How to Start Currency Trading: Your Practical Guide

Before you dive headfirst into currency trading, the smartest move any new trader can make is to open a demo account with a regulated broker. Think of it as your personal trading sandbox—a place to practice without any real financial risk while you get a feel for the fundamentals.

This is your time to understand how the market moves, test out a few strategies, and build some confidence before putting any of your hard-earned money on the line. The whole journey really boils down to three things: getting to grips with currency pairs, understanding market dynamics, and building a rock-solid risk management plan.

First Steps Into The World of Currency Trading

Jumping into currency trading means you're stepping into the largest, most liquid financial market on the planet. The sheer scale can feel a bit much at first, but the core ideas are surprisingly straightforward once you break them down. Your goal right now isn't to get rich quick; it's to build a solid foundation of how this whole thing works.

Understanding the Forex Market Landscape

At its core, the foreign exchange (Forex) market is a massive, global marketplace where currencies are bought and sold. Unlike the stock market, there's no central exchange. Instead, trading happens over-the-counter (OTC) through a huge network of banks, financial institutions, and individual traders like us.

It’s a true 24-hour market, kicking off with the Sydney session and rolling right through to the New York close, five days a week.

The scale is almost hard to comprehend. The global Forex market sees a staggering daily turnover estimated at $7.5 trillion as of 2022. We're also seeing more everyday investors getting involved; brokers worldwide pulled in roughly $17.5 billion in revenue in 2023, a 5.8% jump from the previous year. You can check out more fascinating Forex industry statistics to see just how rapidly the market is growing.

Decoding Currency Pairs

In Forex, you're never just trading one currency; you're always trading them in pairs. When you place a trade, you're buying one currency while simultaneously selling another. It’s this relationship that creates the opportunity for profit.

These pairs fall into three main buckets:

- Major Pairs: These are the big leagues. They always feature the US Dollar (USD) paired with another powerhouse currency, like the Euro (EUR), British Pound (GBP), or Japanese Yen (JPY). They're the most heavily traded, which means high liquidity and usually tighter transaction costs (spreads).

- Minor Pairs (Crosses): These pairs don't involve the US Dollar. Think of pairs like EUR/GBP or AUD/JPY. They’re still quite liquid but often have slightly wider spreads than the majors.

- Exotic Pairs: This is where a major currency gets paired with one from an emerging economy, like the South African Rand (ZAR) or the Mexican Peso (MXN). These are far less liquid, much more volatile, and come with significantly higher trading costs. Honestly, they’re best avoided when you're starting out.

For anyone just figuring out how to start currency trading, sticking to major pairs like EUR/USD or GBP/USD is the way to go. Their massive trading volume generally leads to more predictable price movements and lower costs, which is exactly what you want when you're still learning the ropes.

Comparing Major Currency Pairs for Beginners

To give you a better idea of where to start, I've put together a quick comparison of the top three major pairs. Each has its own personality, and understanding these differences can help you pick the right one to focus on as you learn.

| Currency Pair | Nickname | Typical Volatility | Average Spread (Pips) | Best Trading Sessions |

|---|---|---|---|---|

| EUR/USD | "The Fiber" | Low to Medium | 0.5 – 1.5 | London & New York Overlap (8 AM-12 PM EST) |

| GBP/USD | "The Cable" | Medium to High | 1.0 – 2.5 | London & New York Sessions |

| USD/JPY | "The Gopher" | Low to Medium | 0.7 – 1.8 | Tokyo & London Sessions |

This table makes it clear why EUR/USD is such a popular choice for beginners. Its relatively low volatility and tight spreads make it a more forgiving market to learn on. As you gain more experience, you might find the higher volatility of a pair like GBP/USD more appealing, but it's always best to start with the most stable options.

