How to Start Trading Stocks A Practical Guide

Getting your start in the stock market is actually pretty straightforward. You just need to open a brokerage account, put some money in it (and I mean money you're truly okay with losing), and then place your first trade. You can do all of this online, sometimes in less than an hour, and many brokers will let you start with just $100.

Your First Steps into the Stock Market

Look, it's completely normal to feel a bit overwhelmed by stock trading. The whole financial world can seem like it's guarded by confusing jargon and charts that look like spaghetti. But it's way more accessible than you think.

At its heart, a stock is just a small piece of a public company. When you buy a share of, say, Apple (ticker: AAPL) or Ford (ticker: F), you're literally buying a tiny slice of that business.

The stock market itself is just the place where all these shares get bought and sold. Think of it like a giant, fast-paced auction where prices are always moving. What moves them? Everything from company profits and new products to big economic news and even just plain old market sentiment. Your job as a trader is to get a feel for which way those prices are headed.

Trading Versus Investing

Before you put a single dollar on the line, you absolutely must understand the difference between trading and investing. They both involve buying stocks, but the mindset and timeline are worlds apart.

- Investing is the long game. This is where you buy stocks in what you believe are solid companies and plan to hold them for years, maybe even decades. You're betting on the company's fundamental growth, letting dividends and compounding do the heavy lifting over time.

- Trading is a short-term game. As a trader, you're looking to profit from the constant up-and-down price swings. You might hold a stock for a few days, a few hours, or even just a few minutes. The focus here is much more on technical chart patterns and market momentum.

This guide is for the active traders out there. It's a path that demands more of your attention, but it opens up a different set of opportunities.

Building Your Foundation

To give yourself a real shot, you need to build your knowledge on a few core pillars. Getting these basics down before you trade isn't just a suggestion—it's what separates disciplined traders from gamblers.

Before we dive deeper, it's helpful to see the big picture. Here are the core concepts every new trader needs to internalize before risking any capital.

Foundational Pillars for New Stock Traders

| Pillar | Why It's Critical | First Action Step |

|---|---|---|

| Broker Selection | Your broker is your gateway to the market. Fees, tools, and reliability directly impact your bottom line. | Compare 2-3 brokers based on fees, available tools, and account minimums. |

| Price Action Basics | You need to learn how to read a chart. Understanding support, resistance, and trends is like learning the basic grammar of the market. | Pull up a stock chart and practice identifying simple uptrends and downtrends from the past year. |

| Risk Management | This is the most important pillar. It's how you protect your capital so you can stay in the game long enough to learn. | Decide on a maximum percentage of your account you're willing to risk on a single trade (e.g., 1-2%). |

| Trading Psychology | The market will test your discipline. Fear and greed are powerful emotions that can wreck a perfectly good strategy. | Keep a simple journal for your first few (paper) trades. Note why you entered and how you felt. |

Mastering these pillars is your primary objective. It’s not about flashy wins; it’s about building a solid, repeatable process.

The journey into trading isn't about learning which buttons to press. It's about developing a mindset rooted in strategy, discipline, and a healthy respect for risk. Your primary job as a new trader is not to make millions overnight but to protect your starting capital while you learn.

Don't just take my word for it. When zero-commission trading became the norm after 2020, millions of new people flooded the market. But the data that followed was sobering. Some research shows that nearly 70% of retail traders lose money within their first year, usually from a lack of planning and poor risk management. You can dig into some of these market trends yourself through resources like J.P. Morgan Asset Management.

I'm not telling you this to scare you off. I'm telling you this so you understand that knowledge and a solid strategy are your best defense. They are what will set you apart.

How to Choose the Right Stock Broker

Let's be honest, picking a stock broker can feel like a massive, overwhelming task. It doesn't have to be.

Your broker is simply your gateway to the market—it's the tool you use to buy and sell. The secret is finding one that truly fits your trading style, not just the one you see advertised everywhere.

Think about it this way: an active day trader needs a completely different set of tools than a long-term, passive investor. The "best" broker for one is a terrible choice for the other. The right broker is the one that's right for you.

