How to Become a Successful Trader in Financial Markets

So, you want to be a successful trader? Let's get one thing straight right away: it’s not about finding some hidden formula or a magic indicator. Anyone selling you that dream is selling you snake oil.

Real, sustainable trading success comes from building a repeatable process. It’s a grind. It’s a business. It's a disciplined mix of deep market understanding, psychological toughness, iron-clad risk management, and a trading plan you execute without fail.

Forget the Lamborghinis and the beach laptop fantasies. It's time to get to work.

Your Realistic Path to Trading Success

Most people who come to trading are chasing financial freedom. They picture themselves clicking a few buttons and watching the profits roll in. The reality? It’s far more demanding than most jobs.

The journey to consistent profitability isn't a sprint for a few quick wins; it's a marathon. It requires genuine dedication, a commitment to constant learning, and an unshakable mindset. You have to stop thinking like a gambler and start acting like a business owner.

What does that mean in practice? It means every single action you take—from the markets you trade to the capital you put on the line—is a calculated decision. Success isn't one huge, life-changing trade. It's the net result of consistent profitability over hundreds, even thousands, of smaller trades. To do that, you need an "edge"—a specific strategy that gives you a slight statistical advantage over time.

Understanding the Market Landscape

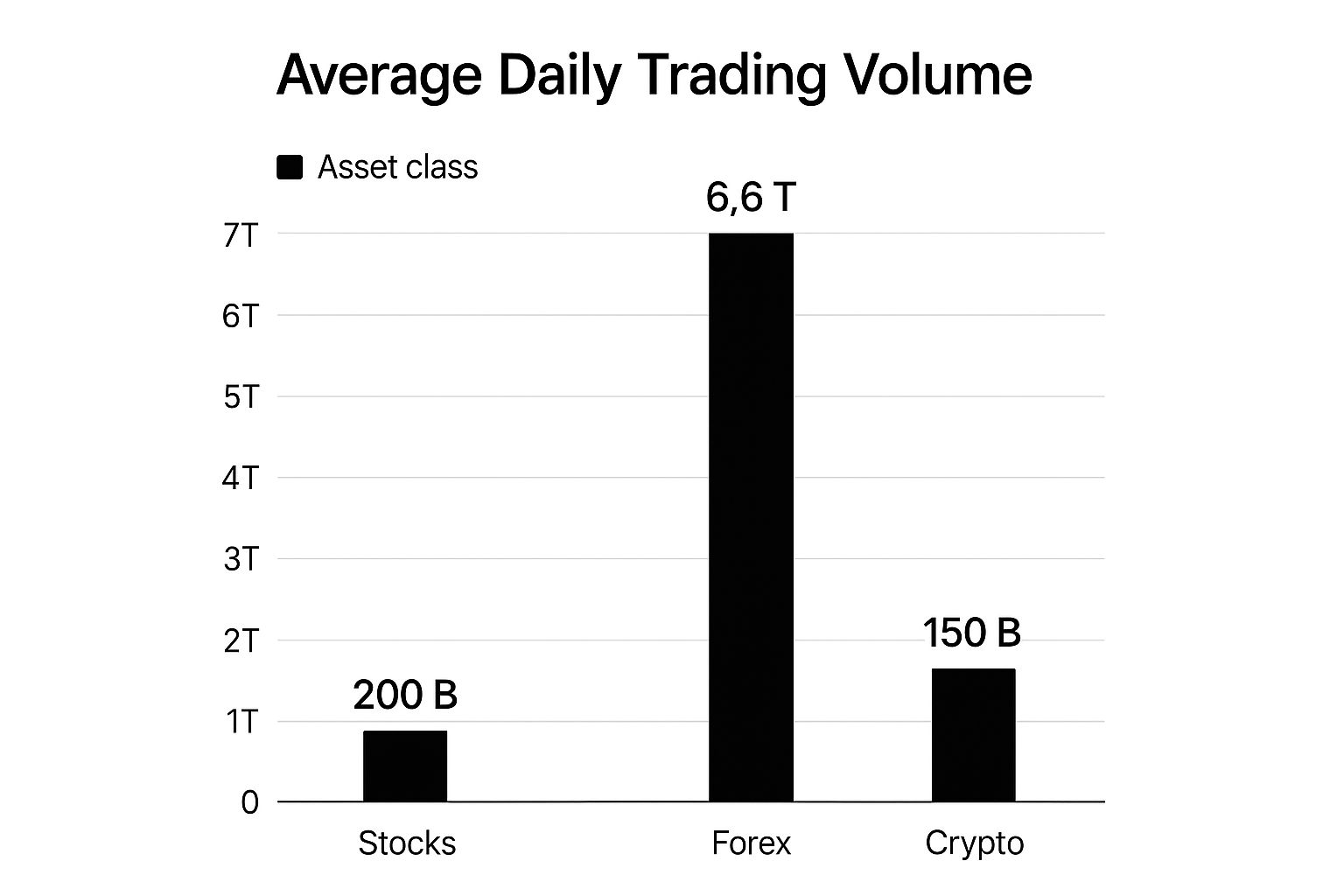

The financial markets are not all the same. Each one—forex, stocks, crypto, commodities—has its own personality, its own volume, and its own unique set of players. Getting a feel for this context is a crucial first step. The sheer size of a market, for example, dictates its liquidity and the kind of opportunities you'll find there.

This chart breaks down the average daily trading volumes across the major asset classes. It gives you a bird's-eye view of where the world's capital is really moving.

As you can see, the Forex market is an absolute behemoth, with $6.6 trillion changing hands every single day. That volume dwarfs stocks and crypto, which means it offers incredible liquidity. Knowing these differences helps you pick a market that actually fits your trading style and account size. You wouldn't bring a knife to a gunfight, and you shouldn't trade a low-liquidity market with a strategy built for forex.