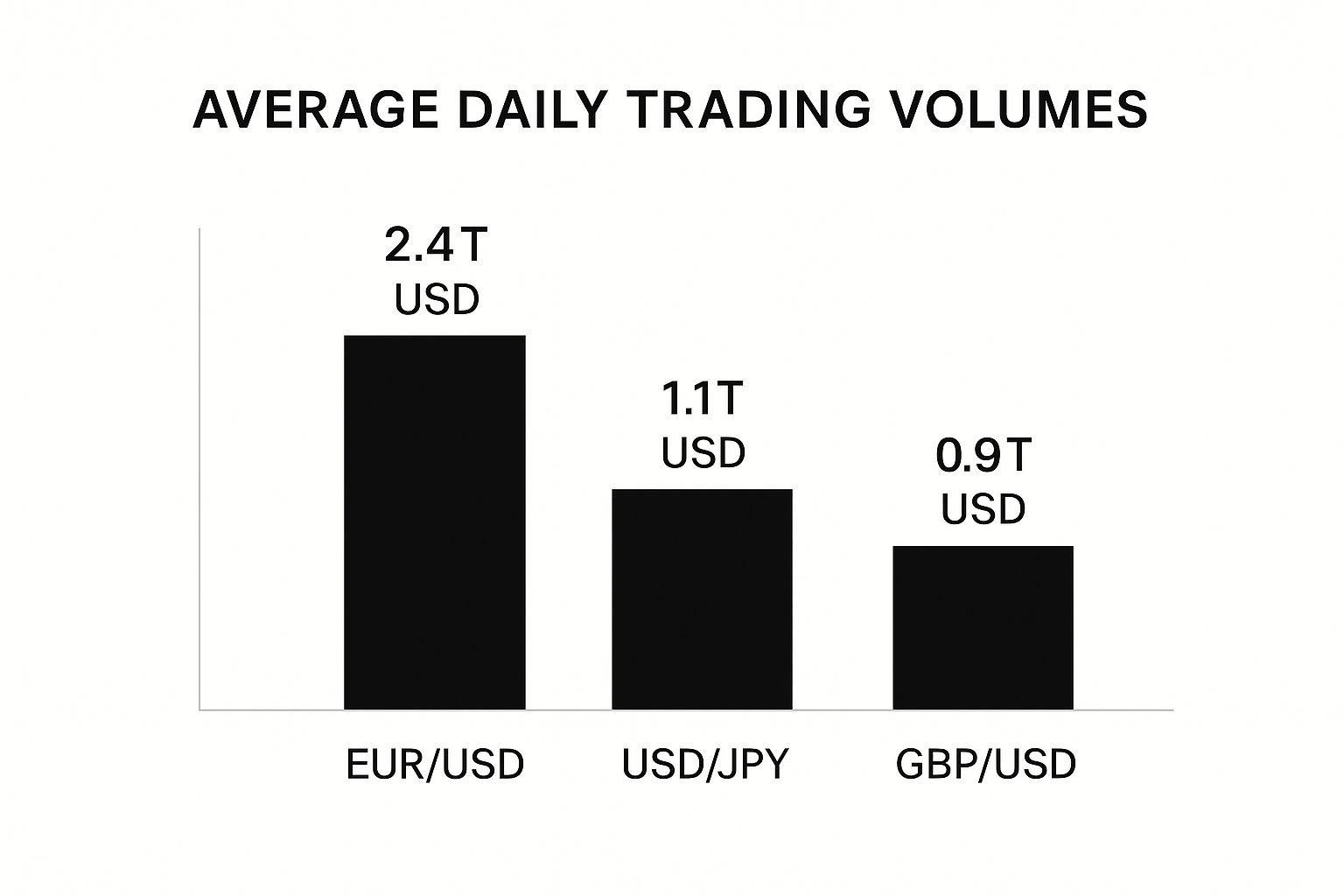

The chart below really drives home just how dominant these major pairs are, especially when it comes to daily trading volume.

You can see why EUR/USD is often called the "king of Forex." Its daily trading volume completely dwarfs the others, making it the most liquid and accessible pair for new traders to get started with.

Key Takeaway: Your journey starts with understanding the playground. Stick to the major currency pairs and spend plenty of time on a demo account. This combo gives you the safest and most effective way to build the skills you'll need for long-term success. Forget about the exotics and fancy strategies for now—just focus on mastering the basics.

How to Choose the Right Forex Broker

Picking a forex broker isn't just a simple chore; it’s more like choosing a business partner. This one decision shapes everything that follows—your trading costs, the tools you use, and, most critically, the safety of your money. It's one of those foundational steps that, if you get it right from the start, will save you a world of headaches down the road.

Your broker is your gateway to the forex market. They handle your trades, hold your funds, and give you the platform where you'll spend countless hours staring at charts. A great broker makes the experience seamless. A bad one? They can be a constant source of frustration and risk.

