How to Day Trade for a Living: Your Path to Profitability

What Nobody Tells You About Trading for a Living

Let's be honest, the internet is plastered with glamorous images of day trading: Lamborghinis, beachside offices, and cries of "financial freedom." But peel back that Instagram filter, and you’ll find a different story. After talking to dozens of full-time day traders, I can tell you it's less about instant riches and more about grinding through months of potential losses, wrestling with intense stress, and facing the harsh reality that most people fail.

This isn't meant to discourage you. It's about giving you the critical mindset that separates those who survive from those who become another cautionary tale. I want you to have the unfiltered truth so you can decide if this career path is truly right for you.

The Brutal Truth About Success Rates

One of the biggest misconceptions is how easy it is to rake in consistent profits as a day trader. The reality? Far less glamorous. The success rate is shockingly low. Research shows only about 13% of day traders stay profitable for six months, and a tiny 1% achieve long-term success over five years. Discover more insights about day trading statistics. These numbers aren’t meant to scare you off, but to underscore the need for realistic expectations. Knowing the odds going in lets you approach this career with healthy skepticism and a commitment to constant learning.

Let's take a look at some hard data to illustrate this point. The following table highlights the challenges traders face at different stages of their journey. It shows why maintaining long-term success is so tough.

Day Trading Success Rates by Time Period

Comparison of trader success rates across different time periods showing the challenging reality of sustainable profitability

| Time Period | Success Rate | Key Challenges |

|---|---|---|

| First 6 Months | ~13% | Emotional control, lack of experience, inconsistent strategy |

| 1-2 Years | ~5% | Adapting to market changes, managing risk, avoiding overconfidence |

| 5+ Years | ~1% | Maintaining discipline, evolving strategies, handling psychological pressure |

As you can see, the attrition rate is steep. Many initial successes are wiped out by the challenges of a constantly shifting market. This highlights the need for not just a good trading strategy, but a robust mental game and the ability to adapt and learn.

The Psychology of Survival

Successful day trading isn’t just about technical analysis and chart patterns. It's about mastering your psychology. Think of your trading strategy as the car and your mindset as the engine. You can have the fastest car, but without a well-tuned engine, you're going nowhere. The same goes for trading. Even with the best strategy, if you’re constantly battling fear, greed, and self-doubt, you’re headed for trouble.

The Real Cost of Trading

Beyond the financial capital to get started, there's another cost: the emotional and mental toll. Trading for a living requires intense focus, discipline, and resilience. The constant pressure to perform, working in isolation, and inevitable losing streaks can wear you down. Many traders find relationships suffer, sleep is disrupted, and their overall quality of life takes a hit. It's crucial to understand this upfront and develop coping mechanisms. This might mean mindfulness practices, strong support systems, or even professional guidance. Protecting your mental and emotional well-being is just as vital as protecting your financial capital.

This journey isn't a walk in the park, but it can be incredibly rewarding. By understanding the real challenges and developing the right mindset, you'll be much better prepared to navigate the market's complexities and increase your chances of joining the small percentage who truly make day trading their living.

Developing the Mental Game That Separates Winners

You could have a flawless day trading strategy, technically perfect in every way, but without a solid mindset, it's worthless. I've chatted with traders who've navigated market crashes and come out stronger on the other side. Their secret weapon? Mental fortitude.

It's not about some vague idea of "positive vibes." It's about building real emotional resilience. This resilience becomes your lifeline during the inevitable losing streaks that sink most aspiring day traders.

Embracing the Isolation and Pressure

Day trading can be a lonely game. Learning to not just survive but thrive in this environment is critical. Successful traders I know develop routines to keep them laser-focused.

Some swear by morning meditation. Others find a rigorous workout clears their head before the market opens. It's all about finding what centers you and helps you face the market with a clear, focused mind.

The pressure to perform can be intense, especially when you're relying on day trading for your income. Setting realistic goals and acknowledging even small victories can make a world of difference. It’s a marathon, not a sprint, remember?

Taming Your Risk Tolerance

Most people's natural risk tolerance just isn't cut out for the world of day trading. They chase the big wins, taking on way too much risk, and then they completely fall apart when losses (inevitably) happen.

This is why so many beginners wipe out their accounts so fast. Learning to manage risk effectively is absolutely essential. It's understanding that protecting your capital is as important – if not more important – than racking up huge gains.