The Four Pillars of Trading Success

To make it in these markets, every single successful trader I know has built their career on four foundational pillars. If you're weak in even one of these areas, your account will eventually pay the price. It's that simple.

- Market Education: This isn't about book smarts. It's about mastering price action, learning to read market structure, and identifying high-probability setups without cluttering your charts with a dozen lagging indicators.

- Psychological Discipline: Trading is a mental game played on an emotional battlefield. You have to learn to control fear, greed, and that gut-wrenching fear of missing out (FOMO). If you can't, you'll constantly make irrational, costly decisions.

- Risk Management: Your number one job as a trader is not to make money; it’s to protect the capital you already have. This means having non-negotiable rules for position sizing and knowing exactly when to cut a losing trade without hesitation.

- A Consistent Plan: A trading plan is your business plan. It’s a written document that spells out what you trade, when you trade, and how you execute. It removes emotion and guesswork from the equation.

The market is a mirror. It doesn't care about your hopes or feelings; it simply reflects your internal state back at you. If you are undisciplined, impulsive, or fearful, your trading account will show it. You have to master yourself before you can ever hope to master the market.

Sure, legends like George Soros and Stanley Druckenmiller are famous for their massive wins, like their famous 1992 trade against the British pound. But those are once-in-a-generation trades built on decades of experience.

The reality for the rest of us is much more grounded. Studies and broker data show that only about 15% of retail Forex traders manage to achieve consistent profits. And what are those pros aiming for? Often, it's a steady 5% to 15% monthly return. You can dig into more professional Forex trading statistics on BestBrokers.com. These numbers aren't flashy, but they prove that trading is a game of skill and patience, not luck and adrenaline.

To build a solid foundation, it's crucial to understand what separates the pros from the struggling masses. The table below contrasts the core habits of successful traders with the common traps that lead to blown accounts. Use it as a checklist for your own trading.

