check out our guide on how to start forex trading with a solid foundation. Only when you can consistently apply your strategy and manage risk in the demo environment should you even think about trading with real money.

Crafting a Price Action Trading Plan

You don't get lucky in trading, not for long anyway. Consistent success comes from a plan—a set of rules you follow without fail. This is where a solid price action trading plan becomes your best friend.

Instead of plastering your charts with a dozen lagging indicators that just tell you what already happened, you learn to read the market's story directly from the price itself. This approach gives you clarity, helping you make decisions based on what the market is doing right now.

The idea is to strip everything back to the essentials: price and time. When you focus on candlestick patterns and market structure, you're really just watching the raw battle between buyers and sellers play out. It’s a powerful way to tap into market psychology and gives you a real edge.

Identifying Key Support and Resistance Levels

The bedrock of any good price action strategy is support and resistance. These aren't just random lines drawn on a chart; they are critical price zones where the balance of power between buyers and sellers has historically shifted.

Think of support as a price floor where buyers have shown they are willing to step in and defend a level, pushing prices back up. Resistance, on the other hand, is a ceiling where sellers tend to emerge in force, causing the price to stall or reverse. Finding these key levels is like building a map for your trading day.

To spot them, scan your charts for areas where the price has repeatedly reversed or paused. The more times a level has been tested and held, the more significant it becomes. These are the zones where you should be patiently waiting for your high-probability setups to appear.

Using Candlesticks as Your Entry Triggers

Once you've mapped out your key levels, your job is to sit back and wait for the price to come to you. You never just trade because the price hits a line; that's gambling. Instead, you wait for a specific candlestick pattern to form, giving you confirmation that the market is reacting to that level just as you expected.

A few key patterns are incredibly powerful signals of a potential turn. Here are the ones you absolutely need to know:

- Bullish/Bearish Engulfing Bar: This is a monster of a pattern. It happens when one candle's body completely swallows, or "engulfs," the body of the previous one. A big bullish engulfing bar at a key support level is a screaming sign of buying pressure. A bearish one at resistance tells you the sellers are now in complete control.

- Pin Bar (or Hammer/Shooting Star): This one is all about rejection. It has a tiny body and a long wick (or "pin"), showing that the price tried to push aggressively in one direction but was slammed back down. A pin bar with a long lower wick popping up at a support level is a classic bullish rejection signal.

- Inside Bar: This is a smaller candle that forms completely within the high-low range of the candle right before it. It signals a pause or consolidation. Think of it like the market taking a quick breath before its next big move—often a breakout in the direction of the prevailing trend.

I see so many new traders make this mistake: they trade every single pattern they find. The real secret is waiting for a clean, high-quality candlestick pattern to form at a pre-identified, significant support or resistance level. Context is everything.

Let's walk through a real-world scenario. Imagine the EUR/USD is in a nice, clean uptrend. The price pulls back to a major support level you identified earlier around 1.0850. You don't just hit the buy button. You wait. A few hours go by, and then a massive bullish engulfing candle prints right on that 1.0850 level. That is your trigger. It's the market confirming that buyers have shown up in force exactly where you expected them to.

This combination of a key level plus a confirmation signal is the heart and soul of a robust trading plan. It creates a simple, rules-based framework that helps keep emotion and guesswork out of your trading. Your plan needs to be crystal clear: which patterns will you trade, at which levels, and what are your exact rules for getting in and getting out?

Mastering Risk and Trading Psychology

Having a solid trading plan is a great start, but it's only half the story. The real dividing line between traders who make it and those who don't almost always boils down to two things: how they handle their risk and how they handle their own emotions.

Get these wrong, and even the most brilliant strategy is doomed from the start.

The single most important rule in this business is capital preservation. Your first job isn’t to make money; it’s to protect the money you already have. This means never risking more than you can truly afford to lose and having ironclad rules that stop a few bad trades from blowing up your account.