Think of it like a professional poker player. They're not gunning for a royal flush every hand. They're playing the odds, managing their bankroll, and making smart, calculated bets. Consistent profits in day trading come from the same place: managing risk, not chasing the next jackpot.

This also explains the high washout rate in this field. Something like 40% of new day traders quit within the first month, and only about 13% are still around after three years. You can dig deeper into day trading statistics here.

Recognizing Emotional Trading

One of the most important skills you can develop is recognizing when emotions are driving your trades instead of strategy. 7 Steps to Become More Disciplined in Your Trading might offer some helpful insights.

Are you chasing losses, trying to "get even" with the market? Are you going all-in on positions because you're feeling invincible? These are red flags. When you notice these emotional triggers, step back, reassess, and maybe even walk away from the market for a bit. Keeping a trading journal, noting both your trades and your emotional state, can help you spot these patterns.

The Mindset Shift

The transformation from struggling trader to consistent earner often comes down to a fundamental shift in mindset. It’s about accepting losses as part of the game, focusing on the long haul, and always learning and adapting.

This means looking at the market objectively, analyzing your mistakes without beating yourself up, and continually refining your strategies. It’s not about being right every single time; it’s about managing your losses and making the most of your wins when you are right.

Think of it as a continuous feedback loop: every trade, win or lose, is a learning opportunity. This mindset shift is often the hardest part, but it’s also the most rewarding once you get there. This ability to learn from your mistakes and adapt to the ever-changing market is what ultimately separates those who build a sustainable career in day trading from those who don’t.

Building Your Trading Business the Smart Way

Forget Lamborghinis and fancy setups. Let's talk about building a real day trading business – one built for profitability. I've spent years observing consistently successful traders, and a clear pattern emerges: it's not about expensive gadgets, but about making smart infrastructure choices that actually support your trading process.

This means focusing on the fundamentals: choosing the right broker, structuring your business for tax efficiency, and creating a workspace that promotes focus. We'll explore these key elements, using real-world examples of traders managing accounts from $10,000 to $500,000, to demonstrate how smart infrastructure decisions can compound over time. We’ll also uncover which subscription services genuinely add value and which are just marketing fluff targeting newcomers eager to day trade for a living.

The Right Tools for the Job

Let's start with the tech. You absolutely don't need five monitors and a custom-built PC to succeed. A reliable computer with a stable internet connection is paramount. Dual monitors can be helpful, but don't fall into the trap of thinking more screens equals more profits. Prioritize functionality over flash.

This screenshot shows the Thinkorswim platform, a popular choice among day traders. It highlights the customizable charting tools and market data feeds available. While platforms like Thinkorswim offer advanced features, starting with a simpler, more user-friendly interface might be better for new traders. Remember, the platform is just a tool; your strategy is what really matters.