Core Factors to Compare

When you start digging in, you'll get hit with a tidal wave of information. To avoid getting lost, just zero in on a few core things that actually impact your trading and your money. My advice? Never go with the first one you find. Compare at least two or three to get a real sense of what’s out there.

Here's what to look for:

- Commissions and Fees: This is the obvious one. A lot of brokers now boast $0 commission trades for stocks and ETFs, which is great, but that's not the whole story. Watch out for the hidden costs: account maintenance fees, inactivity fees, or extra charges for professional-grade data feeds.

- Account Minimums: How much money do you need just to get in the door? Many great brokers have a $0 minimum, which is perfect for starting out. Some might require a few thousand dollars, so this is one of the first things you should check.

- Platform and Tools: This is a big one. Is the trading platform actually easy to use, or is it a clunky mess? Does it have the charting capabilities and research you need to execute your strategy? A good platform makes trading easier, not harder.

- Account Types: You'll see two main options: cash and margin. A cash account is exactly what it sounds like—you trade with the funds you've deposited. A margin account lets you borrow money from your broker, which can amplify gains but also magnify losses. New traders should almost always start with a cash account.

A huge mistake I see new traders make is focusing only on low fees. A broker with a clunky, unreliable platform can cost you far more in missed trades and pure frustration than you'd ever save on commissions.

For example, a day trader will gladly pay a monthly platform fee for a broker with lightning-fast execution and top-tier charting tools. A swing trader, on the other hand, might care more about high-quality research and stock scanning tools. Figuring this out is a crucial step when you how to make a trading plan, as it clarifies what you really need from your broker.

Matching a Broker to Your Trading Style

Let's make this real. Imagine two new traders, Alex and Ben. They have very different goals.

- Alex the Swing Trader: Alex wants to trade a few times a week, holding positions for several days. He needs solid charting software to spot trends and good access to company research. For him, a broker like TD Ameritrade (with its thinkorswim platform) or Interactive Brokers would be a fantastic fit, offering powerful tools for his strategy.

- Ben the Passive Investor: Ben just wants to buy a few ETFs every month and let them grow for years. His main concerns are low costs and simplicity. A streamlined, mobile-friendly broker like Fidelity or Charles Schwab is perfect for him. They offer commission-free ETFs and an easy-to-use interface for his simple buy-and-hold approach.

Once you define your own trading style, you can immediately filter out 90% of the brokers that aren't built for you.

The Final Check Before Committing

Okay, you've narrowed it down. Before you pull the trigger, do one last check on two things that are easy to overlook but incredibly important.

First, customer support. Trust me, when you have an issue with a trade or your account, you'll want to speak to a real person, and you'll want to do it quickly.

Second, make sure the broker is regulated and insured. In the US, this means they must be members of FINRA and SIPC. SIPC insurance protects your account for up to $500,000 if the brokerage goes bankrupt. This is an absolute non-negotiable for protecting your capital.

Developing Your Personal Trading Strategy

Alright, you've picked a broker. Now for the real work: figuring out how you're actually going to trade. A trading strategy is your personal rulebook for the markets. It's the system that keeps you from making emotional, gut-wrenching decisions when fear or greed inevitably kicks in.

Let me be clear: there is no single "best" strategy out there. The one that works for you has to fit your personality, your financial situation, and, most importantly, how much time you can realistically spend staring at charts.

Find Your Trading Style

The first big decision is your time horizon. Are you in this for the long haul, or are you looking for quicker gains? This choice shapes everything that follows, from the tools you'll use to how often you need to check your positions.

For most beginners, swing trading hits that sweet spot. It gives you enough breathing room to analyze a trade without the constant, high-stakes pressure of day trading.

To help you see where you might fit, I've broken down the most common approaches. Think about your lifestyle and goals as you read through them.

Comparing Popular Trading Strategies

This table gives a quick overview of the main trading strategies. It’s designed to help you see which approach might align best with your financial goals and the time you're willing to commit.

| Strategy | Time Horizon | Typical Analysis Used | Best For |

|---|---|---|---|

| Long-Term Investing | Years to Decades | Primarily Fundamental | Individuals who prefer a "set-it-and-forget-it" approach, focusing on company growth over market noise. |

| Swing Trading | Days to Weeks | Blend of Technical & Fundamental | Traders looking to capture short-to-medium term price moves without being glued to the screen all day. |

| Day Trading | Intra-day | Primarily Technical | Highly active individuals who can dedicate full-time hours and thrive in a high-pressure environment. |

Ultimately, the best way to find your style is to start with one, likely swing trading, and see how it feels. You can always adjust as you gain more experience in the markets.