Core Pillars of Trading Success vs Common Failure Points

| Pillar of Success | What Successful Traders Do | Common Failure Point |

|---|---|---|

| Market Education | Master one strategy (e.g., price action) and understand market structure. | Chase "holy grail" indicators and jump between dozens of confusing strategies. |

| Psychology | Follow a trading plan emotionlessly. Accept losses as a business expense. | Let fear and greed drive decisions. Suffer from FOMO and revenge trade. |

| Risk Management | Define risk on every trade (e.g., 1-2% of account). Use a stop-loss. | Risk too much per trade. Refuse to take a loss, hoping it will "come back." |

| Consistency & Planning | Treat trading like a business with a detailed plan and a daily routine. | Gamble on gut feelings. Lack a clear plan for entries, exits, and management. |

Take this table to heart. The path to trading success isn't paved with secrets; it's built, brick by brick, with these core principles. The sooner you embrace the mindset of a business owner and let go of the gambler's mentality, the sooner you'll be on the right track.

Building Your Psychological Fortress

Technical analysis and a solid strategy are essential, but they are only half the battle. I've seen countless traders correctly identify a fantastic setup, yet still end up losing money. Why does this happen? The moment real capital is on the line, emotion storms the cockpit and takes over.

This is exactly where most aspiring traders fail. They become obsessed with chart patterns while completely ignoring their own internal patterns of fear and greed. Truly successful trading is about building a mental fortress to withstand the psychological warfare the market wages on you, day in and day out. It’s not about suppressing emotion; it's about managing it so you remain the one in command.

Identifying Your Emotional Triggers

The market is an absolute master at triggering our most primal human emotions. Fear, greed, hope, and regret can easily hijack your decision-making, turning a well-thought-out trading plan into a series of impulsive, disastrous clicks.

Recognizing these triggers is your first step toward neutralizing their power. For a trader, these four emotional states are the most destructive:

- Fear of Missing Out (FOMO): You see a market rocketing higher without you and jump in late—often right as the early, smart-money buyers are taking their profits off the table.

- Revenge Trading: After a frustrating loss, you immediately dive back into the market to "win your money back." This almost always involves a bigger position size and a much worse setup.

- Greed: A trade is going your way and hits your pre-defined profit target. Instead of closing it, you hold on, hoping for an even bigger win. Then the market reverses, turning a solid winner into a loser.

- Fear of Loss: You hesitate to pull the trigger on a perfect setup because you're scared of another loss. Or, you cut a winning trade far too early for a tiny gain, destroying your risk-to-reward ratio.

These aren't just abstract concepts; they are account killers. Every single trader, from the greenest novice to the seasoned veteran, grapples with them. The only difference is that professionals have built systems to mitigate their impact. You can explore how to master your mind by digging into the core tenets of a winning trading mindset in our detailed guide.

The market is the most expensive self-development program you will ever enroll in. It serves as a mirror, reflecting all your internal flaws—impatience, anger, lack of discipline—directly onto your profit and loss statement.

Forging Discipline Through Routines

You can't rely on willpower alone to defeat these emotional enemies. It just doesn't work. Discipline isn't a feeling you conjure up; it's a habit you build through consistent, structured action. This is where pre-trade and post-trade routines become your most powerful allies.

A pre-trade routine primes your mind for peak performance. Think of it as a non-negotiable checklist you must complete before ever placing a trade. This simple process removes impulse from the equation and ensures every action you take is deliberate.

Your routine could look something like this:

- Market Analysis: Review the key levels, the overall trend, and any high-impact economic news. Does the current market environment actually align with your strategy?

- Plan Confirmation: Does this specific trade setup meet every single rule in your trading plan? No exceptions. Ever.

- Risk Calculation: What is your exact entry price, stop-loss, and profit target? How much of your account are you risking on this single idea?

- Mental Check-in: Are you calm and focused? Are you free from emotional distress? If the answer is no, you don't trade. Period.

This ritual is what shifts you from being a reactive gambler to a proactive, professional operator.