The Non-Negotiable Role of Regulation

Before you even think about spreads or fancy platforms, your very first checkpoint is regulation. An unregulated broker is operating in the Wild West. There's no oversight, no accountability if they mishandle your funds, and no one to turn to if things go wrong. You simply don't want your trading capital anywhere near that kind of environment.

Stick to brokers regulated by top-tier financial authorities. These organizations impose strict rules to protect traders like you.

- Financial Conduct Authority (FCA) in the United Kingdom

- Australian Securities and Investments Commission (ASIC) in Australia

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus

These regulators mandate things like keeping client funds separate from the company's own cash. This is huge. It means your money is protected even if the brokerage firm itself gets into financial trouble.

The regulatory backdrop is vital, especially in forex. Unlike stock exchanges, the currency market is "over-the-counter" (OTC), meaning there's no single physical location. This decentralized nature makes choosing a regulated broker absolutely critical for ensuring fair play. For instance, top brokers in the European Union, which hold about 20% of the global market share, must abide by rules from the European Securities and Markets Authority (ESMA). This includes capping leverage at 1:30 for major pairs for retail traders. To get a better feel for these dynamics, it's worth reading up on the global currency market structure.

Understanding Fees and Account Types

Okay, so you've got a shortlist of regulated brokers. Now it's time to dig into their fee structures and the different accounts they offer. This is where you'll see major differences that directly impact your profitability.

A broker makes money in two main ways: through the spread or a commission.

- Spread-based accounts (often called "Standard" accounts) don't charge a direct commission. The fee is baked into the spread—that tiny difference between the buy and sell price of a currency pair.

- Commission-based accounts (you might see them labeled "ECN" or "Raw Spread") boast incredibly tight spreads, sometimes even zero. To make their money, they charge a flat commission for every trade you place.

For most beginners, a standard spread-based account is easier to wrap your head around. But as you start trading more volume, a commission-based model might end up being cheaper.

Pro Tip: Don't get fixated on the "minimum" spread a broker advertises. Look for the average spread on the currency pairs you actually plan to trade, particularly during active market hours. That number gives you a much truer picture of your real trading costs.

Also, look closely at the account specifics. What's the minimum deposit? What trade sizes are available? For a new trader, having access to micro lots is a must for proper risk management. If you're not sure what that means, check out our deep dive on what is a lot size in Forex.

Test Driving the Trading Platform

Your trading platform is your command center. It's where you'll be doing all your chart analysis, placing orders, and managing your open trades. The vast majority of retail brokers use MetaTrader 4 (MT4) or its successor, MetaTrader 5 (MT5), and for good reason—they've been the industry standard for years.

These platforms are powerful, reliable, and have a massive ecosystem of custom indicators and tools built around them. But before you deposit a single dollar, open a demo account and take it for a spin. Seriously, do this.

- Does the interface feel intuitive to you?

- Is it easy to place and adjust orders (like a stop-loss)?

- Does it run smoothly, or does it lag and freeze?

Spending a week or two on a demo is the best way to answer these questions. It lets you get comfortable with the software's mechanics without risking any real money. It’s a hands-on part of your trading education you shouldn't skip.

Developing a Simple and Effective Trading Strategy

Jumping into the markets without a clear plan is one of the fastest ways to lose money. Seriously. It’s the critical difference between making calculated decisions and just gambling your capital away.

Think of your trading strategy as your personal roadmap. It’s what tells you what to trade, when to pull the trigger, and just as importantly, when to get out—whether that's with a profit or a small, controlled loss.

A solid strategy doesn't have to be complicated. In fact, when you're starting out, simplicity is your best friend. A straightforward plan is easier to follow under pressure. We’ll build your approach around two core methods of market analysis, each giving you a different lens to view the markets.

The Two Pillars of Market Analysis

First up is fundamental analysis. This is the big-picture stuff. It involves looking at the economic, social, and political forces that drive a currency's value. You’re essentially playing detective and assessing a country's economic health.

Key drivers you'll want to watch include:

- Interest rate decisions from central banks (a huge one).

- Inflation reports like the Consumer Price Index (CPI).

- Employment data, like the monthly Non-Farm Payrolls (NFP) report in the U.S.

- Gross Domestic Product (GDP) figures, which track economic growth.