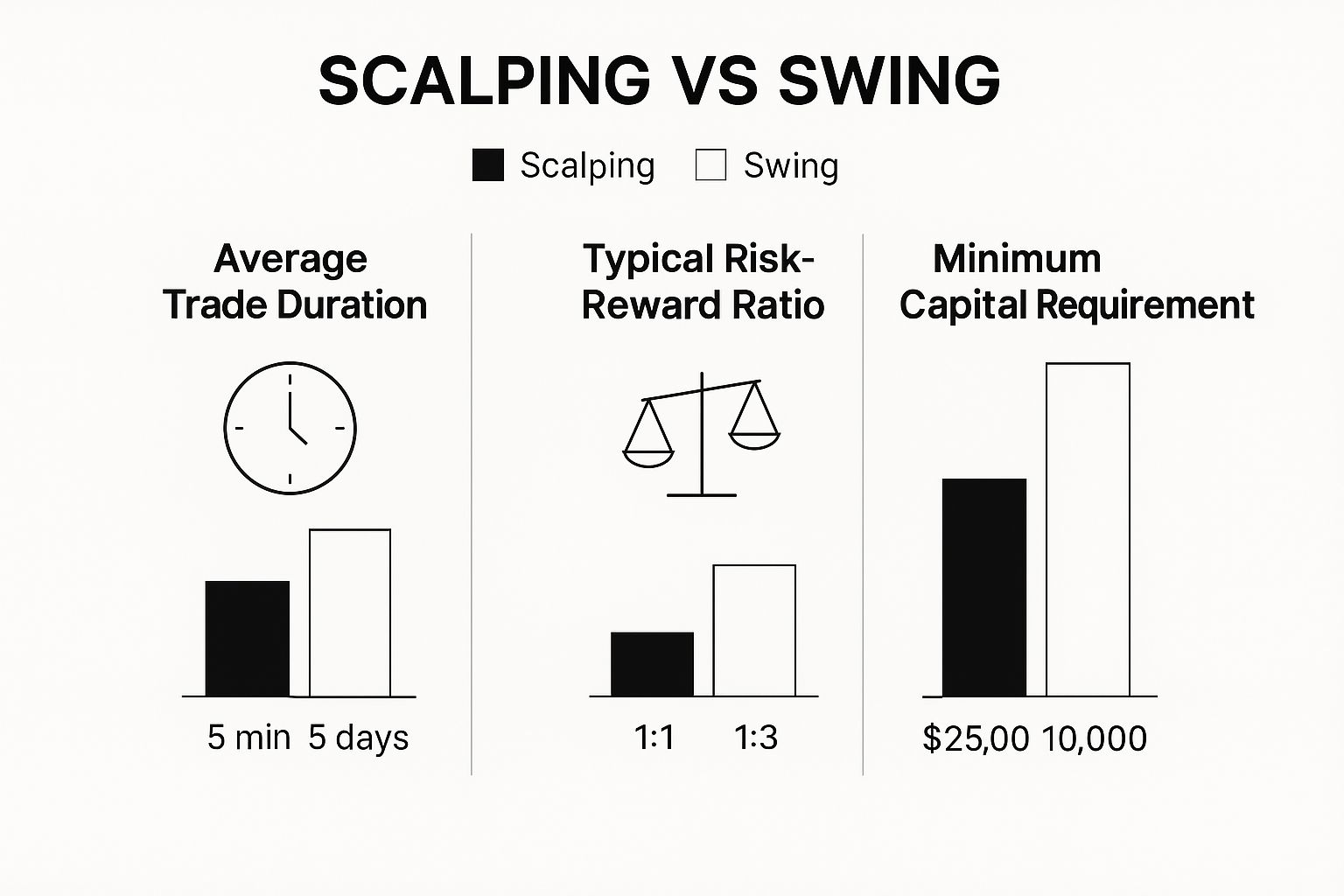

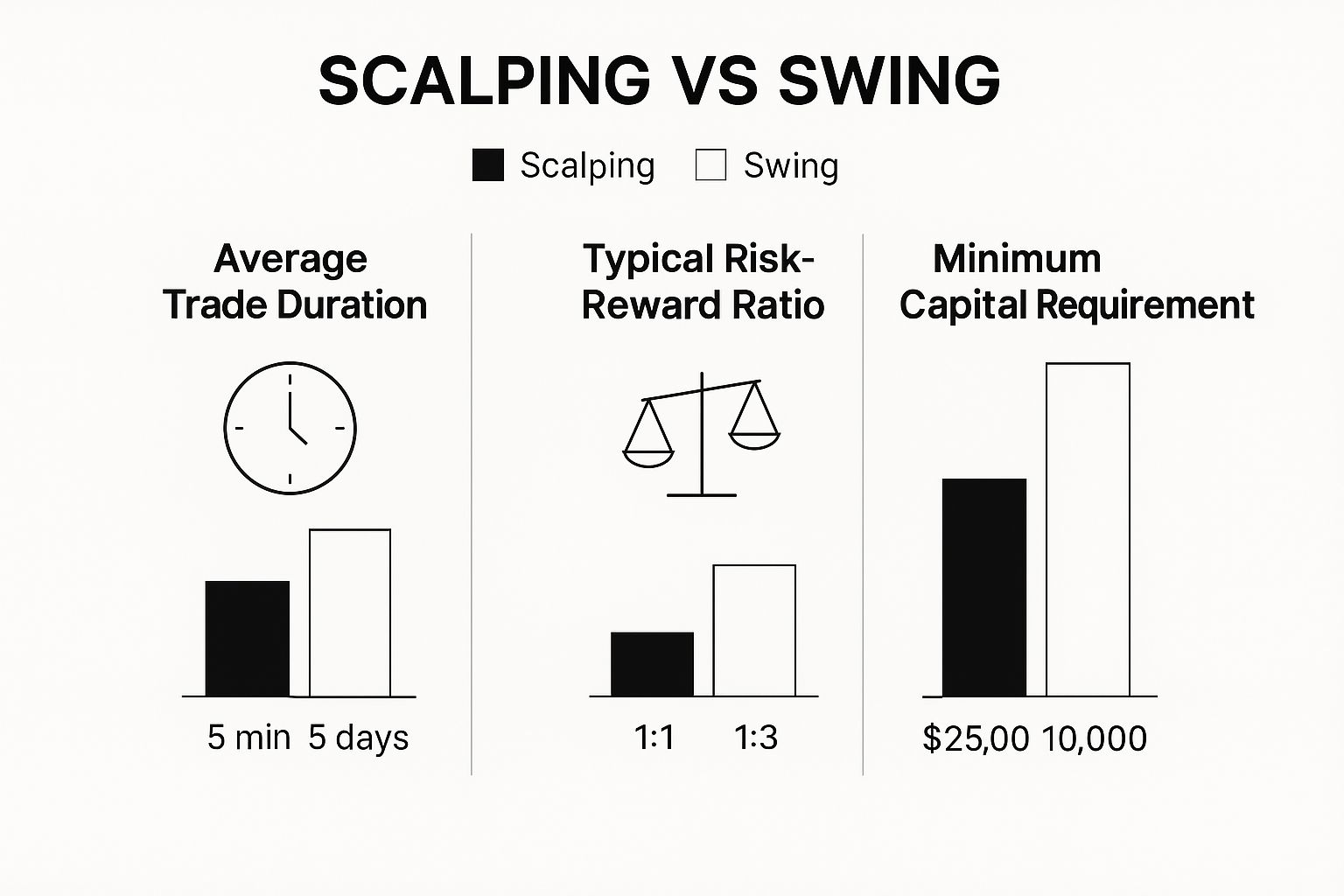

This infographic visualizes the key differences between scalping and swing trading. It compares average trade duration, typical risk-reward ratios, and minimum capital requirements. Scalping involves shorter trades, lower risk-reward ratios, and potentially lower capital requirements than swing trading. Choosing a strategy that aligns with your personal resources and risk tolerance is crucial.

Choosing Your Broker Wisely

Your broker is your gateway to the market, so making the right choice is critical. Here are some essential factors to consider:

- Commission and Fees: Low commissions are vital, especially for high-volume trading strategies.

- Platform Stability and Features: A reliable platform with the tools you actually need (like charting and efficient order execution) is a must.

- Customer Service: Responsive customer support is a lifesaver when technical issues inevitably arise.

- Regulation and Security: Choose a reputable, regulated broker to safeguard your funds.

Don't be swayed by fancy features you won't use. A solid, reliable broker with a user-friendly platform and low fees is often the best choice. I've seen traders with $25,000 accounts waste hundreds on premium data feeds they don’t even understand. That's money that could have been working for them as trading capital.

Structuring Your Trading Business

Treat your day trading like a business. This means thinking about tax efficiency and meticulous record keeping. Setting up a separate business entity (like an LLC or S-Corp) can protect your personal assets and potentially reduce your tax burden. Consulting a tax advisor is always a good idea to determine the best structure for your specific situation. For a deeper dive into planning, check out our guide on how to make a trading plan.