Learning from Wins and Losses

Just as critical is your post-trade routine. How you process the outcome of a trade—win or lose—is what determines your long-term growth curve as a trader. The best way to do this is with a trading journal.

After you close a position, you have to analyze it objectively. Don't just jot down the profit or loss. Document your emotional state, why you took the trade, and whether you followed your plan to the letter. This creates a data-driven feedback loop for genuine self-improvement.

By meticulously reviewing your performance, you stop seeing losses as personal failures. Instead, they become what they really are: tuition paid to the market for a valuable lesson. This objective analysis is fundamental to becoming a trader who can adapt, learn, and ultimately thrive under pressure.

Mastering Price Action to Develop Your Edge

Forget trying to predict the future with a crystal ball or a cluttered mess of indicators. The real secret to figuring out where the market might go next is already right in front of you—it's in the price itself. This is the heart of price action trading, a clean, powerful method for understanding what the market is actually doing.

If you want to trade successfully, you have to move beyond lagging indicators that only show you what has already happened. The goal is to learn how to read the raw story told by the candlesticks on a naked chart. You're essentially learning to spot the footprints of the big institutional players so you can trade with them, not against them.

Reading the Market's Narrative

At its core, price action is about understanding the constant tug-of-war between buyers (bulls) and sellers (bears). Every candlestick, every swing high, and every swing low is a chapter in a larger story. Your job is to learn how to read this story as it unfolds in real time.

The building blocks are surprisingly simple, but they become incredibly powerful when you learn to combine them:

- Market Structure: Is the market making higher highs and higher lows? That's an uptrend. Or is it carving out lower lows and lower highs? That's a downtrend. This is the very first question you should ask when you open any chart. It provides the context for everything else.

- Support and Resistance: These are much more than just lines. Think of them as critical psychological zones—floors and ceilings—where the battle between buyers and sellers previously hit a turning point. Price is likely to react at these levels again.

- Key Candlestick Patterns: Specific patterns, like pin bars or engulfing candles, can act as signals for a potential reversal or continuation. They offer high-probability clues about what might happen next, especially when they form at those critical support and resistance levels.

The real skill comes from putting these pieces together. For instance, a bullish pin bar appearing randomly in choppy, sideways action doesn't mean much. But a bullish pin bar that forms right on a major support level, in the context of a clear uptrend? That's a high-quality signal you can build a trade around.

Building and Verifying Your Trading Edge

A trading edge is nothing more than a specific, repeatable advantage you have over other people in the market. It's your unique recipe for finding setups where the odds are tilted in your favor.

An edge doesn't mean you'll win every trade. Nobody does. Instead, it's a statistical advantage that, when you apply it with discipline over dozens or hundreds of trades, should lead to profit.

Developing an edge means you stop gambling and start operating like a casino. You know that over the long run, the probabilities are on your side, even if you hit a string of losses.

So, how do you actually find and prove you have an edge? It's a two-part process that separates the pros from the hopeful amateurs. You have to be methodical, patient, and brutally honest with yourself.

Step 1: Backtesting Your Strategy

Backtesting is where you manually scroll back in time on your charts to see how a specific set of rules would have performed. You're essentially "trading" your strategy on historical data to see if it even has a leg to stand on.

- Define Your Rules: Write down the exact, non-negotiable criteria for a trade. For example: "I will only go long when the price pulls back to a confirmed support level in an uptrend and forms a bullish engulfing candle on the 4-hour chart." Be specific.

- Collect the Data: Go back at least a year on your chosen instrument, or until you find 100-200 setups that match your rules. Log every single one. Record the date, the potential entry and exit, the risk-to-reward ratio, and whether it would have been a win or a loss.

- Analyze the Results: Once you have your data, it's time for some simple math. Calculate your strategy's historical win rate, average risk-to-reward, and potential profit. Does it have a positive expectancy? If not, it's back to the drawing board.

This process is tedious, I won't lie. But it's absolutely non-negotiable. It builds the statistical confidence you need to stick with your strategy when you inevitably face a losing streak.