For example, let's say the U.S. Federal Reserve starts hiking interest rates. This generally makes the dollar more attractive to foreign investors who are chasing higher returns on their money. This flood of demand often causes the USD to strengthen against other currencies. A trader using fundamentals would see this coming and plan their trades around a stronger dollar.

The second pillar is technical analysis. This approach couldn't be more different. It completely ignores the economic news and focuses purely on what the price chart is telling you. The core idea here is that all known information—all the hopes, fears, and news—is already baked into the price.

Technical analysts believe historical price patterns tend to repeat themselves. They use tools like trend lines, support and resistance levels, and chart patterns to get a read on market psychology and forecast where the price might go next.

To get started, you'll need a basic grasp of market structure and the major currency pairs. Their high liquidity means you get tighter spreads and lower trading costs, which is a huge advantage for beginners. If you want to dive deeper, you can learn about the U.S. Forex market to understand its core dynamics.

Key Takeaway: You don't have to pick a side. Most experienced traders I know use a hybrid approach. They use fundamental analysis to figure out what to trade (e.g., "the dollar looks strong") and then use technical analysis to pinpoint exactly when to enter and exit.

An Actionable Strategy for Beginners: Trend Following

One of the most intuitive and effective strategies for new traders is trend following. The concept is as simple as it sounds: find the market's dominant direction (the trend) and only take trades that go with it. You're swimming with the current, not fighting it.

Here’s a practical way to apply it:

- Identify the Trend: Pull up a daily or 4-hour chart. Is the price consistently making higher highs and higher lows? That’s an uptrend. Or is it making lower lows and lower highs? That’s a downtrend. Easy enough.

- Wait for a Pullback: Prices never move in a straight line. In an uptrend, the price will rally, dip back a bit, and then continue higher. That temporary dip, or "pullback," is your potential entry zone.

- Confirm Your Entry: Don't just buy the dip blindly. Wait for a simple technical clue—like a bullish candlestick pattern—to signal that the pullback might be over and the main trend is about to kick back in.

Let’s say the EUR/USD pair is in a clear, strong uptrend. You'd patiently wait for the price to pull back to a key support level. Once it touches that level and prints a bullish candle, you could enter a "buy" trade, placing your protective stop-loss just below that support.

The Power of the Demo Account

Reading about a strategy is one thing. Executing it with real money on the line is a whole different ball game. This is where your demo account becomes your most valuable training tool. Before you risk a single real dollar, your mission is to test your strategy until you know it inside and out.

Use your demo account to:

- Practice identifying trends and entry points in a live market.

- Get comfortable with your platform, placing orders, and setting your stop-loss and take-profit levels.

- Build iron discipline by sticking to your rules, even when your emotions are screaming at you to do something else.

- Keep a trading journal to track your results. This is non-negotiable. It’s how you’ll find out what's working and what isn't.

Treat your demo trading like it's real. The habits you forge here—good or bad—will absolutely carry over to your live account. If you can achieve consistent results on a demo account for a few months, that's the best sign you're truly ready to start trading with real capital.

Mastering Risk Management to Protect Your Capital

Profit is exciting, but survival is everything. I've seen countless aspiring traders blow up their accounts, and it's rarely because their strategy was bad. The brutal truth is they just ran out of money.

The line between making it in this game and joining the statistics comes down to one core skill: risk management.

This isn't the flashy part of trading, but I guarantee it's the most important. Think of it as your defensive playbook. It’s what protects your capital and keeps you in the game long enough for your skills to actually start paying off. A killer strategy means nothing if you can't survive a losing streak.

The Double-Edged Sword of Leverage

Let's talk about one of the biggest draws to forex: leverage. It's the tool that lets you control a large position with a relatively small amount of capital. Brokers will throw offers at you like 100:1 leverage, which means for every $1 in your account, you can control $100 in the market.

Sounds incredible, right? It can be. Imagine you have a $1,000 account. Using 100:1 leverage, you open a $100,000 position on EUR/USD. If the market moves just 1% in your favor, your position gains $1,000. You’ve just doubled your account on a single trade. That's the allure.

But here’s the other side of that coin. What if the market moves against you by 1%? Your position loses $1,000, and your entire account is gone. Wiped out. On one trade. To really get a handle on this, it's worth digging into what leverage in Forex is so you can approach it with the caution it demands.