Finally, your workspace needs to be a place of focus, free from distractions. This doesn't necessarily mean you need a dedicated office, but a clean, organized space where you can concentrate without interruptions is essential. Even small infrastructure choices can significantly impact your trading performance.

To help you budget effectively, I've put together a table summarizing essential trading tools and their associated costs:

Essential Trading Tools and Costs

Breakdown of necessary equipment, software, and services with realistic budget ranges for different trader levels

| Tool Category | Budget Option | Professional Option | Monthly Cost |

|---|---|---|---|

| Computer | Refurbished Desktop/Laptop | High-end Desktop with Multiple Monitors | $0 (existing) / $50-$100 (refurbished) / $1000+ (new) |

| Internet | Basic Home Internet | Dedicated High-Speed Internet Line | $50 – $80 |

| Trading Platform | Broker's Basic Platform | Advanced Platform with Direct Market Access | Included with Brokerage / $0 – $50 |

| Market Data | Free or Broker Provided | Real-Time Level 2 Data | $0 – $20 |

| Charting Software | Broker's Built-in Charts | Specialized Charting Software (e.g., TradingView) | $0 |

| News & Research | Free Financial News Websites | Premium News and Analytics Subscriptions | $0 |

This table provides a starting point for budgeting your trading infrastructure. As your trading business grows, you can invest in more advanced tools. But initially, focus on getting the core components right. Remember, efficient capital allocation is key to long-term success in trading.