Step 2: Forward-Testing in a Demo Environment

Once backtesting proves your strategy has potential, you need to forward-test it. This means trading your exact strategy in a live market, but on a demo account with zero financial risk.

Forward-testing is the bridge between theory and reality. It forces you to make decisions as the market unfolds, with all its unpredictability. This is where you test yourself. Can you execute your plan without hesitation? Can you handle the pressure of live market conditions?

Treat your demo account like it's real money. Follow your risk management rules to the letter. Only after you've proven you can be consistently profitable in a demo account for at least a few months should you even think about putting real capital on the line.

Implementing Iron-Clad Risk and Money Management

If there's one area where aspiring traders consistently crash and burn, it's this. They get so caught up in finding the perfect entry, chasing monster profits, and tweaking their strategy that they completely miss the most important part of the puzzle: iron-clad risk and money management.

A winning strategy and a disciplined mindset are useless if you don't protect your capital. It's that simple. Your first job as a trader isn't to make money; it's to survive. Think of your trading account as the lifeblood of your business. Run out of it, and you're out of the game.

What follows are the non-negotiable rules that turn trading from a reckless gamble into a calculated business.

The One Percent Rule

Let's start with the most fundamental rule in any professional trader's playbook: the 1% Rule. It's incredibly simple but profoundly powerful.

The rule is this: you never, ever risk more than 1% of your total account balance on a single trade.

If you're working with a $10,000 account, your maximum loss on any one idea is $100. For a $2,500 account, it’s just $25. This isn't just a suggestion; it’s your primary defense against the inevitable losing streaks that every single trader faces. It ensures that even a string of bad luck can't knock you out of the market.

A stop-loss is not a sign of failure. It is a calculated business expense. It's the insurance premium you pay to protect your business from a devastating fire. Embrace it, plan for it, and never, ever trade without it.

This level of discipline is what separates the pros from the amateurs. While the average return for day traders can hover around 20%, this number hides the brutal reality of how many people fail. As some of the latest day trading statistics on Highstrike.com show, long-term success is almost entirely dependent on a trader's ability to control losses. A strict risk model like the 1% Rule is your best defense.

Calculating Your Position Size Correctly

Okay, so the 1% Rule tells you how much you can risk in dollars, but it doesn't tell you how many shares or lots to trade. That's where position sizing comes in. This is the practical step that connects your risk rule to your actual trade execution.

To get it right, you need two pieces of information:

- Your maximum dollar risk (that 1% we just talked about).

- Your per-share risk (the distance from your entry to your stop-loss).

Let's walk through a real-world example.

- Account Size: $10,000

- Maximum Risk (1%): $100

- Trade Setup: You see a setup to buy Stock XYZ at $50. Based on the chart's structure (let's say a recent swing low), you place your protective stop-loss at $48.

- Risk Per Share: $50 (your entry) – $48 (your stop) = $2 per share.

Now for the easy part. Just divide your max dollar risk by your per-share risk:

$100 / $2 = 50 shares

That's it. For this specific trade, your correct position size is 50 shares. If you're wrong and the trade hits your stop-loss, you will lose exactly $100—your planned 1% risk. This isn't guesswork; it's math. It removes the emotion from deciding how big to trade. For a closer look, we have a number of position sizing strategies to explore in our guide that cater to different styles.

Prioritizing Your Risk-to-Reward Ratio

Finally, let’s talk about making actual money. Having a high win rate feels great, but it's often a vanity metric. What truly builds an account over time is your risk-to-reward ratio (R:R). This simply compares the potential profit of a trade to its potential loss.

A trader who loses more often than they win can still be wildly profitable if their winning trades are significantly larger than their losing ones.