Key Takeaway: Treat leverage with extreme respect. It’s a tool, not a shortcut to riches. Using too much leverage is the number one reason I see new traders fail, turning small market ripples into account-ending tsunamis.

Setting a Stop-Loss on Every Single Trade

Your single most important tool for managing risk is the stop-loss order. This is a pre-set order you place with your broker to automatically close a losing trade once it hits a certain price. It's your safety net, your emergency exit, and your absolute best defense against a catastrophic loss.

This is not optional. It should be an unbreakable rule for every trade you ever take.

A stop-loss removes raw emotion from the decision to cut a loser. Without one, you're left with hope—that incredibly dangerous belief that a bad trade will just "turn around." Trust me, hope is not a strategy.

- For a buy trade: Your stop-loss is placed below your entry price.

- For a sell trade: Your stop-loss is placed above your entry price.

Think of it this way: before you even click "buy" or "sell," you're defining the maximum amount you're willing to lose. You are in control, no matter what the market does next.

Position Sizing and the 1-2% Rule

So, how much should you actually risk on a single trade? This is where position sizing comes in, and it's arguably more critical than your entry signal. The most widely accepted rule of thumb, especially when you're starting out, is to never risk more than 1% to 2% of your total account balance on any one trade.

This simple rule is incredibly powerful. Let's say you hit a string of ten losing trades in a row—and believe me, it will happen. By risking just 1% per trade, you'd only be down 10% of your capital. You'd still have plenty of ammo left to keep trading and wait for your edge to play out.

Here’s how you’d calculate it in a real-world scenario:

- Determine Your Risk Amount: With a $1,000 account, a 1% risk is $10. This is the absolute maximum you can lose on this trade. No exceptions.

- Define Your Stop-Loss: Your chart analysis tells you the trade idea is invalid if the price moves 20 pips against you. So, your stop-loss goes 20 pips from your entry.

- Calculate Position Size: Now you can figure out how big your trade can be. If you're risking $10 and your stop is 20 pips away, then each pip is worth $0.50 ($10 / 20 pips). This calculation tells you exactly what lot size to use.

This capital preservation mindset is what separates professional traders from gamblers. Professionals obsess over managing their downside first, knowing that if they can protect their capital, the profits will eventually take care of themselves. Every decision must be filtered through the lens of risk.

Your First Trade: A Practical Walkthrough

Let’s be honest: theory and practice can feel like two different worlds. You've read about risk management, strategy, and picking a broker, but now it's time to actually put it all together. This is where the rubber meets the road.

We’re going to demystify the mechanics of placing your very first trade.

We'll run through a simple, hypothetical scenario using the EUR/USD pair, which is where most new traders get their start. The goal here isn't to pinpoint a perfect, A+ setup. It's about walking through the process so you feel confident clicking the buttons when it's your turn.

For this example, let's pretend we're working with a $1,000 demo account.

Finding a Simple Trade Setup

Imagine we're looking at the 4-hour chart for EUR/USD and spot a clear uptrend. The price has been making a series of higher highs and higher lows—a classic sign of bullish momentum.

Just now, the price has pulled back to a previous support area around the 1.0850 level. This is a great, simple setup: an existing trend pulling back to a known zone of support. It signals a potential "buy" opportunity.

Our trading plan says to enter a long (buy) trade if we see a bullish confirmation candle at this support level. Right on cue, a bullish engulfing candle appears, telling us that buyers are likely stepping back in. That's our trigger.

- Currency Pair: EUR/USD

- Direction: Buy (Long)

- Entry Signal: Bullish engulfing candle right at the 1.0850 support.

- Entry Price: We'll aim to get in near the close of this candle, around 1.0860.

Calculating Position Size and Setting Your Stops

Before you even think about hitting "buy," you absolutely must manage your risk. This is the single most important part of learning how to trade currencies. We’ll stick to the 1% rule, meaning on our $1,000 account, the most we're willing to lose is $10.

My strategy dictates placing the stop-loss just below the recent swing low and the support level itself. Let's set it at 1.0830. The distance from our entry (1.0860) to our stop (1.0830) is 30 pips.