Finding Your Edge in Competitive Markets

Let's be honest, those one-size-fits-all trading patterns you see everywhere online? They rarely work in the real world. To truly make a living day trading, you need a competitive edge – something that sets you apart. And you need to be adaptable because the market always changes. This section is about how successful traders find their edge and how you can too, based on your personality, schedule, and risk tolerance.

Matching Strategies to Your Style

There's no magic bullet in day trading. What works for me might not work for you. Take scalping, for example. It's all about making tons of small profits on tiny price movements. You need lightning-fast reflexes and nerves of steel. Some traders thrive on it, others burn out fast. It's all about finding what fits you.

Even momentum strategies, riding the wave of existing trends, perform differently depending on the market. In a volatile market, momentum can be amazing. But in a quiet market? Forget it. Sometimes, holding positions for a few days (swing trading) might be more profitable than strict day trading. Recognizing these market nuances is crucial.

Backtesting Without Curve-Fitting

Finding your edge requires backtesting – trying out different strategies on historical data. You're essentially simulating trades based on past market behavior. But watch out for curve-fitting. This is where you tweak your strategy to perfectly match past data. It looks great on paper, but it probably won't work in the future.

The right way to backtest? Test your strategy across different market conditions and time periods – volatile markets, calm markets, bull markets, bear markets, even crashes. This stress-testing shows you how your strategy performs under pressure and reveals its weaknesses.

Recognizing a Deteriorating Edge

Markets are constantly changing. What worked yesterday might not work today. Your edge can dull over time. Knowing how to spot this is just as important as finding the edge in the first place. Constantly monitor your trading performance. Are your win rates dropping? Are your drawdown periods getting longer? Are you consistently missing profit targets? These are all warning signs that your edge might be fading and it's time to adapt.

Adapting to Changing Markets

The best traders have a flexible trading playbook that evolves with the market. They know that being rigid is a death sentence in day trading. For instance, during the 2020 crash, traders relying only on momentum strategies got hammered. Those who adapted – maybe by using mean reversion or volatility strategies – fared much better.

Being flexible doesn't mean abandoning your core strategy. It means being willing to adjust. Maybe you change your position sizing, tweak your entry and exit points, or even focus on different assets. The market rewards adaptability. Most traders – 88% – use stop-loss orders to limit losses. Even with the challenges, the number of day traders is growing. American stock traders jumped from 15% in 2019 to 25% in 2021. Clearly, many are undeterred. Learn more about these stats.

Learning from Real-World Examples

Look at how experienced traders handled past market shifts. A trader focused on tech stocks might have diversified into commodities or currencies during the dot-com bubble burst. A high-frequency trader might have switched to longer-term swing trades during periods of high volatility. These real-world examples show why it's essential to have a plan B (and C!) to protect your capital and stay profitable when things get rough.

By building your unique edge, understanding your trading style, and constantly adapting, you'll be far better prepared to handle the challenges of day trading and build a sustainable career. This constant learning and adaptation separates the pros from the amateurs.

Risk Management That Actually Protects Your Capital

This is where the rubber meets the road in trading. It's the make-or-break point. Surprisingly, so many new traders treat risk management like an optional extra. But the seasoned pros? They live and breathe it. They know a secret: nailing market direction isn't as crucial as surviving long enough to trade another day. So let's dive into protecting your hard-earned capital and building a trading career that lasts. Remember, we're not trying to eliminate risk entirely—that's impossible. We're aiming to manage it like a pro.

Position Sizing: Your First Line of Defense

How much you put on the line for each trade is everything. Professional traders rely on position sizing formulas. These automatically adjust based on your account size and how wild the market's acting. Think of it as a built-in safety net, preventing you from over-leveraging and watching your account vanish after one bad trade.

Let's say you've got a $10,000 account. You spot a trade with a 1:2 risk-reward ratio. This means you're risking $1 to potentially make $2. If you're using a 2% risk rule (risking only 2% of your account per trade), your position size should be $200. A loss costs you $200; a win nets you $400. Simple, right?

This kind of automated approach takes the emotion out of trading, especially when things get intense. It keeps you honest with your risk parameters, no matter how good a setup looks.

Defining Your Psychological Risk Tolerance

Your maximum daily loss limit shouldn't come from a textbook—it should come from you. It's about what you can handle emotionally, not some arbitrary percentage. If a 5% loss sends you spiraling into revenge trading, then dial it back. This takes serious self-awareness. It's all about knowing your breaking point and building your risk management around it.