Introducing Your Two Main Tools

No matter which style you lean towards, you'll be using two core methods to find trading opportunities. The best traders I know don't just pick one; they learn to blend both.

Fundamental Analysis: The Health Check

Think of fundamental analysis as being a business detective. You're digging into a company's financial health to determine its true value, separate from the day-to-day market hype.

This means you’re looking at things like:

- Earnings Reports: Is the company actually making money consistently?

- Revenue Growth: Are their sales on an upward trajectory?

- Debt Levels: Is the company over-leveraged and at risk?

- Competitive Advantage: What is their "moat"? What makes them special?

A fundamental trader, for example, might look at a company like NVIDIA (ticker: NVDA), see its dominance in the AI chip market and its explosive revenue growth, and decide to buy based on the belief that these strong business fundamentals will push the stock price higher over the long term.

Technical Analysis: Reading the Charts

Technical analysis flips the script. It completely ignores the company's financials and focuses only on one thing: price action. The core belief here is that all known information—every hope, fear, and news report—is already baked into the stock's price on the chart.

Technical analysis is the language of the market. By learning to read charts, you can interpret the story of supply and demand that unfolds every single day.

You'll use stock charts to spot trends, identify key support and resistance levels, and recognize specific patterns that can signal when to get in and when to get out. For instance, a technical trader might notice a stock has bounced off the same price level three times (a classic "support" level) and decide to buy, betting it will bounce again.

Building Your Trading Plan

A strategy is just an idea until you write it down. Your trading plan makes it real. This is your personal business plan for the market, and you should never place a trade without it. No exceptions.

Your plan needs to clearly define your rules for every part of the trade:

- Entry Rules: What exactly needs to happen for you to buy a stock? (e.g., "The stock must be in a clear uptrend and pull back to its 50-day moving average.")

- Exit Rules (for Profit): When will you take your winnings off the table? (e.g., "I will sell half my position when the stock is up 20%.")

- Exit Rules (for Loss): When will you admit you were wrong and cut your losses? This is your stop-loss, and it is absolutely non-negotiable. (e.g., "I will sell my entire position if the stock drops 8% below my entry price.")

- Position Sizing: How much of your account will you risk on any single trade? A common rule is to risk no more than 1% of your total account value on one trade.

Developing a solid strategy also means being aware of what's happening in the broader market. A rigid, one-size-fits-all approach is a recipe for disaster. For instance, data from mid-2025 showed wildly different returns across the globe. While the S&P 500 returned about 7.1%, Hong Kong's Hang Seng Index was up 19.3%, and Germany's DAX 40 gained 18.1%.

Within those markets, certain sectors were on fire. A stock like Palantir, for example, temporarily surged 82%. This is a powerful reminder of why you need to look beyond your home market for opportunities. You can see a great breakdown of these numbers in this Visual Capitalist analysis. This is a critical part of learning how to start trading stocks—staying flexible and following the momentum.

Mastering Practical Risk Management

Let's get right into the single most important skill that separates traders who make a career out of this from those who blow up their accounts and quit. I’m talking about risk management. This isn't just some textbook theory; it's the gritty, daily work of protecting your capital so you can stick around long enough to actually get good at this.

Look, winning every trade is a fantasy. The best traders I know are often wrong 40-50% of the time. Their secret isn't a magic crystal ball. It’s a simple formula: they make more on their winners than they lose on their losers. That’s it. And the only way to do that consistently is with iron-clad risk control.

Your Two Most Important Orders

Before you place another trade, you need to master two specific order types. Think of them as your automated safety net, designed to yank emotion out of the driver's seat when a trade goes south or hits your goal.

- Stop-Loss Order: This is your eject button. It's an order to automatically sell a stock if it falls to a specific price. You decide your maximum acceptable loss on a trade before you even click "buy."