Across the board, the professional standard is to risk only 1-2% of your account balance on any single trade.

This isn’t just a friendly suggestion—it’s the bedrock of staying in the game long enough to succeed. A small loss is easy to recover from. A catastrophic one can take you out for good.

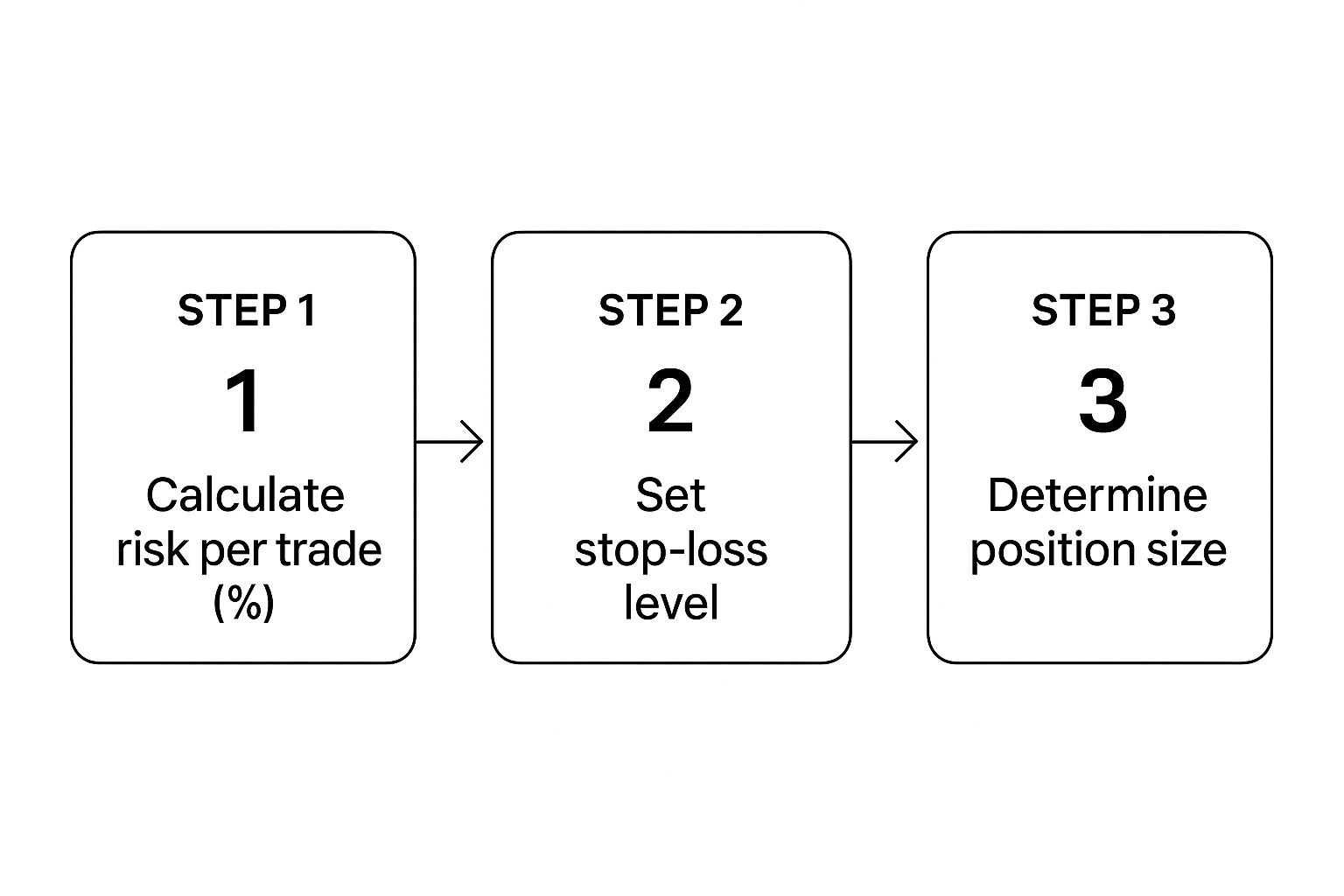

Calculating Your Position Size

So, how do you actually stick to that 1-2% rule? It all comes down to calculating your position size—the number of lots you trade—before you even think about clicking the buy or sell button.