For example, if a $500 loss on your $10,000 account doesn’t rattle you, then that’s your daily stop. The magic is in finding a loss level that lets you think clearly, even when you're losing. And trust me, everyone handles losses differently.

The Art of Walking Away

Here's a powerful truth: sometimes the best trade is no trade at all. If the market's confusing, or you're feeling off, stepping back is a sign of strength, not weakness. This isn't about throwing in the towel; it's about saving your capital and your sanity for days when the market's giving you clear signals. It's about recognizing those bad setups and patiently waiting for the right moment.

Advanced Risk Management: Portfolio Heat and Correlation

As your account grows and you're juggling multiple positions, things like portfolio heat and correlation risk become essential. Portfolio heat measures your overall market vulnerability. Correlation risk looks at how your different positions react to the same market events. Want to dive deeper? Check out our guide on managing trading risk.

Let's say you're long on a bunch of tech stocks. If the tech sector takes a dive, your entire portfolio could sink. This is concentrated exposure – high portfolio heat and high correlation risk. Diversifying across sectors reduces both. It's like having insurance against a single market event wiping you out.

The Counterintuitive Truth About Position Size

Here's a curveball: smaller positions can actually lead to bigger profits over time. By managing losses effectively and staying in the game longer, your winners have time to grow and offset the smaller hits. This means focusing on consistency, not trying to knock it out of the park every single time.

Imagine two winning traders. One chases big wins, riding a rollercoaster of profits and losses. The other focuses on smaller, consistent gains. Guess who usually ends up ahead? The consistent trader, thanks to controlled drawdowns. It's not about how much you make, it's about how much you keep.

Risk management isn't just about protecting your money; it's about protecting you. Your mental game, your emotional well-being, and the length of your trading career all depend on it. Master these principles, and you won't just survive market volatility—you'll thrive in it.

Growing Your Account Without Blowing It Up

So you’re consistently profitable. Give yourself a pat on the back! That’s a huge achievement. Now comes the really interesting part: scaling up without turning your winning streak into a losing one. This is where I’ve seen so many talented traders get tripped up. They assume that bigger profits just mean bigger positions. Nope. Scaling requires a whole different mindset, one that often feels counterintuitive. Chatting with traders who've built their accounts from $25,000 to seven figures has taught me a lot about the surprising truths of sustainable growth.

The Danger of Increasing Position Size

It seems so simple, right? If you're winning, bet bigger. But this can be a quick way to end a promising trading career. Why? Because larger positions magnify everything – the thrill of the win, the sting of the loss. A manageable drawdown with smaller positions can morph into a devastating loss with larger ones. And the psychological pressure? It's a game-changer. Trading with $1,000 on the line feels entirely different than trading with $10,000. That pressure can turn even disciplined traders into emotional wrecks.

Managing the Psychology of Larger Trades

As your account grows, the mental game becomes even more crucial. You absolutely need systems to manage the pressure. This could mean sticking to a strict routine, scheduling regular breaks, or even working with a trading coach. Remember, your mental capital is just as important as your financial capital. The most successful day traders I know understand this and actively work on keeping their emotions in check as the stakes get higher.

Milestones That Indicate You're Ready to Scale

How do you know you’re ready to increase your position size? There are a few key indicators. First, consistent profitability over a significant period – at least six months, ideally a year – is essential. This shows your strategy has staying power. Next, consider your maximum drawdown. This is the biggest peak-to-trough decline your account has experienced. If you've handled significant drawdowns without panicking or abandoning your strategy, that's a really positive sign. Finally, how do you react to losing trades? If you can take losses in stride without chasing them or letting them rattle your next trade, you're likely ready to step up your game.

Market Impact: A Factor With Larger Size

As your trading volume grows, you might actually start to influence market prices, especially with less liquid assets. This is called market impact. Buying or selling large quantities can move the market against you, shrinking your profits. Understanding this and adapting your strategies is critical for continued success with larger trades. This could mean breaking up large orders into smaller ones, trading during periods of higher liquidity, or focusing on highly liquid assets.

Diversifying Your Strategies

Another secret to sustainable growth? Don't put all your eggs in one basket. Diversification isn't just about trading different assets; it’s also about using different strategies. This reduces your reliance on any single approach. If one strategy stops working, you have others to keep you going. Strategic diversification can protect your account during market shifts and contribute to consistent long-term growth.