- Take-Profit Order: This is the other side of the coin. It’s an order to automatically sell a stock once it climbs to your target price, locking in those profits before the market has a chance to take them back.

Thankfully, most modern brokers make this incredibly easy. When you’re setting up a buy order, you'll almost always see fields to add a "Stop-Loss" and a "Take-Profit" right on the same ticket. Use them. Every single time.

The Power of Position Sizing

How much should you risk on one idea? This question trips up almost every new trader, and the consequences can be brutal. The answer is found in position sizing—a simple technique for figuring out how many shares to buy based on your personal risk rules.

The most time-tested guideline here is the 1% rule. The principle is non-negotiable: never risk more than 1% of your total trading capital on any single trade.

If you have a $10,000 trading account, the 1% rule means the absolute most you can lose on one trade is $100. This isn't just a suggestion; it's a lifeline that prevents one bad decision from wrecking your account.

Let's see how this works in the real world:

- Your Account Size: $10,000

- Max Risk Per Trade (1%): $100

- Stock You Want to Buy: XYZ Corp, currently trading at $50 per share.

- Your Stop-Loss: Based on your chart analysis, you decide to get out if the stock drops to $48. This means your risk is $2 per share.

- Calculate Your Position Size: Now, just divide your max risk ($100) by your per-share risk ($2).

$100 / $2 = 50 shares.

That's your answer. You can buy 50 shares of XYZ. If the trade goes against you and your stop-loss at $48 gets triggered, you will lose exactly $100 (50 shares x $2 loss), which is precisely 1% of your account. This is how you control risk with pure mathematics, not hope.

Navigating Psychological Traps

Let's be honest. Your biggest enemy in the market isn't a hedge fund or a market maker; it's the person staring back at you in the mirror. Fear and greed are powerful emotions that can sabotage even the most brilliant trading plan.

One of the worst habits is revenge trading. This happens after a loss, when you feel an overwhelming urge to "get your money back" from the market. You impulsively jump into another trade—usually a poorly planned, overly large one—and almost always dig a deeper hole.

Just as deadly is clinging to a loser, praying for it to turn around. This is pure ego, an inability to admit you were wrong. Your stop-loss is the antidote. When it’s hit, you're out. No second-guessing, no hesitation. Building this kind of mental toughness is critical, and it's worth reading about the 7 steps to become more disciplined in your trading to build the right habits from day one.

Understanding market volatility is another piece of the puzzle. For instance, the global stock market crash that began on April 2, 2025, was triggered by unexpected tariff policies, sending the S&P 500 tumbling by 12% in a single week. Yet, when those policies were relaxed, the market rebounded with incredible force, hitting all-time highs by late June 2025. This shows why traders must follow geopolitical events but, more importantly, have the discipline to not panic-sell into sharp declines. You can explore the details of this market event on Wikipedia to better understand these powerful dynamics.

A Walkthrough of Your First Stock Trade

Alright, it's time to put theory into practice. This is the moment you've been working towards—placing your very first stock trade. I know it can feel a bit daunting, but I promise the actual process is way more straightforward than you probably think. Let’s walk through it together, step-by-step, to take the mystery out of the platform and get you comfortable.

Whether you're starting with real money or using a paper trading simulator (which I strongly recommend), the mechanics are exactly the same. The goal of this first trade isn't to strike it rich. It's about mastering the process and turning abstract ideas into a real, tangible skill.

Finding and Selecting a Stock

The first thing you'll do inside your brokerage account is look up the stock you plan to trade. Every company on the stock market has a unique ticker symbol, which is usually a one-to-four-letter code. For example, Ford Motor Company is just 'F', and Microsoft is 'MSFT'.

Just type the company name or ticker into the search bar on your broker's platform. This will take you to that stock's main quote page. You'll see the current price, a chart, and the most important buttons on the screen: 'Buy' and 'Sell'. This is your command center.

Understanding Different Order Types

When you click 'Buy', the trade doesn't happen instantly. You'll see an order ticket pop up, and you need to tell your broker how you want to buy the stock. This is a critical step that trips up a lot of new traders, so let's clear it up right now.