Take a look at this comparison:

| Trader Profile | Win Rate | Risk-to-Reward | Outcome of 10 Trades (Risking $100) |

|---|---|---|---|

| Trader A | 70% | 1:0.5 R | Wins: 7 x $50 = $350. Losses: 3 x $100 = $300. Net Profit: $50 |

| Trader B | 40% | 1:3 R | Wins: 4 x $300 = $1,200. Losses: 6 x $100 = $600. Net Profit: $600 |

See the difference? Trader B, despite being "wrong" 60% of the time, is crushing it. They understand that the size of the wins matters far more than the frequency of them. Your job is to build a trading plan that only targets setups offering, at a bare minimum, a 1:2 or 1:3 risk-to-reward. This is how you build a genuine, sustainable edge in the markets.

Designing Your Professional Trading Routine

If you want consistent results, you need consistent actions. It's that simple. If you show up to the market with a different process and mindset every single day, your P/L will be a chaotic mess to match.

The shift from a reactive hobbyist to a proactive business owner begins with building a professional trading routine. This isn't just about looking professional; it's about transforming trading from a source of constant stress into a controlled, repeatable operation.

A solid routine is what builds real discipline. It reinforces your strategy and, most importantly, keeps emotional, gut-based decisions from wrecking your account. The pros don't just roll out of bed and start clicking buttons; they execute a well-honed plan, day in and day out.

The Pre-Market Warm-Up

Your trading day doesn't kick off when the opening bell rings. The real work, the focused work, starts an hour or two before in the quiet of your pre-market analysis. This is your time to get your head in the game, plan your attack, and align yourself with what the market is actually doing, not what you hope it will do.

Think of it like a pilot's pre-flight checklist. You wouldn't want them winging it, and you shouldn't either. This routine is your checklist to make sure you're fully prepared to act on opportunities that fit your specific plan.

A non-negotiable pre-market routine must include:

- Checking the Economic Calendar: Is there a major news release or a central bank announcement on the docket? These events inject massive volatility. You absolutely have to know they're coming so you can either step aside or tighten up your risk management.

- Building a Watchlist: This is where you scan the markets for instruments that are actually moving and showing signs of life. You're not looking for trade setups just yet. You're simply identifying the "markets in play" for the day that meet your initial strategy criteria.

- Mapping Key Levels: Once you have your watchlist, get on those charts and mark the most critical support and resistance zones. These are the battlegrounds, the specific price areas where you'll be patiently waiting for your trade setups to appear.

This preparation primes your mind. When the market opens, you aren't desperately hunting for a trade. You're calmly waiting for the market to come to you at your pre-identified levels.

The Trading Journal: Your Ultimate Performance Tool

If your trading account is the lifeblood of your business, your trading journal is its performance review. I'm not exaggerating when I say it is the single most important tool for your long-term survival and improvement. It's where you get the raw, objective data on your own behavior.

A trading journal is the ultimate accountability partner. It doesn't care about your excuses or how you felt in the moment. It just shows you the unfiltered truth about your decisions. Use it to learn the expensive lessons without having to pay for them over and over again.

For every single trade you take, you must meticulously log the details. This goes way beyond just the entry, exit, and P/L. A proper journal entry is a complete case study. If you're serious about this business, you need a structured document. You can learn exactly what to include by checking out our guide on how to make a trading plan.

Post-Market Review and Weekly Analysis

The final bell doesn't mean your work is done. The post-market review is where the most valuable learning happens. This is your time to go back through your journal entries for the day and analyze your execution, discipline, and mindset without the pressure of live money on the line.

This process is what separates the amateurs from the pros. It's how you spot bad habits before they become account-killers. For example, a day trader targeting $150,000 a year needs to average around $3,000 in weekly profit. If they aim for a modest $300 per winning trade, that means they need to find and execute about 10 successful trades a week. It’s not about hitting home runs; it's about consistent, disciplined execution.

At the end of each week, zoom out and do a broader review. Look for recurring patterns in your journal. Are you always making the same mistake on Fridays? Are you cutting your winners short out of fear? This weekly analysis gives you the high-level insights needed to make real, meaningful adjustments to your process, turning you into a smarter, more disciplined trader week after week.