Avoiding the Biggest Scaling Mistakes

One of the biggest mistakes I see traders make is scaling up too quickly. This can lead to a string of losses and shatter your confidence. Another common error is neglecting risk management as your account grows. Your risk parameters should always be tied to your account balance and your personal risk tolerance. A study from NewTrading found that even unprofitable traders are persistent. Those with over 50 days of experience have a 95.3% chance of returning to day trading within 12 months, only slightly less than the 96.4% return rate for profitable traders. Discover more insights on trader persistence. This highlights the importance of a solid risk management strategy.

The Systematic Approach to Consistent Growth

Successful scaling requires a systematic approach. This means:

- Continuously monitoring your performance: Track your win rate, average profit/loss, and maximum drawdown to identify areas for improvement.

- Adapting your strategies: Refine your approach based on changing market conditions and your performance data.

- Managing your psychology: Develop routines and strategies for handling the increased pressure and staying disciplined.

By following a systematic approach and avoiding common pitfalls, you can dramatically increase your chances of growing your account sustainably. Remember, it's not about getting rich quick; it's about building a resilient and profitable trading business that can weather the inevitable market fluctuations.

Making the Transition Without Financial Suicide

Switching from part-time to full-time day trading can be a risky move. Many traders fail, not because of bad strategies, but because they can't handle the emotional and financial pressure. This isn't just about reading charts; it’s about navigating the psychological minefield that comes with relying solely on the market. Consider this your survival guide, based on real conversations with traders who've successfully made the leap.

Structuring the Transition: A Gradual Approach

Quitting your job on a whim to day trade full-time? Not usually the best approach. A gradual transition is crucial. Think of it like learning to swim: you wouldn't jump straight into the deep end, would you? Start by trading smaller amounts while you still have your primary income stream. This lowers the pressure and lets you focus on learning without the stress of needing every trade to pay the bills.

Consider this period your training ground. You’re building experience and confidence. As your trading income becomes more consistent, gradually reduce your other work hours. This creates a smoother, much less risky transition.

The Emergency Fund: Your Financial Buffer

In day trading, an emergency fund isn't just for unexpected expenses; it's your lifeline during inevitable losing streaks (drawdowns). These periods can be tough, especially when trading is your only income. A healthy emergency fund gives you the breathing room to weather the storm without panicking and making rash trades.

So, how much is enough? Aim for at least six to twelve months of living expenses. This buffer lets you ride out rough patches, refine your strategy, and avoid making desperate, account-destroying decisions.

Navigating Family Support: Transparency and Trust

Trading for a living means your income will probably fluctuate. Honesty with your family about this is key. Don’t hide the bad days; build trust and understanding. Explain your risk management strategies, show them how you’re protecting your capital, and highlight that this is a long-term journey. Transparency reduces stress for everyone.

Backup Income Strategies: Diversification Beyond Trading

Having backup income sources isn’t admitting defeat; it’s being smart. Think about related areas that could generate a more stable income, like teaching or mentoring. These not only provide financial stability but can also sharpen your trading skills.

The Psychological Challenges: Mastering Your Emotions

Depending entirely on the market is mentally and emotionally taxing. There will be exhilarating wins and crushing losses. Develop coping mechanisms for stress. This could be mindfulness, exercise, or even therapy. Protecting your mental well-being is as crucial as protecting your capital.

Milestone Markers: Signs You're Ready

Knowing when you’re ready for full-time trading is tricky. Look for these signs: consistent profitability over a substantial period, the ability to handle losses without emotional trading, and a deep understanding of your risk tolerance. These suggest you might be prepared to take the plunge.

Here’s a practical checklist:

- Consistent Trading Profits: Are your profits consistently exceeding your current income needs?

- Solid Emergency Fund: Do you have 6-12 months of living expenses saved?

- Defined Risk Management Plan: Is your risk management plan clear and consistently followed?

- Family Support and Understanding: Does your family understand the realities of day trading as a career?

- Psychological Readiness: Can you handle the emotional rollercoaster without it impacting your trading decisions?

Making the transition to full-time day trading is a major commitment. By taking a gradual approach, building a solid financial base, and prioritizing both your mental and financial health, you significantly increase your chances of success. Want to learn more about price action trading and gain the skills to make this transition a reality? Visit Colibri Trader and explore our programs designed to help you master trading.