You’ll mainly be dealing with two types of orders:

- Market Order: This is the most basic order. It tells your broker to buy the stock right now at whatever the best available price is. It guarantees your order gets filled, but you don't get to specify the exact price, which can move in the blink of an eye.

- Limit Order: This gives you much more control. You set the absolute maximum price you're willing to pay for each share. Your order will only execute if the stock price drops to your limit price or lower. If the price never hits your target, your trade simply won't happen.

For your very first trade, using a market order is perfectly fine just to get the feel of it. But as you gain experience, you'll find that you use limit orders almost exclusively to make sure you get the entry price you've planned for.

Your trading platform is not something to fear—it's a tool. The order entry screen is designed to give you precise control. Taking a moment to understand each field before you click 'confirm' is the mark of a disciplined trader.

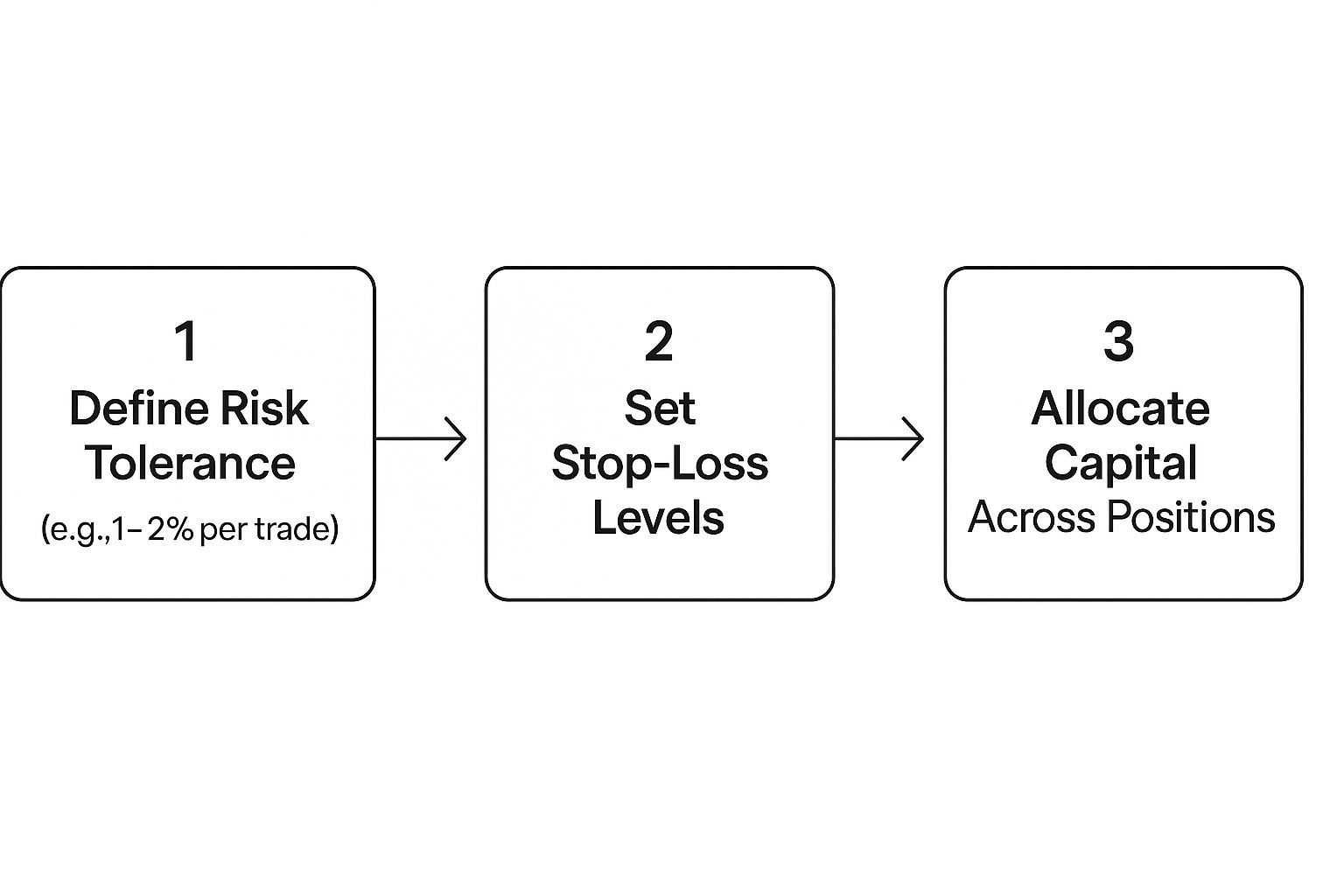

The infographic below really breaks down the mental checklist you should run through before every trade. Notice how risk comes first, long before you even think about hitting the buy button.