Common Questions New Traders Always Ask

When you're just starting out, the trading world can feel like a maze of conflicting advice and wild claims. It's totally normal to feel a bit lost. Most new traders I talk to are all asking the same handful of questions about getting started.

Let's clear the air and tackle these head-on. No hype, just straight answers based on real-world experience. My goal is to give you a realistic picture so you can start this journey on the right foot.

How Much Money Do I Really Need to Start?

This is the big one, the question I hear more than any other. The honest answer? There’s no magic number. But there is a golden rule: only trade with capital you are fully prepared to lose.

This isn't about being negative; it's about being a professional. It's what allows you to separate your personal finances from the outcome of a trade, which is crucial for your psychology. Many aspiring traders start with a few thousand dollars, but the amount is less important than what it allows you to do.

Your starting capital has one main job: to be big enough to let you practice proper risk management. If one or two losses can cripple your account, you're not trading—you're gambling. You simply don't have enough runway to survive the learning curve.

Focus on the process first. A trader who learns how to consistently grow a $2,000 account has the exact same skills needed to manage a $20,000 account. The reverse is never true.

How Long Until I'm Consistently Profitable?

Forget anyone selling you a dream of quick riches. Becoming a consistently profitable trader is a marathon, not a sprint, and there is absolutely no fixed timeline. For most people who stick with it, the journey takes anywhere from one to several years of real, dedicated effort.

Your progress will boil down to a few critical things:

- Your dedication to learning: Are you putting in the screen time? This means studying market structure, backtesting your strategies, and, most importantly, reviewing every single trade you take.

- Your discipline in execution: Can you stick to your trading plan like glue, even when you're in a losing streak and your emotions are screaming at you to do something else?

- The market itself: Let's be honest, some market environments are just easier to trade than others.

Trading is one of the most expensive self-development programs you will ever enroll in. The market magnifies all of your emotional flaws—impatience, fear, greed—and forces you to confront them. Success comes after you’ve done the inner work.

Focus on mastering the process, and I promise, the profits will follow. Chasing a deadline is a recipe for frustration and expensive lessons.

Do I Need a Finance Degree to Succeed?

Absolutely not. I've met phenomenal traders from all walks of life—engineers, teachers, artists, you name it. The market is the great equalizer; it couldn't care less about your diploma or your pedigree.

What really matters is your mental toughness and your commitment to a disciplined process. The skills that the market rewards have nothing to do with formal education. Your ability to manage risk, control your emotions, and execute your plan day-in and day-out is infinitely more valuable than a textbook.

In fact, some might argue that a formal finance background can be a disadvantage. Academic theories often fail spectacularly when faced with the raw, emotional, and sometimes irrational dynamics of a live market.

What Market Is Best for a Beginner?

This is another classic question. Should you trade stocks, forex, or futures? The truth is, the "best" market is simply the one that fits you—your personality, your schedule, and how much risk you're comfortable with.

- Forex (FX): The foreign exchange market is open 24/5, which is fantastic if you have a full-time job. It’s incredibly liquid, but that also means it can be very volatile.

- Stocks: Trading individual stocks gives you thousands of choices. It requires a bit more homework to find good setups, but it's often less leveraged than other markets.

- Futures: These are leveraged instruments based on commodities or indices. Day traders often love them for their clean price structures, but they demand very tight risk management.

Here’s my best advice: Pick one market and commit to mastering it. Seriously. Learn its quirks, its rhythm, and how your strategy behaves in that specific environment. Trying to trade everything at once as a beginner is a surefire way to get overwhelmed and burn out. Once you're consistently profitable in one, then you can think about expanding.

Ready to stop gambling and start building a real trading business? At Colibri Trader, we teach a straightforward, price-action based approach that works in any market. Forget indicators and confusing theories—learn the skills that create consistency. Discover your trading potential with our free quiz and start your journey today.