This calculation isn't some complex mathematical puzzle, but it is a non-negotiable step for every single trade you take.

You just need to know three things: your risk percentage (that 1-2%), where your stop-loss will go, and your account size. This simple process ensures your risk stays fixed and predictable, no matter how wide or tight your stop-loss needs to be for a particular setup.

Your stop-loss order is your automated escape hatch if a trade turns against you. On the flip side, a take-profit order automatically cashes you out when the trade hits your target. Using both is what separates disciplined traders from gamblers, as it pulls emotional, in-the-moment decision-making out of the equation.

For those just starting out, you can get a better sense of how leverage impacts your trading capital and risk in our detailed guide.

How Risk Management Protects Your Account

It's easy to dismiss a 1% or 2% rule as being too conservative, but the math doesn't lie. Let's look at how a string of five losing trades—which will happen to every trader—impacts an account at different risk levels.

| Starting Balance | Risk Per Trade | Balance After 5 Losses | Percentage Drawdown |

|---|---|---|---|

| $10,000 | 2% | $9,039.21 | -9.6% |

| $10,000 | 5% | $7,737.81 | -22.6% |

| $10,000 | 10% | $5,904.90 | -41% |

As you can see, small risks lead to manageable drawdowns that are easy to recover from. Higher risks create deep holes that become exponentially harder to climb out of. This is why the pros stick to small, consistent risk.

Taming Your Trading Mindset

Beyond the mechanics of risk, you have to face the beast of trading psychology. The market is an emotional rollercoaster, and two feelings are especially destructive for a trader:

- Fear: This is what makes you cut winning trades short just to lock in a small profit. It's also what paralyzes you from taking a perfectly valid setup that fits your plan.

- Greed: This is the little voice that tells you to over-leverage on a "sure thing," chase a move that's already left the station, or hold a winning trade for way too long until it completely reverses on you.

The key to building a resilient mindset is to completely detach your self-worth from the outcome of any single trade. You have to accept that losses are just a part of doing business. Your focus should be on executing your plan flawlessly, not on being right every time.

To build this discipline, start treating your trading like a business. Follow your plan with obsessive consistency, keep a detailed trade journal to learn from your mistakes, and have the self-awareness to step away from the charts when you feel your emotions getting the best of you.

This mental fortitude, combined with disciplined risk management, is the real secret to figuring out how to trade in forex for the long haul.

Your Path to Consistent Trading

Getting a handle on a solid strategy and managing your risk are massive steps forward, but that’s not the end of the road. Far from it. Learning to trade forex is a journey of constant tweaking and adapting to what the market throws at you. To really find that long-term consistency, your focus has to shift from just making trades to actively improving your entire process.

This is where a trading journal becomes the single most important tool you have. Seriously. It’s not just a diary of your wins and losses; it’s a hard-data record of your actual performance.

When you log every single trade—why you got in, where you got out, and what you were feeling at the time—you create a powerful feedback loop. It will mercilessly expose your weaknesses and shine a bright light on your strengths.

Are you constantly cutting winning trades short because you're scared of giving profits back? Do you have a bad habit of revenge trading after a loss? Your journal will show you these patterns in black and white, giving you the evidence you need to make real, targeted changes.

Evolving Your Analytical Skills

Once journaling is a daily habit and your core strategy feels like second nature, it’s time to start layering in some more advanced analysis. A great next step is multi-timeframe analysis. This just means looking at the same currency pair across a few different chart durations to get the full story of what's happening.