This visual is a great reminder that risk management isn't an afterthought. It's the foundation of a good trade, and it all starts with your personal risk tolerance.

Executing and Monitoring the Trade

Once you've chosen your order type and the number of shares, you'll hit a 'Review Order' or 'Confirm' button. Your broker will show you a final summary: the stock, share count, estimated total cost, and any commissions. Take a breath, give it one last check to make sure it's all correct, and then execute the trade.

Congratulations! You are officially a shareholder.

Your new position will show up in your portfolio, where you can watch its value change in real-time. You’ll see your total profit or loss update with every tick of the market. This is where your pre-trade plan is so important. Stick to the stop-loss and profit-taking levels you decided on before you entered the trade.

When it's time to close the position, the process is just the reverse of buying. You'll find the stock in your portfolio, click 'Sell', choose your order type (market or limit), and confirm. This locks in your result, turning a paper profit or loss into real money in your account.

Common Questions About Starting to Trade

I know that even after you've gone through the basics, a few nagging questions can still hold you back. It's completely normal. Let's tackle some of the most common concerns I hear from new traders so you can move forward with a bit more confidence.

How Much Money Do I Need to Start Trading Stocks?

Technically, you can start with very little. With the rise of zero-commission brokers and fractional shares, you could open an account with just $100. It's not a bad way to get your feet wet and feel what it's like to have real money on the line.

However, if you're serious about giving this a real shot, a more practical starting point is somewhere between $500 and $2,000. This amount hits a sweet spot. It’s small enough that the inevitable beginner mistakes won't be financially devastating, but it's large enough to let you buy a few different stocks and practice real position sizing.

The golden rule here, and always, is to only trade with money you are genuinely prepared to lose.

Should I Use a Paper Trading Account First?

Absolutely, and I can't stress this enough. Kicking things off with a paper trading account, or a simulator, is one of the smartest moves any new trader can make. It's an invaluable, 100% risk-free learning environment.

Think of it as your practice arena. A simulator lets you execute trades, test your strategy ideas, and get comfortable with your broker’s platform—all with virtual money. You get to make all the rookie mistakes without any of the painful financial consequences.

I recommend spending at least a few weeks paper trading. This helps you build a routine and see how your strategy actually holds up in live market conditions. Skipping this step is one of the classic blunders, and you can learn about others by exploring the 10 fatal mistakes that traders make to better prepare yourself.

Think of paper trading as your flight simulator. No pilot would attempt to fly a real plane without countless hours in a simulator first. The stock market is no different.

How Are Stock Trading Profits Taxed?

This is a crucial area that beginners often overlook until it's too late. In most places, the profits you make from selling stocks are subject to capital gains tax.

The rate you'll pay usually boils down to how long you held the stock before selling it:

- Short-Term Gains: These are your profits from stocks you held for one year or less. They are typically taxed at your ordinary income tax rate, which is almost always higher.

- Long-Term Gains: These come from stocks held for more than one year. They usually get a lower, more favorable tax rate, which is a big advantage for investors.

It is absolutely essential to keep detailed records of every single trade: the entry date, exit date, price, and size. Tax laws are complex and vary by country and even state, so consulting with a qualified tax professional is always a wise investment. It’s the best way to stay compliant and avoid any nasty surprises come tax season.

Ready to move beyond theory and build real, practical trading skills? At Colibri Trader, we teach a straightforward, price-action-based approach to help you succeed in any market condition. Start your journey today by taking our free Trading Potential Quiz and see how our proven methods can transform your performance. Find out more at https://www.colibritrader.com.