Now we can figure out our position size:

- Max Risk: $10

- Stop-Loss Distance: 30 pips

- Value per Pip: $10 / 30 pips = $0.33 per pip

On EUR/USD, a standard micro lot (0.01 lots) has a pip value of about $0.10. To get as close to our $0.33/pip target as possible, we'll trade 0.03 lots (which is $0.30 per pip). This keeps us right under our maximum risk.

For our take-profit, we'll target the next clear resistance level, which we spot up at 1.0950. This gives us a potential profit of 90 pips.

Risk vs. Reward: Here, our potential profit is 90 pips, while our potential loss is just 30 pips. This gives us an attractive 1:3 risk-to-reward ratio, a cornerstone of any solid trading approach.

Placing the Order

With all the key numbers defined, it’s time to open the order ticket on your trading platform.

- Select the Pair: Find and choose EUR/USD.

- Enter the Volume: Type 0.03 into the volume (or lot size) field.

- Set the Stop-Loss: Enter 1.0830 into the stop-loss field.

- Set the Take-Profit: Enter 1.0950 into the take-profit field.

- Execute the Trade: Click the "Buy by Market" button.

And just like that, the trade is live. Your platform will show the open position, with its profit or loss ticking up and down in real-time.

Now, the best thing you can do is walk away. Seriously. Your stop-loss and take-profit orders are in place, so let the trade play out according to your plan without emotional interference.

After the trade closes—win or lose—the work isn't over. Go back and review the outcome in your trading journal. Did you follow your plan to the letter? What could you have done better? This kind of honest review is what builds real experience and turns you from someone who just clicks buttons into a disciplined trader.

For more structured guidance on building your own rules, check out our guide on how to make a forex trading plan in 10 steps.

Got Questions About Getting Started?

Even when you feel like you've got the basics down, a few questions always pop up. That's completely normal. Let's run through some of the most common ones I hear from new traders. Getting clear on these will help you move forward with a lot more confidence.

How Much Money Do I Really Need to Start Trading?

You’ll see brokers advertising that you can start with as little as $10, but let’s be realistic. Trying to manage risk with an account that small is practically impossible. A much more sensible starting point is somewhere between $500 and $1,000.

An account of this size gives you the breathing room to trade with micro lots (very small position sizes) and actually stick to the crucial 1-2% risk rule on every trade. It means you can handle the normal ups and downs of the market without the crushing psychological pressure that comes from risking half your account on a single price swing.

Is This a Fast Way to Get Rich?

I have to be blunt here: no, absolutely not. This is probably the most dangerous myth in the entire industry.

Trading is a serious business. It demands skill, patience, and a level of discipline that can only be built over hundreds of hours of screen time and practice. It's not a lottery ticket. While the potential for good returns is certainly there, the risk of losing your capital is just as real. Sustainable success comes from a solid strategy and strict risk management, not from chasing some fantasy of overnight riches.

Trading is a marathon, not a sprint. Any guru promising you fast, guaranteed profits is selling you a dream. Focus on learning the craft, and the results will eventually take care of themselves.

How Long Should I Stick With a Demo Account?

There's no magic number here, but a good rule of thumb is to practice until you've been consistently profitable for at least two or three months in a row.

The point of a demo account isn't to rack up a huge pile of fake money. It’s to prove to yourself that you can follow your trading plan without real emotions getting in the way. It’s all about building the right habits. I see it all the time—traders who jump into a live account before proving their strategy and discipline on a demo. It’s one of the costliest mistakes you can make.

What’s the Best Time of Day to Trade?

You want to trade when the markets are most active and liquid. This usually happens when the major global trading sessions overlap.

For most traders, especially if you're looking at major pairs like EUR/USD or GBP/USD, the sweet spot is the London and New York session overlap. This window, from about 8 AM to 12 PM EST, is when you'll often see the highest volume and volatility. More movement can mean clearer opportunities.

That said, the "best" time really hinges on your strategy and what pairs you're watching. For example:

- Asian Session: Great for JPY pairs like USD/JPY and AUD/JPY.

- London Session: The busiest session by far, impacting pretty much every pair.

- New York Session: Huge liquidity, especially for USD pairs. This is also when major US economic news hits the wires.

Getting a feel for these market rhythms helps you focus your energy when the odds are stacked a little more in your favor.

Ready to stop guessing and start trading with a proven, indicator-free approach? At Colibri Trader, we teach you the price action strategies that build real, lasting skill. Take our free Trading Potential Quiz to discover your edge today!