For instance, you might spot a major support level on the daily chart. That's your big-picture context. Then, you could drop down to the 4-hour chart and wait for a clear uptrend to form. Finally, you use something like a bullish engulfing pattern on the 1-hour chart to pinpoint your exact entry. This simple method helps make sure you’re trading in line with the bigger trend, which can stack the odds in your favor.

The whole point is to see the market from different angles. Think of the daily chart as the main plot of a story, while the lower timeframes give you the specific scenes where you decide to get in or out.

Committing to Continuous Learning

The forex market is always in flux. What worked like a charm last year might not work so well tomorrow. Staying profitable over the long haul means you have to commit to being a lifelong student of the markets. That means seeking out quality education and surrounding yourself with other traders who are serious about their craft.

- Follow Reputable Blogs: Places like the Colibri Trader blog consistently offer fresh insights on price action and what’s happening in the markets right now.

- Join a Community: Getting involved in a professional trading community is invaluable. It gives you support and exposes you to ideas you might not have considered, which helps you sharpen your own edge.

The sheer size of the market guarantees there’s always something new to learn. Back in April 2019, the forex market’s daily turnover hit a staggering $6.6 trillion, with over 170 currencies being traded. It absolutely dwarfs the stock market, which means endless opportunities for those who are willing to adapt and grow. You can read more of these mind-boggling forex market statistics on The Tokenist to truly appreciate the scale we're playing in.

Building a lasting trading career isn't about finding some secret formula. It's about building a system for constant, deliberate improvement.

Common Questions About Forex Trading

When you're just starting out in forex, you're bound to have a lot of questions. It's totally normal. Everyone does.

Getting straight answers to the big questions is the best way to build a solid foundation. Let's tackle some of the most common ones I hear from new traders.

How Much Money Do I Need to Start Trading Forex?

Technically, you don't need a fortune. A lot of brokers will let you open an account with as little as $100.

But the real question is, how much do you need to trade safely and give yourself a fighting chance? From my experience, a much more practical starting point is closer to $500 or $1,000.

Why? Because that amount gives you enough breathing room to manage risk properly. You can stick to the golden rule of risking just 1-2% of your account per trade without being forced into positions that are too small to be meaningful. With a tiny balance, you’re basically stuck trading micro-lots.

Your first goal in trading isn't getting rich; it's survival. A decent starting balance lets you make the inevitable beginner mistakes without blowing up your account on day one.

It also helps you trade with a clearer head. When each small loss doesn't feel like a catastrophe, you can stop worrying about the money and start focusing on executing your strategy flawlessly.

What Is the Best Time of Day to Trade Forex?

The market is busiest and has the most liquidity when major trading sessions overlap. The absolute sweet spot is the London and New York session overlap, which happens between 8:00 AM and 12:00 PM EST.

During this four-hour window, trading volume is at its peak. This usually means you get tighter spreads (which lowers your trading costs) and bigger, more decisive price moves—exactly what a price action trader wants to see.

But here's the thing: the "best" time really depends on your strategy and what you're trading.

- If you're focused on pairs with the Japanese Yen (JPY), you'll often find more action during the Asian session.

- Trading EUR or GBP pairs? The London session is your prime time.

Your own schedule is a huge factor, too. It’s always better to trade a less active session with 100% focus than to force trades during the busiest hours when you’re tired or distracted.

Can I Teach Myself to Trade Forex?

Yes, you absolutely can. With the sheer volume of high-quality resources available online today, becoming a self-taught trader is more achievable than ever before. The trick is to be structured and disciplined about it.

Don't try to learn everything at once. Start with the absolute basics, like understanding what a pip is in trading and how it affects your profits. Then, pick one simple strategy—price action is a great place to start—and practice it on a demo account until you know it inside and out.

The most successful self-taught traders I know are patient, disciplined, and treat trading as a skill that requires lifelong learning. While you can definitely go it alone, finding a mentor or joining a solid trading community can dramatically speed up your progress and help you sidestep a lot of common rookie mistakes.